3.1. Sample Description

Zhengzhou, which is one of the provincial capitals as well as eight national central cities in China, is traditionally located at the intersection of the Beijing-Guangzhou transport corridor and the Longhai-Lanxin transport corridor (between Lianyungang, Jiangsu, and Urumqi, Xinjiang). Benefitting from a good location, Zhengzhou has rapidly developed since the reform and opening in 1978. Under China’s “One Belt, One Road” initiative, Zhengzhou has been transformed into a major logistics and manufacturing hub on the Silk Road Economic Belt between China and Europe. In 2017, the GDP and population of Zhengzhou respectively ranked seventh and tenth among 28 provincial capitals and four municipalities in China, while the average housing price ranked 15th. That is to say, its housing price rank is lower than the ranks in terms of its population and economic growth, thus indicating that there might be room for housing prices to rise.

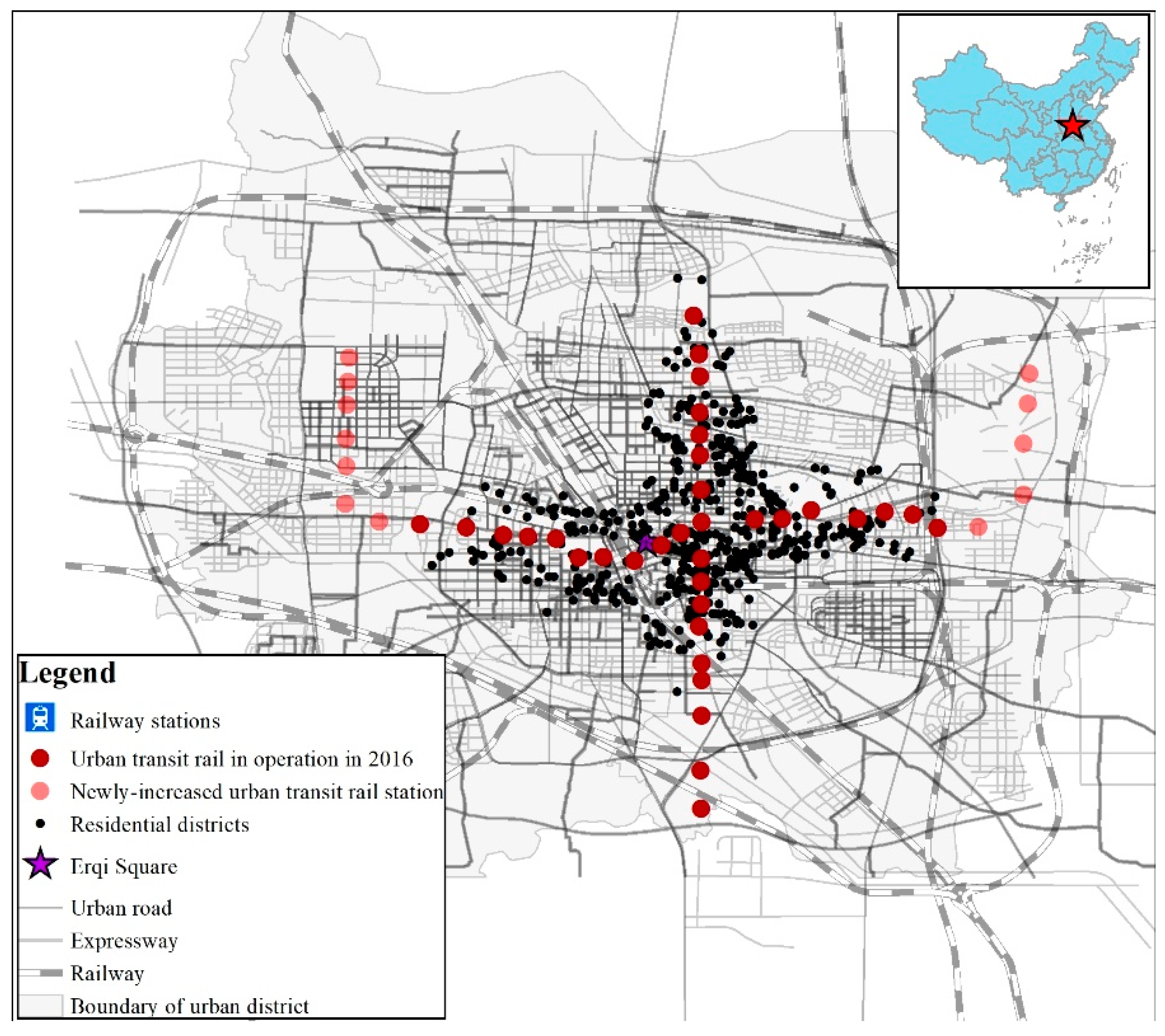

The development of URT in Zhengzhou could date back to 2001. In 2001, the Urban and Rural Planning Bureau (URPB) of Zhengzhou firstly proposed the idea to build URT in Zhengzhou. In 2009, the National Development and Reform Commission (NDRC) submitted the plans of Zhengzhou Metro Line 1 and Zhengzhou Metro Line 2. The first phase of Line 1 with 20 stations and the total mileage of 26.34 km started to construct in June 2009 and operated in December 2013. Line 2 (the segment between Liuzhuang Station and Nansihuan Station) began to construct in December 2010 and commenced operations in August 2016. In 2017, Line 1 expanded to the west and the east by adding 15.01 km and nine stations. At the same year, the third URT line, named Chengjiao line, was opened in 2017, which started from Nansihuan in Guancheng and ending in Xinzheng International Airport. Until the end of 2017, Zhengzhou had three operating lines with a total mileage of 85.6 km and 59 stations. According to the Zhengzhou Urban Rail Transit Network Planning (2015–2050) revised in 2016, there will be 21 URT lines, including eight lines in the urban areas (Lines 1–8), firve lines in the suburbs (Line 9–13), and eight intercity express lines in 2050. The total mileage of the rail transit in Zhengzhou will reach 945.2 km in 2050. The rapid development of URT in Zhengzhou has raised a fierce debate among users and non-users since its overall profitability is difficult to assess. Additionally, the URT had generated obvious influence on the RPV. Thus, it is significant to explore the relationship between URT and RPV for the policy-makers, users and the operating company of URT in Zhengzhou.

According to the data availability, the first phases of both Line 1 with 20 stations and Line 2 with 22 stations were chosen in this study to explore the impacts of URT on residential property values. Based on previous studies [

