1. Introduction

Economic theories are often operationalized under linearity assumptions on the relationships between the underlying variables or joint normality assumptions on their distributions. Famous examples include the Capital Asset Pricing Model (CAPM) and Value at Risk models. Often, linearity and normality assumptions are needed in order to obtain analytical formulas and elegant characterizations of the phenomena of interest. However, such assumptions may lead to wrong conclusions when they are not valid. Recognizing these limits and observing the relatively high frequency of extreme economic events (e.g., financial crises and recessions), a body of the empirical literature in finance emphasizes the distributional characteristics of assets returns that do not reflect normality, in particular asymmetry and fat tails.

For example,

Harvey and Siddique (

1999,

2000) propose a model to estimate the conditional skewness and highlight the importance of taking this into account when analyzing the cross sectional properties of assets prices.

Christoffersen et al. (

2006) propose a framework to price options in the presence of conditional skewness.

Feunou and Tedongap (

2012) propose a stochastic volatility model with conditional skewness for assets prices and show that these distributional aspects are very important to explain how investors value options.

Gabaix (

2009,

2016) argues that stable laws approximate the distribution of many economic and financial variables fairly well while

Gabaix (

2011) proves that macroeconomic fluctuations can have granular origins. Indeed, Gabaix’s work draws attention on a more general issue, namely, the fact that the aggregation of independent phenomena does not always lead to the normal distribution as stipulated by the central limit theorem.

If non-normality is now well entrenched in the mind of academic researchers and financial risk managers, non-linearity has received much less attention in the literature. The joint normality of two random variables X and Y implies that is a linear function of X and that conversely is linear in Y. While a linear relation can still exist between X and Y without joint normality, a nonlinear relationship precludes joint normality. This shows that nonlinearity and non-normality are distinct concepts. Despite the availability of more and more complex computer solutions, linear relationships remain largely advocated for empirical inquiries in economics and finance. Prominent models that are based on linear relationships include the Arbitrage Pricing Theory (APT), Taylor rules and Keynesian consumption functions. Unfortunately, a linearity assumption may lead to wrongly falsifying a theory when the true unknown relationship of interest is nonlinear. Even after acknowledging that the relationship between two variables is nonlinear, finding the functional form that works best for the situation of interest may still be difficult.

In this paper, I propose an approach to measure the degree of nonlinearity of the relationship between two variables. For any pair , I define the exposure of Y to X as the expectation of Y given X. The relationship between X and Y is then said to be nonlinear if either Y is nonlinearly exposed to X or X is nonlinearly exposed to Y. Said differently, the relationship between X and Y is linear if and only if Y is linearly exposed to X and in turn X is linearly exposed to Y. Indeed, it is possible that be a linear function of X without being linear in Y. In this case, the linearity of is spurious as it is misleading about the true relationship between the two variables. Please note that the relationship between variables is approached in this paper from a predictive point of view rather than from a causal perspective. Knowing that the predictive relationship between X and Y is nonlinear is a good starting point for the search of the true underlying causal relationship.

The proposed measure for the degree of nonlinearity of the function , denoted , exploits the relative importance of the norms of the linear and nonlinear parts of in a functional space. The decomposition of into its linear and nonlinear part is done via a functional projection of onto a basis of orthogonal polynomials , where is a polynomial of order j and the orthogonality is defined with respect to a metrics . Upon observing that linear functions of X are loaded only on and , a function is said to be purely nonlinear when it is entirely loaded on the higher order polynomials . For any function of X, the value of always lies between 0 and 1, with 0 meaning that is linear in X and 1 meaning that is purely nonlinear as per the previous definition. The index is invariant to linear transformations of Y as well as to the addition of an independent noise to Y. It is not invariant to the choice of the metrics and it is therefore sensitive to transformations of X.

Unlike our proposed measure of nonlinearity, the Pearson

linear correlation coefficient measures the propensity of a random variable

Y of being replicated by a linear function of another variable

X. It always lies between

and

, with 1 meaning a perfectly linear and positive relationship, 0 the absence of linear relationship and

a perfectly linear and negative relationship. A linear correlation coefficient lying strictly between

and 1 indicates that a fit of

Y by a linear function of

X will not be perfect. This imperfection arises either from the dependence of

Y on random factors other than

X or from nonlinearity in the relationship between

Y and

X (or both). The linear correlation coefficient is smaller than 1 in absolute value when

X and

Y are bound by a deterministic but nonlinear relationship. In an effort to repair the limitations of the linear correlation, measures of nonlinear association (typically, based on ranks) have been proposed. Notably, we have the rank correlation coefficient of

Spearman (

1904), Kendall’s tau (

Kendall 1938,

1970), Goodman and Kruskal’s gamma (

Goodman and Kruskal 1954,

1959) and the quadrant count ratio (see

Holmes 2001). All rank correlation measures are designed to detect the strength of possibly nonlinear but monotonic relationships between

Y and

X. Unlike the linear correlation, a rank correlation coefficient equals 1 if for instance

and

if

(assuming

). However, like the linear correlation, a rank correlation coefficient can be non significant if the relationship between

X and

Y is non-monotonic.

The remainder of the paper is organized as follows.

