Gold against Asian Stock Markets during the COVID-19 Outbreak

Abstract

:1. Introduction

2. Literature Review

2.1. Gold and Stock Markets

2.2. Gold and Financial Markets during the COVID-19 Outbreak

3. Methods

3.1. Time-Varying Correlations Based on the DCC-GARCH Model

3.2. Diversification, Hedge, and Safe-Haven Properties of Gold Using Regression Analyses

3.3. Optimal Weights, Hedge Ratios and Hedging Effectiveness

3.3.1. Optimal Weights

3.3.2. Optimal Hedge Ratios

3.3.3. Hedging Effectiveness

3.3.4. Determinants of the Hedge Portfolio Returns

- (1)

- The VIX is the US stock market’s expectation of 30-day volatility. Higher levels of the VIX have larger impacts on the stock index than on gold prices, which leads to a reduction in the hedge portfolio return. Therefore, we expect a negative sign for the DVIX.

- (2)

- The GVZ is the gold market’s expectation of 30-day volatility. Higher levels of the GVZ have larger positive impacts on gold prices than on stock prices, due to the safe haven property of gold. This in turn leads to a reduction in the hedge portfolio return. Therefore, we expect a negative sign for the DGVZ.

- (3)

- Constructed by Baker et al. (2016), the US EPU is widely used in empirical studies that indicate a negative relationship between EPU and stock markets (Brogaard and Detzel 2015). Conversely, a positive relationship exists between EPU and gold prices (Gao and Zhang 2016). Therefore, we expect a negative sign for the DEPU.

- (4)

- We use inflation expectation which is measured by the difference between 10-year Treasuries and 10-year Treasury Inflation-Protected Security (TIPS) yields. Higher levels of inflation can lead to an increase in the interest rates which in turn can reduces stock prices. Conversely, higher inflation rates and thus higher interest rates make gold more appealing to investors which in turn leads to increase in its prices. Therefore, a positive sign is expected for the DInflation.

- (5)

- The GRA index is recently constructed by Bekaert et al. (2019). It is a time-varying daily index that reflects the risk appetite computed from observable financial information at high frequencies. Generally, risk aversion is inversely related with stock prices. However, it is positively related with gold prices given that gold is seen as a hedge and safe have asset (Beckmann et al. 2015; Shahzad et al. 2020). Therefore, a neutral sign is expected for the DGRA.

