Does Fiscal Stress Improve the Environmental Efficiency? Perspective Based on the Urban Horizontal Fiscal Imbalance

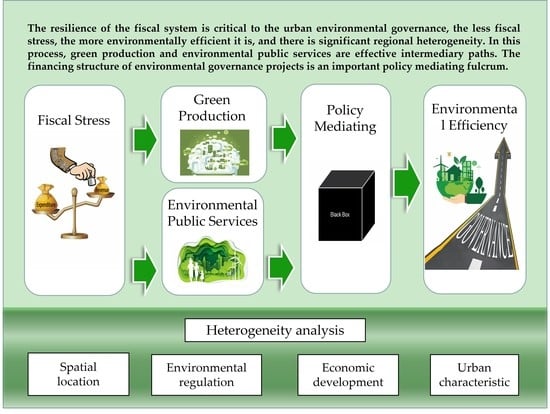

Abstract

:1. Introduction

2. Literature Review

3. Methodology and Data

3.1. Model Setting

3.1.1. Random-Effect Model for Testing Baseline Regression

3.1.2. Instrumental Variable Model for Dealing with the Endogeneity

3.1.3. Stepwise Regression Models for Testing Mediation Effects

3.1.4. Interaction Term Regression Model for Testing Moderating Effects

3.2. Variable Description

3.2.1. Independent Variables

3.2.2. Dependent Variable and Moderator Variables

3.2.3. Instrumental Variable and Moderator Variables

3.3. Data Source and Application

4. Results

4.1. Baseline Regression

4.2. Endogenous Test

4.3. Robustness Test

5. Discussion

5.1. Analysis of Heterogeneity

5.1.1. Spatial Location Factors

5.1.2. Environmental Regulation Factors

5.1.3. Economic Development Factors

5.1.4. Urban Characteristic Factors

5.2. Mediating Effect and Moderating Effect

5.2.1. Mediating Effect

5.2.2. Moderating Effect

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lingyan, M.; Zhao, Z.; Malik, H.A.; Razzaq, A.; An, H.; Hassan, M. Asymmetric impact of fiscal decentralization and environmental innovation on carbon emissions: Evidence from highly decentralized countries. Energy Environ. 2021, 33, 752–782. [Google Scholar] [CrossRef]

- Huang, C.; Wang, J.W.; Wang, C.M.; Cheng, J.H.; Dai, J. Does tourism industry agglomeration reduce carbon emissions? Environ. Sci. Pollut. Res. 2021, 28, 30278–30293. [Google Scholar] [CrossRef] [PubMed]

- Yuan, X.C.; Sun, X.; Zhao, W.; Mi, Z.; Wang, B.; Wei, Y.M. Forecasting China’s regional energy demand by 2030: A Bayesian approach. Resour. Conserv. Recy 2017, 127, 85–95. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Zhang, H. Could environmental regulation and R&D tax incentives affect green product innovation? J. Clean. Prod. 2020, 258, 120849. [Google Scholar]

- Cheng, S.; Fan, W.; Chen, J.; Meng, F.; Liu, G.; Song, M.; Yang, Z. The impact of fiscal decentralisation on CO2 emissions in China. Energy 2020, 192, 116685. [Google Scholar] [CrossRef]

- Yuan, H.; Feng, Y.; Lee, C.; Cen, Y. How does manufacturing agglomeration affect green economic efficiency? Energy Econ. 2020, 92, 104944. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Dong, K.; Li, R.Y.M. How does fiscal decentralisation affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 2021, 94, 60. [Google Scholar] [CrossRef]

- Lin, B.; Zhou, Y. Does fiscal decentralization improve energy and environmental performance? New perspective on vertical fiscal imbalance. Appl. Energy 2021, 302, 117495. [Google Scholar] [CrossRef]

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Change 2021, 162, 120398. [Google Scholar] [CrossRef]

- Wang, Q.S.; Su, C.W.; Hua, Y.F.; Umar, M. Can fiscal decentralisation regulate the impact of industrial structure on energy efficiency? Econ. Res.-Ekon. Istraz. 2021, 34, 1727–1751. [Google Scholar] [CrossRef]

- Sun, Y.; Razzaq, A. Composite fiscal decentralisation and green innovation: Imperative strategy for institutional reforms and sustainable development in OECD countries. Sustain. Dev. 2022, 1–14. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Mamingi, N.; Wang, H. Inspections, pollution prices, and environmental performance: Evidence from China. Ecol. Econ. 2001, 36, 487–498. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J. Do environmental regulations cost jobs? An industry-level analysis of the UK. BE. J. Econ. Anal. Policy 2007, 7, 28–48. [Google Scholar] [CrossRef]

