On the Possibilities of Critical Raw Materials Production from the EU’s Primary Sources

Abstract

:1. Introduction

2. Materials and Methods

- The first step focused on CRMs’ domestic and external sourcing, production and/or processing in the EU to manufacture a wide range of value-added products of key importance for the EU’s economic growth, as well as on their key applications, especially with regard to new technologies (Table 1);

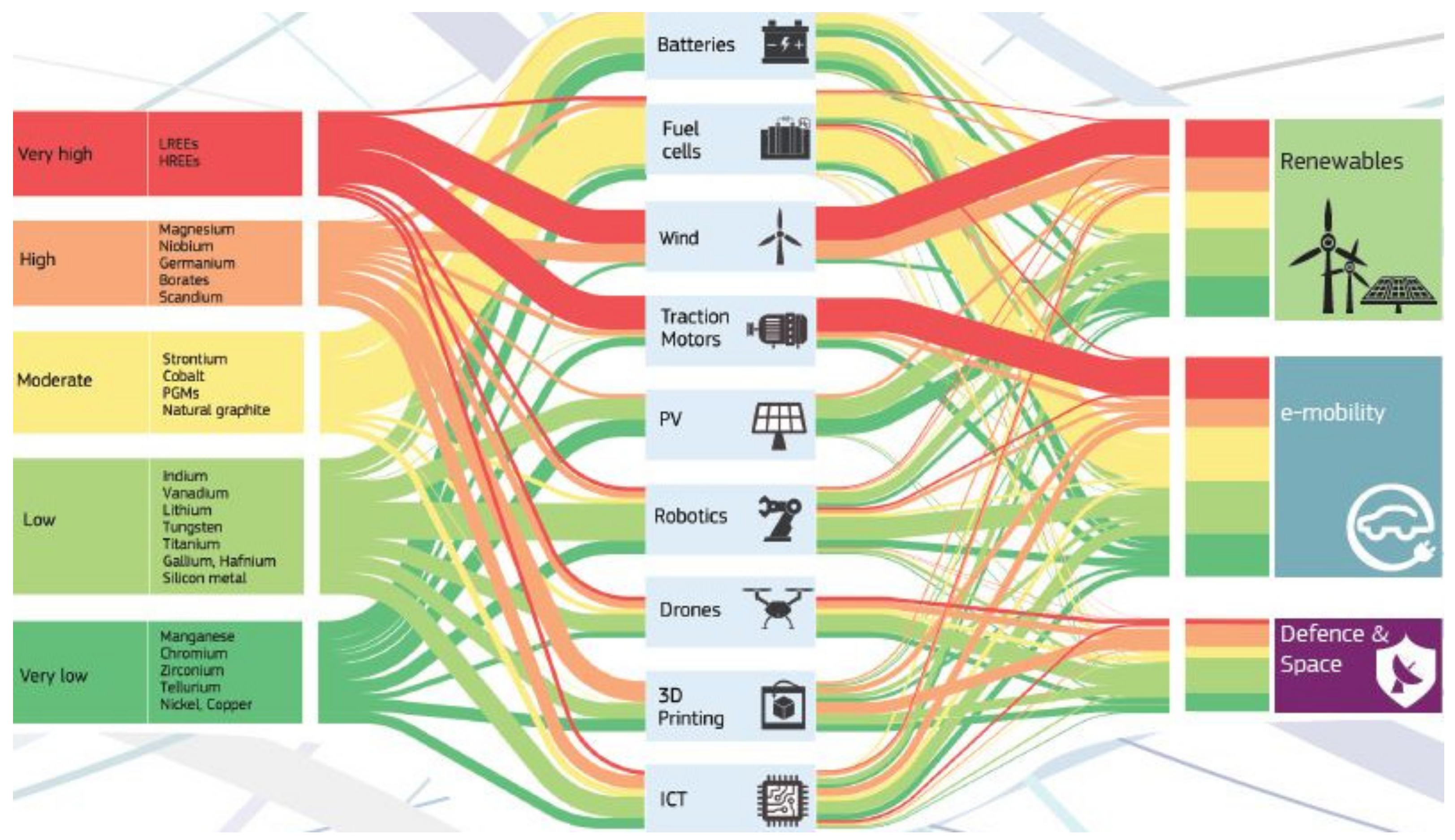

- The second step was related to the importance of CRMs for strategic technologies and sectors development, i.e., renewable energy, e-mobility, defense, and aerospace, that have been identified by the European Commission [51]; raw materials recognized as important for at least two strategic industry sectors were selected for further analysis in the third step (Table 2);

- In the third step the potential availability of the primary sources of the selected critical raw materials in the EU, including deposits with identified resources and/or reserves, as well as occurrences or showings, was examined and assessed on the basis of existing data collected from past EU-financed projects [53,54,59,60], as well as on the European Commission reports [40,41,42,43,46,47] (Table 3).

3. Results

3.1. Mineral Raw Materials of High Economic Importance for the EU, Their Sources, Criticality and Applications

3.2. Assessment of Importance of CRMs for Strategic Technologies and Sectors Development

- Li-ion batteries (LiBs), which are emerging as an important technology across a wide range of civil and defense applications. As a result of the increasing spreading of electric vehicles, mobile electrical appliances, and stationary energy storage systems, the demand for LiBs is expected to skyrocket (>30% per year) for the next 10 years [4,51,68,69]. The basic CRMs required in this technology are cobalt, graphite (natural), lithium, niobium, silicon, and titanium.

- Fuel cells (FCs)—the deployment of FCs has grown during the last 10 years, but it is still uncertain when they will be widely commercialized. The main barriers to their widespread use are reliability (availability and lifetime), efficiency, and cost [51]. The CRMs essential for the production of fuel cells are cobalt, graphite (natural), palladium, platinum, titanium, strontium.

- Wind turbine generators are among the most cost-effective technologies in the clean energy generation in the EU [49]. The most relevant CRMs required include boron metal and borates, dysprosium, niobium, neodymium, and praseodymium. The main critical material containing components in wind turbines are the permanent magnets.

- Electric traction motors (permanent magnets) are also used in numerous applications for small electronic products, e-bikes, electric cars, and heavy transportation. In the future, NdFeB magnet technology is expected to dominate the market; by 2025, between 90% and 100% of hybrids and EVs could be driven by NdFeB-containing motors [49,51]. Critical raw materials utilized in traction motors are boron, dysprosium, neodymium, and praseodymium.

