Jump Driven Risk Model Performance in Cryptocurrency Market

Abstract

:1. Introduction

2. Methodology

3. Data and Empirical Results

3.1. Data

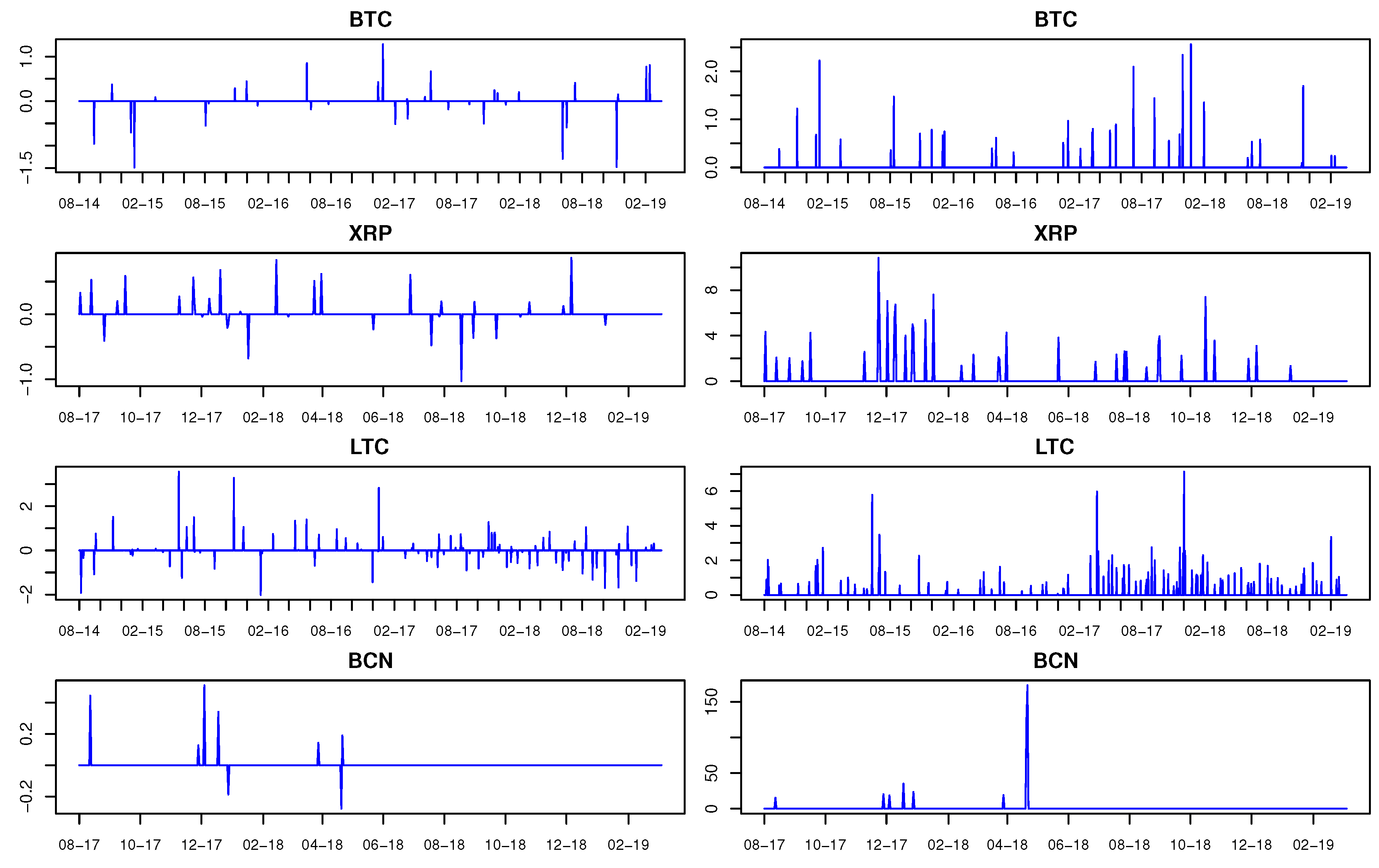

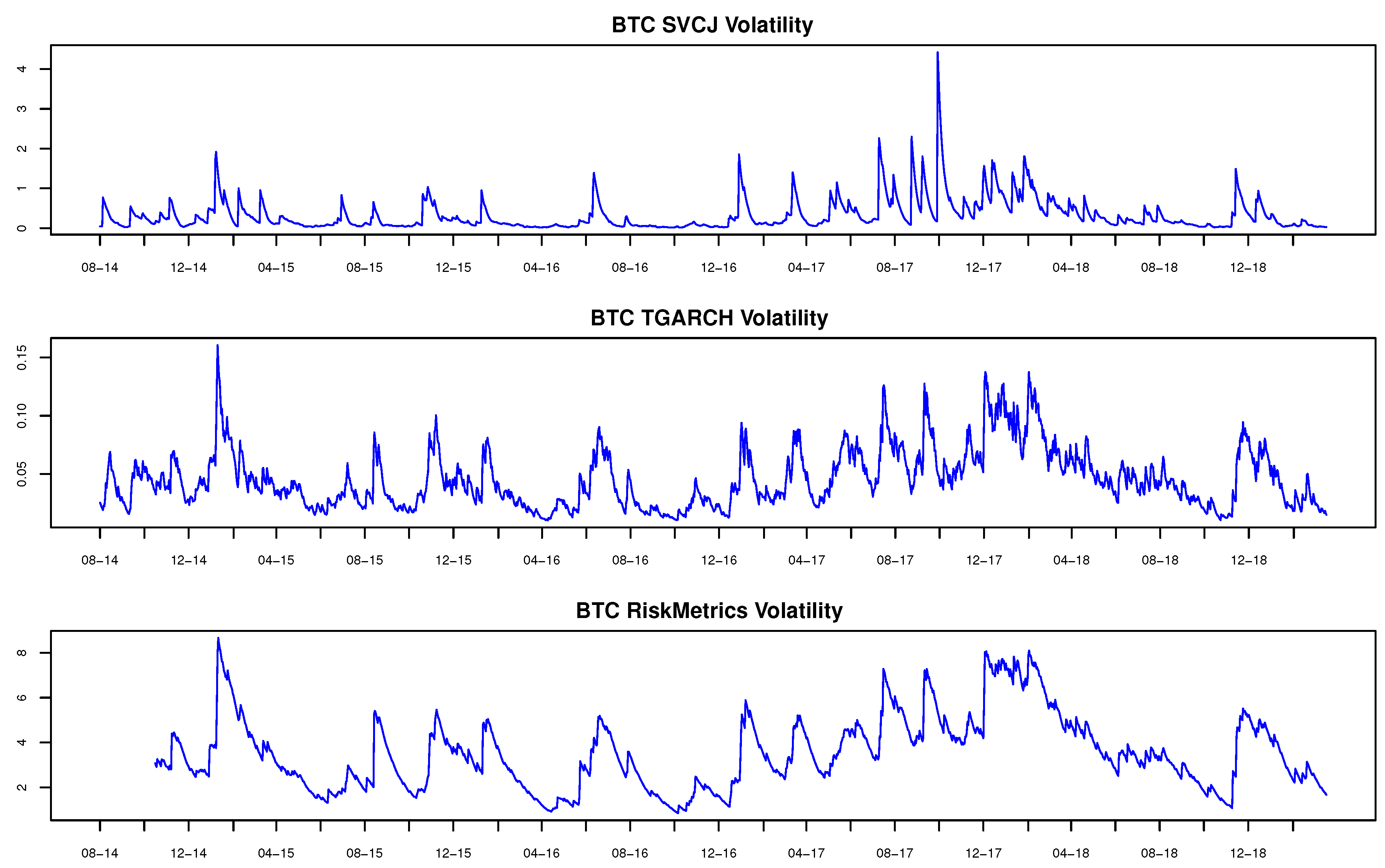

3.2. In-Sample Estimation

3.3. Out-of-Sample Validation

4. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

| GARCH | GARCH | IGARCH | IGARCH | TGARCH | TGARCH | GJR-GARCH | GJR-GARCH | |

|---|---|---|---|---|---|---|---|---|

| ∼t | ∼ Skewed t | ∼t | ∼ Skewed t | ∼t | ∼ Skewed t | ∼t | ∼ Skewed t | |

| Bitcoin (BTC) | ||||||||

| 0.191 (0.048) | 0.140 (0.058) | 0.191 (0.048) | 0.140 (0.057) | 0.175 (0.032) | 0.093 (0.040) | 0.197 (0.050) | 0.149 (0.056) | |

| −0.021 (0.026) | −0.021 (0.026) | −0.022 (0.026) | −0.021 (0.026) | −0.051 (0.023) | −0.055 (0.018) | −0.031 (0.031) | −0.032 (0.027) | |

| −0.043 (0.025) | −0.044 (0.025) | −0.043 (0.025) | −0.044 (0.025) | −0.059 (0.014) | −0.061 (0.024) | −0.048 (0.023) | −0.050 (0.025) | |

