1. Introduction

Quality of service can be understood as a comprehensive customer evaluation of a particular service and the extent to which it meets their expectations and provides satisfaction [

1].

Mualla [

2] stated that banks amend, develop and, create effective strategies to determine the different parameters influencing service quality, in order to increase the number of their customers based on the competitive market situation by evaluating customer satisfaction with respect to the various dimensions that influence service quality.

Due to the important role played by the banking sector in Jordan—being one of the sectors that contribute to the national economy—organizations need innovative solutions to improve the value delivered to shareholders and customers in order to gain and maintain a competitive advantage as well as to avoid elimination from the banking sector. Managing supply chain integration is a solution that has become recently popular.

The SERVQUAL model is mainly used as a multi-dimensional research instrument for customer satisfaction, and consists of the following dimensions: reliability, empathy, responsiveness, assurance, and tangibility. Three other dimensions were added to this model in our study, which are financial aspect, access and employee competences.

This study attempts to address this gap in the literature by investigating customer satisfaction with service quality in Jordanian banks. Particularly, Agbor [

3] stated that customer satisfaction has a relationship with service quality. At this point, there is an important need to lead research in the business, economic, and management fields. Some research has clarified the relationship between customer satisfaction and service quality with service quality dimensions. This indicates that there is a need for further studies in this area.

This study aims to identify service quality dimensions, which can be used to measure customer satisfaction, and evaluate the effect of service quality dimensions (tangibles, responsiveness, empathy, assurance, reliability, access, financial aspect, and employee competences) on customer satisfaction in the Jordanian-banking sector.

The question had been structured to explore the research objective. The research question is the following: which service quality subscales have the most significant impact on customer satisfaction in the Jordanian banking sector?

Finally, this is the first study to investigate these proposed relationships in Jordan. Therefore, it contributes to the existing literature by filling these apparent gaps, providing insights for both researchers and practitioners.

3. Research Hypotheses

Service quality and customer satisfaction

Service quality is unanimously recognized as an indicator of an organization’s competitiveness [

5,

24]. Service performance is considered a strategic weapon which leads to achieving customer satisfaction in a service industry [

32]. Hence, by offering a superior quality of service, organizations can obtain a competitive advantage [

32]. Parasuraman et al. [

24] argue that customers assess the service quality differences between what they are looking for according to their needs and their expectations related to it on the one hand, and the actual perceived services that they receive, on the other. Parasuraman et al. [

5] and Parasuraman et al. [

24] proposed the SERVQUAL model to fill the gap between customers’ expectations and perceptions, and actual service performance. Service quality can be measured using five dimensions: tangibility, reliability, assurance, responsiveness, and empathy. Moreover, SERVPERF arose as a response to criticism of the gap in the SERVQUAL model, because the SERVQUAL model measured customer satisfaction only after the service was provided [

41]. However, the SERVQUAL model is the most commonly used to measure and evaluate service quality around the world, even in the banking sector. Therefore, regardless of the increasing use of SERVQUAL, there are differing opinions on its operation and effectiveness. Thus, researchers have modified the SERVQUAL model and added new dimensions: access, financial aspect and employee competences [

5,

24,

27,

42,

43,

44].

H1:

Service quality positively influences customer satisfaction.

The relationship between service quality dimensions and customer satisfaction

In the literature, authors are convinced of the intimate relationship between service quality and customer satisfaction, and they point out that the higher the service quality, the higher the levels of customer satisfaction, especially in the banking sector [

27,

45,

46,

47]. Parasuraman et al. [

24] argued that service quality and customer satisfaction are two diverse notions but closely related to each other in the service sector. In recent years, several authors have discussed and emphasized the relationship between these two common constructs in banking sectors and have found a positive and predictive relationship between service quality and customer satisfaction [

27,

48,

49,

50]. Ultimately, service quality dimensions—tangibility, reliability, assurance, responsiveness, empathy, access, financial aspects, and employee competences—are used to assess the effect of the quality of the banking service on customer satisfaction in the Jordanian banking sector. The next section presents the sub-hypotheses.

The relationship between tangibility and customer satisfaction

In the banking sector, the tangibility dimension becomes intrinsic in service quality, according to the tangible facets of the servicescape, such as equipment, physical facilities, and visual appeal [

5]. Subsequently, in the banking sector, it can be said that there is a significant influence of tangibility on customer satisfaction [

46,

51,

52]. Similarly, many researchers have found a meaningful influence in this sense [

48,

49,

50].