Section 2 motivates the use of the nonlinearity index (

) proposed in this paper.

Section 3 presents the derivation of

.

Section 4 discusses the choice of the metrics

used to calculate

.

Section 5 examines the invariance properties of

.

Section 6 illustrates the calculation of

for simple functions and warns against coarse errors when choosing the metrics

.

Section 7 proposes a feasible estimator for

and shows its consistency.

Section 8 proposes three applications of our methodology. In the first application, I compute the nonlinearity index of a European option relatively to the underlying asset. It is found that the degree of nonlinearity of the option depends on its maturity and strike as well as on the volatility of the underlying asset. The second application underscores the importance of performing a nonlinearity diagnosis prior to designing a hedging strategy for a portfolio. In the third application, I analyze the nature of the relationship between the returns on the SP500 index and the associated risk as measured by the realized variance (RV). The empirical results are supportive of the existence of a nonlinear relationship between the expected return and the expected risk. The SP500 seems to be driven by two regimes, one regime in which the expected return is increasing in the expected risk and another regime in which the trade-off is negative. Within each regime, the return-risk trade-off is approximately linear.

Section 9 concludes. The mathematical proofs are gathered in

Appendix A.

3. Measuring Nonlinearity

Let the exposure of

Y to

X be given by:

where

X and

Y are scalar random variables and

is a possibly nonlinear function of

X. In assets pricing,

Y could be the risk premium on an asset and

X a measure of the risk for bearing that asset, in which case

describes a nonlinear risk-return trade-off. Alternatively,

Y can be viewed as an investors portfolio and

X the traditional market index. In the latter case,

would be reflecting a nonlinear exposure to the market stemming from a non-directional investment strategy. In macroeconomics,

Y could be the inflation rate and

X the unemployment rate, in which case

features a nonlinear Phillips curve. Finally,

could be an arbitrary process and

its lagged value in a nonlinear time series model.

My objective is to assess the extent of nonlinearity of

. Let the population linear regression of

Y onto

X be denoted by:

where

and

are real numbers. Please note that

coincides with the linear regression of

onto

X and that

coincides with

if and only if

Y can be represented as:

where

is linearly uncorrelated with

X. In the particular case where

is bivariate Gaussian,

and

are necessarily identical and

is normally distributed as well. That is, the joint Gaussianity of

is sufficient but not necessary for linearity.

With no loss of generality, I assume that

admits a series representation of the following form:

where

is a complete sequence of orthogonal polynomials over the support of

X under some metrics

, that is:

and

is the

tight range of

X, that is, the domain over which the values of

X are meaningful. For instance,

is a priori

for a price process and

for a log-return process.

is a polynomial of order

j and

. Please note that

satisfies (

5) if and only if:

See

Carrasco et al. (

2007) and the references therein. Upon knowing

, the metrics

can always be selected to meet the condition (

6).

Let the projection of

onto

under the metrics

be given by:

where:

and

denotes the scalar product under

. The function

is linear if and only if it is loaded only on the first two basis functions, that is:

where the first equality is deduced from (

5) and the last equality stems from (

4).

is nonlinear if and only if the residual of the projection of

onto

, i.e.,

, is not identically null. Therefore, the nonlinear part of

may be isolated as:

Based of this observation, a measure of the degree of nonlinearity of

is given by:

By construction,

if

is perfectly linear and

if

is fully loaded on the nonlinear basis functions. Hence,

always lies between 0 and 1 and is decreasing in the degree of linearity of

as measured by the ratio of the norms of

and

. Equivalent expressions of

are therefore given by:

Please note that

is not defined when

, just as the linear correlation coefficient between

Y and a constant does not exist.

The choice of the metrics is a crucial step of the methodology presented above. Indeed, the value of depends on the metrics used and a bad choice of metrics may lead to spuriously detect nonlinearity. This issue is discussed in the next section.

4. The Conditioning Information Set and the Suitable Choice of Metrics

Let

denote the conditioning information set, that is, the support of

X. A probability measure

on

is said to belong to Pearson’s family if and only if it satisfies:

For instance, letting

and

leads to:

which is the Gaussian probability distribution function on

. Likewise, letting

yields the uniform distribution on

while setting

(

) and

yields an exponential distribution on

. The Student, Gamma, Beta distributions are also special members of the Pearson family. See

Johnson et al. (

1994, pp. 15–25) and

Bontemps and Meddahi (

2012) for more details.

If a probability measure

defined on

belongs to the Pearson family, the sequence of orthogonal polynomials under

are given by Rodrigues’ formula (see

Askey 2005):

where

is the

nth order differentiation operator and

is a sequence of normalization factors that could be chosen so as to achieve specific purposes. That is, any sequence

given by (

14) satisfies:

Subsequently, we consider five cases that are representative of the situations that researchers will often face in practice.

Case 1: When

, a suitable choice of metrics is

. The corresponding orthogonal basis is given by Hermite polynomials:

where

is the derivative of

with respect to

x. In this case, the nonlinearity of

is given by:

where:

Case 2: When

, one may use

along with the corresponding orthogonal basis formed by Laguerre polynomials:

The nonlinearity of

is then given by:

where:

Case 3: If

X can realistically not fall below a given threshold

, one may consider defining the domain of

X as

. The corresponding Laguerre polynomials are obtained by noting that:

Hence for

,

is orthogonal to

with respect to

on

.

