1. Introduction

As concerns about global warming arise, many countries around the world are setting regulations and policies to mitigate climate change. In the transportation sector, governments are introducing market-pull and technology-push policies to have car manufacturers develop eco-friendlier vehicles as one of the eco-innovation initiatives. The objectives of promoting eco-friendly vehicles are to reduce oil consumption and air pollution, and stake out an industrial leadership position in advanced technologies [

1,

2].

Car manufacturers pursue eco-innovation to comply with regulations set by governments as technology-push policies. Car manufacturers develop fuel-efficient technologies for internal combustion engine vehicles (ICEVs) as incremental innovation solutions for the short- and mid-term. On the other hand, they also develop alternative fuel vehicles (AFV) including hybrid electric vehicles (HEV), plug-in electric vehicles (PHEV), electric vehicles (EV) and fuel cell electric vehicles (FCEV). They invest a huge amount of funds in research and development in order to benefit from the effect of mitigating the stringency in terms of corporate average fuel economy by selling those products in the market. Nevertheless, there is an issue that the electrification through the diffusion of EVs collaborating with the generation of cleaner electricity is regarded as a promising pathway to mitigate air pollution from on-road vehicles and energy dependency [

3].

In the early 1990s, there was an attempt to penetrate the mainstream automotive market with EVs. The American state of California led a technology-push regulation to introduce zero emissions vehicles (ZEVs) in the US during that period [

4]. The California Air Resources Board (CARB) was eager to set strict regulations to make the air clean in its area provoked by vehicles’ tailpipe emissions. Coincidentally, General Motors introduced an EV concept car in the LA Auto Show (later marketed as the EV1), and it might have signaled to the CARB that EVs were ready for serial production. CARB adopted the signal into its standard and intended to initiate further R&D and sales of EVs [

4]. In contrast, the European Union made it difficult to adopt a similar regulation to CARB’s ZEV mandate because there was an obvious consensus among policymakers that using incentives was more effective way of promoting eco-friendly cars than using disincentives, meanwhile national or local governments could impose a ZEV mandate [

5]. After solar vehicles and lightweight EVs were displayed to the public in Europe, these eco-friendly vehicles motivated policy makers to promote mass production and commercialization [

6]. This led to the support of R&D programs in Europe [

4]. In the end of the attempts by the biggest automotive markets (US and EU), EVs could not penetrate ICEVs market because of its inferior functionalities compared to ICEVs and market demand uncertainty as a disruptive innovation in spite of eco-friendliness.

Disruptive technologies such as EVs face barriers in the market because they frequently compare inferiorly to existing dominant designs like ICEVs in terms of price and product functionalities [

7]. For that reason, the early adopters of a disruptive innovation often pay a premium or comply with poor product function in order to enjoy the state-of-the-art technology [

8]. Majority of the total population known as early or late majority adopters are far more risk-averse, and are not willing to buy an innovative product so different from the dominant design [

8]. It is vital for disruptive technology products to attract enough innovators or early adopters to secure a viable market niche [

9]. Eventually, car manufactures failed to achieve great success with EVs—an eco-innovation with inferior functionalities to ICEVs—in main automotive markets in the 1990s.

However, there was new momentum for transition toward electrification developed from the second half of 2000s in the transportation sector. Firstly, government regulation on the automotive industry had grown from urban air quality to concerns over climate change, which is important for sustainability and now encompasses a broader sustainability topic with attention given from production process to disposal [

10]. These movements influenced policy makers to enact regulations and market instruments framework to secure substantial performance in environmental protection [

11]. The Electric Vehicles Initiative (EVI) is a multi-government policy forum founded in 2009 under the Clean Energy Ministerial (CEM) which is dedicated to accelerating EVs adoption among consumers worldwide with an ambitious goal of accumulated 20 million EVs sales by 2020 [

12].

