Industrial Structure Adjustment and Regional Green Development from the Perspective of Mineral Resource Security

Abstract

:1. Introduction

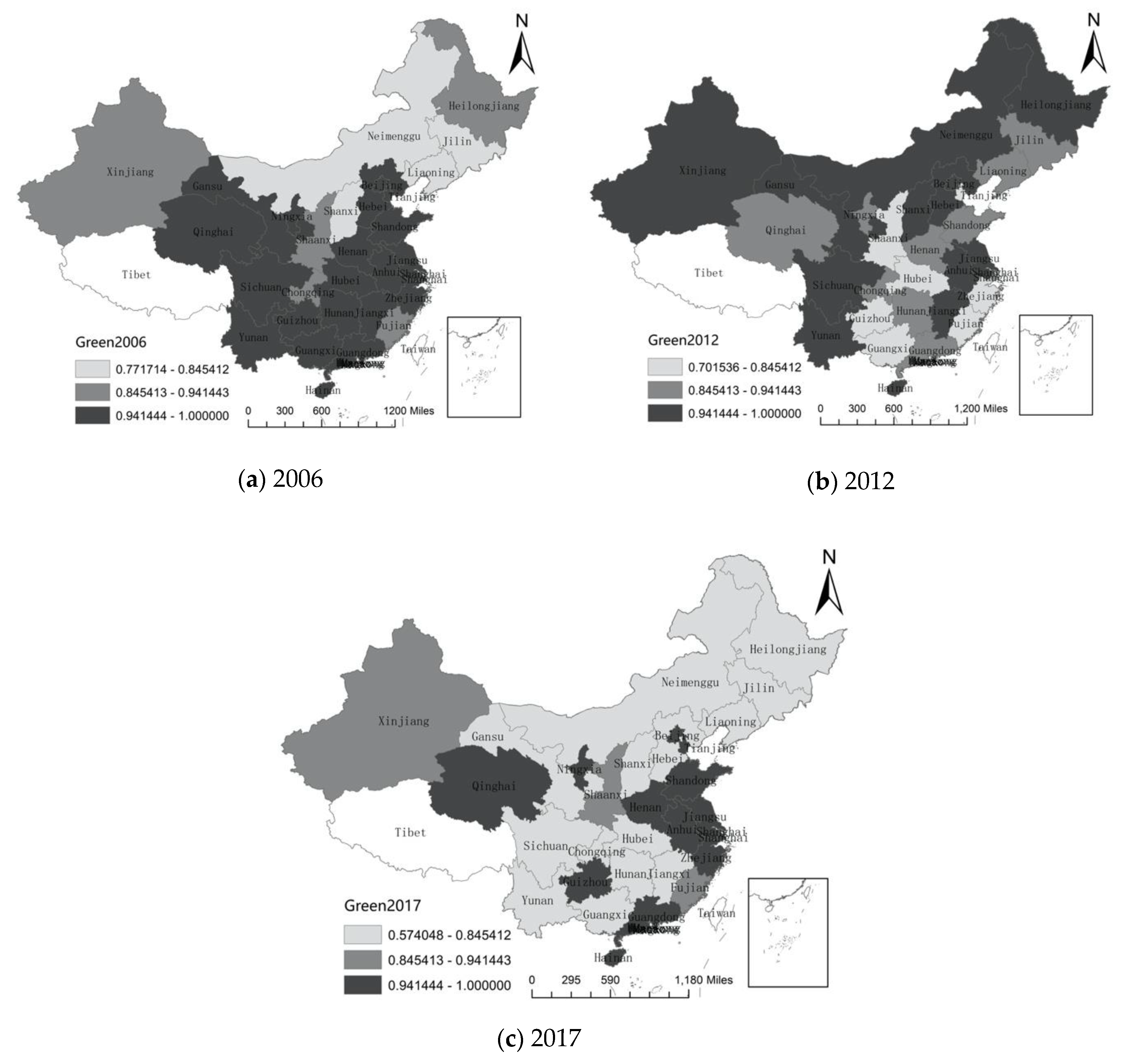

2. Variables and Model Specification

2.1. Dependent Variable

2.2. Core Independent Variable

2.3. Control Variables

2.4. Spatial Doberman Model (SDM)

2.5. DEA Model

3. Evaluation of Regional Green Development Competitiveness from the Perspective of Mineral Resource Security

3.1. Resource System

3.2. Environmental System

3.3. Population System

3.4. Economic System

3.5. Social System

4. Spatial Econometrics Results

4.1. Benchmark Regression Model and Results

4.2. Regression Results of Spatial Regression Model

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhu, B.; Zhang, M.; Zhou, Y.; Wang, P.; Sheng, J.; He, K.; Wei, Y.; Xie, R. Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: A novel integrated approach. Energy Policy 2019, 134, 110946. [Google Scholar] [CrossRef]