- Robotics is an emerging technology with enormous potential for many applications. Out of the 44 raw materials used in robotics, 19 materials are identified as critical for the EU [51]. The most important are boron, beryllium, dysprosium, gallium, indium, niobium, neodymium, praseodymium, and titanium.

- Drones are used for various civil and military applications. Of the 48 raw materials, 15 materials, namely borates, bismuth, beryllium, cobalt, gallium, graphite (natural), hafnium, indium, lithium, magnesium, niobium, PGMs, REEs, antimony, silicon metal, tantalum, titanium, tungsten, and vanadium, are identified as critical to the EU economy [2,51].

- 3D printing (3DP) technology utilization is expected to grow substantially, especially in aerospace, defense, and medical industries. However, key challenges include achieving sufficient quality and lowering the production cost [51]. The main CRMs required are cobalt, hafnium, magnesium, niobium, scandium, silicon metal, titanium, vanadium, and tungsten.

- Digital technologies are strategic technologies that have changed the contemporary style of life and communication, as well as industrial productivity [51]. The essential raw materials in these technologies include boron, cobalt, gallium, germanium, graphite, indium, lithium, magnesium, PGMs, REE, silicon metal, strontium, titanium, and tungsten.

3.3. Possible Sources of Critical Raw Materials in the EU

4. Discussion

- Firstly, are essential for the EU economy and the risk of their supply disruption is high;

- Secondly, are recognized as important for at least two of the EU’s strategic industrial sectors;

- Thirdly, there are some recognized, though often limited, resources in the EU, which are, or can be, utilized for the production of these raw materials. Launching and/or developing their production from primary sources may contribute to mitigating the EU’s import dependency and risk of supply disruption.

5. Conclusions

- Promoting the use of secondary raw materials and improving recycling rates of electronic waste (e.g., to obtain REEs and some other CRMs), coupled with restrictions on exports of electronic scrap to Asia (especially China) or Africa;

- Developing the recovery of accompanying elements contained in the raw materials imported to the EU, e.g., REEs from imported phosphate rock, gallium, germanium, or indium from imported concentrates of polymetallic ores;

- The assessment of waste sources (old slags and dams) for the recovery of CRMs (e.g., REEs from phosphogypsum);

- Considering re-starting some domestic CRMs operations;

- A geological (re)assessment of known deposits and metallogenic provinces within the EU, with feedback from academia, industries, and governmental agencies;

- Promoting exploration surveys in foreign countries with which the EU may establish raw materials partnerships to diversify the sources of its supply;

- Prioritizing the rational and effective use of raw materials (in line with circular economy approach).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bide, T.; Brown, T.J.; Gunn, A.G.; Mankelow, J.M. Utilisation of multiple current and legacy datasets to create a national minerals inventory: A UK case study. Resour. Policy 2020, 66, 101654. [Google Scholar] [CrossRef]

- Blagoeva, D.; Pavel, C.; Wittmer, D.; Huisman, J.; Pasimeni, F. Materials dependencies for dual-use technologies relevant to Europe’s defence sector. Publ. Off. Eur. Union 2020. [Google Scholar] [CrossRef]

- Lebedeva, N.; Di Persion, F.; Boon-Brett, L. Lithium ion battery value chain and related opportunities for Europe. Publ. Off. Eur. Union 2017. [Google Scholar] [CrossRef]

- Jussani, A.C.; Wright, J.T.C.; Ibusuki, U. Battery global value chain and its technological challenges for electric vehicle mobility. Rev. Adm. Inov. 2017, 14, 333–338. [Google Scholar] [CrossRef]

- Roelich, K.; Dawson, D.A.; Purnell, P.; Knoeri, C.; Revel, R.; Busch, J.; Steinberger, J.K. Assessing the dynamic material criticality of infrastructure transitions: A case of low carbon electricity. Appl. Energy 2014, 123, 378–386. [Google Scholar] [CrossRef] [Green Version]

- Gloser, S.; Espinoza, L.T.; Gandenberger, C.; Faulstich, M. Raw material criticality in the context of classical risk asessement. Resour. Policy 2015, 44, 35–46. [Google Scholar] [CrossRef]

- Bartekova, E.; Kemp, R. National strategies for securing a stable supply of rare earths in different world regions. Resour. Policy 2016, 49, 153–164. [Google Scholar] [CrossRef]

- European Commission. The European Green Deal. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions, COM (2019) 640; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Tiess, G. Minerals policy in Europe: Some recent developments. Resour. Policy 2010, 35, 190–198. [Google Scholar] [CrossRef]

- Tiess, G.; Majumder, T.; Cameron, P. (Eds.) Encyclopedia of Mineral and Energy Policy; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Nieć, M.; Galos, K.; Szamałek, K. Main challenges of mineral resources policy of Poland. Resour. Policy 2014, 42, 93–103. [Google Scholar] [CrossRef]

- Endl, A. Addressing “wicked problems” through governance for sustainable development—A comparative analysis of national mineral policy approaches in the European Union. Sustainability 2017, 9, 1830. [Google Scholar] [CrossRef] [Green Version]

- Galos, K.; Tiess, G.; Kot-Niewiadomska, A.; Murguia, D.; Wertichova, B. Mineral Deposits of Public Importance (MDoPI) in relation to the Project of National Mineral Policy of Poland. Gosp. Sur. Min. Min. Resour. Man. 2018, 34, 5–24. [Google Scholar] [CrossRef]

- Smol, M.; Marcinek, P.; Duda, J.; Szołdrowska, D. Importance of Sustainable Mineral Resource Management in Implementing the Circular Economy (CE) Model and the European Green Deal Strategy. Resources 2020, 9, 55. [Google Scholar] [CrossRef]

- Mancini, L.; Legaz, B.V.; Vizzarri, M.; Wittmer, D.; Grassi, G.; Pennington, D. Mapping the role of raw materials in sustainable development goals. A preliminary analysis of links, monitoring indicators and related policy initiatives. Publ. Off. Eur. Union 2019. [Google Scholar] [CrossRef]

- Graedel, T.E.; Barr, R.; Chandler, C.; Chase, T.; Choi, J.; Christoffersen, L.; Friedlander, E.; Henly, C.; Jun, C.; Nassar, N. Methodology of metal criticality determination. Environ. Sci. Technol. 2012, 46, 1063–1070. [Google Scholar] [CrossRef]

- Graedel, T.; Harper, E.M.; Nassar, N.T.; Nuss, P.; Reck, B.K. Criticality of metals and metalloids. Proc. Natl. Acad. Sci. USA 2015, 112, 4257–4262. [Google Scholar] [CrossRef] [Green Version]

- Hounari, Y.; Speirs, J.; Gross, R. Materials availability: Comparison of material criticality studies—Methodologies and Results Working Paper III. UK Energy Res. Cent. 2013, 30. Available online: https://d2e1qxpsswcpgz.cloudfront.net/uploads/2020/03/materials-availability-working-paper-iii.pdf (accessed on 25 March 2021).