- Ogawa, H.; Wildasin, D.E. Think locally, act locally: Spillovers, spillbacks and efficient decentralized policy making. Am. Econ. Rev. 2009, 99, 1206–1217. [Google Scholar] [CrossRef] [Green Version]

- Guo, J.; Bai, J.H. The role of public participation in environmental governance: Empirical evidence from China. Sustainability 2019, 11, 4696. [Google Scholar] [CrossRef] [Green Version]

- Bian, J.; Zhang, Y.; Shuai, C.; Shen, L.; Ren, H.; Wang, Y. Have cities effectively improved ecological well-being performance? Empirical analysis of 278 Chinese cities. J. Clean Prod. 2020, 245, 118913. [Google Scholar] [CrossRef]

- Zhao, X.G.; Meng, X.; Zhou, Y.; Li, P.L. Policy inducement effect in energy efficiency: An empirical analysis of China. Energy 2020, 211, 148–196. [Google Scholar]

- Feng, C.; Huang, J.B.; Wang, M. Analysis of green total-factor productivity in china’s regional metal industry: A meta-frontier approach. Resour. Policy 2018, 58, 219–229. [Google Scholar] [CrossRef]

- Guo, K.; Li, S.; Wang, Z.; Shi, J.; Cheng, J. Impact of regional green development strategy on environmental total factor productivity: Evidence from the Yangtze river economic belt, China. Int. J. Environ. Res. Public Health 2021, 18, 2496. [Google Scholar] [CrossRef]

- Li, H.; Zhu, X.; Chen, J.; Jiang, F. Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecol. Econ. 2019, 165, 106397. [Google Scholar] [CrossRef]

- Chang, Y.T.; Zhang, N.; Danao, D.; Zhang, N. Environmental efficiency analysis of transportation system in china: A non-radial dea approach. Energy Policy 2013, 58, 277–283. [Google Scholar] [CrossRef]

- Li, L.B.; Hu, J.L. Ecological total-factor energy efficiency of regions in China. Energy Policy 2012, 46, 216–224. [Google Scholar] [CrossRef]

- Tao, X.; Wang, P.; Zhu, B. Provincial green economic efficiency of china: A non-separable input–output SBM approach. Appl. Energy 2016, 171, 58–66. [Google Scholar] [CrossRef]

- Lee, T.; Yeo, G.T.; Thai, V.V. Environmental efficiency analysis of port cities: Slacks-based measure data envelopment analysis approach. Transp. Policy 2014, 33, 82–88. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, Y.; Hao, Y.; Liu, Z. Shooting two hawks with one arrow: Could china’s emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ. 2021, 101, 105412. [Google Scholar] [CrossRef]

- Peng, G.; Zhang, X.; Liu, F.; Ruan, L.; Tian, K. Spatial–temporal evolution and regional difference decomposition of urban environmental governance efficiency in China. Environ. Dev. Sustain. 2021, 23, 8974–8990. [Google Scholar] [CrossRef]

- Liu, Y.; Zhu, J.; Meng, Z.; Song, Y. Environmental regulation, green technological innovation, and eco-efficiency: The case of Yangtze river economic belt in China. Technol. Forecast. Soc. Change 2020, 155, 119993. [Google Scholar] [CrossRef]

- Song, M.; Peng, J.; Wang, J.; Dong, L. Better resource management: An improved resource and environmental efficiency evaluation approach that considers undesirable outputs. Resour. Conserv. Recycl. 2018, 128, 197–205. [Google Scholar] [CrossRef]

- Zhou, Y.; Xing, X.; Fang, K.; Liang, D.; Xu, C. Environmental efficiency analysis of power industry in China based on an entropy SBM model. Energy Policy 2013, 57, 68–75. [Google Scholar] [CrossRef]

- Wu, J.; An, Q.; Yao, X.; Wang, B. Environmental efficiency evaluation of industry in China based on a new fixed sum undesirable output data envelopment analysis. J. Clean. Prod. 2014, 74, 96–104. [Google Scholar] [CrossRef]

- Wang, K.; Wei, Y.; Huang, Z. Environmental efficiency and abatement efficiency measurements of China’s thermal power industry: A data envelopment analysis based materials balance approach. Eur. J. Oper. Res. 2018, 269, 35–50. [Google Scholar] [CrossRef]