- Boulding, K.E. The Economics of the Coming Spaceship Earth. In Environmental Quality in a Growing Economy, Resources for the Future; Baltimore: Johns Hopkins University Press: Washington, DC, USA, 1966. [Google Scholar]

- United Nations Statistics. Data U.N.; United Nations Statistics: New York, NY, USA, 2017. [Google Scholar]

- Pearce, D.; Markandya, A.; Barbier, E.B. Blueprint for a Green Economy Earthscan; Publications Limited: London, UK, 1989. [Google Scholar]

- Indicators, O.E.C.D. Towards Green Growth: Monitoring Progress; O.E.C.D.: Paris, France, 2011. [Google Scholar]

- Lin, B.; Benjamin, N.I. Green development determinants in China: A non-radial quantile outlook. J. Clean. Prod. 2017, 162, 764–775. [Google Scholar] [CrossRef]

- Liu, L.-Q.; Liu, C.-X.; Gao, Y.-G. Green and sustainable City will become the development objective of Chinas Low Carbon City in future. J. Environ. Health Sci. Eng. 2014, 12, 34. [Google Scholar]

- Guo, Y.; Zeng, Z.; Tian, J.; Xu, F.; Chen, L.; Zhou, A. Uncovering the strategies of green development in a Chinese province driven by reallocating the emission caps of multiple pollutants among industries. Sci. Total Environ. 2017, 607, 1487–1496. [Google Scholar] [CrossRef] [PubMed]

- Wang, M.; Zhao, H.; Cui, J.; Fan, D.; Lv, B.; Wang, G.; Li, Z.; Zhou, G. Evaluating green development level of nine cities within the Pearl River Delta, China. J. Clean. Prod. 2018, 174, 315–323. [Google Scholar] [CrossRef]

- Chen, L.; Zhang, X.; He, F.; Yuan, R. Regional green development level and its spatial relationship under the constraints of haze in China. J. Clean. Prod. 2019, 210, 376–387. [Google Scholar] [CrossRef]

- Guo, Y.; Tong, L.; Mei, L. The effect of industrial agglomeration on green development efficiency in Northeast China since the revitalization. J. Clean. Prod. 2020, 258, 120584. [Google Scholar] [CrossRef]

- Zhou, L.; Zhou, C.; Che, L.; Wang, B. Spatio-temporal evolution and influencing factors of urban green development efficiency in China. J. Geogr. Sci. 2020, 30, 724–742. [Google Scholar] [CrossRef]

- Zhang, J.; Chang, Y.; Zhang, L.; Li, D. Do technological innovations promote urban green development?—A spatial econometric analysis of 105 cities in China. J. Clean. Prod. 2018, 182, 395–403. [Google Scholar] [CrossRef]

- Jin, B.; Li, G. Green economic growth from a developmental perspective. China Financ. Econ. Rev. 2013, 1, 4. [Google Scholar] [CrossRef] [Green Version]

- Li, W.N. The impact of industrial restructuring on environmental efficiency and policy recommendations. Econ. Vert. Horiz. 2017, 03, 54–58. [Google Scholar]

- Cheng, J.; Zhu, Y.; Xu, D.; Wang, A.; You, Z.; Shen, J. Impact of industrial structure change on mineral resources demand. Resour. Sci. 2018, 40, 558–566. [Google Scholar]

- Huang, L.X.; An, Y.; Liu, S.L. Industrial Structure Change in China: Measures Based on Three Different Dimensions. China Ind. Econ. 2013, 10, 70–82. [Google Scholar]

- Yu, B. How does industrial restructuring improve regional energy efficiency? An empirical study based on two dimensions of magnitude and quality. J. Financ. Econ. 2017, 43, 86–97. [Google Scholar]