4. Data and Preliminary Analysis

4.1. Data

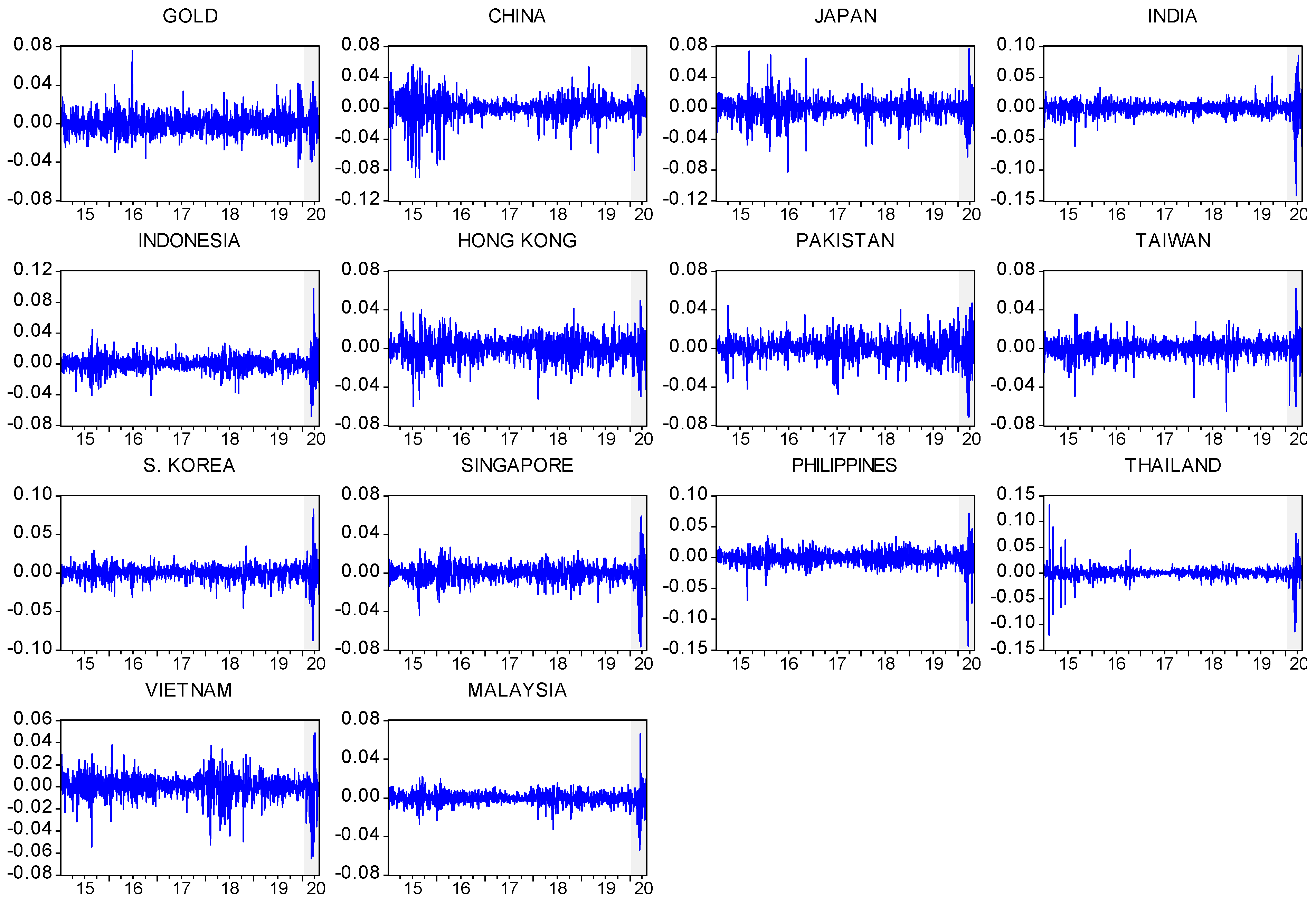

4.2. Preliminary Analysis

5. Empirical Findings

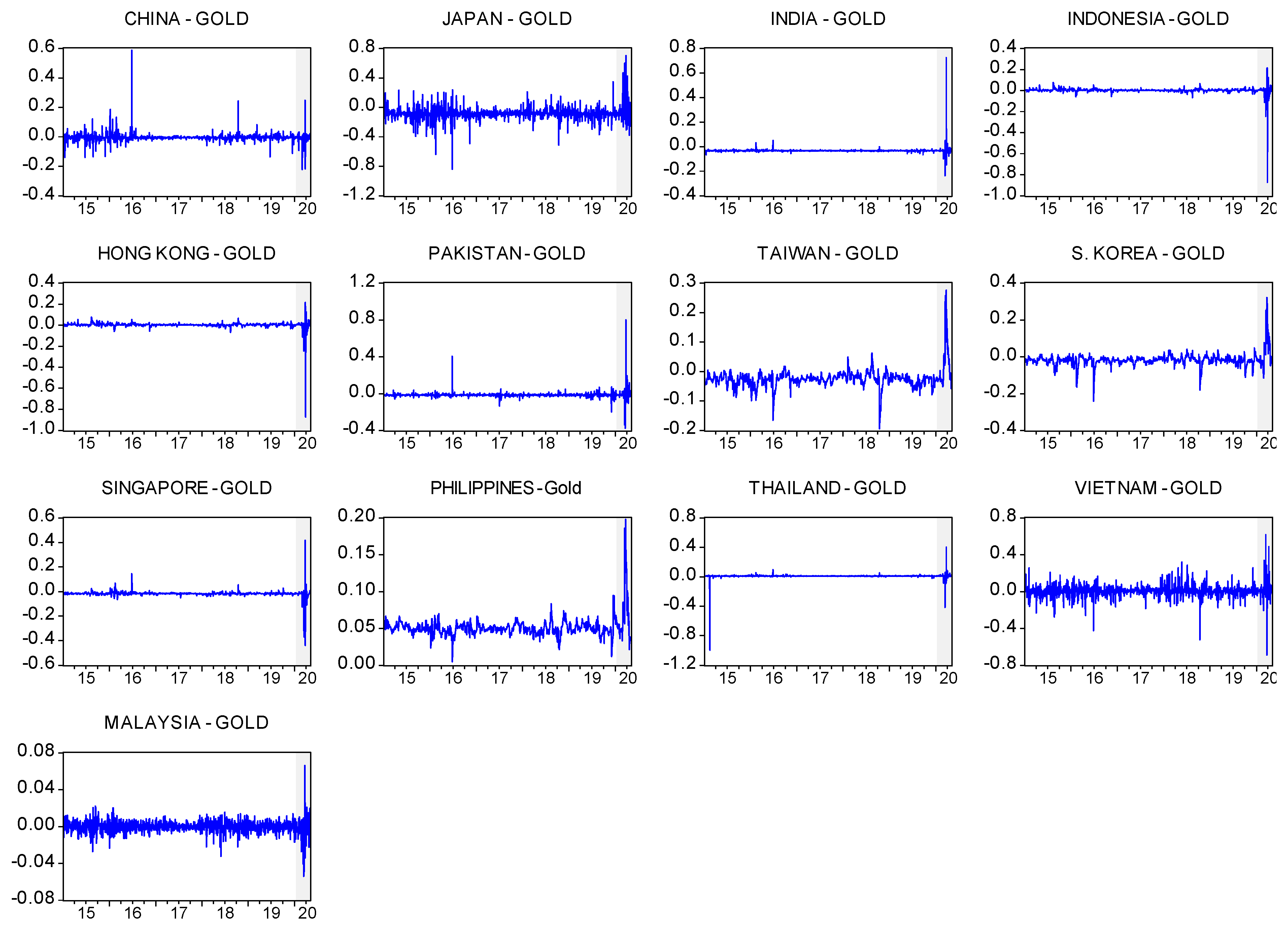

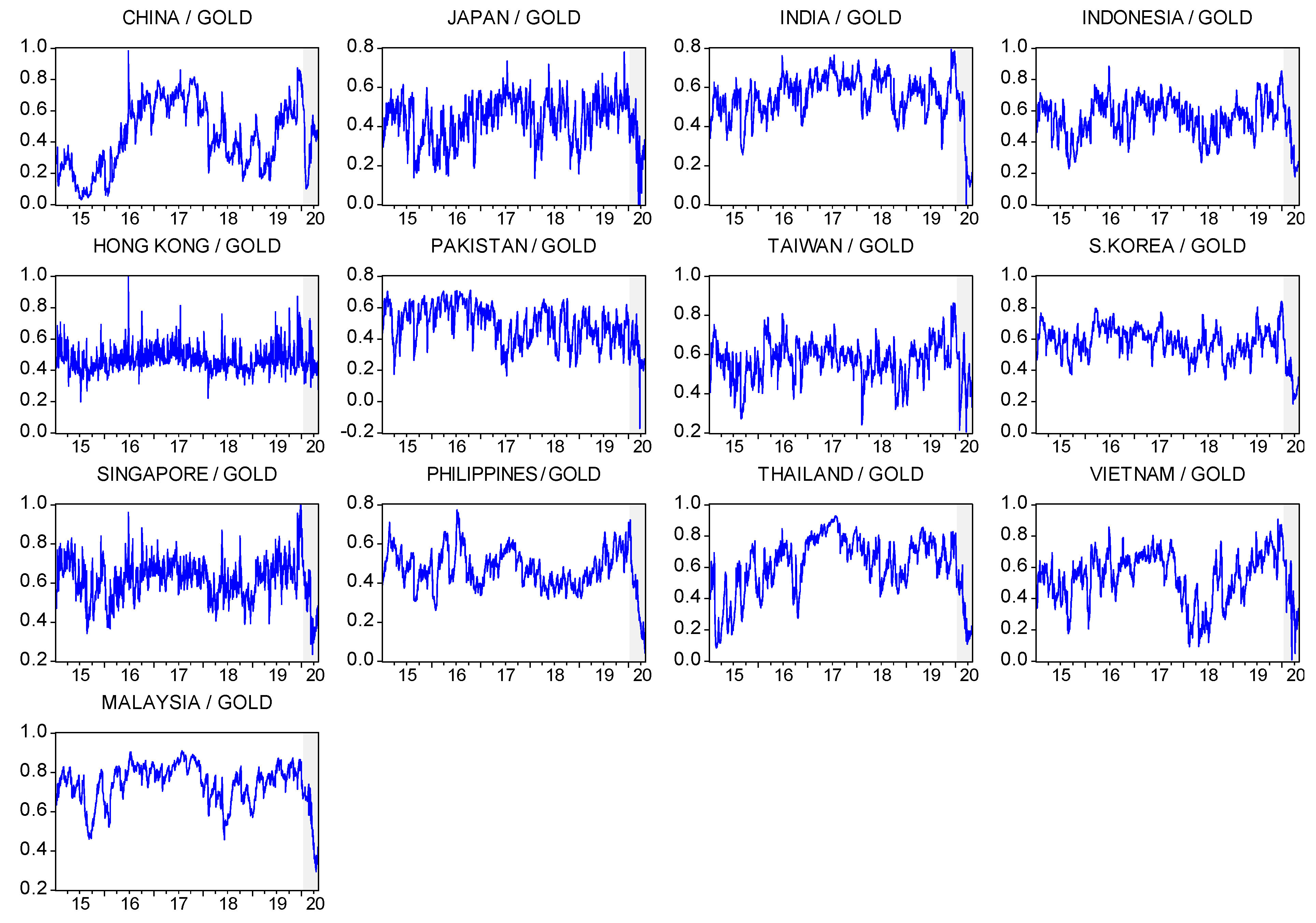

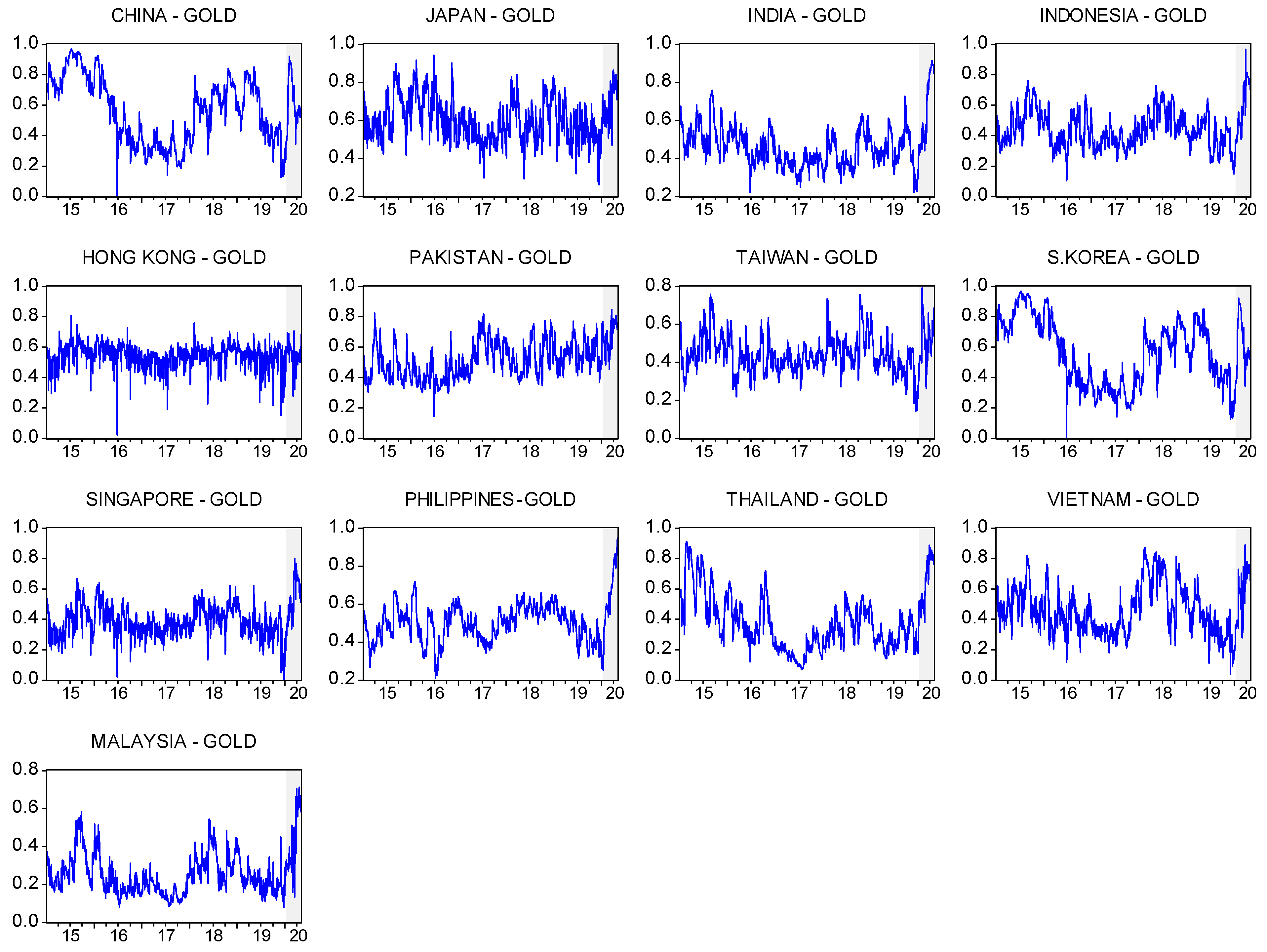

5.1. Dynamic Conditional Correlations

5.2. Results of Diversification, Hedge, and Safe-Haven Analysis

5.2.1. Full Sample Period

5.2.2. The COVID-19 Period

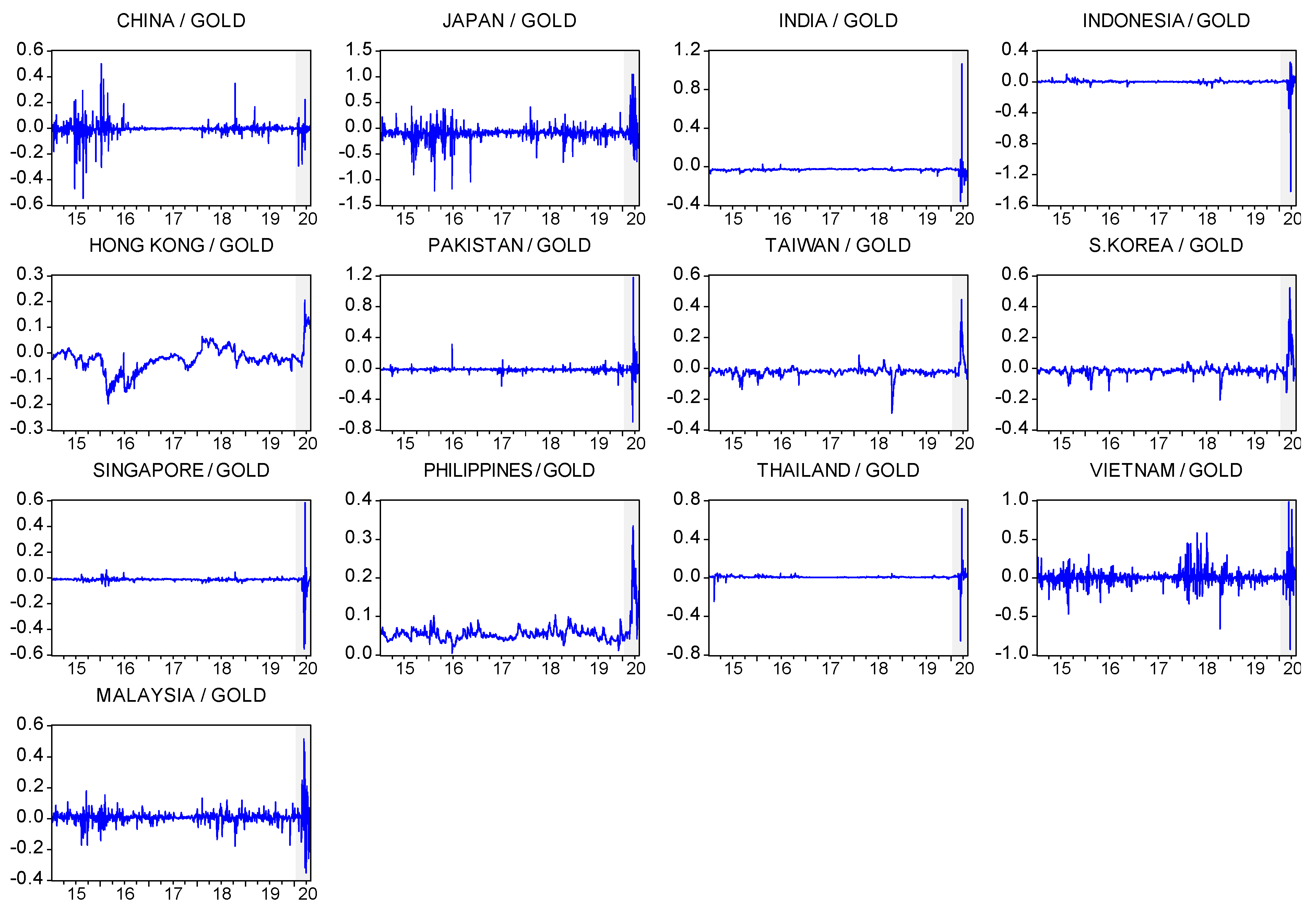

5.3. Results of Optimal Weights, Hedge Ratios, and Hedging Effectiveness

5.3.1. Results of Optimal Weights

5.3.2. Results of Optimal Hedge Ratios

5.3.3. Results of Hedging Effectiveness

5.4. Determinants of the Hedge Portfolio Returns

