A Framework for Risk Assessment in Collaborative Networks to Promote Sustainable Systems in Innovation Ecosystems

Abstract

:1. Introduction

2. Literature Review

2.1. Open Innovation Ecosystems

2.2. Risk Assessment

3. Research Methodology

3.1. Proposed Approach

- Time–accomplishment degree of the timeframe to complete the project within the planned;

- Cost—accomplishment degree of the allocated budget constrain, regarding the project completion;

- Performance–accomplishment degree of business and technical goals of the project, through the process outputs.

- Strategy (S)—resulting from the errors in strategy (e.g., by developing a technology regarding a component that cannot work with other technologies from other product components or even a product technology that cannot meet the consumer needs) [27];

- Operational (O)—resulted from the risks regarding the production process implementation, the existence of problems around the procurement and distribution or even the delay (due to the production) with the product to be lunched [27];

- Marketing (M)—resulted from the value perceived by the costumers, which is related to the effectiveness of marketing actions (e.g., failure to generate demand for a product lunch and other risks related to demand, customer feels uncertain that the product do not meet the needs or expectation) [28,29].

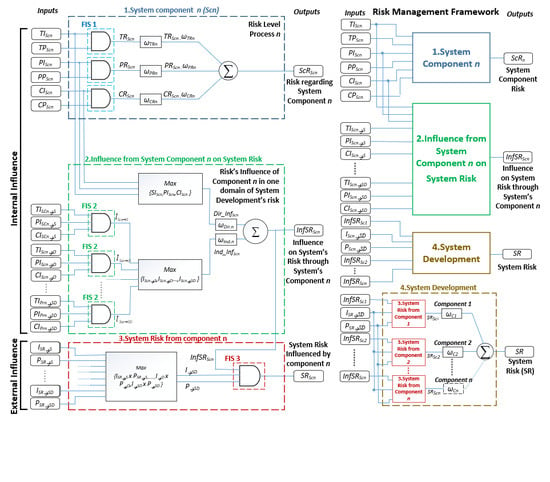

3.2. Model Architecture

3.3. Fuzzy Implementation

3.4. Definition of Linguistic Variables: Values and Pertinence Functions

3.5. Fuzzy Deployment

4. Case Study, Results & Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Xie, X.; Wang, H. How can open innovation ecosystem modes push product innovation forward? An fsQCA analysis. J. Bus. Res. 2020, 108, 29–41. [Google Scholar] [CrossRef]

- Urze, P.; Abreu, A. System Thinking to Understand Networked Innovation; Springer: Berlin/Heidelberg, Germany, 2014; Volume 434, pp. 327–335. [Google Scholar]

- Januška, M. Communication as a key factor in Virtual Enterprise paradigm support. In Innovation and Knowledge Management: A Global Competitive Advantage; Int. Bus. Inf. Manag. Assoc. (IBIMA): Kuala Lumpur, Malaysia, 2011; pp. 1–9. ISBN 978-0-9821489-5-2. [Google Scholar]

- Abreu, A.; Camarinha Matos, L.M. An Approach to Measure Social Capital in Collaborative Networks. In IFIP International Federation for Information Processing; Adaptation and Value Creating Collaborative Networks; Camarinha-Matos, L.M., Pereira-Klen, A., Afsarmanesh, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2011; pp. 29–40. [Google Scholar]

- Enkel, E.; Gassmann, D.O.; Chesbrough, H. Open R&D and open innovation: Exploring the phenomenon. Rd Manag. 2009, 39, 311–316. [Google Scholar] [CrossRef]

- Granstrand, O.; Holgersson, M. Innovation ecosystems: A conceptual review and a new definition. Technovation 2020. [Google Scholar] [CrossRef]

- Arenal, A.; Armuña, C.; Feijoo, C.; Ramos, S.; Xu, Z.; Moreno, A. Innovation ecosystems theory revisited: The case of artificial intelligence in China. Telecommun. Policy 2020, 44, 101960. [Google Scholar] [CrossRef]

- Pereira, L.; Tenera, A.; Wemans, J. Insights on Individual’s Risk Perception for Risk Assessment in Web-based Risk Management Tools. Procedia Technol. 2013, 9, 886–892. [Google Scholar] [CrossRef] [Green Version]

- Yin, D.; Ming, X.; Zhang, X. Sustainable and Smart Product Innovation Ecosystem: An integrative status review and future perspectives. J. Clean. Prod. 2020, 274, 123005. [Google Scholar] [CrossRef]

- Santos, R.; Abreu, A.; Anes, V. Developing a Green Product-Based in an Open Innovation Environment. Case Study: Electrical Vehicle. In Security Education and Critical Infrastructures; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2019; Volume 568, pp. 115–127. [Google Scholar]

- Innocentive. Available online: https://www.innocentive.com/ (accessed on 1 January 2019).