- Jin, Y.; Kim, J.; Guillaume, B. Review of critical materials studies. Resour. Conserv. Recycl. 2016, 113, 77–87. [Google Scholar] [CrossRef]

- Erdmann, L.; Graedel, T.E. Criticality of non-fuel minerals: A review of major approaches and analyses. Environ. Sci. Technol. 2011, 45, 7620–7630. [Google Scholar] [CrossRef]

- Bedder, J.C.M. Classifying critical materials: A review of European approaches. Appl. Earth Sci. 2015, 124, 207–212. [Google Scholar] [CrossRef]

- Dewulf, J.; Blengini, G.A.; Pennington, D.; Nuss, P.; Nasaar, N.T. Criticality on the international scene: Quo vadis? Resour. Policy 2016, 50, 169–176. [Google Scholar] [CrossRef] [Green Version]

- Blengini, G.A.; Nuss, P.; Dewulf, J.; Nita, V.; Peiro, L.T.; Vidal-Legaz, B.; Latunussa, C.; Mancini, L.; Blagoeva, D.; Pennington, D.; et al. EU methodology for critical raw materials assessment: Policy needs and proposed solutions for incremental improvements. Resour. Policy 2017, 53, 12–19. [Google Scholar] [CrossRef] [Green Version]

- European Commission. Methodology for Establishing the EU List of Critical Raw Materials; European Commission: Brussels, Belgium, 2017. [Google Scholar] [CrossRef]

- Frenzel, M.; Kullik, J.; Reuter, M.A.; Gutzmer, J. Raw material “criticality”—Sense or nonsense? J. Phys. D Appl. Phys. 2017, 50, 123002. [Google Scholar] [CrossRef]

- Worldwide Governance Indicators (WGI). Available online: http://info.worldbank.org/governance/wgi (accessed on 24 March 2021).

- Schrijvers, D.; Hool, A.; Blengini, G.A.; Chen, W.Q.; Dewulf, J.; Eggert, R.; Ellen, L.; Gauss, R.; Gossin, J.; Habib, K.; et al. A review of methods and data to determine raw material criticality. Resour. Conserv. Recycl. 2020, 155, 104617. [Google Scholar] [CrossRef]

- Galos, K.; Lewicka, E.; Burkowicz, A.; Guzik, K.; Kot-Niewiadomska, A.; Kamyk, J.; Szlugaj, J. Approach to identification and classification of the key, strategic and critical minerals important for the mineral security of Poland. Resour. Policy 2021, 70, 101900. [Google Scholar] [CrossRef]

- National Research Council. Minerals, Critical Minerals, and the U.S. Economy; The National Academies Press: Washington, DC, USA, 2008; 246p. [Google Scholar] [CrossRef]

- Schulz, K.J.; DeYoung, J.H., Jr.; Seal, R.R., II; Bradley, D.C. Critical mineral resources of the United States—Economic, environmental geology and prospects for future supply. USGS Prof. Pap. 2017, 1802, 797. [Google Scholar] [CrossRef]

- McCullough, E.; Nassar, N.T. Assessment of critical minerals—Updated application of early-warning screening methodology. Miner. Econ. 2017, 30, 257–272. [Google Scholar] [CrossRef] [Green Version]

- He, Y. The trade-security nexus and U.S. policy making in critical minerals. Resour. Policy 2018, 59, 238–249. [Google Scholar] [CrossRef]

- Risk List 2015. An Update to the Supply Risk Index for Elements and Element Groups That Are of Economic Value. British Geological Survey. Available online: http://www.bgs.ac.uk/mineralsuk/statistics/risklist.html (accessed on 22 March 2021).

- Brown, T. Measurement of mineral supply diversity and its importance in assessing risk and criticality. Resour. Policy 2018, 58, 202–218. [Google Scholar] [CrossRef]

- Hatayama, H.; Tahara, K. Criticality assessment of metals for Japan’s resources strategy. Mater. Trans. 2015, 56, 229–235. [Google Scholar] [CrossRef] [Green Version]

- Gloser-Chahoud, S.; Espinoza, L.T.; Walz, R.; Faulstich, M. Taking the step towards more dynamic view on raw material criticality: An indicator based analysis for Germany and Japan. Resources 2016, 5, 45. [Google Scholar] [CrossRef] [Green Version]

- Habib, K.; Wenzel, H. Reviewing resource criticality assessment from a dynamic and technology specific perspective—Using the case of direct-drive wind turbines. J. Clean. Prod. 2016, 112, 3852–3863. [Google Scholar] [CrossRef]

- Knoeri, C.; Wager, P.A.; Stamp, A.; Althaus, H.J.; Weil, M. Towards a dynamic assessment of raw materials criticality: Linking agent-based demand—with material flow supply modelling approaches. Sci. Total Environ. 2013, 461–462, 808–812. [Google Scholar] [CrossRef] [PubMed]

- European Commission. The Raw Materials Initiative: Meeting our Critical Needs for Growth and Jobs in Europe. Communication from the Commission to the European Parliament and the Council, COM(2008) 699 Final; European Commission: Brussels, Belgium, 2008. [Google Scholar]

- European Commission. Critical Raw Materials for the EU. Report of the Ad-hoc Working Group on Defining Critical Raw Materials; European Commission: Brussels, Belgium, 2010. [Google Scholar] [CrossRef]

- European Commission. Tackling the Challenges in Commodity Markets and on Raw Materials. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM(2011) 25 Final; European Commission: Brussels, Belgium, 2011. [Google Scholar]