- Oates, W.E. Oates: An essay on fiscal federalism an essay on fiscal federalism. J. Econ. Lit. 1999, 37, 1120–1149. [Google Scholar] [CrossRef] [Green Version]

- Greene, J.D. Cities and privatization. Examining the effect of fiscal stress, location, and wealth in medium-sized cities. Policy Stud. J. 2010, 24, 135–144. [Google Scholar] [CrossRef]

- Musgrave, R.A. The Theory of Public Financea a Study in Public Economy; Kogakusha: Tokyo, Japan, 1959. [Google Scholar]

- Weingast, B.R. Second generation fiscal federalism: Political aspects of decentralization and economic development. World Dev. 2013, 53, 14–25. [Google Scholar] [CrossRef]

- Oates, W.E. Toward a second-generation theory of fiscal federalism. Int. Tax Public Financ. 2005, 12, 349–373. [Google Scholar] [CrossRef]

- Zhuravskaya, E.V. Incentives to provide local public goods: Fiscal federalism, Russian style. J. Public Econ. 2000, 76, 337–368. [Google Scholar] [CrossRef] [Green Version]

- Aldag, A.M.; Kim, Y.; Warner, M.E. Austerity urbanism or pragmatic municipalism? Local government responses to fiscal stress in New York State. Environ. Plan. A 2019, 51, 1287–1305. [Google Scholar] [CrossRef]

- Peck, J. Austerity urbanism American cities under extreme economy. City 2012, 16, 626–655. [Google Scholar] [CrossRef]

- Warner, M.E.; Aldag, A.M.; Kim, Y. Pragmatic municipalism: US local government responses to fiscal stress. Public Admin. Rev. 2020, 80, 389–398. [Google Scholar] [CrossRef]

- Pandey, S.K. Cutback management and the paradox of publicness. Public Admin. Rev. 2010, 70, 564–571. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. Fiscal spending and green economic growth: Evidence from china. Energy Econ. 2019, 83, 264–271. [Google Scholar] [CrossRef]

- Song, M.; Du, J.; Tan, K.H. Impact of fiscal decentralization on green total factor productivity. Int. J. Prod. Econ. 2018, 205, 359–367. [Google Scholar] [CrossRef]

- Guo, S.; Wen, L.; Wu, Y.; Yue, X.; Fan, G. Fiscal decentralization and local environmental pollution in china. Int. J. Environ. Res. Public Health 2020, 17, 8661. [Google Scholar] [CrossRef]

- Li, T.; Du, T. Vertical fiscal imbalance, transfer payments, and fiscal sustainability of local governments in china. Int. Rev. Econ. Financ. 2021, 74, 392–404. [Google Scholar] [CrossRef]

- Jia, J.; Liu, Y.; Martinez-Vazquez, J.; Zhang, K. Vertical fiscal imbalance and local fiscal indiscipline: Empirical evidence from china. Eur. J. Political Econ. 2021, 68, 101992. [Google Scholar] [CrossRef]

- Bellofatto, A.A.; Besfamille, M. Regional state capacity and the optimal degree of fiscal decentralization. J. Public Econ. 2018, 159, 225–243. [Google Scholar] [CrossRef] [Green Version]

- Ehrenfeld, J.R. Eco-efficiency: Philosophy, theory, and tools. J. Ind. Ecol. 2005, 9, 6–8. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Førsund, F.R.; Sarafoglou, N. On the origins of data envelopment analysis. J. Product. Anal. 2002, 17, 23–40. [Google Scholar] [CrossRef]

- Bian, Y.; Feng, Y. Resource and environment efficiency analysis of provinces in China: A DEA approach based on Shannon’s entropy. Energy Policy 2010, 38, 1909–1917. [Google Scholar] [CrossRef]

- Du, J.; Liang, L.; Zhu, J. A slacks-based measure of super-efficiency in data envelopment analysis: A comment. Eur. J. Oper. Res. 2010, 204, 694–697. [Google Scholar] [CrossRef]

- Barros, C.P.; Wanke, P. Efficiency in Angolan thermal power plants: Evidence from cost structure and pollutant emissions. Energy 2017, 130, 129–143. [Google Scholar] [CrossRef]

