1. Introduction

Supply chain risks can generate huge losses for companies. Factors such as increasingly spatially dispersed supply chains, increasing interdependence between companies, shorter life cycles of ever-smaller products, and strategies such as Lean Six Sigma and Just in Time, are examples that have increased the exposure of chains to risk [

1,

2]. Given the relevance of the theme, the concept of supply chain risk management (SCRM) has emerged from the intersection between risk management and supply chain management [

3]. Moreover, the SCRM comes to contribute to business sustainability, by increasing the probability of projects achieving their strategic goals and also enabling a shift from the short- and medium-term perspective to a long-term perspective regarding business strategy. It is a relatively new subject, and according to Pfohl et al. [

4], its scope is broader than the traditional risk management process.

A reflection of this relative novelty of SCRM is the lack of consensus among researchers about its stages. For example, Wu, Blackhurst & Chidambaram [

5], Khan & Burnes [

6], and Singhal, Agarwal & Mittal [

7] argue that SCRM should be carried out in at least three stages, which differ in their procedures from author to author. Other authors [

8,

9,

10] advocate different procedures, with more than three stages. Ritchie & Brindley [

11] favor seven stages for SCRM. Because of these variances, De Oliveira et al. [

12] and Santos & De Oliveira [

13] propose ISO 31000 as a systematic procedure for SCRM. Santos et al. [

14] in turn, propose the techniques presented by ISO 31010 as tools for the execution of this process.

ISO 31010 (Risk Management—Risk Assessment Techniques) was created to complement ISO 31000 and presents 31 tools to help professionals to structure their risk management processes. The document presents and classifies the tools as applicable or not to each stage of management. However, with such a wide range of tools, a question of practical application arises: for the import and export process of an automotive industry, located in Brazil, which of the tools presented by ISO 31010, in the view of specialists who work in this process, are the more appropriate in identifying risks, analyze their consequences and probabilities and, finally, evaluate them?

In view of the question presented, our main objective is to select ISO 31010 tools that can be used in each of the risk management stages (identifying, analyzing, and evaluating) of the import and export process of an automotive industry located in Brazil. This general objective is aligned with other recent researches, for example [

15,

16,

17] and others.

In order for the aforementioned general objective to be achieved, the research will carry out a unique case study in the import and export process of an automotive industry, whereby seven specialists with extensive professional experience, who work in this process, will be interviewed by means of a structured questionnaire, previously organized so that the collected data can later be used as input data in the AHP method, for establishing the hierarchy of the ISO 31010 tools most suitable for identification, analysis, and assessment of risks. More details of the method will be provided in

Section 3 (Materials and Methods).

The automobile company mentioned is the Brazilian subsidiary of a multinational group. Within the company, the Alliance Customs & Trade (ACT) department was chosen as a key department in the company’s strategy. The department is responsible for importing productive inputs and exporting finished products. In other words, it is simultaneously in one of the initial links and in one of the final links in the company’s supply chain: at the entrance of the imported productive inputs (which, after a study by the costs team, was found to account for about 53% of the cost of the vehicle); and at the exit of the finished product, ensuring that the product reaches the final consumer (in this case, the importer).

This is a relevant research for at least four reasons: (i) research on SCRM applied in the automotive industry is relatively scarce; (ii) research on the application of risk management tools in automotive industry import and export processes is non-existent—unless mistaken, no article on this topic was published in journals listed in the Web of Science database; (iii) risk management processes have the potential to improve the sustainability of supply chains; and (iv) the import process of the target company of this study works with inputs that are responsible for more than 50% of the final cost of a produced vehicle. Except for the last justification, which is related to the empirical study, the other justifications will be addressed in literature review section.

3. Materials and Methods

To meet the general objective, that is, to select ISO 31010 tools that could be used to identify, analyze, and assess risks in the import and export process of an automotive industry, a unique case study was developed, where specialists who work in this process were interviewed. Allied to the case study, the AHP method (analytic hierarchy process) was used because it has a wide structure for multi-criteria decision making to determine priorities, using sets of paired comparisons, based on the intrinsic capacity that a human being has to structure their perceptions hierarchically when comparing two similar alternatives, with reference to a certain criterion, judging the degree of importance of one over the other [

54].