- European Commission. On the Review of the List of Critical Raw Materials for the EU and the Implementation of the Raw Materials Initiative. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM(2014) 297 Final; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- European Commission. On the 2017 List of Critical Raw Materials for the EU. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM(2017) 490 Final; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- European Commission. Critical Raw Materials Resilience: Charting a Path towards Greater Security and Sustainability. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM(2020) 474 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Study on the EU’s List of Critical Raw Materials—Final Report; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Study on the Review of the List of Critical Raw Materials—Criticality Assessment. Critical Raw Materials Factsheets; Deloitte Sustainability: New York, NY, USA; British Geological Survey: Nottingham, UK; Bureau de Recherches Géologiques et Minières: Orléans, France; Netherlands Organisation for Applied Scientific Research: Hague, The Netherlands, 2017. [Google Scholar] [CrossRef]

- Mancheri, N.A.; Sprecher, B.; Bailey, G.; Ge, J.; Tukker, A. Effect of Chinese policies on rare earth supply chain resilience. Resour. Conserv. Recycl. 2019, 142, 101–112. [Google Scholar] [CrossRef]

- Rabe, W.; Kostka, G.; Smith Stegen, K. China’s supply of critical raw materials: Risks for Europe’s solar and wind industries? Energy Policy 2017, 101, 692–699. [Google Scholar] [CrossRef]

- Leader, A.; Gaustad, G. Critical material applications and intensities in clean energy technologies. Clean Technol. 2019, 1, 164–184. [Google Scholar] [CrossRef] [Green Version]

- Grandell, L.; Lehtilä, A.; Kivinen, M.; Koljonen, T.; Kihlman, S.; Lauri, L. Role of critical metals in the future markets of clean energy technologies. Renew. Energy 2016, 95, 53–62. [Google Scholar] [CrossRef]

- European Commission. Critical Materials for Strategic Technologies and Sectors in the EU—A Foresight Study; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Ziemann, S.; Grunwald, A.; Schebek, L.; Müller, D.B.; Weil, M. The future of mobility and its critical raw materials. Rev. Métall. 2013, 110, 47–54. [Google Scholar] [CrossRef]

- Lauri, L.S.; Eilu, P.; Brown, T.; Gunn, G.; Kalvig, P.; Sievers, H. Identification and Quantification of Primary CRM Resources in Europe. 2018. Available online: http://scrreen.eu/wp-content/uploads/2018/03/SCRREEN-D3.1-Identification-and-quantification-of-primary-CRM-resources-in-Europe.pdf (accessed on 22 March 2021).

- Cassard, D.; Bertrand, G.; Billa, M.; Serrano, J.-J.; Tourlière, B.; Angel, J.-M.; Gaál, G. ProMine Mineral Databases: New tools to assess primary and secondary mineral resources in Europe. In 3D, 4D and Predictive Modelling of Major Mineral Belts in Europe. Mineral Resource Reviews; Weihed, P., Ed.; Springer: Cham, Switzerland, 2015; pp. 9–58. [Google Scholar] [CrossRef]

- Bertrand, G.; Cassard, D.; Arvanitidis, N.; Stanley, G.; EuroGeoSurvey Mineral Resources Expert Group. Map of Critical raw material deposits of Europe. Energy Procedia 2016, 97, 44–50. [Google Scholar] [CrossRef] [Green Version]

- Patino Douce, A.E. Metallic mineral resources in the twenty-first century. I. Historical extraction trends and expected demand. Nat. Resour. Res. 2015, 25, 71–90. [Google Scholar] [CrossRef]

- Wittmer, D.; Sievers, H. 2015—Minerals4EU Project. Foresight Study. Thematic Report I—European Raw Material Potential. Available online: http://minerals4eu.brgm-rec.fr/sites/default/files/Minerals4EU_Foresight-Study_Topic-Report-I_European-RM-Potential.pdf (accessed on 31 May 2019).

- Vidovic, J.; Solar, S. Recent developments in raw materials policy in the European Union: Perspective of Eurogeosurveys as a data supplier. Biul. Państw. Inst. Geol. 2018, 472, 11–20. [Google Scholar] [CrossRef]

- Cassard, D.; Bertrand, G.; Billa, M.; Serrano, J.-J.; Tourlière, B.; Angel, J.-M.; Gaál, G. The ProMine Mineral Databases: New Tools to Assess Primary and Secondary Mineral Resources in Europe. In 3D, 4D and Predictive Modelling of Major Mineral Belts in Europe; Weihed, P., Ed.; Springer International Publishing: Cham, Switzerland, 2015; pp. 9–58. Available online: https://www.eurogeosurveys.org/wp-content/uploads/2015/08/312472_1_En_2_Chapter_OnlinePDF.pdf (accessed on 15 May 2021).

- Minerals4EU. Knowledge Data Platform. Available online: http://www.minerals4eu.eu (accessed on 17 March 2021).

- EURare Project. Available online: https://cordis.europa.eu/project/id/309373/reporting (accessed on 22 March 2021).

- Huisman, J.; Leroy, P.; Tertre, F.; Söderman, M.L.; Chancerel, P.; Cassard, D.; Løvik, A.N.; Wäger, P.; Kushnir, D.; Rotter, S.; et al. Prospecting Secondary Raw Materials in the Urban Mine and Mining Wastes; (ProSUM)—Final Report; ProSUM Consortium: Brussels, Belgium, 2017. [Google Scholar] [CrossRef]

- GeoERA/FRAME Project. Available online: https://geoera.eu/wp-content/uploads/2018/10/FRAME_D3.1-1.pdf (accessed on 25 March 2021).

- Mineral Resources in Sustainable Land-Use Planning: MINLAND Project. Available online: https://www.minland.eu/project/ (accessed on 15 May 2019).

