Risk Management and Financial Stability in the Polish Public Hospitals: The Moderating Effect of the Stakeholders’ Engagement in the Decision-Making

Abstract

:1. Introduction

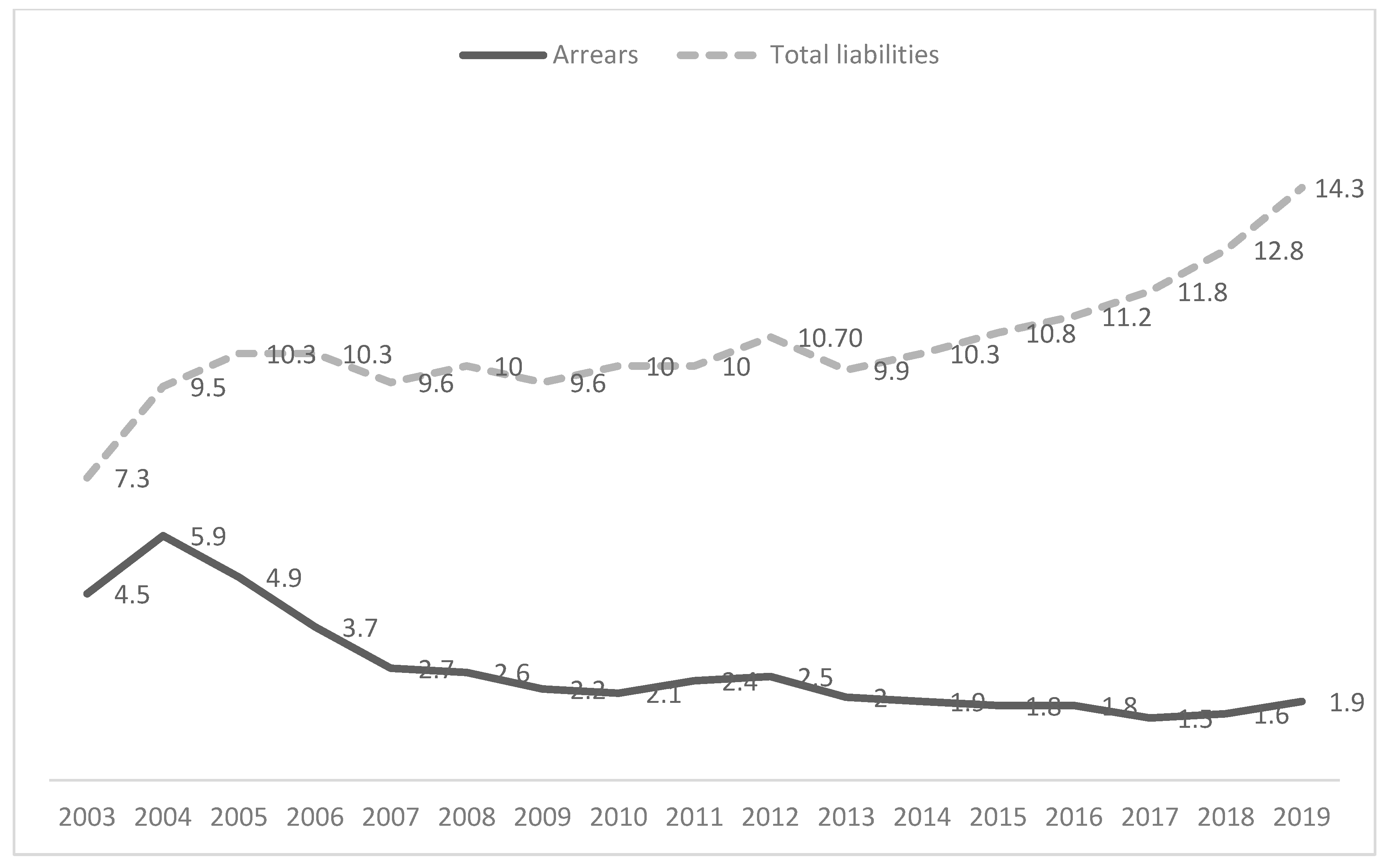

2. Legal and Economic Determinants of Hospital Functioning

3. Risk and Stakeholders in the Decision-Making Processes in Public Hospitals

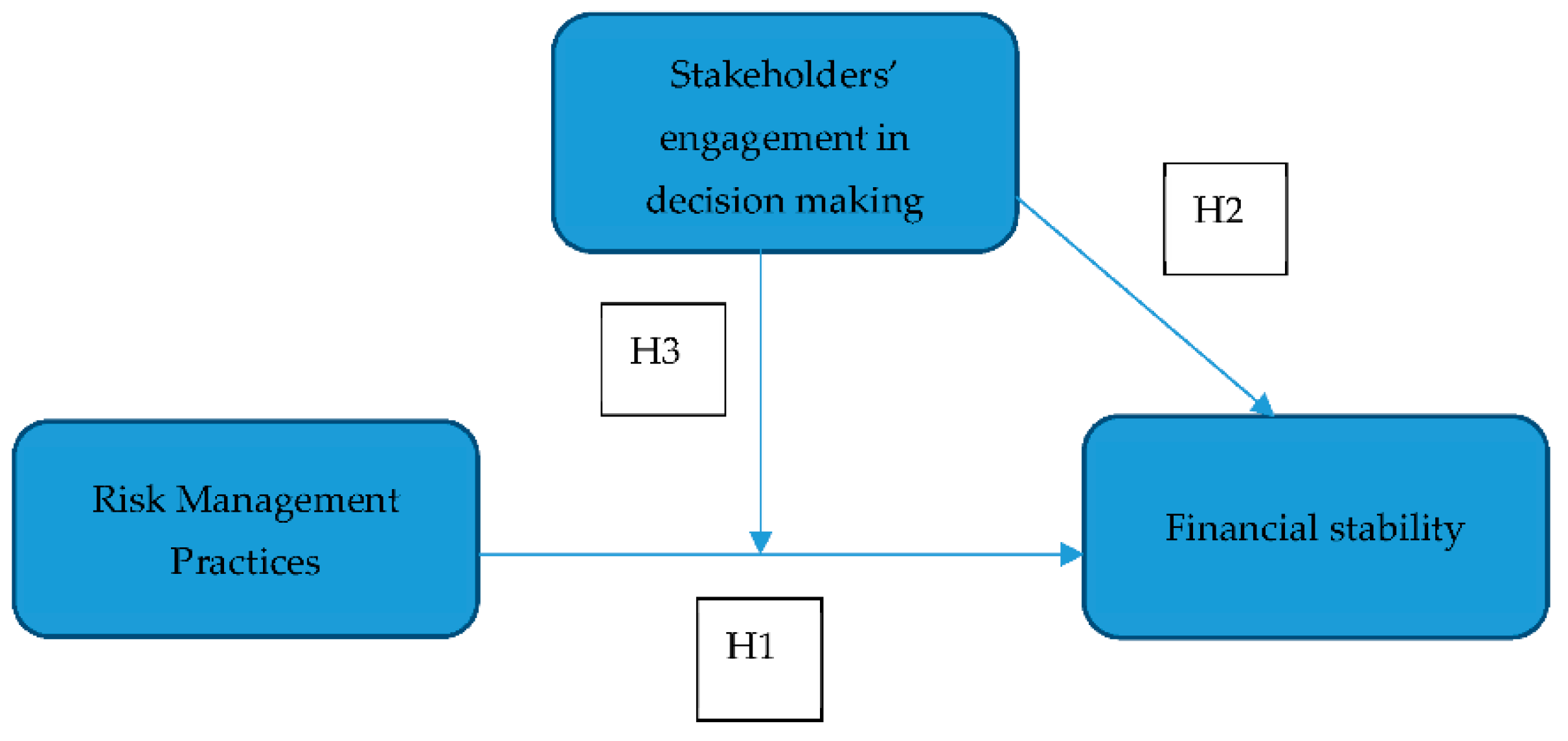

4. Research Methods and Way of Data Collection

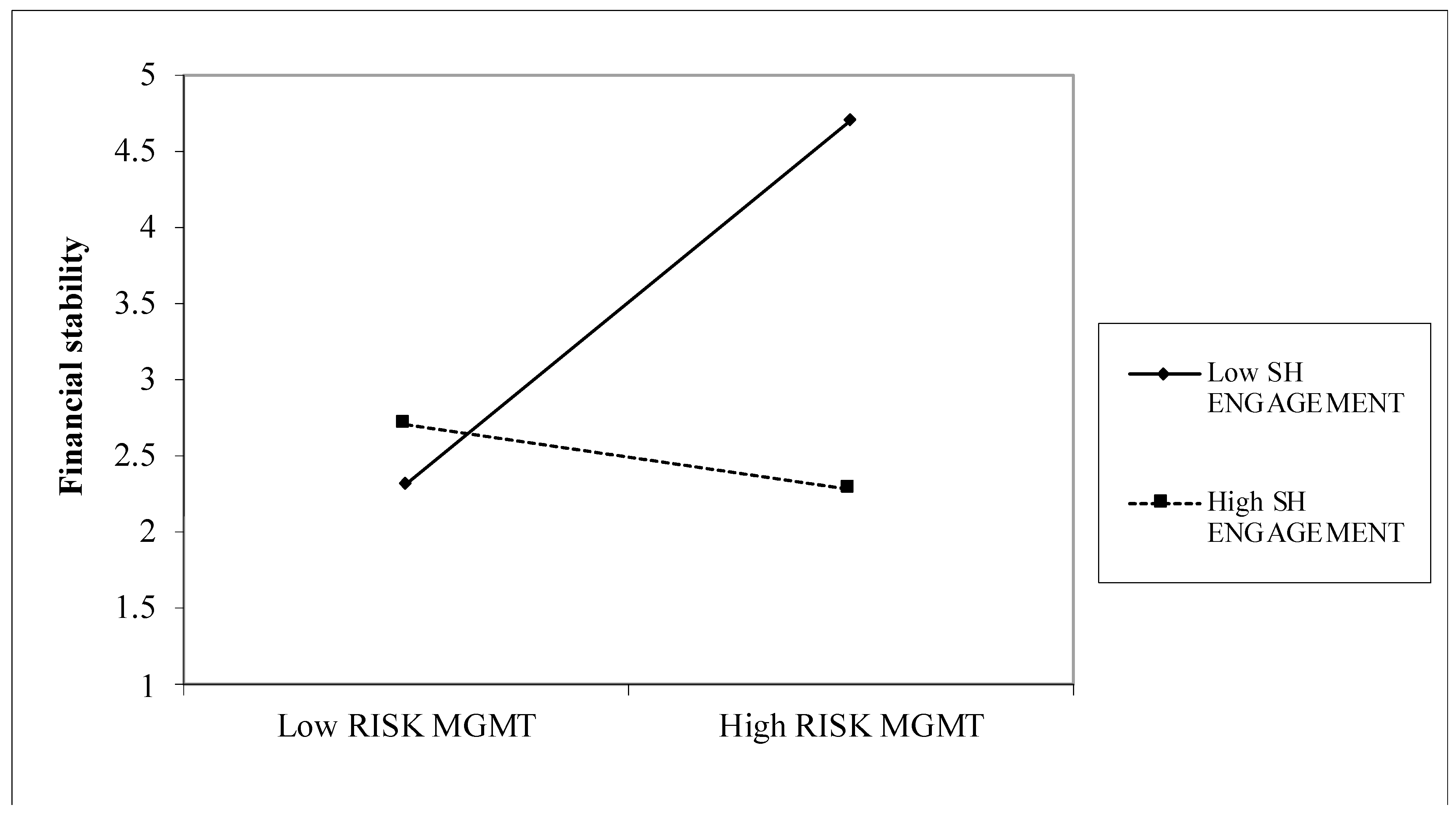

5. Research Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ab Aziz, Nur Farhani, Farid Wajdi Akashah, and Aniza Abdul Aziz. 2019. Conceptual framework for risk communication between emergency response team and management team at healthcare facilities: A Malaysian perspective. International Journal of Disaster Risk Reduction 41: 101282. [Google Scholar] [CrossRef]

- Adil, Mahmood. 2008. Risk communication in healthcare: An overview. Journal of Communication in Healthcare 1: 363–72. [Google Scholar] [CrossRef]

- Agnew, John E., Nicholas Komaromy, and Richard E. Smith. 2006. Healthcare Institution Risk Assessments: Concentration on “Process” or “Outcome”? Journal of Risk Research 9: 503–23. [Google Scholar] [CrossRef]

- Akpieyi, Alex, Terry L. Tudor, and Cleber Dutra. 2015. The utilisation of risk-based frameworks for managing healthcare waste: A case study of the National Health Service in London. Safety Science 72: 127–32. [Google Scholar] [CrossRef] [Green Version]