| 0.205 (0.090) | 0.210 (0.089) | 0.203 (0.077) | 0.207 (0.077) | 0.063 (0.030) | 0.066 (0.032) | 0.169 (0.175) | 0.173 (0.085) | |

| 0.171 (0.024) | 0.173 (0.024) | 0.171 (0.023) | 0.173 (0.023) | 0.254 (0.053) | 0.271 (0.061) | 0.195 (0.032) | 0.197 (0.030) | |

| 0.827 (0.025) | 0.825 (0.025) | 0.828 (NA) | 0.826 (NA) | 0.857 (0.021) | 0.852 (0.020) | 0.839 (0.049) | 0.837 (0.027) | |

| −0.141 (0.073) | −0.136 (0.071) | −0.073 (0.041) | −0.073 (0.032) | |||||

| shape | 3.385 (0.240) | 3.401 (0.242) | 3.377 (0.191) | 3.393 (0.193) | 2.517 (0.216) | 2.473 (0.218) | 3.417 (0.284) | 3.441 (0.246) |

| skewness | 0.951 (0.030) | 0.951 (0.030) | 0.930 (0.027) | 0.951 (0.030) | ||||

| LogLikelihood | −3333.9 | −3332.6 | −3333.7 | −3332.4 | −3315.8 | −3313.3 | −3331.4 | −3330.2 |

| AIC | 5.035 | 5.034 | 5.033 | 5.033 | 5.009 | 5.007 | 5.033 | 5.032 |

| Ripple (XRP) | ||||||||

| −0.256 (0.067) | −0.161 (0.083) | −0.256 (0.067) | −0.162 (0.082) | −0.220 (0.054) | −0.117 (0.041) | −0.250 (0.068) | −0.156 (0.083) | |

