The Effect of Renewable and Nuclear Energy Consumption on Decoupling Economic Growth from CO2 Emissions in Spain

Abstract

:1. Introduction

2. Literature Review

3. Data and Country-Specific Energy Policies

4. Methods: Threshold VAR Model and GIRF

5. Empirical Results

5.1. Tests for Non-Linearity and TVAR Model

5.2. Granger Causality in Regimes

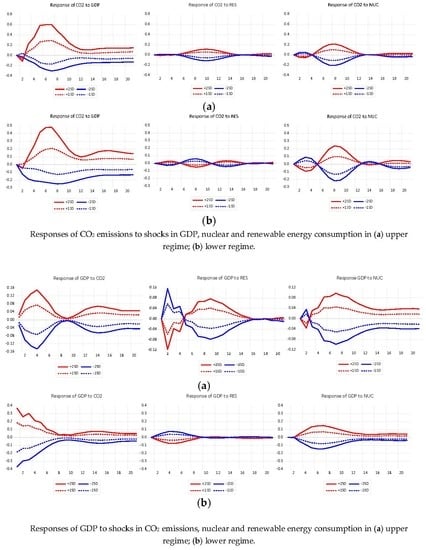

5.3. Generalized Impulse Response Functions in Regimes

6. Discussion and Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- IPCC Summary for Policymakers—Global Warming of 1.5 °C, an IPCC Special Report. Available online: https://www.researchgate.net/publication/329866816_Summary_for_Policymakers_In_Global_warming_of_15C_An_IPCC_Special_Report (accessed on 25 February 2020).

- Intergovernmental Panel on Climate Change (IPCC). Mitigation of Climate Change: Energy Systems. Fifth Assessment Report; IPCC: Geneva, Switzerland, 2014. [Google Scholar]

- WEO-2015 Special Report: Energy and Climate Change—Analysis—IEA; IEA: Paris, France, 2015.

- Jaforullah, M.; King, A. Does the use of renewable energy sources mitigate CO2 emissions? A reassessment of the US evidence. Energy Econ. 2015, 49, 711–717. [Google Scholar] [CrossRef]

- Jin, T.; Kim, J. What is better for mitigating carbon emissions—Renewable energy or nuclear energy? A panel data analysis. Renew. Sustain. Energy Rev. 2018, 91, 464–471. [Google Scholar] [CrossRef]

- Berahab, R. Decoupling economic growth from CO2 emissions in the world. Policy Notes Policy Briefs 2017. [Google Scholar]

- Choi, E.; Heshmati, A.; Cho, Y. An Empirical Study of the Relationships between CO2 Emissions, Economic Growth and Openness; IZA Discussion Paper, 5304; Institute of Labor Economics (IZA): Bonn, Germany, 2010. [Google Scholar]

- Jorgenson, A.K.; Clark, B. Are the economy and the environment decoupling? A comparative international study, 1960–2005. Am. J. Sociol. 2012, 118, 1–44. [Google Scholar] [CrossRef]

- Mikayilov, J.I.; Hasanov, F.J.; Galeotti, M. Decoupling of CO2 emissions and GDP: A time-varying cointegration approach. Ecol. Indic. 2018, 95, 615–628. [Google Scholar] [CrossRef]

- Piłatowska, M.; Włodarczyk, A. Decoupling Economic Growth From Carbon Dioxide Emissions in the EU Countries. Montenegrin J. Econ. 2018, 14, 7–26. [Google Scholar] [CrossRef]

- Richmond, A.K.; Kaufmann, R.K. Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol. Econ. 2006, 56, 176–189. [Google Scholar] [CrossRef]

- Tapio, P. Towards a theory of decoupling: Degrees of decoupling in the EU and the case of road traffic in Finland between 1970 and 2001. Transp. Policy 2005, 12, 137–151. [Google Scholar] [CrossRef] [Green Version]

- Vavrek, R.; Chovancova, J. Decoupling of Greenhouse Gas Emissions from Economic Growth in V4 Countries. Procedia Econ. Financ. 2016, 39, 526–533. [Google Scholar] [CrossRef] [Green Version]

- IEA Global Energy-Related Emissions of Carbon Dioxide Stalled in 2014. Available online: https://www.iea.org/news/global-energy-related-emissions-of-carbon-dioxide-stalled-in-2014 (accessed on 26 February 2020).

