Unequal Recovery? Federal Resource Distribution after a Midwest Flood Disaster

Abstract

:1. Introduction

- (1)

- how does recovery vary by acquisition funding source; and

- (2)

- what is the relationship between recovery and vulnerable populations?

2. Justice and Flood Recovery

3. Case Study

3.1. Federal Programs for Property Acquisition

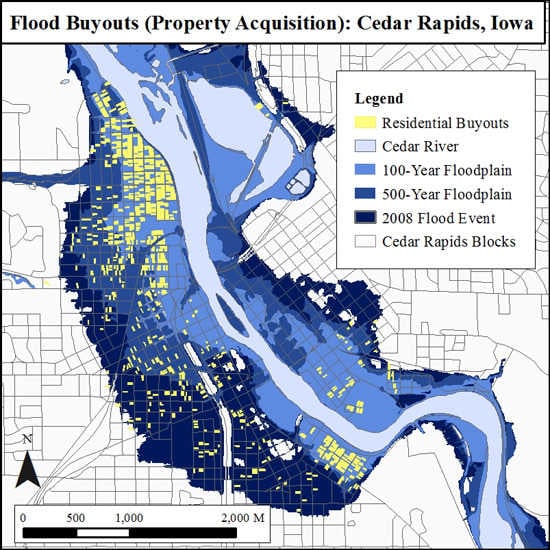

3.2. Study Area

4. Methods

4.1. Input Data

4.2. Measuring Recovery

4.3. Recovery and Social Vulnerability

5. Results

5.1. The Relative Recovery Ratio (RRR)

5.2. Recovery by Federal Program

5.3. Recovery for Vulnerable Populations

6. Discussion

6.1. Recovery Differences by Federal Program

6.2. Social Vulnerability and Recovery

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| HMGP | Hazard Mitigation Grant Program |

| CDBG | Community Development Block Grant |

| FEMA | Federal Emergency Management Agency |

| SBA | Small Business Administration |

| IEDA | Iowa Economic Development Authority |

| RRR | Relative Recovery Ratio |

| OLS | Ordinary Least Squares |

| AICc | Adjusted Akaike’s Information Criterion |

| SD | Standard Deviations |

| GWR | Geographically weighted regression |

References

- Federal Emergency Management Agency (FEMA). Mitigation Assessment Team Report: Midwest Floods of 2008 in Iowa and Wisconsin; FEMA: Washington, DC, USA, 2009.

- Mutel, C.F. A Watershed Year Anatomy of the Iowa Floods of 2008; University of Iowa Press: Iowa City, IA, USA, 2010. [Google Scholar]

- Federal Emergency Management Agency (FEMA). Rebuilding for a More Sustainable Future: An Operational Framework; FEMA: Washington, DC, USA, 2000.

- Chizewer, D.M.; Tarlock, A.D. New challenges for urban areas facing flood risks. Fordham Urban Law J. 2012, 40, 1739–1792. [Google Scholar]

- Federal Emergency Management Agency (FEMA). HMGP Closed Property Acquisitions Projects; FEMA: Washington, DC, USA, 2016.

- De Vries, D.H.; Fraser, J.C. Citizenship rights and voluntary decision making in post-disaster us floodplain buyout mitigation programs. Int. J. Mass Emerg. Dis. 2012, 30, 1–33. [Google Scholar]

- Federal Emergency Management Agency (FEMA). Property Acquisition Handbook for Local Communities: A Summary for States; FEMA: Washington, DC, USA, 1998.

- Simunovich, D.V. Quiet of dissolution: Post-disaster redevelopment and status-preserving compensation. Seton Hall Law Rev. 2008, 38, 331–357. [Google Scholar] [CrossRef]

- Adger, W.N. Vulnerability. Glob. Environ. Chang. 2006, 16, 268–281. [Google Scholar] [CrossRef]

- Elliott, J.R.; Pais, J. Race, class, and hurricane katrina: Social differences in human responses to disaster. Soc. Sci. Res. 2006, 35, 295–321. [Google Scholar] [CrossRef]

- Garrett, T.A.; Sobel, R.S. The political economy of fema disaster payments. Econ. Inq. 2003, 41, 496–509. [Google Scholar] [CrossRef]

- Hooks, J.P.; Miller, T.B. Continuing storm: How disaster recovery excludes those most in need. Calif. West. Law Rev. 2006, 43, 21–73. [Google Scholar]

- Berke, P.R.; Kartez, J.; Wenger, D. Recovery after disaster: Achieving sustainable development, mitigation and equity. Disasters 1993, 17, 93–109. [Google Scholar] [CrossRef] [PubMed]