- Amaeshi, Kenneth M., and Andrew Crane. 2006. Stakeholder engagement: A mechanism for sustainable aviation. Corporate Social Responsibility and Environmental Management 13: 245–60. [Google Scholar] [CrossRef]

- Antonucci, Domenic. 2016. Risk Maturity Models. London: Kogan Page Limited. [Google Scholar]

- Austen, Agata, and Aldona Frączkiewicz-Wronka. 2018. Stakeholders and resources in public hospitals: Towards an integrated view. Argumenta Oeconomica 1: 253–74. [Google Scholar] [CrossRef] [Green Version]

- Bakalikwira, Lasuli, Juma Bananuka, Twaha K. Kigongo, Doreen Musimenta, and Veronica Mukyala. 2017. Accountability in the public health care systems: A developing economy perspective. Cogent Business & Management 4: 1–14. [Google Scholar] [CrossRef]

- Banoun, Arnaud, Lucas Dufour, and Meena Andiappan. 2016. Evolution of a service ecosystem: Longitudinal evidence from multiple shared services centers based on the economies of worth framework. Journal of Business Research 69: 2990–98. [Google Scholar] [CrossRef]

- Beck de Silva Etges, Ana Paula, Joana Siqueira de Souza, Francisco José Kliemann Neto, and Elaine Aparecida Felix. 2016. A proposed enterprise risk management model for health organizations. Journal of Risk Research 22: 513–31. [Google Scholar] [CrossRef]

- Beierle, Thomas C. 2002. The quality of stakeholder-based decisions. Risk Analysis 22: 739–49. [Google Scholar] [CrossRef] [PubMed]

- Bennet, Peter, Kenneth Calman, Sarah Curtis, and Denis Fischbacher-Smith. 2010. Risk Communication and Public Health. Oxford: Oxford University Press. [Google Scholar]

- Biggs, Reinette, Frances R. Westley, and Stephen R. Carpenter. 2010. Navigating the back loop: Fostering social innovation and transformation in ecosystem management. Ecology and Society 15: 28. [Google Scholar] [CrossRef]

- Borraz, Olivier. 2007. Risk and Public Problems. Journal of Risk Research 10: 941–57. [Google Scholar] [CrossRef]

- Bromiley, Philip, Michael McShane, Anil Nair, and Elzotbek Rustambekov. 2015. Enterprise risk management: Review, critique, and research directions. Long Range Planning 48: 265–76. [Google Scholar] [CrossRef] [Green Version]

- Bryson, John M. 2004. What to do when stakeholders matter: Stakeholder identification and analysis techniques. Public Management Review 6: 21–53. [Google Scholar] [CrossRef]

- Buliński, Leszek, and Aleksandra Błachnio. 2017. Health in old age, and patients’ approaches to telemedicine in Poland. Annals of Agricultural and Environmental Medicine 24: 322–28. [Google Scholar] [CrossRef]

- Burchett, Danielle, and Yossef S. Ben-Porath. 2019. Methodological considerations for developing and evaluating response bias indicators. Psychological Assessment 31: 1497–511. [Google Scholar] [CrossRef] [PubMed]

- Burke, Richard, and Istemi Demirag. 2017. Risk transfer and stakeholder relationships in Public Private Partnerships. Accounting Forum 41: 28–43. [Google Scholar] [CrossRef]

- Cagliano, Anna Corina, Sabrina Grimaldi, and Carlo Rafele. 2011. A systemic methodology for risk management in healthcare sector. Safety Science 49: 695–708. [Google Scholar] [CrossRef] [Green Version]

- Carroll, Robert, ed. 2009. Risk Management Handbook for Health Care Organizations. Hoboken: John Wiley & Sons Inc. [Google Scholar]

- Chambers, Naomi, Gill Harvey, and Russell Mannion. 2017. Who should serve on health care boards? What should they do and how should they behave? A fresh look at the literature and the evidence. Cogent Business & Management 4: 1–14. [Google Scholar] [CrossRef]

- Chapin, F. Stuart, Pamela A. Matson, and Harold A. Mooney. 2002. Principles of Terrestrial Ecosystem Ecology. New York: Springer. [Google Scholar]

- Cleemput, Irina, Wendy Christiaens, Laurence Kohn, Christian Léonard, François Daue, and Alain Denis. 2015. Acceptability and Perceived Benefits and Risks of Public and Patient Involvement in Health Care Policy: A Delphi Survey in Belgian Stakeholders. Value Health 18: 477–83. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Collins, David. 1992. The Strategic Management of Uncertainty. European Management Journal 10: 125–35. [Google Scholar] [CrossRef]

- Cornforth, Chris. 1978. What makes boards effective? An examination of the relationships between board inputs, structures, processes and effectiveness in non-profit organizations. Corporate Governance: An International Review 9: 217–27. [Google Scholar] [CrossRef] [Green Version]

- Coronado, Anthony J., and Timothy L. Wong. 2014. Healthcare cybersecurity risk management: Keys to an effective plan. Biomedical Instrumentation & Technology 48: 26–30. [Google Scholar] [CrossRef]

- Crosby, Barbara C., and John M. Bryson. 2018. Why leadership of public leadership research matters: And what to do about it. Public Management Review 20: 1265–86. [Google Scholar] [CrossRef]

- Dansoh, Ayirebi, Samuel Frimpong, Godslove Amppatwaum, Goodenough Dennis Oppong, and Robert Kyei-Osei. 2020. Exploring the role of traditional authorities in managing the public as stakeholders on PPP projects: A case study. International Journal of Construction Management 20: 628–41. [Google Scholar] [CrossRef]

- Dillon, Stuart, John Buchanan, and Jim Corner. 2010. Comparing Public and Private Sector Decision Making: Problem Structuring and Information Quality Issues. Paper presented at 45th Annual Conference of the ORSNZ, Auckland, New Zealand, November 29–30. [Google Scholar]

- Dixit, Sunil K. 2017. A new multiperspective emphasis on the public hospital governance. International Journal of Healthcare Management 13: 267–75. [Google Scholar] [CrossRef]

- Djellouli, Nehla, Lorelei Jones, Helen Barratt, Angus I. G. Ramsay, Steven Towndrow, and Sandy Oliver. 2019. Involving the public in decision-making about large-scale changes to health services: A scoping review. Health Policy 123: 635–45. [Google Scholar] [CrossRef]

- Dubas-Jakóbczyk, Katarzyna, Iwona Kowalska-Bobko, and Christoph Sowada. 2019. The 2017 reform of the hospital sector in Poland—The challenge of consistent design. Health Policy 123: 538–43. [Google Scholar] [CrossRef]

