The Dynamic Correlation among Financial Leverage, House Price, and Consumer Expenditure in China

Abstract

:1. Introduction

2. Literature Review

2.1. The Impact of Financial Leverage on House Price

2.2. The Impact of Financial Leverage on Consumer Expenditure

2.3. The Impact of House Price on Consumer Expenditure

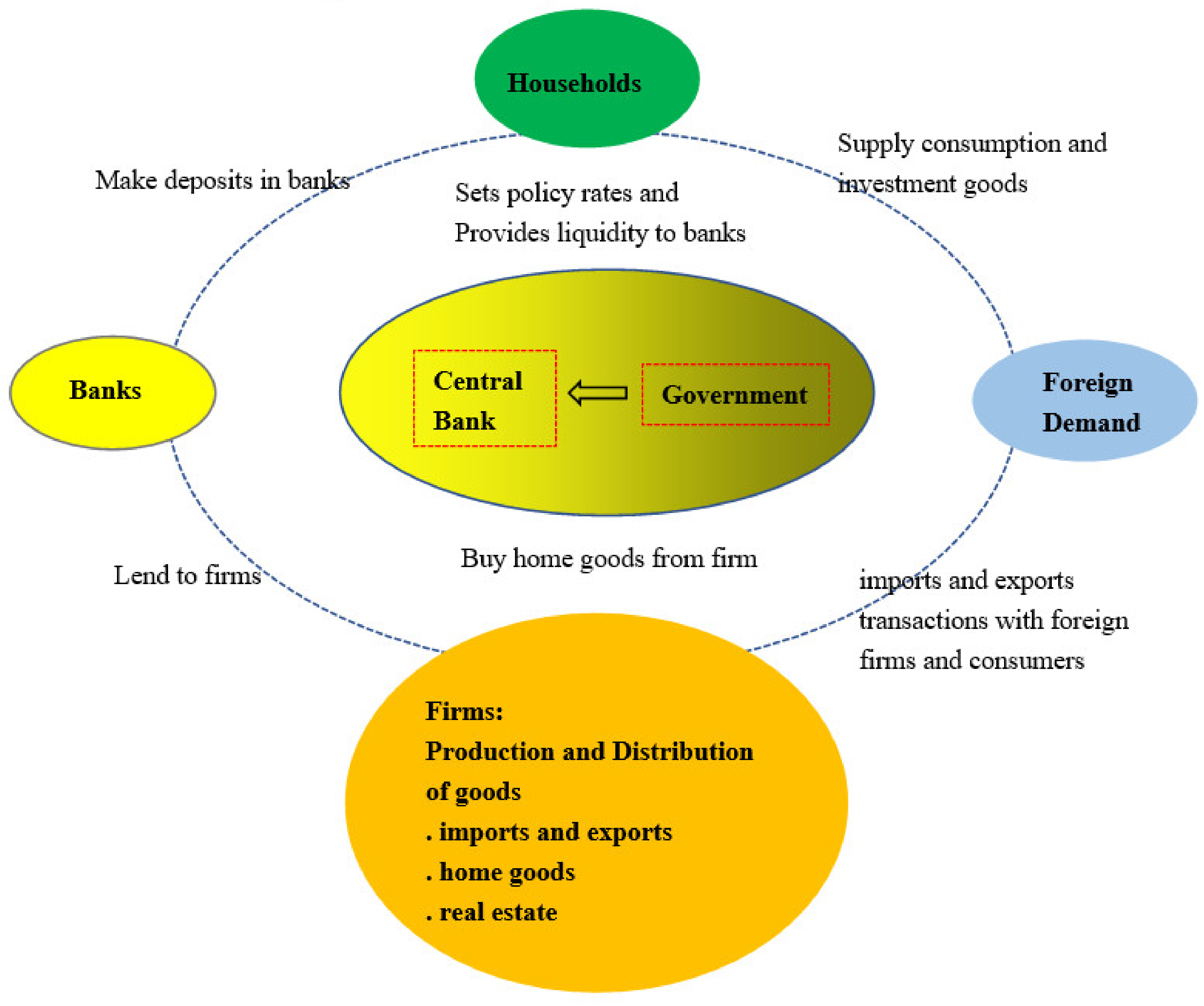

3. Theoretical Analysis and Model Description

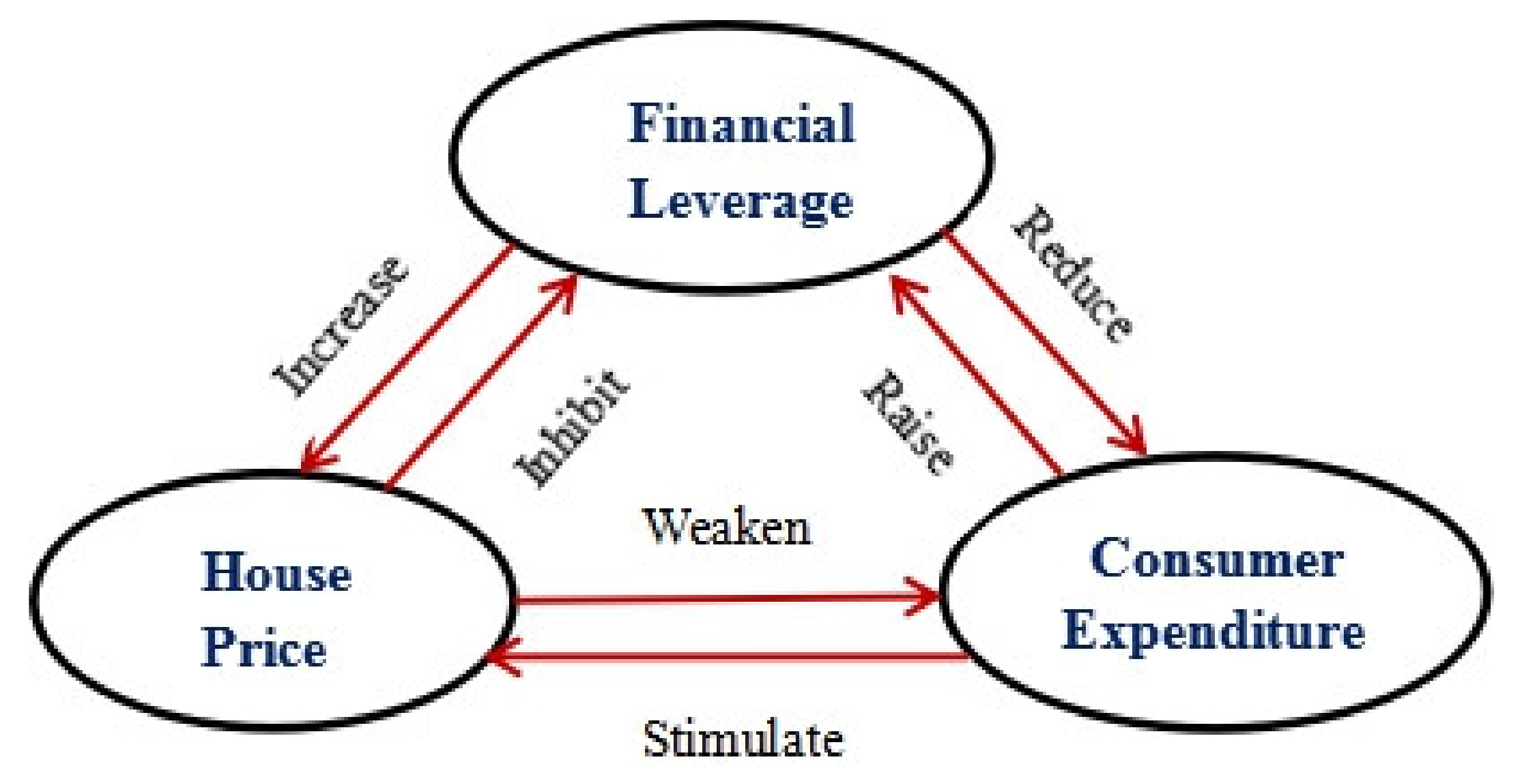

3.1. Theoretical Analysis

3.2. Model Description

3.2.1. TVP-SV-VAR Model

3.2.2. Bayesian DCC-GARCH Model

4. Empirical Analysis

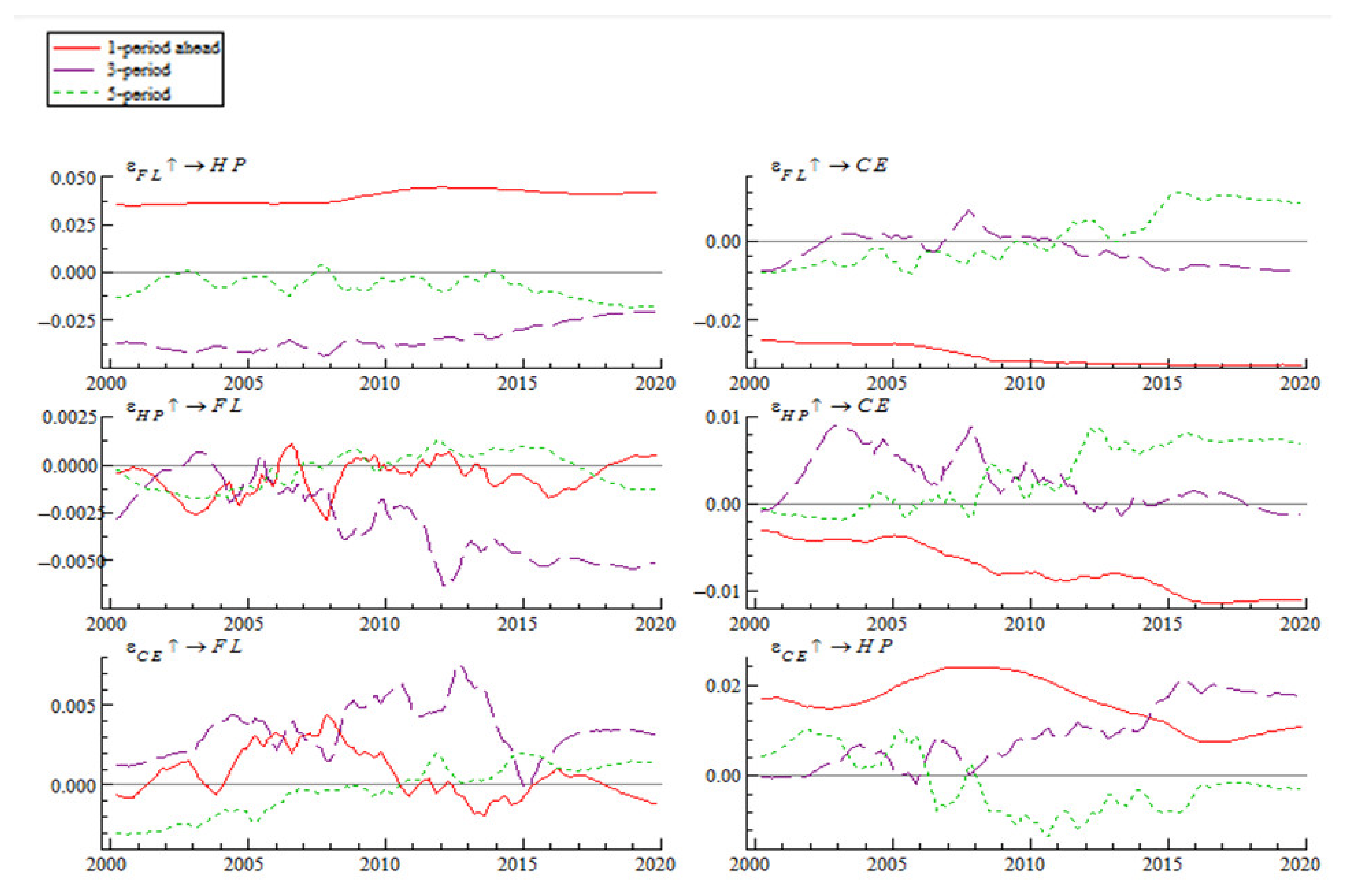

4.1. Empirical Analysis Based on the TVP-SV-VAR Model

