The Role of Dynamic Capabilities as Drivers of Business Model Innovation in Mergers and Acquisitions of Technology-Advanced Firms

Abstract

:1. Introduction

2. Literature Review

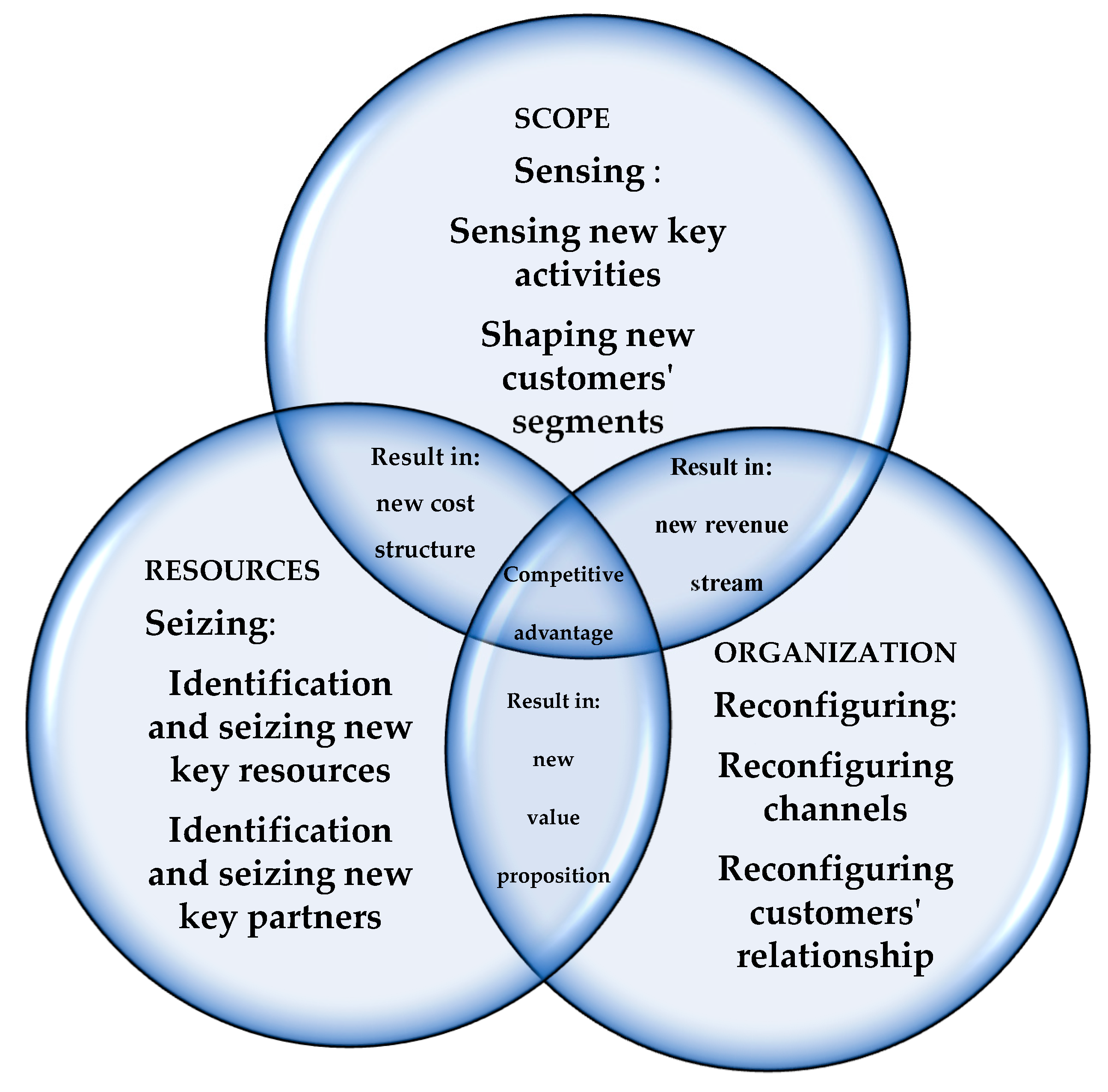

2.1. Dynamic Capabilities

2.2. The Business Model of Acquirer’s Company

2.3. Business Model Innovation

3. Research Design and Methodology

4. Case Analysis to Interpretation

4.1. Samsung’s Acquisition of Harman in November 2016

4.1.1. First Research Question: What Triggers off Dynamic Capabilities, Particularly in M&A of Technology Advanced Firms?