- Fizaine, F. Byproduct production of minor metals: Threat or opportunity for the development of clean technologies? The PV sector as an illustration. Resour. Policy 2013, 38, 373–383. [Google Scholar] [CrossRef]

- Nassar, N.T.; Graedel, T.E.; Harper, E.M. By-product metals are technologically essential but have problematic supply. Sci. Adv. 2015, 1. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- European Commission. Study on the EU’s List of Critical Raw Materials, Factsheets on Critical Raw Materials; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Manthiram, A. An outlook on lithium-ion battery technology. ACS. Cent. Sci. 2017, 3, 1063–1069. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Olivetti, E.; Ceder, G.; Gaustad, G.; Fu, X. Lithium-ion battery supply chain considerations: Analysis of potential bottlenecks in critical metals. Joule 2017, 1, 229–243. [Google Scholar] [CrossRef] [Green Version]

- Badera, J. Problems of the social non-acceptance of mining projects with particular emphasis on the European Union—A literature review. Environ. Soc. Econ. Stud. 2014, 2, 27–34. [Google Scholar] [CrossRef] [Green Version]

- European Minerals Yearbook 2015. Available online: http://minerals4eu.brgm-rec.fr/m4eu-yearbook (accessed on 19 March 2021).

- Strategic Research Agenda for Batteries 2020. European Technology and Innovation Platform on Batteries—Batteries Europe. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/batteries_europe_strategic_research_agenda_december_2020__1.pdf (accessed on 23 March 2021).

- OECD 2020. Inventory of Export Restrictions on Industrial Raw Materials. Available online: https://qdd.oecd.org/subject.aspx?Subject=ExportRestrictions_IndustrialRawMaterials (accessed on 22 March 2021).

- Korinek, J. Trade restrictions on minerals and metals. Miner. Econ. 2019, 32, 171–185. [Google Scholar] [CrossRef]

- Mancheri, N.A.; Sprecher, B.; Deetman, S.; Young, S.; Bleischwitz, R.; Dong, L.; Kleijn, R.; Tukker, A. Resilience in the tantalum supply chain. Resour. Conserv. Recycl. 2018, 129, 56–69. [Google Scholar] [CrossRef]

- Vyboldina, E.; Cherepovitsyn, A.; Fedoseev, S.; Tsvetkov, P. Analysis of export restrictions and their impact on metals world markets. Indian J. Sci. Technol. 2016, 9. [Google Scholar] [CrossRef] [Green Version]

- Augé, T.; Petrunov, R.; Bailly, L. On the mineralization of the PGE mineralization in the Elatsite porphyry Cu–Au deposit, Bulgaria: Comparison with the Baula-Nuasahi Complex, India, and other alkaline PGE-rich porphyries. Can. Mineral. 2005, 43, 1355–1372. [Google Scholar] [CrossRef]

- Economou-Eliopoulos, M.; Eliopoulos, D.G. Palladium, platinum and gold concentration in porphyry copper systems of Greece and their genetic significance. Ore Geol. Rev. 1999, 16, 59–70. [Google Scholar] [CrossRef]

- Wang, M.; Zhao, R.; Shang, X.; Wei, K. Factors controlling Pt–Pd enrichments in intracontinental extensional environment: Implications from Tongshankou deposit in the Middle–Lower Yangtze River Metallogenic Belt, Eastern China. Ore Geol. Rev. 2000, 124, 103621. [Google Scholar] [CrossRef]

- Harben, P.W.; Kužvart, M. A Global Geology; Industrial Minerals Information: Surrey, UK, 1997. [Google Scholar]

- Eilu, P. (Ed.) Mineral Deposits and Metallogeny of Fennoscandia; Special Paper 53; Geological Survey of Finland: Espoo, Finland, 2012. [Google Scholar]

- Goodenough, K.M.; Schilling, J.; Jonsson, E.; Kalvig, P.; Charles, N.; Tuduri, J.; Deady, E.A.; Sadeghi, M.; Schiellerup, H.; Mueller, A.; et al. Europe’s rare earth element resource potential: An overview of REE metallogenic provinces and their geodynamic setting. Ore Geol. Rev. 2016, 72, 838–856. [Google Scholar] [CrossRef]

- Machacek, E.; Kalvig, P. (Eds.) 2017: EURARE. Development of a Sustainable Exploitation Scheme for Europe’s Rare Earth Ore Deposits. European REE Market Survey—Task 1.1.2. Available online: http://www.eurare.org/docs/T1.1.2_Report-final-280217.pdf (accessed on 24 March 2021).

- Horn, S.; Gunn, A.G.; Petavratzi, E.; Shaw, R.A.; Eilu, P.; Tormanen, T.; Bjerkgård, T.; Sandstad, J.S.; Jonsson, E.; Kountourelis, S.; et al. Cobalt resources in Europe and the potential for new discoveries. Ore Geol. Rev. 2021, 130, 103915. [Google Scholar] [CrossRef]

- FODD Fennoscandian Mineral Deposits, Fennoscandian Ore Deposit Database. 2017. Available online: http://en.gtk.fi/informationservices/databases/fodd/index.html (accessed on 24 March 2021).

- Apostolikas, A.; Kountourellis, E.I. GMMSA LARCO: Mineral Resources, Present, Future, Opportunities Laterite—Nickel Industry (Power Point Presentation NTUA-NOA 2014, for Raw Materials University Day). Available online: https://www.researchgate.net/publication/294870228 (accessed on 23 April 2021). [CrossRef]

- Gautneb, H.; Gloaguen, E.; Törmänen, T. Lithium, cobalt and graphite occurrences in Europe. Results from GeoEra FRAME project WP 5. EGU Gen. Assem. 2020. [Google Scholar] [CrossRef]

- Bradley, D.C.; Stillings, L.L.; Jaskula, B.W.; LeeAnn, M.; McCauley, A.D. Lithium. In Critical Mineral Resources of the United States—Economic and Environmental Geology and Prospects for Future Supply; U.S. Geological Survey Professional Paper 1802; Schulz, K.J., DeYoung, J.H., Jr., Seal, R.R., II, Bradley, D.C., Eds.; U.S. Geological Survey: Reston, VA, USA, 2017; pp. K1–K21. [Google Scholar] [CrossRef]

- Holley, E. Zero Hour for Lithium in Europe. Mining Journal 2019, 17 July. Available online: https://www.mining-journal.com/project-finance/news/1367501/zero-hour-for-lithium-in-europe (accessed on 8 March 2021).

- Damm, S.; Zhou, Q. Supply and Demand of Natural Graphite; German Mineral Resources Agency (DERA) at the Federal Institute for Geosciences and Natural Resources (BGR): Berlin, Germany, 2020.