| 0.001 (0.028) | 0.001 (0.029) | 0.001 (0.028) | 0.001 (0.028) | −0.011 (0.028) | −0.098 (0.028) | 0.004 (0.028) | 0.005 (0.028) | |

| −0.040 (0.023) | −0.035 (0.025) | −0.040 (0.022) | −0.035 (0.025) | −0.047 (0.017) | −0.042 (0.025) | −0.041 (0.023) | −0.035 (0.025) | |

| 1.940 (0.776) | 1.843 (0.766) | 1.932 (0.671) | 1.834 (0.663) | 0.617 (0.196) | 0.632 (0.201) | 2.033 (0.806) | 1.933 (0.808) | |

| 0.375 (0.072) | 0.364 (0.073) | 0.374 (0.071) | 0.364 (0.072) | 0.640 (0.140) | 0.634 (0.139) | 0.425 (0.092) | 0.411 (0.095) | |

| 0.623 (0.080) | 0.634 (0.081) | 0.624 (NA) | 0.635 (NA) | 0.625 (0.051) | 0.620 (0.053) | 0.615 (0.081) | 0.627 (0.084) | |

| −0.055 (0.064) | −0.061 (0.064) | −0.083 (0.041) | −0.077 (0.032) | |||||

| shape | 3.025 (0.184) | 3.036 (0.187) | 3.023 (0.152) | 3.034 (0.154) | 2.370 (0.163) | 2.383 (0.165) | 3.014 (0.184) | 3.021 (0.187) |

| skewness | 1.062 (0.032) | 1.062 (0.032) | 1.057 (0.026) | 1.062 (0.032) | ||||

| LogLikelihood | −3778.7 | −3776.7 | −3778.6 | −3776.6 | −3759.5 | −3757.8 | −3778.1 | −3776.2 |

| AIC | 5.705 | 5.704 | 5.704 | 5.702 | 5.678 | 5.672 | 5.706 | 5.705 |

| Litecoin (LTC) | ||||||||

| −0.027 (0.034) | 0.043 (0.055) | −0.027 (0.044) | 0.043 (0.055) | −0.028 (0.040) | 0.046 (0.054) | −0.021 (0.044) | 0.054 (0.055) | |

| −0.084 (0.024) | −0.083 (0.022) | −0.084 (0.022) | −0.083 (0.022) | −0.086 (0.021) | −0.081 (0.022) | −0.086 (0.022) | −0.083 (0.022) | |

| −0.057 (0.021) | −0.076 (0.021) | −0.075 (0.021) | −0.076 (0.021) | −0.071 (0.021) | −0.072 (0.021) | −0.075 (0.021) | −0.074 (0.020) | |

| 0.181 (0.087) | 0.182 (0.085) | 0.179 (0.081) | 0.180 (0.081) | 0.126 (0.058) | 0.125 (0.059) | 0.139 (0.070) | 0.146 (0.071) | |

| 0.115 (0.027) | 0.115 (0.020) | 0.116 (0.018) | 0.116 (0.019) | 0.448 (0.066) | 0.421 (0.095) | 0.139 (0.024) | 0.143 (0.026) | |

| 0.883 (0.036) | 0.883 (0.020) | 0.883 (NA) | 0.883 (NA) | 0.859 (0.021) | 0.859 (0.021) | 0.900 (0.017) | 0.900 (0.017) | |

| −0.158 (0.086) | −0.169 (0.087) | −0.083 (0.023) | −0.086 (0.024) | |||||

| shape | 2.677 (0.119) | 2.679 (0.118) | 2.670 (0.075) | 2.672 (0.075) | 2.102 (0.006) | 2.117 (0.038) | 2.639 (0.114) | 2.631 (0.114) |

| skew | 1.063 (0.030) | 1.063 (0.030) | 1.056 (0.028) | 1.067 (0.031) | ||||

| LogLikelihood | −3610.6 | −3608.4 | −3610.4 | −3608.1 | −3588.6 | −3586.5 | −3604.0 | −3601.5 |

| AIC | 5.452 | 5.450 | 5.450 | 5.448 | 5.420 | 5.419 | 5.444 | 5.441 |

| Stellar (XLM) | ||||||||

| −0.407 (0.089) | −0.162 (0.111) | −0.407 (0.089) | −0.162 (0.111) | −0.385 (0.074) | −0.098 (0.040) | −0.384 (0.090) | −0.140 (0.113) | |

| −0.156 (0.028) | −0.162 (0.028) | −0.156 (0.028) | −0.162 (0.028) | −0.157 (0.025) | −0.157 (0.041) | −0.154 (0.028) | −0.156 (0.028) | |

| −0.061 (0.025) | −0.056 (0.024) | −0.061 (0.025) | −0.056 (0.024) | −0.062 (0.028) | −0.048 (0.019) | −0.057 (0.025) | −0.050 (0.025) | |

| 3.069 (1.197) | 3.046 (1.101) | 3.057 (1.127) | 3.037 (1.071) | 0.490 (0.179) | 0.474 (0.158) | 3.395 (1.246) | 3.377 (1.174) | |

| 0.272 (0.058) | 0.267 (0.056) | 0.272 (0.055) | 0.268 (0.051) | 0.305 (0.065) | 0.271 (0.054) | 0.341 (0.080) | 0.332 (0.080) | |