- Dwyer, Joseph, Michael Paskavitz, Sylvia Vriesendorp, and Sarah Johnson. 2006. An urgent call to professionalize leadership and management in health care worldwide. Management Sciences for Health Occasional Papers 4: 1–14. [Google Scholar]

- Edelenbos, Jurian, and Erik-Hans Klijn. 2006. Managing Stakeholder Involvement in Decision Making: A Comparative Analysis of Six Interactive Processes in the Netherlands. Journal of Public Administration Research and Theory 16: 417–46. [Google Scholar] [CrossRef] [Green Version]

- Elias, Arun A. 2019. Strategy Development Through Stakeholder Involvement: A New Zealand Study. Global Journal of Flexible Systems Management 20: 313–22. [Google Scholar] [CrossRef]

- Elleuch, Hatem, Wafik Hachicha, and Habib Chabchoub. 2014. A combined approach for supply chain risk management: Description and application to a real hospital pharmaceutical case study. Journal of Risk Research 17: 641–63. [Google Scholar] [CrossRef]

- Feng, Ziqin. 2011. Financial risks from three dimensions and risk identification model of enterprise. Strategic Finance 6: 71–80. [Google Scholar] [CrossRef]

- Ferdosi, Masoud, Reza Rezayatmand, and Yasamin Molavi Taleghani. 2020. Risk Management in Executive Levels of Healthcare Organizations: Insights from a Scoping Review 2018. Risk Management and Healthcare Policy 13: 215–43. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Flemig, Sophie, Stephen Osborne, and Tony Kinder. 2016. Risky Business—Reconceptualizing Risk and Innovation in Public Services. Public Money & Management 36: 425–32. [Google Scholar]

- Fone, Martin, and Peter C. Young. 2007. Managing Risks in Public Organizations. London: Palgrave Macmillan. [Google Scholar]

- Frączkiewicz-Wronka, Aldona. 2012. Rola i znaczenie interesariuszy w procesie podejmowania decyzji w organizacjach publicznych [Role and importance of stakeholders in decision making in public organizations]. In Wykorzystanie Analizy Interesariuszy w Zarządzaniu Organizacją Zdrowotną [Using Stakeholder Analysis in Managing a Health Organization]. Edited by Aldona Frączkiewicz-Wronka. Katowice: Śląsk, pp. 15–46. [Google Scholar]

- Frączkiewicz-Wronka, Aldona. 2018. Stakeholders as a source of risk in public hospitals in Poland—selected problems. In Public Relations w Przestrzeni Publicznej [Public Relations in Public Space]. Edited by Anna Adamus-Matuszyńska. Prace Naukowe Uniwersytetu Ekonomicznego w Katowicach. Katowicach: Uniwersytetu Ekonomicznego w Katowicach, pp. 150–57. [Google Scholar]

- Fraser, Martin D., and Vijay Vaishnavi. 1997. A formal specifications maturity model. Communications of the ACM 40: 95–103. [Google Scholar] [CrossRef]

- George, Bert, Sebastian Desmidt, and Julie De Moyer. 2016. Strategic decision quality in Flemish municipalities. Public Money & Management 36: 317–24. [Google Scholar] [CrossRef] [Green Version]

- Gerard, Nathan. 2019. Perils of professionalization: Chronicling a crisis and renewing the potential of healthcare management. Health Care Analysis 27: 269–88. [Google Scholar] [CrossRef]

- Główny Urząd Statystyczny (GUS) [Main Statistical Office]. 2019. Ochrona Zdrowia w Gospodarstwach Domowych w 2017 r. [Healthcare in Households in 2017]. Warsaw: GUS. [Google Scholar]

- Gomes, Ricardo Corrêa, Joyce Liddle, and Luciana O.M. Gomes. 2010. A five-sided model of stakeholder influence. A cross-national analysis of decision making in local government. Public Management Review 12: 701–24. [Google Scholar] [CrossRef]

- Griffith, John R. 2000. Championship management for healthcare organizations. Journal of Healthcare Management 45: 17–30. [Google Scholar] [CrossRef] [PubMed]

- Hinna, Alessandro, Danila Scarozza, and Fabrizio Rotundi. 2018. Implementing Risk Management in the Italian Public Sector: Hybridization between Old and New Practices. International Journal of Public Administration 41: 110–28. [Google Scholar] [CrossRef]

- Hood, John, Andrew Mills, and William M. Stein. 2003. Development in UK public sector risk management: The implications for PPP/PFI projects. In Public-Private Partnership: Managing Risks and Opportunities. Edited by Akintola Akintoye, Cliff Hardcastle and Matthias Beck. Hoboken: Blackwell Science Ltd. [Google Scholar]

- Hooper, Daire, Joseph Coughlan, and Michael R. Mullen. 2008. Evaluating Model Fit: A Synthesis of the Structural Equation Modelling Literature. Electronic Journal of Business Research Methods 6: 53–60. [Google Scholar] [CrossRef]

- Hunt, Brian. 2010. Risk and Crisis Management in the Public Sector. Public Management Review 12: 747–51. [Google Scholar] [CrossRef]

- Ingram, Tomasz, and Wojciech Glod. 2016. Talent management in healthcare organizations-qualitative research results. Procedia Economics and Finance 39: 339–46. [Google Scholar] [CrossRef] [Green Version]

- Jajuga, Krzysztof, ed. 2019. Zarządzanie Ryzykiem [Risk Management]. Warszawa: PWN. [Google Scholar]

- Jansen, Maarten P. M., Rob Baltussen, and Kristine Bærøe. 2018. Stakeholder Participation for Legitimate Priority Setting: A Checklist. International Journal of Health Policy and Management 7: 973–76. [Google Scholar] [CrossRef] [Green Version]

- Johnsen, Åge. 2015. Strategic Management Thinking and Practice in the Public Sector: A Strategic Planning for All Seasons? Financial Accountability & Management 31: 243–268. [Google Scholar] [CrossRef]

- Karam, Marlène, Isabelle Brault, Thérèse Van Durme, and Jean Macq. 2018. Comparing interprofessional and interorganizational collaboration in healthcare: A systematic review of the qualitative research. International Journal of Nursing Studies 79: 70–83. [Google Scholar] [CrossRef] [PubMed]

- Kavaler, Florence, and Allen D. Spiegel. 2003. Risk Management in Health Care Institutions: A Strategic Approach. Burlington: Jones & Bartlett Publishers. [Google Scholar]

