Overcoming the Myths of Mainstream Economics to Enable a New Wellbeing Economy

Abstract

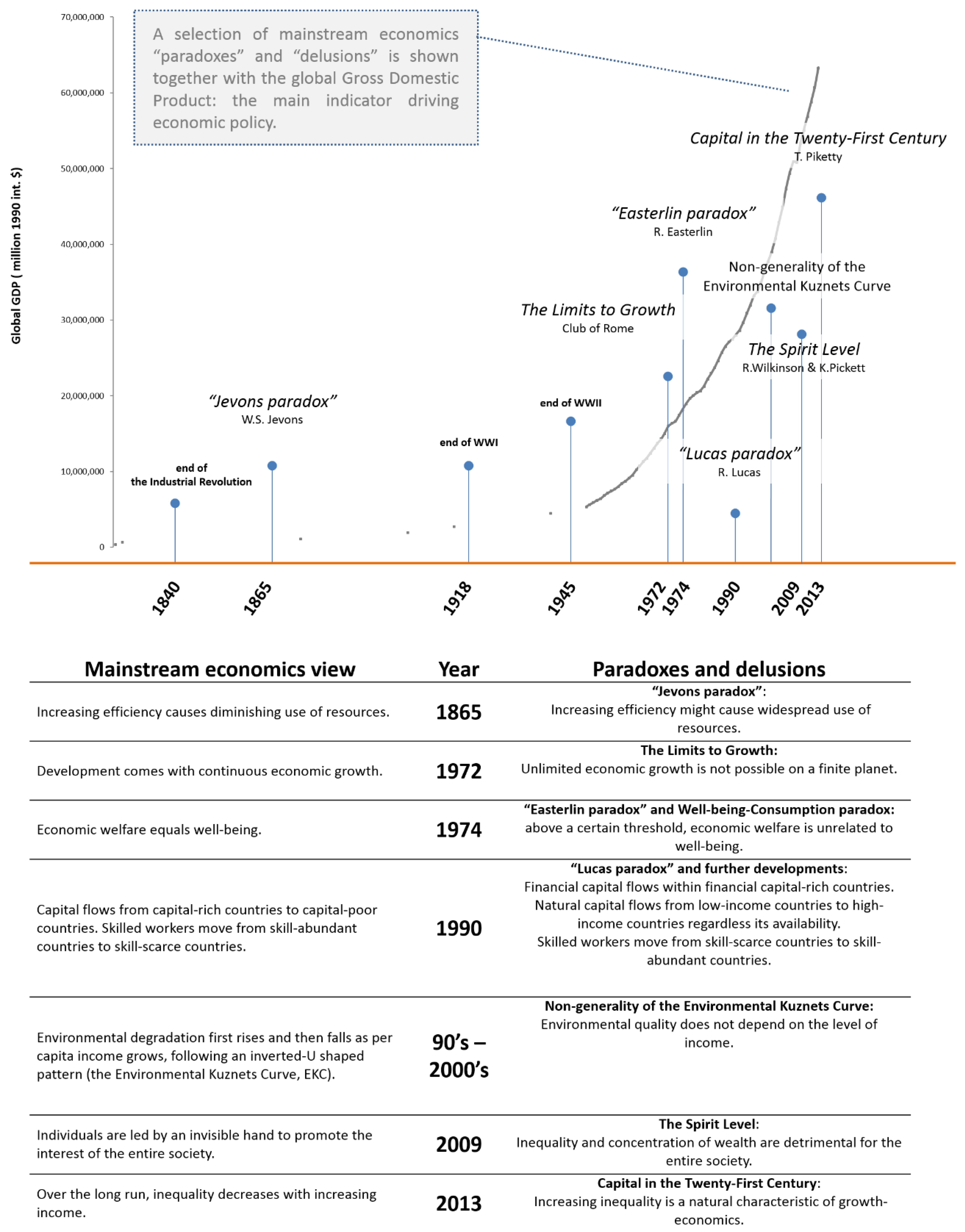

:1. Introduction

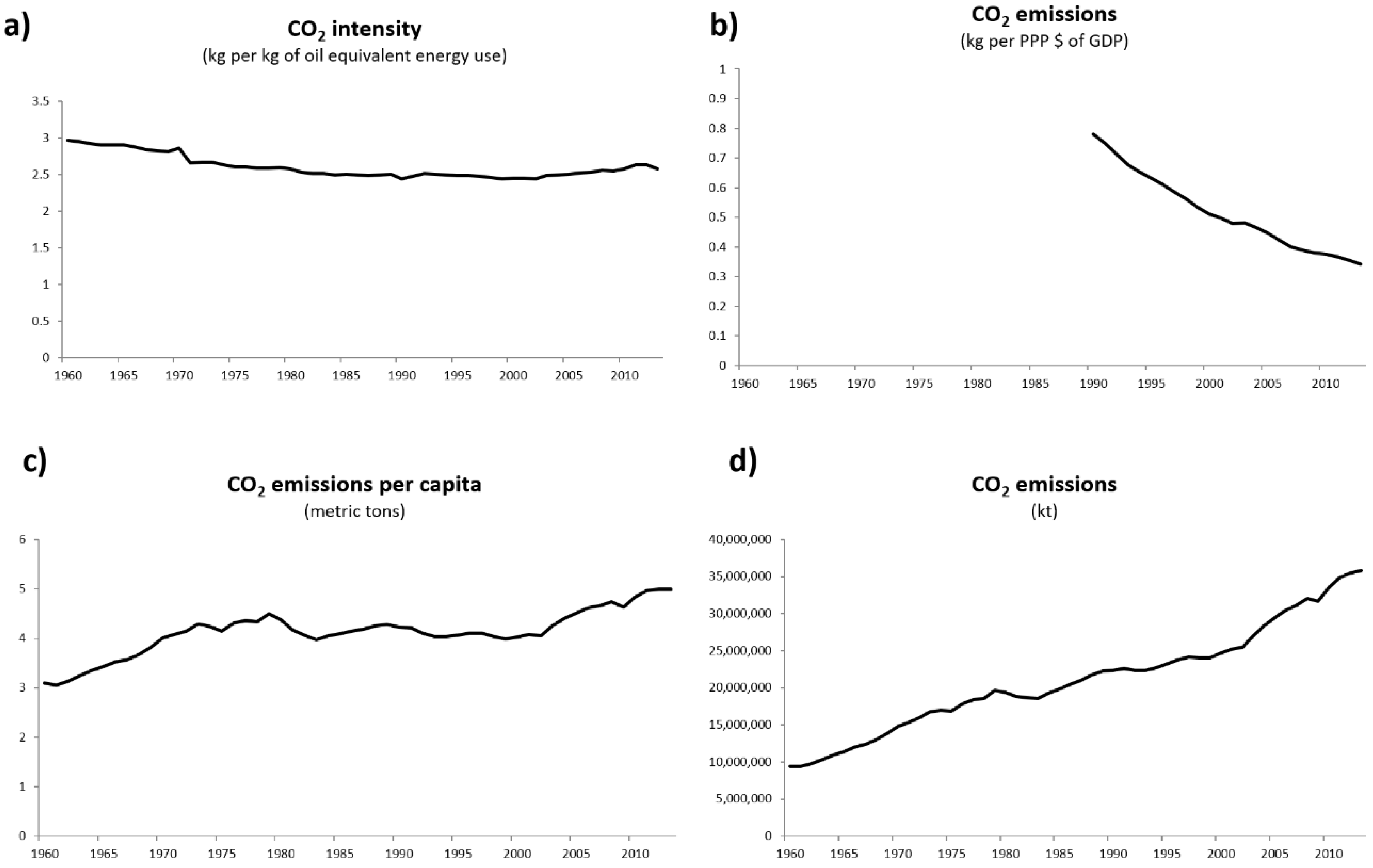

2. The Jevons Paradox and the Dematerialization Delusion

3. The Limits to Growth, Planetary Boundaries, and the Delusion of Infinite Growth

4. The Easterlin Paradox and the Delusion That Money Equals Happiness and Wellbeing

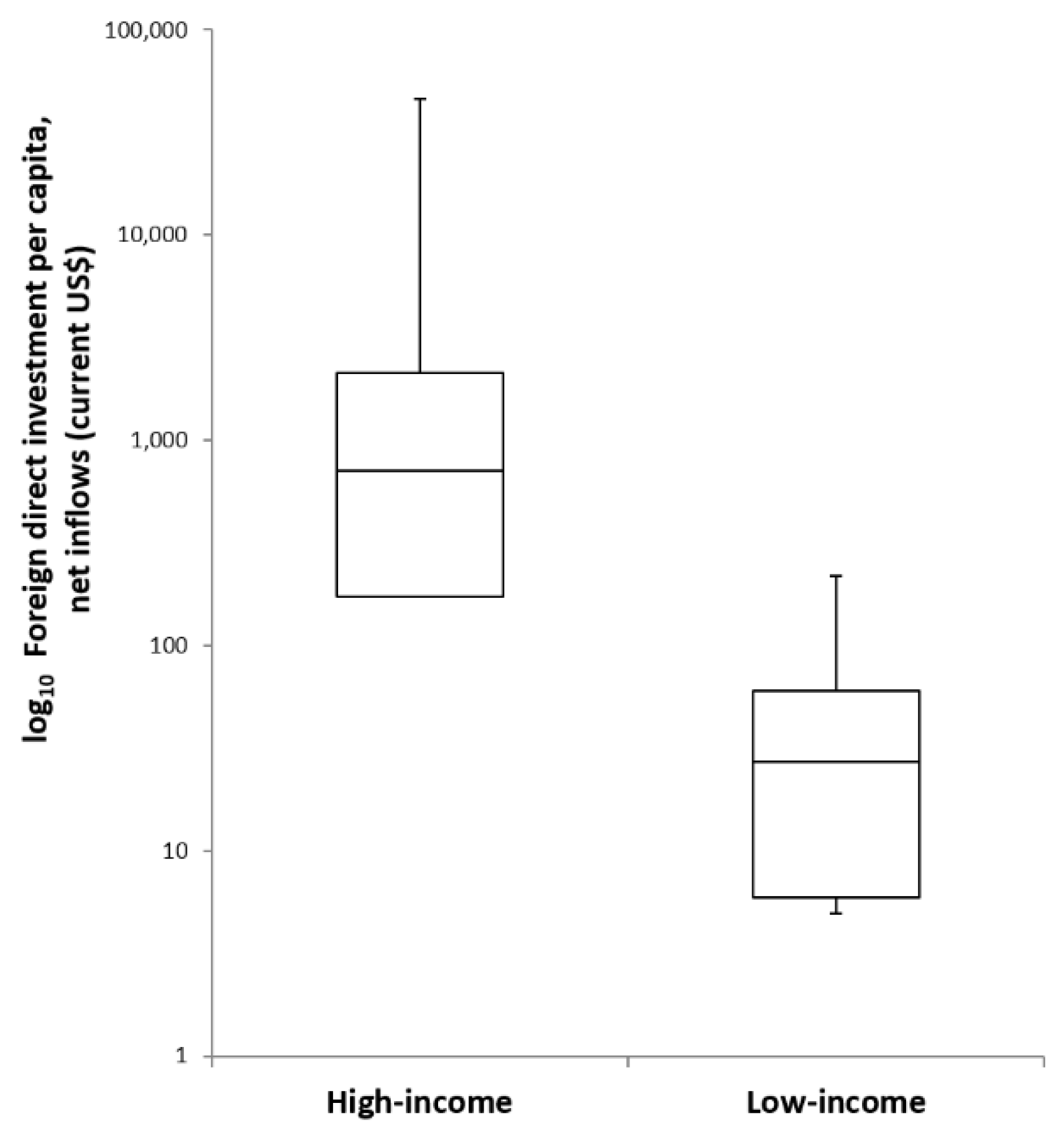

5. The Lucas Paradox and the Delusion of the Glory of Globalization

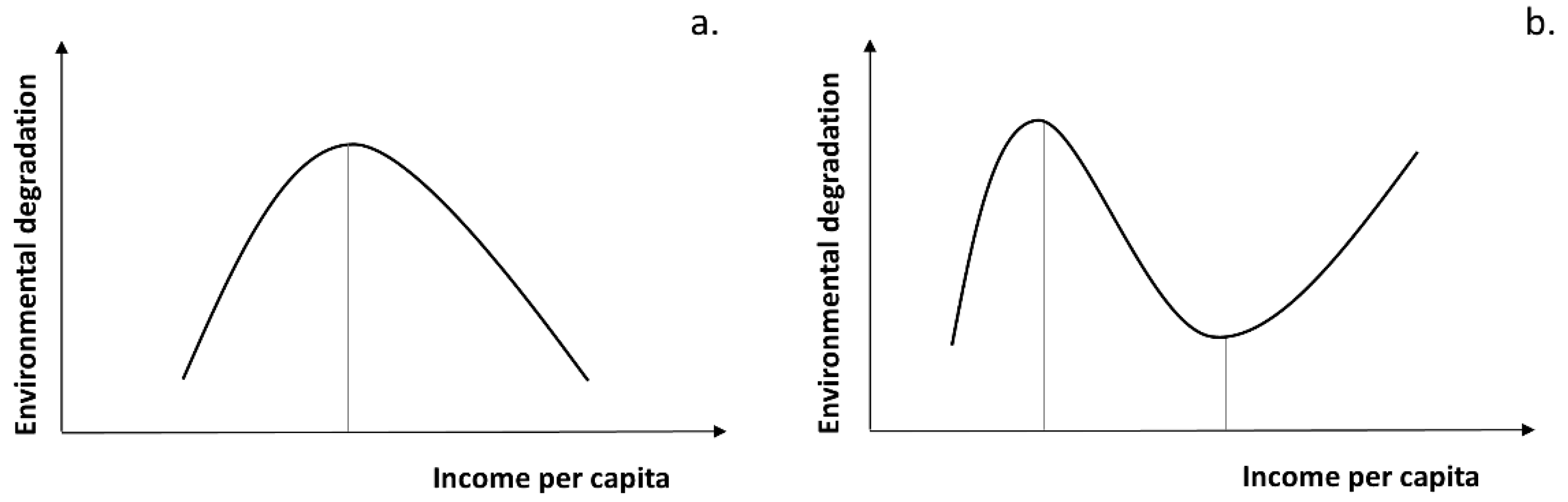

6. The Delusion of the Environmental Kuznets Curve

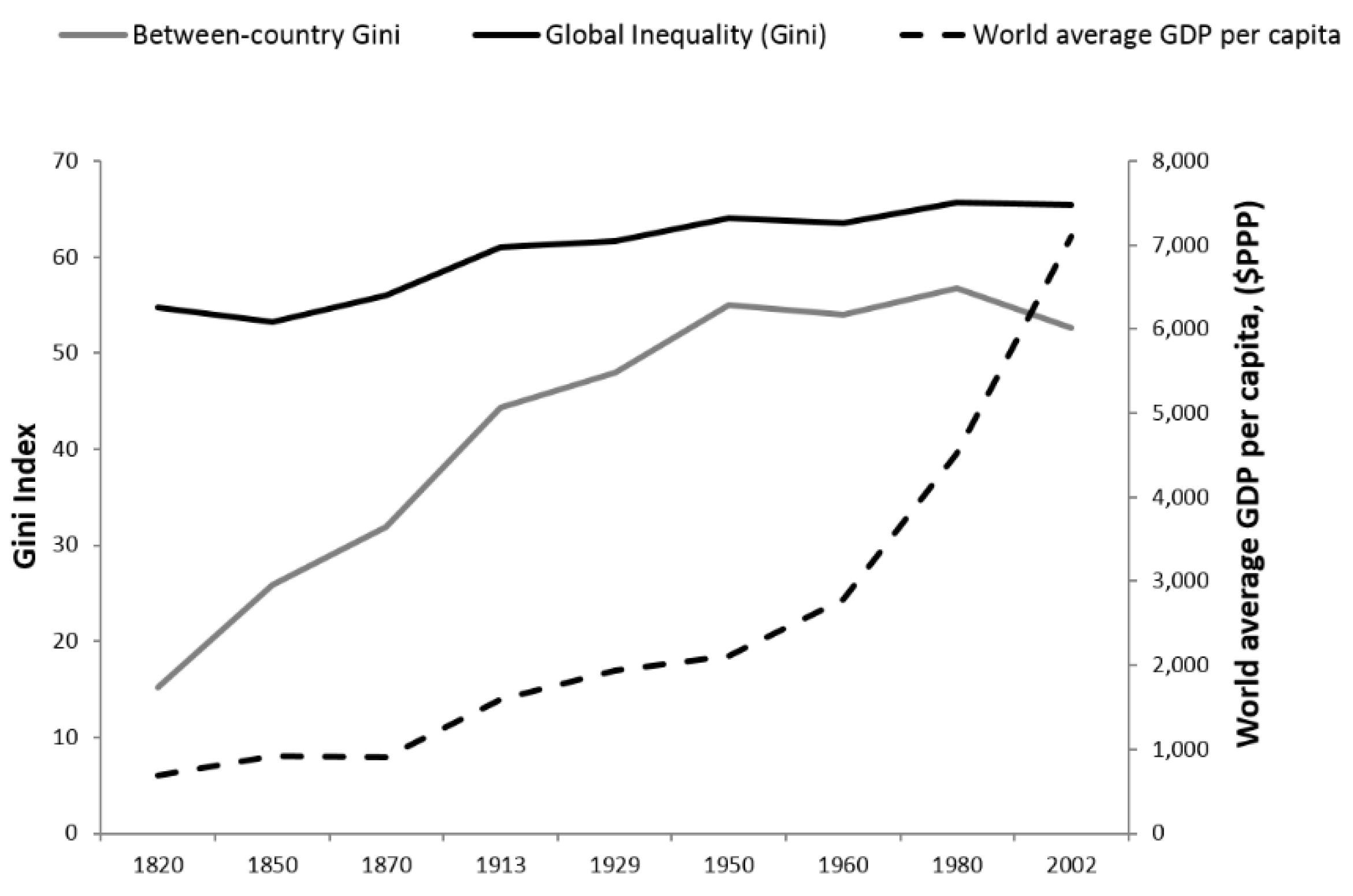

7. The Short-Circuit of Growth, Inequality, and Wellbeing, and the Delusion of the Invisible Hand

8. Discussion

8.1. An Apostasy from Free-Market Fetishism

8.2. A Modest Proposal to Reform the Logic of Economics

- (1)

- Live within planetary boundaries and achieve environmental sustainability;

- (2)

- Achieve and maintain an equitable distribution of wealth and opportunity, both within and between generations;