4.1.2. Second Research Questions: What Is the Role of Dynamic Capabilities as Drivers of BMI?

4.2. Microsoft’s Acquisition of LinkedIn in 2016

4.2.1. First Research Question: What Triggers off Dynamic Capabilities, Particularly, in M&A of Technology Advanced Firms?

4.2.2. Second Research Questions: What Is the Role of Dynamic Capabilities as Drivers of BMI?

5. Findings and Discussion

6. Conclusions, Limitation, and Future Work

Funding

Acknowledgments

Conflicts of Interest

References

- Teece, D.J. Business Models, Business Strategy, and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation; Self-Published; John Wiley and Sons, Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Christensen, C.M.; Alton, R.; Rising, C.; Waldeck, A. The Big Idea: The New M&A Playbook. Harv. Bus. Rev. 2011, 89, 49–57. [Google Scholar]

- Foss, N.J.; Saebi, T. Fifteen Years of Research on Business Model Innovation: How Far Have We Come, and Where Should We Go? J. Manag. 2017, 43, 200–227. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic Capabilities and Strategic Management; Oxford University Press Inc.: New York, NY, USA, 2009; pp. 3–136. [Google Scholar]

- Helfat, C.E.; Finkelstein, S.; Mitchell, M.; Peteraf, M.A.; Singh, H.; Teece, D.J.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; Blackwell Publishing: Malden, MA, USA, 2007. [Google Scholar]

- Helfat, C.E.; Raubitschekb, R.S. Dynamic and integrative capabilities for profiting from innovation in digital platform-based ecosystems. Res. Policy 2018, 47, 1391–1399. [Google Scholar] [CrossRef]

- Schreyogg, G.; Kliesch-Eberl, M. How dynamic can organizational capabilities be? Towards a dual-process model of capability dynamization. Strateg. Manag. J. 2007, 28, 913–933. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities, and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Zahra, S.A.; Sapienza, H.J.; Davidsson, P. Entrepreneurship, and Dynamic Capabilities: A Review, Model and Research Agenda. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and micro-foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Sheenan, N.T.; Foss, N.J. Using Porterian activity analysis to understand organizational capabilities. J. Gen. Manag. 2017, 42, 41–51. [Google Scholar]

- Teece, D.; Leih, S. Uncertainty, Innovation, and Dynamic Capabilities. Calif. Manag. Rev. 2016, 58, 5–12. [Google Scholar] [CrossRef]

- Teece, D.J. A dynamic capabilities-based entrepreneurial theory of the multinational enterprise. J. Int. Bus. Stud. 2014, 45, 8–37. [Google Scholar] [CrossRef]

- Lessard, D.; Teece, D.J.; Leih, S. The dynamic capabilities of meta-multinationals. Glob. Strateg. J. 2016, 6, 211–234. [Google Scholar] [CrossRef]

- Adner, R.; Helfat, C.E. Corporate effect and dynamic managerial capabilities. Strateg. Manag. J. 2003, 24, 1011–1025. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Krishnan, H.A.; Miller, A.; Judge, W.Q. Diversification and top management team complementarity: Is performance improved by merging similar or dissimilar teams? Strateg. Manag. J. 1997, 18, 361–374. [Google Scholar] [CrossRef]

- Makri, M.; Hitt, M.A.; Lane, P.J. Complementary technologies, knowledge relatedness, and invention outcomes in high technology mergers and acquisitions. Strateg. Manag. J. 2010, 31, 602–628. [Google Scholar] [CrossRef]

- Kim, J.-Y.; Finkelstein, S. The effects of strategic and market complementarity on acquisition performance: Evidence from the U.S. commercial banking industry, 1989–2001. Strateg. Manag. J. 2009, 30, 617–646. [Google Scholar]

- Wang, L.; Zajac, E.J. Alliance or acquisition? A dyadic perspective on interfirm resource combinations. Strateg. Manag. J. 2007, 28, 1291–1317. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as Structure: An Actionable Construct for Strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Johnson, M.W.; Christensen, C.M.; Kagermann, H. Reinventing your business model. Harv. Bus. Rev. 2008, 86, 57–68. [Google Scholar]

- Teece, D.J. Business models and dynamic capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Business Model Design: A Dynamic Capability Perspective. In The Oxford Handbook of Dynamic Capabilities; Teece, D.J., Leigh, S., Eds.; Oxford Handbooks: Oxford, UK, 2016. [Google Scholar]