- Mileti, D. Disasters by Design: A Reassessment of Natural Hazards in the United States; National Academies Press: Washington, DC, USA, 1999. [Google Scholar]

- Wisner, B.; Blaikie, P.; Cannon, T.; Davis, I. At Risk: Natural Hazards, People’s Vulnerability, and Disasters, 2nd ed.; Routledge: New York, NY, USA, 1994. [Google Scholar]

- Collins, T.W. The political ecology of hazard vulnerability: Marginalization, facilitation and the production of differential risk to urban wildfires in arizona’s white mountains. J. Political Ecol. 2008, 15, 21–43. [Google Scholar]

- Smith, G.P.; Wenger, D. Sustainable disaster recovery: Operationalizing an existing agenda. In Handbook of Disaster Research; Springer: New York, NY, USA, 2007; pp. 234–257. [Google Scholar]

- Stehr, S.D. The political economy of urban disaster assistance. Urban Aff. Rev. 2006, 41, 492–500. [Google Scholar] [CrossRef]

- Dommel, P.R.; Rich, M.J. The rich get richer the attenuation of targeting effects of the community development block grant program. Urban Aff. Rev. 1987, 22, 552–579. [Google Scholar] [CrossRef]

- Kahn, M.E. The death toll from natural disasters: The role of income, geography, and institutions. Rev. Econ. Stat. 2005, 87, 271–284. [Google Scholar] [CrossRef]

- Smith, G. Planning for Post-Disaster Recovery: A Review of the United States Disaster Assistance Framework; Island Press: Washington, DC, USA, 2012. [Google Scholar]

- Cutter, S.L.; Boruff, B.J.; Shirley, W.L. Social vulnerability to environmental hazards. Soc. Sci. Q. 2003, 84, 242–261. [Google Scholar] [CrossRef]

- Morrow, B.H. Identifying and mapping community vulnerability. Disasters 1999, 23, 1–18. [Google Scholar] [CrossRef] [PubMed]

- Adger, W.N.; Arnell, N.W.; Tompkins, E.L. Successful adaptation to climate change across scales. Glob. Environ. Chang. 2005, 15, 77–86. [Google Scholar] [CrossRef]

- Walker, G.; Burningham, K. Flood risk, vulnerability and environmental justice: Evidence and evaluation of inequality in a UK context. Crit. Soc. Policy 2011, 31, 216–240. [Google Scholar] [CrossRef] [Green Version]

- Haas, J.E.; Kates, R.W.; Bowden, M.J. Reconstruction following disaster. In Reconstruction Following Disaster; The Massachusetts Institute of Technology: Cambridge, MA, USA, 1977. [Google Scholar]

- Bolin, B. Race, class, ethnicity, and disaster vulnerability. In Handbook of Disaster Research; Springer: New York, NY, USA, 2007; pp. 113–129. [Google Scholar]

- Finch, C.; Emrich, C.T.; Cutter, S.L. Disaster disparities and differential recovery in new orleans. Popul. Environ. 2010, 31, 179–202. [Google Scholar] [CrossRef]

- Peacock, W.G.; Van Zandt, S.; Zhang, Y.; Highfield, W.E. Inequities in long-term housing recovery after disasters. J. Am. Plan. Assoc. 2014, 80, 356–371. [Google Scholar] [CrossRef]

- Cutter, S.; Emrich, C.T.; Mitchell, J.T.; Piegorsch, W.W.; Smith, M.M.; Weber, L. Hurricane Katrina and the Forgotten Coast of Mississippi; Cambridge University Press: Cambridge, MA, USA, 2014. [Google Scholar]

- Johnson, C.; Penning-Rowsell, E.; Parker, D. Natural and imposed injustices: The challenges in implementing ‘fair’ flood risk management policy in england. Geogr. J. 2007, 173, 374–390. [Google Scholar] [CrossRef]

- Godschalk, D.R.; Rose, A.; Mittler, E.; Porter, K.; West, C.T. Estimating the value of foresight: Aggregate analysis of natural hazard mitigation benefits and costs. J. Environ. Plan. Manag. 2009, 52, 739–756. [Google Scholar] [CrossRef]

- Laska, S.; Nance, E.; King, K.; Devalcourt, J. Achieving Successful Long-Term Recovery and Safety from a Catastrophe: Recommendations for Mitigation; CHART Publications: Middleton, WI, USA, 2010; pp. 1–11. [Google Scholar]

- Conrad, D.R.; McNitt, B.; Stout, M. Higher Ground: A Report on Voluntary Property Buyouts in the Nation's Floodplains: A Common Ground Solution Serving People At Risk, Taxpayers and the Environment; National Wildlife Federation: Reston, VA, USA, 1998. [Google Scholar]

- Federal Emergency Management Agency (FEMA). Hazard Mitigation Grant Program. Available online: http://www.fema.gov/hazard-mitigation-grant-program (accessed on 28 July 2014).

