1. Introduction

Over the past decade, cardless banking (CB) has emerged as an important tool in the reduction of financial crime and the protection of consumers’ sensitive information leakage to identity thefts. Generally, financial crime is described as financial loss through unlawful activities such as fraud, tax evasion, and money laundering (

Ofori-Dwumfuo and Gyimah 2013). During the last 40 years, financial crime, also described as a white-collar crime, has become an issue of global, governmental, and industrial concern. Moreover, it is defined as a nonviolent offence committed by or against an individual or corporation resulting in financial loss (

Frunza 2016;

Reuters 2018). In Malaysia, financial crime refers to cases involving cheque cloning, Automated Teller Machines (ATM) and credit card fraud, “Fly by Night” scams, Internet fraud such as spoofing, love scams, parcel scams, email hacking as well, as money laundering (

PWC 2018). Malaysians lost nearly RM1.3 billion due to financial crime from January to August 2017. The Commercial Crime Investigation Department (CCID) of Malaysia investigated 26,548 cases of financial crime and reported a 42% increase in the year 2017 (

PWC 2018). Although banks are considered the most protected and secure institutions providing security to their customers against financial crime, bank customers are still unable to avoid monetary loss.

The monetary loss suffered by customers was found to seriously damage banks’ reputations and to negatively affect customer loyalty and shareholders’ confidence (

Lim et al. 2017). Banks continuously strive to discover efficient methods to provide financial security and convenience to their customers by developing and upgrading their services. CB is a service provided by banks to protect their customers from falling prey to card fraud (

Lim et al. 2017). Furthermore, CB enables customers to virtually access, withdraw, and manage their funds. Today’s customers live in a stressful and globalised society and expect banks to provide innovative methods of accessing and managing their funds. Even though the usage of digital and card payment channels is continuously rising, there are times when cash is still needed as it is a widely preferred and accepted medium of exchange for goods and services. Based on these expectations, many global banks have introduced CB as a means to provide convenience and security to their customers.

CB falls under the category of mobile banking technology, which includes initiating a transaction through mobile phone devices and accessing and managing funds through authentication codes. Despite this, there are key differences in these technologies. For instance, CB users are required to provide physical proof of identity through audio, video, and biometric scanning to authenticate, access, and withdraw funds unlike mobile banking (

Pons and Polak 2008). Furthermore, while mobile banking codes are only valid for short intervals, CB banking codes are valid for longer durations, which allow customers to conveniently withdraw cash at the nearest Automated Teller Machine (ATM) (

Valentine 2014). CB is more secure compared to mobile banking as it requires dual authentication codes for the transaction (

Istrate 2014) and the amount of cash withdrawn is limited compared to mobile banking, which allows users to transfer and pay lower amounts.

The commercial use of CB on a global scale was started by Webster Bank in the United States through biometric technology in the form of fingerprint authentication. Webster bank customers used Apple’s touch identification to login and check their balance and transaction history or to initiate cash withdrawal without a bank card (

Banking Technology 2015). Because of its convenience and security features as well as its potential influence to minimise financial crime, it gained huge popularity in the banking industry (

FIS 2015). The attractive benefits and security features also drew in a growing number of consumers who have already adopted or are planning to adopt this technology. Furthermore, the increase in customers’ interest in adopting this technology generates revenue for banks and allows them to enhance the range of their products and services.

CB technology in general and the CB system in particular are both developing at a rapid pace; this has created uncertainty among consumers. Because of the associated risks and the lack of knowledge of the benefits of CB, consumers hesitate to use this technology as the perceived risks may be overwhelming compared to the traditional method of banking. Additionally, CB is viewed as a form of complicated technology, where consumers’ judgements about the capabilities (such as required knowledge, skill, and self-efficacy) to use the technology may impact their intentions. According to the Global Mobile Banking Report (

KPMG 2015), the mobile banking adoption rate has increased by 43% and it was projected that, by 2019, there will be 1.8 billion mobile banking users. Bank Negara Malaysia’s (BNM) recent statistics also show that mobile banking has a penetration rate of 42.8%, which is an optimistic indication for CB banking developers of the increase in consumer intentions to adopt the technology (

BNM 2018). Although previous studies have analysed Internet and mobile banking adoption in Malaysia (

Mansour 2016;

Nor and Pearson 2009;

Poon 2008;

Low et al. 2017;

Hanudin et al. 2007;

Amin et al. 2012;

Tan et al. 2010), there has been little or no research analysing the intentions to use CB, especially in the context of Malaysia.