- Wei, Y.D.; Li, W.; Wang, C. Restructuring industrial districts, scaling up regional development: A study of the Wenzhou model, China. Econ. Geogr. 2007, 83, 421–444. [Google Scholar] [CrossRef]

- Haibo, H. A Historical Overview of China’s Upgrading of Its Industrial Structure. China Econ. 2014, 9, 113. [Google Scholar]

- Zhang, B. The Impact of Industrial Structure Adjustment on Economic Growth in Japan. Int. Bus. Manag. 2015, 10, 57–63. [Google Scholar]

- Li, T. Land use dynamics driven by rural industrialization and land finance in the peri-urban areas of China: “The examples of Jiangyin and Shunde”. Land Use Policy 2015, 45, 117–127. [Google Scholar]

- Cheng, Z.; Li, L.; Liu, J. Industrial structure, technical progress and carbon intensity in China’s provinces. Renew. Sustain. Energy Rev. 2018, 81, 2935–2946. [Google Scholar] [CrossRef]

- Zhang, G.; Zhang, P.; Zhang, Z.; Li, J. Impact of environmental regulations on industrial structure upgrading: An empirical study on Beijing-Tianjin-Hebei region in China. J. Clean. Prod. 2019, 238, 117848. [Google Scholar] [CrossRef]

- Yu, D.; Gao, S.; Shen, L. The empirical study of the education investment’s influences on the industrial structure rationalization in Hainan province. J. Serv. Sci. Manag. 2017, 10, 447–463. [Google Scholar] [CrossRef] [Green Version]

- Tao, C.Q.; Liu, Z. Does Land Finance Contribute to the Rationalization of Industrial Structure? Empirical Evidence from Chinese Provincial Panel Data. Financ. Trade Res. 2017, 28, 54–63. [Google Scholar]

- Wellmer, F.W.; Becker-Platen, J. Sustainable development and the exploitation of mineral and energy resources: A review. Int. J. Earth Sci. 2002, 91, 723–745. [Google Scholar]

- Parsons, D.; Vincent, D. High Stakes: Mineral and Petroleum Development in Papua New Guinea; Institute of National Affairs: Port Moresby, Papua-Noua Guinee, 2019. [Google Scholar]

- Liu, S.; Qi, X.; Han, C.; Liu, J.; Sheng, X.; Li, H.; Luo, A.; Li, J. Novel nano-submicron mineral-based soil conditioner for sustainable agricultural development. J. Clean. Prod. 2017, 149, 896–903. [Google Scholar] [CrossRef]

- Lèbre, É.; Corder, G.D.; Golev, A. Sustainable practices in the management of mining waste: A focus on the mineral resource. Miner. Eng. 2017, 107, 34–42. [Google Scholar] [CrossRef]

- Kuz’min, M.I.; Kuznetsova, A.N. Ecological-geologic risks related to the development of resource regions. Geogr. Nat. Resour. 2018, 39, 95–102. [Google Scholar] [CrossRef]

- Krausmann, F.; Wiedenhofer, D.; Lauk, C.; Hass, W.; Tanikawa, H.; Fishman, T.; Miatto, A.; Schandl, H.; Haberl, H. Global socioeconomic material stocks rise 23-fold over the 20th century and require half of annual resource use. Proc. Natl. Acad. Sci. USA 2017, 114, 1880–1885. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.; Weaver, N.; Xue, N. Challenges for the Chinese economy in the new era of development. J. Chin. Econ. Bus. Stud. 2019, 17, 1–7. [Google Scholar] [CrossRef]

- Guan, J.; Li, K.; Lv, X. Enlightenment of Japan’s Low-carbon Economy Building on China. In Proceedings of the 2017 6th International Conference on Energy and Environmental Protection (ICEEP 2017), Zhuhai, China, 29–30 June 2017. [Google Scholar]

- Lusty PA, J.; Gunn, A.G. Challenges to global mineral resource security and options for future supply. Geol. Soc. 2015, 393, 265–276. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Wang, Y.; Qi, Y.; Wu, J.; Liao, W.; Shui, W.; Zhang, Y.; Deng, S.; Peng, H.; Yu, X.; et al. Evaluating the trends of China’s ecological civilization construction using a novel indicator system. J. Clean. Prod. 2016, 133, 910–923. [Google Scholar] [CrossRef]