- Federal Emergency Management Agency (FEMA). Robert T. Stafford Disaster Relief and Emergency Assistance Act, as Amended; FEMA: Washington, DC, USA, 2013.

- Jackson, A.M. Chapter 1: Federal funding and financing programs post-disaster. In Building Community Resilience Post-Disaster: A Guide for Affordable Housing and Community Economic Development Practitioners; Gilmore, D.R., Standaert, D.M., Eds.; American Bar Association: Chicago, IL, USA, 2013; pp. 3–27. [Google Scholar]

- U.S. Department of Housing and Urban Development (HUD). Guide to National Objectives and Eligible Activities for State CDBG Programs; HUD: Washington, DC, USA, 2015.

- Federal Emergency Management Agency (FEMA). Hazard Mitigation Assistance Tool for Identifying Duplication of Benefits; FEMA: Washington, DC, USA, 2012.

- Fazio, C. Ensuring equitable disaster relief to homeowners and businesses impacted by natural disasters. Fordham Environ. Law Rev. 2014, 26, 1–9. [Google Scholar]

- U.S. Census Bureau. American community survey (2005–2009). In American FactFinder; U.S. Census Bureau: Suitland, MD, USA, 2009. [Google Scholar]

- City of Cedar Rapids (CCR). Flood of 2008 Facts & Statistics. Available online: http://www.cedar-rapids.org/discover_cedar_rapids/flood_of_2008/2008_flood_facts.php (accessed on 3 March 2014).

- Smith, R. Cedar rapids flood buyout is history. The Gazette, 14 September 2014. [Google Scholar]

- City of Cedar Rapids (CCR). Frequently Asked Questions: Demolition Process; CCR: Cedar Rapids, IA, USA, 2010. [Google Scholar]

- Belz, A. Palo defends contractor choice—Local businessman with second highest bid awarded contract. The Gazette, 16 December 2008. [Google Scholar]

- Federal Emergency Management Agency (FEMA). Long-Term Recovery Strategy Palo, Iowa. Available online: http://publications.iowa.gov/12146/ (accessed on 7 April 2014).

- Belz, A. Linn finalizes buyouts of 10 flood-damaged homes. The Gazette, 8 December 2009. [Google Scholar]

- Helms, M. Iowa City River Corridor: Flood Protection Options for Parkview Terrace and Idyllwild Neighborhoods; Stanley Consultants Inc.: Iowa City, IA, USA, 2009. [Google Scholar]

- Hennigan, G. Iowa City Closes Books on Flood Buyouts. The Gazette, 31 March 2014. [Google Scholar]

- Yu, D.; Wei, Y.D.; Wu, C. Modeling spatial dimensions of housing prices in Milwaukee, WI. Environ. Plan. B Plan. Des. 2007, 34, 1085–1102. [Google Scholar] [CrossRef]

- Müller, B. Varieties of distributive justice in climate change. Clim. Chang. 2001, 48, 273–288. [Google Scholar] [CrossRef]

- Bell, D. Environmental justice and Rawls’ difference principle. Environ. Earth 2004, 26, 287–306. [Google Scholar] [CrossRef]

- Godschalk, D.R. Urban hazard mitigation: Creating resilient cities. Nat. Hazards Rev. 2003, 4, 136–143. [Google Scholar] [CrossRef]

- Norris, F.H.; Stevens, S.P.; Pfefferbaum, B.; Wyche, K.F.; Pfefferbaum, R.L. Community resilience as a metaphor, theory, set of capacities, and strategy for disaster readiness. Am. J. Commun. Psychol. 2008, 41, 127–150. [Google Scholar] [CrossRef] [PubMed]

- Thomas, D.S.; Twyman, C. Equity and justice in climate change adaptation amongst natural-resource-dependent societies. Glob. Environ. Chang. 2005, 15, 115–124. [Google Scholar] [CrossRef]

- Anselin, L.; Rey, S. Properties of tests for spatial dependence in linear regression models. Geogr. Anal. 1991, 23, 112–131. [Google Scholar] [CrossRef]