- (3)

- Efficiently allocate resources to provide high levels of human wellbeing.

8.3. Reforming Global Economy’s Leadership

9. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ostrom, E. A general framework for analysing sustainability of socio-ecological systems. Science 2009, 325, 419–422. [Google Scholar] [CrossRef]

- Fioramonti, L. The World after GDP: Economics, Politics and International Relations in the Post-Growth Era; Polity: Cambridge, UK, 2017. [Google Scholar]

- Besley, T.; Hennessy, P. The Global Financial Crisis—Why Didn’t Anybody Notice? Letter to Her Majesty the Queen. 22 July 2009. Available online: http://www.feed-charity.org/user/image/besley-hennessy2009a.pdf (accessed on 14 December 2017).

- Fioramonti, L. Gross Domestic Problem: The Politics behind the World’s Most Powerful Number; Zed Book: London, UK, 2013. [Google Scholar]

- Costanza, R.; Kubiszewski, I.; Giovannini, E.; Lovins, H.; McGlade, J.; Pickett, K.; Vala Ragnarsdóttir, K.; Roberts, D.; De Vogli, R.; Wilkinson, R. Time to leave GDP behind. Nature 2014, 505, 283–285. [Google Scholar] [CrossRef]

- Kubiszewski, I.; Costanza, R.; Franco, C.; Lawn, P.; Talberth, J.; Jackson, T.; Aylmer, C. Beyond GDP: Measuring and achieving global genuine progress. Ecol. Econ. 2013, 93, 57–68. [Google Scholar] [CrossRef] [Green Version]

- Abarca-Gómez, L. Worldwide trends in body-mass index, underweight, overweight, and obesity from 1975 to 2016: A pooled analysis of 2416 population-based measurement studies in 1289 million children, adolescents, and adults. Lancet 2017, 390, 2627–2642. [Google Scholar] [CrossRef]

- WHO. Obesity and Overweight. World Health Organization’s Media Centre Fact Sheet. Available online: http://www.who.int/mediacentre/factsheets/fs311/en/ updated (accessed on 1 May 2019).

- FAO (Food and Agriculture Organization of the United Nations). The State of Food Insecurity in the World: Economic Growth Is Necessary but Not Sufficient to Accelerate Reduction of Hunger and Malnutrition; The Food and Agriculture Organization of the United Nations: Rome, Italy, 2012. [Google Scholar]

- Kubiszewski, I.; Farley, J.; Costanza, R. The production and allocation of information as a good that is enhanced with increased use. Ecol. Econ. 2010, 69, 1344–1354. [Google Scholar] [CrossRef]

- Wilkinson, R.; Pickett, K. The Spirit Level; Penguin Books Ltd.: London, UK, 2009. [Google Scholar]

- Wilkinson, R.; Pickett, K. The Inner Level; Penguin Books Ltd.: London, UK, 2018. [Google Scholar]

- Schwartz, B. Paradox of Choice; Harper Perennial: New York, NY, USA, 2004. [Google Scholar]

- Stiglitz, J.E. The Price of Inequality: How Today’s Divided Society Endangers Our Future; W.W. Norton & Company, Inc.: New York, NY, USA, 2012. [Google Scholar]

- Stierli, M.; Shorrocks, A.; Davies, J.B.; Lluberas, R.; Koutsoukis, A. Global Wealth Report 2014; Credit Suisse AG: Zurich, Switzerland, 2014. [Google Scholar]

- Milanovic, B. A short history of global inequality: The past two centuries. Explor. Econ. Hist. 2011, 48, 494–506. [Google Scholar] [CrossRef]