| 0.726 (0.058) | 0.731 (0.052) | 0.727 (NA) | 0.731 (NA) | 0.760 (0.048) | 0.775 (0.043) | 0.711 (0.056) | 0.718 (0.051) | |

| −0.195 (0.086) | −0.222 (0.089) | −0.106 (0.074) | −0.097 (0.073) | |||||

| shape | 3.073 (0.215) | 3.090 (0.224) | 3.069 (0.167) | 3.086 (0.170) | 2.738 (0.225) | 2.852 (0.244) | 3.043 (0.217) | 3.046 (0.224) |

| skew | 1.141 (0.039) | 1.141 (0.039) | 1.145 (0.033) | 1.138 (0.039) | ||||

| LogLikelihood | −4243.1 | −4235.6 | −4243.1 | −4235.5 | −4237.9 | −4230.5 | −4241.9 | −4243.5 |

| AIC | 6.405 | 6.395 | 6.404 | 6.394 | 6.399 | 6.389 | 6.405 | 6.395 |

| Monero (XMR) | ||||||||

| −0.064 (0.127) | 0.153 (0.154) | −0.067 (0.126) | 0.152 (0.155) | −0.021 (0.127) | 0.218 (0.106) | −0.031 (0.130) | 0.183 (0.156) | |

| −0.044 (0.025) | −0.044 (0.024) | −0.044 (0.026) | −0.044 (0.026) | −0.054 (0.027) | −0.053 (0.025) | −0.044 (0.026) | −0.043 (0.028) | |

| −0.024 (0.026) | −0.023 (0.026) | −0.024 (0.026) | −0.023 (0.025) | −0.031 (0.026) | −0.027 (0.023) | −0.024 (0.025) | −0.021 (0.026) | |

| 3.852 (1.275) | 3.633 (1.232) | 3.810 (1.271) | 3.570 (1.228) | 0.601 (0.181) | 0.569 (0.177) | 3.838 (1.265) | 3.655 (1.235) | |

| 0.235 (0.053) | 0.224 (0.051) | 0.244 (0.042) | 0.236 (0.042) | 0.199 (0.036) | 0.193 (0.035) | 0.265 (0.064) | 0.255 (0.063) | |

| 0.754 (0.042) | 0.762 (0.042) | 0.755 (NA) | 0.763 (NA) | 0.785 (0.039) | 0.794 (0.038) | 0.756 (0.042) | 0.764 (0.042) | |

| −0.185 (0.094) | −0.183 (0.093) | −0.076 (0.058) | −0.072 (0.056) | |||||

| shape | 3.420 (0.365) | 3.486 (0.374) | 3.358 (0.254) | 3.395 (0.264) | 3.432 (0.365) | 3.487 (0.371) | 3.448 (0.371) | 3.503 (0.378) |

| skew | 1.094 (0.039) | 1.094 (0.039) | 1.104 (0.036) | 1.094 (0.039) | ||||

| LogLikelihood | −4324.1 | −4320.9 | −4326.7 | −4322.9 | −4324.1 | −4321.0 | −4323.2 | −4320.1 |

| AIC | 6.527 | 6.524 | 6.533 | 6.529 | 6.526 | 6.523 | 6.527 | 6.524 |

| Dash (DASH) | ||||||||

| −0.057 (0.094) | 0.166 (0.116) | −0.057 (0.044) | 0.166 (0.166) | −0.089 (0.063) | 0.103 (0.069) | −0.074 (0.095) | 0.144 (0.116) | |

| −0.058 (0.028) | −0.049 (0.028) | −0.057 (0.028) | −0.049 (0.028) | −0.061 (0.024) | −0.062 (0.020) | −0.058 (0.027) | −0.052 (0.027) | |

| −0.055 (0.026) | −0.055 (0.026) | −0.055 (0.026) | −0.055 (0.026) | −0.065 (0.020) | −0.064 (0.017) | −0.054 (0.026) | −0.055 (0.026) | |

| 2.779 (0.814) | 2.616 (0.770) | 2.777 (0.809) | 2.615 (0.770) | 0.481 (0.140) | 0.448 (0.130) | 2.680 (0.788) | 2.486 (0.734) | |

| 0.290 (0.058) | 0.275 (0.056) | 0.291 (0.045) | 0.276 (0.043) | 0.292 (0.047) | 0.268 (0.042) | 0.244 (0.054) | 0.227 (0.051) | |

| 0.708 (0.045) | 0.723 (0.043) | 0.708 (NA) | 0.723 (NA) | 0.741 (0.040) | 0.755 (0.038) | 0.711 (0.044) | 0.725 (0.042) | |

| −0.141 (0.073) | −0.136 (0.071) | −0.073 (0.041) | −0.073 (0.032) | |||||

| shape | 3.313 (0.293) | 3.342 (0.309) | 3.309 (0.226) | 3.336 (0.292) | 3.147 (0.296) | 3.246 (0.313) | 3.367 (0.292) | 3.419 (0.310) |

| skew | 1.127 (0.039) | 1.127 (0.039) | 1.118 (0.035) | 1.129 (0.039) | ||||

| LogLikelihood | −4071.2 | −4065.3 | −4071.2 | −4070.6 | −4069.1 | −4064.0 | −4070.3 | −4064.3 |

| AIC | 6.145 | 6.139 | 6.145 | 6.140 | 6.145 | 6.138 | 6.146 | 6.139 |

| Bytecoin (BCN) | ||||||||

| −0.015 (0.147) | 0.184 (0.180) | −0.011 (0.145) | 0.199 (0.182) | 0.049 (0.147) | 0.308 (1.002) | −0.009 (0.149) | 0.203 (0.183) | |