Parasuraman et al. [

5] have defined tangibility as the appearance of physical facilities, equipment, personnel, and communication materials. It may also be defined as the clear visibility of resources necessary for providing a service to customers, the appearance of the management team and professional employees, brochures and booklets, which will have an effect on customer satisfaction [

53]. Ananth et al. [

51] found that attractiveness, physical facility, and visual appeal could be considered positive indicators of tangibility on customer satisfaction in the banking sector. Furthermore, various researchers have found that there is a positive effect on the relationship between customer satisfaction and tangibility in the banking sector [

53,

54,

55]. Moreover, Krishnamurthy et al. [

49] and Selvakumar [

50] emphasized that tangibility has a positive impact on customer satisfaction in banking services. Ananth et al. [

51] showed that in the banking sector sophisticated equipment and an attractive ambiance is viewed as the impact of tangibility on customer satisfaction. Thus, based on the above arguments, this leads to the development of the following hypothesis:

H1a:

Tangibility positively influences customer satisfaction in the Jordanian banking sector.

The relationship between reliability and customer satisfaction

Researchers have demonstrated that the reliability dimension of service quality has a positive impact on customer satisfaction [

5,

24]. Ennew et al. [

42] revealed that reliability could be considered the extent to which customers can rely on the service promised by the organization. Parasuraman et al. [

5] has defined reliability as the organization's capability to tool up the service, dependently and independently. As a standard of service quality, reliability has a significant impact on customer satisfaction [

24]. Ennew et al. [

42] defined reliability as the ability to do and perform the required service for customers dependably, accurately and as promised, and the capacity to treat problems faced by customers. Taking actions to solve problems, performing the required services right from the first occasion, or providing services at the proper time are critical. Maintaining an error-free record is the paradigm of reliability in terms of service quality, and has an important impact on customer satisfaction [

24].

Peng and Moghavvemi [

47] contend that the most important factors in retaining customers in banking services are accuracy in completing orders, maintaining precise records and quotations, accuracy in billing, and fulfilling promised services. These are the basic aspects of reliability. The extant literature has also revealed that reliability has a positive relationship with customer satisfaction in the banking sector [

46,

47,

49,

50,

54]. Therefore, based on the above arguments, we reached the following hypothesis:

H1b:

Reliability positively influences customer satisfaction in the Jordanian banking sector.

The relationship between assurance and customer satisfaction

The assurance dimension of service quality indicates employees’ competence, knowledge and courtesy, and the ability to build bridges of trust with customers [

5]. Assurance is defined as the knowledge and good manners or courtesy of employees [

46]. Further, it is defined as the ability of employees, with the help of the knowledge they possess, to inspire the trust and confidence that will strongly influence the level of customer satisfaction [

24]. There is a positive relationship between assurance and customer satisfaction [

49,

50,

53,

54]. In the banking sector, assurance is related to the security that a customer feels when conducting his banking transactions [

42]. Providing customer assistance in a courteous manner, accuracy in completing orders, easy access to account details, convenience within the bank, maintaining precise records and quotations, employing an experienced professional team, and fulfilling promised services will have a positive impact on customer satisfaction [

56]. Based on the above discussion, we reached the following hypothesis:

H1c:

Assurance positively influences customer satisfaction in the Jordanian banking sector.

The relationship between responsiveness and customer satisfaction

The responsiveness dimension of service quality is related to the organization’s willingness and ability to help customers, and to provide quick service with proper timeliness [

5]. The willingness of employees to provide the required service at any time without any inconvenience will have an impact on customer satisfaction [

24].

Responsiveness is primarily concerned with how service firms respond to customers via their personnel. Individual attention will increase the customer’s satisfaction and so will the attention paid by employees to the problems that face customers; when this happens, a radical shift occurs in their satisfaction.

Arguably, banking sector responsiveness has a direct relationship with customer satisfaction [

46,

49,

50,

55]. Based on the above statements, we can state that the responsiveness dimension of service quality will strongly influence customer satisfaction in banking and therefore, the research proposes the following hypothesis.

H1d:

Responsiveness positively influences customer satisfaction in the Jordanian banking sector.

The relationship between empathy and customer satisfaction

Ennew et al. [

42] point out that the empathy dimension of service quality means being attentive in communicative situations, understanding customer needs, showing friendly behavior, and taking care of a customer's needs individually. Navaratnaseel and Periyathampy [

57] defined empathy as the ability to take care of customers and pay attention to them individually, especially while providing services. Moreover, Parasuraman et al. [

24] argued that understanding customer expectations better than competitors and the provision of care and customized attention to customers strongly influences the level of customer satisfaction. Ananth et al. [

51] revealed that a positive impact on customer satisfaction is brought about by convenient working hours, individualized attention, a better understanding of customer's specific needs in the banking sector and the empathy dimension, all of which play a crucial role in customer satisfaction [

49,

50,

54,

57]. According to the above reviews, the study proposed the following hypothesis:

H1e:

Empathy positively influences customer satisfaction in the Jordanian banking sector.

