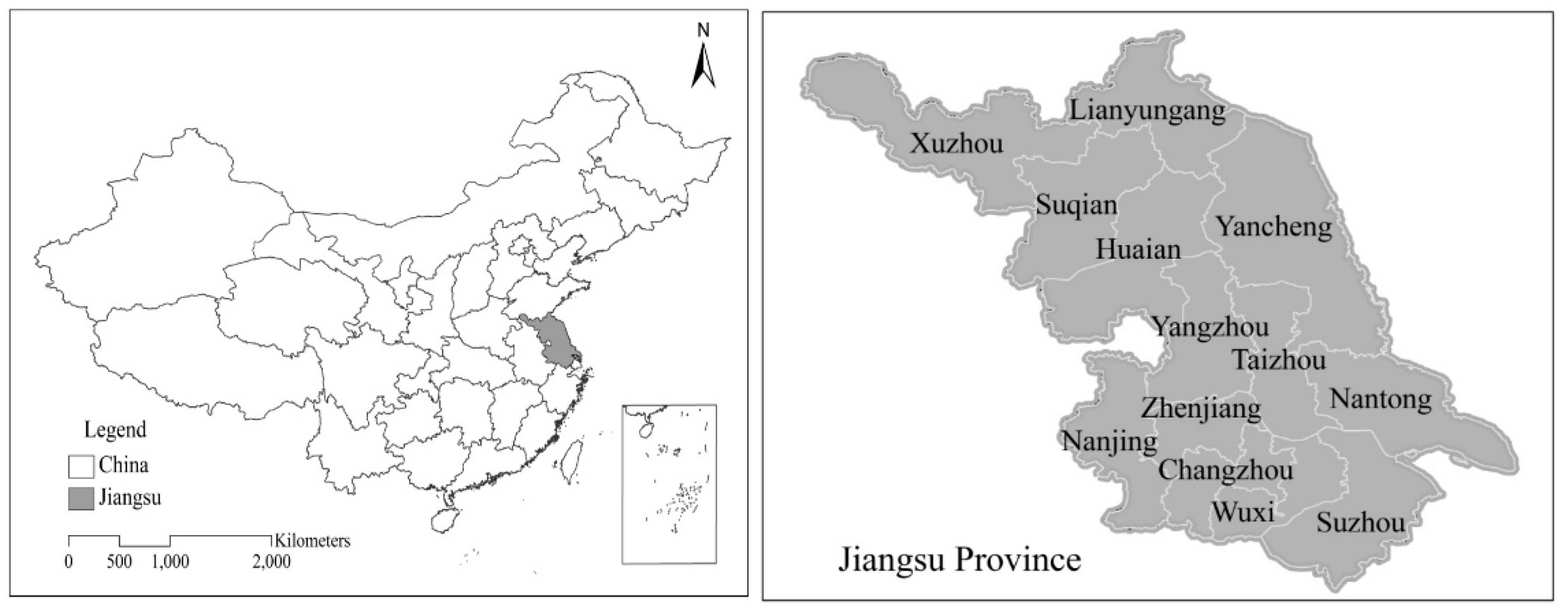

Design of Temperature Insurance Index and Risk Zonation for Single-Season Rice in Response to High-Temperature and Low-Temperature Damage: A Case Study of Jiangsu Province, China