- Klinke, Andreas, and Ortwin Renn. 2012. Adaptive and Integrative Governance on Risk and Uncertainty. Journal of Risk Research 15: 273–92. [Google Scholar] [CrossRef]

- Kloutsiniotis, Panagiotis V., and Dimitrios M. Mihail. 2017. Linking innovative human resource practices, employee attitudes and intention to leave in healthcare services. Employee Relations 39: 34–53. [Google Scholar] [CrossRef]

- Kolluru, Rao V., Steven M. Bartell, Robin M. Pitblado, and Scott R. Stricoff. 1996. Risk Assessment and Management Handbook. For Environmental, Health and Safety Professional. New York: McGraw-Hill. [Google Scholar]

- Krewski, Daniel, Victoria Hogan, Michelle C. Turner, Patricia L. Zeman, Ian McDowell, Nancy Edwards, and Joseph Loses. 2007. An Integrated Framework for Risk Management and Population Health. Human and Ecological Risk Assessment: An International Journal 13: 1288–312. [Google Scholar] [CrossRef]

- Kwiecińska-Bożek, Lidia. 2018. Risk Management in Public Hospitals in Poland—Selected Issues. In Public Relations w Przestrzeni Publicznej [Public Relations in Public Space]. Edited by Anna Adamus-Matuszyńska. Prace Naukowe Uniwersytetu Ekonomicznego w Katowicach. Katowicach: Uniwersytetu Ekonomicznego w Katowicach, pp. 140–49. [Google Scholar]

- Langrafe, Taiguara de Freitas, Simone Ruchdi Barakat, Fabricio Stocker, and Joao Maurício Gama Boaventura. 2020. A stakeholder theory approach to creating value in higher education institutions. The Bottom Line 33. [Google Scholar] [CrossRef]

- Li, Yanwei, Araz Taeihagh, Martin de Jong, and Andreas Klinke. 2020. Toward a Commonly Shared Public Policy Perspective for Analyzing Risk Coping Strategies. Risk Analysis, 1–14. [Google Scholar] [CrossRef]

- Lin, Lexin, Claudia Rivera, Marcus Abrahamsson, and Henrik Tehler. 2017. Communicating risk in disaster risk management systems—experimental evidence of the perceived usefulness of risk descriptions. Journal of Risk Research 20: 1534–53. [Google Scholar] [CrossRef]

- Linnander, Erika L., Jeannie M. Mantopoulos, Nikole Allen, Ingrid M. Nembhard, and Elizabeth H. Bradley. 2017. Professionalizing healthcare management: A descriptive case study. International Journal of Health Policy and Management 6: 555–60. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mahama, Habib, Mohamed Elbashirs, Stave Sutton, and Vicky Arnold. 2020. New development: Enabling enterprise risk management maturity in public sector organizations. Public Money & Management, 1–5. [Google Scholar] [CrossRef]

- Malfait, Simon, Ann Van Hecke, Johan Hellings, Griet De Bodt, and Kristof Eeckloo. 2017. The impact of stakeholder involvement in hospital policy decision making: A study of the hospital’s business processes. International Journal of Clinical and Laboratory Medicine 72: 63–71. [Google Scholar] [CrossRef]

- Malfait, Simon, Ann Van Hecke, Griet De Bodt, Nele Palsterman, and Kristof Eeckloo. 2018. Patient and public involvement in hospital policy-making: Identifying key elements for effective participation. Health Policy 122: 380–88. [Google Scholar] [CrossRef]

- McCarron, Tamara L., Karen Moffat, Gloria Wilkinson, Sandra Zelinsky, Jamie M. Boyd, Deborah White, Derek Hassay, Diane L. Lorenzetti, Nancy J. Marlett, and Thomas Noseworthy. 2019. Understanding patient engagement in health system decision-making: A co-designed scoping review. Systematic Reviews 8: 97. [Google Scholar] [CrossRef]

- McCue, Michael J., and Forrest R. MCluer. 2008. Financial and Operational Ratios for Bond-Insured Hospitals. Hospital Topics 86: 3–8. [Google Scholar] [CrossRef] [PubMed]

- McEvoy, Rachel, Edel Tierney, and Anne MacFarlane. 2019. ‘Participation is integral’: Understanding the levers and barriers to the implementation of community participation in primary healthcare: A qualitative study using normalisation process theory. BMC Health Services Research 19: 515. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mennen, Marcel G., and Maaike Van Tuyll. 2015. Dealing with Future Risks in the Netherlands: The National Security Strategy and the National Risk Assessment. Journal of Risk Research 18: 860–76. [Google Scholar] [CrossRef]

- Min, Naon, Ruowen Shen, David Berlan, and Keon-Hyung Lee. 2020. How Organizational Identity Affects Hospital Performance: Comparing Predictive Power of Mission Statements and Sector Affiliation. Public Performance & Management Review 43: 845–70. [Google Scholar] [CrossRef]

- Nieszporska, Sylwia. 2012. Ryzyko w ochronie zdrowia [The Risk in Heath Care]. Logistyka 5: 149–52. [Google Scholar]

- Nonaka, Ikujiro. 1994. A dynamic theory of organizational knowledge creation. Organization Science 5: 14–37. [Google Scholar] [CrossRef]

- Noordegraaf, Mirko, and Martijn Van der Meulen. 2008. Professional power play: Organizing management in health care. Public Administration 86: 1055–69. [Google Scholar] [CrossRef]

- Noronha, Aruna Mesquita, and Nandakumar Mekoth. 2013. Social support expectations from healthcare systems: Antecedents and emotions. International Journal of Healthcare Management 6: 269–75. [Google Scholar] [CrossRef]

- Norris, Jill M., Deborah E. White, Lorelli Nowell, Kelly Mrklas, and Henry T. Stelfox. 2017. How do stakeholders from multiple hierarchical levels of a large provincial health system define engagement? A qualitative study. Implementation Science 12: 1–13. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Nutt, Paul. 1999. Public-private differences and the assessment of alternatives for decision making. Journal of Public Administration Research and Theory 9: 305–49. [Google Scholar] [CrossRef]

- Nutt, Paul. 2005. Comparing Public and Private Sector Decision-Making Practices. Journal of Public Administration Research and Theory 16: 289–318. [Google Scholar] [CrossRef] [Green Version]