Case 4: When

, the simplest possible choice of metrics is uniform weighting function

. The corresponding orthogonal basis of functions consists of Legendre’s polynomials:

4 Case 5: For an arbitrary bounded domain

, we simply note that:

Hence, by letting

, it is straightforward to show that:

Hence, a suitable choice of basis functions when

is given by the sequence

. The measure of nonlinearity for this case is:

where:

The latter set up best suits for measuring nonlinearity on segments of the support of X.

Any metrics that follows the guideline described above will delivers a measure of nonlinearity that is reliable. This means that for an appropriately chosen metrics, the function under consideration is nonlinear as soon as is strictly positive. However, the interpretation of the result is “metrics specific”, meaning that is a relative measure of nonlinearity. While the degrees of nonlinearity of different functions obtained under different metrics cannot be compared, different functions sharing the same support can be compared under the same metrics.

5. Invariance Properties

Observe that has the flavor of the of a linear regression as it measures the “goodness-of-fit” of the functional projection of onto . Based on this observation, one is tempted to claim that shares all the invariance properties as an . However, such a statement is only partially true because of the dependence of on the metrics . The invariance properties of are discussed below.

Proposition 1. κ is invariant to a linear transformation of Y.

Proposition 1 establishes that the amount of nonlinearity remains the same under drifting and scaling of Y. Applied to a portfolio of financial assets, this property means that leverage does not affect the nonlinearity of a financial position. Another property shared by the is stated below.

Proposition 2. κ is invariant to the addition of a randomness ε to Y provided that ε is independent of X.

This property is rather interesting as it implies that may be used to diagnose linear models with additive error terms. Let us assume that X is the return on the market index and Y the return on the portfolio of an investor such that (i.e., we are assuming that the exposure of Y to X is perfectly linear). The strength of the exposure of Y to X is given by the linear correlation between Y and , that is, the square root of of the regression of Y onto X. Suppose the investor decides to implement a non-directional (i.e., market neutral) diversification strategy by changing Y into , where is independent of X. The exposure of the new position is given by , where and . The alpha of the new position may have increased of decreased depending on the value of and its beta is reduced by half. However, the nonlinearity of the new position as measured by is unaltered since remains linear in X.

The next proposition examines the consequence of an addition of a linear function of X to Y.

Proposition 3. If Y is nonlinearly exposed to X, Adding a linear function of X to Y does not necessarily decrease its degree of nonlinearity.

Indeed,

is not invariant to the addition of a linear function of

X to

Y. To understand this result in the context of the proposition (see the proof in

Appendix A for more details), suppose

is positive so that

. Then adding

to

Y exacerbates its nonlinearity if

a is negative and lies within the range

. The degree of nonlinearity decreases only if

or

. Alternatively, suppose

is negative so that

. Then adding

to

Y exacerbates its nonlinearity if

a is positive and lies within the range

. Otherwise, the nonlinearity of

Y decreases. Applied to portfolio choice, Proposition 3 implies that an asset that is linearly exposed to

X can be used to increase the nonlinearity of an already nonlinear position

Y. A sufficient condition for the addition of

to reduce the nonlinearity of

Y is that

a be of the same sign as

.

The property of highlighted by Proposition 3 is also shared by the linear correlation coefficient. Unlike the correlation coefficient however, the value of is sensitive to drifting and scaling of X.

Proposition 4. Let where a and b are some constants. Then the degree of nonlinearity of Y with respect to X under is equal to its degree of nonlinearity with respect to Z under .

The result of Proposition 4 stems from the fact that any transformation of X alters the metrics , which in turn invalidates the orthogonality of . It implies that the values of are not directly comparable across different choices of metrics, which is a drawback of the proposed methodology. However, this drawback is a minor one if is continuous and puts zero weights outside the support of X. Also, functions that are defined on the same domain may be compared under the same metrics provided that they all have finite norms.

6. Spurious Nonlinearity

This section illustrates how to compute

when

is known and in passing, underscores the importance of selecting the metrics

wisely. Indeed,

spurious nonlinearity may arise from a bad choice of metrics. To see this, let us consider the exponential function

, which also has the following representation:

It is tempting to claim based on (

24) that

. However, such a claim would be false since

and

have been defined as the coordinates of

in the basis formed by the orthogonal polynomials

. By noting that

for the exponential function, we let

so that

, where

are Hermite polynomials and:

This yields the following measure of nonlinearity:

Let us now consider

. This function is defined only for

and hence, its nonlinearity

should not be measured as though

x lies on the whole real line. For illustration purposes, let us ignore this warning by letting

. This leads to:

The measure of nonlinearity that results is:

which is quite excessive compared to what is obtained for the exponential. In reality, the nonlinearity calculated above is for the function given by:

which is distinct from

on

. The domain of

is the whole real line whereas the

tight domain of

is

. This explains why we obtain a spuriously high value of

.

Let us now account for the fact that the domain of

is

by letting

, where

are Laguerre polynomials. We obtain:

This yields:

which is more reasonable than previously.