As a data collection instrument, a questionnaire was prepared that asked respondents to make hierarchical comparisons, side by side, of the tools listed in ISO 31010, judging the degree of importance of one over the other. This data collection instrument was organized so that respondents could classify the degree of importance among different risk management tools.

Table 3 presents all the risk tools/methods considered in ISO 31010 [

55] and the classification of applicability for the stages of identification, analysis, and evaluation. It is important to highlight that to facilitate the use of the term tools/methods from the table, from here on, the use of the term “tools” may also be referring to methods because brainstorming, for example, could be considered a method.

The survey questionnaire considered all the risk tools listed in ISO 31010 and participants were asked to identify the risk tools they knew or had previously applied. Initial data on the respondents, such as time of professional experience, time in the company, education, etc., were also collected.

For the survey, seven employees of the company directly connected to the Alliance Customs & Trade (ACT) process were interviewed. These respondents were selected intentionally, based on their experience, knowledge, and interaction with the import/export process (see

Table 4). The choice for this selection was to ensure that only key people in the process were interviewed. These interviewees had the following characteristics:

All interviewees had college degrees

29% had master’s degrees

All interviewees had at least five years of professional experience

All interviewees have been in the company for at least two years

The questionnaire was prepared taking into account the recommendations of Saaty [

56], as regards: (i) defining the problem based on the type of knowledge sought; (ii) structuring the hierarchy; (iii) building peer comparison matrices; and (iv) obtaining the global priority of the alternatives.

The intention was to raise tools to identify risks, analyze the consequences of risks, analyze the probability of risks, and assess them. The problem was divided into four questions: (a) Which tool is more suitable to identify risks in operations importation/exportation? (b) Which tool is best suited to analyze the consequences of risks in import/export operations? (c) Which tool is best suited to analyze the probability of risks in import/export operations? (d) Which tool is best suited to assess risks in import/export operations? For each of these questions, a hierarchical structure was developed based on the tools in the ISO 31010 (see

Table 3), where peer comparison matrices were elaborated, as shown in

Table 5.

In these matrices, respondents made paired comparisons based on an ordinal scale (see

Table 6) known in the literature as the Saaty fundamental scale [

57]. When making the comparisons, the respondent evaluated, in relation to the four questions elaborated in the previous step, how much more important the tool in the column on the left was in relation to the tool that appeared in the line at the top of the matrix.

After completing the questionnaires, in the presence of the researcher, a verification of the consistency of the responses was carried out, aiming to detect possible contradictions in the weight values attributed by the specialists. This action is supported by Ishizaka and Nemery [

58] as, according to these authors, when several comparisons in pairs are considered successively, they can contradict each other. The responses were then entered into a comparison matrix and checked for consistency. The questionnaires that presented inconsistent results were separated and, through a perturbation matrix, respondents were shown where the inconsistencies occurred, so that they, occasionally, could reassess their judgments, as recommended by Saaty [

59].

The perturbation matrix was elaborated according to Saaty [

59], with the values obtained through Equation (1).

where:

Ɛij = disturbance value in the wij cell of the matrix.

aij = weight value assigned in cell aij of the comparison matrix.

wj = value of the relative priority of element j, obtained by the comparison matrix.

wi = value of the relative priority of element i, obtained by the comparison matrix.

Table 7 and

Table 8, below, exemplify this phase of the research method.

Table 7 illustrates a comparison matrix. The inconsistent cell is highlighted with borders.

Table 8, in turn, illustrates a disturbance matrix, which indicates which judgment should be reviewed. The disturbance value that departs the most from 1 indicates the point where the specialist must review his judgment [

59]. In the case of the example, the cell T2/Tn, which is 11.21.

After reviewing the judgment, the questionnaire was again submitted to the consistency test. If the result was less than 0.10—the standard defined by Saaty [

60]—the questionnaire was accepted; otherwise, it was again subjected to the disturbance matrix. Four AHP analyzes were performed, one for each stage of the risk management (risk identification, analysis of consequences, analysis of probability, and final assessment).