Abstract

:1. Introduction

2. Research Summary

3. Research Data and Methods

3.1. Data Sources

3.2. Determination of Weather Production and Yield Reduction

3.3. Weather Index Selection and Design

3.3.1. Single-Season Rice High-Temperature Damage Index

3.3.2. Single-Season Rice Low-Temperature Damage Index

3.4. Design of Single-Season Rice Temperature Index-Based Insurance in Jiangsu

3.4.1. Relations between the Yield Reduction and Weather Disaster Index in Single-Season Rice

3.4.2. Determination Method of Pure Insurance Premium Rate

4. Results and Analysis

4.1. Regression Analysis

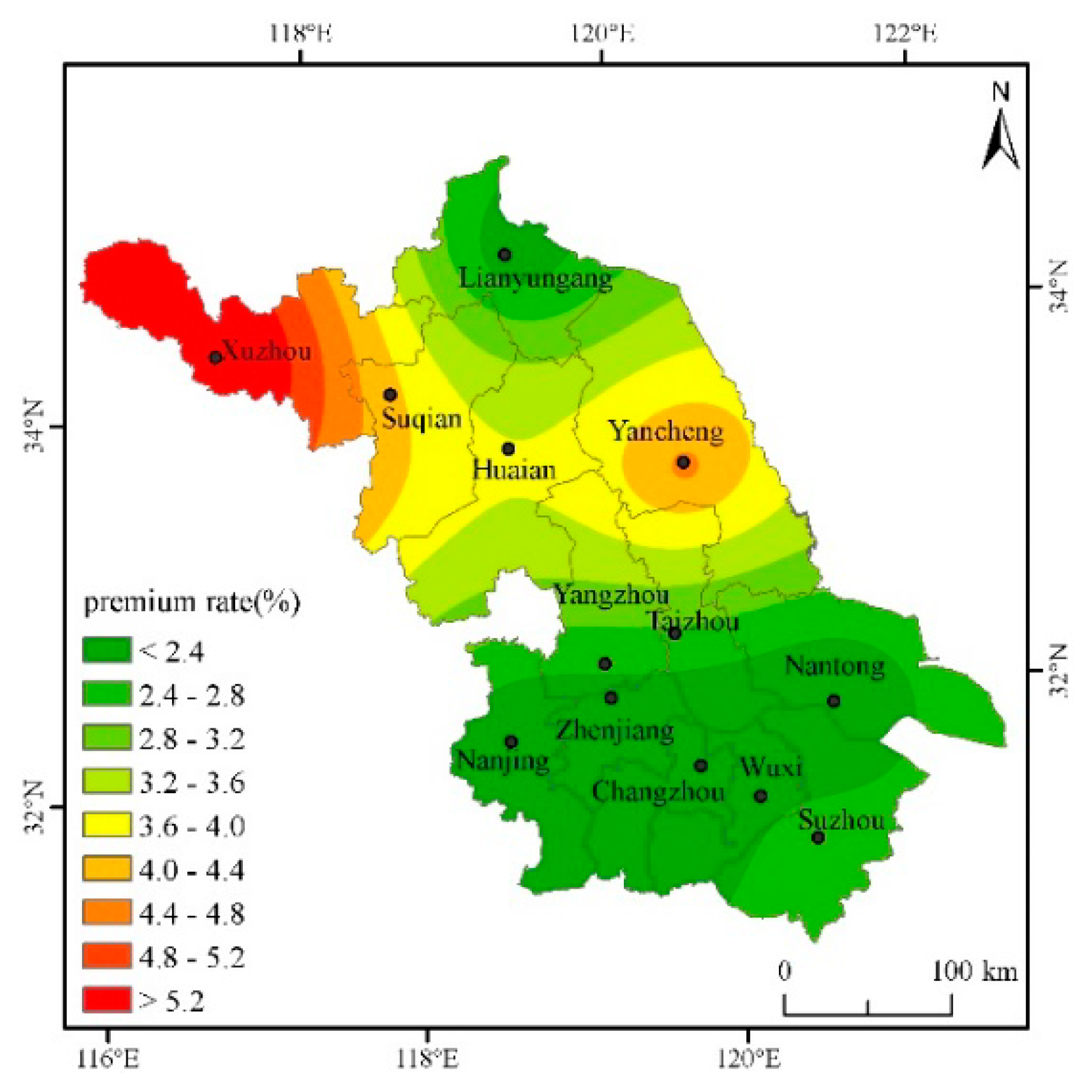

4.2. Analysis on the Pure Insurance Premium Rate of Cities in Jiangsu under the Deductibles at All Levels

5. Discussion and Conclusions

5.1. Research Conclusion

5.2. Research Prospect

- (1)

- Due to the lack of data on single-season rice production in some cities before 2005 in Jiangsu, data from eight cities from 1999 to 2015 is selected for empirical analysis, so the data is incomplete. In addition, the lack of county-level city data makes the actuarially fair premium rate only determined based on prefecture-level cities, so there is still a certain basis risk.

- (2)

- The weather output is separated through the moving average method, losing some production data. In the future, better models can be selected by comparing other models such as the Autoregressive Integrated Moving Average (ARIMA) model and the linear moving average method.