- Zhao, Y.; Ju, M.; Shen, L. Status Quo and Countermeasures of China’s Mineral Resources Security. Resour. Ind. 2011, 13, 79–83. [Google Scholar]

- Pan, J. China’s Environmental Governing and Ecological Civilization; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Fu, Y.; Ye, X.; Wang, Z. Structure changes in manufacturing industry and efficiency improvement in economic growth. Econ. Res. J. 2016, 8, 86–100. [Google Scholar]

- Lin, G.; Jiang, D.; Fu, J.; Wang, D.; Li, X. A spatial shift-share decomposition of energy consumption changes in China. Energy Policy 2019, 135, 111034. [Google Scholar] [CrossRef]

- Liao, W.; Zhang, G.; Qiu, H.; Gao, X. Evaluation of Urban Sustainable Development Ability from the Perspective of Mineral Resources Security-Taking 11 Cities in Jiangxi Province as Examples. J. Agric. For. Econ. Manag. 2016, 15, 585. [Google Scholar]

- Qiu, F.D.; Li, B.; Tong, L.J. Evaluation of Sustainable Development Ability of Mining Cities in Northeast China Based on MFA and DEA. Resour. Sci. 2009, 31, 1898–1906. [Google Scholar]

- Ouyang, Z.; Zhao, J.; Gui, Z.; Ni, Y.; Han, B.; Zhuang, C. Evaluation of Green Development in Cities of China. China Popul. Resour. Environ. 2009, 19, 11–15. [Google Scholar]

- Wu, J.; Lu, W.; Li, M. A DEA-based improvement of China’s green development from the perspective of resource reallocation. Sci. Total Environ. 2020, 717, 137106. [Google Scholar] [CrossRef]

- Deng, K.W. Research on Industrial Transformation in Resource-Exhausted Cities. Ph.D. Thesis, Shandong University of Finance and Economics, Shandong, China, 2017. [Google Scholar]

- Gan, C.H.; Zheng, R.G. Research on the Evolution of Industrial Structure and Productivity Growth since Reform and Opening-up-A Test of China’s “Structural Dividend Hypothesis” from 1978 to 2007. China’s Ind. Econ. 2009, 2, 55–65. [Google Scholar]

- Liu, W.; Zhang, H. Industrial Structure Changes and Technological Progress in China’s Economic Growth. Econ. Res. 2008, 43, 4–15. [Google Scholar]

- Vu, K.M. Structural change and economic growth: Empirical evidence and policy insights from Asian economies. Struct. Chang. Econ. Dyn. 2017, 41, 64–77. [Google Scholar] [CrossRef]

- Wang, A.; Wang, G.; Chen, Q.; Yu, W. Mineral Resources Demand Theory and Model Forecast. Acta Geol. Sin. 2010, 31, 131–147. [Google Scholar]

- Jia, L.W.; Xu, D.Y. Study on the Impact of Regional Economy and Urbanization on Iron Ore Demand-Based on a Sample of 27 Countries. Resour. Sci. 2016, 38, 144–154. [Google Scholar]

- Zhao, L.D.; Zhang, L.; Xu, L.; Hu, M.B. Mechanism of Human Capital, Industrial Structure Adjustment and Green Development Efficiency. China’s Popul. Resour. Environ. 2016, 11, 114. [Google Scholar]

- Lee, L.; Yu, J. Estimation of spatial autoregressive panel data models with fixed effects. J. Econ. 2010, 154, 165–185. [Google Scholar] [CrossRef]

- Cueto, B.; Mayor, M.; Suárez, P. Entrepreneurship and unemployment in Spain: A regional analysis. Appl. Econ. Lett. 2015, 22, 1230–1235. [Google Scholar] [CrossRef]

- Feng, Z.; Chen, W. Environmental regulation, green innovation, and industrial green development: An empirical analysis based on the Spatial Durbin model. Sustainability 2018, 10, 223. [Google Scholar] [CrossRef] [Green Version]

- Liu, H.; Song, Y. Financial development and carbon emissions in China since the recent world financial crisis: Evidence from a spatial-temporal analysis and a spatial Durbin model. Sci. Total Environ. 2020, 715, 136771. [Google Scholar] [CrossRef]