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2019, 4, 226–233. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as structure: An actionable construct for strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Reynolds, E.B.; Uygun, Y. Strengthening advanced manufacturing innovation ecosystems: The case of Massachusetts. Technol. Forecast. Soc. Chang. 2017, 136, 178–191. [Google Scholar] [CrossRef]

- Gordon, T.J.; Greenspan, D. Chaos and fractals: New tools for technological and social forecasting. Technol. Forecast. Soc. Chang. 1988, 34, 178–191. [Google Scholar]

- Wei, F.; Feng, N.; Yang, S.; Zhao, Q. A conceptual framework of two-stage partner selection in platform-based innovation ecosystems for servitization. J. Clean. Prod. 2020, 262, 121431. [Google Scholar] [CrossRef]

- Robaczewska, J.; Vanhaverbeke, W.; Lorenz, A. Applying open innovation strategies in the context of a regional innovation ecosystem: The case of Janssen Pharmaceuticals. Glob. Transit. 2019, 1, 120–131. [Google Scholar] [CrossRef]

- Xu, G.; Wu, Y.; Minshall, T.; Zhou, Y. Exploring innovation ecosystems across science, technology, and business: A case of 3D printing in China. Technol. Forecast. Soc. Chang. 2017, 136, 208–221. [Google Scholar] [CrossRef]

- Sun, S.L.; Zhang, Y.; Cao, Y.; Dong, J.; Cantwell, J. Enriching innovation ecosystems: The role of government in a university science park. Glob. Transit. 2019, 1, 104–119. [Google Scholar] [CrossRef]

- Madsen, H.L. Business model innovation and the global ecosystem for sustainable development. J. Clean. Prod. 2020, 247, 119102. [Google Scholar] [CrossRef]

- Keizer, J.; Halman, J.; Song, M. From experience: Applying the Risk Diagnosing methodology. J. Prod. Innov. Manag. 2002, 19, 213–232. [Google Scholar] [CrossRef]

- West, J.; Salter, A.; Vanhaverbeke, W.; Chesbrough, H. Open innovation: The next decade. Res. Policy 2014, 43, 805–811. [Google Scholar] [CrossRef]

- Henschel, T. Risk Management Practices of SMEs: Evaluating and Implementing Effective Risk Management Systems. ESV—Erich Schmidt Verlag. (Edwards & Bowen, 2005). 2008. Available online: https://www.researchgate.net/publication/259812085_Risk_Management_Practices_of_SMEs_Evaluating_and_Implementing_Effective_Risk_Management_Systems (accessed on 4 April 2020).

- Hülle, J.; Kaspar, R.; Möller, K. Analytic network process—An overview of applications in research and practice. Int. J. Oper. Res. 2013, 16, 172. [Google Scholar] [CrossRef]

- Piet, G.J.; Culhane, F.E.; Jongbloed, R.; Robinson, L.; Rumes, B.; Tamis, J. An integrated risk-based assessment of the North Sea to guide ecosystem-based management. Sci. Total. Environ. 2019, 654, 694–704. [Google Scholar] [CrossRef]

- Pereira, L.; Tenera, A.; Bispo, J.; Wemans, J. A Risk Diagnosing Methodology Web-Based Platform for Micro, Small and Medium Businesses: Remarks and Enhancements. In Biomedical Engineering Systems and Technologies; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2015; Volume 454, pp. 340–356. [Google Scholar]

- PMBOK Guide. A Guide to the Project Management Body of Knowledge: PMBOK Guide. Int. J. Prod. Res. 2017, 53, 13–14. [Google Scholar]

- Abreu, A.; Martins, J.D.M.; Calado, J.M. Fuzzy Logic Model to Support Risk Assessment in Innovation Ecosystems. In Proceedings of the 2018 13th APCA International Conference on Control and Soft Computing (CONTROLO), Azores, Portugal, 17 July 2018; Institute of Electrical and Electronics Engineers (IEEE): Piscataway, NJ, USA, 2018; pp. 104–109. [Google Scholar]