Secondly, governments invest more in R&D and the provision of electric vehicle supply equipment (EVSE) than in the 1990s. In the period 2010–2011 compared to in the 1990s, thousands of projects with a far larger budget were implemented. These are significant numbers compared to the number of projects on-going in the 1990s [

4]. In regard with the latter, large number of organizations including Swiss Energie, Oregon’s Portland General Electric, San Diego’s Gas and Electric Tokyo Electric Power Company are making efforts in various ways to invest in recharging infrastructure and their involvement led to gain momentum in 2010s [

13].

Lastly, battery performance has improved. Major barriers for consumers’ EV adoption like expensive price of EVs and driving range anxiety are related to EV batteries directly. Once EVs production becomes large-scale, the cost differences between EVs and ICEVs may decline to below 10% of the total vehicle cost [

12], making them increasingly competitive. Some researchers even suggest that EV costs may reach the level of competing ICEV within a decade [

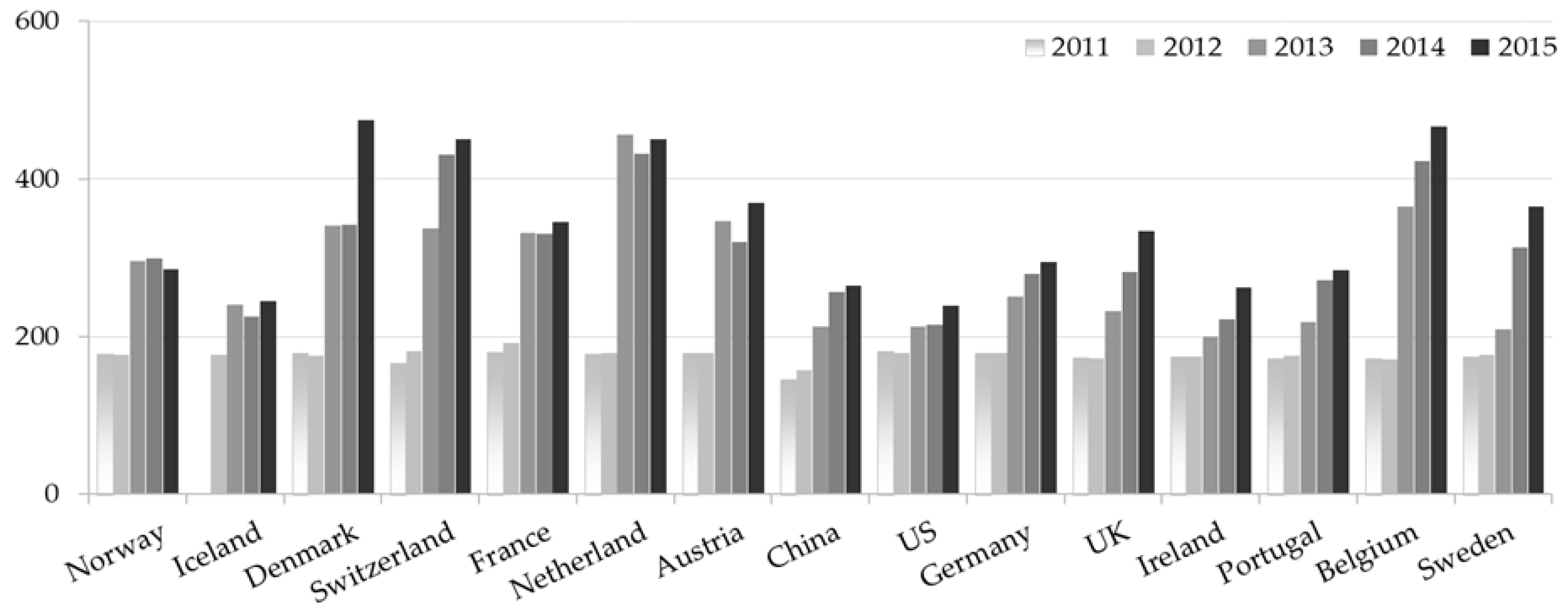

12]. Recent developments provide encouraging signs based on the financial and technological support from governments, as well as huge investment from car manufacturers and suppliers. With regard to products’ attractiveness, increasing numbers of car manufacturers have displayed various types of EV models in auto shows and have launched EVs equipped with improved battery performance. Nissan was more aggressive with its EV Leaf in making efforts to better commercialize from 2005. By 2012, consumers are able to choose between the four EV models of Renault, and the Leaf of Nissan. Especially, the Renault–Nissan alliance cooperated with Better Place and introduced new business models including the concept of swapping batteries to mitigate EV driver’s driving range anxiety even though the service is no longer available. In addition to this, Tesla Inc. (Palo Alto, California, USA) is taking a huge part of EV market share with Model S and X, featuring a longer driving range than any other EVs as a new entrant in automotive industry. Battery performance for vehicles was stimulated by EV development competition and the mass commercialization of EVs from the middle of 2000s.