4.1.1. Analysis of Results of Parameter Regression

4.1.2. Analysis of Time-Variant Impulse Responses

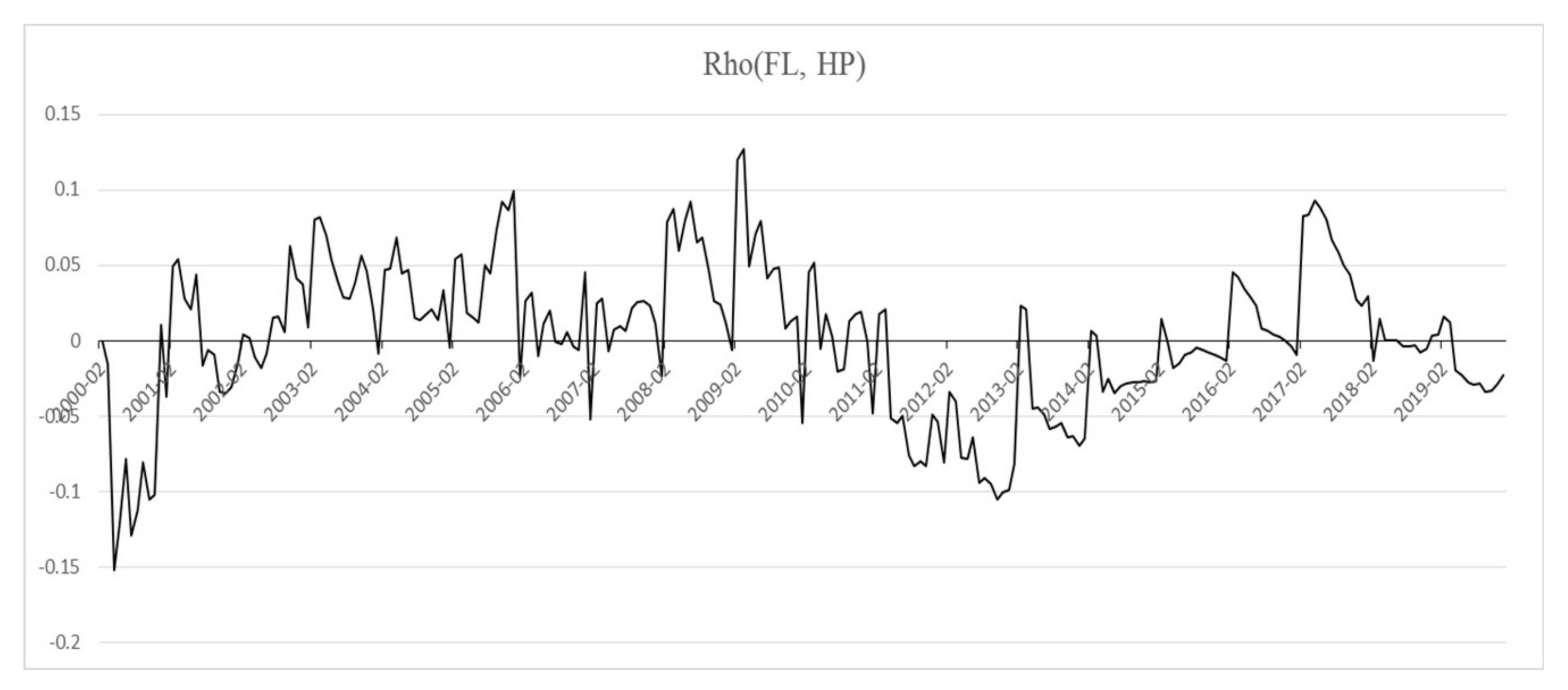

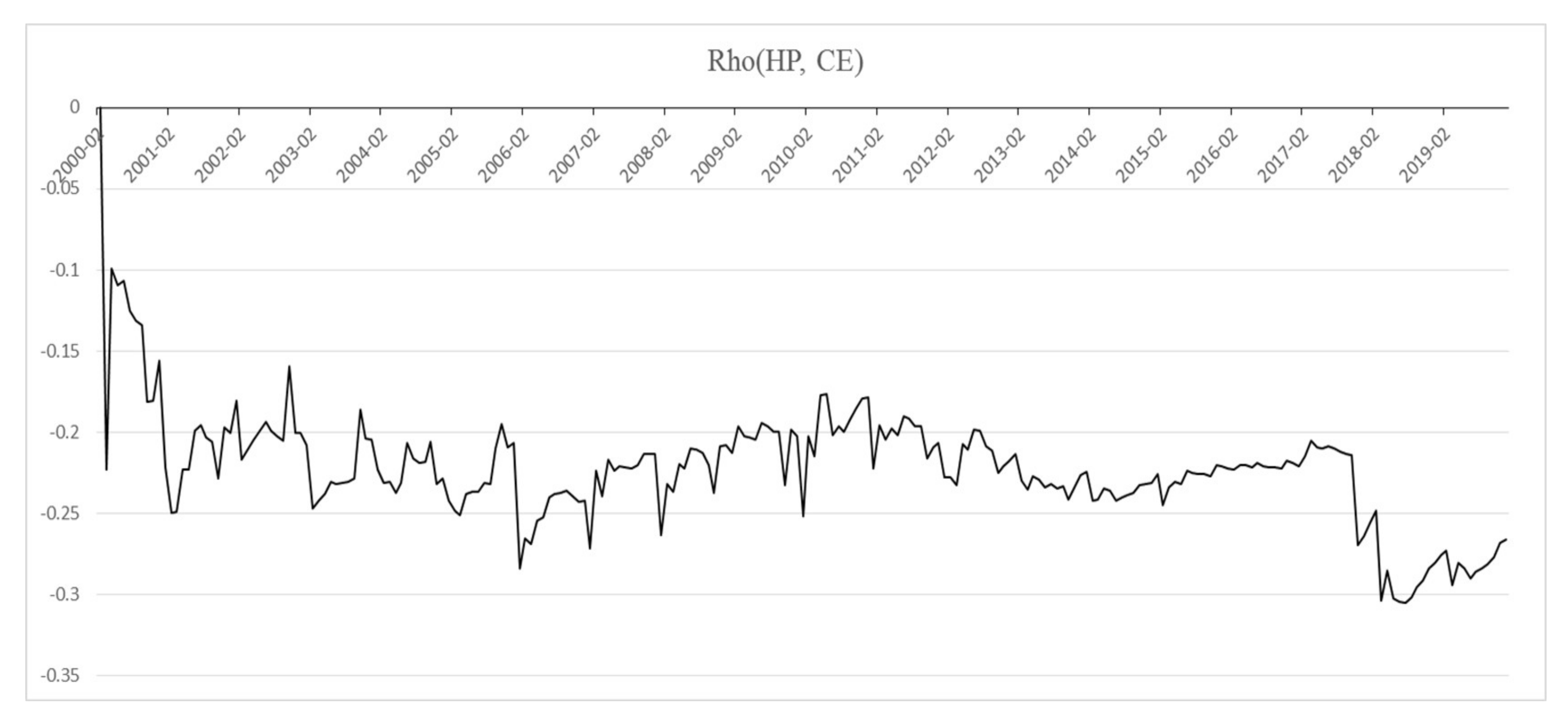

4.2. Empirical Analysis Based on the Bayesian DCC-GARCH Model

4.2.1. Estimation Results of the Model

4.2.2. Analysis of Dynamic Correlation Coefficients

5. Conclusions and Discussion

5.1. Conclusions

5.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Xu, H. Sustainable Development of China’s Economy under the “New Normal”. China Dev. Observ. 2014, 9, 21–25. [Google Scholar]

- Lamont, O.; Stein, J.C. Leverage and house-price dynamics in US cities. Rand J. Econ. 1999, 30, 498–514. [Google Scholar] [CrossRef] [Green Version]