17,

41], a radius of 2 km is set as the influencing scope of URT stations. Thus, 480 gated communities located within a range of 2 km to the 42 transit stations were chosen as the study objects in this study, as shown in

Figure 1. A “gated community” is generally located in an urban district and is a residential community or residential area characterized by the enclosed walls and fences. In addition, gated communities strictly control pedestrians, bicycles, and car entrances, and typically include small residential streets and a variety of shared facilities. The apartments in the same gated community are built by one real estate developer who traditionally controls the location and neighborhood characteristics.

The average housing price of each gated community was chosen to reflect the RPV, which was also used by Haizhen Wen [

42] and Qingzhi Liu [

43]. It is calculated by using the average housing prices of all transaction apartments in it, which is measured using the total transaction prices of all the apartments divided by their total areas. These data can be collected from the Anjuke website. All apartments located in the selected 480 gated communities are ordinary apartments, not luxury apartments or high-end apartments.

Table 1 shows the statistical characteristics of the housing prices in the selected gated communities. These gated communities were randomly chosen in different groups with different total numbers of apartments. According to the statistical characteristics of the housing prices in the selected gated communities, the housing prices of about 0.53–0.90 of the apartments in the same gated communities are between the value of the average price minus (

) and plus the standard deviation (

). Additionally, the coefficient of variation (CV, which is the standard deviation divided by the average value) of the housing prices in most gated communities is lower than the coefficient of variation of the average housing price of all gated communities (0.2315). This indicates that the housing prices in one certain gated community are much more concentrated around the average value and the differences among the housing prices in one certain gated community is lower than those between different gated communities. Since there is no gated community that was built after 2013, the average prices per square meter for the second-hand apartments in gated communities were chosen as dependent variables of the model.

In addition, four residential characteristics, namely, URT facilities, construction, neighborhood, and location were used as independent variables.

Table 2 lists the variables along with the definition, name, data sources, and symbol for each variable. The details of the four independent variables are as follows.