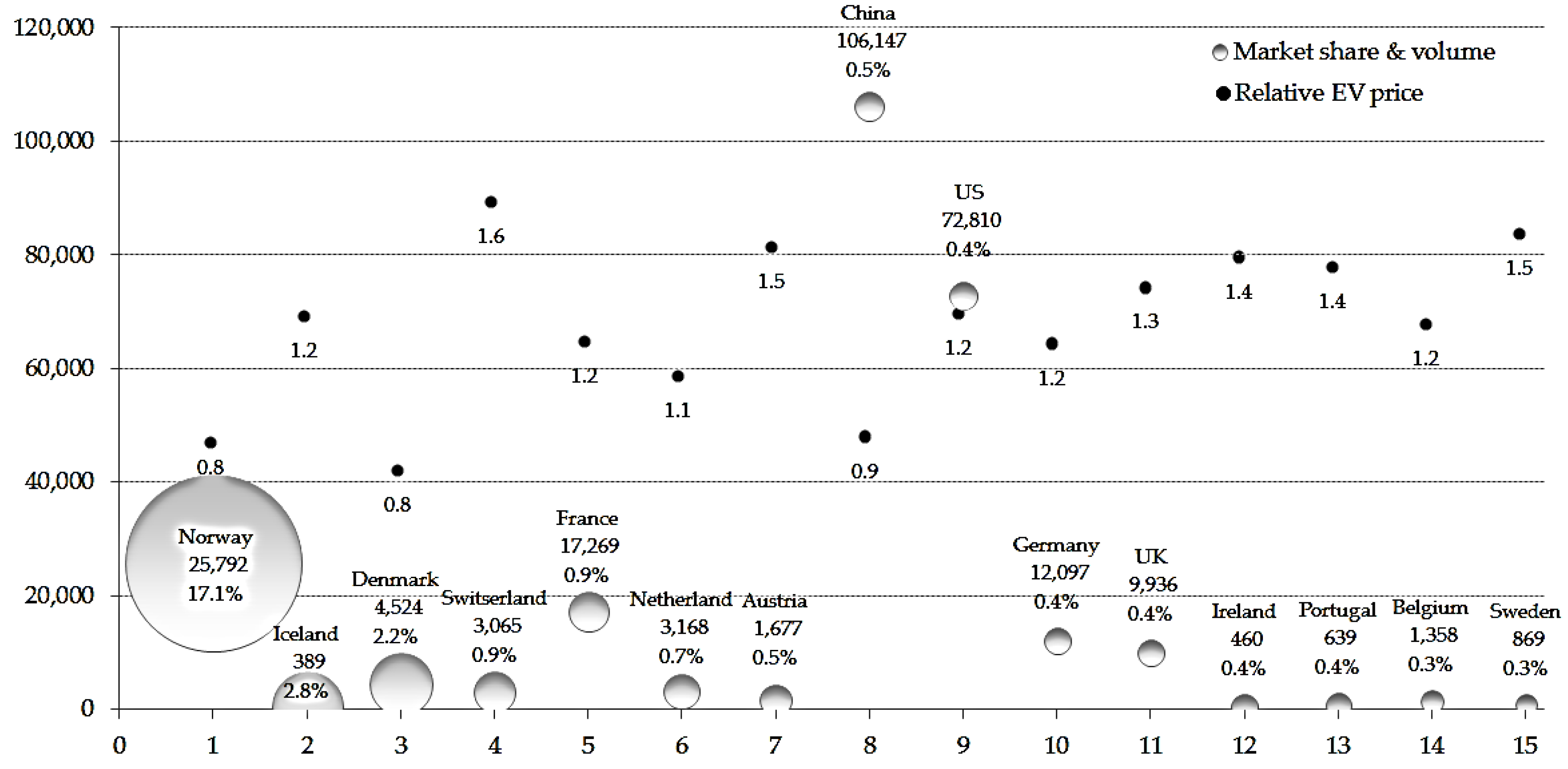

With these favorable factors influencing EV penetration, EVs account for just a small fraction of the vehicle stocks (only 0.1% of cars running on the road) for all transport modes worldwide [

12]. Governments face the issue of how they can efficiently allocate resources to make EVs penetrate the ICEVs market for the purpose of air quality improvement. EV penetration is regarded as being very limited without stimulation from influential factors like emissions regulations, financial incentives, and rising oil prices [

14,

15].

To date, however, little attention has been given to empirical research determining the influential factors on consumers’ EV adoption because of insufficient sales data in the market. Especially, the effect of battery performance on EV sales remains largely unstudied with real market data, even though an empirical study found that financial incentives, EVSEs, and the local presence of production sites were positively correlated with EV penetration [

16].

This paper aims to contribute to the literature by examining to what extent battery performance accounts for consumers’ EV adoption compared to incentives, infrastructure and available models in the market.