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Pre COVID-19 Sub-Period | COVID-19 Sub-Period | |||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Maximum | Minimum | Std. Dev. | Mean | Maximum | Minimum | Std. Dev. | |

| Gold | 0.00016 | 0.0759 | −0.0453 | 0.0098 | 0.00130 | 0.0440 | −0.0396 | 0.0144 |

| China | 0.00003 | 0.0560 | −0.0887 | 0.0148 | −0.00216 | 0.0310 | −0.0804 | 0.0168 |

| Japan | 0.00006 | 0.0743 | −0.0825 | 0.0122 | −0.00316 | 0.0773 | −0.0627 | 0.0225 |

| India | 0.00033 | 0.0519 | −0.0612 | 0.0085 | −0.00375 | 0.0859 | −0.1410 | 0.0317 |

| Indonesia | 0.00010 | 0.0445 | −0.0409 | 0.0089 | −0.00321 | 0.0970 | −0.0681 | 0.0231 |

| Hong Kong | 0.00022 | 0.0413 | −0.0602 | 0.0110 | −0.00150 | 0.0493 | −0.0498 | 0.0182 |

| Pakistan | 0.00023 | 0.0442 | −0.0477 | 0.0103 | −0.00123 | 0.0468 | −0.0710 | 0.0230 |

| Taiwan | 0.00018 | 0.0352 | −0.0652 | 0.0082 | −0.00108 | 0.0617 | −0.0601 | 0.0187 |

| South Korea | 0.00021 | 0.0347 | −0.0454 | 0.0078 | −0.00184 | 0.0825 | −0.0877 | 0.0247 |

| Singapore | 0.00000 | 0.0266 | −0.0439 | 0.0075 | −0.00256 | 0.0589 | −0.0764 | 0.0228 |

| Philippines | 0.00005 | 0.0358 | −0.0694 | 0.0098 | −0.00618 | 0.0717 | −0.1432 | 0.0318 |

| Thailand | 0.00012 | 0.1324 | −0.1209 | 0.0099 | −0.00201 | 0.0765 | −0.1143 | 0.0271 |

| Vietnam | 0.00061 | 0.0378 | −0.0542 | 0.0097 | −0.00196 | 0.0486 | −0.0648 | 0.0184 |