| −0.221 (0.028) | −0.220 (0.028) | −0.221 (0.028) | −0.220 (0.028) | −0.240 (0.027) | −0.235 (0.026) | −0.221 (0.028) | −0.219 (0.028) | |

| −0.034 (0.026) | −0.033 (0.026) | −0.034 (0.025) | −0.034 (0.026) | −0.038 (0.025) | −0.036 (0.143) | −0.034 (0.026) | −0.033 (0.026) | |

| 8.810 (2.772) | 8.472 (2.630) | 8.972 (3.038) | 8.589 (2.891) | 0.829 (0.255) | 0.794 (0.244) | 8.795 (2.754) | 8.496 (2.610) | |

| 0.199 (0.052) | 0.193 (0.050) | 0.242 (0.045) | 0.237 (0.044) | 0.169 (0.034) | 0.167 (0.039) | 0.205 (0.059) | 0.207 (0.059) | |

| 0.759 (0.046) | 0.764 (0.044) | 0.757 (NA) | 0.762 (NA) | 0.806 (0.039) | 0.810 (0.038) | 0.760 (0.045) | 0.765 (0.043) | |

| −0.159 (0.120) | −0.197 (0.161) | −0.016 (0.066) | −0.033 (0.064) | |||||

| shape | 3.290 (0.336) | 3.345 (0.350) | 3.045 (0.198) | 3.075 (0.204) | 3.346 (0.340) | 3.398 (0.363) | 3.294 (0.337) | 3.351 (0.352) |

| skew | 1.065 (0.034) | 1.064 (0.034) | 1.078 (0.117) | 1.067 (0.035) | ||||

| LogLikelihood | −4737.8 | −4735.9 | −4738.3 | −4736.5 | −4738.3 | −4735.8 | −4737.8 | −4736.8 |

| AIC | 7.151 | 7.149 | 7.150 | 7.149 | 7.153 | 7.151 | 7.152 | 7.152 |

References

- Ali, Ghulam. 2013. EGARCH, GJR-GARCH, TGARCH, AVGARCH, NGARCH, IGARCH and APARCH models for pathogens at marine recreational sites. Journal of Statistical and Econometric Methods 2: 57–73. [Google Scholar]

- Andersen, Torben G., Luca Benzoni, and Jesper Lund. 2002. An empirical investigation of continuous-time equity return models. Journal of Finance 57: 1239–84. [Google Scholar] [CrossRef] [Green Version]

- Angelidis, Timotheos, Alexandros Benos, and Stavros Degiannakis. 2004. The use of GARCH models in VaR estimation. Statistical Methodology 1: 105–28. [Google Scholar] [CrossRef] [Green Version]

- Ardia, David, Keven Bluteau, and Maxime Rüede. 2019. Regime changes in Bitcoin GARCH volatility Dynamics. Finance Research Letters 29: 266–71. [Google Scholar] [CrossRef]

- Bakshi, Gurdip, Charles Cao, and Zhiwu Chen. 1997. Empirical performance of alternative option pricing models. Journal of Finance 52: 583–602. [Google Scholar] [CrossRef]

- Bariviera, Aurelio F., Maria José Basgall, Waldo Hasperué, and Marcelo Naiouf. 2017. Some stylized facts of the Bitcoin market. Physica A: Statistical Mechanics and Its Applications 484: 82–90. [Google Scholar] [CrossRef] [Green Version]

- Barone-Adesi, Giovanni, Kostas Giannopoulos, and Les Vosper. 1999. VaR without Correlations for Nonlinear Portfolios. Journal of Futures Markets 19: 583–602. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. 2013. Fundamental Review of the Trading Book: A Revised Market Risk Framework. Second Consultative Paper. Switzerland: Bank for International Settlement. [Google Scholar]

- Bates, David. 1996. Jump and Stochastic Volatility: Exchange Rate Processes Implicit in Deutsche Mark Options. The Review of Financial Studies 9: 69–107. [Google Scholar] [CrossRef]

- Bauwens, Luc, and Sébastien Laurent. 2005. A New Class of Multivariate Skew Densities, With Application to Generalized Autoregressive Conditional Heteroscedasticity Models. Journal of Business & Economic Statistics 23: 346–54. [Google Scholar]

- Bernanke, Ben S. 2008. Risk management in financial institutions. Presented at the Federal Reserve Bank of Chicago’s Annual Conference on Bank Structure and Competition, Chicago, IL, USA, May 15. [Google Scholar]

- Brownlees, Christian T., and Robert F. Engle. 2012. Volatility, Correlation and Tails for Systemic Risk Measurement. Working Paper, NYU, New York, NY, USA. Available online: http://https://www.semanticscholar.org/paper (accessed on 12 February 2019).