4. Conclusions

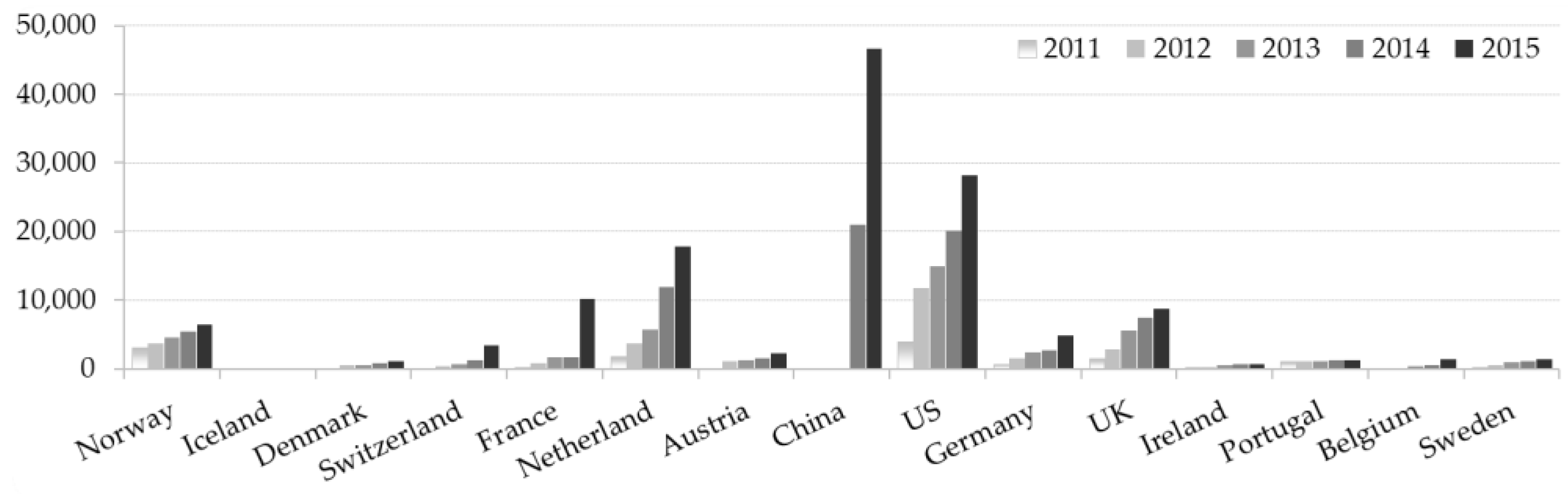

This study began with the question of how the technical performance of EVs—an important factor of eco-innovation product penetration in the market—has a significant impact on demand. Electric vehicle adoption began to expand in Norway, the Netherlands, and France from 2013 onwards since going on sale in earnest from 2010. Therefore, this study was conducted through panel data analysis on the factors affecting EV sales using time series data from 2011 to 2015.

This study is distinct from other studies in three dimensions. The first is that this is an empirical analysis using time series data from 2011 to 2015 when EVs started to have meaningful sales in markets. The second is that more accurate data analysis is performed by eliminating heterogeneity by country through panel data analysis. Lastly, driving range which was omitted in the previous empirical study is reflected as an independent variable.