- Caves, D.W.; Christensen, L.R.; Diewert, W.E. Multilateral comparisons of output, input, and productivity using superlative index numbers. Econ. J. 1982, 92, 73–86. [Google Scholar] [CrossRef]

| Item | Specific Data Name | GTFP | PESE | EE |

|---|---|---|---|---|

| Input | Labor force employment | √ | − | √ |

| Capital Stock | √ | − | − | |

| Fixed Assets Investment | − | − | √ | |

| Total electricity consumption | √ | − | √ | |

| Total water consumption | − | − | √ | |

| Public environmental service practitioners | − | √ | − | |

| Fixed Assets Investment in public environmental services a | − | √ | − | |

| Public environmental service construction land b | − | √ | − | |

| Desirable output | GDP | √ | − | √ |

| Utilization rate of general industrial solid waste | − | − | √ | |

| Road clearance area | − | √ | √ | |

| Total length of drainage pipe | − | √ | √ | |

| Total sewage treatment | − | √ | √ | |

| Amount of dry sludge disposal | − | √ | √ | |

| Harmless disposal amount of household garbage | − | √ | √ | |

| Green area of park | − | √ | √ | |

| Undesirable output | Discharge of industrial wastewater | √ | − | √ |

| Industrial sulfur dioxide emissions | √ | − | √ | |

| Industrial soot emission | √ | − | √ |

| Variables | N | Mean | Sd. | Min | Max |

|---|---|---|---|---|---|

| EE | 1158 | 0.8145 | 0.3177 | 0.0008 | 2.9989 |

| FS | 1158 | 0.5346 | 0.2248 | 0.1152 | 1.5968 |

| PG | 1158 | 2.3436 | 1.4383 | −3.2189 | 7.1405 |

| RT | 1158 | 0.4264 | 0.0993 | 0.1644 | 0.8098 |

| RW | 1158 | 0.4118 | 0.1348 | 0.0514 | 0.9437 |

| RE | 1158 | 0.6618 | 0.1563 | 0.1190 | 0.9724 |

| EG | 1158 | 0.0682 | 0.1369 | −0.9999 | 1.5473 |

| CA | 1158 | 9.2328 | 0.8106 | 7.0909 | 11.4078 |

| GC | 1158 | 0.4094 | 0.0415 | 0.1476 | 0.5811 |

| RAPC | 1158 | 1.6711 | 0.5534 | 0.4291 | 4.6356 |

| GTFP | 1158 | 0.4277 | 0.2464 | 0.0557 | 1.9966 |

| PESE | 1158 | 0.2519 | 0.3947 | 0.0051 | 9.5701 |

| FF | 1158 | 0.3218 | 0.3059 | 0.0000 | 1.0000 |

| SF | 1158 | 0.3150 | 0.2904 | 0.0000 | 1.0000 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| RE | FE | RE | FE | RE | FGLS | |

| EE | EE | EE | EE | EE | EE | |

| FS | 0.1481 ** | 0.2128 ** | 0.1290 ** | 0.0386 * | 0.1290 ** | 0.1204 *** |

| (0.0611) | (0.0965) | (0.0628) | (0.0987) | (0.0604) | (0.0300) | |

| PG | −0.0420 *** | −0.0084 * | −0.0420 *** | −0.0448 *** | ||

| (0.0061) | (0.0119) | (0.0074) | (0.0046) | |||

| RT | −0.3207 *** | −0.1812 * | −0.3207 *** | 0.0339 | ||

| (0.1128) | (0.2024) | (0.1219) | (0.0723) | |||

| RW | 0.2873 *** | 0.3632 *** | 0.2873 *** | 0.3212 *** | ||

| (0.0829) | (0.0976) | (0.0982) | (0.0554) | |||

| RE | −0.4401 *** | −0.2718 ** | −0.4401 *** | −0.5248 *** | ||

| (0.0805) | (0.1071) | (0.0958) | (0.0439) | |||

| EG | 0.1234 ** | 0.0671 | 0.1234 * | 0.1363 ** | ||

| (0.0518) | (0.0506) | (0.0849) | (0.0633) | |||

| GC | −0.2989 | −0.1218 | −0.2989 | −0.6442 *** | ||

| (0.2615) | (0.3054) | (0.3672) | (0.1884) | |||

| CA | −0.0339 * | 0.0868 * | −0.0339 * | −0.0480 *** | ||

| (0.0196) | (0.0832) | (0.0253) | (0.0086) | |||

| _cons | 0.7353 *** | 0.7008 *** | 1.5810 *** | 0.3269 * | 1.5810 *** | 1.7726 *** |