| Malaysia | −0.00003 | 0.0222 | −0.0324 | 0.0058 | −0.00147 | 0.0663 | −0.0540 | 0.0156 |

| Mean | Max | Min | S. Dev. | Skewness | Kurtosis | Jarque-Bera | Q-Stat (6) | ARCH | ADF | PP | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Gold | 0.00023 | 0.076 | −0.045 | 0.010 | 0.444 | 6.920 | 937.17 *** | 25.025 *** | 28.621 *** | −42.470 *** | −42.832 *** |

| China | −0.00011 | 0.056 | −0.089 | 0.015 | −1.288 | 10.101 | 3310.3 *** | 34.874 *** | 72.189 *** | −34.241 *** | −34.390 *** |

| Japan | −0.00014 | 0.077 | −0.083 | 0.013 | −0.207 | 8.878 | 2014.9 *** | 18.546 *** | 159.90 *** | −35.678 *** | −35.706 *** |

| India | 0.00006 | 0.086 | −0.141 | 0.012 | −1.728 | 28.470 | 38319 *** | 53.685 *** | 69.913 *** | −30.617 *** | −36.582 *** |

| Indonesia | −0.00011 | 0.097 | −0.068 | 0.010 | −0.120 | 12.537 | 5278.4 *** | 27.945 *** | 127.16 *** | −32.464 *** | −32.555 *** |

| Hong Kong | 0.00011 | 0.049 | −0.060 | 0.012 | −0.392 | 5.491 | 396.39 *** | 20.086 *** | 76.200 *** | −36.232 *** | −36.262 *** |

| Pakistan | 0.00014 | 0.047 | −0.071 | 0.012 | −0.564 | 7.368 | 1180.9 *** | 70.800 *** | 76.524 *** | −30.306 *** | −30.494 *** |

| Taiwan | 0.00010 | 0.062 | −0.065 | 0.009 | −0.857 | 11.231 | 4100.1 *** | 22.984 *** | 212.79 *** | −33.815 *** | −36.003 *** |

| South Korea | 0.00008 | 0.083 | −0.088 | 0.010 | −0.378 | 16.054 | 9917.3 *** | 44.356 *** | 964.64 *** | −27.592 *** | −36.129 *** |

| Singapore | −0.00017 | 0.059 | −0.076 | 0.009 | −0.990 | 14.981 | 8553.8 *** | 40.431 *** | 487.75 *** | −23.668 *** | −36.364 *** |

| Philippines | −0.00035 | 0.072 | −0.143 | 0.013 | −2.146 | 24.258 | 27280 *** | 41.612 *** | 92.320 *** | −32.925 *** | −32.915 *** |

| Thailand | −0.00002 | 0.132 | −0.121 | 0.012 | −0.990 | 41.010 | 8402.4 *** | 72.470 *** | 148.59 *** | −44.702 *** | −44.098 *** |

| Vietnam | 0.00045 | 0.049 | −0.065 | 0.010 | −0.869 | 8.426 | 1883.4 *** | 45.085 *** | 28.554 *** | −22.885 *** | −33.773 *** |

| Malaysia | −0.00011 | 0.066 | −0.054 | 0.007 | −0.391 | 16.044 | 9904.3 *** | 25.197 *** | 208.73 *** | −34.230 *** | −34.377 *** |

References

- Aftab, Muhammad, Syed Zulfiqar Ali Shah, and Izlin Ismail. 2019. Does Gold Act as a Hedge or a Safe Haven against Equity and Currency in Asia? Global Business Review 20: 105–18. [Google Scholar] [CrossRef]

- Ali, Sajid, Elie Bouri, Robert Lukas Czudaj, and Syed Jawad Hussain Shahzad. 2020. Revisiting the valuable roles of commodities for international stock markets. Resources Policy 66: 101603. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, Amine Lahiani, and Duc Khuong Nguyen. 2015. World gold prices and stock returns in China: Insights for hedging and diversification strategies. Economic Modelling 44: 273–82. [Google Scholar] [CrossRef] [Green Version]

- Aruga, Kentaka, and Sudha Kannan. 2020. Effects of the 2008 financial crisis on the linkages among the oil, gold, and platinum markets. Cogent Economics & Finance 8: 1807684. [Google Scholar]

- Aslam, Faheem, Saima Latif, and Paulo Ferreira. 2020. Investigating Long-Range Dependence of Emerging Asian Stock Markets Using Multifractal Detrended Fluctuation Analysis. Symmetry 12: 1157. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle J. Kost, Marco C. Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Impact of COVID-19 (No. w26945). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Basher, Syed Abul, and Perry Sadorsky. 2016. Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics 54: 235–47. [Google Scholar] [CrossRef] [Green Version]

- Baur, Dirk G., and Thomas K. McDermott. 2010. Is gold a safe haven? International evidence. Journal of Banking & Finance 34: 1886–98. [Google Scholar]

- Beckmann, Joscha, Theo Berger, and Robert Czudaj. 2015. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling 48: 16–24. [Google Scholar] [CrossRef] [Green Version]

- Bekaert, Geert, Eric C. Engstrom, and Nancy R. Xu. 2019. The Time Variation in Risk Appetite and Uncertainty (No. w25673). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Bekiros, Stelios, Sabri Boubaker, Duc Khuong Nguyen, and Gazi Salah Uddin. 2017. Black swan events and safe havens: The role of gold in globally integrated emerging markets. Journal of International Money and Finance 73: 317–34. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Brian Lucey, Tareq Saeed, and Xuan Vinh Vo. 2021. The realized volatility of commodity futures: Interconnectedness and determinants. International Review of Economics & Finance 73: 139–51. [Google Scholar]

- Bouri, Elie, Oguzhan Cepni, David Gabauer, and Rangan Gupta. 2020. Return connectedness across asset classes around the COVID-19 outbreak. International Review of Financial Analysis 20: 101646. [Google Scholar] [CrossRef]

- Bouri, Elie, Naji Jalkh, Peter Molnár, and David Roubaud. 2017. Bitcoin for energy commodities before and after the December 2013 crash: Diversifier, hedge or safe haven? Applied Economics 49: 5063–73. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, and Andrew Detzel. 2015. The asset-pricing implications of government economic policy uncertainty. Management Science 61: 3–18. [Google Scholar] [CrossRef] [Green Version]