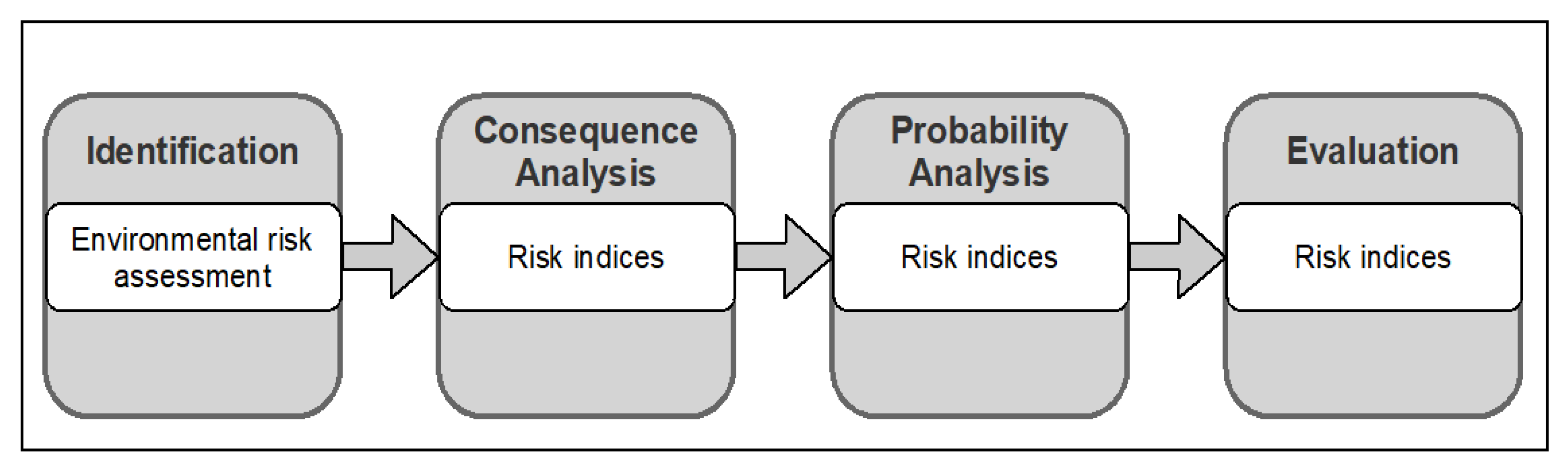

Figure 1 ends this section, illustrating the construction of the research based on the AHP method.

4. Results and Discussion

Although seven people participated in the survey, this section only describes the results related to Interviewee 1 (hereinafter referred to as I1), in order to optimize the available space. The final tables in this section organize the results of the seven experts interviewed.

4.1. Parity Matrices

This topic presents I1′s parity matrices for the four steps: identification, consequence analysis, probability analysis, and evaluation. In

Table 9, the interviewee evaluated which tool, in his opinion, stood out from the others due to its ability to identify, analyze, and evaluate risks. Each section in this table addresses one of the steps recommended by ISO 31010.

4.2. Consistency Test

The twenty-eight matrices (four for each of the seven specialists) were submitted to a consistency test and obtained a CR (consistency ratio) equal to or less than 0.10, as recommended by Saaty [

56]. The participants were informed of the consistency criteria and received guidance and examples to rely on when judging their parity matrices. When a questionnaire showed inconsistency, the respondent was invited to review their responses (for more details, see

Section 3). This ensured the minimum consistency required by the AHP method in all matrices (identification, consequence analysis, probability analysis, and evaluation), as shown in

Table 10.

4.3. Aggregation of Individual Priorities

Considering all respondents with equal weight within the decision, the geometric means of the priorities for each step were calculated. Tools that at least one of the respondents was not aware of or had not applied in his/her professional experience were excluded from the means.

Therefore, the tools used had to meet the following requirements:

Table 11,

Table 12,

Table 13 and

Table 14 show the geometric means for each ISO 31000 risk management step. The tools with “#” results are those that were excluded from the geometric mean because they were not scored by all seven respondents.

Table 11 presents the geometric means of the risk identification step.

Table 12 presents the geometric means of the consequence analysis step.

Table 13 presents the geometric means of the probability analysis step.

Finally,

Table 14 presents the geometric means of the evaluation step.

The fact that there were seven interviewees who were instructed to tick only the tools they knew or had already applied created a natural filter of the various tools proposed by ISO.

As can be seen in the previous

Table 11,

Table 12,

Table 13 and

Table 14, for the analysis and evaluation steps, the choice was between two options of tools. This shows that the group had a degree of homogeneity of knowledge regarding the tools.