- O’Shea, Alison, Annette L. Boaz, and Mary Chambers. 2019. A Hierarchy of Power: The Place of Patient and Public Involvement in Healthcare Service Development. Frontiers in Sociology 4: 38. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Organisation for Economic Cooperation and Development (OECD). 2020. Health at a Glance 2019: OECD Indicators. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Osborne, Stephen. P., Zoe Radnor, Tony Kinder, and Isabel Vidal. 2014. Sustainable public service organisations: A public service-dominant approach. Society and Economy 36: 313–38. [Google Scholar] [CrossRef] [Green Version]

- Osborne, Stephen P., Zoe Radnor, Tony Kinder, and Isabel Vidal. 2015. The SERVICE Framework: A Public-service-dominant Approach to Sustainable Public Services. British Journal of Management 26: 424–38. [Google Scholar] [CrossRef] [Green Version]

- Osborne, Stephen P., Taco Brandsen, Valentina Mele, Juraj Nemec, Marieke van Genugten, and S. Sophie Fleming. 2020. Risking innovation. Understanding risk and public service innovation—Evidence from a four nation study. Public Money & Management 40: 52–56. [Google Scholar] [CrossRef]

- Oulasvirta, Lasse, and Ari-Veikko Anttiroiko. 2017. Adoption of comprehensive risk management in local government. Local Government Studies 43: 451–74. [Google Scholar] [CrossRef] [Green Version]

- Ozcan, Yasar A., and Michael J. McCue. 1996. Development of a Financial Performance Index for Hospitals: DEA Approach. Journal of the Operational Research Society 47: 18–26. [Google Scholar] [CrossRef]

- Pel, Bonno, Julia Wittmayer, Jens Dorland, and Michael S. Jorgensen. 2020. Unpacking the Social Innovation Ecosystem: An empirically grounded typology of empowering network constellations. Innovation: The European Journal of Social Science Research 33: 311–36. [Google Scholar] [CrossRef] [Green Version]

- Petkovic, Jennifer, Alison Riddle, Elie A. Akl, Joanne Khabsa, Lyubove Lytvyn, Pearl Atwere, Pauline Cambell, Kalipso Chalkidou, Stephanie M. Chang, Sally Crowe, and et al. 2020. Protocol for the development of guidance for stakeholder engagement in health and healthcare guideline development and implementation. Systematic Reviews 9: 1–11. [Google Scholar] [CrossRef] [PubMed]

- Pichler, Franz, Wija Oortwijn, Alric Ruether, and Rebecca Trowman. 2019. Defining capacity building in the context of HTA: A proposal by the HTAi Scientific Development and Capacity Building Committee. International Journal of Technology Assessment in Health Care 35: 362–66. [Google Scholar] [CrossRef] [PubMed]

- Power, Michael. 2016. Riskwork: Essays on the Organizational Life of Risk Management. Oxford: Oxford University Press. [Google Scholar]

- Professeure, Lucie Rouillard. 2004. Managing Risk: A New Approach to Government Intervention. Public Management Review 6: 95–111. [Google Scholar] [CrossRef]

- Quick, Kathryn S., and John M. Bryson. 2016. Public Participation. In Handbook on Theories of Governance. Edited by Chris Ansell and Jacob Torfing. Cheltenham: Edward Elgar Press. [Google Scholar]

- Raczkowski, Konrad, and Piotr Tworek. 2017. What Does Risk Management in an Economy Really Mean? In Risk Management in the Public Administration. Edited by Konrad Raczkowski. London: Palgrave Macmillan. [Google Scholar]

- Rainey, Hal G. 2003. Understanding and Managing Public Organizations. San Francisco: Jossey-Bass. [Google Scholar]

- Rana, Tarek, Danture Wickramasinghe, and Enrico Bracci. 2019. New development: Integrating risk management in management control systems—lessons for public sector managers. Public Money & Management 39: 148–51. [Google Scholar] [CrossRef]

- Reed, Mark, Steven Vella, Edward Challies, Joris de Vente, Lynne Frewer, Daniela Hohenwallner-Ries, Tobias Huber, Rosmarie Neumann, Elizabeth Oughton, Julian Sidoli del Ceno, and et al. 2018. A theory of participation: What makes stakeholder and public engagement in environmental management work? Restoration Ecology 26: 7–17. [Google Scholar] [CrossRef] [Green Version]

- Rixon, Daphne. 2010. Stakeholder Engagement in Public Sector Agencies: Ascending the Rungs of the Accountability Ladder. International Journal of Public Administration 33: 374–556. [Google Scholar] [CrossRef]

- Roberts, Geoff. 2002. Risk Management in Healthcar. London: Witherby & Co. [Google Scholar]

- Rudawska, Iga. 2011. Ku rynkowi w opiece zdrowotnej [Towards a market in healthcare]. Polskie Stowarzyszenie Zarządzania Wiedzą 55: 131–38. [Google Scholar]

- Sarens, Gerrit, Christian de Visscher, and Diane van Gils. 2010. Risk management and internal control in the public sector: An in-depth analysis of Belgian Social Security Public Institutions. Federale Overheidsdienst Financiën—België 70: 65–90. [Google Scholar]

- Schalk, Jelmer. 2015. Linking Stakeholder Involvement to Policy Performance: Nonlinear Effects in Dutch Local Government Policy Making. American Review of Public Administration 47: 479–59. [Google Scholar] [CrossRef]

- Sheppard, Faye, Marcie Williams, and Victor R. Klein. 2013. TeamSTEPPS and patient safety in healthcare. Journal of Healthcare Risk Management 32: 5–10. [Google Scholar] [CrossRef] [PubMed]

- Skoczylas, Wanda, and Piotr Waśniewski. 2014. Wskaźniki finansowe w raporcie z badania sprawozdania finansowego przez biegłego rewidenta [Financial ratios in the report supplementing the opinion on the audit of financial statement by the statutory auditor]. Finanse, Rynki Finansowe, Ubezpieczenia 69: 243–52. [Google Scholar]

- Snow, Donald. 1992. Inside the Environmental Movement: Meeting the Leadership Challenge. Washington: Island Press. [Google Scholar]

- Sohn, Kitae. 2016. Risk Incomprehension and Its Economic Consequences. The Journal of Development Studies 52: 1545–60. [Google Scholar] [CrossRef]

- Sowada, Christoph, Iwona Kowalska-Bobko, and Anna Sagan. 2020. What next after the ‘commercialization’ of public hospitals? Searching for effective solutions to achieve financial stability of the hospital sector in Poland. Health Policy 124: 1050–55. [Google Scholar] [CrossRef]

- Stroh, Patrick J. 2005. Enterprise Risk Management at UnitedHealth Group. Strategic Finance 87: 26–27. [Google Scholar]

- Szymaniec-Mlicka, Karolina. 2017. The decision-making process in public healthcare entities. identification of the decision-making process type. Management 21: 191–204. [Google Scholar] [CrossRef] [Green Version]

- The Orange Book. Management of Risk—Principles and Concepts. 2004. London: HM Treasury UK.