| (0.0368) | (0.0520) | (0.2410) | (0.7933) | (0.3104) | (0.1298) | |

| Hausman p-value | 0.3864 | 0.6451 | ||||

| N | 1158 | 1158 | 1158 | 1158 | 1158 | 1158 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| 2SLS | LIML | GMM | IGMM | |

| EE | EE | EE | EE | |

| FS | 0.3358 *** | 0.3454 *** | 0.3405 *** | 0.3397 *** |

| (0.0886) | (0.0909) | (0.0890) | (0.0890) | |

| PG | −0.0512 *** | −0.0511 *** | −0.0487 *** | −0.0484 *** |

| (0.0079) | (0.0079) | (0.0079) | (0.0079) | |

| RT | −0.1268 | −0.1341 | −0.1306 | −0.1271 |

| (0.1199) | (0.1212) | (0.1203) | (0.1203) | |

| RW | 0.3842 *** | 0.3875 *** | 0.3684 *** | 0.3645 *** |

| (0.0820) | (0.0823) | (0.0821) | (0.0821) | |

| RE | −0.4856 *** | −0.4861 *** | −0.4940 *** | −0.4963 *** |

| (0.0697) | (0.0698) | (0.0701) | (0.0701) | |

| EG | 0.1510 | 0.1509 | 0.0678 | 0.0555 |

| (0.0977) | (0.0977) | (0.0979) | (0.0986) | |

| GC | −0.6682 ** | −0.6784 ** | −0.6638 ** | −0.6508 ** |

| (0.2698) | (0.2707) | (0.2706) | (0.2706) | |

| CA | −0.0203 | −0.0196 | −0.0161 | −0.0164 |

| (0.0149) | (0.0150) | (0.0149) | (0.0149) | |

| _cons | 1.4233 *** | 1.4172 *** | 1.3889 *** | 1.3882 *** |

| (0.2082) | (0.2089) | (0.2080) | (0.2079) | |

| N | 1158 | 1158 | 1158 | 1158 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Planning Cycle | Political Cycle | International Trade | Administrative Level | Measured Deviation | |

| EE | EE | EE | EE | EE | |

| FS | 0.1222 *** | 0.1346 *** | 0.1225 *** | 0.0734 * | 0.1163 *** |

| (0.0328) | (0.0370) | (0.0247) | (0.0403) | (0.0042) | |

| PG | −0.0450 *** | −0.0449 *** | −0.0483 *** | −0.0577 *** | −0.0500 *** |

| (0.0049) | (0.0050) | (0.0055) | (0.0052) | (0.0046) | |

| RT | −0.0017 | −0.0201 | −0.0753 | −0.1938** | 0.0696 |

| (0.0807) | (0.0827) | (0.0592) | (0.0863) | (0.0654) | |

| RW | 0.3164 *** | 0.3297 *** | 0.2751 *** | 0.3819 *** | 0.3176 *** |

| (0.0604) | (0.0591) | (0.0456) | (0.0595) | (0.0537) | |

| RE | −0.5003 *** | −0.4942 *** | −0.5235 *** | −0.5360 *** | −0.5076 *** |

| (0.0494) | (0.0455) | (0.0341) | (0.0489) | (0.0420) | |

| EG | 0.1637 ** | 0.1481 ** | 0.1273 ** | 0.1131 * | 0.1340 ** |

| (0.0702) | (0.0725) | (0.0579) | (0.0646) | (0.0625) | |

| GC | −0.7881 *** | −0.5660 *** | −0.6504 *** | −0.4577 ** | −0.5094 *** |

| (0.2082) | (0.1927) | (0.1664) | (0.2086) | (0.1846) | |

| CA | −0.0576 *** | −0.0362 *** | −0.0417 *** | −0.0674 *** | −0.0610 *** |

| (0.0096) | (0.0091) | (0.0081) | (0.0094) | (0.0091) | |

| _cons | 1.9323 *** | 1.6226 *** | 1.7964 *** | 1.9939 *** | 1.8644 *** |

| (0.1439) | (0.1339) | (0.1141) | (0.1387) | (0.1294) | |

| N | 965 | 965 | 965 | 1056 | 1158 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Baseline | North Cities | South Cities | Eastern Region | Western Region | |