- Fischer-Kowalski, M. (Ed.) Decoupling Environmental Resource Use and Economic Growth Summary; UNEP: Nairobi, Kenya, 2011; ISBN 978-92-807-3167-5. [Google Scholar]

- Fosten, J.; Morley, B.; Taylor, T. Dynamic misspecification in the environmental Kuznets curve: Evidence from CO2 and SO2 emissions in the United Kingdom. Ecol. Econ. 2012, 76, 25–33. [Google Scholar] [CrossRef] [Green Version]

- Jackson, R.B.; Canadell, J.G.; Le Quéré, C.; Andrew, R.M.; Korsbakken, J.I.; Peters, G.P.; Nakicenovic, N. Reaching peak emissions. Nat. Clim. Chang. 2016, 6, 7–10. [Google Scholar] [CrossRef] [Green Version]

- Weizsäcker, E.U.; de Larderel, J.; Hargroves, K.; Hudson, C.; Smith, M.; Rodrigues, M. Decoupling 2 Technologies, Opportunities and Policy Options; UNEP: Nairobi, Kenya, 2014; ISBN 978-92-807-3383-9. [Google Scholar]

- York, R.; McGee, J.A. Does Renewable Energy Development Decouple Economic Growth from CO2 Emissions? Socius 2017, 3. [Google Scholar] [CrossRef] [Green Version]

- McGee, J.A. Does certified organic farming reduce greenhouse gas emissions from agricultural production? Agric. Human Values 2015, 32, 255–263. [Google Scholar] [CrossRef]

- York, R. Do alternative energy sources displace fossil fuels? Nat. Clim. Chang. 2012, 2, 441–443. [Google Scholar] [CrossRef]

- Lahiani, A.; Sinha, A.; Shahbaz, M. Renewable energy consumption, income, CO2 emissions, and oil prices in G7 countries: The importance of asymmetries. J. Energy Dev. 2018, 43, 157–191. [Google Scholar]

- Sharif, A.; Mishra, S.; Sinha, A.; Jiao, Z.; Shahbaz, M.; Afshan, S. The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: Fresh insights from quantile-on-quantile regression approach. Renew. Energy 2020, 150, 670–690. [Google Scholar] [CrossRef] [Green Version]

- Acaravci, A.; Ozturk, I. On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 2010, 35, 5412–5420. [Google Scholar] [CrossRef]

- Magazzino, C. The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int. J. Sustain. Energy 2014, 35, 844–857. [Google Scholar] [CrossRef]

- Mercan, M.; Karakaya, E. Energy Consumption, Economic Growth and Carbon Emission: Dynamic Panel Cointegration Analysis for Selected OECD Countries. Procedia Econ. Financ. 2015, 23, 587–592. [Google Scholar] [CrossRef] [Green Version]

- Tiwari, A.K. A structural VAR analysis of renewable energy consumption, real GDP and CO2 emissions: Evidence from India. Econ. Bull. 2011, 31, 1793–1806. [Google Scholar]

- Ozcan, B.; Ari, A. Nuclear Energy Consumption-economic Growth Nexus in OECD: A Bootstrap Causality Test. Procedia Econ. Financ. 2015, 30, 586–597. [Google Scholar] [CrossRef] [Green Version]

- Han, D.; Li, T.; Feng, S.; Shi, Z. Application of threshold regression analysis to study the impact of clean energy development on China’s carbon productivity. Int. J. Environ. Res. Public Health 2020, 17, 1060. [Google Scholar] [CrossRef] [Green Version]

- Baek, J.; Pride, D. On the income-nuclear energy—CO2 emissions nexus revisited. Energy Econ. 2014, 43, 6–10. [Google Scholar] [CrossRef]

- Menyah, K.; Wolde-Rufael, Y. CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 2010, 38, 2911–2915. [Google Scholar] [CrossRef]

- Zafrilla, J.E.; Cadarso, M.Á.; Monsalve, F.; De La Rúa, C. How carbon-friendly is nuclear energy? A hybrid MRIO-LCA model of a Spanish facility. Environ. Sci. Technol. 2014, 48, 14103–14111. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Awaworyi Churchill, S.; Paramati, S.R. The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew. Energy 2017, 111, 157–167. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Shafiei, S.; Salim, R.A. Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: A comparative analysis. Energy Policy 2014, 66, 547–556. [Google Scholar] [CrossRef] [Green Version]