- Cappiello, Lorenzo, Robert F. Engle, and Kevin Sheppard. 2006. Asymmetric dynamics in the correlations of global equity and bond returns. Journal of Financial Econometrics 4: 537–72. [Google Scholar] [CrossRef]

- Chen, Ke, and Meng Wang. 2019. Is gold a hedge and safe haven for stock market? Applied Economics Letters 26: 1080–86. [Google Scholar] [CrossRef]

- Chkili, Walid. 2016. Dynamic correlations and hedging effectiveness between gold and stock markets: Evidence for BRICS countries. Research in International Business and Finance 38: 22–34. [Google Scholar] [CrossRef]

- Dutta, Anupam, Debojyoti Das, R. K. Jana, and Xuan Vinh Vo. 2020a. COVID-19 and oil market crash: Revisiting the safe haven property of gold and Bitcoin. Resources Policy 69: 101816. [Google Scholar] [CrossRef]

- Dutta, Anupam, Elie Bouri, Debojyoti Das, and David Roubaud. 2020b. Assessment and optimization of clean energy equity risks and commodity price volatility indexes: Implications for sustainability. Journal of Cleaner Production 243: 118669. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–350. [Google Scholar]

- Engle, Robert, and Bryan Kelly. 2012. Dynamic equicorrelation. Journal of Business & Economic Statistics 30: 212–28. [Google Scholar]

- Gao, Ruzhao, and Bing Zhang. 2016. How does economic policy uncertainty drive gold–stock correlations? Evidence from the UK. Applied Economics 48: 3081–87. [Google Scholar] [CrossRef]

- Gorton, Gary, and K. Geert Rouwenhorst. 2006. Facts and fantasies about commodity futures. Financial Analysts Journal 62: 47–68. [Google Scholar] [CrossRef] [Green Version]

- Gürgün, Gözde, and İbrahim Ünalmış. 2014. Is gold a safe haven against equity market investment in emerging and developing countries? Finance Research Letters 11: 341–48. [Google Scholar] [CrossRef]

- Klein, Tony, Hien Pham Thu, and Thomas Walther. 2018. Bitcoin Is Not the New Gold: A Comparison of Volatility, Correlation, and Portfolio Performance. International Review of Financial Analysis 58: 105–16. [Google Scholar] [CrossRef]

- Klein, Tony. 2017. Dynamic correlation of precious metals and flight-to-quality in developed markets. Finance Research Letters 23: 283–90. [Google Scholar] [CrossRef]

- Low, Rand Kwong Yew, Yiran Yao, and Robert Faff. 2016. Diamonds vs. precious metals: What shines brightest in your investment portfolio? International Review of Financial Analysis 43: 1–14. [Google Scholar] [CrossRef] [Green Version]

- Ming, Lei, Xinran Zhang, Qianqiu Liu, and Shenggang Yang. 2020. A revisit to the hedge and safe haven properties of gold: New evidence from China. Journal of Futures Markets 40: 1442–56. [Google Scholar] [CrossRef]

- Mirza, Nawazish, Birjees Rahat, Bushra Naqvi, and Syed Kumail Abbas Rizvi. 2020. Impact of Covid-19 on corporate solvency and possible policy responses in the EU. The Quarterly Review of Economics and Finance. in press. [Google Scholar] [CrossRef]

- Mohti, Wahbeeah, Andreia Dionísio, Isabel Vieira, and Paulo Ferreira. 2019. Regional and global integration of Asian stock markets. Research in International Business and Finance 50: 357–68. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, Cuong M. Ishaq Bhatti, Magda Komorníková, and Jozef Komorník. 2016. Gold price and stock markets nexus under mixed-copulas. Economic Modelling 58: 283–92. [Google Scholar] [CrossRef]

- Pan, Zhiyuan, Yudong Wang, and Li Yang. 2014. Hedging crude oil using refined product: A regime switching asymmetric DCC approach. Energy economics 46: 472–84. [Google Scholar] [CrossRef]

- Ratner, Mitchell, and Chih-Chieh Jason Chiu. 2013. Hedging stock sector risk with credit default swaps. International Review of Financial Analysis 30: 18–25. [Google Scholar] [CrossRef]

- Raza, Naveed, Syed Jawad Hussain Shahzad, Aviral Kumar Tiwari, and Muhammad Shahbaz. 2016. Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Resources Policy 49: 290–301. [Google Scholar] [CrossRef]

- Saeed, Tareq, Elie Bouri, and Xuan Vinh Vo. 2020. Hedging Strategies of Green Assets against Dirty Energy Assets. Energies 13: 3141. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, David Roubaud, and Ladislav Kristoufek. 2020. Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling 87: 212–24. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, Ladislav Kristoufek, and Tareq Saeed. 2021. Impact of the COVID-19 outbreak on the US equity sectors: Evidence from quantile return spillovers. Financial Innovation 7: 1–23. [Google Scholar] [CrossRef]

- Wen, Xiaoqian, and Hua Cheng. 2018. Which is the safe haven for emerging stock markets, gold or the US dollar? Emerging Markets Review 35: 69–90. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Shoaib Ali. 2020a. The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: Evidence from the VAR-DCC-GARCH approach. Borsa Istanbul Review 20: S1–S10. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Shoaib Ali. 2020b. Discovering interlinkages between major cryptocurrencies using high-frequency data: New evidence from COVID-19 pandemic. Financial Innovation 6: 1–18. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Shoaib Ali. 2021. Linkages between stock and cryptocurrency markets during the COVID-19 outbreak: An intraday analysis. The Singapore Economic Review. in press. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Arshad Hassan. 2019. Linkages between crude oil and emerging Asian stock markets: New evidence from the Chinese stock market crash. Finance Research Letters 31: 207–17. [Google Scholar] [CrossRef]