- Aizenman, J.; Jinjarak, Y. Real estate valuation, current account and credit growth pat terns, before and after the 2008–2009 crisis. J. Int. Money Financ. 2014, 48, 249–270. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Du, L.; Zeng, Z. Special report 4: The current situation, problems and Countermeasures of the coordination of China’s macro-control departments. Econ. Res. Ref. 2014, 4, 60–69. [Google Scholar]

- Bemanke, B.; Gertler, M. Agency costs, net worth, and business fluctuations. Am. Econ. Rev. 1989, 79, 14–31. [Google Scholar]

- Bernanke, B.S.; Gertler, M.; Gilchrist, S. The financial accelerator in a quantitative business cycle framework. Handb. Macroecon. 1999, 1, 1341–1393. [Google Scholar]

- Gertler, M.; Karadi, P. A model of unconventional monetary policy. J. Monet. Econ. 2011, 58, 17–34. [Google Scholar] [CrossRef]

- Herring, R.J.; Wachter, S.M. Real estate booms and banking busts: An international perspective. In The Wharton School Research Paper No. 99-27; The Wharton School, University of Pennsylvania: Philadelphia, PA, USA, 1999; p. 110. [Google Scholar]

- Krugman, P. Balance sheets, the transfer problem, and financial crises. In International Finance and Financial Crises; Springer: Dordrecht, The Netherlands, 1999; pp. 31–55. [Google Scholar]

- Edelstein, R.H.; Paul, J. Japanese land prices: Explaining the boom-bust cycle. In Asia’s Financial Crisis and the Role of Real Estate; Mera, K., Renaud, B., Eds.; Routledge: Milton Park, UK, 2000; pp. 65–82. [Google Scholar]

- Schularick, M.; Taylor, A.M. Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870–2008. Am. Econ. Rev. 2012, 102, 1029–1061. [Google Scholar] [CrossRef] [Green Version]

- Carlin, W.; Soskice, D. How should macroeconomics be taught to undergraduates in the post-crisis era? A concrete proposal. VoxEU. Org. 2012, 1990, 1–3. [Google Scholar]

- Geanakoplos, J.; Zame, W.R. Collateral equilibrium, I: A basic framework. Econ. Theory 2014, 56, 443–492. [Google Scholar] [CrossRef]