The relationship between access and customer satisfaction

Access refers to whether the service is convenient, easy to access, and can be contacted easily. It includes convenient office times and available times for transactions to be executed. Four measurement items for this construct were taken from [

31]. Access to service means the ease and convenience at which customers can use the services that banks make available to their customers. Approachability and ease of contact are the two most important elements of accessibility. Research shows that greater accessibility to services results in increased customer satisfaction [

31]. As one of the dimensions of service image, accessibility may have a significant direct or indirect influence on bank customers’ satisfaction and loyalty [

32]. The following hypothesis is suggested:

H1f:

Access positively influences customer satisfaction in the Jordanian banking sector.

The relationship between the financial aspect and customer satisfaction

Sharma Naveen [

58] has modified the SEVQUAL model by adding the financial aspect. Significantly, the financial aspect is a new dimension, not similar to any of the original SERVQUAL scale dimensions. It refers to the organization's profit, which is subjectively measured through profit in recent years, the profit increment ratio, the effectiveness of financial management, the achievement of financial goals and the effectiveness of financial measures [

33]. The financial aspect dimension of service quality is attentive to the customer as a factor of financial benefits [

16,

58]. Many researchers have argued that financial aspect has a positive impact on customer satisfaction. Many researchers [

35,

61] have stated that a competitive interest rate offered on different loans and deposits has a great impact. Moreover, customers compare the reasonableness of the charges among different banks, and choose the most suitable charge [

58,

60]. Based on the above publications, the following hypothesis is proposed:

H1g:

The financial aspect positively influences customer satisfaction in the Jordanian banking sector.

The relationship between employee competences and customer satisfaction

Human competences is one of the most common areas in the management of people in the workplace. Competences include knowledge, skills, abilities, values, motivation, initiative, and self- control [

35]. Many researchers argue that employee competences have a positive impact on customer satisfaction [

6,

35,

58]. Sharma Naveen [

58] argues that it is necessary that the employees know a bank's products well, be prompt in serving the bank, and have the necessary knowledge to serve customers promptly. Employees should not hesitate to find the time to serve the customer better, and know what satisfies customers, since all these components relate to giving customers the necessary knowledge and to understanding their specific needs [

6]. Accordingly, based on the above reviews, the study formulates the following hypothesis:

H1h:

Employee competences positively influence customer satisfaction in the Jordanian banking sector.