| EE | EE | EE | EE | EE | |

| FS | 0.1204 *** | 0.0287 | 0.1572 *** | 0.1163 ** | 0.0802 |

| (0.0300) | (0.0392) | (0.0434) | (0.0583) | (0.0580) | |

| PG | −0.0448 *** | −0.0261 *** | −0.0634 *** | −0.0477 *** | −0.0147 * |

| (0.0046) | (0.0042) | (0.0062) | (0.0058) | (0.0091) | |

| RT | 0.0339 | −0.1764 ** | 0.2225 ** | 0.1166 | −0.3439 ** |

| (0.0723) | (0.0850) | (0.1015) | (0.1158) | (0.1462) | |

| RW | 0.3212 *** | 0.3900 *** | 0.3708 *** | 0.2561 *** | 0.4894 *** |

| (0.0554) | (0.0492) | (0.0861) | (0.0778) | (0.1028) | |

| RE | −0.5248 *** | −0.3101 *** | −0.7125 *** | −0.6731 *** | −0.2959 *** |

| (0.0439) | (0.0584) | (0.0631) | (0.0734) | (0.0752) | |

| EG | 0.1363 ** | 0.1316 *** | 0.1179 * | 0.0825 * | 0.0700 * |

| (0.0633) | (0.0440) | (0.1055) | (0.0506) | (0.0730) | |

| GC | −0.6442 *** | −0.2295 | −0.5291 ** | 0.0633 * | 0.1155 ** |

| (0.1884) | (0.1890) | (0.2279) | (0.2213) | (0.5294) | |

| CA | −0.0480 *** | −0.0573 *** | −0.0508 *** | −0.0741 *** | −0.0798 *** |

| (0.0086) | (0.0151) | (0.0116) | (0.0156) | (0.0166) | |

| Constant | 1.7726 *** | 1.6862 *** | 1.7136 *** | 1.7870 *** | 1.7267 *** |

| (0.1298) | (0.1794) | (0.1720) | (0.1934) | (0.2851) | |

| N | 1158 | 498 | 660 | 882 | 276 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Baseline | APTC | NAPTC | YRB | NYRB | |

| EE | EE | EE | EE | EE | |

| FS | 0.1204 *** | 0.1803 ** | 0.1083 *** | 0.1812 *** | 0.0967 ** |

| (0.0300) | (0.0843) | (0.0364) | (0.0457) | (0.0420) | |

| PG | −0.0448 *** | −0.0460 *** | −0.0571 *** | −0.0525 *** | −0.0478 *** |

| (0.0046) | (0.0082) | (0.0053) | (0.0064) | (0.0069) | |

| RT | 0.0339 | −0.0996 | 0.4501 *** | 0.1748 | −0.1229 |

| (0.0723) | (0.1441) | (0.0880) | (0.1228) | (0.0940) | |

| RW | 0.3212 *** | 0.5604 *** | 0.5692 *** | 0.3420 *** | 0.4313 *** |

| (0.0554) | (0.0919) | (0.0675) | (0.0966) | (0.0671) | |

| RE | −0.5248 *** | −0.5359 *** | −0.3352 *** | −0.8461 *** | −0.3990 *** |

| (0.0439) | (0.1116) | (0.0486) | (0.0723) | (0.0550) | |

| EG | 0.1363 ** | 0.0460 | 0.1228 | 0.1632 | 0.1603 ** |

| (0.0633) | (0.0546) | (0.0811) | (0.1263) | (0.0659) | |

| GC | −0.6442 *** | 0.5980 | 0.3885 ** | 0.0054 | −0.6928 *** |

| (0.1884) | (0.3768) | (0.1767) | (0.2701) | (0.2590) | |

| CA | −0.0480 *** | −0.0856 *** | 0.0548 *** | −0.0552 *** | −0.0748 *** |

| (0.0086) | (0.0187) | (0.0077) | (0.0127) | (0.0114) | |

| Constant | 1.7726 *** | 1.6680 *** | 1.2170 *** | 1.6293 *** | 2.0433 *** |

| (0.1298) | (0.2842) | (0.1842) | (0.1899) | (0.1749) | |

| N | 1158 | 294 | 864 | 486 | 672 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Per_GDP | GDP | ||||