- Punzi, M.T. Housing market and current account imbalances in the international economy. Rev. Int. Econ. 2013, 21, 601–613. [Google Scholar] [CrossRef] [Green Version]

- Gete, P.; Reher, M. Two Extensive Margins of Credit and Loan-to-Value Policies. J. Money Credit. Bank. 2016, 48, 1397–1438. [Google Scholar] [CrossRef]

- Mishkin, F.S. Illiquidity, consumer durable expenditure, and monetary policy. Am. Econ. Rev. 1976, 66, 642–654. [Google Scholar]

- Bacchetta, P.; Gerlach, S. Consumption and credit constraints: International evidence. J. Monet. Econ. 1997, 40, 207–238. [Google Scholar] [CrossRef]

- Dynan, K.; Mian, A.; Pence, K.M. Is a Household Debt Overhang Holding Back Consumption? [with comments and discussion]. In Brookings Papers on Economic Activity. JSTOR. 2012, p. 299. Available online: http://0-www-jstor-org.brum.beds.ac.uk/stable/23287219 (accessed on 3 April 2020).

- Dynan, K.; Edelberg, W. The relationship between leverage and household spending behavior: Evidence from the 2007–2009 survey of consumer finances. Fed. Reserve Bank St. Louis Rev. 2013, 95, 425–448. [Google Scholar] [CrossRef] [Green Version]

- Johnson, K.W.; Li, G. Do High Debt Payments Hinder Household Consumption Smoothing? (No. 2007-52); Board of Governors of the Federal Reserve System (US): Washington, DC, USA, 2007. [Google Scholar]

- Baker, S.R. Debt and the Consumption Response to Household Income Shocks. Available online: https://web.stanford.edu/~srbaker/Papers/Baker_DebtConsumption.pdf (accessed on 9 March 2020).

- Mian, A.; Rao, K.; Sufi, A. Household balance sheets, consumption, and the economic slump. Q. J. Econ. 2013, 128, 1687–1726. [Google Scholar] [CrossRef]

- Yao, J.; Fagereng, A.; Natvik, G. Housing, debt and the marginal propensity to consume. Nor. Bank Res. Pap. 2015, pp. 1–38. Available online: http://www.good2use.com/knet/economic/gloss/iaae2016-171.pdf (accessed on 3 April 2020).

- Case, K.E.; Quigley, J.M.; Shiller, R.J. Comparing wealth effects: The stock market versus the housing market. BE J. Macroecon. 2005, 5, 1–34. [Google Scholar] [CrossRef]

- Carroll, C.D.; Otsuka, M.; Slacalek, J. How large are housing and financial wealth effects? A new approach. J. Money Credit Bank. 2011, 43, 55–79. [Google Scholar] [CrossRef] [Green Version]

- Mian, A.; Sufi, A. The consequences of mortgage credit expansion: Evidence from the US mortgage default crisis. Q. J. Econ. 2009, 124, 1449–1496. [Google Scholar] [CrossRef]

- De Bonis, R.; Silvestrini, A. The effects of financial and real wealth on consumption: New evidence from OECD countries. Appl. Financ. Econ. 2012, 22, 409–425. [Google Scholar] [CrossRef] [Green Version]

- Cristini, A.; Sevilla, A. Do House Prices Affect Consumption? A Re-assessment of the Wealth Hypothesis. Economica 2014, 81, 601–625. [Google Scholar] [CrossRef] [Green Version]

- Catte, P.; Girouard, N.; Price, R.; André, C. Housing Markets, Wealth and the Business Cycle (No. 394); OECD Publishing: Paris, France, 2004. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Cocco, J.F. How do house prices affect consumption? Evidence from micro data. J. Monet. Econ. 2007, 54, 591–621. [Google Scholar] [CrossRef] [Green Version]

- Chamon, M.D.; Prasad, E.S. Why are saving rates of urban households in China rising? Am. Econ. J. Macroecon. 2010, 2, 93–130. [Google Scholar] [CrossRef] [Green Version]

- McKinnon, R.I. Money and Capital in Economic Development; Brookings Institution Press: Washington, DC, USA, 1973. [Google Scholar]

- Shaw, E.S. Financial Deepening in Economic Development; Oxford University Press: Oxford, UK, 1973. [Google Scholar]

- Lambertini, L.; Mendicino, C.; Punzi, M.T. Leaning against boom–bust cycles in credit and housing prices. J. Econ. Dyn. Control 2013, 37, 1500–1522. [Google Scholar] [CrossRef] [Green Version]

- Gao, D.; Yue, Q.; Yang, D.; Deng, D.; Xu, G. The effect of residents’ leverage ratio on consumption: Promotion or inhibition. Economist 2020, 8, 100–109. [Google Scholar]

- Ruan, J.; Liu, X.; Ye, H. Research on the current situation and influencing factors of China’s residents’ leverage ratio. Financ. Res. 2020, 8, 18–33. [Google Scholar]

- Ma, E.; Zubairy, S. Homeownership and Housing Transitions: Explaining the Demographic Composition. Available online: https://0-onlinelibrary-wiley-com.brum.beds.ac.uk/doi/10.1111/iere.12493 (accessed on 7 July 2020).

