Financial Distress and Information Sharing: Evidences from the Italian Credit Register

Abstract

:1. Introduction

2. Literature Review

3. Empirical Analysis

3.1. Sample

3.2. Methodology

3.3. Results

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | According to the regulation of Centrale dei Rischi in force at the time of the sample collection (Banca d’Italia 1991), an exposure is classified in the default status when the classification variable “relationship status” takes on different domains from “other credits”, therefore it encompasses the following: doubtful loans; restructured loans; doubtful loans—past due and overdue credits by more than 90 days and not more than 180; doubtful loans—past due and overdue credits loans past due for more than 180 days; doubtful loans—restructured loans; not doubtful loans—loans past due or overdue more than 90 days and not more than 180 days; not doubtful loans—loans past due for more than 180 days. Data provided externally for research purpose normally have some years of lags with respect to the last available ones, and so at the time of the database construction the mot updated information provided was related to 2010. |

| 2 | The default status used for Table 2 includes both the past dues and overdrafts (90 or 180 days) and the restructured credits; |

| 3 | The panel data regression model is necessary in order to consider the heterogeneity of the sample on the basis of the debtor and the time of the event because customers in the sample may be have different fundamentals (like total assets, revenue, etc.) that may affect their access to the credit market and even in the five-year horizon considered for the analysis the market, conditions are slightly different month by month and they may affect the frequently of past dues and overdraft. Data on the dependent variables used in the analysis are winsorized in order to avoid some outliers (threshold 99%). |

References

- Anctil, Regina M., John Dickhaut, Chandra Kanodia, and Brian Shapiro. 2004. Information transparency and coordination failure: Theory and experiment. Journal of Accounting Research 42: 159–95. [Google Scholar] [CrossRef]

- Angelini, Paolo, Roberto Di Salvo, and Giovanni Ferri. 1998. Availability and cost of credit for small businesses: Customer relationships and credit cooperatives. Journal of Banking and Finance 22: 925–54. [Google Scholar] [CrossRef]

- Asquith, Paul, Robert Gertner, and David Scharfstein. 1994. Anatomy of Financial Distress: An Examination of Junk-bond Issuers. Quarterly Journal of Economics 109: 625–58. [Google Scholar] [CrossRef]

- Banca d’Italia. 1991. Centrale dei Rischi. Istruzioni per gli Intermediari Creditizi, Circular no.139 and further updates. Available online: https://www.bancaditalia.it/compiti/vigilanza/normativa/archivio-norme/circolari/c139/index.html (accessed on 1 May 2021).

- Banca d’Italia. 2015. Foglio Informativo, Centrale dei Rischi. Available online: www.bancaditalia.it (accessed on 1 May 2021).

- Barth, James R., Chen Lin, Ping Lin, and Frank M. Song. 2009. Corruption in bank lending to firms: Cross-country micro evidence on the beneficial role of competition and information sharing. Journal of Financial Econom. [Google Scholar] [CrossRef]

- Bennardo, Alberto, Marco Pagano, and Salvatore Piccolo. 2015. Multiple Bank Lending, Creditor Rights, and Information Sharing. Review of Finance 19: 519–70. [Google Scholar] [CrossRef]

- Berger, Allen N., and Gregory F. Udell. 1990. Collateral, loan quality and bank risk. Journal of Monetary Economics 25: 21–42. [Google Scholar] [CrossRef]

- Berger, Allen N., and Gregory F. Udell. 1995. Relationship Lending and Lines of Credit in Small Firm Finance. Journal of Business 68: 351–81. [Google Scholar] [CrossRef] [Green Version]

- Berger, Allen N., and Gregory F. Udell. 2006. A more complete conceptual framework for SME finance. Journal of Banking and Finance 30: 2945–66. [Google Scholar] [CrossRef]

- Berglöf, Erik, and Ernst-Ludwig Von Thadden. 1994. Short-term versus long-term interests: Capital structure with multiple investors. Quarterly Journal of Economics 109: 1055–84. [Google Scholar] [CrossRef] [Green Version]

- Bolton, Patrick, and David S. Scharfstein. 1996. Optimal Debt Structure and the Number of Creditors. Journal of Political Economy 104: 1–25. [Google Scholar] [CrossRef]

- Bonfim, Diana, Daniel A. Dias, and Christine Richmond. 2012. What happens after corporate default? Stylized facts on access to credit. Journal of Banking & Finance 36: 2007–25. [Google Scholar]

- Boot, Arnoud W. A., and Anjan V. Thakor. 2000. Can relationship banking survive competition? Journal of Finance 55: 679–713. [Google Scholar] [CrossRef]

- Bouckaert, Jan, and Hans Degryse. 2006. Entry and strategic information display in credits market. Economic Journal 116: 702–20. [Google Scholar] [CrossRef]

- Bris, Arturo, and Ivo Welch. 2005. The optimal concentration of creditors. Journal of Finance 60: 2193–212. [Google Scholar] [CrossRef] [Green Version]