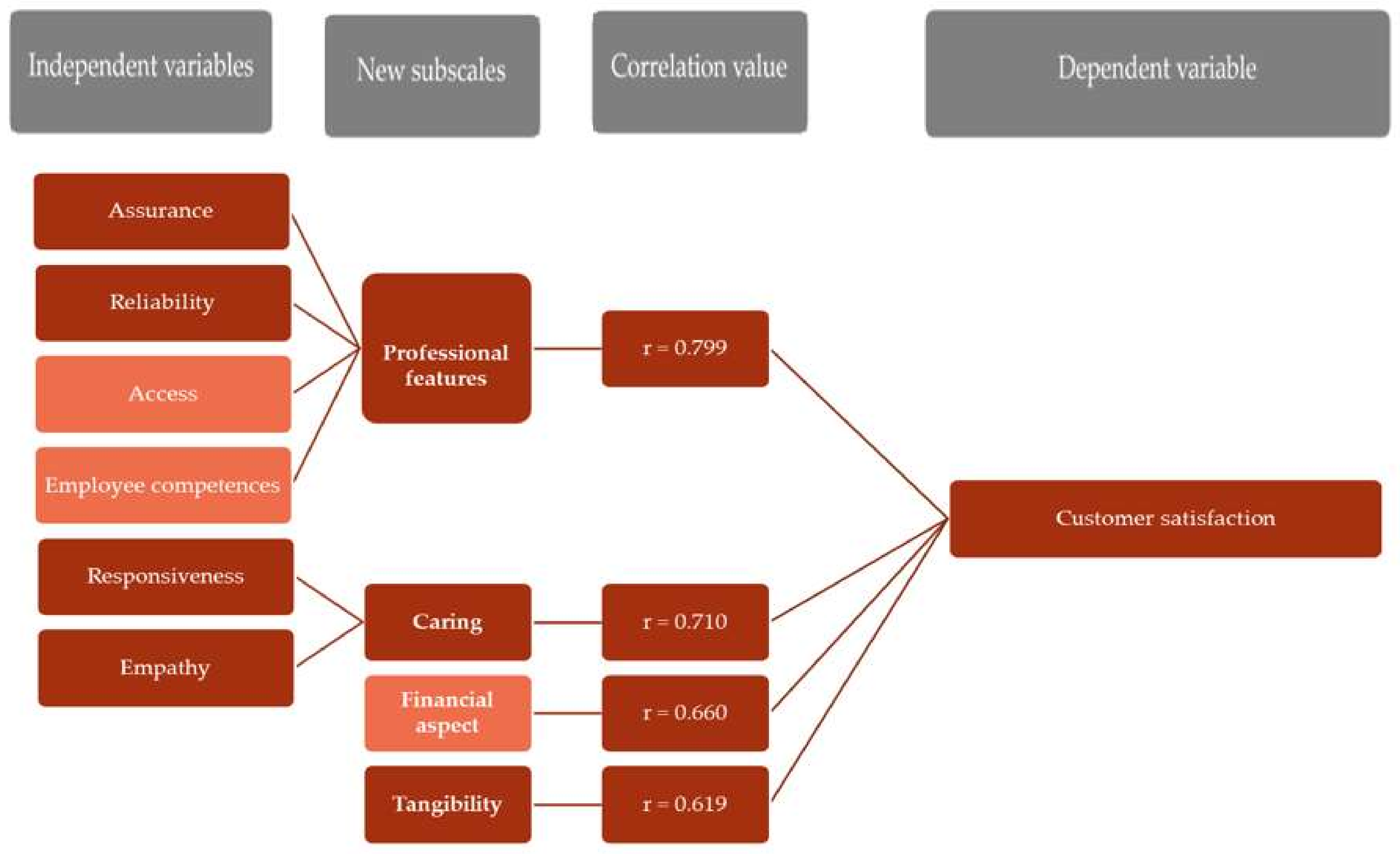

3.1. Conceptual Framework

Figure 2 shows a model that represents the effects of service quality dimensions on customer satisfaction using the modified SERQUAL model. Three new dimensions were added to the original SERQUAL model, which consisted of five factors. The new added factors are financial aspect, employee competences, and access [

24,

28,

35,

61,

62,

63].

3.2. Research Variables and Operational Definitions

The operational definition developed below is based on the literature review, and clarify the effect of service quality dimensions on customer satisfaction in the Jordanian banking sector. It provides a theoretical foundation and develops research hypotheses.

3.2.1. Independent Variables

Service quality includes a number of dimensions that have an influence on customer satisfaction from a customer’s perspective. The model shows the improved service quality model with the following dimensions: tangibles, responsiveness, empathy, reliability, assurance, financial aspect, access, and employee competences [

23].

The questionnaire for the service quality model was constructed for the independent variables with the number of questions as follows: 5 for tangibility, 4 for responsiveness, 4 for assurance, 5 for empathy, 4 for reliability, 3 for access, 6 for financial aspect, and 3 for employee competences. The number of questions selected was determined based on their importance in the literature.

3.2.2. Dependent Variable

Customer satisfaction is a measure of how services are supplied to customers. In order to develop service standards and techniques, managers have to be willing to understand the gap between the perceptions and expectations of customers [

4]. Customers’ decisions are affected by the service support available after delivery of the service. Delivery of high-quality service helps to build and maintain long-term relationships with bank customers. As a result of this, banks try to work on customer retention and market share by aiming at special target markets. How service quality in Jordanian banks affects customer satisfaction is the main core of the present study. The rapid growth of the Jordanian banking sector creates a competitive environment and makes banks understand customer perceptions of the quality of service in order to attract customers in a competitive market. Four questions are related to customer satisfaction.