| Baseline | Low Rank | High Rank | Low Rank | High Rank | |

| EE | EE | EE | EE | EE | |

| FS | 0.1204 *** | 0.0730 | 0.1513 *** | 0.5161 | 0.1312 * |

| (0.0300) | (1.2753) | (0.0467) | (1.3965) | (0.0676) | |

| PG | −0.0448 *** | −0.1106 *** | −0.0349 *** | −0.0819 | −0.0496 *** |

| (0.0046) | (0.0388) | (0.0053) | (0.0553) | (0.0086) | |

| RT | 0.0339 | −0.7124 | 0.3193 *** | −1.4834 | 0.1145 |

| (0.0723) | (0.7559) | (0.0805) | (1.3897) | (0.1439) | |

| RW | 0.3212 *** | 1.2468 | 0.2378 *** | 0.6144 | 0.3429 *** |

| (0.0554) | (0.9636) | (0.0835) | (0.5032) | (0.1114) | |

| RE | −0.5248 *** | −1.2396 * | −0.4669 *** | −1.3706 * | −0.4229 *** |

| (0.0439) | (0.6635) | (0.0613) | (0.7484) | (0.0954) | |

| EG | 0.1363 ** | 0.1343 | 0.0461 | −0.0644 | 0.1084 |

| (0.0633) | (0.1426) | (0.0788) | (0.2483) | (0.0994) | |

| GC | −0.6442 *** | −2.2307 | −0.0153 | −0.8478 | 0.2937 |

| (0.1884) | (1.7913) | (0.2454) | (2.7893) | (0.3098) | |

| CA | −0.0480 *** | 0.4766 | −0.0004 | 0.1291 | −0.0207 |

| (0.0086) | (0.3154) | (0.0107) | (0.1986) | (0.0168) | |

| Constant | 1.7726 *** | −2.4801 | 0.9166 *** | 1.3547 | 1.0154 *** |

| (0.1298) | (3.3391) | (0.1590) | (1.8728) | (0.2551) | |

| N | 1158 | 582 | 576 | 582 | 576 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Baseline | Resource-Based Cities | Non-Resource Cities | Urban Agglomerations | Non-Urban Agglomerations | |

| EE | EE | EE | EE | EE | |

| FS | 0.1204 *** | 0.0155 | 0.1406 *** | 0.1553 *** | 0.0961 |

| (0.0300) | (0.0978) | (0.0337) | (0.0479) | (0.0658) | |

| PG | −0.0448 *** | −0.0609 *** | −0.0383 *** | −0.0246 *** | −0.0638 *** |

| (0.0046) | (0.0115) | (0.0051) | (0.0059) | (0.0090) | |

| RT | 0.0339 | −0.4096 ** | 0.2271 *** | 0.0842 | −0.0737 |

| (0.0723) | (0.1894) | (0.0851) | (0.0913) | (0.1340) | |

| RW | 0.3212 *** | 0.5201 *** | 0.1733 ** | 0.3568 *** | 0.3213 *** |

| (0.0554) | (0.1221) | (0.0761) | (0.0897) | (0.0939) | |

| RE | −0.5248 *** | −0.4055 *** | −0.4933 *** | −0.7865 *** | −0.3856 *** |

| (0.0439) | (0.1180) | (0.0606) | (0.0754) | (0.0766) | |

| EG | 0.1363 ** | 0.2241 ** | 0.1343 * | 0.0627 | 0.1713 ** |

| (0.0633) | (0.1025) | (0.0775) | (0.0894) | (0.0817) | |

| GC | −0.6442 *** | −0.1993 | −0.8038 *** | −0.4809 * | −0.5842 ** |

| (0.1884) | (0.4072) | (0.2239) | (0.2511) | (0.2879) | |

| CA | −0.0480 *** | −0.0194 | −0.0322 *** | −0.0376 *** | −0.0381 ** |

| (0.0086) | (0.0181) | (0.0106) | (0.0111) | (0.0153) | |

| _cons | 1.7726 *** | 1.4002 *** | 1.6195 *** | 1.6856 *** | 1.6437 *** |

| (0.1298) | (0.2879) | (0.1589) | (0.1601) | (0.2255) | |

| N | 1158 | 438 | 720 | 420 | 738 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Baseline | Paths I | Paths II | |||