- Caporale, Guglielmo, and Timur Zeokokh. 2019. Modelling volatility of cryptocurrencies using Markov-Switching GARCH models. Research in International Business and Finance 48: 143–55. [Google Scholar] [CrossRef]

- Chan, Stephen, Jeffrey Chu, Saralees Nadarajah, and Joerg Osterrieder. 2017. A statistical analysis of cryptocurrencies. Journal of Risk Financial Management 10: 2–32. [Google Scholar] [CrossRef] [Green Version]

- Christoffersen, Peter F. 1998. Evaluating Interval Forecasts. International Economic Review 39: 841–62. [Google Scholar] [CrossRef]

- Danielsson, Jon, and Yuji Morimoto. 2000. Forecasting Extreme Financial Risk: A Critical Analysis of Practical Methods for the Japanese Market. Monetary and Economic Studies 18: 25–48. [Google Scholar]

- Danielsson, Jon, Kevin R. James, Marcela Valenzuela, and Ilknur Zer. 2016. Model risk of risk models. Journal of Financial Stability 23: 79–91. [Google Scholar] [CrossRef] [Green Version]

- Duffie, Darrell, Jun Pan, and Kenneth Singleton. 2000. Transform analysis and asset pricing for affine jump-diffusions. Econometrica 68: 1343–76. [Google Scholar] [CrossRef] [Green Version]

- Efron, Bradley, and Robert J. Tibshirani. 1994. An Introduction to the Bootstrap. New York: Chapman & Hall/CRC, pp. 141–152. [Google Scholar]

- Eraker, Bjørn, Michael Johannes, and Nicholas Polson. 2003. The impact of jumps in volatility and returns. Journal of Finance 59: 227–60. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jaganathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the normal excess return on stocks. Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Heston, Steven L. 1993. A Closed-Form Solution of Options with Stochastic Volatility with Applications to Bond and Currency Options. The Review of Financial Studies 6: 327–43. [Google Scholar] [CrossRef] [Green Version]

- Jorion, Philippe. 2000. Risk Management Lessons from Long-Term Capital Management. European Financial Management 6: 277–300. [Google Scholar] [CrossRef]

- J.P.Morgan/Reuters. 1996. RiskMetrics—Technical Document, 4th ed. New York: J.P.Morgan/Reuters. [Google Scholar]

- Maheu, John M., and Thomas H. McCurdy. 2004. News Arrival, Jump Dynamics, and Volatility Components for Individual Stock Returns. The Journal of Finance 59: 755–93. [Google Scholar] [CrossRef] [Green Version]

- McNeil, Alexander J., Rúdiger Frey, and Paul Embrechts. 2005. Quantitative Risk Management. Princeton: Princeton University Press. [Google Scholar]

- Pan, Jun. 2002. The jump-risk premia implicit in options: Evidence from an integrated time-series study. Journal of Financial Economics 63: 3–50. [Google Scholar] [CrossRef] [Green Version]

- Sarma, Mandira, Susan Thomas, and Ajay Shah. 2003. Selection of Value-at-Risk models. Journal of Forecasting 22: 337–58. [Google Scholar] [CrossRef]

- Segnon, Mawuli, and Stelios Bekiros. 2019. Forecasting Volatility in Cryptocurrency Markets. CQE Working Papers 7919. Münster: Center for Quantitative Economics (CQE), University of Muenster, Available online: www.uni-munster.de (accessed on 12 February 2019).

- Su, Jung-Bin, and Jui-Cheng Hung. 2011. Empirical analysis of jump dynamics, heavy-tails and skewness on value-at-risk estimation. Economic Modelling 28: 1117–30. [Google Scholar] [CrossRef]

- Ze-To, Samuel Y. M. 2012. Crisis, Value at Risk and Conditional Extreme Value Theory via the NIG + Jump Model. Journal of Mathematical Finance 2: 225–37. [Google Scholar] [CrossRef] [Green Version]

| 1. | The term “London Whale” was based on the enormous size of the bet on credit default swaps made by the London office of the bank’s risk management division. |

| 2. | |

| 3. | Interestingly, JPM CEO Jaime Dimon had initially described the problem as “a tempest in a teapot”. |

| 4. | Other volatility forecasting models would include ARCH, GARCH, I-GARCH, GARCH-M, GJR-GARCH, and TARCH, for example. However, it is very tough to generalize the statement because results from the above models may vary due to differences in assets, data, and time period under study. See, for example, Ali (2013). |

| 5. | The probability of an exception does not depend on the previous day’s outcome. |

| 6. | ), and . |

| 7. | In fact, Facebook is planning to introduce a cryptocurrency, appropriately named as ’Stablecoin’ for its “WhatsApp” platform. |

| 8. | Our sample of cryptocurrencies captures market dynamics for various market capitalizations, ranging from high to low. Among the largest market caps (22 May 2019), we have Bitcoin ($136.13 billion) and XRP ($15.88 billion), in the middle market cap category, we have Litecoin ($5.44 billion), and Bytecoin ($0.169 billion) represents the small market cap category. |

| 9. | It is important to acknowledge that there are significant differences in the quality of data that are available at multiple sites including CoinAPI, Cryptodatadownload, Cryptocompare, Coinmarketcap, and Coingecko. According to Alexander and Dakos (2019), some of these data are traded prices while others are non-traded prices issued by the exchanges, leading to questionable results in empirical studies. |