- Zhu, Y.; Xu, D.; Cheng, J.; Zhu, W.; You, Z. Spatial Interaction Process of International Iron Ore Trade and Analysis of China’s Import Strategy. Resour. Sci. 2017, 39, 664–677. [Google Scholar]

- Cao, Z.; Zhao, Y.; Yuan, F.L.C. Analysis of Development Degree of China’s Mining Cities Based on Energy Theory. China Popul. Resour. Environ. 2010, 20, 56–61. [Google Scholar]

- Sun, H.; Zhu, K.J. Evaluation of Western Mineral Resources Competitiveness. J. Xi Univ. Sci. Technol. 2008, 28, 808–812. [Google Scholar]

- Du, Q.J.; Wu, J.Z.; Feng, L.G. Evaluation of Mineral Resources Development Efficiency Based on Successive DEA. J. Manag. 2015, 12, 299–305. [Google Scholar]

- Zhang, B.; Lv, X.L. Research and Application on Competitiveness Evaluation of Integrated Exploration Area. Min. Res. Dev. 2014, 34, 99–103. [Google Scholar]

- Wei, J.M. Analysis on Competitiveness and Sustainability of Heilongjiang Mineral Resources Carrying Capacity. China Min. 2006, 15, 102–106. [Google Scholar]

- Zhang, B.Y.; Xiao, W.; Zhu, W.P. Evaluation of China’s Regional Mineral Resources Competitiveness and Research on Its Correlation with Regional Economy. J. Nat. Resour. 2012, 27, 1623–1634. [Google Scholar]

- Scheel, H. Undesirable outputs in efficiency valuations. Eur. J. Oper. Res. 2001, 132, 400–410. [Google Scholar] [CrossRef]

- Dai, P. Research on Evaluation System of Green Development Level in Qinghai Province. Qinghai Soc. Sci. 2015, 3, 170–177. [Google Scholar]

- Sun, C.; Tong, Y.; Zou, W. The evolution and a temporal-spatial difference analysis of green development in China. Sustain. Cities Soc. 2018, 41, 52–61. [Google Scholar] [CrossRef]

- Xu, J.; Zhou, M.; Li, H. ARDL-based research on the nexus among FDI, environmental regulation, and energy consumption in Shanghai (China). Nat. Hazards 2016, 84, 551–564. [Google Scholar] [CrossRef]

- Ma, L.; Shi, D. Research on the Green Coordinated Development Process of Beijing-Tianjin-Hebei: Based on the Re-examination of the Kuznets Curve of Space Environment. China Soft Sci. 2017, 10, 82–93. [Google Scholar]

- Seiford, L.M.; Zhu, J. Modeling undesirable factors in efficiency evaluation. Eur. J. Oper. Res. 2002, 142, 16–20. [Google Scholar] [CrossRef]

- Hu, A.J.; Guo, A.J.; Zhong, F.L.; Wang, X.B. Can High-tech Industrial Agglomeration Improve Regional Green Economy Efficiency? China Popul. Resour. Environ. 2018, 28, 96–104. [Google Scholar]

- Ru, H. Study on Environmental Risk of Using FDI to Undertake Industrial Transfer in Central and Western Regions. Ph.D. Thesis, Wuhan University of Technology, Wuhan, China, 2012. [Google Scholar]

- Elhorst, J.P.; Gross, M.; Tereanu, E. Spillovers in Space and Time: Where Spatial Econometrics and Global VAR Models Meet. ECB Working Paper. No. 2134, ISBN 978-92-899-3239-4. 2018. Available online: https://poseidon01.ssrn.com/delivery.php?ID=940123101123003100064096093086090110050080061059011018113092076111000021125031091090041007038028040060043010122069082100083098001072063049059108082013094096112068021058079030120003027026086102123088000106024021113027117114084010101097067010116069070&EXT=pdf (accessed on 22 September 2020).