- Brown, Martin, and Christian Zehnder. 2007. Credit Reporting, Relationship Banking, and Loan Repayment. Journal of Money, Credit and Banking 39: 1883–918. [Google Scholar] [CrossRef] [Green Version]

- Brown, Martin, and Christian Zehnder. 2010. The emergence of information sharing in credit markets. Journal of Financial Intermediation 19: 255–78. [Google Scholar] [CrossRef] [Green Version]

- Brunner, Antje, and Jan Pieter Krahnen. 2008. Multiple lenders and corporate distress: Evidence on debt restructuring. Review of Economic Studies 75: 415–42. [Google Scholar] [CrossRef] [Green Version]

- Carletti, Elena, Vittoria Cerasi, and Sonja Daltung. 2007. Multiple-bank lending: Diversification and free-riding in monitoring. Journal of Financial Intermediation 16: 425–51. [Google Scholar] [CrossRef] [Green Version]

- Chen, Yehning. 2006. Collateral, loan guarantees, and the lenders’ incentives to resolve financial distress. Quarterly Review of Economics and Finance 46: 1–15. [Google Scholar] [CrossRef]

- Cole, Rebel A. 1998. The importance of relationships to the availability of credit. Journal of Banking and Finance 22: 959–77. [Google Scholar] [CrossRef]

- Cornand, Camille, and Frank Heinemann. 2008. Optimal degree of public information dissemination. Economic Journal 118: 718–42. [Google Scholar] [CrossRef] [Green Version]

- Doblas-Madrid, Antonio, and Raoul Minetti. 2013. Sharing information in the credit market: Contract-level Grunert evidence from U.S. firms. Journal of Financial Economics 109: 198–223. [Google Scholar] [CrossRef]

- Elsas, Ralf, and Jan Pieter Krahnen. 2002. Collateral, Relationship Lending and Financial Distress: An Empirical Study on Financial Contracting. CFS Working Paper, no. 17. Frankfurt am Main, Germany: Goethe-Universität. [Google Scholar]

- Foglia, Antonella, Sebastiano Laviola, and P. Marullo Reedtz. 1998. Multiple banking relationships and the fragility of corporate borrowers. Journal of Banking and Finance 22: 1441–56. [Google Scholar] [CrossRef]

- Franks, Julian, and Oren Sussman. 2005. Financial Distress and Bank Restructuring of Small to Medium Size UK Companies. Review of Finance 9: 65–96. [Google Scholar] [CrossRef]

- Grunert, Jens, and Martin Weber. 2009. Recovery rates of commercial lending: Empirical evidence for German companies. Journal of Banking and Finance 33: 505–13. [Google Scholar] [CrossRef]

- Haiss, Peter. 2010. Bank herding and incentive systems as catalysts for the financial crisis. IUP Journal of Behavioral Finance 7: 30–58. [Google Scholar]

- Hart, Oliver, and Luigi Zingales. 2011. A New Capital Regulation for Large Financial Institutions. American Law and Economics Review 13: 453–90. [Google Scholar] [CrossRef] [Green Version]

- He, Zhiguo, and Wei Xiong. 2012. Dynamic debt runs. Review of Financial Studies 25: 1799–843. [Google Scholar] [CrossRef]

- Hertzberg, Andrew, Jose Maria Liberti, and Daniel Paravisini. 2011. Public Information and Coordination: Evidence from a Credit Registry Expansion. Journal of Finance 66: 379–412. [Google Scholar] [CrossRef]

- Houston, Joel F., Chen Lin, Ping Lin, and Yue Ma. 2010. Creditor rights, information sharing, and bank risk taking. Journal of Financial Economics 96: 485–512. [Google Scholar] [CrossRef]

- Hubert, Franz, and Dorothea Schäfer. 2002. Coordination failure with multiple-source lending: The cost of protection against a powerful lender. Journal of Institutional and Theoretical Economics 158: 256–75. [Google Scholar] [CrossRef] [Green Version]

- Jappelli, Tullio, and Marco Pagano. 2003. Public Information: A European Perspective. In Credit Reporting Systems and the International Economy. Edited by Margaret J. Miller. Cambridge: MIT Press. [Google Scholar]

- Jiménez, Gabriel, and Jesus Saurina. 2004. Collateral, type of lender and relationship banking as determinants of credit risk. Journal of Banking and Finance 28: 2191–212. [Google Scholar] [CrossRef] [Green Version]

- Jiménez, Gabriel, Vicente Salas, and Jesús Saurina. 2006. Determinants of collateral. Journal of Financial Economics 81: 255–81. [Google Scholar] [CrossRef] [Green Version]

- Karapetyan, Artashes, and Bogdan Stacescu. 2014. Information sharing and information acquisition in credit markets. Review of Finance 18: 1583–615. [Google Scholar] [CrossRef] [Green Version]

- Koziol, Christian. 2006. When does single-source versus multiple-source lending matter? International Journal of Managerial Finance 2: 19–48. [Google Scholar] [CrossRef]