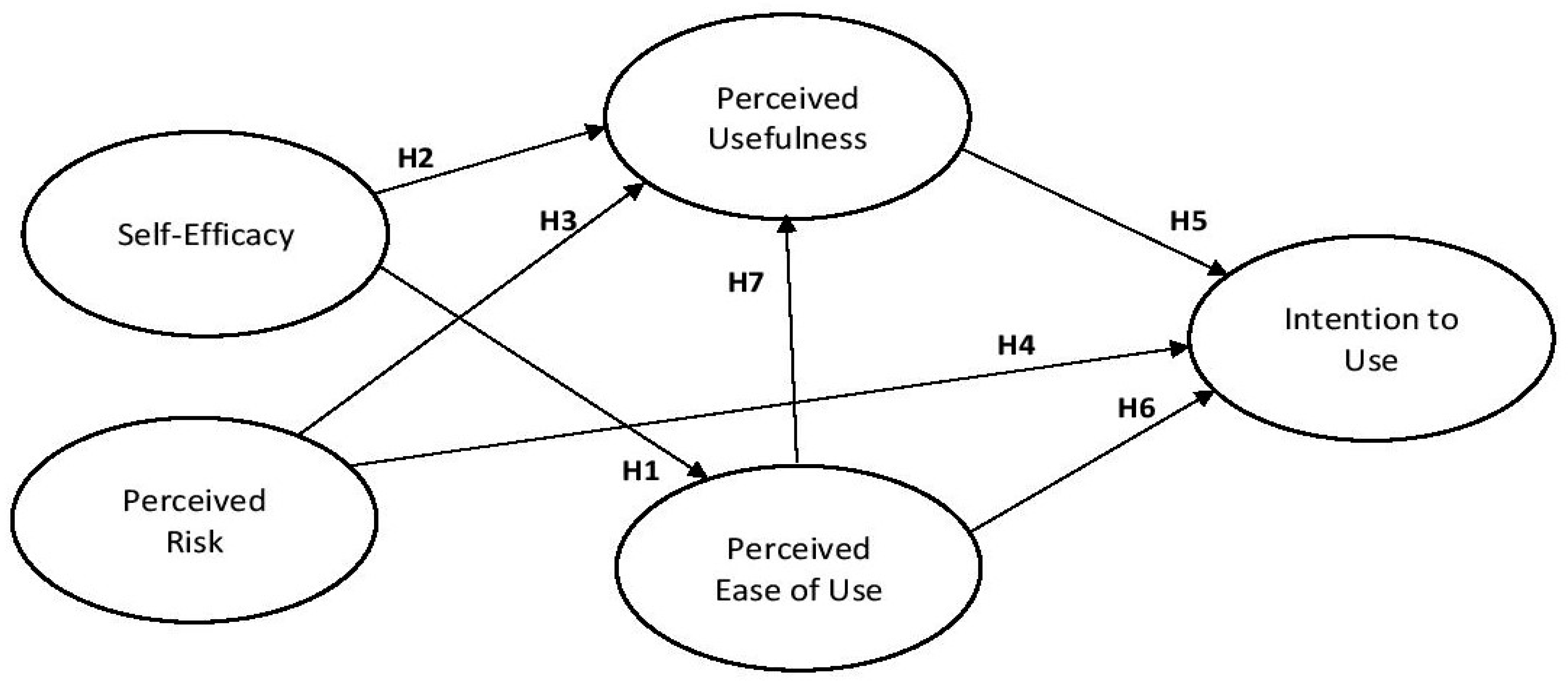

Based on the preceding discussion, the present study aims to develop and test a comprehensive conceptual framework to analyse the acceptance of a CB system in Malaysia. To achieve the objective of this study, the Technology Acceptance Model (TAM) is used to test and propose the extended framework (