- Willing, N. Graphite Firms Integrate European Battery Supply Chain. Available online: https://www.argusmedia.com/en/news/2144154-graphite-firms-integrate-european-battery-supply-chain (accessed on 29 March 2020).

- De Klerk, L. Battery Metals and the Green Tech Revolution—How Easy Is It to Mine in Europe? Available online: http://mplaninternational.com/battery-metals-and-the-green-tech-revolution-how-easy-is-it-to-mine-in-europe/ (accessed on 29 March 2021).

- Smakowski, T.; Galos, K.; Lewicka, E. (Eds.) Minerals Yearbook of Poland 2013; Polish Geological Institute—National Research Institute: Warsaw, Poland, 2015. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2013/Minerals_Yearbook_of_Poland_2013.pdf (accessed on 24 March 2021).

- European Parliament. Regulation (EC) No 1907/2006 of the European Parliament and of the Council of 18 December 2006 concerning the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), establishing a European Chemicals Agency, amending Directive 1999/45/EC and repealing Council Regulation (EEC) No 793/93 and Commission Regulation (EC) No 1488/94 as well as Council Directive 76/769/EEC and Commission Directives 91/155/EEC, 93/67/EEC, 93/105/EC and 2000/21/EC. Off. J. Eur. Union 2006, 46, L396/1. [Google Scholar]

- European Commission. A New Industrial Strategy for Europe. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM(2020) 102 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Nansai, K.; Nakajima, K.; Kagawa, S.; Kondo, Y.; Takayanagi, W.; Shigetomi, Y. The role of primary processing in the supply risks of critical metals. Econ. Syst. Res. 2017, 29, 335–356. [Google Scholar] [CrossRef] [Green Version]

- Schmid, M. The revised German raw materials strategy in the light of global political and market developments. Rev. Policy Res. 2020. [Google Scholar] [CrossRef]

- Løvika, A.N.; Hagelüken, C.; Wägera, P. Improving supply security of critical metals: Current developments and research in the EU. Sustain. Mater. Technol. 2018, 15, 9–18. [Google Scholar] [CrossRef]

| Mineral Raw Material | Classified as Critical Raw Material | EI Index | SR Index | Mining Production in the EU | Processing in the EU | Production of Semi-Finished Products in EU | Subject of Trade Flows | Production in the EU | Main Applications | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2011 | 2014 | 2017 | 2020 | 2020 | 2020 | |||||||

| Antimony | YES | YES | YES | YES | 4.8 | 2.0 | NO | YES 1 | YES | unwrought metal, antimony trioxide (ATO), antimony powders, scrap | antimony trioxide (ATO) | flame retardants, lead-acid batteries, lead alloys, plastics (catalysts and stabilizers), glass and ceramics |

| Baryte | NO | NO | YES | YES | 3.3 | 1.3 | YES | YES | YES | baryte aggregates, ground and micronized baryte, blanc baryte | ground baryte | weighting agent in drilling fluids, filler in rubbers, plastics, paints and paper, chemical industry |

| Bauxite | na | NO | NO | YES | 2.9 | 2.1 | YES | YES | YES | bauxite (dried or calcined) | bauxite (dried or calcined) | alumina (mostly for the production of aluminum metal), refractories, cement, abrasives, chemicals |

| Beryllium | YES | YES | YES | YES | 4.2 | 2.3 | NO | NO | YES | Be metal, Be alloys, and master alloys, Be oxides | - | electronics, automotive components, aerospace components, energy applications |

| Bismuth | na | na | YES | YES | 4.0 | 2.2 | NO | YES | YES | refined bismuth | refined bismuth, Bi chemicals, Bi alloys | chemicals, fusible alloys, metallurgical additives, and others |

| Borates | NO | YES | YES | YES | 3.5 | 3.2 | NO | YES | YES | natural borates, boric acid, boron metal | - | specialty glass and glass fiber, frits and ceramics, fertilizers, chemicals, construction materials, boron metal production |

| Cobalt | YES | YES | YES | YES | 5.9 | 2.5 | YES | YES | YES | ores and concentrates, oxides and hydroxides, chlorides, intermediate products, refined cobalt | refined cobalt | superalloys, hard-facing alloys, hard materials (carbides and diamond tools), pigments, catalysts, magnets, batteries |

| Coking coal | na | YES | YES | YES | 3.0 | 1.2 | YES | YES | YES | coking coal, coke | coking coal, coke | iron and steel production, tar and benzol production |

| Fluorspar | YES | YES | YES | YES | 3.3 | 1.2 | YES | YES | YES | fluorspar AG, fluorspar MG, cryolite, fluorine compounds | fluorspar AG (min. 97% CaF2) | Fe making, Al making, UF6 in nuclear uranium fuel, HF in oil refining, CFCs for refrigeration and air conditioning |

| Gallium | YES | YES | YES | YES | 3.5 | 1.3 | NO 2 | YES | YES | unwrought gallium, galium compounds (e.g., GaAs) | refined high purity gallium | integrated circuits, electronics, LED lighting, CIGS (Cu-In-Se-Ga) photovoltaics panels |

| Germanium | YES | YES | YES | YES | 3.5 | 3.9 | NO | YES | YES | germanium metal and powders, GeO2, GeCl4 | germanium metal, GeCl4 | IR optics, optical fiber, satellite solar |

| Graphite (natural) | YES | YES | YES | YES | 3.2 | 2.3 | YES | YES | YES | graphite powder, graphite flakes, other natural graphite | natural graphite concentrates | refractories, Li-ion and other types of batteries, friction products, lubricants, pencils |

| Hafnium | na | NO | YES | YES | 3.9 | 1.1 | NO | YES 3 | YES | hafnium metal | hafnium oxide, hafnium metal | superalloys, nuclear energy production (nuclear control rods), semiconductors |

| Indium | YES | YES | YES | YES | 3.3 | 1.8 | NO | YES 4 | YES | In-bearing zinc concentrates, residues, and slags; unwrought indium | refined indium | flat monitors, CIGS (Cu-In-Se-Ga) photovoltaics panels, solders, batteries, semiconductors, and LEDs |

| Lithium | na | na | NO | YES | 3.1 | 1.6 | YES 5 | NO | NO | lithium carbonate and hydroxide, lithium spodumene concentrate | lepidolite concentrate, lithium metal | glass and ceramics, batteries, lubricants, aluminum production, pharmaceuticals |