- Fisher, I. The debt-deflation theory of great depressions. Econometrica 1933, 1, 337–357. [Google Scholar] [CrossRef] [Green Version]

- Tobin, J. Keynesian models of recession and depression. Am. Econ. Rev. 1975, 65, 195–202. [Google Scholar]

- Mian, A.; Sufi, A.; Verner, E. Household debt and business cycles worldwide. Q. J. Econ. 2017, 132, 1755–1817. [Google Scholar] [CrossRef]

- Scholnick, B. Consumption smoothing after the final mortgage payment: Testing the magnitude hypothesis. Rev. Econ. Stat. 2013, 95, 1444–1449. [Google Scholar] [CrossRef]

- Mendoza, E.G. Sudden stops, financial crises, and leverage. Am. Econ Rev. 2010, 100, 1941–1966. [Google Scholar] [CrossRef]

- Friedman, M. A Theory of the Consumption Function; Princeton University Press: Princeton, NJ, USA, 1957. [Google Scholar]

- Ando, A.; Modigliani, F. The” life cycle” hypothesis of saving: Aggregate implications and tests. Am. Econ Rev. 1963, 53, 55–84. [Google Scholar]

- De Veirman, E.; Duncan, A. Does wealth variation matter for consumption? Reserve Bank N. Zeal. 2010. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.691.4961&rep=rep1&type=pdf (accessed on 16 July 2020).

- Burrows, V. The impact of house prices on consumption in the UK: A new perspective. Economica 2018, 85, 92–123. [Google Scholar] [CrossRef]

- Cloyne, J.; Huber, K.; Ilzetzki, E.; Kleven, H. The effect of house prices on household borrowing: A new approach. Am. Econ Rev. 2019, 109, 2104–2136. [Google Scholar] [CrossRef]

- Wang, X.; Wen, Y. Can Rising Housing Prices Explain China’s High Household Saving Rate? Fed. Reserve Bank St. Louis Work. Paper Series. 2010. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1707062 (accessed on 23 July 2020).

- Bernanke, B.; Gertler, M.; Gilchrist, S. The financial accelerator and the flight to quality. Rev. Econ. Stat. 1996, 78, 1–15. [Google Scholar] [CrossRef]

- Oikarinen, E. Interaction between housing prices and household borrowing: The Finnish case. J. Bank. Financ. 2009, 33, 747–756. [Google Scholar] [CrossRef]

- DeFusco, A.A. Homeowner borrowing and housing collateral: New evidence from expiring price controls. J. Financ. 2018, 73, 523–573. [Google Scholar] [CrossRef]

- Sinai, T.; Souleles, N.S. Owner-occupied housing as a hedge against rent risk. Q. J. Econ. 2005, 120, 763–789. [Google Scholar]

- Stiglitz, J. Joseph Stiglitz and why inequality is at the root of the recession. Next Left Website. 2009. Available online: http://www.nextleft.org/2009/01/joseph-stiglitz-and-why-inequality-is.html (accessed on 3 May 2020).

- Barba, A.; Pivetti, M. Rising household debt: Its causes and macroeconomic implications—a long-period analysis. Camb. J. Econ. 2009, 33, 113–137. [Google Scholar] [CrossRef] [Green Version]

- Primiceri, G.E. Time varying structural vector autoregressions and monetary policy. Rev. Econ. Stud. 2005, 72, 821–852. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Christodoulakis, G.A.; Satchell, S.E. Correlated ARCH (CorrARCH): Modelling the time-varying conditional correlation between financial asset returns. Eur. J. Oper. Res. 2002, 139, 351–370. [Google Scholar] [CrossRef]

- Nakajima, J. Time-Varying Parameter VAR Model with Stochastic Volatility: An Overview of Methodology and Empirical Applications (No. 11-E-09); Institute for Monetary and Economic Studies, Bank of Japan: Tokyo, Japan, 2011. [Google Scholar]