- Tončinić, Sara, Renée Wildt-Liesveld, and Hubertus Vrijhoef. 2020. Evaluation of a digital platform that engages stakeholders in the co-creation of healthcare innovations: A mixed-methods study. International Journal of Care Coordination 23: 33–42. [Google Scholar] [CrossRef]

- Tseng, Ming-Lang, Hien Minh Ha, Ming K. Lim, Kuo-Jui Wu, and Mohammad Iranmanesh. 2020. Sustainable supply chain management in stakeholders: Supporting from sustainable supply and process management in the healthcare industry in Wietnam. International Journal of Logistics Research and Applications, 1–20. [Google Scholar] [CrossRef]

- Turner, Scott F., Laura B. Cardinal, and Richard M. Burton. 2017. Research design for mixed methods: A triangulation-based framework and roadmap. Organizational Research Methods 20: 243–67. [Google Scholar] [CrossRef]

- Tworek, Piotr. 2016. Understanding Public Risk. In Public Risk Management. Tome I: Perspective of Theory and Practice. Edited by Piotr Tworek and Józef Myrczek. Katowice: Publishing House of the University of Economics. [Google Scholar]

- Vargo, Stephen. L., Heiko Wieland, and Melissa Archpru Akaka. 2015. Innovation through institutionalization: A service ecosystems perspective. Industrial Marketing Management 44: 63–72. [Google Scholar] [CrossRef]

- Vargo, Stephen L., Melissa Archpru Akaka, and Claudia M. Vaughan. 2017. Conceptualizing Value: A Service-ecosystem View. Journal of Creating Value 3: 1–8. [Google Scholar] [CrossRef]

- Wędzki, Dariusz. 2012. The sequence of cash flow in bankruptcy prediction: Evidence from Poland. Zeszyty Teoretyczne Rachunkowosci 68: 161–79. [Google Scholar]

- Węgrzyn, Maria. 2012. Healthcare as a link in the public finance system. Existing and desired directions of change. Zeszyty Naukowe Wyższej Szkoły Bankowej w Poznaniu 41: 187–99. [Google Scholar]

- Wheeler, David, and Maria Sillanpää. 1997. The Stakeholder Corporation: A Blueprint for Maximising Stakeholder Value. London: Pitman. [Google Scholar]

- Williams, Iestyn, and Heather Shearer. 2011. Appraising public value: Past, present and futures. Public Administration 89: 1367–84. [Google Scholar] [CrossRef]

- World Health Organziation (WHO). 2011. Report on the Burden of Endemic Health Care-Associated Infection Worldwide, Clean Care is Safer Care. Geneva: WHO. [Google Scholar]

- Wortley, Sally, Jackie Street, Wendy Lipworth, and Kristen Howard. 2016. What factors determine the choice of public engagement undertaken by health technology assessment decision-making organizations? Journal of Health Organization and Management 30: 872–90. [Google Scholar] [CrossRef] [PubMed]

- Wronka-Pośpiech, Martyna. 2014. Sukces i jego pomiar w przedsiębiorstwach społecznych—próba operacjonalizacji [Success and its measurement in social enterprises—An attempt of operationalisation]. Prace Naukowe Wałbrzyskiej Wyższej Szkoły Zarządzania i Przedsiębiorczości 27: 363–87. [Google Scholar]

- Wu, Minyu. 2012. Managing stakeholders: An integrative perspective on the source of competitive advantage. Asian Social Science 8: 160. [Google Scholar] [CrossRef] [Green Version]

- Young, Peter C., and Steven C. Tippins. 2001. Managing Business Risk: An Organization—Wide Approach to Risk Management. New York: American Management Association. [Google Scholar]

- Zaleska, Beata. 2017. Rola wskaźników finansowych w analizie i prognozie sytuacji ekonomiczno-finansowej samodzielnych publicznych zakładów opieki zdrowotnej. [The role of financial ratios in analysis and forecast of economic and financial situation of the independent public healthcare centers]. Zeszyty Naukowe Wydziału Nauk Ekonomicznych 21: 373–86. [Google Scholar]

- Zheng, Yi, Wei Wang, Wenbin Liu, and John Mingers. 2019. A performance management framework for the public sector: The balanced stakeholder model. Journal of the Operational Research Society 70: 568–39. [Google Scholar] [CrossRef]

| Stakeholder | Interest | Impact | Relevance | Identified Risks |

|---|---|---|---|---|

| Founding body | High level of medical security in a given area; secured provision of health care services; stable financial condition; achievement of statutory objectives; improved image of the organization. | Grants subsidies for provision of services, approves a plan for development of the entity reporting to it. | Attempts are made to take into consideration the expectations and suggestions of a social supervisory board. | Lack of acceptance for actions taken by managers in the hospital and, as a consequence, reduction in financial support and/or boardroom changes in the hospital. |

| Patients | High quality and availability of medical services; well-developed and modern hospital infrastructure; a comprehensive range of medical services; competent and friendly staff; a variety of medical services on offer. | Their positive feedback is an incentive for and an indicator of future development and a way to attract new patients; patients’ preferences determine the performance of the contract; claims may affect the entity’s financial condition. | Decisions which are made do not always take into account the expectations of patients’ families. | Change of a service and, consequently, a risk that the contract with the NHF may not be completed. Negative feedback, once spread, may damage the organization’s positive image. |

| Ministries (e.g., Ministry of Health, Ministry of Labor and Social Policy) | Tasks performed in compliance with legal requirements (acts and ordinances); adherence to legal standards in the area of public obligations; provision of top quality services, in line with valid regulations and standards; ensured and secured medical services in a given area; an increase in one’s own political capital. | Indirect impact through legal regulations, decide about some funds allocated to health care units. | It is important to meet their requirements and perform a contract in compliance with accepted documents, without the need to incur additional costs of service provision. | Withdrawal of funds allocated for operations. Refusal to finance activities planned for the future. |

| The National Health Fund (NHF) | Correct performance of contractual provisions; a wider range of services; maintaining the right cash flow from provision of services; timely accounting for service provision; furnishing of complete and up-to-date information. | Decides about awarding contracts for provision of services. If a contract is not signed the entity is not able to continue its operations. | The adopted strategy must take into account the legal regulations. | Inability to sign a contract for provision of medical services. |