Davis 1989). The proposed model contains two additional constructs of perceived self-efficacy and perceived risk in addition to perceived ease of use and perceived usefulness. Furthermore, the present study aims to analyse the impact of self-efficacy on perceived usefulness and perceived ease of use as well as the impact of perceive risk on perceived usefulness and intention to use. Finally, this study focuses on analysing the relationship between perceived usefulness, perceived ease of use, and behavioural intentions to use CB technology. The remaining paper proceeds as follows:

Section 2 outlines the literature review and conceptual framework adopted in this study.

Section 3 discusses the methodology.

Section 4 presents the findings and analysis, and lastly,

Section 5 presents the discussion, conclusion, and implications of this study.

3. Methodology

The data for this study were collected from 20 February 2019 to 20 March 2019 through a self-administrated questionnaire from 447 CB users in 5 branches located in Kuala Lumpur and Selangor states of Malaysia. The non-random convenience sampling technique was adopted for data collection. The sampling population was comprised of Maybank and Hong Leong bank customers who heard of or have used CB in the past. The reason we limit population sampling on these customers is due to the expectation that they have substantial experience and knowledge of using CB since Maybank and Hong Leong Bank are the pioneers of CB in Malaysia. Because of this, the customers from these banks were considered appropriate respondents for this study. These walk-in customers were approached politely and were asked if they were willing to participate in the survey. A brief background of CB and the purpose of the survey was provided in the introduction of each questionnaire.

The survey questionnaire was divided into two sections: section A contained demographics of the respondents, and section B comprised of 22 sub-items. These items were adopted from a slight modification of TAM. This study specially adopted TAM as it was widely put into use by the scholars in the past to predict and foresee individuals’ behaviour in the acceptance of technology (

Davis 1989;

Dishaw and Strong 1999;

Carey and Day 2005). Perceived ease of use (PEOU) and perceived usefulness (PU) were measured by four items and were adopted from

Davis (

1989). Self-efficacy (SE) was measured by five items adopted from

Compeau and Higgins (

1995), while perceived risk (PR) was measured using 4 items adopted from

Im et al. (

2008). Finally, behavioural intention to use (IU) was measured using 5 items adopted from

Davis et al. (

1992). Respondents were then required to answer a question using a five-point Likert scale that ranged from strongly disagree (1) to strongly agree (5).

A total of 470 questionnaires were circulated; however, only 457 were returned by respondents, which shows a return rate of 97.23%. For data analysis, 447 questionnaires were considered suitable to use as the remaining 10 were found incompletely responded. To test this proposed model, a two-step approach was adopted based on a previous study of

Fornell and Larcker (

1981). The model was tested through a principal component analysis (PCA) and structural equation model (SEM) analysis.

5. Discussion and Conclusions

The purpose of this study was to propose and test a theoretical model to analyse consumers’ behavioural intentions to use the cardless banking system in Malaysia. The study used an extended version of TAM to empirically examine the relationship between two exogenous variables (self-efficacy and perceived risk) and three endogenous variables (perceived usefulness, perceived ease of use, and behavioural intention).

The findings of this study indicate that self-efficacy has a positive impact on perceived ease of use (H1-path coefficient = 0.16). This finding is consistent with prior studies (

Singh and Srivastava 2020;

Mutahar et al. 2018;

Ozturk 2016) which confirm that consumers with a higher level of self-efficacy are more likely to use cashless payment technologies. On the other hand, findings related to H2 (path coefficient = 0.04) reveal that self-efficacy does not positively impact perceived usefulness. The findings for H3 (path coefficient = −0.38) and H4 (path coefficient = −0.36) confirm that perceived risk has a negative impact on perceived usefulness and intention to use. Overall, these results are parallel with the findings of prior studies such as

Zhu et al. (

2012),

Ozturk (

2016), and

Chawla and Joshi (

2020), which support the idea that perceived risk has a negative influence on perceived usefulness and intention to use cashless payment technology.