- Meyer, W.G. Quantifying risk: Measuring the invisible. In Proceedings of the PMI® Global Congress 2015 EMEA, London, UK, 11–13 May 2015; PMI: Newtown Square, PA, USA, 2015. [Google Scholar]

- Grace, M.F.; Leverty, J.T.; Phillips, R.D.; Shimpi, P. The Value of Investing in Enterprise Risk Management. J. Risk Insur. 2014, 82, 289–316. [Google Scholar] [CrossRef]

- Mansor, N. Risk factors affecting new product development (NPD) Performance in small Medium Enterprises (SMES). Int. J. Rev. Appl. Soc. Sci. 2016, 27, 18–25. [Google Scholar]

- Ricardo Ricardo Santos ISEL- Instituto Superior de Engenharia de Lisboa, Instituto Politécnico de Lisboa, University of Aveiro, Portugal GOVCOPP, University of Aveiro; Antonio Antonio Abreu ISEL- Instituto Superior de Engenharia de Lisboa, Instituto Politécnico de Lisboa, CTS Uninova, FCT, Universidade Nova de Lisboa, Portugal; Calado, J.M.; Anes, V. An Approach Based on Fuzzy Logic, to Improve Quality Management on Research and Development Centres. In Proceedings of the 3rd International Conference on Vision, Image and Signal Processing 2019, Vancouver, BC, Canada, 26–28 August 2019; Volume 36, pp. 1–6. [Google Scholar] [CrossRef]

- Abreu, A.; Santos, R.; Calado, J.M.; Requeijo, J. A Fuzzy Logic Model to Enhance Quality Management on R&D Units. Kne Eng. 2020, 5, 285–298. [Google Scholar] [CrossRef]

| Pertinence Levels. | Description | Frequency | Fuzzy Parameters [a, b, c] |

|---|---|---|---|

| Rare | It is accounted that the event will happen only in certain circumstances. | Event has occurred or is expected to occur once in the next 48 months | (0, 0,0.25) |

| Unlikely | The event is not likely, although it can occur. | Event has occurred or is expected to occur once in the next 24 months | (0, 0.25,0.50) |

| Likely | Probable occurrence event | Event has occurred or is expected to occur once in the next 18 months | (0.25,0.50,0.75) |

| Very Likely | The event will likely occur | Event has occurred or is expected to occur once in the next 12 months | (0.5,0.75,1.0) |

| Expected | The event is expected to occur | Event has occurred or is expected to occur once in the next 6 months | (0.75, 1, 1) |

| Pertinence Levels | Process Domain | Fuzzy Parameters (a, b, c) | ||

|---|---|---|---|---|

| Time (T) | Performance (P) | Cost (C) | ||

| Neglectable | Insignificant impact on the processes required to obtain deliverables. No changes in established activities | Insignificant impact on the initial project budget (<2%) | Timing delay is easily recoverable. | (0,0,2.5) |

| Low | Prevents the fulfillment of one or more activities established for each project task. No task changes. | Low impact on project budget (2–5%) | Low schedule delay is not recoverable. | (0,2.5, 5.0) |

| Moderate | Prevents the fulfillment of one or more tasks. No requirement changes. | Moderate impact on the initial project budget (5–10%) | Moderate delay in the completion of the project. Without compromising the project requirements. | (2.5,5.0,7.5) |

| High | Prevents the fulfillment of one or more project requirements. Scope change required. | High impact on the initial project budget (10–30%) | Acceleration in the fulfillment of tasks with anticipation of the project calendar. | (5.0,7.5,10.0) |

| Severe | It prevents the fulfillment of the project objective(s) and it is not possible to achieve it even with changes in scope. | Impact on the initial heavy budget making the project unfeasible (>30%) | Project deadline exceeded making it impossible to complete the project since the project is no longer adequate to the organizational reality. | (7.5,10.0,10.0) |

| Pertinence Levels | Description | Fuzzy Parameters (a, b, c) |

|---|---|---|

| Very low | Risk can be accepted as it does not pose a threat to the project/organization, it must be monitored to ensure that its level does not change. | (0, 0, 0.25) |

| Low | Risk can be accepted. Risk control must be carried out based on a cost–benefit analysis | (0, 0.25, 0.50) |

| Moderate | Risk must be mitigated; the effectiveness of controls must be monitored. | (0.25, 0.50, 0.75) |