| Mean | StDev | Min | Max | Skewness | Kurtosis | AR1 | AR2 | ||

|---|---|---|---|---|---|---|---|---|---|

| BTC | 0.010 | 0.166 | −0.146 | 1.788 | 3.609 | 22.78 | 0.091 | 0.117 | |

| XRP | 0.037 | 0.355 | −0.309 | 6.190 | 5.546 | 65.93 | 0.421 | 0.048 | |

| LTC | 0.016 | 0.248 | −0.136 | 4.789 | 9.196 | 130.18 | 0.880 | 0.766 | |

| XLM | 0.015 | 0.213 | −0.206 | 3.808 | 5.532 | 68.53 | 0.037 | 0.039 | |

| XMR | 0.007 | 0.134 | −0.147 | 1.306 | 2.998 | 15.12 | 0.733 | 0.423 | |

| DASH | 0.012 | 0.175 | −0.196 | 1.595 | 2.705 | 12.23 | 0.671 | 0.180 | |

| BCN | 0.009 | 0.163 | −0.157 | 3.049 | 6.775 | 95.30 | 0.234 | 0.117 |

| BTC | XRP | LTC | XLM | XMR | DASH | BCN | |

|---|---|---|---|---|---|---|---|

| 0.023 | −0.042 | −0.003 | −0.046 | −0.009 | −0.020 | −0.032 | |

| (0.007) | (0.023) | (0.009) | (0.016) | (0.018) | (0.014) | (0.042) | |

| 0.088 | 0.162 | 0.055 | 0.309 | 0.356 | 0.188 | 0.108 | |

| (0.003) | (0.016) | (0.002) | (0.006) | (0.015) | (0.005) | (0.230) | |

| 0.091 | 0.314 | 0.165 | 0.168 | 0.132 | 0.186 | 0.505 | |

| (0.009) | (0.025) | (0.010) | (0.012) | (0.016) | (0.016) | (0.138) | |

| −0.002 | −0.003 | 0.004 | 0.003 | 0.001 | 0.000 | 0.002 | |

| (0.031) | (0.050) | (0.040) | (0.030) | (0.030) | (0.028) | (0.048) | |

| 2.37 | 1.83 | 7.05 | 1.92 | 1.92 | 1.51 | 1.76 | |

| (0.068) | (0.065) | (0.105) | (0.065) | (0.067) | (0.050) | (0.062) | |

| 0.038 | 0.106 | 0.093 | 0.050 | 0.061 | 0.079 | 0.025 | |

| (0.007) | (0.017) | (0.010) | (0.009) | (0.012) | (0.011) | (0.011) | |

| 0.732 | 2.509 | 1.079 | 3.787 | 1.583 | 1.796 | 2.747 | |

| (0.110) | (0.383) | (0.107) | (0.531) | (0.240) | (0.224) | (11.747) | |

| 0.011 | 0.029 | 0.010 | 0.041 | 0.034 | 0.021 | 0.162 | |

| (0.003) | (0.008) | (0.002) | (0.007) | (0.011) | (0.004) | (0.046) | |

| 0.012 | −0.016 | 0.002 | 0.006 | 0.005 | −0.020 | 0.007 | |

| (0.021) | (0.041) | (0.026) | (0.023) | (0.023) | (0.022) | (0.040) | |

| 0.000 | 0.003 | 0.001 | 0.000 | 0.001 | 0.001 | 0.000 | |

| (0.001) | (0.013) | (0.024) | (0.005) | (0.012) | (0.010) | (0.001) | |

| MSE | 0.854 | 0.853 | 0.869 | 0.837 | 0.878 | 0.853 | 0.826 |

| BTC | XRP | LTC | XLM | XRM | DASH | BCN | |

|---|---|---|---|---|---|---|---|

| 0.093 | −0.117 | 0.046 | −0.098 | 0.218 | 0.103 | 0.308 | |

| (0.040) | (0.041) | (0.054) | (0.040) | (0.106) | (0.069) | (1.002) | |

| −0.055 | −0.098 | −0.081 | −0.157 | −0.053 | −0.062 | −0.235 | |

| (0.018) | (0.028) | (0.022) | (0.041) | (0.025) | (0.020) | (0.026) | |

| −0.061 | −0.042 | −0.072 | −0.048 | −0.027 | −0.064 | −0.036 | |

| (0.024) | (0.025) | (0.021) | (0.019) | (0.023) | (0.017) | (0.143) | |

| 0.066 | 0.632 | 0.125 | 0.474 | 0.569 | 0.448 | 0.794 | |

| (0.032) | (0.201) | (0.059) | (0.158) | (0.177) | (0.130) | (0.244) | |

| 0.271 | 0.634 | 0.421 | 0.271 | 0.193 | 0.268 | 0.167 | |

| (0.061) | (0.139) | (0.095) | (0.054) | (0.035) | (0.042) | (0.039) | |

| 0.852 | 0.620 | 0.859 | 0.775 | 0.794 | 0.755 | 0.810 | |

| (0.020) | (0.053) | (0.021) | (0.043) | (0.038) | (0.038) | (0.038) | |

| −0.136 | −0.061 | −0.169 | −0.222 | −0.183 | 0.066 | −0.197 | |

| (0.071) | (0.064) | (0.087) | (0.089) | (0.093) | (0.073) | (0.161) | |

| Shape | 2.473 | 2.383 | 2.117 | 2.852 | 3.487 | 3.246 | 3.398 |

| (0.218) | (0.026) | (0.038) | (0.244) | (0.371) | (0.313) | (0.363) | |

| Skewness | 0.930 | 1.057 | 1.056 | 1.145 | 1.104 | 1.118 | 1.078 |

| (0.027) | (0.026) | (0.028) | (0.033) | (0.036) | (0.035) | (0.117) | |

| LogLikelihood | −3315.8 | −3757.8 | −3586.5 | −4230.5 | −4321 | −4064 | −4735.8 |