- Yousaf, Imran, Shoaib Ali, and Wing-Keung Wong. 2020. Return and volatility transmissions between metals and Stocks: A study of the emerging Asian markets by using the VAR-AGARCH approach. Asia-Pacific Journal of Operational Research. in press. [Google Scholar] [CrossRef]

| CHN | JAP | IND | INDO | HK | PAK | TAIW | KOR | SING | PHIL | THAI | VIET | MYS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre COVID sub-period | −0.003 | −0.086 | −0.033 | 0.003 | 0.003 | −0.015 | −0.027 | −0.020 | −0.016 | 0.050 | 0.010 | 0.005 | 0.000 |

| COVID-19 sub-period | −0.010 | −0.048 | −0.029 | −0.014 | −0.014 | −0.013 | 0.022 | 0.027 | −0.037 | 0.069 | 0.009 | 0.018 | −0.001 |

| Hedge () | ||||

|---|---|---|---|---|

| China | −0.003 a | −0.002 | 0.006 | −0.005 |

| Japan | −0.083 a | −0.000 | 0.005 | 0.015 |

| India | −0.032 a | −0.000 | 0.000 | −0.003 |

| Indonesia | 0.002 a | 0.009 b | −0.009 c | −0.046 a |

| Hong Kong | −0.025 a | −0.011 | 0.026 c | 0.040c |

| Pakistan | −0.015 a | −0.002 | −0.000 | −0.052 a |

| Taiwan | −0.024 a | −0.003 | 0.004 | 0.076 a |

| South Korea | −0.018 a | −0.000 | 0.005 | 0.090 a |

| Singapore | −0.016 a | −0.000 | −0.004 | −0.053 a |

| Philippine | 0.050 a | 0.000 | 0.002 | 0.023 a |

| Thailand | 0.011 a | −0.000 | −0.021 a | 0.021 b |

| Vietnam | 0.006 a | −0.008 | −0.004 | 0.028 |

| Malaysia | 0.013 a | 0.001 | 0.013 | 0.049 a |

| COVID-19 | ||

|---|---|---|

| China | −0.003 a | −0.006 b |

| Japan | −0.085 a | 0.037 a |

| India | −0.032 a | 0.003 |

| Indonesia | 0.003 a | −0.017 a |

| Hong Kong | −0.030 a | 0.093 a |

| Pakistan | −0.015 a | −0.002 |

| Taiwan | −0.026 a | 0.049 a |

| South Korea | −0.019 a | 0.047 a |

| Singapore | −0.016 a | −0.020 a |

| Philippine | 0.049 a | 0.019 a |

| Thailand | 0.010 a | −0.001 |

| Vietnam | 0.005 a | −0.012 c |

| Malaysia | 0.014 a | 0.021 a |

| CHN/ GOLD | JAP/ GOLD | IND/ GOLD | INDO/ GOLD | HK/ GOLD | PAK/ GOLD | TAIW/ GOLD | KOR/ GOLD | SING/ GOLD | PHIL/ GOLD | THAI/ GOLD | VIET/ GOLD | MYS/ GOLD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A. Pre COVID-19 sub-period | |||||||||||||

| 0.440 | 0.441 | 0.563 | 0.562 | 0.468 | 0.500 | 0.575 | 0.590 | 0.624 | 0.480 | 0.627 | 0.541 | 0.750 | |

| −0.005 | −0.102 | −0.029 | 0.003 | −0.029 | −0.016 | −0.024 | −0.017 | −0.013 | 0.053 | 0.009 | 0.006 | 0.007 | |

| Panel B. COVID-19 sub-period | |||||||||||||

| 0.400 | 0.323 | 0.363 | 0.431 | 0.441 | 0.324 | 0.484 | 0.393 | 0.499 | 0.339 | 0.352 | 0.428 | 0.562 | |

| −0.014 | −0.071 | −0.047 | −0.026 | 0.036 | −0.021 | 0.029 | 0.047 | −0.043 | 0.110 | 0.013 | 0.030 | 0.030 | |

| CHN | JAP | IND | INDO | HK | PAK | TAIW | KOR | SING | PHIL | THAI | VIET | MYS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre COVID sub-period | 0.562 | 0.599 | 0.453 | 0.437 | 0.545 | 0.507 | 0.438 | 0.562 | 0.384 | 0.495 | 0.368 | 0.457 | 0.245 |

| During COVID sub-period | 0.605 | 0.693 | 0.650 | 0.575 | 0.543 | 0.679 | 0.504 | 0.605 | 0.518 | 0.630 | 0.644 | 0.561 | 0.422 |

| CHN | JAP | IND | INDO | HK | PAK | TAIW | KOR | SING | PHIL | THAI | VIET | MYS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.001 ** | 0.000 |

| 0.952 | 0.508 | 0.193 | 0.720 | 0.442 | 0.539 | 0.320 | 0.271 | 0.96 | 0.854 | 0.618 | 0.013 | 0.937 | |

| AR (1) | 0.048 * | −0.055 * | 0.071 *** | 0.106 *** | −0.008 | 0.207 *** | −0.034 | 0.018 | 0.015 | 0.034 | −0.218 *** | 0.047 * | 0.095 *** |

| 0.087 | 0.073 | 0.010 | 0.000 | 0.791 | 0.000 | 0.248 | 0.540 | 0.610 | 0.231 | 0.000 | 0.092 | 0.001 | |

| DVIX | −0.020 ** | −0.008 | −0.007 | 0.001 | −0.022 ** | 0.002 | −0.002 | −0.008 * | −0.009 * | 0.018 *** | −0.006 | 0.012 ** | 0.003 |

| 0.036 | 0.225 | 0.185 | 0.892 | 0.002 | 0.736 | 0.673 | 0.089 | 0.052 | 0.004 | 0.318 | 0.039 | 0.413 | |

| DGVZ | −0.009 | −0.012 * | −0.007 | −0.006 | −0.014 ** | −0.002 | −0.011 ** | −0.012 ** | −0.001 | −0.003 | −0.014 ** | 0.004 | −0.006 ** |

| 0.344 | 0.065 | 0.184 | 0.297 | 0.028 | 0.741 | 0.026 | 0.012 | 0.779 | 0.657 | 0.019 | 0.501 | 0.085 | |