7. Feasible Estimators

Upon observing a sample

of size

T from the joint distribution of

, the conditional expectation

can be estimated by the nonparametric method of

Nadaraya (

1964) and

Watson (

1964):

where

is a kernel function and

h is a bandwidth.

With the estimator

above in hand, the sample counterpart of

is:

where

with

if

,

if

and

if

. Given these choices of metrics, integrals of the form

can be solved analytically when

is a polynomial. For more complicated functions however, numerical quadratures should be used.

When

, the quadrature rule yields:

where

are Gauss-Hermite quadrature points associated with the weights

.

For the alternative metrics

, the quadrature rule becomes:

where

are Gauss-Laguerre quadrature points associated with the weights

.

Finally, for the natural metrics

, we have:

where

are Gauss-Legendre quadrature points associated with the weights

.

The quadrature rules above are designed such that they are exact when the integrand is a polynomial of order

. That is:

Thus, it is straightforward to show that:

where

. If

, the approximation error of

by a quadrature rule is:

Please note that the finiteness of the norm of

imposes that

. Furthermore,

is an approximation of

. Consequently, the approximation error (

42) converges to zero fast as

N increases (especially for

and

). This is a good news given that the expression of

only requires on

and

.

The next proposition states a consistency result for by assuming that its numerical approximation error is negligible.

Proposition 5. Assume that , where is a sequence of bandwidth satisfying as . Then we have: According to Proposition 5, any consistent estimator

of

may be plugged into (

30) to (32) to obtain a consistent estimator of

. Nonparametric estimators of type (

28) have been shown to be consistent under quite general settings (

Bierens 1987).

8. Applications

This section presents three applications of . The first subsection discusses the degree of nonlinearity of a European option with respect to the underlying asset. The second subsection discusses the optimal hedge ratio in the presence of nonlinearity. The third subsection presents an empirical example where the relationship between the risk and the returns on the SP500 index is analyzed.

8.1. How Nonlinear Are Put and Call Options?

This section examine the nonlinearity of the price of a European style option with respect to the underlying asset. This exercise is trivial in a sense as options generate nonlinear payoffs by construction. However, it is nevertheless useful as it gives us a pretext to compare the degree of nonlinearity of several functions under the same metrics and to further illustrate the importance of correctly selecting the metrics .

The payoff a European Call option at maturity is given by , where X is the price of the underlying asset and K is the strike.

If one ignores the fact that the support of

X is

and use

to compute the nonlinearity of

, then one obtains the following expressions:

where

is the standard normal cumulative distribution function. This suggests that

where

,

and

are given above. Evaluating this formula at

yields:

The value of

is clearly misleading since

is linear when

.

To avoid spurious nonlinearity, one uses

. We have:

Hence the nonlinearity of the payoff of an European Call is given by:

We see that the formula above now implies that

, consistently with the fact that

when

.

I now consider the payoff a Put option with strike

K, given by

. Having learned from the previous example, I set

and obtain:

The nonlinearity of the payoff of an European Put is given by:

Please note that for a Put,

when

. Hence, we expect to see

as

. Indeed, we have:

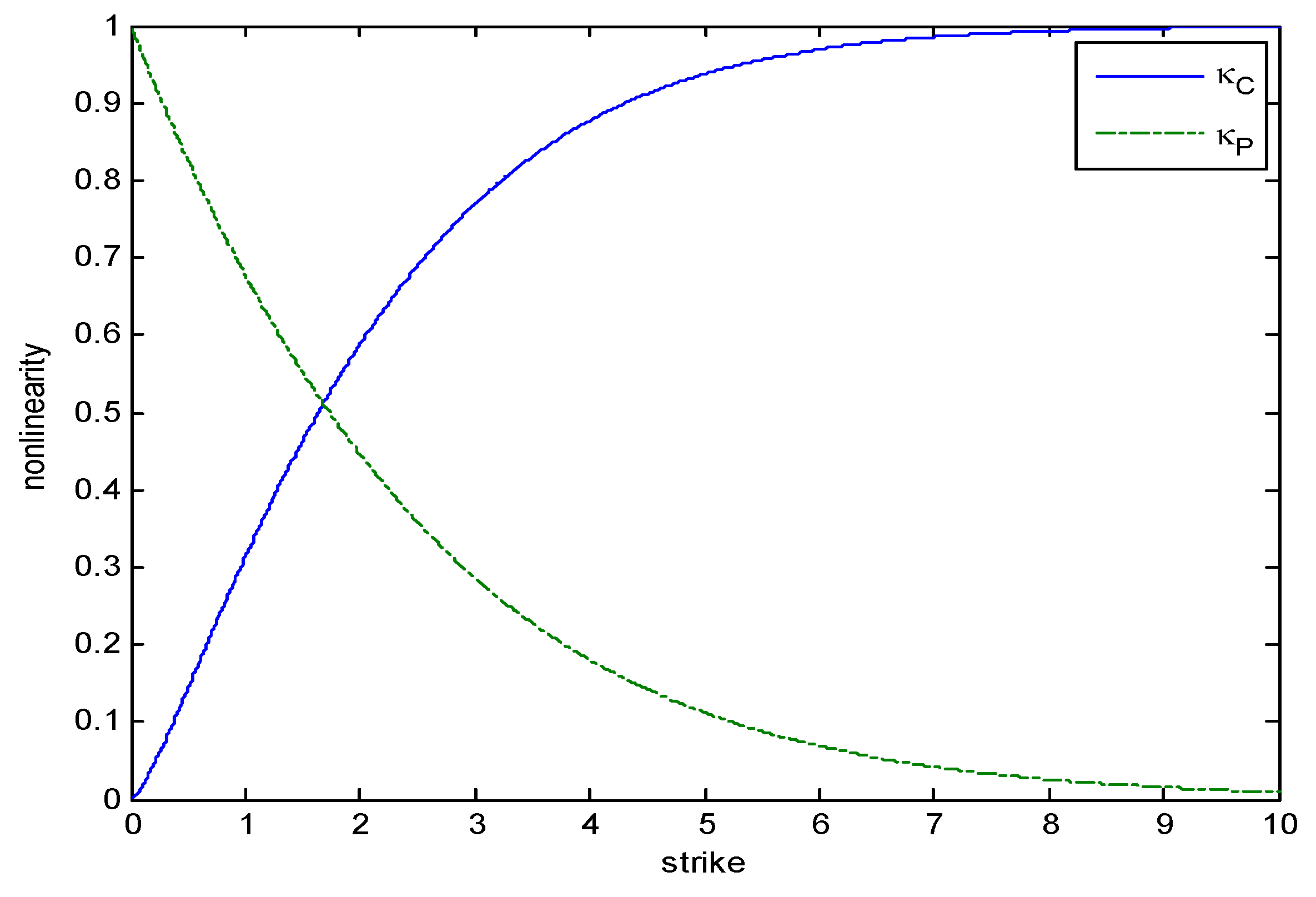

Figure 4 compares the nonlinearity of a the payoffs of a Call and a Put under the metrics

. As

K increases to infinity,

starts at

and converges to 1 whereas

at

and converges to zero

.

5 Over the course of its lifetime, the price of a Call as given by the Black-Scholes formula is:

where:

X is the price of the underlying asset,

K is the strike,

t is the current date,

T is the maturity and

is the spot volatility of

X.

The following quantities are needed in order to evaluate the nonlinearity of

as

K,

t and

vary:

These integrals cannot be computed in closed form. A numerical approximation based on Gauss-Laguerre rule yields:

where

are quadrature points associated with weights

. Hence,

For an European Put option, the price evolves according to:

The nonlinearity of this price with respect to the underlying asset is:

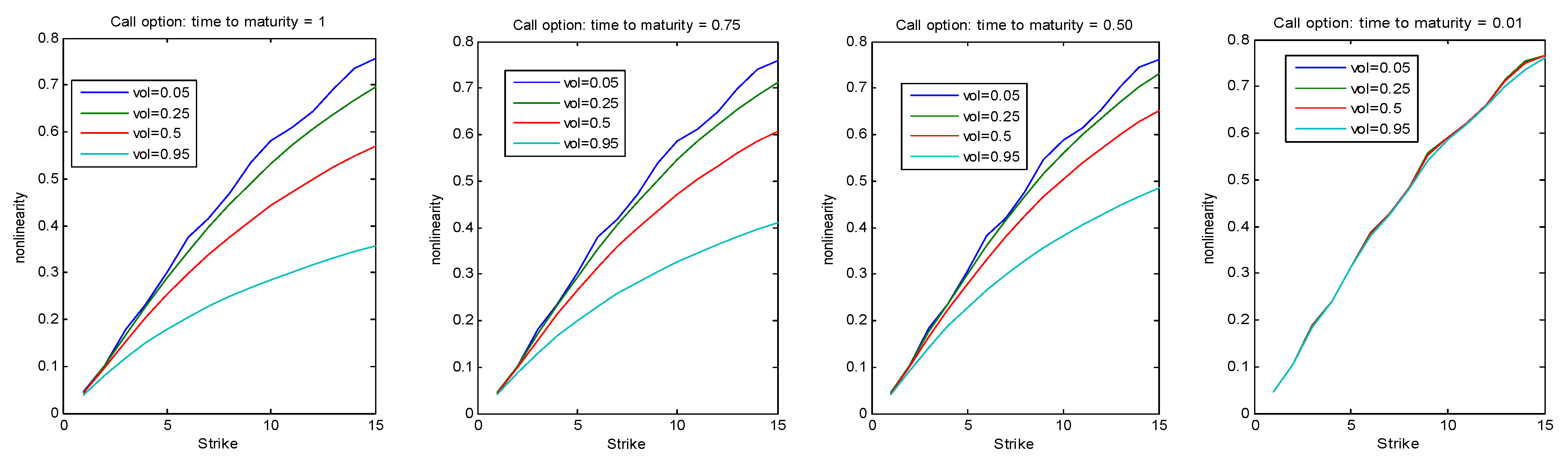

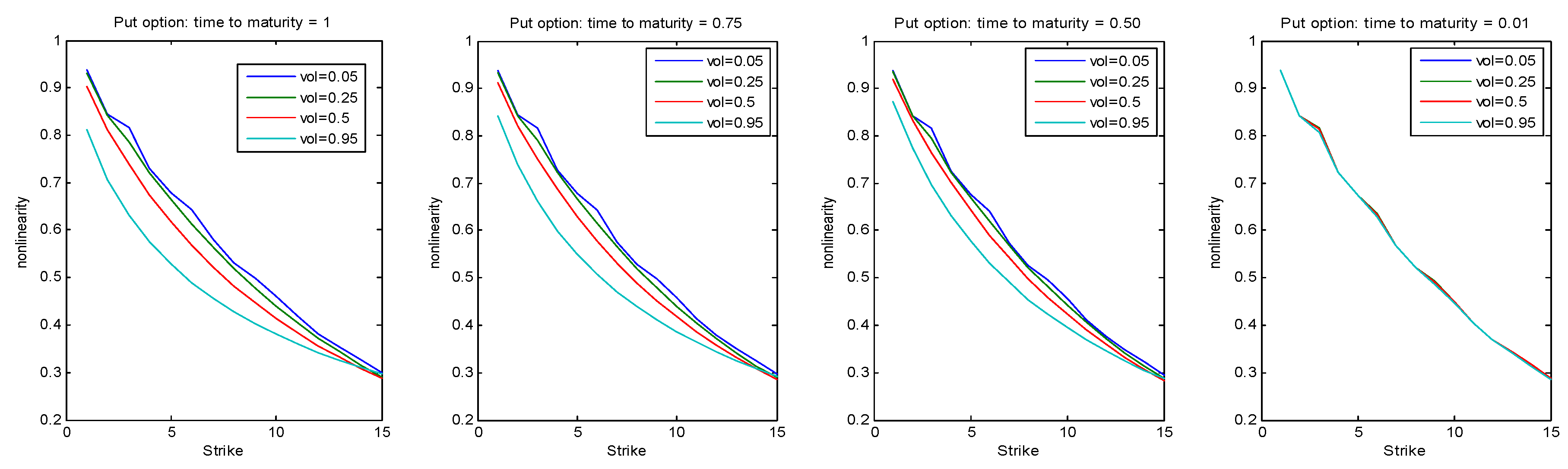

Figure 5 is drawn by assuming that

year,

,

and

. For a Call option (resp., Put options), nonlinearity increases (resp., decreases) in the strike

K for all values of volatility and time to maturity. For both types of options, the nonlinearity is decreasing in the volatility and time to maturity. The nonlinearity appears to be more sensitive in the volatility and time to maturity for a Call than for a Put.

8.2. Nonlinearity and Optimal Hedging

Assume that an investor wants to hold

units of a risk free asset (

) and

units of a risky asset (

) so as to hedge against the volatility of an asset

. This investor would form a hedge portfolio whose value is

. The hedging error is given by:

where

In practice, a perfect hedge that results in can rarely be achieved. Therefore, the best solution often consists of minimizing the variance of the hedging error with respect to the “hedge ratio” , which is the number of units of Asset to hold per unit of Asset . When is the payoff of an option and the price of the underlying asset, corresponds to the “delta” of the option (hence the expression “Delta Hedging”).

The optimal hedging problem boils down to the following minimization:

The optimal hedge ratio is given by

. However,

can be zero if

is nonlinearly exposed to

. In this case, one would wrongly conclude that Asset

is of no help for hedging against the fluctuations of

.

Now, suppose we have detected that

is nonlinear using the methodology proposed in this paper. A reasonable hedging strategy would therefore consist of first using state-of-the-art models to predict

as

and next linearizing

around this prediction to obtain:

An approximately optimal hedge ratio would then be given by:

This example underscores the importance of being aware of the presence of nonlinearity in assets returns for a sound portfolio risk management.

8.3. Empirical Application: Return-Risk Trade-Off on the SP500

In this section, I illustrate an empirical use of the measure of nonlinearity

by performing an analysis of the return-risk trade-off based on the

Merton’s (

1973) intertemporal capital asset pricing model (ICAPM). This model posits the following relation between the conditional expected return on the market index

and the conditional expected variance

:

where

is the risk free rate and

is the relative risk aversion coefficient of the representative agent. A multivariate version of the ICAPM is proposed in

Bollerslev et al. (

1988).

Ghysels et al. (

2005) employed a MIxed DAta Sampling (MIDAS) methodology to the CRSP value-weighted portfolio and concluded that “

there is a [positive] risk-return trade-off after all.” Previous studies who found a positive relationship between risk premium and expected risk include

French et al. (

1987) and

Campbell and Hentschel (

1992), in contrast with

Nelson (

1991) who find a negative relationship or

Glosten et al. (

1993) and

Harvey (

2001) whose conclusions are mixed.

Ghysels et al. (

2005) attributes the conflicting conclusions to differences in the models posited for the conditional variance.

Jacquier and Okou (

2014) suspect the differences in data frequencies to be responsible of the inconsistencies across findings. The empirical results of the current paper suggest that the controversy on the nature of the return-risk trade-off is mainly due to nonlinearity.