(1) Regarding the URT facilities, unlike previous studies [

16,

17], the travel time to the nearest URT stations and the dummy of the travel time were introduced in the model to reflect the accessibility to URT. The first is a continuous variable, while the second is a dummy variable. The travel time to the nearest URT station is collected using web crawler technology, which accounts for both the road distance and walking speed.

(2) The residential property values of a gated community are always related to its physical characteristics itself. Since the basic research object of this paper is gated communities, there is no need to consider factors such as the floor levels (low, medium, and high) and the total number of floors of the apartment blocks. When a consumer purchases an apartment, the technological quality, the environment within the community, etc. are usually considered.

Thus, with regard to the construction characteristic variables, the property fee of the community (fee), the total number of households in a gated community (number), the housing age (age) [

17,

42], the greening rate (gre) [

44,

45], and the plot ratio (rate) of the building [

46] are taken into account as the control variables in this paper. All of these are continuous variables. It is predicted that the age of the building and the plot ratio both have a negative impact on residential property values, the greening rate might have a positive effect, and there is an unknown relationship between the property fees (fee) and the total numbers of households (number) in the community on the residential property values.

(3) For the variables related to the neighborhood characteristics, the number of supermarkets [

47] and banks located within 1000 m of the gated community, the number of bus stations within 500 m, the dummy of whether there are middle schools or primary schools in 1000 m [

5,

6], and a dummy variable measuring whether there is a park/hospital within 1000 m were introduced in the model. All of these variables are predicted to have positive effects on residential property values.

(4) Regarding the location characteristics, the shortest car travel times to Erqi Square (d_27), the central business district (CBD, d_cbd), and the district government (d_c) are introduced in the model. Here, the CBD in Zhengzhou is located in Zhengzhou New District and is named the Zhengdong CBD. The shortest car travel time was calculated using web crawler technology considering the real travel conditions.

The data for the study comprises two parts: (1) a GIS database including the travel distance and travel time to rail transit station, city central, or the other facilities, obtained from the Baidu Openmap website (

http://apistore.baidu.com/astore/shopinfo/579.html); (2) the attributes of gated communities, sourced from the Anjuke website (

https://zhengzhou.anjuke.com/), which is a leading second-hand trading platform in China.

3.2. Model and Variable Determination

The hedonic price model defines the residential property in a complex real estate market as a function of its heterogeneous commodity and average housing prices of apartments in one certain gated community [

23]. Thus, the HPM is widely used to explore the relationships between the RPVs and the community’s physical and environment attributes [

48]. There are four widely used forms of the HPM, including the linear Equation (1), the semilog-linear Equations (2) and (3), and the log-linear Equation (4) [

17].

Among these, the linear model (Equation (1)) can only reflect the relationship of the housing price and these characteristics, but not the law of diminishing marginal utility. Equations (3) and (4) quite strictly require that the variables cannot be zero. Compared with Equation (1), Equation (2) can improve heteroscedasticity by reducing the scale of the dependent variable. In comparison with Equations (3) and (4), Equation (2) has no restrictions on whether the variables are zero. Therefore, we chose Equation (2) as the basic equation, and the semilog-linear form of HPM is formulated as follows:

where

represents the average housing price of gated community

i in year

t;

represents the travel time from gated community

i to the nearest URT station in year

t;

,

, and

respectively represents the construction, neighborhood, and location characteristics of gated community

i in year

t.

The second model is an extension of Equation (1) that distinguishes between various travel distance (travel time) categories. In this model, the travel time to the nearest URT station is replaced by indicators reflecting the access to URT stations, which can be used to estimate the impacts of URT on RPVs with respect to spatial dimensions. For modeling purposes, the access to URT stations is implemented using either the dummies based on the travel time to URT stations (e.g., 0–4 min, 4–8 min, 8–12 min, 12–16 min, and >16 min) or the continuous travel time to the nearest URT.

where D includes the spatial dummies of

d1,

d2,

d3,

d4, and

d5, as shown in

Table 3.

With the third model, we explore the impacts of URT on RPV considering only the variables of the temporal dimensions or both the variables of the spatial and temporal dimensions. In this model, the year dummies (as shown in

Table 3) are introduced in the models to explore the impacts from temporal dimensions. The model can be written as

where

represents the time dummy of gated community

i in year

t.