- Vasylieva, T.; Lyulyov, O.; Bilan, Y.; Streimikiene, D. Sustainable Economic Development and Greenhouse Gas Emissions: The Dynamic Impact of Renewable Energy Consumption, GDP, and Corruption. Energies 2019, 12, 3289. [Google Scholar] [CrossRef] [Green Version]

- Balsalobre-Lorente, D.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef] [Green Version]

- Silva, S.; Soares, I.; Pinho, C. The impact of renewable energy sources on economic growth and CO2 emissions—A svar approach. Eur. Res. Stud. J. 2012, 15, 133–144. [Google Scholar] [CrossRef] [Green Version]

- Apergis, N.; Payne, J.E. Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy 2010, 38, 656–660. [Google Scholar] [CrossRef]

- Bulut, U. The impacts of non-renewable and renewable energy on CO2 emissions in Turkey. Environ. Sci. Pollut. Res. 2017, 24, 15416–15426. [Google Scholar] [CrossRef]

- Aguirre, M.; Ibikunle, G. Determinants of renewable energy growth: A global sample analysis. Energy Policy 2014, 69, 374–384. [Google Scholar] [CrossRef] [Green Version]

- Pang, R.Z.; Deng, Z.Q.; Hu, J.L. Clean energy use and total-factor efficiencies: An international comparison. Renew. Sustain. Energy Rev. 2015, 52, 1158–1171. [Google Scholar] [CrossRef]

- Singh, N.; Nyuur, R.; Richmond, B. Renewable Energy Development as a Driver of Economic Growth: Evidence from Multivariate Panel Data Analysis. Sustainability 2019, 11, 2418. [Google Scholar] [CrossRef] [Green Version]

- Luqman, M.; Ahmad, N.; Bakhsh, K. Nuclear energy, renewable energy and economic growth in Pakistan: Evidence from non-linear autoregressive distributed lag model. Renew. Energy 2019, 139, 1299–1309. [Google Scholar] [CrossRef]

- Mbarek, M.B.; Khairallah, R.; Feki, R. Causality relationships between renewable energy, nuclear energy and economic growth in France. Environ. Syst. Decis. 2015, 35, 133–142. [Google Scholar] [CrossRef]

- Ocal, O.; Aslan, A. Renewable energy consumption-economic growth nexus in Turkey. Renew. Sustain. Energy Rev. 2013, 28, 494–499. [Google Scholar] [CrossRef]

- Sadorsky, P. Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ. 2009, 31, 456–462. [Google Scholar] [CrossRef]

- Chen, S.; Saud, S.; Bano, S.; Haseeb, A. The nexus between financial development, globalization, and environmental degradation: Fresh evidence from Central and Eastern European Countries. Environ. Sci. Pollut. Res. 2019, 26, 24733–24747. [Google Scholar]

- Menegaki, N.A. Growth and renewable energy in Europe: A random effect model with evidence for neutrality hypothesis. Energy Econ. 2011, 33, 257–263. [Google Scholar] [CrossRef]

- Simionescu, M.; Bilan, Y.; Krajňáková, E.; Streimikiene, D.; Gędek, S. Renewable Energy in the Electricity Sector and GDP per Capita in the European Union. Energies 2019, 12, 2520. [Google Scholar] [CrossRef] [Green Version]

- Omri, A.; Ben Mabrouk, N.; Sassi-Tmar, A. Modeling the causal linkages between nuclear energy, renewable energy and economic growth in developed and developing countries. Renew. Sustain. Energy Rev. 2015, 42, 1012–1022. [Google Scholar] [CrossRef]

- Tahir, A.; Ahmed, J.; Ahmed, W. Robust Quarterization of GDP and Determination of Business Cycle Dates for IGC Partner Countries; SBP Working Paper Series; State Bank of Pakistan: Karachi, Pakistan, 2018. [Google Scholar]

- Bildirici, M.E.; Gökmenoğlu, S.M. Environmental pollution, hydropower energy consumption and economic growth: Evidence from G7 countries. Renew. Sustain. Energy Rev. 2017, 75, 68–85. [Google Scholar] [CrossRef]

- Dones, R.; Heck, T.; Hirschberg, S. Greenhouse Gas Emissions from Energy Systems, Comparison and Overview | Request PDF. Available online: https://www.researchgate.net/publication/253408795_Greenhouse_Gas_Emissions_from_Energy_Systems_Comparison_and_Overview (accessed on 17 March 2020).