| Magnesium | YES | YES | YES | YES | 6.6 | 3.9 | NO | NO | YES | magnesium metal, magnesium alloys | Magnesium alloys | automotive industry, steel desulfurization agent, packaging, construction |

| Niobium | YES | YES | YES | YES | 6.0 | 3.9 | NO | NO | YES | ferroniobium, niobium metal | Nb-based alloys, Nb chemicals (e.g., lithium niobate) | HSLA steel (for construction and vehicles), stainless and special steel, chemicals |

| Platinum Group Metals | YES | YES | YES | YES | 5.7 | 2.4 | YES | YES | YES | PGM metals, PGM alloys, PGM chemicals | concentrates, refined PGMs, alloys, PGM chemicals | catalysts (automotive, chemical and petroleum), electronics, glass, jewelry, dental, investment |

| Phosphate rock | na | YES | YES | YES | 5.6 | 1.1 | YES | YES | YES | phosphate rock, phosphoric acid, phosphate fertilizers | phosphate rock, phosphate acid, fertilizers | phosphate and multicomponent fertilizers, food additives, detergents, flame retardants |

| Phosphorus | na | na | YES | YES | 5.3 | 3.5 | NO | NO | YES | elemental phosphorus | phosphoric acid | chemicals, electronics, metals production |

| Rare Earth Elements | YES | YES | YES | YES | LREE 4.3 HREE 3.9 | LREE 6.0 HREE 5.6 | NO | YES | YES | REE oxides (REO), REE metals and alloys, REE compounds | REE chemicals and compounds, REE metals | catalysts, permanent magnets (for automotive applications), special alloys, glass, and ceramics, phosphors, batteries, electronics |

| Scandium | YES | NO | YES | YES | 4.4 | 3.1 | NO | YES | YES | scandium oxide (also scandium compounds and scandium metal) | Sc-Al alloys | Solid Oxide Fuel Cells (SOFC), Sc-Al alloys |

| Silicon metal | na | YES | YES | YES | 4.2 | 1.2 | YES | YES | YES | silicon metal, intermediate products (Si-based chemicals, silicon wafers) | silicon metal | chemicals (silicons and silanes), aluminum alloys, semiconductors (photovoltaics, wind turbines, electronics), Li-ion batteries |

| Strontium | na | na | na | YES | 3.5 | 2.6 | YES | YES | YES | strontium ore and concentrates, strontium carbonate, strontium metal | celestite concentrate, strontium carbonate | glass, ceramics, pyrotechnics, magnets, master alloys, drilling fluid |

| Tantalum | YES | NO | YES | YES | 4.0 | 1.4 | NO 6 | YES | YES | tantalum pentoxide, tantalum ores and concentrates | tantalum chemical compounds, superalloys | capacitors, superalloys (aviation), carbides |

| Titanium | NO | NO | NO | YES | 4.7 | 1.3 | NO | YES 7 | YES | titanium ores and concentrates, titanium white, titanium metal | titanium white, titanium metal, alloys | alloys (space and aircraft, military, and medical applications), paints and polymers (plastics) |

| Tungsten | YES | YES | YES | YES | 8.1 | 1.6 | YES | YES | YES | tungsten ores and concentrates, tungsten carbides, powders, APT | ores and concentrates, APT | mill and cutting tools, other wear tools, catalysts, and pigments, lighting, electronics, aeronautics, and energy uses |

| Vanadium | NO | NO | YES | YES | 4.4 | 1.7 | NO | YES | YES | vanadium ores and concentrates, vanadium oxides, ferrovanadium | vanadium oxides, ferrovanadium | ferrovanadium, HSLA steel, Al-Ti-V alloys (aviation, nuclear energy), stainless and special steel, catalysts (chemical) |

| CRMs | Renewable Energy | E-Mobility | Defense and Aerospace | CRMs in at Least Two Sectors |

|---|---|---|---|---|

| Antimony (Sb) | ||||

| Baryte | + | |||

| Bauxite | ||||

| Beryllium (Be) | + | |||

| Bismuth (Bi) | ||||

| Borates (and boron) | + | + | + | + |

| Cobalt (Co) | + | + | + | |

| Coking coal | ||||

| Fluorite | ||||

| Gallium (Ga) | + | + | + | + |

| Germanium (Ge) | + | + | + | + |

| Graphite natural | + | + | + | |

| Hafnium (Hf) | + | |||

| Indium (In) | + | + | + | + |

| Lithium (Li) | + | + | + | |

| Magnesium (Mg) | + | + | + | |

| Niobium (Nb) | + | + | + | + |

| Phosphate rock | ||||

| Phosphorus | ||||

| Platinum Group metals (PGMs) | + | + | + | |

| Heavy Rare Earth Elements (HREEs) | + | + | + | + |

| Light Rare Earth Elements (LREEs) | + | + | + | + |

| Scandium (Sc) | ||||

| Silicon metal (Si) | + | + | + | |

| Tantalum (Ta) | + | |||

| Titanium (Ti) | + | + | + | |

| Tungsten (W) | + | + | + | |

| Vanadium (V) | + | + | + |

| Mineral Raw Material | Countries with Reported: | Main Types of Deposits | |||

|---|---|---|---|---|---|

| Mineral Deposits According to [60] | Mineral Resources According to [61] | Mineral Reserves According to [61] | Mineral Occurrences/Deposits According to [54] | ||

| Borates | - | not known | not known | not analyzed | evaporites in volcanic activity areas, |

| Cobalt | Finland, Greece, Poland, Spain, Sweden | Finland, Germany, Sweden | Finland | Austria, Bulgaria, Cyprus, Czech Republic, Finland, France, Germany, Greece, Italy, Poland, Romania, Slovakia, Spain, Sweden | sediment-hosted, hydrothermal, and volcanogenic, magmatic sulphide deposits, laterites |

| Gallium 1 | Poland | data not available | data not available | Austria, Bulgaria, France, Hungary, Poland | rarely forms its own deposits, mostly occurring as a trace element in bauxite ores, subordinately in Zn ores |