| High | Efforts should be made to mitigate risk as soon as possible. | (0.50, 0.75,1.0) |

| Very High | Immediate action must be taken to mitigate the risk. | (0.75, 1.0, 1.0) |

| Variable Type | |||||

|---|---|---|---|---|---|

| Impact of Occurrence | Probability of Occurrence | Risk of Occurrence | |||

| Linguistic Levels | Numeric Correspondence | Linguistic Levels | Numeric Correspondence | Linguistic Levels | Numeric Correspondence |

| Insignificant | [0,2] | Very Low | [0,0.2] | Very low | [0,2] |

| Low | [2,4] | Low | [0.2,0.4] | Low | [2,4] |

| Moderate | [4,6] | Moderate | [0.4,0.6] | Moderate | [4,6] |

| High | [6,8] | High | [0.6,0.8] | High | [6,8] |

| Severe | [8,10] | Very High | [0.8,1.0] | Very high | [8,10] |

| Pr. | Ref. | Description | Partners Involved |

|---|---|---|---|

| 1 | K01Pr1 | Consumer requirements | P8, P7 |

| 2 | K02Pr3 | PV system design | P3, P12 |

| 3 | K87Pr4 | System deployment (tests on site) | P3 |

| 4 | K01Pr6 | Human machine interface (HMI) | P6 e P7 |

| 5 | K02Pr5 | Systems tests on lab | P2, P6 e P12 |

| 6 | K01Pr6 | General system monitoring and control | P2, P8 |

| 7 | K01Pr6 | Fuel tanks design | P9, P10 |

| 8 | K01Pr6 | Fuel cell | P4, P9 |

| 9 | K01Pr6 | Preliminary studies (solar irradiation on site, load diagram, other measures) | P12 |

| 10 | K01Pr6 | electrolyzer | P2 |

| 11 | K01Pr6 | Sensors & actuators (valves, electric valves, tubes, temperature, pressure | P9, P10 |

| 12 | K01Pr6 | power converters | P8, P11 |

| FIS F1 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| N. | Sc. | TIScn | TPScn | PIScn | PPScn | CIScn | CPScn | |||

| Inputs | 1 | Insignificant | Low | Low | Rare | Low | Unlikely | |||

| 2 | Low | Moderate | Low | Unlikely | Moderate | Unlikely | ||||

| 3 | Insignificant | Low | Moderate | Likely | Low | Likely | ||||

| 4 | Insignificant | High | Severe | Very Likely | High | Unlikely | ||||

| 5 | Low | Moderate | Moderate | Expected | Moderate | Expected | ||||

| 6 | Moderate | Expected | Insignificant | Rare | Insignificant | Very Likely | ||||

| 7 | Moderate | Unlikely | Severe | Unlikely | Moderate | Very Likely | ||||

| 8 | High | Likely | Moderate | Very Likely | Moderate | Rare | ||||

| 9 | Severe | Very Likely | Low | Unlikely | Low | Unlikely | ||||

| 10 | Low | Likely | Severe | Likely | Severe | Rare | ||||

| 11 | Low | Rare | Low | Expected | Severe | Unlikely | ||||

| FIS F2 | ||||||||||

| Sc. | TIScn→S | PIScn→S | CIScn→S | TIScn→O | PIScn→O | CIScn→O | TIScn→M | PIScn→M | CIScn→M | |

| Inputs | 1 | Insignificant | Insignificant | High | Insignificant | Insignificant | Insignificant | Low | Insignificant | High |

| 2 | Low | Moderate | Low | Severe | Moderate | Low | Insignificant | Severe | Low | |

| 3 | Moderate | Moderate | Moderate | Moderate | Insignificant | Moderate | Moderate | Moderate | Moderate | |

| 4 | Severe | Moderate | High | High | Moderate | High | Low | High | High | |

| 5 | Moderate | Severe | Low | Moderate | Low | Severe | Low | Severe | Low | |

| 6 | Insignificant | Moderate | Moderate | Moderate | Low | Insignificant | Low | Insignificant | Moderate | |

| 7 | Severe | Moderate | Moderate | Severe | Severe | High | Moderate | Low | Insignificant | |

| 8 | Moderate | Insignificant | Severe | Moderate | Insignificant | Moderate | Moderate | High | Moderate | |

| 9 | Low | Low | Moderate | Insignificant | High | Low | Insignificant | Low | Moderate | |

| 10 | Moderate | Moderate | High | Moderate | Low | Low | Insignificant | Moderate | High | |