- (3)

- Many factors are affecting the fertility of single-season rice. In this paper, only the high-temperature damage and low-temperature damage indexes are included in the model, which can be further enriched in the future.

Author Contributions

Funding

Conflicts of Interest

References

- Field, C.B.; Barros, V.; Stocker, T.F.; Qin, D.; Dokken, D.J.; Ebi, K.L.; Mastrandrea, M.D.; Mach, K.J.; Plattner, G.-K.; Allen, S.K.; et al. Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation: IPCC Special Report on Working Groups I and II of the Intergovernmental Panel on Climate Change. J. Clin. Endocr. Metab. 2012, 18, 582. [Google Scholar] [CrossRef]

- Lesk, C.; Rowhani, P.; Ramankutty, N. Influence of extreme weather disasters on global crop production. Nature 2016, 529, 84–87. [Google Scholar] [CrossRef]

- Huang, R.H. Progresses in Research on the Formation Mechanism and Prediction Theory of Severe Climatic Disasters in China. Adv. Earth Sci. 2006, 21, 564–575. [Google Scholar]

- Zhang, J.; Zhang, S.; Cheng, M.; Jiang, H.; Zhang, X.; Peng, C.; Lu, X.; Zhang, M.; Jin, J. Effect of Drought on Agronomic Traits of Rice and Wheat: A Meta-Analysis. Int. J. Environ. Res. Public Health 2018, 15, 839. [Google Scholar] [CrossRef] [PubMed]

- Wang, S.Z.; Zhu, G.Z. Records of Song Poems 100; Shanghai Ancient Books Publishing House: Shanghai, China, 1997. [Google Scholar]

- Zuo, J.; Wang, X.J.; Guo, Y.L.; Kong, H.; Zhou, X.; Huang, Q.X.; Jia, R.Z.; Xu, L.; Guo, A.P. Weed Species in A Transgenic Rice Field at the Plant Breeding Base of Hainan Province. Weed Sci. 2014, 32, 40–44. [Google Scholar]

- Xu, H.B.; Wang, G.M.; Wei, M.; Zhou, W.B. Correlation Analysis of the Characters of Pollen Grains and Seed-setting of Rice under High Temperature Stress. J. Southwest Agric. Univ. 2001, 23, 205–207. [Google Scholar]

- Luo, L.H.; Liu, G.H.; Xiao, Y.H.; Tang, W.B.; Chen, L.Y. Influences of High-Temperature Stress on the Fertility of Pollen, Spikelet and Grain-Weigh in Rice. J. Hunan Agric.Univ. 2005, 31, 593–596. [Google Scholar]

- World Bank. Weather Index Insurance for Agriculture: Guidance for Development Practitioners; Agriculture and Rural Development Discussion; World Bank: Washington, DC, USA, 2013; pp. 50–54. [Google Scholar]

- Leblois, A.; Quirion, P.; Sultan, B. Price vs. weather shock hedging for cash crops: Ex ante evaluation for cotton producers in Cameroon. Ecol. Econ. 2014, 101, 67–80. [Google Scholar] [CrossRef] [Green Version]

- Skees, J.R.; Hazell, P.B.R.; Miranda, M. New Approaches to Crop Yield Insurance in Developing Countries. Eptd Discuss. Pap. 1999, 55, 18–23. [Google Scholar]

- Zanini, F.C.; Sherrick, B.J.; Schnitkey, G.D.; Lrwin, S.H. Crop Insurance Valuation under Alternative Yield Distributions. Am. J. Agric. Econ. 2004, 86, 406–419. [Google Scholar] [CrossRef]

- Turvey, C.G.; Weersink, A. Pricing Weather Insurance with a Random Strike Price: An Application to the Ontario Ice Wine Harvest. Am. J. Agric. Econ. 2005, 88, 696–709. [Google Scholar] [CrossRef]

- Clarke, D.J.; Clarke, D.; Mahul, O.; Verma, N. Index Based Crop Insurance Product Design and Ratemaking: The Case of Modified Nais in India; Policy Research Working Paper; The World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Norton, M.T.; Turvey, C.; Osgood, D. Quantifying Spatial Basis Risk for Weather Index Insurance. J. Credit Risk. 2012, 14, 20–34. [Google Scholar] [CrossRef]