5. Results and Discussion

5.1. Respondents’ Demographic Characteristics

The analysis of the data gathered revealed the following results in terms of gender, age, academic level, relationship duration with the bank, type of banks, bank preferences, clients, type of account, type of product and service, currency, type of transactions, reason for choosing the bank, location, and profession of customers. Sample by gender distribution shows that males represent 49.9% of the 825 respondents, while the ratio of females is 50.1%. The results indicate that most of the respondents (73.47%) are middle-aged, from 18 to 39 years old. Distribution by academic level shows that most respondents have a higher level of education (82.8%). Banks attract new customers—35.75% of the interviewees have a relationship lasting from one to five years, although more than half of the respondents (58.96) have been committed to the banks for 10 years. Most customers prefer to deal with Jordanian banks (94.42%) rather than foreign banks (5.75), and the customers of Jordanian banks prefer commercial banks (89.93%) to Islamic banks (10.06%). The respondents are customers of 19 Jordanian banks; 73.31% of them are customers of four banks: The Trade Bank, Ahli Bank, and Union Bank. The current account (65.09) is the most popular type of account used by customers of Jordanian banks; the second most popular is the savings account (29.45%) and third is the deposit account (5.45%). In Jordanian banks, there are five types of products and services: bank loans for individuals, corporate banking, electronic services, investment accounts, and bank account services; of these, most customers use bank account services (60.24%). The interviewees prefer to use Jordanian Dinars (96.36%) instead of other currencies. The banking transactions that respondents prefer are in-person branch experiences and ATM transactions (79.99%). The most important factors when a customer selects a bank are the quality of service and location of the bank (55.87%). Amman is the capital of Jordan and most of the commercial transactions are here, 68% of banks are located in the capital. Half of the banks’ customers work in the private sector (50.56%).

5.2. Relationship between Service Quality and Customer Satisfaction

Checking the hypothesis, we tested the correlation between the dependent variable customer satisfaction and the items of the independent variables of service quality, which are tangibility, responsiveness, empathy, assurance, reliability, financial aspect, access, and employee competences, using Spearman’s non-parametric test, which requires fewer assumptions about the distribution of values in a sample than a parametric test. It measures the rank correlation between the variables

Tangibility and customer satisfaction: All the five tangibility items have significant and positive correlations with customer satisfaction; variable Tan1 (0.436) has the lowest and variable Tan5 (0.551) has the highest value.

Responsiveness and customer satisfaction: The four responsiveness items are also significantly and positively associated with customer satisfaction, with lowest and highest correlation values of Res3 (0.548) and Res1 (0.641), respectively.

Empathy and customer satisfaction: The six empathy items and customer satisfaction are significantly and positively correlated, with the lowest item being Emp6 (0.465) and the highest Emp5 (0.654).

Assurance and customer satisfaction: the statistical results indicate that there are significant and positive correlations between the four items of the independent variables and customer satisfaction (Assur4 (0.576) is the lowest and Assur3 (0.682) the highest).

Reliability and customer satisfaction: As a result of the analysis, variable Rel4 (0.548) has the lowest and variable Rel5 (0.700) has the highest correlation value. The five reliability items are significantly and positively associated with the dependent variable customer satisfaction.

Access and customer satisfaction: Three access items and customer satisfaction are also significantly and positively correlated. The minimum and maximum correlation values are Acc3 (0.597) and Acc2 (0.668), respectively.

Financial aspect and customer satisfaction: Six items of financial aspect are correlated significantly and positively with customer satisfaction, with Fin2 having the lowest value (0.456) and Fin5 the highest (0.670).

Employee competences and customer satisfaction: All the three employee competences items are significantly and positively associated with the dependent variable, with Ecom3 having the highest value (0.702) and Ecom1 the highest (0.728).

5.3. Structure of Items of Service Quality Variables

Factor analysis assesses the relationship structure between research variables. Our first analysis found that there are four factors with eigenvalues above one. Because the items mostly lie on one dimension, we can decide on one component, but we can decide between one and four according to the number of factors. Taking into account that we originally had eight groups of questions, we will use the maximum possible number of principle components, which proved to be four, so we will try to build a model of four principle components.

In the first trial of the principle component analysis, all the communalities were appropriate, ranging between 74.5% which is found with Emp2, and 44.1% with Emp6, both from the empathy scale.

Of the factors extractable from the analysis (tangibility, responsiveness, empathy, assurance, reliability, access, financial aspect, employee’s competences( and the related eigenvalues, four factors were extracted. There were four values above the eigenvalue of one and they are listed as items 1-4. The first factor accounts for 53.424% of the variance, while all the remaining factors are weak.

All the communalities are high enough for the analysis to be continued (the rule of thumb is to be above 0.25). The highest communalities are found at Emp2 from the empathy scale with extraction explaining 75.4 % of the variance, while the lowest communalities are found at Emp6 from the empathy scale, with extraction explaining 41.1 % of the variance. The original sum of the squared loadings of components was 19.233, 1.957, 1.290, and 1.030. After rotation, the sum of the squared loadings of components was 17.077, 16.136, 10.386, and 13.144. We extracted an appropriate number of factors. Rotation will ensure that the variability explained is more or less evenly distributed between the factors.

Four factors were determined: Factor 1, consisting of reliability, assurance, access and employee competences; factor 2, consisting of empathy and responsiveness; factor 3, consisting of financial aspect, and factor 4, consisting of tangibility. A pattern matrix provides information about the unique contribution of a variable to a factor. We used the loading greater than 0.4, following Stevens (2012). At this stage, we reached a rotated solution, and were able to see the factor scores. In the solution, all four components are almost appropriate because at least five items belong to each component; however, the cross-loading problem still exists. In the following stage, step by step, we left out several items so that we could complete the model without cross loading.