- Goda, T.; Torres Garcia, A. The Rising Tide of Absolute Global Income Inequality during 1850–2010? Is It Driven by Inequality Within or Between Countries? Soc. Indic. Res. 2017, 130, 1051–1072. [Google Scholar] [CrossRef]

- Calvin, K.; Bond-Lamberty, B.; Clarke, L.; Edmonds, J.; Eom, J.; Hartin, C.; Kim, S.; Kyle, P.; Link, R.; Moss, R.; et al. The SSP4: A world of deepening inequality. Glob. Environ. Chang. 2017, 42, 284–296. [Google Scholar] [CrossRef]

- World Inequality Lab. World Inequality Report 2018; Alvaredo, F., Chancel, L., Piketty, T., Saez, E., Zucman, G., Eds.; Creative Commons: Mountain View, CA, USA, 2018. [Google Scholar]

- Pulselli, F.M.; Coscieme, L.; Neri, L.; Regoli, A.; Sutton, P.C.; Lemmi, A.; Bastianoni, S. The world economy in a cube: A more rational structural representation of sustainability. Glob. Environ. Chang. 2015, 35, 41–51. [Google Scholar] [CrossRef]

- Costanza, R.; Daly, H.; Cumberland, J.H.; Goodland, R.; Norgaard, R.B.; Kubiszewski, I.; Franco, C. An Introduction to Ecological Economics, 2nd ed.; Taylor and Francis: Boca Raton, FL, USA, 2014. [Google Scholar]

- Bolt, J.; Van Zanden, J.L. The Maddison Project: collaborative research on historical national accounts. Econ. Hist. Rev. 2014, 67, 627–651. [Google Scholar] [CrossRef] [Green Version]

- Jevons, W.S. The Coal Question. An Inquiry Concerning the Progress of the Nation, and the Probable Exhaustion of Our Coal-Mines; Macmillan and Co.: London, UK, 1865. [Google Scholar]

- Sorrell, S. Jevons’s Paradox revisited: The evidence for backfire from improved energy efficiency. Energy Policy 2009, 37, 1456–1469. [Google Scholar] [CrossRef]

- Greening, L.A.; Greene, D.L.; Difiglio, C. Energy efficiency and consumption—The rebound effect—A survey. Energy Policy 2000, 28, 389–401. [Google Scholar] [CrossRef]

- Ward, J.D.; Sutton, P.C.; Werner, A.D.; Costanza, R.; Mohr, S.H.; Simmons, C.T. Is Decoupling GDP Growth from Environmental Impact Possible? PLoS ONE 2016, 11, e0164733. [Google Scholar] [CrossRef]

- Bastianoni, S.; Coscieme, L.; Caro, D.; Marchettini, N.; Pulselli, F.M. The needs of sustainability: The overarching contribution of systems approach. Ecol. Indic. 2019, 100, 69–73. [Google Scholar] [CrossRef]

- Kander, A. Baumol’s disease and dematerialization of the economy. Ecol. Econ. 2005, 55, 119–130. [Google Scholar] [CrossRef]

- Parrique, T.; Barth, J.; Briens, F.; Kerschner, C.; Kraus-Polk, A.; Kuokkanen, A.; Spangenberg, J.H. Decoupling Debunked: Evidence and Arguments against Green Growth as a Sole Strategy for Sustainability; European Environmental Bureau: Brussels, Belgium, 2019. [Google Scholar]

- Caro, D.; Pulselli, F.M.; Borghesi, S.; Bastianoni, S. Mapping the international flows of GHG emissions within a more feasible consumption-based framework. J. Clean. Prod. 2017, 147, 142–151. [Google Scholar] [CrossRef]

- Jiborn, M.; Kander, A.; Kulionis, V.; Nielsen, H.; Moran, D.D. Decoupling or delusion? Measuring emissions displacement in foreign trade. Glob. Environ. Chang. 2018, 49, 27–34. [Google Scholar] [CrossRef]

- Rulli, M.C.; Saviori, A.; D’Odorico, P. Global land and water grabbing. Proc. Natl. Acad. Sci. USA 2013, 110, 892–897. [Google Scholar] [CrossRef] [Green Version]

- Coscieme, L.; Pulselli, F.M.; Niccolucci, V.; Patrizi, N.; Sutton, P.C. Accounting for “land-grabbing” from a biocapacity viewpoint. Sci. Total Environ. 2016, 539, 551–559. [Google Scholar] [CrossRef]

- Carmody, P. The New Scramble for Africa. Cambridge; Polity Press: Cambridge, UK, 2016. [Google Scholar]

- Steffen, W.; Rockström, J.; Richardson, K.; Lenton, T.M.; Folke, C.; Liverman, D.; Summerhayes, C.P.; Barnosky, A.D.; Cornell, S.E.; Crucifix, M.; et al. Trajectories of the Earth System in the Anthropocene. Proc. Natl. Acad. Sci. USA 2018, 115, 8252–8259. [Google Scholar] [CrossRef] [Green Version]

- Gowdy, J. Sustainability and collapse: What can economics bring to the debate? Glob. Environ. Chang. 2005, 15, 181–183. [Google Scholar] [CrossRef]

- Easterlin, R.A. Does Economic Growth Improve the Human Lot? Some Empirical Evidence. In Nations and Households in Economic Growth; Elsevier: Berlin/Heidelberg, Germany, 1974; pp. 89–125. [Google Scholar]

- Piketty, T. Capital in the Twenty-First Century; The Belknap Press of Harvard University Press: London, UK; Cambridge, MA, USA, 2014. [Google Scholar]

- Borghesi, S.; Vercelli, A. Sustainable globalisation. Ecol. Econ. 2003, 44, 77–89. [Google Scholar] [CrossRef]

