Value Capture and Vertical Allocations of Public Amenities

Abstract

:1. Introduction

2. The Literature on Value Capture, Verticality, and Exactions

2.1. Value Capture and Its Ability to Mobilize Value Uplifts

2.2. Exactions and Other Pathways for Allocating Public Land through Value Capture

2.3. Value Capture, Incentives, and Verticality

3. Israel as a Case Study

4. Methodology

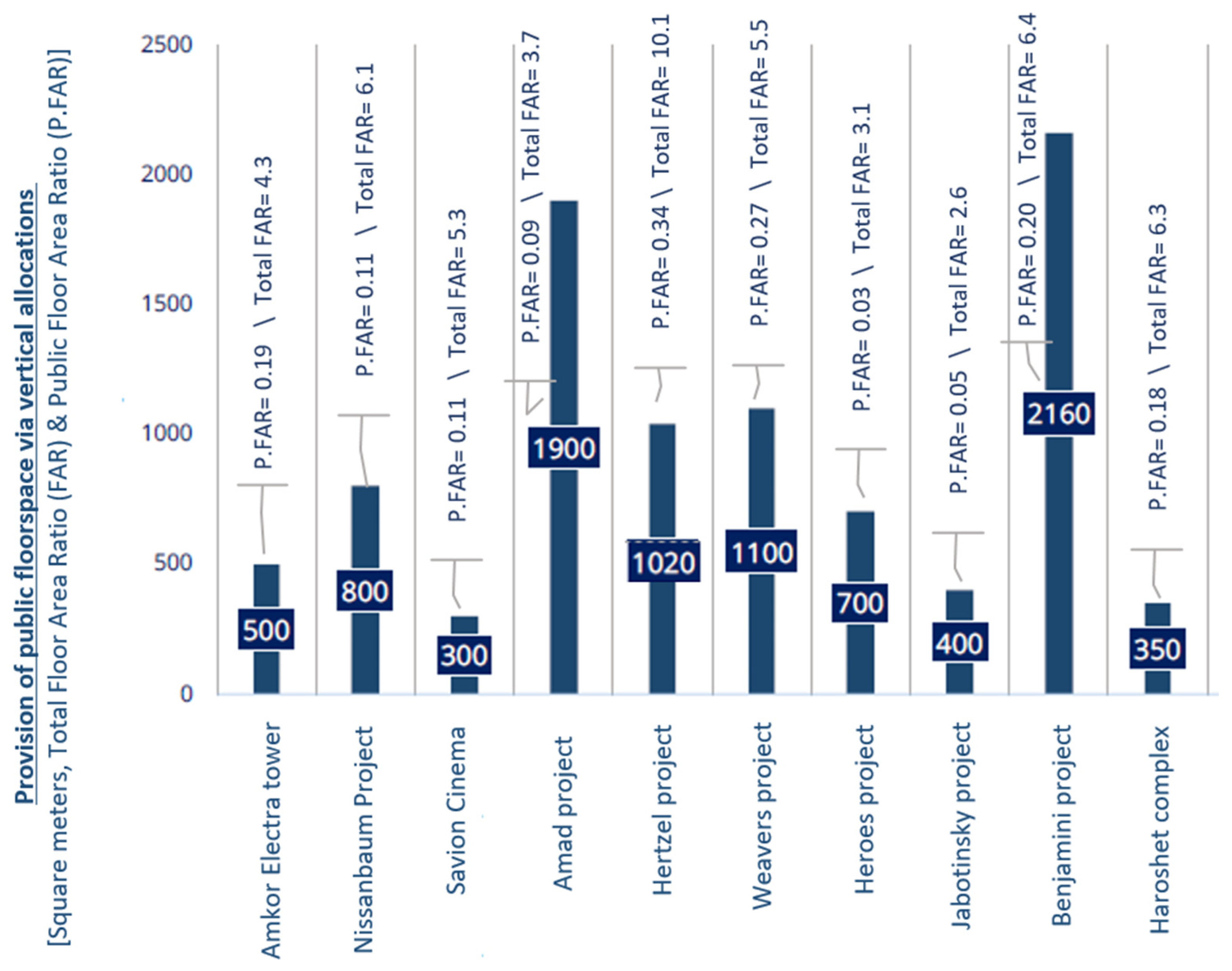

5. Findings and Discussion

5.1. Mechanisms for Vertical Value Capture

5.2. Growing Critiques of Vertical Allocations

5.3. The Nexus Question and Vertical Allocations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. List of Interviews and Personal Communications

- Interview with an urban planner. City Planning Department, & Engineering Administration, Tel Aviv-Jaffa Municipality. 16 March 2017.