Below we present the final model. Communalities are appropriate because all of the items above are higher than 0.25. The highest communalities were found at Emp3 from the empathy scale with an extraction of 76% of the variance, while the lowest communalities were found at Emp4 from the empathy scale with an extraction of 51.4% of the variance.

The initial eigenvalues indicate that the first four factors are meaningful as they have eigenvalues higher than one. Factors 1, 2, 3 and 4 explain 53.188%, 5.769%, 4.003%, and 3.249% of the variance, respectively, with a cumulative total of 66.208% (completely acceptable). The extraction sums of squared loadings provide similar information based only on the extracted factors. The original sum of squared loadings was 16.488, 1.788, 1.241, and 1.007. After rotation, the sum of squared loadings was 14.614, 13.668, 9.854, and 11.354.

The Pattern Matrix shows the factor loadings for the rotated solution. Factor loadings are similar to regression weights (or slopes) and indicate the strength. The solution has been rotated to achieve an interpretable structure. When the factors are uncorrelated, the Pattern Matrix and the Structure Matrix should be the same, which is not the case here. In

Table 2, the component correlation matrix shows that factors 1, 2, 3 and 4 are statistically correlated.

Reliability has been examined for the items, as shown in

Table 3, which includes the original 36 items, which become 31 after rotation; the new subscale score of the Cronbach’s alpha value is 0.969. The new subscales of assurance, reliability, access, and employee competencies were originally made up of 15 items; but three of them have been deleted (Assur2, Assur3, Assur4) because of cross loading. The final Cronbach’s alpha is 0.951. The subscale of responsiveness and empathy originally included 10 items; two of them have been deleted—one from the responsiveness subscale (Res1), and the other from the empathy subscale (Emp6); the final Cronbach alpha value here is 0.931. The subscale of the financial aspect originally consisted of six items, none of which have been deleted; the total Cronbach alpha value is 0.886. The subscale of tangibility initially consisted of five items; no items have been deleted, and the final Cronbach’s alpha value is 0.843.

5.4. New Model after Rotation

Comparing the new model of service quality in

Figure 3 with the old one in

Figure 2, we can observe that we now have four subscales in the new model, instead of eight subscales in the initial model. The first subscale contains four dimensions—assurance, reliability, access and employee competences. The second subscale consists of two dimensions—responsiveness and empathy. The third and the fourth subscales, financial aspect and tangibility, are separate factors.

The subscales of service quality and customer satisfaction in the Jordanian banking sector shown in

Table 4,

Table 5 and

Table 6 consist of 31 items; the Cronbach alpha of reliability is 0.969, which indicates that the scale has high reliability. The total items show the reliability for each item on each factor. Reliability could not be improved by deleting any of the items.

All tested correlations were significant at the

p < 0.0005 level, and are shown in

Table 6. The statistical results indicate that all research hypotheses are true. The order of principle components based on the measure of correlation is tangibility, responsiveness, empathy, assurance, reliability, access, employee competences, and financial aspect.

The first subscale affecting customer satisfaction consists of assurance, reliability, access and employee competences dimensions, and this subscale is in a significant and positive relationship with customer satisfaction (r = 0.799). The second subscale contains responsiveness and empathy, which is significantly and positively correlated to customer satisfaction (r = 0.710). In the third subscale, the correlation between financial aspect and customer satisfaction is positive and significant (r = 0.660). Finally, in the fourth subscale, tangibility and customer satisfaction has a correlation value of 0.619, which also indicates a significant and positive relationship.

5.5. Service Quality Positively Influences Customer Satisfaction

The relationship between service quality and customer satisfaction is examined in the Jordanian banking sector, using the modified SERVQUAL model and adding three dimensions—access, financial aspect, and employee competences—to the basic model. The result shows that service quality has a positive and significant effect on customer satisfaction.

These results are consistent with previous studies in Iran, Uganda, Jordan and India, which show the importance of service quality to improve bank customer satisfaction [

45,

46,

62,

69].

5.5.1. Tangibility Positively Influences Customer Satisfaction in the Jordanian Banking Sector

The results reveal that tangibility has a positive and significant effect on customer satisfaction. The results showed that tangibility is the fourth factor of the service quality dimensions. Moreover, the result indicates that Jordanian bank customers were satisfied with the physical appearance of the service, such as employees’ neat appearance, modern looking equipment, and the materials associated with the service, and that they found it easy to use. Many studies defined tangibility as those things related to appearance, equipment, personnel, and communication [

24,

25]. The results imply that the customers of the Jordanian banking sector are satisfied and that they view tangibility as an important factor. These findings are similar to previous studies [

45,

46,

48,

49,

50,

51,

52] and inconsistent with one study [

70] that found the opposite relationship between tangibles and customer satisfaction.