| 11 | Severe | Moderate | Low | Insignificant | Insignificant | Moderate | High | Moderate | Low | |

| 12 | Moderate | Insignificant | Moderate | High | High | Moderate | Low | Low | Moderate | |

| FIS F3 | ||||||||||

| Sc. | I → S | P → S | I → O | P → O | I → M | P → M | I → SD | P → SD | InfSRScn | |

| Inputs | 1 | Insignificant | Rare | High | Rare | Insignificant | Rare | Moderate | Rare | Insignificant |

| 2 | Moderate | Unlikely | Low | Unlikely | Moderate | Unlikely | Severe | Unlikely | Low | |

| 3 | Insignificant | Unlikely | Moderate | Unlikely | Moderate | Likely | Moderate | Unlikely | Moderate | |

| 4 | Moderate | Very Likely | High | Very Likely | Moderate | Very Likely | High | Very Likely | High | |

| 5 | Low | Very Likely | Low | Very Likely | Severe | Expected | Severe | Very Likely | Severe | |

| 6 | Low | Rare | Moderate | Rare | Moderate | Rare | Severe | Rare | Insignificant | |

| 7 | Severe | Unlikely | Insignificant | Unlikely | Moderate | Unlikely | Insignificant | Unlikely | Low | |

| 8 | Insignificant | Very Likely | Moderate | Very Likely | Insignificant | Very Likely | Low | Very Likely | Low | |

| 9 | High | Unlikely | Moderate | Unlikely | Low | Unlikely | Severe | Unlikely | Moderate | |

| 10 | Low | Likely | High | Likely | Moderate | Likely | Moderate | Likely | Severe | |

| 11 | Insignificant | Expected | Low | Expected | Moderate | Expected | Moderate | Expected | Moderate | |

| 12 | High | Likely | Moderate | Likely | Insignificant | Expected | Insignificant | Likely | Insignificant | |

| FIS F1 | FIS F2 | FIS F3 | ||||||

|---|---|---|---|---|---|---|---|---|

| Sc. | TRScn | PRScn | CRScn | IScn→S | IScn→O | IScn→M | SRScn | |

| Outputs | 1 | Very Low | Low | Low | Low | Very Low | Low | Very Low |

| 2 | Moderate | Low | Low | Moderate | High | Moderate | Low | |

| 3 | Very Low | Moderate | Low | Moderate | Moderate | Moderate | Moderate | |

| 4 | Moderate | Severe | High | High | Moderate | High | High | |

| 5 | High | Low | Moderate | High | Moderate | Low | High | |

| 6 | Low | Moderate | Very Low | Moderate | Low | Low | Moderate | |

| 7 | Moderate | Moderate | Moderate | Moderate | Severe | Low | Low | |

| 8 | High | High | Moderate | High | Moderate | Moderate | Low | |

| 9 | High | Low | Low | Low | Moderate | Low | High | |

| 10 | Moderate | Moderate | High | Moderate | Low | Moderate | Moderate | |

| 11 | Low | Moderate | High | Moderate | Very Low | Moderate | Moderate | |

| 12 | Low | Moderate | Moderate | Moderate | High | Low | Very Low | |

| Sc. | TRScn | PRScn | CRScn | ωTRn | ωPRn | ωCRn | System Component Risk (ScRScn) |