- Interview with a (second) urban planner. City Planning Department. Tel Aviv-Jaffa Municipality. 16 March 2017.

- Interview with a (third) urban planner. City Planning Department. Tel Aviv-Jaffa Municipality. 16 March 2017.

- Interview with a consultant and planner, Tel Aviv District Planning and Building Committee. 16 March 2017.

- Interview with senior legal consultant, Haifa metro area. 24 April 2017.

- Interview with a senior financial consultant in a local municipality, Gush Dan Area, 24 April 2017.

- City planner and planning consultant in the city of Bnei Brak. 24 April 2017.

- Interview with senior planner in Petah Tiqwa municipality. 1 May 2017.

- Interview with a senior financial consultant in a local municipality, Gush Dan Area, 9 May 2017.

- A telephone conversation with a senior legal advisor in a local municipality in the Gush Dan Area. 14 May 2017.

- Interview with a municipal planner, Tel Aviv-Jaffa Municipality, 24 May 2017.

- Interview with a Deputy Mayor in a city located in Gush Dan Area 2 July 2017.

- A telephone conversation with a senior planner, Bat Yam Municipality. 26 July 2017.

- A telephone conversation with a city planner, working in a private planning office. 1 August 2017.

- Interview with the Director of the Senior Division of the Ministry of Education. 17 August 2017.

- A telephone conversation with a senior planner, Tel Aviv-Jaffa Municipality 10 September 2017.

- Interview with a senior real estate expert, Ramat Gan Municipality, 24 October 2017.

- Interview with architect in city planning department, Ramat Gan municipality. 24 October 2017.

- Interview with an architect in the city planning department, the municipality of Beit Shemesh. 29 November 2017.

- A telephone conversation with a senior appraiser. 14 December 2017.

- Interview with a senior appraiser. 3 January 2018.

- Interview with a senior appraiser representing entrepreneurs in urban renewal projects. 3 January 2018.

- Interview with a senior manager in the city’s property department in the center of the country. 16 January 2018.

- A telephone conversation with a senior legal adviser in a government ministry. 31 January 2018.

- Roundtable discussion on vertical allocations with the following experts: Senior legal advisor in Tel Aviv’s planning commission, an expert real estate appraiser, and a municipal planner working for a municipality in Tel Aviv metro area. 4 February 2018.

- A telephone conversation with a law professor, Israeli college of management. 8 August 2018.

- Roundtable discussion on vertical allocations with several experts; Senior planner (retired) in Tel Aviv’s District Planning Committee; senior real-estate appraiser in the Israeli Ministry of Justice; the deputy president of Israel’s Builders Association; head of a municipal real-estate department in a municipality in Tel Aviv metro area. 15 December 2019.

- E-mail correspondence with a real-estate appraiser who was involved in a vertical allocations project. 17 December 2019.

References

- Hall, P. Good Cities, Better Lives: How Europe Discovered the Lost Art of Urbanism; Routledge: London, UK, 2014. [Google Scholar]

- Hale, T. Introduction. In Land and Power: The Impact of Eminent Domain in Urban Communities; Castano, T.N., Ed.; Princeton University: Princeton, NJ, USA, 2008; pp. 3–8. [Google Scholar]

- Tarlock, D. A U.S. Perspective on Expropriation: A Radically Different View. In Instruments of Land Policy: Dealing with Scarcity of Land; Gerber, J.D., Hartmann, T., Hengstermann, A., Eds.; Routledge: Abingdon, UK, 2018; pp. 311–314. [Google Scholar]

- Hartmann, T.; Gerber, J.-D. Land, Scarcity, and Property Rights. In Instruments of Land Policy: Dealing with Scarcity of Land; Gerber, J.D., Hartmann, T., Hengstermann, A., Eds.; Routledge: Abingdon, UK, 2018; pp. 3–7. [Google Scholar]

- UN-Habitat. Global Experiences in Land Readjustment; United Nations Human Settlements Programme (UN-Habitat): Nairobi, Kenia, 2018. [Google Scholar]

- Brown, J.H.; Smolka, M.O. Capturing Public Value from Public Investments. In Land Use and Taxation: Applying the Insights of Henry George; Brown, J.H., Ed.; Lincoln Institute for Land Policy: Cambridge, MA, USA, 1997; pp. 17–32. [Google Scholar]