- Miranda, M.; Skees, J.R.; Hazell, P. New Approaches to Public/Private Crop Yield Insurance; IFPRI: Washington, DC, USA, 1999. [Google Scholar]

- Castaneda, V.A.; Barrios, L.; Garrido, A. Assessment of Insurance Coverage and Claims in Rainfall Related Risks in Processing Tomato in Western Spain. Eur J Agron. 2014, 59, 39–48. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, Q. Influence of Flexible Crop Yield Distributions on Crop Insurance Premium Rate: A Case Study on Cotton Insurance in Three Counties of Xinjiang Province. J. China Agric. Univ. 2010, 15, 114–120. [Google Scholar] [CrossRef]

- Wu, L.H.; Lou, W.P.; Yao, Y.P.; Mao, Y.D.; Su, G.L. Design of Products for Rice Agro-Meteorological Index Insurance: A case in Zhejiang Province. Sci. Agric. Sin. 2010, 43, 4942–4950. [Google Scholar] [CrossRef]

- Lu, P. Design of Weather Index Crop Insurance Contract for Northeast China; Tsinghua University: Beijing, China, 2010. [Google Scholar]

- Wu, X.H.; Xu, Z.; Liu, H.; Guo, J.; Zhou, L. What are the impacts of tropical cyclones on employment?—An Analysis Based on Meta-regression. Wea. Climate and Soc. 2019, 11, 259–275. [Google Scholar] [CrossRef]

- Wu, X.H.; Cao, Y.R.; Xiao, Y.; Guo, J. Finding of Urban Rainstorm and Waterlogging Disasters Based on Microblogging Data and the Location-routing Problem Model of Urban Emergency Logistics. Ann. Oper. Res. 2018, 1–18. [Google Scholar] [CrossRef]

- Bai, L.; Duan, D.X.; Wan, Z. Evaluating Production Risk in Rice Production of Guangdong Province. Southwest China. J. Agric. SCI-Camb. 2014, 27, 1762–1767. [Google Scholar]

- Zhang, F.F. The Spatial and Temperature Distribution of Rice Heat Injury Hubei Province. J. Huazhong Agric. Univ. 2012. Available online: http://en.cnki.com.cn/Article_en/CJFDTOTAL-NCSY200905099.htm (accessed on 1 January 2019).

- You, Z.X. Research on System of Agricultural Insurance in Jiangsu Province; Soochow University: Suzhou, China, 2008. [Google Scholar]

- Qiang, H.T. Study on High Temperature Induced Heat Damage and its Impacts on Rice Production in Jiangsu Province; Nanjing University of Information Science & Technology: Nanjing, China, 2011. [Google Scholar]

- Meng, Z.H.; Wang, Y.J.; Sun, Z.S.; Meng, Q.X.; Liu, Y.W.; Lei, C.G.; Zhang, J.L. The Research of Rice Sterile-type Chilling Injury and Irrigation Technique. Chin. Agric. Sci. Bull. 2005, 21, 197–201. [Google Scholar]

- China Meteorological Administration. Technical Specifications for Evaluation of Rice Cold Damage [QX/T 182-2013]; China Meteorological Administration: Beijing, China, 2013. [Google Scholar]

- Ker, A.P.; Goodwin, B.K.G. Nonparametric estimation of crop insurance rates revisited. Am. J. Agric. Econ. 2000, 82, 463–478. [Google Scholar] [CrossRef]

- Lou, W.P.; Ji, Z.W.; Qiu, X.F. Design of Tea Frost Weather Index Insurance. Chin. J. Nat. Resour. 2011, 26, 2053–2059. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, L.; Wu, X.H. Tendency of Embodied Carbon Change in the Export Trade of Chinese Manufacturing Industry from 2000 to 2015 and Its Driving Factors. Sustainability 2018, 10, 1839. [Google Scholar] [CrossRef]