| EE | GTFP | EE | PESE | EE | |

| FS | 0.1204 *** | 0.3081 *** | 0.0232 | 0.1075 *** | 0.0820 *** |

| (0.0300) | (0.0203) | (0.0344) | (0.0168) | (0.0257) | |

| GTFP | 0.4054 *** | ||||

| (0.0249) | |||||

| PESE | 0.1107 *** | ||||

| (0.0120) | |||||

| PG | −0.0448 *** | 0.0016 | −0.0531 *** | −0.0043 * | −0.0346 *** |

| (0.0046) | (0.0024) | (0.0046) | (0.0024) | (0.0026) | |

| RT | 0.0339 | 0.0212 | 0.1162 | 0.1720 *** | 0.0236 |

| (0.0723) | (0.0385) | (0.0729) | (0.0390) | (0.0456) | |

| RW | 0.3212 *** | 0.0106 | 0.5683 *** | −0.0300 | 0.3067 *** |

| (0.0554) | (0.0240) | (0.0564) | (0.0222) | (0.0324) | |

| RE | −0.5248 *** | −0.3677 *** | −0.1071 ** | 0.0489 ** | −0.3736 *** |

| (0.0439) | (0.0225) | (0.0439) | (0.0205) | (0.0326) | |

| EG | 0.1363 ** | 0.1241 *** | 0.0487 | 0.0187 | 0.0841 *** |

| (0.0633) | (0.0222) | (0.0555) | (0.0261) | (0.0292) | |

| GC | −0.6442 *** | −0.1900 *** | 0.5709 *** | 0.1535 * | −0.3394 ** |

| (0.1884) | (0.0705) | (0.1435) | (0.0898) | (0.1497) | |

| CA | −0.0480 *** | 0.0010 | 0.0339 *** | −0.0454 *** | −0.0525 *** |

| (0.0086) | (0.0037) | (0.0064) | (0.0048) | (0.0114) | |

| _cons | 1.7726 *** | 0.5096 *** | 0.9841 *** | 0.3957 *** | 1.5709 *** |

| (0.1298) | (0.0529) | (0.1366) | (0.0650) | (0.1311) | |

| N | 1158 | 1158 | 1158 | 1158 | 1158 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| EE | EE | EE | EE | |

| FS | 0.1013 *** | 0.0939 *** | 0.0637 * | 0.0755 ** |

| (0.0246) | (0.0313) | (0.0330) | (0.0308) | |

| M1 (FS * GTFP * FF) | 0.1551 *** | |||

| (0.0307) | ||||

| M2 (FS * PESE * FF) | 0.3600 | |||

| (0.0801) | ||||

| M3 (FS * GTFP * SF) | 0.3118 *** | |||

| (0.0662) | ||||

| M4 (FS * PESE * SF) | 0.4689 *** | |||

| (0.0570) | ||||

| PG | −0.0356 *** | −0.0457 *** | −0.0453 *** | −0.0440 *** |

| (0.0026) | (0.0046) | (0.0044) | (0.0046) | |

| RT | −0.0001 | −0.0070 | 0.0020 | −0.0103 |

| (0.0475) | (0.0752) | (0.0747) | (0.0741) | |

| RW | 0.3280 *** | 0.3401 *** | 0.3226 *** | 0.3333 *** |

| (0.0337) | (0.0557) | (0.0555) | (0.0542) | |

| RE | −0.3941 *** | −0.5427 *** | −0.5512 *** | −0.5708 *** |

| (0.0318) | (0.0447) | (0.0450) | (0.0441) | |

| EG | 0.0971 *** | 0.1367 ** | 0.1206 * | 0.1278 ** |

| (0.0317) | (0.0635) | (0.0616) | (0.0636) | |

| GC | −0.3209 ** | −0.6028 *** | −0.5719 *** | −0.6301 *** |

| (0.1524) | (0.1895) | (0.1873) | (0.1854) | |

| CA | −0.0516 *** | −0.0454 *** | −0.0486 *** | −0.0436 *** |

| (0.0094) | (0.0088) | (0.0084) | (0.0086) | |

| _cons | 1.5938 *** | 1.7545 *** | 1.7878 *** | 1.7716 *** |

| (0.1193) | (0.1289) | (0.1269) | (0.1296) | |

| N | 1158 | 1158 | 1158 | 1158 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Y.; Zhu, D.; Zhang, Z.; Yan, N. Does Fiscal Stress Improve the Environmental Efficiency? Perspective Based on the Urban Horizontal Fiscal Imbalance. Int. J. Environ. Res. Public Health 2022, 19, 6268. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph19106268

Sun Y, Zhu D, Zhang Z, Yan N. Does Fiscal Stress Improve the Environmental Efficiency? Perspective Based on the Urban Horizontal Fiscal Imbalance. International Journal of Environmental Research and Public Health. 2022; 19(10):6268. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph19106268

Chicago/Turabian StyleSun, Youshuai, Demi Zhu, Zhenyu Zhang, and Na Yan. 2022. "Does Fiscal Stress Improve the Environmental Efficiency? Perspective Based on the Urban Horizontal Fiscal Imbalance" International Journal of Environmental Research and Public Health 19, no. 10: 6268. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph19106268