Perpetual American Cancellable Standard Options in Models with Last Passage Times

Abstract

:1. Introduction

2. Preliminaries

2.1. The Optimal Stopping Problems

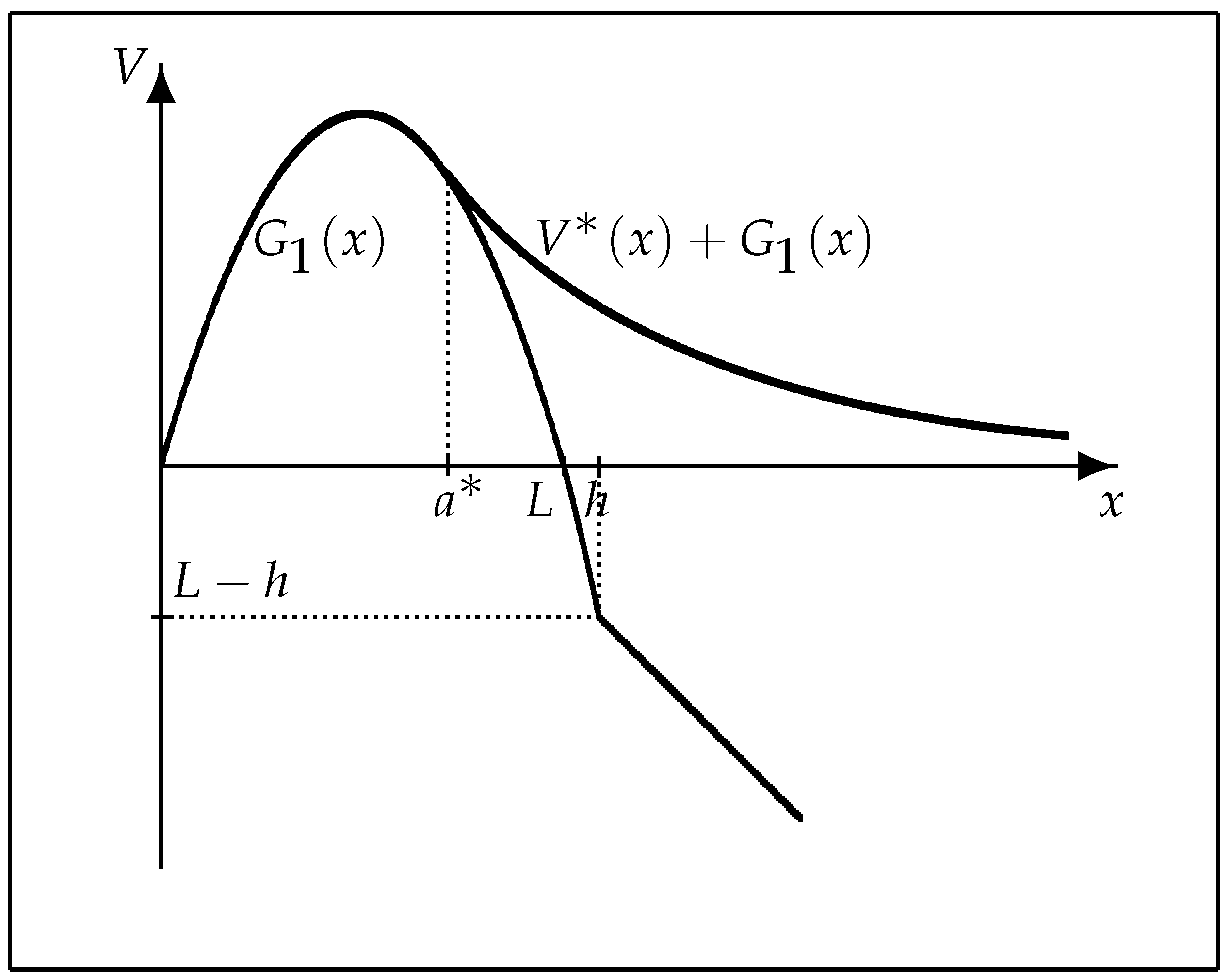

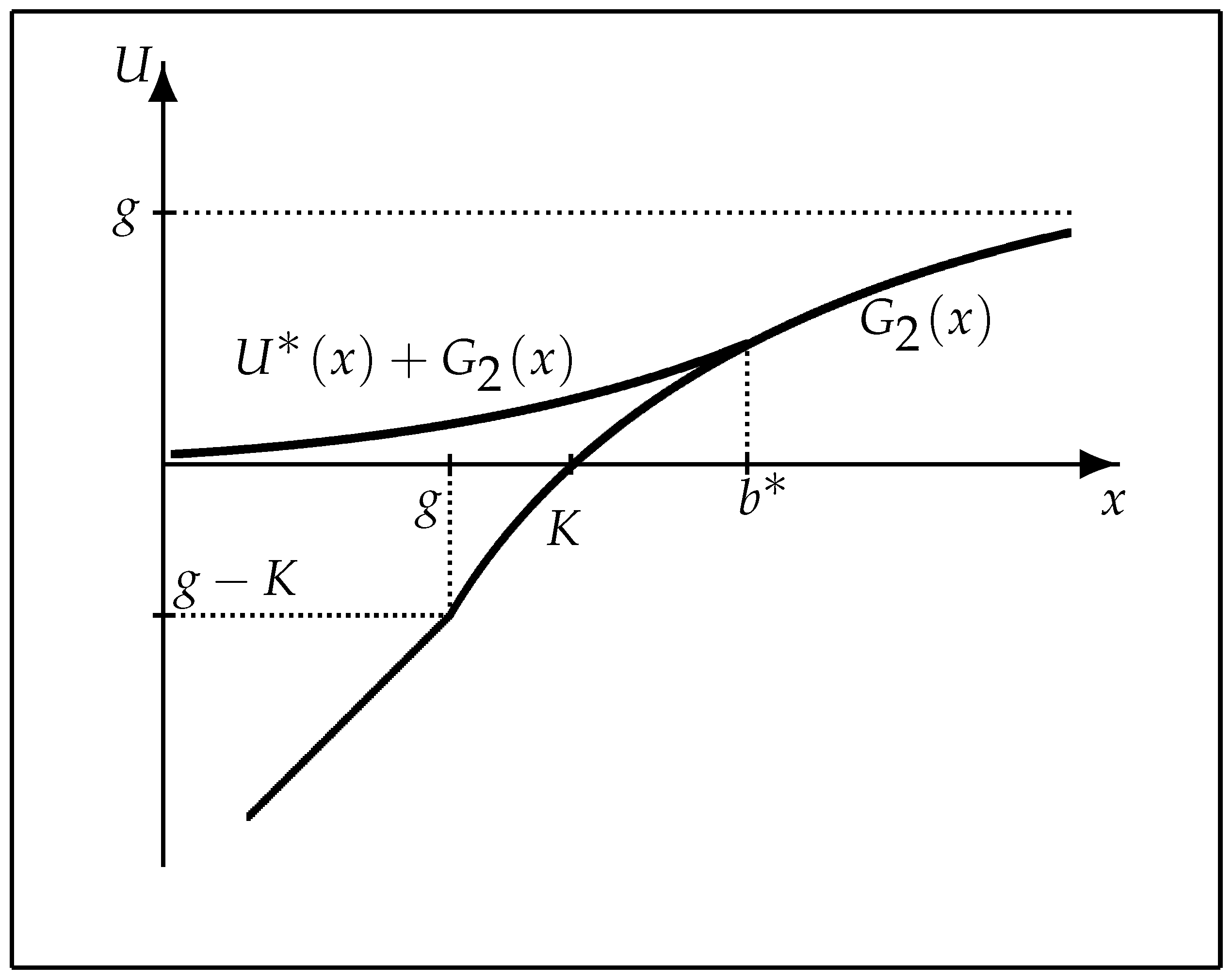

2.2. The Structure of Optimal Exercise Times

2.3. The Free-Boundary Problems

3. Solutions to the Free-Boundary Problems

3.1. The Candidate Value Functions

3.2. The Candidate Stopping Boundaries

4. Main Results and Proofs

Author Contributions

Funding

Conflicts of Interest

References

- Nikeghbali, A.; Yor, M. Doob’s maximal identity, multiplicative decomposition and enlargement of filtrations. Ill. J. Math. 2006, 50, 791–814. [Google Scholar] [CrossRef]