- Fotheringham, A.S.; Brunsdon, C.; Charlton, M. Geographically Weighted Regression: The Analysis of Spatially Varying Relationships; John Wiley & Sons: New York, NY, USA, 2003. [Google Scholar]

- Mustafa, D.; Ahmed, S.; Saroch, E.; Bell, H. Pinning down vulnerability: From narratives to numbers. Disasters 2011, 35, 62–86. [Google Scholar] [CrossRef] [PubMed]

- Ashley, S.T.; Ashley, W.S. Flood fatalities in the united states. J. Appl. Meteorol. Climatol. 2008, 47, 805–818. [Google Scholar] [CrossRef]

- Spielman, S.E.; Folch, D.; Nagle, N. Patterns and causes of uncertainty in the american community survey. Appl. Geogr. 2014, 46, 147–157. [Google Scholar] [CrossRef] [PubMed]

- Hoaglin, D.C.; Iglewicz, B. Fine-tuning some resistant rules for outlier labeling. J. Am. Stat. Assoc. 1987, 82, 1147–1149. [Google Scholar] [CrossRef]

- Hoaglin, D.C.; Iglewicz, B.; Tukey, J.W. Performance of some resistant rules for outlier labeling. J. Am. Stat. Assoc. 1986, 81, 991–999. [Google Scholar] [CrossRef]

- Spader, J.; Turnham, J. CDBG disaster recovery assistance and homeowners‘ rebuilding outcomes following hurricanes katrina and rita. Hous. Policy Debate 2014, 24, 213–237. [Google Scholar] [CrossRef]

- Symonds, M.R.; Moussalli, A. A brief guide to model selection, multimodel inference and model averaging in behavioural ecology using akaike’s information criterion. Behav. Ecol. Sociobiol. 2011, 65, 13–21. [Google Scholar] [CrossRef]

- Cherniack, E.P. The impact of natural disasters on the elderly. Am. J. Dis. Med. 2007, 3, 133–139. [Google Scholar]

- Durant, T.J. The utility of vulnerability and social capital theories in studying the impact of hurricane katrina on the elderly. J. Fam. Issues 2011, 32, 1285–1302. [Google Scholar] [CrossRef]

- Messias, D.K.H.; Barrington, C.; Lacy, E. Latino social network dynamics and the hurricane katrina disaster. Disasters 2012, 36, 101–121. [Google Scholar] [CrossRef] [PubMed]

- Van Zandt, S.; Peacock, W.G.; Henry, D.W.; Grover, H.; Highfield, W.E.; Brody, S.D. Mapping social vulnerability to enhance housing and neighborhood resilience. Hous. Policy Debate 2012, 22, 29–55. [Google Scholar] [CrossRef]

- Devkota, M.L.; Hatfield, G.; Chintala, R. Effect of sample size on the performance of ordinary least squares and geographically weighted regression. Br. J. Math. Comput. Sci. 2014, 4, 1–21. [Google Scholar] [CrossRef]

- Páez, A.; Farber, S.; Wheeler, D. A simulation-based study of geographically weighted regression as a method for investigating spatially varying relationships. Environ. Plan. A 2011, 43, 2992–3010. [Google Scholar] [CrossRef]

- City of Cedar Rapids (CCR). Administrative Plan Voluntary Property Acquisition Funded under the Hmgp for DR-1763; CCR: Cedar Rapids, IA, USA, 2010. [Google Scholar]

- City of Cedar Rapids (CCR). Administrative Plan: Voluntary Property Acquisition Funded under the Iowa Department of Economic Development CDBG; CCR: Cedar Rapids, IA, USA, 2010. [Google Scholar]

- Fraser, J.; Elmore, R.; Godschalk, D.; Rohe, W. Implementing Floodplain Land Acquisition Programs in Urban Localities; The Center for Urban & Regional Studies University of North Carolina at Chapel Hill: Chapel Hill, NC, USA, 2003. [Google Scholar]

- Tate, E.; Strong, A.; Kraus, T.; Xiong, H. Flood recovery and property acquisition in Cedar Rapids, Iowa. Nat. Hazards 2016, 80, 2055–2079. [Google Scholar] [CrossRef]

- City of Cedar Rapids (CCR). Replacement Housing Assistance a CDGB Voluntary Acquisition Program Benefit; CCR: Cedar Rapids, IA, USA, 2010. [Google Scholar]