| AIC | 5.007 | 5.672 | 5.419 | 6.389 | 6.523 | 6.138 | 7.151 |

| SVCJ | TGARCH | RM | |||||||

|---|---|---|---|---|---|---|---|---|---|

| VaR (%) | ES (%) | VaR (%) | ES (%) | VaR (%) | ES (%) | ||||

| 1% Level | |||||||||

| BTC | 0.660 | 6.89 | 9.41 | 0.499 | 9.23 | 13.96 | 0.017 | 8.91 | 13.24 |

| XRP | 0.047 | 11.34 | 16.74 | 0.993 | 9.62 | 12.36 | 0.476 | 12.90 | 19.53 |

| LTC | 0.177 | 11.45 | 17.05 | 0.407 | 12.74 | 19.80 | 0.017 | 11.72 | 19.00 |

| XLM | 0.053 | 15.99 | 22.43 | 0.408 | 10.13 | 12.60 | 0.047 | 14.38 | 21.35 |

| XMR | 0.289 | 10.76 | 15.13 | 0.289 | 10.94 | 14.67 | 0.940 | 15.11 | 21.96 |

| DASH | 0.083 | 9.42 | 13.67 | 0.452 | 11.91 | 15.85 | 0.256 | 13.57 | 19.77 |

| BCN | 0.098 | 17.79 | 24.78 | 0.365 | 18.10 | 20.75 | 0.630 | 24.62 | 37.38 |

| 5% Level | |||||||||

| BTC | 0.401 | 2.49 | 5.09 | 0.998 | 4.38 | 7.52 | 0.181 | 4.67 | 7.55 |

| XRP | 0.623 | 4.34 | 8.65 | 0.499 | 4.85 | 7.70 | 0.913 | 6.94 | 11.07 |

| LTC | 0.446 | 5.04 | 9.10 | 0.842 | 5.74 | 10.25 | 0.001 | 5.88 | 10.06 |

| XLM | 0.239 | 5.38 | 11.57 | 0.457 | 5.17 | 7.87 | 0.150 | 7.99 | 12.40 |

| XMR | 0.296 | 3.49 | 7.89 | 0.159 | 5.94 | 8.96 | 0.163 | 8.37 | 12.94 |

| DASH | 0.404 | 3.66 | 7.13 | 0.235 | 6.78 | 9.85 | 0.649 | 7.54 | 11.69 |

| BCN | 0.050 | 5.75 | 12.61 | 0.348 | 10.20 | 14.50 | 0.256 | 13.02 | 21.04 |

| 1% Level | 5% Level | |||||

|---|---|---|---|---|---|---|

| SVCJ | TGARCH | RM | SVCJ | TGARCH | RM | |

| BTC | 0.334 | 0.798 | Fail | 0.137 | 0.610 | 0.703 |

| XRP | Fail | 0.999 | 0.999 | 0.701 | 0.871 | 0.708 |

| LTC | 0.996 | 0.999 | Fail | 0.881 | 0.998 | Fail |

| XLM | 0.685 | 0.999 | Fail | 0.984 | 0.940 | 0.390 |

| XMR | 0.753 | 0.509 | 0.923 | 0.281 | 0.788 | 0.896 |

| DASH | 0.539 | 0.533 | 0.920 | 0.000 | 0.982 | 0.234 |

| BCN | 0.546 | 0.865 | 0.957 | 0.571 | 0.971 | 0.907 |

| SVCJ vs. TGARCH | SVCJ vs. RM | TGARCH vs. RM | ||||

|---|---|---|---|---|---|---|

| B | p-Value | B | p-Value | B | p-Value | |

| 1% Level | ||||||

| BTC | 277 | 1.0000 | SVCJ | TGARCH | ||

| XRP | TGARCH | RM | 4 | 0.0000 | ||

| LTC | 155 | 0.0023 | SVCJ | TGARCH | ||

| XLM | 287 | 1.0000 | SVCJ | TGARCH | ||

| XMR | 176 | 0.2480 | 100 | 0.0000 | 8 | 0.0000 |

| DASH | 147 | 0.0001 | 105 | 0.0000 | 56 | 0.0000 |

| BCN | 234 | 1.0000 | 162 | 0.0159 | 12 | 0.0000 |

| 5% Level | ||||||

| BTC | 93 | 0.0000 | 209 | 0.9975 | 147 | 0.0001 |

| XRP | 86 | 0.0000 | 85 | 0.0000 | 2 | 0.0000 |

| LTC | 131 | 0.0000 | 112 | 0.0000 | 157 | 0.0034 |

| XLM | 185 | 0.6030 | SVCJ | TGARCH | ||

| XMR | 95 | 0.0000 | 27 | 0.0000 | 0 | 0.0000 |

| DASH | 77 | 0.0000 | 40 | 0.0000 | 46 | 0.0000 |

| BCN | 130 | 0.0000 | 96 | 0.0000 | 43 | 0.0000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nekhili, R.; Sultan, J. Jump Driven Risk Model Performance in Cryptocurrency Market. Int. J. Financial Stud. 2020, 8, 19. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs8020019

Nekhili R, Sultan J. Jump Driven Risk Model Performance in Cryptocurrency Market. International Journal of Financial Studies. 2020; 8(2):19. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs8020019

Chicago/Turabian StyleNekhili, Ramzi, and Jahangir Sultan. 2020. "Jump Driven Risk Model Performance in Cryptocurrency Market" International Journal of Financial Studies 8, no. 2: 19. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs8020019