5.5.2. Responsiveness Positively Influences Customer Satisfaction in the Jordanian Banking Sector

Responsiveness has a positive and significant effect on customer satisfaction. The result shows that customers were satisfied with the responsiveness of the employees as found by previous studies [

6,

25,

29,

55,

64]. Findings indicate that employees are willing to help customers, bank employees are able to respond to requests and that they have the confidence to tell customers when services will be performed. Several authors identify responsiveness as being willing to help clients and give quick service; it is communicated to customers by the length of time they have to wait for assistance and attention to problems.

5.5.3. Empathy Positively Influences Customer Satisfaction in the Jordanian Banking Sector

Empathy and responsiveness together form the second factor. Empathy also proved to be significantly related to customer satisfaction. With good communication and an understanding of customer needs and friendly behavior, empathy will be achieved [

42]. The result implies that customers of the Jordanian banking sector are satisfied in terms of the empathy dimension when branches are in a convenient location, they receive good care, there are good operating hours, and staff have an understanding of their needs. In addition, understanding customer expectations will influence better performance among competitors. These findings are in line with previous studies [

49,

50,

54,

57].

Communication might be an element that could build an empathetic relation between a bank and its customers [

71]. A possible solution could be sustainable market communication. Academics and professionals pay more attention to social and environmental aspects that affect human behavior. Companies are more aware of and responsible for activities that impact the society and the environment. Consequently, companies adopt sustainable development as a cornerstone in their policies to boost the relationship between social and environmental issues. Value creation by marketing action can be achieved, as can communication to achieve business sustainability, which positively influences performance.

5.5.4. Reliability Positively Influences Customer Satisfaction in the Jordanian Banking Sector

The results showed that reliability takes its place as a primary factor in service quality dimensions, together with assurance, access, and employee competences. The results show that reliability has a positive and significant effect on customer satisfaction. The expectation in the bank is to have sympathy with customers’ problems and to keep bank records. The findings imply that Jordanian bank customers were satisfied with the reliability dimensions, including the bank keeping accurate records, performing the promised service on time, and having staff ready to help with problems. Moreover, Parasuraman et al. [

5] found that reliability is the ability to perform services required by the customer. These findings are consistent with previous studies [

46,

47,

49,

50,

54].

5.5.5. Assurance Positively Influences Customer Satisfaction in the Jordanian Banking Sector

Assurance is a primary factor, together with reliability, access, and employee competences. The assurance dimension was found to have a positive and significant effect on customer satisfaction in the Jordanian banking sector. The customers of Jordanian banks showed their satisfaction in terms of the assurance dimension in that the bank employees have knowledge, courtesy, and the ability to inspire confidence in customers. Jordanian bank employees are polite, have sufficient knowledge, and can be trusted. Many studies point out the positive relationship between assurance and customer satisfaction [

49,

50,

53,

54].

5.5.6. Access Positively Influences Customer Satisfaction in the Jordanian Banking Sector

Access is a primary factor, together with reliability, assurance, and employee competences. The results show that the access dimension significantly influences customer satisfaction in the Jordanian banking sector. Parasuraman et al. [

28] stated that access could be understood in terms of services being easy to access and delivered in time. Moreover, approachability and ease of contact are relevant. Access was included in empathy in the SERVQUAL model, which was developed by [

28]. This result implies that, according to the customer’s perspective, the access dimension was perceived with significantly positive expectations in the Jordanian banking sector. The finding confirmed that customers are looking for easy ways of receiving the services offered, more options related to receiving services, and also the facility to receive the chosen service in the preferred location, time and way. The findings are in line with [

32], and in constant with [

31].

5.5.7. Financial Aspect Positively Influences Customer Satisfaction in the Jordanian Banking Sector

The results showed that the third factor of service quality dimensions is the financial aspect. The result shows that there is a significant relationship between financial aspect and customer satisfaction. The finding means that customers in Jordanian banks are satisfied with the financial aspect in terms of pricing, bank charges, and interest policy. This explains why the variation is significant in customers’ overall satisfaction.

Pricing, bank charges, and interest policy are considered factors that have turned out to be rather insignificant determinants of customer satisfaction.