4.4. Selected Tools for Risk Management in the Import/Export Process

As a result of the judgment of the seven interviewees’ priorities, the tools presented by ISO 31010 that would be most appropriate to identify, analyze consequences and probabilities and, finally, assess risks in the import and export process of an automotive industry located in Brazil, are shown in

Figure 2.

For the identification step, the AHP analysis resulted in selecting the environmental risk assessment tool. This tool involves the assessment of the environment through observation and factual and quantitative/qualitative analysis of the risks of the environment in order to define the effects of exposure. Additionally, according to ISO 31010, this tool can be used in different fields, as its methodology explores the different ways in which a target can be exposed to a certain source of risk. Initially, this tool was used to assess risks in plants, animals, and humans when exposed to environmental risks. One of the known strengths of this tool is the provision of a more detailed understanding of the nature of the problem and the factors that increase risk.

The inputs for this tool come from observation and factual analysis. For this reason, the participants were asked to provide documents identifying the sources of risk that their processes have already suffered or an analysis of any potential sources of risk.

For the analysis and evaluation steps, the AHP analysis returned the same tool: risk indices. According to ISO 31010, a risk index is a semi-quantitative measure of risk. It is a derived estimate using a scoring approach using ordinal scales.

Analyzing separately the reasons behind the fact that the two steps returned the same tool, it is possible to highlight a few points:

For the consequence analysis step, risk indices had the highest relative priority for five of the seven respondents, and for the other two respondents they represented the second highest relative priority.

For the probability analysis step, risk indices had the highest relative priority for three of the seven respondents, while for two respondents they represented the second highest relative priority, and for the others, the third.

In the evaluation step, risk indices again had the highest relative priority for five of the seven respondents and came in second place for the other two.

These data prove the interviewees’ preference for this tool. Additionally, their matrices obtained a consistency index within the recommended range. Therefore, this would not prevent the application of the same method for the steps.

Another factor that can explain the preference of this tool is the interviewees’ familiarity with the risk indices in their professional practice. Not only at the company studied, but also in their previous experiences, the interviewees mentioned having used KPIs (key performance indicators) to measure process performance.

When analyzing the literature on the tools “environmental risk assessment” and “risk indices”, it is observed that: (i) both are considered to be strongly applicable for a risk management process, that is, for the stages of identification, analysis and assessment of risks [

55]; (ii) a way to improve the communication of a certain level of risk between people and, thus, to prevent information from being misinterpreted is through risk indices, which can be expressed by numbers or categories, such as words, letters or colors [

61]; (iii) the “environmental risk assessment” tool finds increasingly broad applications [

62], such as megaprojects [

63], transportation [

64], industrial parks [

65], and in support of decision-making processes [

66].

5. Final Considerations

As risk management processes are appropriately implemented in supply chains, the level of resilience of these chains increases and, as a result, business sustainability is positively impacted, which can occur in the economic, environmental, and social spheres as a whole, or in any of them separately. The logic behind this relationship is, in theory, relatively simple: the more investments in “formal instruments” adjusted for a company’s SCRM, the fewer the occurrences of: (i) accidents; (ii) machines breaking; (iii) adverse effects on workers’ health; (iv) problems with suppliers; (v) environmental problems; (vi) loss of financial resources (which can lead to the dismissal of employees, decreased generation of taxes, and less investment in social projects), among other side effects of risks, which can be avoided together or alone.

In the case of the Brazilian automotive industry targeted by this study, the research had the general objective of selecting ISO 31010 tools that could be used in each of the stages (identification, consequence analysis, probability analysis, and evaluation) of the risk management of the import and export process, so that an appropriate “formal instrument” of SCRM could be obtained. This objective was achieved through interviews (structured questionnaires) with professionals with extensive experience in the Alliance Customs & Trade (ACT) department, who made priority comparisons between the tools proposed by ISO 31000, one by one, based on the AHP method. One of the biggest advantages of the AHP method is shown in the analysis of possible inconsistencies in the responses of the specialists, through a “disturbance matrix”, developed for this purpose. This analysis happens almost immediately after the delivery of the completed questionnaire, still in the presence of the respondent, with the answers checked against this matrix of disturbance. As a result of the empirical study, the “environmental risk assessment” and “risk indices” tools were selected, culminating in a customized process to meet the risk management needs of the target process of this study. A relevant aspect of this result is the support that the specialized literature on risk management (ISO 31010) gives to both tools, making them as applicable to all stages of a risk management process.