| Local government | Availability and high quality of services for the local community; fulfilment of statutory obligations; ensuring highly specialized medical care for inhabitants; pursuing the political interest (health care tends to be one of the main points on the political agenda). | Through a decision-making process related to financial support they approve a specific strategy of the health care unit. | Maintenance of good relationships by meeting the contractual provisions. | Making a decision on replacement of managerial staff. Refusal to grant funds. |

| Expenditure Structure on Healthcare in 2017 | Structure |

|---|---|

| Government schemes | 10.4% |

| Compulsory contributory health insurance schemes | 59.1% |

| Voluntary health insurance schemes | 5.7% |

| NPISH financing schemes | 0.8% |

| Enterprise financing schemes | 1.2% |

| Household out-of-pocket payment | 22.8% |

| 1991 | Healthcare Units Act from 30 August 1991 [Ustawa z dnia 30 sierpnia 1991 r. o zakładach opieki zdrowotnej], Polish Journal of Laws 1991 No. 91, act: 408. |

| |

| 1997 | Common Health Insurance Act from 6 February 1997 [Ustawa z dnia 6 lutego 1997 r. o powszechnym ubezpieczeniu zdrowotnym], Polish Journal of Laws 1997, No. 28, act: 153. |

| |

| 2003 | Common Health Insurance in National Health Fund Act from 23 January 2003 [Ustawa z dnia 23 stycznia 2003 r. o powszechnym ubezpieczeniu zdrowotnym w Narodowym Funduszu Zdrowia], Polish Journal of Laws 2003, No. 45, act: 391. |

| |

| 2004 | Publicly Funded Healthcare Services Act from 27 August 2004 [Ustawa z dnia 27 sierpnia 2004 r. o świadczeniach opieki zdrowotnej finansowanych ze środków publicznych], Polish Journal of Laws 2004, No. 210, act: 2135. |

| |

| 2010 | Healing Activities Act from 15 April 2011 [Ustawa z dnia 15 kwietnia 2011 r. o działalności leczniczej], Polish Journal of Laws 2011, No. 112, act: 654. |

| |

| 2017 | The change of the Publicly Funded Healthcare Services Act from 23 March 2017 [Ustawa z dnia 23 marca 2017 r. o zmianie ustawy o świadczeniach opieki zdrowotnej finansowanych ze środków publicznych], Polish Journal of Laws 2017, act: 844. |

| |

| Voivodeship | Sampling Frame—Number of the First-Level Hospitals in Voivodeships | Number of Received Questionnaires | Number of Discarded Questionnaires | Number of Questionnaires Included in Analyses | |

|---|---|---|---|---|---|

| 1 | Lower Silesia Province | 20 | 15 | 7 | 8 |

| 2 | Kuyavian-Pomeranian Province | 16 | 8 | 5 | 3 |

| 3 | Lublin Province | 18 | 7 | 5 | 2 |

| 4 | Lubuskie Province | 10 | 5 | 4 | 1 |

| 5 | Łódź Province | 15 | 15 | 0 | 15 |

| 6 | Lesser Poland Province | 11 | 9 | 5 | 5 |

| 7 | Masovian Province | 37 | 17 | 4 | 13 |

| 8 | Holy Cross Province | 8 | 6 | 2 | 4 |

| 9 | Pomeranian Province | 11 | 8 | 3 | 5 |

| 10 | Podkarpackie Provnice | 12 | 9 | 2 | 7 |

| 11 | Podlasie Province | 14 | 8 | 4 | 5 |

| 12 | Opole Province | 12 | 4 | 2 | 2 |

| 13 | West Pomeranian Province | 15 | 8 | 3 | 5 |

| 14 | Greater Poland Province | 24 | 12 | 3 | 9 |

| 15 | Warmia-Masuria Province | 19 | 8 | 1 | 7 |

| 16 | Silesia Province | 32 | 16 | 2 | 12 |

| Together | 274 | 155 | 52 | 103 | |

| Constructs | Financial Stability | Risk Management Practices | Stakeholders’ Engagement |

|---|---|---|---|

| Mean | 3.6893 | 5.6951 | 5.2994 |

| Std. Deviation | 1.47474 | 0.97612 | 0.94695 |

| Model | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| The Effect of Risk Management Practices on Financial Stability | The Effect of Risk Management Practices and Stakeholders’ Engagement on Financial Stability | The Effect of Risk Management Practices on Financial Stability Moderated by Stakeholders’ Engagement | |

| MODEL FIT STATISTICS | |||

| RMSEA | 0.074 | 0.092 | - |

| CFI (Compound Fit Index) | 0.980 | 0.913 | - |

| TLI (Tucker–Lewis Index) | 0.968 | 0.889 | - |

| Akaike Information Criterion (AIC) | 2304.632 | 3838.519 | 3834.898 |

| r2 | 0.060 | 0.110 | 0.121 |

| MODEL ESTIMATION RESULTS | |||

| Independent variables (IV) | Estimate β (S.E. σ) | Estimate β (S.E. σ) | Estimate β (S.E. σ) |

| Risk management practices | 0.572 (0.269) * | 1.003 (0.465) | 0.265 (0.253) |

| Stakeholders’ engagement | - | −0.623 (0.619) | −0.221 (0.224) |

| Risk management practices × stakeholders’ engagement (the interaction) | - | - | −0.207 (0.088) |

| Constant | 2.230 (0.440) | 2.106 (0.431) | 0.904 (0.061) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Frączkiewicz-Wronka, A.; Ingram, T.; Szymaniec-Mlicka, K.; Tworek, P. Risk Management and Financial Stability in the Polish Public Hospitals: The Moderating Effect of the Stakeholders’ Engagement in the Decision-Making. Risks 2021, 9, 87. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9050087

Frączkiewicz-Wronka A, Ingram T, Szymaniec-Mlicka K, Tworek P. Risk Management and Financial Stability in the Polish Public Hospitals: The Moderating Effect of the Stakeholders’ Engagement in the Decision-Making. Risks. 2021; 9(5):87. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9050087

Chicago/Turabian StyleFrączkiewicz-Wronka, Aldona, Tomasz Ingram, Karolina Szymaniec-Mlicka, and Piotr Tworek. 2021. "Risk Management and Financial Stability in the Polish Public Hospitals: The Moderating Effect of the Stakeholders’ Engagement in the Decision-Making" Risks 9, no. 5: 87. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9050087