- Fioruci, J.A.; Ehlers, R.S.; Andrade Filho, M.G. Bayesian multivariate GARCH models with dynamic correlations and asymmetric error distributions. J. Appl. Stat. 2014, 41, 320–331. [Google Scholar] [CrossRef]

- Bauwens, L.; Laurent, S. A new class of multivariate skew densities, with application to generalized autoregressive conditional heteroscedasticity models. J. Bus Econ. Stat. 2005, 23, 346–354. [Google Scholar] [CrossRef]

- Verner, E.; Gyöngyösi, G. Household debt revaluation and the real economy: Evidence from a foreign currency debt crisis. Am. Econ. Rev. 2020, 110, 2667–2702. [Google Scholar] [CrossRef]

- Yin, Z.; Li, Q.; Zhang, C. The impact of income inequality on household leverage. Financ. Trade Econ. 2021, 1, 11–15. [Google Scholar]

| Parameter | Mean Value | Standard Deviation | 95% Confidence Interval | Geweke | Non-Effective Factor |

|---|---|---|---|---|---|

| sb1 | 0.0229 | 0.0026 | [0.0184, 0.0287] | 0.05 | 13.01 |

| sb2 | 0.0208 | 0.0021 | [0.0171, 0.0253] | 0.81 | 9.99 |

| sa1 | 0.0903 | 0.0435 | [0.0428, 0.2086] | 0.405 | 149.21 |

| sa2 | 0.0743 | 0.0249 | [0.0412, 0.1314] | 0.816 | 81.91 |

| sh1 | 0.5188 | 0.062 | [0.4130, 0.6568] | 0.001 | 57.02 |

| sh2 | 0.5949 | 0.1496 | [0.3393, 0.9272] | 0.272 | 71.59 |

| Quantile | |||||||

|---|---|---|---|---|---|---|---|

| Variable | Parameter | Mean Value | 2.50% | 25.00% | 50.00% | 75.00% | 97.50% |

| FL | 0.5629 | 0.5048 | 0.5314 | 0.5479 | 0.5688 | 0.9255 | |

| 0.0021 | 0.0002 | 0.0003 | 0.0004 | 0.0005 | 0.0434 | ||

| 0.2651 | 0.0651 | 0.1818 | 0.2520 | 0.3392 | 0.5110 | ||

| 0.3172 | 0.0331 | 0.1718 | 0.2520 | 0.3392 | 0.5110 | ||

| HP | 1.0096 | 0.9807 | 0.9976 | 1.0067 | 1.0213 | 1.0445 | |

| 0.0042 | 0.0018 | 0.0028 | 0.0036 | 0.0046 | 0.0117 | ||

| 0.3696 | 0.0606 | 0.2405 | 0.3639 | 0.4839 | 0.7355 | ||

| 0.3464 | 0.1168 | 0.2326 | 0.3164 | 0.4305 | 0.8066 | ||

| CE | 0.9407 | 0.8622 | 0.9060 | 0.9347 | 0.9696 | 1.0370 | |

| 0.0048 | 0.0023 | 0.0034 | 0.0040 | 0.0047 | 0.0270 | ||

| 0.0639 | 0.0054 | 0.0262 | 0.0534 | 0.0898 | 0.1858 | ||

| 0.2098 | 0.0161 | 0.0855 | 0.1796 | 0.2916 | 0.6885 | ||

| 0.7859 | 0.2554 | 0.7562 | 0.7959 | 0.8456 | 0.9332 | ||

| 0.0093 | 0.0006 | 0.0031 | 0.0065 | 0.0112 | 0.0387 | ||

| 0.411 | 0.0094 | 0.1222 | 0.3175 | 0.6870 | 0.9726 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, K.; Chang, C.-T.; Wang, S.; Liu, X. The Dynamic Correlation among Financial Leverage, House Price, and Consumer Expenditure in China. Sustainability 2021, 13, 2617. https://0-doi-org.brum.beds.ac.uk/10.3390/su13052617

Dong K, Chang C-T, Wang S, Liu X. The Dynamic Correlation among Financial Leverage, House Price, and Consumer Expenditure in China. Sustainability. 2021; 13(5):2617. https://0-doi-org.brum.beds.ac.uk/10.3390/su13052617

Chicago/Turabian StyleDong, Kai, Ching-Ter Chang, Shaonan Wang, and Xiaoxi Liu. 2021. "The Dynamic Correlation among Financial Leverage, House Price, and Consumer Expenditure in China" Sustainability 13, no. 5: 2617. https://0-doi-org.brum.beds.ac.uk/10.3390/su13052617