| Germanium 2 | Austria, France, Slovenia, Poland | France, Czech Republic | not known | Austria, Bulgaria, Czech Republic, France, Germany, Italy, Poland, Portugal, Romania, Slovenia | does not form its own deposits; mostly occurring in as trace metal in Zn ores and coal ashes |

| Graphite natural | Austria, Bulgaria, Czech Republic, Germany, Sweden | Austria, Czech Republic, Germany, Spain, Slovakia, Sweden | Austria, Czech Republic, Spain | Austria, Czech Republic, Finland, France, Germany, Greece, Italy, Romania, Sweden | flake graphite, amorphous graphite, vein/lump graphite |

| Indium 3 | Germany, Portugal | Germany | data not available | Austria, Bulgaria, Czech Republic, Germany, Greece, Hungary, Ireland, Portugal | does not form its own deposits; occurs primarily as trace element in Zn ores |

| Lithium | Austria, France, Ireland, Slovenia | Austria, Czech Republic, Finland, France, Ireland, Germany, Portugal, Spain, Sweden | Austria, Czech Republic, Finland, Germany, Portugal | Czech Republic, Finland, France, Greece, Portugal, Spain, Sweden | pegmatite, brines, thermal water |

| Magnesium | Slovakia, Greece | Austria, Bulgaria, Greece, Ireland, Poland, Slovakia, Spain | Austria, Poland, Slovakia, Spain | Austria, Bulgaria, Finland, France, Greece, Ireland, Italy, Netherlands, Poland, Slovakia, Spain, United Kingdom * | high purity deposits of dolomite, magnesite and carnalite |

| Niobium 4 | Czech Republic | Finland, France, Germany, Portugal, Sweden | data not available | Austria, Bulgaria, Czech Republic, Finland, France, Germany, Italy, Portugal, Slovakia, Spain | carbonatite-hosted primary, carbonatite-sourced secondary, alkaline granite and syenite |

| Platinum Group Metals | Finland, Poland, Sweden | Finland, Germany, Sweden | Finland | Bulgaria, Finland, Greece, Germany, Poland, Spain, Sweden, United Kingdom * | PGM-bearing (Merensky Reef type and chromite reef type), nickel-copper sulfides |

| Rare Earth Elements (LREEs, HREEs) | Greece, Finland, Portugal, Sweden | Greece, Finland, Germany, Portugal, Sweden | Sweden | Belgium, Czech Republic, Finland, France, Greece, Germany, Poland, Portugal, Romania, Slovakia, Spain, Sweden, United Kingdom * | carbonatite-associated, laterite (ion adsorption deposits), alkaline igneous rock, placers |

| Silicon metal 5 | data not available | Czech Republic, Greece, Latvia, Poland, Slovakia, Slovenia, United Kingdom * | Croatia, Czech Republic, Denmark, Poland, Slovakia, Slovenia, United Kingdom * | Austria, Bulgaria, Finland, Greece, Germany, Poland, Portugal, Sweden, Italy | high purity silica sand, quartz veins, quartzites |

| Titanium | Finland, France, Portugal, Romania | Finland, France, Portugal, Slovakia, Sweden | Slovakia | Finland, France, Greece, Italy, Portugal, Romania, Sweden | primary: igneous, metamorphic; weathered rocks and unconsolidated sediments (placers) |

| Tungsten | Austria, Czech Republic, Finland, France, Germany, Greece, Spain, Portugal, Sweden, United Kingdom * | Austria, Bulgaria, Czech Republic, Germany, Finland, Poland, Portugal, Slovakia, Spain, Sweden, United Kingdom * | Austria, Spain, United Kingdom * | Austria, Bulgaria, Czech Republic, Finland, France, Germany, Greece, Spain, Portugal, Sweden, United Kingdom * | vein/stockwork, greisen, hydrothermal, skarn |

| Vanadium | Finland, Poland, Sweden, United Kingdom * | Sweden | data not available | Estonia, Finland, Poland, Sweden | sedimentary phosphates, bauxites, fossil fuel |

| CRMs 2020 | EI 2020 | SR 2020 | IR (%) | Deposits * | Renewable Energy | E-Mobility | Defense and Aerospace |

|---|---|---|---|---|---|---|---|

| CRMs with the highest potential for mining production development from their own deposits | |||||||

| Cobalt (Co) | 5.9 | 2.5 | 86 | + | + | + | |

| Graphite natural | 3.2 | 2.3 | 98 | + | + | + | |

| Lithium (Li) | 3.1 | 1.6 | 100 | + | + | + | |

| Niobium (Nb) | 6.0 | 3.9 | 100 | + | + | + | + |

| Platinum Group Metals (PGMs) | 5.7 | 2.4 | 98 | + 1 | + | + | |

| Heavy Rare Earth Elements (HREEs) | 3.9 | 5.6 | 100 | + | + | + | + |

| Light Rare Earth Elements (LREEs) | 4.3 | 6.0 | 100 | + | + | + | + |

| Titanium (Ti) | 4.7 | 1.3 | 100 | + | + | + | |

| Tungsten (W) | 8.1 | 1.6 | na | + | + | + | |

| CRMs with the highest potential for production development as by-products from other metal ores | |||||||

| Gallium (Ga) | 3.5 | 1.3 | 31 | bauxite | + | + | + |

| Germanium (Ge) | 3.5 | 3.9 | 31 | Zn-Pb ore | + | + | + |

| Indium (In) | 3.3 | 1.8 | 0 | Zn, Zn-Cu-Sn ore | + | + | + |

| Vanadium (V) | 4.4 | 1.7 | na | Fe, Fe-Ti ore | + | + | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lewicka, E.; Guzik, K.; Galos, K. On the Possibilities of Critical Raw Materials Production from the EU’s Primary Sources. Resources 2021, 10, 50. https://0-doi-org.brum.beds.ac.uk/10.3390/resources10050050

Lewicka E, Guzik K, Galos K. On the Possibilities of Critical Raw Materials Production from the EU’s Primary Sources. Resources. 2021; 10(5):50. https://0-doi-org.brum.beds.ac.uk/10.3390/resources10050050

Chicago/Turabian StyleLewicka, Ewa, Katarzyna Guzik, and Krzysztof Galos. 2021. "On the Possibilities of Critical Raw Materials Production from the EU’s Primary Sources" Resources 10, no. 5: 50. https://0-doi-org.brum.beds.ac.uk/10.3390/resources10050050