- Inigo, E.A.; Albareda, L.; Ritala, P. Business model innovation for sustainability: Exploring evolutionary and radical approaches through dynamic capabilities. Ind. Innov. 2017, 24, 515–542. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Business models and business model innovation: Between wicked and paradigmatic problems. Long Range Plan. 2018, 51, 9–21. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Creating value through business model innovation. MIT Sloan Manag. Rev. 2012, 53, 41–49. [Google Scholar]

- Yin, R.K. Case Study Research: Design and Methods; Sage: Newbury Park, CA, USA, 1984. [Google Scholar]

- Sekaran, U.; Bougie, R. Research Methods for Business: A Skill Building Approach; Wiley: Hoboken, NJ, USA, 2018; p. 448. [Google Scholar]

- Siggelkow, N. Persuasion with case studies. Acad. Manag. J. 2007, 50, 20–24. [Google Scholar] [CrossRef]

- Smith, E. Using Secondary Data in Educational and Social Research; McGraw-Hill Education: New York, NY, USA, 2008. [Google Scholar]

- Johnston, M.P. Secondary Data Analysis: A Method of which the Time Has Come. Qual. Quant. Methods Libr. 2014, 3, 619–626. [Google Scholar]

- Andrews, L.; Higgins, A.; Andrews, M.W.; Lalor, J.G. Classic grounded theory to analyze secondary data: Reality and reflections. Grounded Theory 2012, 11, 12–26. [Google Scholar]

- Morris, R. A Computerized content analysis in management research: A demonstration of advantages & limitations. J. Manag. 1994, 20, 903–931. [Google Scholar]

- Rosenberg, S.D.; Schnurr, P.P.; Oxman, T.E. Content analysis: A comparison of manual and computerized systems. J. Pers. Assess. 1990, 54, 298–310. [Google Scholar] [PubMed]

- Teece, D.J. Dynamic Capabilities: A Guide for Managers. Ivey Bus. J 2011. Available online: http://iveybusinessjournal.com/publication/dynamic-capabilities-a-guide-for-managers/ (accessed on 29 December 2018).

- Sapersen, J.; Gonzales, M. LinkedIn: Bridging the Global Employment Gap; Ivey Publishing: Western University, London, Canada, 2017; pp. 1–9. [Google Scholar]

- Jhosan, E. Microsoft’s Earnings Provide Fresh Proof that the LinkedIn Deal Is Paying off. 2018. The Street. Available online: https://www.thestreet.com/opinion/microsoft-earnings-show-linkedin-deal-is-paying-off-14657542 (accessed on 25 November 2018).

- Ambrosini, V.; Bowman, C.; Collier, N. Dynamic capabilities: An exploration of how firms renew their resource base. Br. J. Manag. 2009, 20, S9–S24. [Google Scholar] [CrossRef]

- Weber, R.P. Basic Content Analysis; Sage: Newbury Park, CA, USA, 1990. [Google Scholar]

- SAS® Contextual Analysis. Available online: https://www.sas.com/en_us/software/contextual-analysis.html (accessed on 22 July 2018).

- Collis, D.J.; Montgomery, C.A. Competing on Resources. Harv. Bus. Rev. 2008, 1–13, from the July–August Issue. [Google Scholar]

- Helfat, C.E.; Peteraf, M.A. Managerial cognition capabilities and the micro-foundations of dynamic capabilities. Strateg. Manag. J. 2015, 36, 831–850. [Google Scholar] [CrossRef]

- Haspeslagh, P.C.; Jemison, D.B. Managing Acquisitions: Creating Value through Corporate Renewal; Free Press: New York, NY, USA, 1991; p. 42. [Google Scholar]

| Products | Sensing | Seizing | Transforming | Result in |

|---|---|---|---|---|

| Electric cars and components | Samsung senses the automotive market is in the development phase of software-based cars, the market potential value is about half of trillion $. | Samsung’s Automotive Electronics Business Team was started up at the end of 2015 to explore opportunities in connected car businesses. Samsung Electronics invested in BYD, a Chinese company that leads the world in electric car sales in 2015 | Samsung’s Electronics Business Team concentrated on products for infotainment and autonomous driving vehicles. | The company was making a delayed entry into connected cars’ solution business. The corporation was the latest technology company to enter the fray by manufacturing electronic parts for the automotive industry |