5.1. Theoretical Implications and Contributions

The literature review showed that, despite advances in research on SCRM, both in quantity and in different approaches, little research had been directed to the automotive industry. As an example, delimiting the universe of research to the Web of Science database, it was observed that less than ten studies focusing on this industry had been published in journals over the past twenty years. Of these works, almost half were published only last year. Recent research, such as that developed by Vanalle et al. [

51], corroborates this gap. Still, as regards the SCRM literature, it was observed that a good portion of what was found focused on raising and identifying the main risks in the automotive supply chain, while few were dedicated to developing “formal instruments” to manage these risks.

Another relevant point observed in the literature refers to the risks that caused the most vulnerability in the supply chain, including delivery delays, quality problems, communication failures between the different layers of suppliers, and forecast errors. When taking into account the issue of vulnerability, it is observed that nowadays the operations of supply chains are more and more exposed, for innumerable reasons, of which the following stand out: new trends in business (life cycles of increasingly smaller products, strategies such as Lean Six Sigma, Just in Time, and Outsourcing); cultural adaptations in operations with less and less geographical barriers; “depreciation” of the environment, which ends up generating a reaction from nature with hurricanes, earthquakes, and other natural disasters capable of generating disruptions in supply chains; amongst others. The fact is that these findings (scarcity of research focused on the automotive industry versus increasing supply chain vulnerability) make this work a relevant complement to SCRM research, by providing suggestions for tools for the execution of risk management steps in the import/export process of the automotive industry.

5.2. Practical and Managerial Implications

Although many managers are aware that SCRM is an indispensable practice to be incorporated into supply chain management, it is observed that in the day-to-day life of the automotive industries—at least as has been found in much of the literature dedicated to this theme—is that many of these managers do not use “formal instruments” to minimize (or even eliminate) risks along the different levels of the supply chain. This does not mean that managers do not use tools for risk management, but that, in most cases, these tools are used focally, without thinking about the chain as a whole.: it is precisely in this context that the so-called “formal instruments” should come in to minimize risks. In this direction, recent studies have shown that smaller suppliers and those more distant from vehicle manufacturers suffer the adverse effects of risks in a disproportionately larger and less predictable manner. However, with chains increasingly connected and interconnected, risks that affect suppliers at more distant levels result in, due to the domino effect, effects across the entire chain.

The final result of this research can contribute to the improvement of the risk management of the import/export processes of the Brazilian automotive industry, which was the target of this case study, insofar as it takes into account the tools previously selected by those who know and directly participate in the operational activities of that process. At this point, it is emphasized that the most significant contribution of this study to practical application was the suggestion of a customized procedure with the tools “environmental risk assessment” and “risk indices”, which will allow the risks to be identified, analyzed, and evaluated by the Alliance Customs & Trade department.

5.3. Limitations and Recommendations for Future Research

Given that the present research was carried out through a single case study, its most significant limitation is that its results cannot be generalized to other industries in the automotive sector, nor to companies from different sectors. In addition, as the research was focused on the process of importing productive inputs and the export of vehicles, its conclusions cannot be extrapolated to different areas of the researched company. Despite these limitations, it is believed that rational analogies—that is, an extrapolation based on the qualitative criteria of the results exposed here,—can be developed by professionals and researchers, since the study had a real application and that followed a logical sequence of structured steps, as explained and exemplified in the selection of organized tools for the identification, analysis, and assessment of risks. It is also noteworthy that the research had an exploratory nature; given the scarcity of research as specific as the one developed here, it contributes to a better understanding and the obtaining of initial insights to increase the familiarity of researchers and professionals on this topic.

Based on the limitations addressed here and the proven scarcity of specific research on this subject, it is recommended, as future research, that: (i) more practical research on applications of tools for the realization of SCRM in automotive industries be developed, regardless of area, department, or process; (ii) descriptive research, which has a focus on obtaining statistical conclusions on risk management in import and export processes for the automotive industry, is considered; (iii) action research should be developed based on the results obtained here, that is, that the risk management process composed by the tools “environmental risk assessment” and “risk indices” is tested, preferably in processes of import and export of automotive industries.