| DEPU | −0.001 | 0.000 | 0.000 | 0.000 | −0.001 | 0.000 | 0.000 | −0.001 * | 0.000 | −0.001 | 0.000 | 0.000 | 0.000 |

| 0.121 | 0.929 | 0.588 | 0.517 | 0.128 | 0.793 | 0.728 | 0.082 | 0.665 | 0.207 | 0.904 | 0.674 | 0.762 | |

| DINFLATION | 0.077 *** | 0.044 ** | 0.078 *** | 0.041 ** | 0.111 *** | 0.044 ** | 0.080 ** | 0.068 ** | 0.063 ** | 0.038 ** | 0.084 ** | 0.041 ** | 0.044 ** |

| 0.009 | 0.040 | 0.000 | 0.017 | 0.000 | 0.030 | 0.000 | 0.000 | 0.000 | 0.048 | 0.000 | 0.016 | 0.000 | |

| DGRA | 0.009 | −0.015 | −0.027 ** | −0.027 ** | 0.010 | −0.012 | −0.027 ** | −0.008 | −0.017 | −0.060 *** | −0.032 ** | −0.069 *** | −0.014 * |

| 0.660 | 0.327 | 0.020 | 0.030 | 0.515 | 0.411 | 0.016 | 0.465 | 0.118 | 0.000 | 0.020 | 0.000 | 0.072 | |

| Adj. R-squared | 0.024 | 0.019 | 0.076 | 0.035 | 0.065 | 0.046 | 0.057 | 0.058 | 0.055 | 0.021 | 0.096 | 0.045 | 0.037 |

| F-statistic | 6.221 *** | 5.113 *** | 18.859 *** | 8.807 *** | 16.109 *** | 11.472 *** | 14.055 *** | 14.259 *** | 13.554 *** | 5.583 *** | 23.882 *** | 11.146 *** | 9.248 *** |

| Prob(F-statistic) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| CHN | JAP | IND | INDO | HK | PAK | TAIW | KOR | SING | PHIL | THAI | VIET | MYS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C | −0.002 | −0.001 | −0.004 | −0.002 | −0.001 | −0.001 | 0.000 | 0.000 | −0.002 | −0.005 | −0.002 | 0.000 | −0.001 |

| 0.385 | 0.472 | 0.272 | 0.370 | 0.499 | 0.696 | 0.893 | 0.910 | 0.444 | 0.103 | 0.545 | 0.743 | 0.480 | |

| AR (1) | 0.171 | −0.098 | −0.145 | 0.112 | −0.199 ** | 0.145 | 0.018 | −0.043 | −0.033 | 0.121 | −0.176 * | 0.129 | −0.042 |

| 0.121 | 0.335 | 0.194 | 0.276 | 0.046 | 0.191 | 0.848 | 0.647 | 0.733 | 0.224 | 0.075 | 0.210 | 0.661 | |

| DVIX | 0.024 | −0.041 | 0.055 | 0.014 | 0.011 | −0.022 | 0.017 | −0.019 | 0.038 | 0.007 | 0.022 | −0.039 | 0.019 |

| 0.426 | 0.133 | 0.345 | 0.730 | 0.657 | 0.610 | 0.483 | 0.549 | 0.304 | 0.881 | 0.598 | 0.104 | 0.306 | |

| DGVZ | −0.050 ** | −0.040 * | −0.112 ** | −0.054 | −0.073 ** | −0.030 | −0.051 ** | −0.061 ** | −0.098 *** | 0.000 | −0.105 *** | −0.004 | −0.058 *** |

| 0.043 | 0.090 | 0.029 | 0.129 | 0.002 | 0.460 | 0.022 | 0.034 | 0.004 | 0.912 | 0.007 | 0.866 | 0.001 | |

| DEPU | −0.006 | −0.016 *** | −0.004 | 0.005 | −0.006 | −0.014 | −0.005 | −0.008 | −0.009 | −0.002 | 0.000 | −0.003 | −0.004 |

| 0.250 | 0.005 | 0.748 | 0.556 | 0.216 | 0.107 | 0.274 | 0.214 | 0.235 | 0.855 | 0.953 | 0.472 | 0.245 | |

| DINFLATION | 0.058 *** | 0.049 ** | 0.071 | 0.098 *** | 0.068 *** | −0.036 | 0.118 *** | 0.136 *** | 0.144 *** | 0.174 *** | 0.102 *** | 0.050 *** | 0.083 *** |

| 0.010 | 0.021 | 0.116 | 0.002 | 0.001 | 0.285 | 0.000 | 0.000 | 0.000 | 0.000 | 0.004 | 0.009 | 0.000 | |

| DGRA | −0.009 | 0.014 | −0.030 | −0.013 | −0.008 | −0.028 * | 0.001 | 0.011 | −0.004 | −0.010 | −0.033 ** | 0.014 * | 0.002 |

| 0.343 | 0.131 | 0.124 | 0.326 | 0.349 | 0.058 | 0.871 | 0.285 | 0.716 | 0.517 | 0.024 | 0.082 | 0.685 | |

| Adj. R-squared | 0.124 | 0.200 | 0.098 | 0.158 | 0.277 | 0.133 | 0.344 | 0.319 | 0.289 | 0.246 | 0.323 | 0.112 | 0.353 |

| F-statistic | 3.080 *** | 4.674 *** | 2.585 *** | 3.747 *** | 6.611 *** | 3.258 *** | 8.685 *** | 7.870 *** | 6.970 *** | 5.791 *** | 7.983 *** | 2.851 ** | 9.003 *** |

| Prob(F-statistic) | 0.009 | 0.000 | 0.024 | 0.002 | 0.000 | 0.006 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.014 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yousaf, I.; Bouri, E.; Ali, S.; Azoury, N. Gold against Asian Stock Markets during the COVID-19 Outbreak. J. Risk Financial Manag. 2021, 14, 186. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm14040186

Yousaf I, Bouri E, Ali S, Azoury N. Gold against Asian Stock Markets during the COVID-19 Outbreak. Journal of Risk and Financial Management. 2021; 14(4):186. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm14040186

Chicago/Turabian StyleYousaf, Imran, Elie Bouri, Shoaib Ali, and Nehme Azoury. 2021. "Gold against Asian Stock Markets during the COVID-19 Outbreak" Journal of Risk and Financial Management 14, no. 4: 186. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm14040186