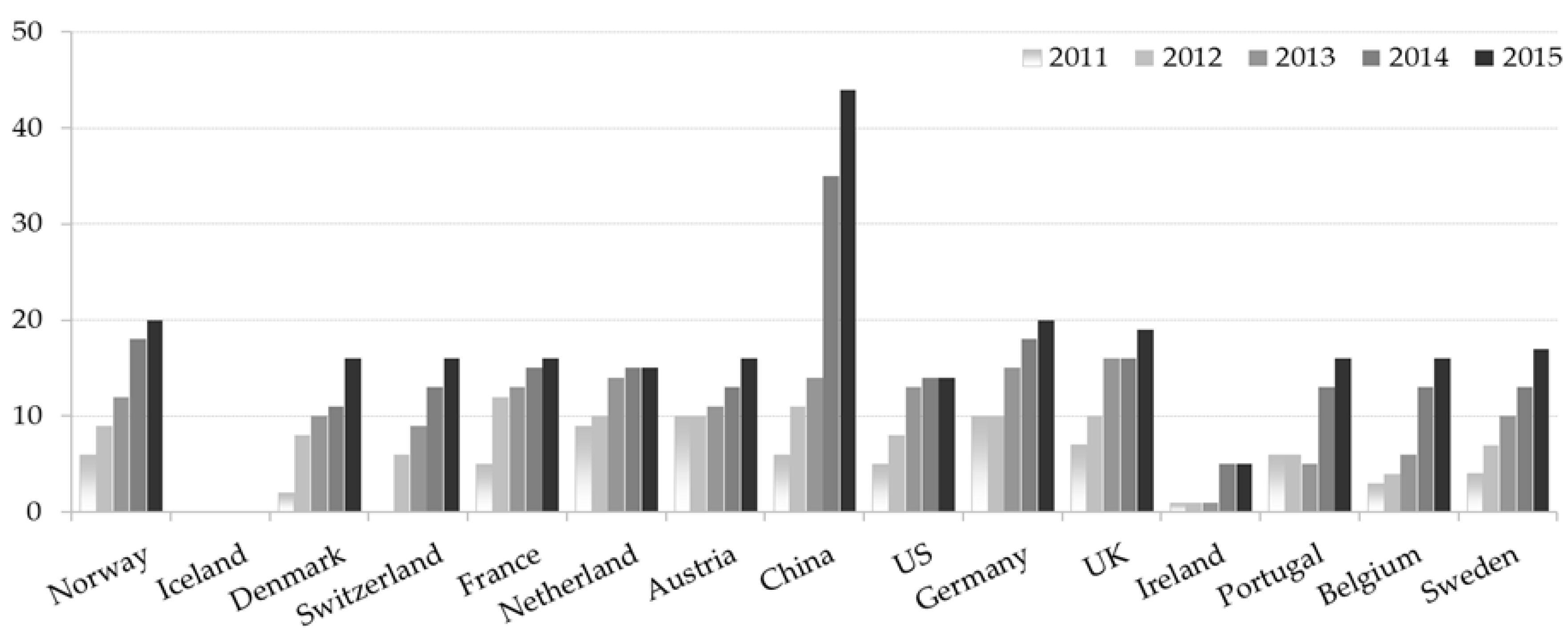

Eco-innovation products based on clean technology require government intervention until they reach a growth phase in their product life cycle. Government incentive programs encourage the participation of product or service providers and induce competition, which helps to bring more competitive products to market. From this point of view, we can once again confirm that the incentives and the diversity of models in this study affect the demand increase of EVs positively. Meanwhile, EVSE—another resource demander for governments—turned out to not be very influential. There was a weak negative correlation in the Fast EVSE at a statistically significant level, and there was no correlation with Slow EVSE. This is interesting because it is a result contradictory to the fact that EVSE is considered an important factor for EV adoption in many existing studies. Range anxiety may be a determinant of a consumer’s decision to purchase an EV, but it does not appear to be an important parameter in the early EV market. We suggest two possible reasons that the demand for long distance driving is small in the early EV market and consumers are heavily dependent on recharging at home. In this study, we did not consider various types of EVSE standards and geographical EVSE installation heterogeneity, which might be important factors for EV recharging. In addition to this, there may be a time lag effect that remains largely unstudied. For this reason, it is difficult to conclude that EV market share and the amount of EVSEs in a country are not important factors.

When it comes to driving range, many researchers conducted survey-based studies and pointed at driving range as one of the largest obstacles to EV adoption [

57]. In this study, it was identified that EV market share increased as driving range extended based on empirical data analysis. However it is found that there is a “functional threshold” for disruptive technology that satisfies customers’ minimum functional requirement [

58]. Daily driving range can be regarded as reference data for the functional threshold of EV with respect to driving range [