| Evaluation Index | Variables |

|---|---|

| Mineral Resources Endowment | Energy Consumption (x1) |

| Environmental Protection | Industrial Wastewater Discharge (x2) |

| Industrial Solid Waste Emissions (x3) | |

| Industrial Waste Gas Emissions (x4) | |

| Human Capital | Number of Employees in the Secondary Industry (x5) |

| Total Labor Productivity (x6) | |

| Economic Base | The proportion of Investment in Mining Industry to Investment in Fixed Assets (x7) |

| Total Industrial Output Value (x8) | |

| Average Wage of On-the-job Workers (x9) | |

| Policy Factors | Highway Mileage (x10) |

| Marketization Index (x11) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| effects_in | 0.0027 (0.0027) | −0.0019 (0.0009) | 0.0899 *** (0.0311) | −0.1265 (0.0165) |

| effects_sta | −0.4676 (0.4888) | 0.3260 (0.1666) | −0.4158 * (0.0774) | −0.8153 (0.2039) |

| effects_dyna | 0.3573 *** (0.0930) | −0.2157 *** (0.0573) | 0.2284 (0.0155) | 0.2549 *** (0.0417) |

| INN | 0.0167 (0.0161) | 0.0232 (0.0159) | −0.0030 (0.0155) | 0.0528 *** (0.0150) |

| CIT | −1.2461 *** (0.1205) | −1.2433 *** (0.1346) | −1.3503 *** (0.1278) | −0.5917 *** (0.1262) |

| GDPpc | 0.0101 * (0.0041) | 0.0176 *** (0.0038) | 0.0093 * (0.0050) | 0.0284 *** (0.0042) |

| OPEN | 0.2333 (0.1556) | 0.2294 (0.1568) | 0.0567 (0.1559) | 0.0935 (0.1442) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| effects_in | 0.002 (0.003) | 0.004 ** (0.002) | 0.078 (0.050) | 0.124 *** (0.023) |

| effects_sta | 0.539 (0.687) | 0.516 (0.345) | 0.672 (0.437) | 0.777 ** (0.299) |

| effects_dyna | 0.186 (0.149) | −0.543 (0.177) | −0.184 (0.182) | 0.243 *** (0.061) |

| INN | −0.012 (0.025) | −0.011 (0.022) | −0.008 (0.024) | 0.029 (0.023) |

| CIT | −1.076 *** (0.191) | −1.441 *** (0.243) | −1.298 *** (0.233) | −0.393 * (0.201) |

| GDPpc | 0.013 * (0.007) | 0.020 *** (0.005) | 0.162 * (0.008) | 0.029 *** (0.006) |

| OPEN | 0.178 (0.172) | 0.127 (0.167) | 0.124 (0.169) | 0.121 (0.152) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| effects_in | 0.206 ** (0.096) | 0.216 *** (0.035) | 0.031 (0.062) | 0.125 *** (0.039) |

| effects_sta | −2.119 (1.327) | 0.596 (0.371) | −0.143 (0.689) | −2.372 (0.454) |

| effects_dyna | 0.793 *** (0.196) | −0.513 (0.194) | 0.236 (0.191) | 0.574 *** (0.105) |

| INN | 0.153 *** (0.328) | 0.138 *** (0.029) | 0.108 *** (0.040) | 0.152 *** (0.031) |

| CIT | −1.277 *** (0.315) | −1.136 *** (0.237) | −1.177 *** (0.276) | −1.390 *** (0.281) |

| GDPpc | 0.029 (0.022) | 0.030 *** (0.011) | −0.016 (0.014) | 0.035 *** (0.013) |

| OPEN | 5.513 *** (0.898) | 4.471 *** (0.880) | 4.090 *** (1.101) | 5.627 *** (0.919) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| effects_in | 0.143 * (0.084) | 0.049 * (0.028) | −0.408 (0.070) | 0.096 *** (0.025) |

| effects_sta | −2.015 (0.705) | −0.486 (0.197) | −0.886 *** (0.299) | −0.756 *** (0.273) |

| effects_dyna | 0.891 *** (0.151) | −0.431 *** (0.088) | 0.440 *** (0.093) | 0.325 *** (0.057) |

| INN | 0.193 *** (0.036) | 0.111 *** (0.038) | 0.109 *** (0.036) | −0.117 (0.034) |

| CIT | −2.099 *** (0.358) | −2.436 *** (0.299) | −2.430 *** (0.220) | −1.938 *** (0.262) |

| GDPpc | 0.091 *** (0.013) | 0.086 *** (0.008) | 0.083 *** (0.014) | 0.084 *** (0.009) |