This is in conformity with previous findings that stated there is a positive relationship between the financial aspect and customer satisfaction [

33,

58,

59]. To a certain extent, this can be attributed to the fact that the standardized regulations laid down by the Central Bank of Jordan are followed by these banks. Therefore, researchers believe that customers’ identification with these factors has a significant influence on their overall satisfaction. It was also found that a majority of the sample customers were, in general, satisfied with the overall service levels of their banks.

5.5.8. Employee Competences Positively Influence Customer Satisfaction in the Jordanian Banking Sector

Employee competence is a primary factor together with reliability, assurance, and access. This study tested the impact of employee competences on customer satisfaction and shows that employee competences have a positive and significant impact on customer satisfaction. The results indicated that employee competences were a primary factor, with reliability, assurance and access of service quality dimensions. This result indicates that customers in the Jordanian banking sector are satisfied with employees’ competences. Furthermore, this result shows that the Jordanian banking sector has invested heavily in training and development efforts to develop a multi-skill approach to understanding different customers.

Training programs help employees to improve their skills and develop a service culture program, following the organizational culture, or the ways the organization conducts its business, treats its employees, customers, and the wider community, specifically with regard to front-line staff. These programs focus on employees’ interpersonal communication skills and customer care and will help Jordanian banks treat their customers in a professional and appropriate manner. Thus, delivery of the promised service will be fulfilled, which in turn will result in greater customer retention and satisfaction in the Jordanian banks. These findings are in line with previous studies [

6,

35,

58].

6. Conclusions

To maintain a good quality service and develop a better-integrated system, it is important to understand the attitudes of the customer. Development of a tool to measure the satisfaction of customers is essential for bank services. The SERVQUAL model is generally applied to evaluate customer satisfaction, which has five dimensions: tangibles, responsiveness, empathy, assurance, and reliability. Study of the literature revealed that by adding three dimensions—access, financial aspects and employee competencies—to the SERVQUAL model, we can create a better tool for assessing customer satisfaction.

Initially, customer satisfaction had eight dimensions: tangibles, responsiveness, empathy, assurance, reliability, access, financial aspect, and employee competences.

The analyses resulted in four subscales that can be applied as appropriate managerial measuring scales for customer satisfaction.

According to the analysis, the order of importance of the subscales’ effects on customer satisfaction is as follows: First subscale (assurance, reliability, access, and employee competences), second subscale (responsiveness and empathy), third subscale (financial aspect), and fourth subscale (tangibility).

Based on this research, it can be recommended that the following factors be applied for the measurement of customer satisfaction in the area in question: professional features, caring, financial aspect, and tangibility.

The issues that can be addressed when measuring customer satisfaction at a bank are as follows.

Professional features: keeping records accurately, on-time service, helpful employees, staff knowledge, courtesy; inspiring confidence in customers, easy ways of receiving services, more service options, flexible service location, and communication with customers.

Caring: appropriate behavior of employees, willingness to help customers, responding to requests, precise timing, branches in convenient locations, good operating hours, and understanding customer needs.

Financial aspect: interest rate offered with a variety of banking products and services, and low risk.

Tangibility: physical appearance, employee’s neat appearance, modern equipment, and easy-to-use methods.

Quality dimensions affect customer satisfaction similarly, so bank managers need to pay attention to all factors; consequently, here the Pareto principle is not applicable for quick improvement.

7. Recommendations

Based on our research in which a modified SERVQUAL model was applied in the Jordanian banking sector, it can be recommended that the model be modified to the area where it is used.

The usual factors to quantify service quality cannot be used in every sector; therefore, it is advisable to apply it critically and amend it if necessary. With this amendment, to obtain a proper model, the number of questions and factors may decrease.

For future usage, we recommend introducing a new factor—financial aspect—to improve the measurement of customer satisfaction in banks.

As a result of the research conducted in the Jordanian banking sector, we recommend evaluating the relationship between service quality factors and customer satisfaction. Four factors are recommended to measure customer satisfaction—professional features, caring, financial aspect, and tangibility. The research questions have been tested to measure the quality of customer satisfaction that we recommend for further studies and bank management.

Referring to earlier research results [

71], it is advisable to consider the concept of sustainable marketing when examining consumer satisfaction, especially in relation to empathy.

An important conclusion of the study is that the impact of the quality dimensions examined is similar to customer satisfaction, so we advocate that managers pay similar attention to quality factors.

The main limitations of the study are the timeframe and location of data collection and consequently the generalizability and applicability of the results. Service processes change over time, so the quality and features of the service can be better understood through long-term data collection and analysis. Similarly, research is also limited geographically, as the subject of research is restricted to Jordanian banks and the results can be used only to some extent in other countries.