- Moreno, J.; Bhattarai, M.; Trouille, B. Pumped Storage in Spain—International Water Power. Available online: https://www.waterpowermagazine.com/features/featurepumped-storage-in-spain/ (accessed on 18 March 2020).

- Kougias, I.; Szabó, S. Pumped hydroelectric storage utilization assessment: Forerunner of renewable energy integration or Trojan horse? Energy 2017, 140, 318–329. [Google Scholar] [CrossRef]

- Baum, A.; Koester, G.B. The Impact of Fiscal Policy on Economic Activity over the Business Cycle-Evidence from a Threshold VAR Analysis; Discussion Paper Series 1: Economic Studies; Deutsche Bundesbank: Frankfurt, Germany, 2011. [Google Scholar]

- Chan, K.S. Consistency and Limiting Distribution of the Least Squares Estimator of a Threshold Autoregressive Model. Ann. Stat. 1993, 21, 520–533. [Google Scholar] [CrossRef]

- Stigler, M. Threshold Cointegration: Overview and Implementation in R Matthieu Stigler. 2010. Available online: http://stat.ethz.ch/CRAN/web/packages/tsDyn/vignettes/ThCointOverview.pdf (accessed on 12 February 2020).

- Ferraresi, T.; Roventini, A.; Fagiolo, G. Fiscal Policies and Credit Regimes: A TVAR Approach. J. Appl. Econom. 2015, 30, 1047–1072. [Google Scholar] [CrossRef] [Green Version]

- Andrews, D.; Ploberger, W. Optimal Tests When a Nuisance Parameter Is Present Only under the Alternative. Econometrica 1994, 62, 1383–1414. [Google Scholar] [CrossRef]

- Hansen, B.E. Inference When a Nuisance Parameter Is Not Identified Under the Null Hypothesis. Econometrica 1996, 64, 413–430. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Balke, N.S. Credit and Economic Activity: Credit Regimes and Nonlinear Propagation of Shocks. Rev. Econ. Stat. 2000, 82, 344–349. [Google Scholar] [CrossRef]

- Ng, S.; Perron, P. LAG Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 2001, 69, 1519–1554. [Google Scholar] [CrossRef] [Green Version]

- Chontanawat, J.; Hunt, L.C.; Pierse, R. Does energy consumption cause economic growth?: Evidence from a systematic study of over 100 countries. J. Policy Model. 2008, 30, 209–220. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E.; Menyah, K.; Wolde-Rufael, Y. On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol. Econ. 2010, 69, 2255–2260. [Google Scholar] [CrossRef]

- Wolde-Rufael, Y.; Menyah, K. Nuclear energy consumption and economic growth in nine developed countries. Energy Econ. 2010, 32, 550–556. [Google Scholar] [CrossRef]

- Payne, J.E.; Taylor, J.P. Nuclear energy consumption and economic growth in the U.S.: An empirical note. Energy Sources Part B Econ. Plan. Policy 2010, 5, 301–307. [Google Scholar] [CrossRef]

- REE (Red Electrica de Espana). Demand for Electricity in Spain Falls 1.3% in June; REE: Madrid, Spain, 2019. [Google Scholar]

- AleaSoft. Nuclear Energy: Fifty Years at the Base of the Spanish Electricity Mix; AleaSoft: Barcelona, Spain, 2019. [Google Scholar]

- Steffen, W.; Rockström, J.; Richardson, K.; Lenton, T.M.; Folke, C.; Liverman, D.; Summerhayes, C.P.; Barnosky, A.D.; Cornell, S.E.; Crucifix, M.; et al. Trajectories of the Earth System in the Anthropocene. Proc. Natl. Acad. Sci. USA 2018, 115, 8252–8259. [Google Scholar] [CrossRef] [Green Version]

- IPCC. Summary for Policymakers of IPCC Special Report on Global Warming of 1.5 °C Approved by Governments; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- Storm, S.; Schröder, E. Economic Growth and Carbon Emissions: The Road to ‘Hothouse Earth’ is Paved with Good Intentions. SSRN Electron. J. 2019. [Google Scholar] [CrossRef] [Green Version]

- Storm, S. How the Invisible Hand is Supposed to Adjust the Natural Thermostat: A Guide for the Perplexed. Sci. Eng. Ethics 2017, 23, 1307–1331. [Google Scholar] [CrossRef] [Green Version]