- Jewson, S.; Brix, A. Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical Foundations; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

| City | High-Temperature Damage Index | Square of High-Temperature Index | Low-Temperature Damage Index | Square of Low-Temperature Damage Index | Adjusted R Square |

|---|---|---|---|---|---|

| Xuzhou | −0.00468 | −0.00361 | −0.041866 ** | −0.003416 ** | 0.539 |

| (0.165) | (0.258) | (0.026) | (0.024) | ||

| Yancheng | −0.00033 | −0.00842 ** | −0.008343 ** | −0.000039 * | 0.543 |

| (0.241) | (0.186) | (0.048) | (0.061) | ||

| Lianyungang | −0.022362 ** | −0.004589 ** | 0.003008 *** | −0.000051** | 0.492 |

| (0.047) | (0.037) | (0.009) | (0.004) | ||

| Nanjing | 0.000712 *** | −0.000873 *** | −0.009874 ** | −0.000401 ** | 0.506 |

| (0.006) | (0.002) | (0.049) | (0.059) | ||

| Nantong | 0.003358 ** | −0.000108 ** | 0.006685 *** | −0.000381 *** | 0.450 |

| (0.015) | (0.046) | (0.001) | (0.005) | ||

| Changzhou | 0.0273 | −0.000912 ** | 0.010007 * | −0.000771 *** | 0.422 |

| (0.155) | (0.037) | (0.055) | (0.002) | ||

| Wuxi | −0.002780 ** | −0.039 | −0.013001 ** | −0.042 | 0.616 |

| (0.049) | (0.127) | (0.042) | (0.131) | ||

| Suzhou | −0.00745 | −0.00631 | −0.005343 ** | −0.0000389 ** | 0.639 |

| (0.26) | (0.142) | (0.024) | (0.024) |

| City | 2.5% Deductible | 5% Deductible | 7.5% Deductible | 10% Deductible | ||||

|---|---|---|---|---|---|---|---|---|

| Actuarially Fair Premium Rate (%) | Actuarially Fair Premium (CNY) | Actuarially Fair Premium Rate (%) | Actuarially Fair Premium (CNY) | Actuarially Fair Premium Rate (%) | Actuarially Fair Premium (CNY) | Actuarially Fair Premium Rate (%) | Actuarially Fair Premium (CNY) | |

| Xuzhou | 6.18 | 370.80 | 6.12 | 367.20 | 6.01 | 360.60 | 6.01 | 360.60 |

| Yancheng | 4.53 | 271.80 | 4.41 | 264.60 | 4.12 | 247.20 | 3.91 | 234.60 |

| Lianyungang | 2.04 | 122.40 | 1.98 | 118.80 | 1.89 | 113.40 | 1.51 | 90.60 |

| Nanjing | 1.90 | 114.12 | 1.80 | 108.12 | 1.78 | 106.86 | 1.53 | 92.04 |

| Changzhou | 1.91 | 114.66 | 1.89 | 113.16 | 1.82 | 109.38 | 1.59 | 95.10 |

| Nantong | 1.85 | 111.06 | 1.85 | 111.00 | 1.85 | 110.94 | 1.72 | 103.26 |

| Wuxi | 2.22 | 133.38 | 2.21 | 132.84 | 2.01 | 120.72 | 2.00 | 120.06 |

| Suzhou | 2.71 | 162.54 | 2.70 | 161.88 | 2.68 | 161.04 | 2.55 | 152.82 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, J.; Jin, J.; Tang, Y.; Wu, X. Design of Temperature Insurance Index and Risk Zonation for Single-Season Rice in Response to High-Temperature and Low-Temperature Damage: A Case Study of Jiangsu Province, China. Int. J. Environ. Res. Public Health 2019, 16, 1187. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph16071187

Guo J, Jin J, Tang Y, Wu X. Design of Temperature Insurance Index and Risk Zonation for Single-Season Rice in Response to High-Temperature and Low-Temperature Damage: A Case Study of Jiangsu Province, China. International Journal of Environmental Research and Public Health. 2019; 16(7):1187. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph16071187

Chicago/Turabian StyleGuo, Ji, Jiajia Jin, Yinshan Tang, and Xianhua Wu. 2019. "Design of Temperature Insurance Index and Risk Zonation for Single-Season Rice in Response to High-Temperature and Low-Temperature Damage: A Case Study of Jiangsu Province, China" International Journal of Environmental Research and Public Health 16, no. 7: 1187. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph16071187