- Mualam, N.; Salinger, E.; Max, D. Increasing the Urban Mix through Vertical Allocations: Public Floorspace in Mixed Use Development. Cities 2019, 87, 131–141. [Google Scholar] [CrossRef]

- Margalit, T. Multi-spot Zoning: A Chain of Public—Private Development Ventures in Tel Aviv. Cities 2014, 37, 73–81. [Google Scholar] [CrossRef]

- Nussbaum, G. A Guide for Mixed Use Development of Public Facilities, Commerce, Residential and Office Space; Research Center for Educational and Welfare Institutions: Tel Aviv, Israel, 2011. [Google Scholar]

- Alterman, R. Land-Use Regulations and Property Values: The “Windfalls Capture” Idea Revisited. In the Oxford Handbook of Urban Economics and Planning; Brooks, N., Donaghy, K., Knap, G.J., Eds.; Oxford University Press: Oxford, UK, 2012; pp. 755–786. [Google Scholar]

- Smolka, M.O. Implementing Value Capture in Latin America—Policies and Tools for Urban Development; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2013. [Google Scholar]

- Mathur, S. Innovation in Public Transport Finance: Property Value Capture; Routledge: Abingdon, UK, 2014. [Google Scholar]

- UN-Habitat. The Vancouver Declaration on Human Settlements. In Proceedings of the Habitat: United Nations Conference on Human Settlements, Vancouver, BC, Canada, 31 May–11 June 1976; UN-Habitat Publications: Vancouver, BC, Canada, 1976. [Google Scholar]

- Walters, L.C. Land Value Capture in Policy and Practice. J. Prop. Tax Assess. Adm. 2012, 10, 5–21. [Google Scholar]

- Mittal, J. Self-financing Land and Urban Development via Land Readjustment and Value Capture. Habitat Int. 2014, 44, 314–323. [Google Scholar] [CrossRef]

- Hendricks, A.; Kalbro, T.; Llorente, M.; Vilmin, T.; Weitkamp, A. Public Value Capture of Increasing Property Values—What are “Unearned Increments”? In Land Ownership and Land Use Development. the Integration of Past, Present and Future in Spatial Planning and Land Management Policies; Hepperle, E., Dixon-Gough, R., Mansberger, R., Paulsson, J., Hernik, J., Kalbro, T., Eds.; vdf Hochschulverlag: Zurich, Switzerland, 2017; pp. 283–294. [Google Scholar]

- Rebelo, E.M. Land Betterment Capture Revisited: A Methodology for Territorial Plans. Land Use Policy 2017, 69, 392–407. [Google Scholar] [CrossRef] [Green Version]

- Callies, D.; Grant, M. Paying For Growth and Planning Gain: An Anglo-American Comparison of Development Conditions, Impact Fees And Development Agreements. Urban Lawyer 1991, 23, 221–248. [Google Scholar]

- Havel, M.B. Unlock the Lock-in! Balance of Rights in Relation to Betterment and Compensation in Poland; Norwegian University of Life Sciences (NMBU): As, Norway, 2016. [Google Scholar]

- Muñoz-Gielen, D.; Mualam, N. A Framework for Analyzing the Effectiveness and Efficiency of Land Readjustment Regulations: Comparison of Germany, Spain and Israel. Land Use Policy 2019, 87, 104077. [Google Scholar] [CrossRef]

- Hendricks, A. Public Value Capture—An Opportunity to Improve the Economic Situation of African Municipalities. In Responsible and Smart Land Management Interventions: An African Context; de Vries, W.T., Tiah Bugri, J., Mandhu, F., Eds.; CRC Press: Boca Raton, FL, USA, 2020; pp. 251–262. [Google Scholar]

- Hong, Y.-H.; Brubaker, D. Integrating the Proposed Proferty Tax with the Public Leasehold System. In China’s Local Public Finance in Transition; Man, J.Y., Hong, Y.H., Eds.; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2010; pp. 165–187. [Google Scholar]

- Cordella, A.; Paletti, A. Government as a Platform, Orchestration, and Public Value Creation: The Italian Case. Gov. Inf. Q. 2019, 36, 101409. [Google Scholar] [CrossRef]

- Squires, G. The Use of Housing Charges to Fund and Finance Bulk Infrastructure: Is this What Innovation Looks Like? The Property Foundation: Palmeson North, New Zealand, 2020. [Google Scholar]