| OPEN | −0.600 (0.147) | −0.504 (0.417) | −1.226 ** (0.487) | −0.208 (0.428) |

| Variables | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|

| effects_in | 0.003 (0.002) | −0.002 (0.001) | 0.087 *** (0.027) | 0.034 * (0.018) |

| effects_sta | −0.595 (0.486) | 0.020 (0.132) | −0.785 *** (0.194) | 0.249 (0.209) |

| effects_dyna | 0.524 *** (0.102) | −0.192 *** (0.046) | 0.292 (0.063) | 0.075 (0.047) |

| INN | 0.040 *** (0.013) | 0.035 *** (0.013) | 0.029 ** (0.012) | 0.040 *** (0.013) |

| CIT | −0.005 (0.137) | −0.134 (0.140) | −0.240 (0.155) | 0.075 (0.142) |

| GDPpc | 0.037 *** (0.004) | 0.047 *** (0.004) | 0.036 ** (0.005) | 0.042 *** (0.004) |

| open | −0.063 (0.127) | −0.095 (0.126) | −0.025 (0.123) | −0.056 (0.125) |

| Variables | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|

| effects_in | 0.008 *** (0.003) | −0.008 * (0.002) | 0.327 *** (0.038) | −0.055 * (0.030) |

| effects_sta | −2.869 (0.966) | 0.196 (0.366) | 0.965 *** (0.321) | −0.279 (0.331) |

| effects_dyna | 1.217 *** (0.194) | −0.856 (0.199) | −0.455 (0.142) | 0.422 *** (0.078) |

| INN | 0.086 *** (0.019) | 0.049 *** (0.017) | 0.075 *** (0.016) | 0.102 *** (0.019) |

| CIT | 0.260 (0.236) | −1.259 *** (0.235) | −0.785 *** (0.235) | 0.215 (0.199) |

| GDPpc | 0.020 *** (0.005) | 0.041 *** (0.005) | 0.077 (0.005) | 0.023 *** (0.005) |

| OPEN | 0.205 (0.134) | 0.574 (0.120) | −0.039 (0.110) | 0.252 * (0.132) |

| Variables | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|

| effects_in | −0.185 (0.103) | −0.040 (0.070) | −0.123 *** (0.070) | 0.050 (0.052) |

| effects_sta | −2.782 (1.513) | −0.896 (0.581) | −1.116 (0.787) | −0.773 (0.716) |

| effects_dyna | 1.021 *** (0.333) | 0.247 (0.383) | 0.546 *** (0.204) | 0.504 ** (0.247) |

| INN | 0.084 * (0.046) | 0.151 *** (0.046) | 0.063 (0.043) | 0.114 *** (0.042) |

| CIT | 0.565 (0.521) | −0.313 (0.588) | 1.416 ** (0.600) | 0.508 (0.489) |

| GDPpc | 0.122 *** (0.004) | 0.047 *** (0.015) | 0.091 *** (0.029) | 0.039 *** (0.015) |

| OPEN | 1.964 * (1.085) | 3.453 *** (1.036) | 0.950 (1.137) | 3.370 *** (0.976) |

| Variables | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|

| effects_in | −0.021 (0.074) | 0.0348 (0.028) | −0.112 ** (0.054) | 0.057 ** (0.028) |

| effects_sta | −0.575 (0.687) | −0.273 (0.214) | −0.499 ** (0.247) | −0.102 (0.268) |

| effects_dyna | 0.425 ** (0.169) | 0.011 (0.112) | 0.257 *** (0.727) | 0.202 *** (0.064) |

| INN | −0.164 * (0.032) | −0.122 *** (0.032) | −0.108 *** (0.030) | −0.196 *** (0.034) |

| CIT | −0.013 (0.426) | −0.171 (0.412) | −0.294 (0.430) | 0.303 (0.337) |

| GDPpc | 0.095 *** (0.012) | 0.106 *** (0.083) | 0.121 *** (0.011) | 0.109 *** (0.007) |

| OPEN | −1.767 *** (0.381) | −0.719 *** (0.647) | −1.177 *** (0.438) | −1.850 *** (0.392) |

| National Regions Variables | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|