I consider estimating the following nonlinear version of the ICAPM:

If one assume that

and

are IID and Gaussian, Equations (

54) and (55) imply that:

As in the ICAPM, the conditional expected return

is increasing in conditional expected variance

. Unlike in the ICAPM, the relationship between the conditional expected return and the innovation on the log-variance process (

) is explicitly characterized. Namely, the conditional expected return is decreasing in the variance of

, as observed empirically by

French et al. (

1987). Finally, the market price of risk is a nonlinear function of the conditional expected variance.

I estimate the AR(1)

for the log-RV and compute the fitted values as

. These fitted values are the expected risk at time

t as perceived by investors at time

. The estimated coefficients are

(significant at

level) and

(significant at

level). The

of this regression is

and the estimated error variance is

.

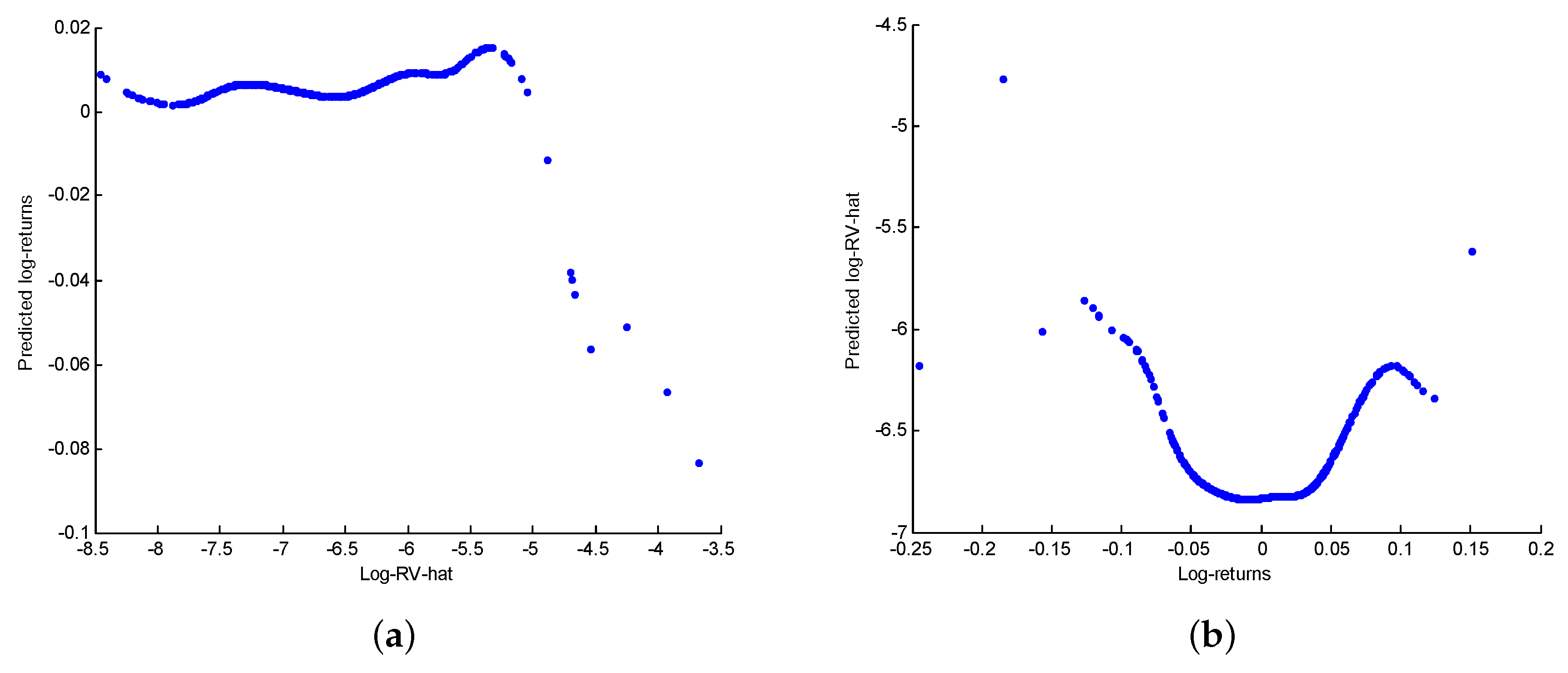

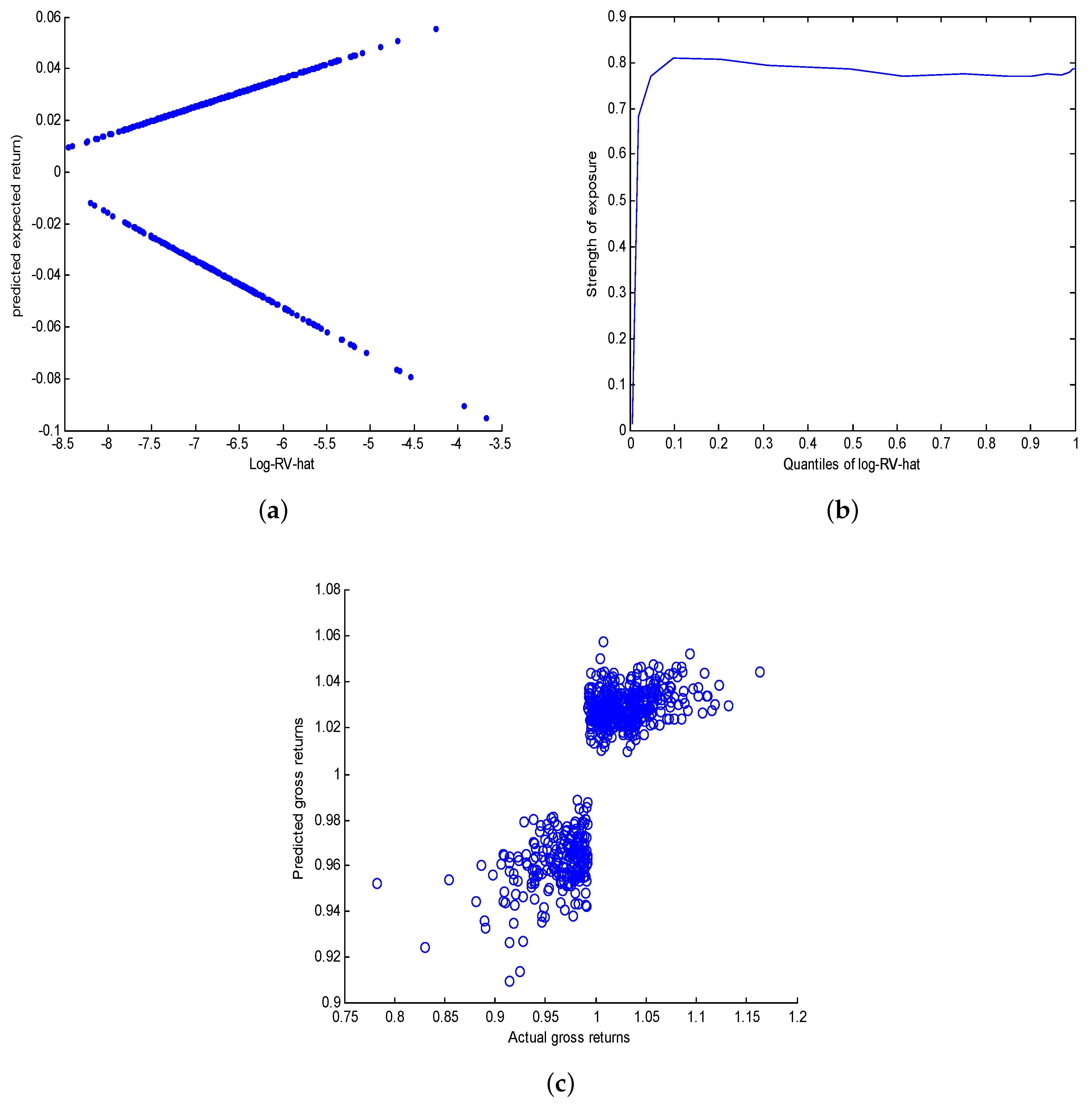

Figure 5a shows the scatter plot of

against

. Next, I regress the log-return

on

and a constant and compute the fitted values as

. This yields

and

. Neither of these coefficients is significant at

level and not surprisingly, the

of the regression is less than

. The poor fit provided but the linear regression of

onto

suggests that the relationship between these variable is nonlinear. This is confirmed by the nonparametric estimator of

shown by

Figure 2.

Figure 6a,b respectively show the estimated nonlinearity of

and

on increasing segments of the support of

and

. The scaling of the x-axis corresponds to the quantiles of the conditioning variable. For any pair

, the nonlinearity of

is computed on the segments

using the metrics

along with Gauss-Legendre’s polynomials, where:

For each

,

is obtained by spline interpolation based on

.