- Pruetz, R. Transferable Development Credits Puts Growth in its Place. In Instruments of Planning: Tensions and Challenges for More Equitable and Sustainable Cities; Leshinsky, R., Legacy, C., Eds.; Routledge: New York, NY, USA, 2016; pp. 142–154. [Google Scholar]

- Hengstermann, A.; Hartmann, T. Land. In Instruments of Land Policy: Dealing with Scarcity of Land; Gerber, J.D., Hartmann, T., Hengstermann, A., Eds.; Routledge: Abingdon, UK, 2018; pp. 27–32. [Google Scholar]

- Schwartz, B.K. Development Agreements: Contracting for Vested Rights. Boston Coll. Env. Aff. L. Rev. 2001, 28, 719–755. [Google Scholar]

- Friendly, A. Land Value Capture and Social Benefits: Toronto and São Paulo Compared. Papers on Municipal Finance and Governance; Institute on Municipal Finance & Governance, University of Toronto: Toronto, ON, Canada, 2017. [Google Scholar]

- Askew, J. A British Perspective on Added Value Capture: Ups and Downs During its History. In Instruments of Land Policy: Dealing with Scarcity of Land; Gerber, J.D., Hartmann, T., Hengstermann, A., Eds.; Routledge: Abingdon, UK, 2018; pp. 74–77. [Google Scholar]

- Peterson, G.E. Unlocking Land Values to Finance Urban Infrastructure; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Evans-Cowley, J. Development Exactions: Process and Planning Issues; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2006. [Google Scholar]

- Germán, L.; Bernstein, A.E. Land Value Capture: Tools to Finance our Urban Future. In Land Lines Policy Brief; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2018; pp. 1–4. [Google Scholar]

- Frieden, B.J.; Sagalyn, L.B. Downtown, Inc.: How America Rebuilds Cities; The MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Hong, Y.-H. Assembling Land for Urban Development: Issues and Opportunities. In Analyzing Land Readjustment: Economics, Law, and Collective Action; Hong, Y.H., Needham, B., Eds.; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2007; pp. 3–36. [Google Scholar]

- Byahut, S.; Mittal, J. Using Land Readjustment in Rebuilding the Earthquake-Damaged City of Bhuj, India. J. Urban Plan. Dev. 2017, 143, 1–11. [Google Scholar] [CrossRef]

- Ruston, D. Let’s Make a Deal: Negotiating Developer Contributions through Voluntary Planning Agreements in New South Wales; University of NSW: Sydney, Australia, 2009. [Google Scholar]

- Austin, P.M.; Gurran, N.; Whitehead, C.M.E. Planning and Affordable Housing in Australia, New Zealand and England: Common Culture; Different Mechanisms. J. Hous. Built Environ. 2014, 29, 455–472. [Google Scholar] [CrossRef]

- Bunnell, G. Planning Gain in Theory and Practice: Negotiation of Agreements in Cambridgeshire. Prog. Plan. 1995, 44, 1–113. [Google Scholar] [CrossRef]

- Crook, A.D.H.; Whitehead, C. Capturing Development Value, Principles and Practice: Why is it So Difficult? Town Plan. Rev. 2019, 90, 359–381. [Google Scholar] [CrossRef]

- Kayden, J.S. Zoning for Dollars: New Rules for an Old Game? Comments on the Municipal Art Society and Nollan Cases. In City Deal Making; Lassar, T.J., Ed.; The Urban Land Institute: Washington, DC, USA, 1990; pp. 97–138. [Google Scholar]

- Smolka, M.O.; Amborski, D. Value Capture for Urban Development: An Inter-American Comparison; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2000. [Google Scholar]

- Altshuler, A.A.; Gomez-Ilbanez, J. Regulation for Revenue: The Political Economy of Land Use Exactions; The Brookings Institution: Washington, DC, USA, 1993. [Google Scholar]

- Mittal, J.; Forson, L.; Byahut, S. Creating Higher-Density Property Development Opportunities in Fringe Areas of Surat, India. In Real Estate in South Asia; Das, P., Aroul, R., Freybote, J., Eds.; Routledge: Abingdon, UK, 2019; pp. 165–190. [Google Scholar]

- van der Veen, M.; Spaans, M.; Janssen-Jansen, L. Using Compensation Instruments as a Vehicle to Improve Spatial Planning: Challenges and Opportunities. Land Use Policy 2010, 27, 1010–1017. [Google Scholar] [CrossRef]