- Rothman, D.S. Environmental Kuznets curves—Real progress or passing the buck? A case for consumption-based approaches. Ecol. Econ. 1998, 25, 177–194. [Google Scholar] [CrossRef]

- Jorgenson, A.K.; Dietz, T. Economic growth does not reduce the ecological intensity of human wellbeing. Sustain. Sci. 2015, 10, 149–156. [Google Scholar] [CrossRef]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, I.I.I.W.W. The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind; Universe Books: New York, NY, USA, 1972; ISBN 0-87663-165-0. [Google Scholar]

- Solow, R. Is the End of the World at Hand? Challenge 1973, 16, 39–50. [Google Scholar] [CrossRef]

- Atkisson, A. Believing Cassandra: How to Be an Optimist in a Pessimist’s World; Routledge: Abingdon, UK, 2010. [Google Scholar]

- Turner, G.M. A comparison of The Limits to Growth with 30 years of reality. Glob. Environ. Chang. 2008, 18, 397–411. [Google Scholar] [CrossRef]

- Turner, G. “Is Global Collapse Imminent?” MSSI Research Paper No. 4; The University of Melbourne: Melbourne, Australia, 2014. [Google Scholar]

- Jackson, T.; Webster, R. Limits Revisited: A Review of the Limits to Growth Debate. Report to the All-Party Parliamentary Group on Limits to Growth; Creative Commons: Mountain View, CA, USA, 2016. [Google Scholar]

- Rockström, J.; Steffen, W.; Noone, K.; Persson, A.; Chapin, F.S., III; Lambin, E.F.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.J.; et al. Planetary boundaries: Exploring the safe operating space for humanity. Ecol. Soc. 2009, 14, 32. Available online: http://www.ecologyandsociety.org/vol14/iss2/art32/ (accessed on 1 May 2019). [CrossRef]

- Wackernagel, M.; Schulz, N.B.; Deumling, D.; Linares, A.C.; Jenkins, M.; Kapos, V.; Monfreda, C.; Loh, J.; Myers, N.; Norgaard, R.; et al. Tracking the ecological overshoot of the human economy. Proc. Natl. Acad. Sci. USA 2002, 99, 9266–9271. [Google Scholar] [CrossRef] [Green Version]

- Raworth, K. Doughnut Economics: Seven Ways to Think Like a 21-St Century Economist; Chelsea Green Publishing: Hartford, VT, USA, 2017. [Google Scholar]

- Trebeck, K.; Williams, J. The Economics of Arrival: Ideas for a Grown up Economy; Policy Press: Bristol, UK, 2019. [Google Scholar]

- Jørgensen, S.E.; Fath, B.D.; Nielsen, S.N.; Pulselli, F.M.; Fiscus, D.A.; Bastianoni, S. Flourishing Within Limits to Growth—Following Nature’s Way; Earthscan from Routledge Taylor & Francis Group: Florence, KY, USA, 2015. [Google Scholar]

- Easterlin, R.A. Diminishing Marginal Utility of Income? Caveat Emptor. Soc. Indic. Res. 2005, 70, 243–255. [Google Scholar] [CrossRef]

- Inglehart, R.; Foa, R.; Peterson, C.; Welzel, C. Development, freedom, and rising happiness—A global perspective (1981–2007). Perspect. Psychol. Sci. 2008, 3, 264–285. [Google Scholar] [CrossRef]

- Di Tella, R.; MacCulloch, R. Gross national happiness as an answer to the Easterlin Paradox? J. Dev. Econ. 2008, 86, 22–42. [Google Scholar] [CrossRef]

- Easterlin, R.A.; McVey, L.A.; Switek, M.; Sawangfa, O.; Zweig, J.S. The happiness–income paradox revisited. Proc. Natl. Acad. Sci. USA 2010, 107, 22463–22468. [Google Scholar] [CrossRef]

- Clark, A.E.; Frijters, P.; Shields, M.A. Relative Income, Happiness, and Utility: An Explanation for the Easterlin Paradox and Other Puzzles. J. Econ. Lit. 2008, 46, 95–144. [Google Scholar] [CrossRef] [Green Version]

- Graham, C. Happiness and Health: Lessons—And Questions—For Public Policy. Health Aff. 2008, 27, 72–87. [Google Scholar] [CrossRef]

- Niccolucci, V.; Pulselli, F.M.; Tiezzi, E. Strengthening the threshold hypothesis: Economic and biophysical limits to growth. Ecol. Econ. 2007, 60, 667–672. [Google Scholar] [CrossRef]

- Sarracino, F. Social capital and subjective well-being trends: Comparing 11 western European countries. J. Socio-Econ. 2010, 39, 482–517. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D.; Deaton, A. High income improves evaluation of life but not emotional well-being. Proc. Natl. Acad. Sci. USA 2010, 107, 16489–16493. [Google Scholar] [CrossRef] [Green Version]

- Fanning, A.L.; O’Neill, D.W. The Wellbeing–Consumption paradox: Happiness, health, income, and carbon emissions in growing versus non-growing economies. J. Clean. Prod. 2019, 212, 810–821. [Google Scholar] [CrossRef]

- Max-Neef, M. Economic growth and quality of life: a threshold hypothesis. Ecol. Econ. 1995, 15, 115–118. [Google Scholar] [CrossRef]

- Asara, V.; Otero, I.; DeMaria, F.; Corbera, E. Socially sustainable degrowth as a social–ecological transformation: repoliticizing sustainability. Sustain. Sci. 2015, 10, 375–384. [Google Scholar] [CrossRef]

- Forin, S.; Radebach, A.; Steckel, J.C.; Ward, H. The effect of industry delocalization on global energy use: A global sectoral perspective. Energy Econ. 2018, 70, 233–243. [Google Scholar] [CrossRef] [Green Version]