We see that the nonlinearity of increases fast and remains high after the 20th percentile of . By contrast, the nonlinearity of decreased on the first portion of the support of and increases steadily after the median. The point at which the nonlinearity of is minimized, , is a good candidate for the threshold of a piecewise linear model.

Figure 6c,d respectively show the strength of the exposure of

to

and

to

on increasing subsample of type

. The correlation of

and

approximately equals

on a large portion of the support of

while that of

and

is on average equal to

. This means that

fits

better than

fits

.

Acting on the fact that the

linearity of

reaches its

maximum at

, I estimate the following piecewise linear regression:

Let

denote the fitted values obtained from this piecewise linear regression.

Figure 7a shows the fitted regression lines while

Figure 7b plots the linear correlation between

and

against the quantiles of

. The correlation between

and

reaches

at the 10th percentile and remains above

thereafter. This strong nonlinear relationship between log-returns and log-realized volatility is completely missed by the naive linear regression of

onto

.

The estimated regression lines are:

The estimated error variances are respectively

for the first regime and

for the second regime. Finally, the estimated nonlinear return-risk trade-offs are:

Based on the equation, the unconditional correlation between the actual gross-returns and their predictions shown on

Figure 7c is

.

A natural implication of these results is that option pricing models should at least account for the presence of regimes or parameter uncertainty in the distribution of the returns on the underlying asset. Our findings provide a strong empirical support for regime switching models in which volatility influences returns (as in

Duan et al. 2002), heteroskedastic mixture models or Bayesian models that naturally account for parameter uncertainty (e.g.,

Rombouts and Stentoft 2014,

2015).