- Shiryaev, A.N. Essentials of Stochastic Finance; World Scientific: Singapore, 1999. [Google Scholar]

- Emmerling, T.J. Perpetual cancellable American call option. Math. Financ. 2012, 22, 645–666. [Google Scholar] [CrossRef] [Green Version]

- Peskir, G.; Shiryaev, A.N. Optimal Stopping and Free-Boundary Problems; Birkhäuser: Basel, Switzerland, 2006. [Google Scholar]

- Detemple, J. American-Style Derivatives: Valuation and Computation; Chapman and Hall/CRC: Boca Raton, FL, USA, 2006. [Google Scholar]

- Szimayer, A. Valuation of American options in the presence of event risk. Financ. Stoch. 2005, 9, 89–107. [Google Scholar] [CrossRef]

- Gapeev, P.V.; Al Motairi, H. Perpetual American defaultable options in models with random dividends and partial information. Risks 2018, 6, 127. [Google Scholar] [CrossRef] [Green Version]

- Glover, K.; Hulley, H. Short Selling with Margin Risk and Recall Risk. Working Paper. arXiv 2019, arXiv:1903.11804. [Google Scholar]

- Dumitrescu, R.; Quenez, M.C.; Sulem, A. American options in an imperfect complete market with default. ESAIM Proc. Surv. 2018, 64, 93–110. [Google Scholar] [CrossRef]

- Grigorova, M.; Quenez, M.C.; Sulem, A. American Options in a Non-Linear Incomplete Market Model with Default. Working Paper. 2019. Available online: https://hal.archives-ouvertes.fr/hal-02025835/document (accessed on 24 December 2020).

- Bielecki, T.R.; Rutkowski, M. Credit Risk: Modeling, Valuation and Hedging, 2nd ed.; Springer: Berlin, Germany, 2004. [Google Scholar]

- Peskir, G. A change-of-variable formula with local time on surfaces. In Séminaire de Probabilité XL; Lecture Notes in Mathematics 1899; Springer: Berlin, Germany, 2007; pp. 69–96. [Google Scholar]

- Mansuy, R.; Yor, M. Random Times and Enlargements of Filtration in a Brownian Setting; Lecture Notes in Mathematics 1873; Springer: Berlin, Germany, 2006. [Google Scholar]

- Revuz, D.; Yor, M. Continuous Martingales and Brownian Motion; Springer: Berlin, Germany, 1999. [Google Scholar]

- Liptser, R.S.; Shiryaev, A.N. Statistics of Random Processes I, 2nd ed.; First Edition 1977; Springer: Berlin, Germany, 2001. [Google Scholar]

- Borodin, A.N.; Salminen, P. Handbook of Brownian Motion, 2nd ed.; Birkhäuser: Basel, Switzerland, 2002. [Google Scholar]

- Karatzas, I.; Shreve, S.E. Brownian Motion and Stochastic Calculus, 2nd ed.; Springer: New York, NY, USA, 1991. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gapeev, P.V.; Li, L.; Wu, Z. Perpetual American Cancellable Standard Options in Models with Last Passage Times. Algorithms 2021, 14, 3. https://0-doi-org.brum.beds.ac.uk/10.3390/a14010003

Gapeev PV, Li L, Wu Z. Perpetual American Cancellable Standard Options in Models with Last Passage Times. Algorithms. 2021; 14(1):3. https://0-doi-org.brum.beds.ac.uk/10.3390/a14010003

Chicago/Turabian StyleGapeev, Pavel V., Libo Li, and Zhuoshu Wu. 2021. "Perpetual American Cancellable Standard Options in Models with Last Passage Times" Algorithms 14, no. 1: 3. https://0-doi-org.brum.beds.ac.uk/10.3390/a14010003