| Product | Sensing | Seizing | Transforming | Result in |

|---|---|---|---|---|

| Connected car solutions | Harman senses connected cars’ business represents great opportunities for a producer to enjoy operating profits by means of promotion of additional services and upgraded features. | Harman seized opportunities by setting a standard in automotive advancements combined with an intuitive interface. The market of the connected car is forecasted to exceed $100 billion by 2025. | Harman transformed tangible and intangible assets and developed lane departure warning systems, collision avoidance, and adaptive cruise control, which are constantly updated. | About 30 million cars are equipped with connected car solutions. Harman became a market leader in the segment of connected car solutions |

| Building Blocks of Business Models | Samsung Business Model | Dynamic Capabilities of Samsung | Harman Business Model |

|---|---|---|---|

| Customer segments (scope) | The Samsung SDI Co., Ltd. (China) was the world No.6 electric car battery maker with a clientele like BMW, Volkswagen, and Chrysler | Samsung sensing | Harman introduced the new era of smart mobility, in which the focus of the automotive industry shifts from individual car ownership to a more service-centric view of a personal mobility |

| Key activity (scope) | Samsung was developing electronic equipment abilities essential for electronic cars | Samsung sensing | Harman is designing and integrating sophisticated in-vehicle technologies: in-car audio equipment, vehicular navigation, and infotainment devices |

| Key resources (resources) | Samsung possesses patents on breakthrough technologies including a drowsy-driven detection system, an alert system for break-in attempts and a transparent display for directions traffic information. | Samsung seizing | Harman’s cohort of about 8000 software engineers who are working on cloud-based consumer, as well as end-to-end services for the automotive market |

| Key partners (resources) | Samsung is partnering up with the firms that are investing throughout the smart side of the automotive space: an Israeli startup Store Dot (development of advanced battery solution); NuTonomy (a self-driving car maker out of USA); LiDar (Quanergy Systems maker); Vinli (infotainment vendor) | Samsung seizing | Harman’s long-term relationships with most of the world’s largest automakers like GM, Ford, Chrysler, Subaru, Toyota, Lexus, Mercedes Benz, Audi, Bentley, Rolls Royce, BMW, and Harley Davidson |

| Channels (organization) | Samsung formed the special team for selling components namely camera modules to new auto clients with consideration for acquisitions in order to enhance the car-related business | Samsung reconfiguring | Harman leads manufacturers down a different technology-driven industry. |

| Customer relationship (organization) | Samsung partnered with Audi to supply its latest memory products. This marked Samsung’s pioneer moves as “an automotive electronic component supplier. Samsung also partnered with AT&A “an automotive aftermarket connected device play—Samsung Connect Auto” | Samsung reconfiguring | Harman’s relationship with manufacturers like GM, Ford, Chrysler, Subaru, Toyota, Lexus, Mercedes Benz, Audi, Bentley, Rolls Royce, BMW, and Harley Davidson. |

| Cost structure | Samsung had always kept tight control of its supply chain—often owing its suppliers outright. | Samsung result in | Harman has introduced the first automotive grade, end-to-end intrusion detection system for connected vehicles. |

| Revenue stream | The corporation was one of the biggest corporate investors in the emerging world of a connected car | Samsung result in | Harman is a player of the connected, smart vehicle’s market which is on course to disrupt the automotive industry. |

| Customer Value proposition | Propose value to their automotive customers and consumers around the world | Samsung result in | Connected vehicles will generate new innovative products and service, therefore enable new value propositions and business models |

| The Reinvention of the Business Model of Samsung | Micro-Foundations of Dynamic Capabilities of Samsung |

|---|---|

| Selection, sensing and shaping new activities and new customer’s segments | Samsung sensed a new customers’ demand and shaped a new key activity in the connected car industry and new business initiatives needed to satisfy this demand on connected technologies. |

| Identification and seizing new resources and a new partnership | Samsung identified, seized, and acquired strategically valuable resources. After laying about $8 billion on the table to scoop up audio and auto space superstar Harman, Samsung is partnering up with the firm that they acquired. |

| Reconfiguration and transforming new customer relationship and new channels. Result in new cost structure, new revenue stream, and a new customer value proposition | Samsung transformed promotion channels to the connected car industry and generated a new revenue stream. The acquisition of Harman gives Samsung a strong presence in the developing market of connected technologies, specifically, in automotive electronics, which was a strategic intent of Samsung with expectation on market volume up to $100 billion by 2025. It is a move that makes sense for Samsung, after its pride was dented by the catastrophe surrounding the Galaxy Note 7, but also because Harman is a leading player in the connected car industry. |