- Weinzettel, J.; Hertwich, E.G.; Peters, G.P.; Steen-Olsen, K.; Galli, A. Affluence drives the global displacement of land use. Glob. Environ. Chang. 2013, 23, 433–438. [Google Scholar] [CrossRef] [Green Version]

- Helliwell, J.; Layard, R.; Sachs, J. (Eds.) World Happiness Report 2017; Sustainable Development Solutions Network: New York, NY, USA, 2017. [Google Scholar]

- Lucas, R.E. Why Doesn’t Capital Flow from Rich to Poor Countries? Am. Econ. Rev. 1990, 80, 92–96. [Google Scholar]

- Salomon, M.; Spanjers, J. Illicit Financial Flows to and from Developing Countries: 2005–2014, Global Financial Integrity. Available online: http://www.gfintegrity.org/report/illicit-financial-flows-to-and-from-developing-countries-2005-2014/ (accessed on 1 May 2019).

- Hickel, J. The Divide: A Brief Guide to Global Inequality and Its Solutions; W.W. Norton & Co.: New York, NY, USA, 2018. [Google Scholar]

- van Mourik, C.; Walton, P. The Routledge Companion to Accounting, Reporting and Regulation; Routledge: Abingdon, UK, 2014. [Google Scholar]

- Milanovic, B. The Haves and the Have-Nots; Basic Books: New York, NY, USA, 2011. [Google Scholar]

- Alfaro, L.; Kalemli-Ozcan, S.; Volosovych, V. Why Doesn’t Capital Flow from Rich to Poor Countries? An Empirical Investigation. Rev. Econ. Stat. 2008, 90, 347–368. [Google Scholar] [CrossRef]

- Azémar, C.; Desbordes, R. Has the Lucas Paradox been fully explained? Econ. Lett. 2013, 121, 183–187. [Google Scholar] [CrossRef]

- Coscieme, L.; Niccolucci, V.; Giannetti, B.F.; Pulselli, F.M.; Marchettini, N.; Sutton, P.C. Implications of Land-Grabbing on the Ecological Balance of Brazil. Resources 2018, 7, 44. [Google Scholar] [CrossRef]

- Stern, D.I. The Rise and Fall of the Environmental Kuznets Curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Shahbaz, M.; Sinha, A. Environmental Kuznets curve for CO2 emissions: a literature survey. J. Econ. Stud. 2019, 46, 106–168. [Google Scholar] [CrossRef]

- Dietz, S.; Adger, W.N. Economic growth, biodiversity loss and conservation effort. J. Environ. Manag. 2003, 68, 23–35. [Google Scholar] [CrossRef]

- Capellán-Pérez, I.; Mediavilla, M.; de Castro, C.; Carpintero, Ó.; Miguel, L.J. More growth? An unfeasible option to overcome critical energy constraints and climate change. Sustain. Sci. 2015, 10, 397–411. [Google Scholar]

- Yang, G.; Wang, Y.; Zeng, Y.; Gao, G.F.; Liang, X.; Zhou, M.; Wan, X.; Yu, S.; Jiang, Y.; Naghavi, M.; et al. Rapid health transition in China, 1990–2010: Findings from the Global Burden of Disease Study 2010. Lancet 2013, 381, 1987–2015. [Google Scholar] [CrossRef]

- Allard, A.; Takman, J.; Uddin, G.S.; Ahmed, A. The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ. Sci. Pollut. Res. 2018, 25, 5848–5861. [Google Scholar] [CrossRef]

- Álvarez-Herránz, A.; Balsalobre, D.; Cantos, J.M.; Shahbaz, M. Energy Innovations-GHG Emissions Nexus: Fresh Empirical Evidence from OECD Countries. Energy Policy 2017, 101, 90–100. [Google Scholar] [CrossRef]

- Martinez-Zarzoso, I.; Bengochea-Morancho, A. Pooled mean group estimation for an environmental Kuznets curve for CO2. Econ. Lett. 2004, 82, 121–126. [Google Scholar] [CrossRef]

- Borghesi, S.; Vercelli, A. Sustainability Conditions and the Environmental Kuznets Curve; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2008; pp. 51–80. [Google Scholar]

- York, R. Asymmetric effects of economic growth and decline on CO2 emissions. Nat. Clim. Chang. 2012, 2, 762–764. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the Environmental Kuznets Curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef]

- Hubacek, K.; Baiocchi, G.; Feng, K.; Patwardhan, A. Poverty eradication in a carbon constrained world. Nat. Commun. 2017, 8, 912. [Google Scholar] [CrossRef]

- Barro, R.J. Inequality and Growth in a Panel of Countries. J. Econ. Growth 2000, 5, 5–32. [Google Scholar] [CrossRef]

- Forbes, K.J. A Reassessment of the Relationship between Inequality and Growth. Am. Econ. Rev. 2000, 90, 869–887. [Google Scholar] [CrossRef]

- Pickett, K.E.; Wilkinson, R.G. Income inequality and health: A causal review. Soc. Sci. Med. 2015, 128, 316–326. [Google Scholar] [CrossRef]

- Neri, L.; D’Agostino, A.; Regoli, A.; Pulselli, F.M.; Coscieme, L. Evaluating dynamics of national economies through cluster analysis within the input-state-output sustainability framework. Ecol. Indic. 2017, 72, 77–90. [Google Scholar] [CrossRef]

- Costanza, R.; Daly, L.; Fioramonti, L.; Giovannini, E.; Kubiszewski, I.; Mortensen, L.F.; Pickett, K.E.; Ragnarsdottir, K.V.; De Vogli, R.; Wilkinson, R. Modelling and measuring sustainable wellbeing in connection with the UN Sustainable Development Goals. Ecol. Econ. 2016, 130, 350–355. [Google Scholar] [CrossRef]