- Putters, B. U.S.: Some Best Practices of Transferable Development Rights. In New Instruments in Spatial Planning: An International Perspective on Non-Financial Compensation; Janssen-Jansen, L., Spaans, M., van der Veen, M., Eds.; IOS Press: Amsterdam, The Netherlands, 2008; pp. 141–171. [Google Scholar]

- Chorus, P. Japan: Using Developing Rights as Driver for Development. In New Instruments in Spatial Planning: An International Perspective on Non-Financial Compensation; Janssen-Jansen, L., Spaans, M., van der Veen, M., Eds.; IOS Press: Amsterdam, The Netherlands, 2008; pp. 41–72. [Google Scholar]

- Suzuki, H.; Murakami, J.; Hong, Y.-H.; Tamayose, B. Financing Transit-Oriented Development with Land Values: Adapting Land Value Capture in Developing Countries; The World Bank: Washington, DC, USA, 2015. [Google Scholar]

- van der Veen, M.; Spaans, M.; Putters, B.; Janssen-Jansen, L. Comparing the Cases and Planning for the Future of Non-Financial Compensation. In New Instruments in Spatial Planning: An International Perspective on Non-Financial Compensation; Janssen-Jansen, L., Spaans, M., van der Veen, M., Eds.; IOS Press: Amsterdam, The Netherlands, 2008; pp. 229–256. [Google Scholar]

- Wise, D. Public Transportation: Federal Role in Value Capture Strategies for Transit is Limited, but Additional Guidance Could Help Clarify Policies; United States Government Accountability Office: Washington, DC, USA, 2010. [Google Scholar]

- Ayerdo-Kaplan, M. Transbay Transit Center: Key Investment in San Francisco’s Future as a World Class City; Transbay Center: San Francisco, CA, USA, 2013. [Google Scholar]

- City of San Francisco. Development Plan for the Transbay Redevelopment Project Area; Board of Supervisors: San Francisco, CA, USA, 2016. [Google Scholar]

- Cho, C.-J. Korea: The Case of Non-Financial Compensation in the District Unit Planning Process in Seoul. In New Instruments in Spatial Planning: An International Perspective on Non-Financial Compensation; Janssen-Jansen, L., Spaans, M., van der Veen, M., Eds.; IOS Press: Amsterdam, The Netherlands, 2008; pp. 73–94. [Google Scholar]

- Nguyen, T.B.; van der Krabben, E.; Spencer, J. Collaborative Development: Capturing the Public Value in Private Real Estate Development Projects in Ho Chi Minh City, Vietnam. Cities 2017, 68, 104–118. [Google Scholar] [CrossRef] [Green Version]

- Pacione, M. Urban Geography: A Global Perspective, 3rd ed.; Routledge: Abingdon, UK, 2009. [Google Scholar]

- Hendricks, A. Urban Contracts: A Method to Refinance the Costs of the Urban Development. In Proceedings of the FIG Working Week, Marrakesch, Morocco, 18–22 May 2011; Available online: https://www.fig.net/resources/proceedings/fig_proceedings/fig2011/papers/ts03d/ts03d_hendricks_5209.pdf (accessed on 4 December 2020).

- LHM (Landeshauptstadt München). Verfahrensgrundsätze zur Sozialgerechten Bodennutzung in der Neufassung vom 26.07.2017; Law of 2017. Available online: https://www.muenchen.de/rathaus/Stadtverwaltung/Referat-fuer-Stadtplanung-und-Bauordnung/Stadt-und-Bebauungsplanung/SoBoN.html (accessed on 4 December 2020).

- McAllister, P.; Shepherd, E.; Wyatt, P. Policy Shifts, Developer Contributions and Land Value Capture in London 2005–2017. Land Use Policy 2018, 78, 316–326. [Google Scholar] [CrossRef]

- Ministry of Housing, Communities and Local Government. The Incidence, Value and Delivery of Planning Obligations and Community Infrastructure Levy in England in 2016–2017; Ministry of Housing, Communities and Local Government: London, UK, 2018. [Google Scholar]

- Ministry of Housing, Communities & Local Government. National Planning Policy Framework; Ministry of Housing, Communities and Local Government: London, UK, 2019. [Google Scholar]

- Ijeh, I. The Plimsoll Building: Close Encounters. Building, 2 September 2015. Available online: https://www.building.co.uk/buildings/the-plimsoll-building-close-encounters/5077356.article (accessed on 16 February 2021).