| Products | Sensing | Seizing | Transforming | Result in |

|---|---|---|---|---|

| Microsoft mobile ecosystem | Microsoft sensed that the corporation had a weak position in the mobile ecosystem in comparison with Apple, Google, and Facebook. | Microsoft seized opportunities by the acquisition of Danger, Inc., a company specializing in design and services for mobile computing devices in 2008 | Microsoft transformed tangible and intangible assets and formed Microsoft Mobile. The Microsoft Band, a smart band with smartwatch and activity tracker features, was launched by Microsoft on 29 October 2014 | Despite the Nokia acquisition and Microsoft Band launched, Microsoft is behind iOS and Google mobile ecosystems. |

| Product | Sensing | Seizing | Transforming | Result in |

|---|---|---|---|---|

| LinkedIn Social Network | LinkedIn sensed a need to connect companies, employees and job seekers. | LinkedIn seized opportunities and the company was developed as a professional social network. LinkedIn allows satisfying professional business needs in recruiting, job advertisements, users’ connections and online communicate by means of the network. | LinkedIn created a single platform that unified companies, employees and job seekers. LinkedIn developed tools, which allow recruiters to search for talents in an advanced, effective way. Advertisement services with an audience of more than 400 million professionals. Acquisition of Bright.com in 2014, a data science firm matching jobs’ descriptions and resumes. | The company expected to earn 3.6–3.7 billion $, with approximately 65% coming from services for recruiters. However, LinkedIn generated $3 billion in revenue had a net loss of $166 million in the 2015 year! |

| Building Blocks of the Business Models | Microsoft Business Model | Dynamic Capabilities of Microsoft | LinkedIn Business Model |

|---|---|---|---|

| Customer segments (scope) |

| Microsoft sensing |

|

| Key activities (scope) |

| Microsoft sensing |

|

| Key resources (resources) |

| Microsoft seizing |

|

| Key partners (resources) |

| Microsoft seizing |

|

| Channels (organization) |

| Microsoft transforming |

|

| Customer relationship (organization) |

| Microsoft transforming |

|

| Cost structure |

| Microsoft result in |

|

| Revenue streams |

| Microsoft result in |

|

| Value propositions |

| Microsoft result in |

|

| The Reinvention of the Business Model of Microsoft | Micro-Foundations of Dynamic Capabilities of Microsoft |

|---|---|

| Selection, sensing and shaping new activities and new customer’s segments | Microsoft sensed their weakness, namely, a low mobile presence; in contrast, LinkedIn is the high mobile presence. Social network for business is not a saturated niche of the social market. LinkedIn will help Microsoft accelerate the shift to enterprise |

| Identification and seizing new resources and a new partnership | Microsoft as the maker of Windows software attempts to put itself at the center of people’s business lives. Acquisition of LinkedIn with a wide professional network and a mobile assess to users’ professional data is leveraging mobility of LinkedIn products and assess to wide professional network with users’ professional data and quality of Microsoft products. |

| Reconfiguration and transforming new customer relationship, new channels, and new customer value proposition. Result in new cost structure and new revenue stream | Joining the idiosyncratic resources and aligning dynamic capabilities, Microsoft and LinkedIn complement customer value propositions of each other and help to sustain competitive advantage in a mobile ecosystem. Reconfiguration of Microsoft’s and LinkedIn’s core competencies is delivered revenue stream by customized, tailored and targeted B2B advertising. The acquisition of LinkedIn also to help Microsoft beef up the ability to generate high-quality leads, run marketing campaigns with improved ROI and offer deep customer insights |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Čirjevskis, A. The Role of Dynamic Capabilities as Drivers of Business Model Innovation in Mergers and Acquisitions of Technology-Advanced Firms. J. Open Innov. Technol. Mark. Complex. 2019, 5, 12. https://0-doi-org.brum.beds.ac.uk/10.3390/joitmc5010012

Čirjevskis A. The Role of Dynamic Capabilities as Drivers of Business Model Innovation in Mergers and Acquisitions of Technology-Advanced Firms. Journal of Open Innovation: Technology, Market, and Complexity. 2019; 5(1):12. https://0-doi-org.brum.beds.ac.uk/10.3390/joitmc5010012

Chicago/Turabian StyleČirjevskis, Andrejs. 2019. "The Role of Dynamic Capabilities as Drivers of Business Model Innovation in Mergers and Acquisitions of Technology-Advanced Firms" Journal of Open Innovation: Technology, Market, and Complexity 5, no. 1: 12. https://0-doi-org.brum.beds.ac.uk/10.3390/joitmc5010012