- Jackson, T. Prosperity without Growth; Earthscan: New York, NY, USA, 2009. [Google Scholar]

- Foster, J.B. The Planetary Rift and the New Human Exemptionalism: A Political-Economic Critique of Ecological Modernization Theory. Organ. Environ. 2012, 25, 211–237. [Google Scholar] [CrossRef]

- Lynch, M.J.; Stretesky, P.B.; Information, R.; Long, M.A. A Proposal for the Political Economy of Green Criminology: Capitalism and the Case of the Alberta Tar Sands. Can. J. Criminol. Crim. Justice 2016, 58, 137–160. [Google Scholar] [CrossRef] [Green Version]

- Higgins, P.; Short, D.; South, N. Protecting the planet: a proposal for a law of ecocide. Contemp. Crises 2013, 59, 251–266. [Google Scholar] [CrossRef]

- Krugman, P. How Did Economists Get It So Wrong? The New York Times Magazine. 2009. Available online: http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html (accessed on 1 May 2019).

- Costanza, R.; De Groot, R.; Sutton, P.; Van Der Ploeg, S.; Anderson, S.J.; Kubiszewski, I.; Farber, S.; Turner, R.K. Changes in the global value of ecosystem services. Glob. Environ. Chang. 2014, 26, 152–158. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Sen, A.; Fitoussi, J.P. Mismeasuring Our Lives: Why GDP Doesn’t Add Up; The New Press: New York, NY, USA, 2010. [Google Scholar]

- Stiglitz, J.E. Globalization and its Discontents Revisited; W.W. Norton & Company, Inc.: New York, NY, USA, 2017. [Google Scholar]

- Akerlof, G.A.; Shiller, R.J. Phishing for Phools: The Economics of Manipulation and Deception; Princeton University Press: Princeton, NJ, USA, 2015. [Google Scholar]

- Tversky, A.; Kahneman, D. Causal Schemas in Judgements under Uncertainty. In Progress in Social Psychology; Psychology Press address: London, UK, 2015; Volume 9, pp. 49–72. [Google Scholar]

- Dietz, S.; Hope, C.; Patmore, N. Some economics of ‘dangerous’ climate change: Reflections on the Stern Review. Glob. Environ. Chang. 2007, 17, 311–325. [Google Scholar] [CrossRef]

- Daly, H.E.; Farley, J. Ecological Economics: Principles and Applications; Island Press: Washington, DC, USA, 2003. [Google Scholar]

- Costanza, R.; Caniglia, E.; Fioramonti, L.; Kubiszewski, I.; Lewis, H.; Lovins, H.; McGlade, J.; Mortensen, L.F.; Philipsen, D.; Pickett, K.; et al. Towards a Sustainable Wellbeing Economy. Solut. J. 2018, 9. [Google Scholar]

- Trebeck, K. A New Economy for All. UN Association 19/6/2019. Available online: http://sustainablegoals.org.uk (accessed on 1 May 2019).

- New Zealand Treasury. The Wellbeing Budget 2019. Available online: http://treasury.govt.nz (accessed on 30 May 2019).

- Scottish Government. National Performance Framework. 2019. Available online: http://nationalperformance.gov.scot (accessed on 1 May 2019).

- Laub, Z. The Group of Seven (G7). 2014. Available online: http://www.cfr.org (accessed on 1 May 2019).

- Fioramonti, L. A Post-GDP World? Rethinking International Politics in the 21st Century. Glob. Policy 2016, 7, 15–24. [Google Scholar] [CrossRef]

- Stiglitz, J. Showing the Way in San José—How Costa Rica Gets It Right. The Guardian. 9 May 2018. Available online: https://www.theguardian.com/world/2018/may/09/showing-the-way-in-san-jose-how-costa-rica-gets-it-right (accessed on 1 May 2019).

- Trebeck, K. Here We Go. The Mint Magazine. 6 April 2019. Available online: https://www.themintmagazine.com/here-we-go (accessed on 1 May 2019).

- UN Environment Global Environment Outlook—GEO 6: Healthy Planet, Healthy People. Nairobi, Kenya, 2019. [CrossRef]

- Wellbeing Economy Alliance (WEAll). How Will We Change the System? Available online: https://wellbeingeconomy.org/how-will-we-change-the-system (accessed on 1 May 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coscieme, L.; Sutton, P.; Mortensen, L.F.; Kubiszewski, I.; Costanza, R.; Trebeck, K.; Pulselli, F.M.; Giannetti, B.F.; Fioramonti, L. Overcoming the Myths of Mainstream Economics to Enable a New Wellbeing Economy. Sustainability 2019, 11, 4374. https://0-doi-org.brum.beds.ac.uk/10.3390/su11164374

Coscieme L, Sutton P, Mortensen LF, Kubiszewski I, Costanza R, Trebeck K, Pulselli FM, Giannetti BF, Fioramonti L. Overcoming the Myths of Mainstream Economics to Enable a New Wellbeing Economy. Sustainability. 2019; 11(16):4374. https://0-doi-org.brum.beds.ac.uk/10.3390/su11164374

Chicago/Turabian StyleCoscieme, Luca, Paul Sutton, Lars F. Mortensen, Ida Kubiszewski, Robert Costanza, Katherine Trebeck, Federico M. Pulselli, Biagio F. Giannetti, and Lorenzo Fioramonti. 2019. "Overcoming the Myths of Mainstream Economics to Enable a New Wellbeing Economy" Sustainability 11, no. 16: 4374. https://0-doi-org.brum.beds.ac.uk/10.3390/su11164374