Alternatively, the findings further indicate that perceived usefulness (H5-path coefficient = 0.45) and perceived ease of use (H6-path coefficient = 0.43) have the strongest impacts on intention to use. These results are compatible with previous studies (

Kucukusta et al. 2015;

Ozturk 2016;

Lai 2017;

Singh and Srivastava 2020;

Ramesh et al. 2020;

Ananda et al. 2020) which found that perceived usefulness and perceived ease of use are the major factors in determining behavioural intention towards technology adoption. Lastly, the study supported H7 (path coefficient = 0.41), which proved that perceived ease of use significantly influences perceived usefulness. This result is consistent with

Shaw and Kesharwani (

2019), who suggested that less complicated technology is perceived to be more useful by users.

This study contributes to authenticating TAM to develop a measurement model analysing customers’ intentions to use the CB system in Malaysia. Academicians and scholars may adopt a similar measurement model to analyse behavioural intentions for information technology services. Lastly, this study will assist bankers’ in planning and promoting CB by enhancing its adoption.

5.1. Theoretical Implications

This study has significantly contributed to the general body of knowledge in the context of technology acceptance, particularly CB technology acceptance in Malaysia, a country where many studies have already analysed the acceptance of Internet and mobile banking technology. In terms of theoretical constructs, the current study is the frontier offering detailed insight into the acceptance of CB technology in Malaysia.

The second theoretical contribution of this study is towards the validation of TAM in the context of CB technology acceptance. This study has analysed the acceptance of technology from a customer perspective as compared to past studies which have used TAM to examine technology acceptance in the context of work-related activities of employees.

Finally, the third most significant contribution of this study is the extension of TAM. This research has successfully extended TAM through two additional constructs which are useful in analysing the acceptance of CB technology under the given settings.

5.2. Practical Implications

The findings of this study provide several practical implications for policymakers in the banking industry who have already adopted, have yet to adopt, or have the intention to adopt CB technology in the future. These findings are valuable for virtual banking consultants as they help identify important factors in developing CB technology. Furthermore, it is suggested that perceived ease of use and perceived usefulness are the most significant factors for consumers’ intentions to use this technology. As a result, CB technology developers should introduce secure, user-friendly, and easily accessible technology so that it is widely accepted by consumers. Additionally, to enhance users’ levels of perceived usefulness, banking professionals and marketers should promote the potential advantages of CB to users by explaining to them the benefits of CB (such as protection of card fraud, card skimming, and card counterfeiting) as well as the convenience they will receive when using CB.

Next, the findings of self-efficacy reveal that users with a high level of self-efficacy are likely to have more ease while using this technology. Therefore, CB facility providers need to organise training sessions to enhance users’ familiarity with this technology. These training sessions can be organised through brief physical and video demonstrations during roadshows, on TV, and/or on social media. Finally, banking industry operators need to develop effective marketing strategies to attract more customers which will add significant value to the overall business of the industry.

5.3. Limitations and Future Research

Like many other technology acceptance studies, this study also has a number of limitations. Firstly, it only measures consumers’ intentions to use CB technology instead of their actual behaviour. Even though a brief explanation of CB technology was provided in the survey questionnaire introduction, future studies may focus on measuring consumers’ actual behaviour.

Secondly, the TAM model used in this study is extended by two additional constructs, whereas other factors such as privacy, security, trust, compatibility, cost, and satisfaction, which were not explored in this research, may also alter consumers’ intentions. Hence, future studies may consider additional constructs to analyse consumers’ intentions towards this technology.

Another limitation is associated with the data collected through the non-random convenience sampling technique, which may result in similar respondents’ characteristics. This was the only effective data collection method as users of CB were unknown to the researchers due to banks’ policies on the confidentiality of customers’ information.