- Siemon, C.L. Public/Private Partnership and Fundamental Fairness. In City Deal Making; Lassar, T.J., Ed.; The Urban Land Institute: Washington, DC, USA, 1990; pp. 81–96. [Google Scholar]

- UN Habitat III. Quito Declaration on Sustainable Cities and Human Settlements for All. New Urban Agenda; UN-Habitat: Quito, Ecuador, 2016. [Google Scholar]

- OECD. Land-Use Planning Systems in the OECD. Country Fact Sheets; OECD Publishing: Paris, France, 2017. [Google Scholar]

- Santos, V.; Alorro, R.; Goliath, G. Land-Based Financing Tools to Support Urban Development in South Africa. Cities Support Programme; National Treasury: Pretoria, South Africa, 2017. [Google Scholar]

- McAllister, P. The Calculative turn in Land Value Capture: Lessons from the English Planning System. Land Use Policy 2017, 63, 122–129. [Google Scholar] [CrossRef]

- Muñoz-Gielen, D.; van der Krabben, E. Introduction. In Public Infrastructure, Private Finance: Developer Obligations and Responsibilities; Muñoz-Gielen, D., van der Krabben, E., Eds.; Routledge: Abingdon, UK, 2019; pp. 1–23. [Google Scholar]

| Pathway and Its Outcome According to the Infographic Abstract | Consent-Based? | What Can Be Taken from the Property Owner? | Suitability for Vertical Allocations | Amount That Can Be Taken from the Owner | How Does the City Determine the Amount of Floor Space to Be Allocated? | Does the Developer Enjoy Density Bonuses? | Who Builds the Public Facilities After Land or Floor Space Is Allocated? | Who Finances the Construction of the Public Floor(s) or the Public Building? | Focus/Scope | Is There a Precondition That the City Owns Part of the Expropriated or Readjusted Parcel(s)? |

|---|---|---|---|---|---|---|---|---|---|---|

| Compulsory Expropriation Outcome: Option A. | No | Mostly land Floor space is rarely expropriated | In theory a city can expropriate a certain floor instead of land surface. The law, however, focuses on taking part of a given plot | Usually up to 40% of land surface can be taken without compensation. Above this threshold, the city would have to pay compensation | This mechanism is rarely used to allocate vertical floor space for public facilities. | No | The city | The city | 1 parcel However, a few parcels can also be expropriated. | No |

| Land Readjustment Outcome: Options B or C | Yes | Land or floor space | Yes The law, however, does not deal directly with vertical allocations | 40% of land surface without in-cash compensation If, instead of land, the city decides to take floor space- The Law does not prescribe how much floor space can be dedicated for public use. | Formula adopted by the city or through professional estimates. | Yes Otherwise city has to pay in-cash compensation. | Developer | Undetermined by law. Each local plan can create its own rule on the matter. | Several parcels | No |

| Compulsory Land Readjustment Outcome: Options B or C | No | Land or floor space | Yes The law, however, does not deal directly with vertical allocations | 40% of land surface without in-cash compensation If, instead of land, the city decides to take floor space, the law does not prescribe how much floor space can be dedicated for public use | Formula adopted by the city or through professional estimates | Yes Otherwise city has to pay in-cash compensation | Developer | Undetermined by law. Each local plan can create its own rule on the matter. | Several parcels | No |

| Negotiated Agreement Outcome: Options B or C | Yes | Land or floor space | Yes | Based on mutual agreement | Bargaining | As agreed between the parties | As agreed between the parties | As agreed between the parties | Several parcels or one parcel | No |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mualam, N.; Hendricks, A.; Maliene, V.; Salinger, E. Value Capture and Vertical Allocations of Public Amenities. Sustainability 2021, 13, 3952. https://0-doi-org.brum.beds.ac.uk/10.3390/su13073952

Mualam N, Hendricks A, Maliene V, Salinger E. Value Capture and Vertical Allocations of Public Amenities. Sustainability. 2021; 13(7):3952. https://0-doi-org.brum.beds.ac.uk/10.3390/su13073952

Chicago/Turabian StyleMualam, Nir, Andreas Hendricks, Vida Maliene, and Eyal Salinger. 2021. "Value Capture and Vertical Allocations of Public Amenities" Sustainability 13, no. 7: 3952. https://0-doi-org.brum.beds.ac.uk/10.3390/su13073952