- Ward, J.D.; Sutton, P.C.; Werner, A.D.; Costanza, R.; Mohr, S.H.; Simmons, C.T. Is decoupling GDP growth from environmental impact possible? PLoS ONE 2016, 11, e0164733. [Google Scholar] [CrossRef] [PubMed] [Green Version]

| Variable | MZa | MZt | MSB | MPT |

|---|---|---|---|---|

| lnCO2 | −1.15919 | −0.51794 | 0.44681 | 44.1338 |

| lnGDP | −7.88524 | −1.86864 | 0.23698 | 11.8845 |

| lnRES | −5.70229 | −1.63417 | 0.28658 | 15.8819 |

| lnNUC | −0.23262 | −0.15519 | 0.66713 | 92.5518 |

| Asymptotic critical values | ||||

| 1% level | −23.8 | −3.42 | 0.143 | 4.03 |

| 5% level | −17.3 | −2.91 | 0.168 | 5.48 |

| 10% level | −14.2 | −2.62 | 0.185 | 6.67 |

| Variable. | MZa | MZt | MSB | MPT |

|---|---|---|---|---|

| ∆lnCO2 | −8.66916 ** | −2.02095 ** | 0.23312 * | 3.06510 ** |

| ∆lnGDP | −12.3738 ** | −2.48168 ** | 0.20056 ** | 2.00267 ** |

| ∆lnRES | −19.5373 *** | −3.12432 *** | 0.15992 *** | 1.25827 *** |

| ∆lnNUC | −16.5068 *** | −2.86917 *** | 0.17382 *** | 1.49836 *** |

| Asymptotic critical values | ||||

| 1% level | −13.8 | −2.58 | 0.174 | 1.78 |

| 5% level | −8.1 | −1.98 | 0.233 | 3.17 |

| 10% level | −5.7 | −1.62 | 0.275 | 4.45 |

| Test Statistics | Value | p-Value |

|---|---|---|

| sup-Wald | 145.73 | <0.01 |

| avg-Wald | 113.07 | <0.01 |

| exp-Wald | 62.24 | <0.01 |

| Dependent Variable. | Causes (Short-Run Effects) | ||||

|---|---|---|---|---|---|

| ∆CO2 | ∆GDP | ∆NUC | ∆RES | ||

| Linear VAR model | |||||

| ∆CO2 | - | 10.24 *** | 0.748 | 0.187 | |

| ∆GDP | 6.446 ** | - | 3.034 * | 1.253 | |

| ∆NUC | 0.027 | 5.101 * | - | 2.682 | |

| ∆RES | 0.578 | 0.445 | 0.49 | - | |

| Threshold VAR model | |||||

| Upper regime | ∆CO2 | - | 8.086 *** | 2.376 * | 0.344 |

| ∆GDP | 2.299 * | - | 3.371 * | 2.611 * | |

| ∆NUC | 0.592 | 7.115 *** | - | 1.189 | |

| ∆RES | 0.03 | 0.07 | 0.362 | - | |

| Lower regime | ∆CO2 | - | 1.035 | 0.237 | 0.002 |

| ∆GDP | 0.353 | - | 0.217 | 0.317 | |

| ∆NUC | 0.623 | 1.950 | - | 1.294 | |

| ∆RES | 1.785 | 1.056 | 0.011 | - | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Piłatowska, M.; Geise, A.; Włodarczyk, A. The Effect of Renewable and Nuclear Energy Consumption on Decoupling Economic Growth from CO2 Emissions in Spain. Energies 2020, 13, 2124. https://0-doi-org.brum.beds.ac.uk/10.3390/en13092124

Piłatowska M, Geise A, Włodarczyk A. The Effect of Renewable and Nuclear Energy Consumption on Decoupling Economic Growth from CO2 Emissions in Spain. Energies. 2020; 13(9):2124. https://0-doi-org.brum.beds.ac.uk/10.3390/en13092124

Chicago/Turabian StylePiłatowska, Mariola, Andrzej Geise, and Aneta Włodarczyk. 2020. "The Effect of Renewable and Nuclear Energy Consumption on Decoupling Economic Growth from CO2 Emissions in Spain" Energies 13, no. 9: 2124. https://0-doi-org.brum.beds.ac.uk/10.3390/en13092124