| effects_in | 0.008 *** (0.003) | −0.002 *** (0.001) | 0.787 *** (0.027) | −0.032 * (0.018) |

| effects_sta | −2.701 *** (0.931) | 0.001 (0.129) | −0.724 *** (0.189) | 0.235 (0.204) |

| effects_dyna | 1.161 *** (0.100) | −0.185 *** (0.045) | 0.280 *** (0.062) | 0.074 (0.046) |

| Eastern Regions | ||||

| effects_in | 0.008 *** (0.003) | −0.008 *** (0.002) | 0.279 *** (0.037) | −0.046 (0.031) |

| effects_sta | −2.701 *** (0.932) | 0.233 (0.372) | 0.969 (0.319) | −0.258 (0.311) |

| effects_dyna | 1.161 *** (0.190) | −0.836 *** (0.220) | −0.493 *** (0.149) | 0.390 *** (0.073) |

| Central Regions | ||||

| effects_in | −0.090 (0.126) | −0.038 (0.070) | −0.091 (0.065) | 0.048 (0.052) |

| effects_sta | −2.523 * (1.510) | −0.891 (0.567) | −0.865 (0.729) | −0.804 (0.666) |

| effects_dyna | 0.954 *** (0.318) | 0.276 (0.373) | 0.483 ** (0.190) | 0.504 ** (0.230) |

| Western Regions | ||||

| effects_in | 0.038 (0.698) | 0.021 (0.026) | −0.063 (0.052) | 0.066 ** (0.027) |

| effects_sta | −0.491 (0.623) | −0.238 (0.192) | −0.382 * (0.229) | −0.109 (0.217) |

| effects_dyna | 0.431 *** (0.150) | −0.042 (0.101) | 0.234 *** (0.072) | 0.194 *** (0.053) |

| National Regions Variables | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|

| effects_in | 0.004 (0.005) | −0.002 (0.002) | 0.244 *** (0.072) | 0.096* (0.049) |

| effects_sta | −2.824 * (1.228) | 1.325 (0.322) | −1.741 *** (0.429) | −0.424 (0.565) |

| effects_dyna | 0.233 (0.251) | −0.261 ** (0.107) | 0.460 *** (0.130) | −0.255 ** (0.126) |

| Eastern Regions | ||||

| effects_in | 0.006 (0.005) | −0.002 (0.003) | 0.492 *** (0.083) | −0.087 * (0.047) |

| effects_sta | −2.937 ** (1.263) | −0.592 (0.4666) | −0.127 (0.391) | −0.393 (0.429) |

| effects_dyna | 0.999 *** (0.366) | −0.091 (0.313) | 0.478 *** (0.178) | 0.430 *** (0.135) |

| Central Regions | ||||

| effects_in | −0.521 * (0.309) | 0.008 * (0.119) | −0.323 ** (0.126) | 0.057 (0.072) |

| effects_sta | −1.990 (2.377) | −0.566 (0.927) | −2.941 ** (1.275) | 0.012 (1.097) |

| effects_dyna | 0.655 (0.514) | 0.049 (0.640) | 0.890 ** (0.350) | 0.778 ** (0.395) |

| Western Regions | ||||

| effects_in | −0.188 (0.192) | 0.156 ** (0.064) | −0.505 *** (0.171) | −0.062 (0.059) |

| effects_sta | −1.484 (1.950) | −0.469 (0.478) | −1.315 * (0.716) | −0.085 (0.795) |

| effects_dyna | 0.075 (0.470) | 0.626 ** (0.250) | 0.312 (0.218) | 0.138 (0.170) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, Y.; Xiao, J.; Cheng, J. Industrial Structure Adjustment and Regional Green Development from the Perspective of Mineral Resource Security. Int. J. Environ. Res. Public Health 2020, 17, 6978. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph17196978

Zheng Y, Xiao J, Cheng J. Industrial Structure Adjustment and Regional Green Development from the Perspective of Mineral Resource Security. International Journal of Environmental Research and Public Health. 2020; 17(19):6978. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph17196978

Chicago/Turabian StyleZheng, You, Jianzhong Xiao, and Jinhua Cheng. 2020. "Industrial Structure Adjustment and Regional Green Development from the Perspective of Mineral Resource Security" International Journal of Environmental Research and Public Health 17, no. 19: 6978. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph17196978