|---|---|---|---|---|---|---|---|

| 1 | 1.9 | 2.1 | 3.7 | 0.32 | 0.26 | 0.42 | 2.7 |

| 2 | 4.3 | 2.5 | 3.1 | 0.26 | 0.23 | 0.51 | 3.3 |

| 3 | 2.0 | 5.6 | 2.5 | 0.29 | 0.21 | 0.50 | 3.0 |

| 4 | 5.4 | 8.7 | 6.9 | 0.41 | 0.19 | 0.40 | 6.6 |

| 5 | 7.3 | 3.4 | 5.9 | 0.36 | 0.14 | 0.50 | 6.1 |

| 6 | 2.1 | 4.8 | 1.7 | 0.27 | 0.21 | 0.52 | 2.5 |

| 7 | 4.4 | 5.5 | 4.1 | 0.31 | 0.21 | 0.48 | 4.5 |

| 8 | 7.5 | 7.1 | 4.9 | 0.18 | 0.26 | 0.56 | 5.9 |

| 9 | 6.2 | 3.1 | 2.7 | 0.42 | 0.18 | 0.40 | 4.2 |

| 10 | 5.1 | 5.8 | 7.8 | 0.38 | 0.13 | 0.49 | 6.5 |

| 11 | 2.8 | 4.2 | 7.2 | 0.38 | 0.14 | 0.48 | 5.1 |

| 12 | 3.9 | 4.9 | 5.6 | 0.36 | 0.14 | 0.50 | 4.9 |

| Sc. | IScn → S | IScn → O | IScn → M | Max {IScn → SD} | Max {SIScn, PIScn,CIScn} | ωInd.n | ωDir.n | InfSRScn | Max {ISR → SD x PSR → SD} | SRScn | ωScn | SRScn x ωScn | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PRScn | TRScn | ||||||||||||

| 1 | 2.8 | 1.8 | 2.6 | 2.8 | 3.7 | 0.61 | 0.39 | 3.15 | 1.5 | 1.9 | 1.5 | 0.07 | 0.11 |

| 2 | 4.1 | 7.8 | 4.7 | 7.8 | 4.3 | 0.28 | 0.72 | 5.28 | 3.8 | 4.3 | 4.7 | 0.08 | 0.38 |

| 3 | 4.7 | 4.7 | 5.1 | 5.1 | 5.6 | 0.46 | 0.54 | 5.37 | 5.8 | 2 | 5.8 | 0.01 | 0.06 |

| 4 | 6.7 | 5.9 | 7.1 | 7.1 | 8.7 | 0.51 | 0.49 | 7.88 | 7.8 | 5.4 | 7.8 | 0.07 | 0.55 |

| 5 | 7.1 | 5.7 | 2.1 | 7.1 | 7.3 | 0.46 | 0.54 | 7.21 | 6.7 | 7.3 | 6.7 | 0.08 | 0.54 |

| 6 | 4.7 | 2.3 | 2.8 | 4.7 | 4.8 | 0.62 | 0.38 | 4.74 | 4.6 | 2.1 | 4.6 | 0.09 | 0.41 |

| 7 | 5.2 | 9.2 | 3.7 | 9.2 | 5.5 | 0.11 | 0.89 | 5.91 | 2.9 | 4.4 | 3.8 | 0.08 | 0.30 |

| 8 | 6.4 | 4.2 | 5.2 | 6.4 | 7.5 | 0.46 | 0.54 | 6.99 | 3.2 | 7.5 | 6.3 | 0.09 | 0.57 |

| 9 | 2.4 | 4.8 | 3.1 | 4.8 | 6.2 | 0.56 | 0.44 | 5.42 | 7.4 | 6.2 | 7.4 | 0.09 | 0.67 |

| 10 | 4.3 | 3.1 | 5.8 | 5.8 | 7.8 | 0.57 | 0.43 | 6.66 | 5.9 | 5.1 | 5.7 | 0.09 | 0.51 |

| 11 | 4.9 | 1.1 | 5.4 | 5.4 | 7.2 | 0.66 | 0.44 | 6.73 | 6.2 | 2.8 | 6.3 | 0.13 | 0.82 |

| 12 | 5.8 | 6.5 | 3.8 | 6.5 | 5.6 | 0.64 | 0.36 | 6.18 | 0.8 | 3.9 | 4.1 | 0.12 | 0.49 |

| system risk (SR) | 5.40 | ||||||||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Santos, R.; Abreu, A.; Dias, A.; Calado, J.M.F.; Anes, V.; Soares, J. A Framework for Risk Assessment in Collaborative Networks to Promote Sustainable Systems in Innovation Ecosystems. Sustainability 2020, 12, 6218. https://0-doi-org.brum.beds.ac.uk/10.3390/su12156218

Santos R, Abreu A, Dias A, Calado JMF, Anes V, Soares J. A Framework for Risk Assessment in Collaborative Networks to Promote Sustainable Systems in Innovation Ecosystems. Sustainability. 2020; 12(15):6218. https://0-doi-org.brum.beds.ac.uk/10.3390/su12156218

Chicago/Turabian StyleSantos, Ricardo, António Abreu, Ana Dias, João M.F. Calado, Vitor Anes, and José Soares. 2020. "A Framework for Risk Assessment in Collaborative Networks to Promote Sustainable Systems in Innovation Ecosystems" Sustainability 12, no. 15: 6218. https://0-doi-org.brum.beds.ac.uk/10.3390/su12156218