- City of Cedar Rapids (CCR). Buyout Program Update: Community Development Block Grant (CDBG); CCR: Cedar Rapids, IA, USA, 2011. [Google Scholar]

| Characteristics | Cedar Rapids | Palo | Iowa City |

|---|---|---|---|

| Total Population (Count) | 125,951 | 941 | 67,067 |

| Elderly (%) | 12.90% | 4.50% | 7.60% |

| Minority (%) | 12.53% | 4.57% | 14.62% |

| Linguistic Isolation Spanish (%) | 6.40% | 0% | 15.50% |

| Tenure Owner-Occupied (%) | 68.98% | 91.46% | 47.54% |

| Median Value of Owner-Occupied Housing (Dollars) | $123,200 | $168,300 | $171,600 |

| City | Acquired Properties | Appraisal Multiplier | Total Cost | Recovery Objectives |

|---|---|---|---|---|

| Cedar Rapids | 1183 | 107% | $58.1 million | Non-structural & structural mitigation, rebuilding, housing development |

| Palo | 12 | 110% | $2 million | Non-structural mitigation, rebuilding, economic development |

| Iowa City | 93 | 112% | $22 million | Non-structural & structural mitigation |

| Input Data | Attributes | Sources |

|---|---|---|

| HMGP buyouts | Addresses and cost | FEMA |

| CDBG buyouts | Addresses and cost | IEDA |

| Flood depth grids | Peak depth in 2008 | Iowa Flood Center |

| Demographics | Block group demographic values | 2000 U.S. Census and TIGER Line |

| Assessed values, and parcels | Addresses, class, occupancy, and 2008 total value | Johnson County, Linn County, and Cedar Rapids assessors |

| Continuous Variables | Mean | SD |

|---|---|---|

| ** Average RRR | 0.93 | 0.20 |

| % Black | 3.85 | 5.58 |

| % Hispanic | 2.62 | 2.63 |

| % Elderly | 19.05 | 9.08 |

| % Renter | 33.93 | 19.24 |

| % Limited English Proficiency | 0.97 | 1.37 |

| Medium Household Income (Ln) | 10.56 | 0.42 |

| Population Density | 996.35 | 827.03 |

| Average Flood Depth | 2.20 | 1.24 |

| Control Variables | Count | |

| City Variable | 25 | |

| HMGP Acquisitions | 6 | |

| CDBG Acquisitions | 14 | |

| Both HMGP and CDBG | 5 |

| Program | Sample Size | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| HMGP | 142 | 1.22 | 0.22 | 0.23 | 1.94 |

| CDBG | 931 | 0.76 | 0.31 | 0.09 | 2.02 |

| Total | 1073 | 0.82 | 0.34 | 0.09 | 2.02 |

| OLS Model | Error Model | ||

|---|---|---|---|

| Adj. R-squared | 0.746 | R-squared | 0.811 |

| Log Likelihood | 28.31 | Log Likelihood | 42.03 |

| AICc | −34.61 | AICc | −62.07 |

| Schwarz Criterion | −21.21 | Schwarz Criterion | −48.66 |

| Breusch-Pagan | 17.62 | Breusch-Pagan | 11.26 |

| Moran’s I (Error) | ** −6.94 | Likelihood Ratio Test | ** 27.45 |

| LM Lag | 0.26 | ||

| Robust LM Lag | * 20.89 | ||

| LM Error | ** 32.73 | ||

| Robust LM Error | ** 32.99 | ||

| Model Variable | OLS | Error |

|---|---|---|

| Constant | ** 1.20 | ** 1.21 |

| % Black | 0.01 | 0.01 |

| % Hispanic | * −0.03 | ** −0.03 |

| % Elderly | * −0.01 | ** −0.01 |

| % Renter | 0.00 | 0.00 |

| % Limited English Proficiency | 0.05 | * 0.05 |

| Population Density | 0.00 | 0.00 |

| Average Flood Depth | * −0.05 | * −0.04 |

| City Dummy | 0.13 | 0.11 |

| HMGP Acquisitions | * 0.26 | * 0.21 |

| CDBG Acquisitions | −0.06 | −0.07 |

| Lambda | – | 0.42 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muñoz, C.E.; Tate, E. Unequal Recovery? Federal Resource Distribution after a Midwest Flood Disaster. Int. J. Environ. Res. Public Health 2016, 13, 507. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph13050507

Muñoz CE, Tate E. Unequal Recovery? Federal Resource Distribution after a Midwest Flood Disaster. International Journal of Environmental Research and Public Health. 2016; 13(5):507. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph13050507

Chicago/Turabian StyleMuñoz, Cristina E., and Eric Tate. 2016. "Unequal Recovery? Federal Resource Distribution after a Midwest Flood Disaster" International Journal of Environmental Research and Public Health 13, no. 5: 507. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph13050507