45]. According to data used in this study, the driving range on a single charge of EVs sold worldwide in 2015 was 310 km, and it is possible for marketers to target the mainstream segment because the driving range is far longer than the average daily driving range, 100 miles, in the US [

45]. A compromise between increasing cost and extending driving range of EVs is decisive in which EV market grow further because there is decreasing marginal utility to increases in driving range [

53]. Taking this perspective into account in future research would be meaningful for EV marketers.

Increasing battery efficiency and economies of scale become more significant in determining EV price as more and more car manufacturers make EVs. Governments need to efficiently allocate resources such as R&D support, incentive payments, and infrastructure investment to promote EVs further. R&D support is often adapted in a country when the national economy is highly dependent on the automobile industry (e.g., Germany) [

53]. We propose future research focusing on the question of which part will become more efficient investment by exploring the relationship between R&D support for battery technology developments and investment in EVSE footprint expansion. This study supports the result that investment in EVSE is a less cost-effective approach than investment in increasing EV battery range [

47] and we propose that policy makers reconsider the importance of R&D in terms of efficient resources allocation when establishing countermeasures to promote and sell EVs. Of course, it is pointed out that R&D support is a factor for reducing private sector R&D investment. Nevertheless, it is clear that the government’s willingness to support R&D leads to the development of related technologies by promoting the investment of other firms and institutions. Especially, it is more important to consider of the ripple effects on the national economic development in countries with high reliance on the automobile industry.

How long financial incentives to promote EVs might be prolonged? How might the incentives be incrementally reduced over time? Research answering those questions would be highly recommended in the future, because governments will face budget limitations as the EV market grows. When the battery technology level reaches a certain level, it is necessary to consider whether to reduce financial incentives.