- Liberti, Jose M., and Atif R. Mian. 2009. Estimating the Effect of Hierarchies on Information Use. Review of Financial Studies 22: 4058–90. [Google Scholar] [CrossRef]

- Melnik, Arie, and Steven Plaut. 1986. Loan commitment contracts, terms of lending, and credit allocation. Journal of Finance 41: 425–35. [Google Scholar] [CrossRef]

- Miller, Margaret. 2003. Credit Reporting System around the Globe: The State of the Art in Public Credit Registries and Private Credit Reporting. In Credit Reporting Systems and the International Economy. Edited by Margaret J. Miller. Cambridge: MIT Press. [Google Scholar]

- Morris, Stephen, and Hyun Song Shin. 2004. Coordination risk and the price of debt. European Economic Review 48: 133–53. [Google Scholar] [CrossRef] [Green Version]

- Ongena, Steven, and David C. Smith. 2000. What Determines the Number of Bank Relationships? Cross-Country Evidence. Journal of Financial Intermediation 9: 26–56. [Google Scholar] [CrossRef]

- Ono, Arito, and Iichiro Uesugi. 2009. Role of Collateral and Personal Guarantees in Relationship Lending: Evidence from Japan’s SME Loan Market. Journal of Money, Credit and Banking 41: 935–60. [Google Scholar] [CrossRef] [Green Version]

- Padilla, A. Jorge, and Marco Pagano. 2000. Sharing default information as a borrower discipline device. European Economic Review 44: 1981–50. [Google Scholar] [CrossRef] [Green Version]

- Pagano, Marco, and Tullio Jappelli. 1993. Information sharing in credit markets. Journal of Finance 48: 1693–718. [Google Scholar] [CrossRef]

- Petersen, Mitchell A., and Raghuram G. Rajan. 1994. The Benefits of Lending Relationships: Evidence from Small Business Data. Journal of Finance 49: 2–37. [Google Scholar] [CrossRef]

- Qian, Jun, and Philip E. Strahan. 2007. How laws and institutions shape financial contracts: The case of bank loans. Journal of Finance 62: 2803–34. [Google Scholar] [CrossRef]

- Rajan, Raghuram, and Andrew Winton. 1995. Covenants and collateral as incentives to monitor. Journal of Finance 50: 1113–46. [Google Scholar] [CrossRef]

- Shaw, Michael J., and James A. Gentry. 1988. Using an expert system with inductive learning to evaluate business loans. Financial Management 17: 45–56. [Google Scholar] [CrossRef]

- Shockley, Richard L., and Anjan V. Thakor. 1997. Bank Loan Commitment Contracts: Data, Theory, and Tests. Journal of Money, Credit and Banking 29: 517–34. [Google Scholar] [CrossRef]

- Udell, Gregory F. 2008. What’s in a relationship? The case of commercial lending. Business Horizons 51: 93–103. [Google Scholar] [CrossRef]

| Counterparties | Number of Contracts | Number of Banks for Each Customer | Real Guarantee | Type | |||||

|---|---|---|---|---|---|---|---|---|---|

| Min | Mean | Max | % With | % Without | % Self-Liquidating | % Callable | |||

| 2006 | 77,745 | 406,789 | 1 | 2.92 | 47 | 4.54% | 95.46% | 43.47% | 56.53% |

| 2007 | 86,086 | 447,427 | 1 | 2.94 | 46 | 4.57% | 95.43% | 43.11% | 56.89% |

| 2008 | 91,187 | 455,008 | 1 | 2.88 | 47 | 4.87% | 95.13% | 42.77% | 57.23% |

| 2009 | 107,575 | 522,242 | 1 | 2.95 | 44 | 4.77% | 95.33% | 39.39% | 60.61% |

| 2010 | 96,872 | 430,099 | 1 | 2.76 | 44 | 4.86% | 95.14% | 38.02% | 61.98% |

| N° Lender | Risk Evaluation | Years to Default | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 5 Years | 4 Years | 3 Years | 2 Years | 1 Year | |||||||

| N | % | N | % | N | % | N | % | N | % | ||

| Two | Aligned | 18,163 | 95.61% | 20,723 | 95.14% | 21,946 | 92.80% | 28,722 | 81.55% | 22,955 | 76.10% |

| Misaligned | 833 | 4.39% | 1058 | 4.86% | 1702 | 7.20% | 6500 | 18.45% | 7209 | 23.90% | |

| Three | Aligned | 10,957 | 95.69% | 12,183 | 95.42% | 12,827 | 92.98% | 16,090 | 82.17% | 12,536 | 78.47% |

| Misaligned | 494 | 4.31% | 585 | 4.58% | 969 | 7.02% | 3941 | 17.83% | 3439 | 21.53% | |

| Four | Aligned | 6620 | 96.39% | 7352 | 96.08% | 7613 | 93.64% | 7016 | 79.51% | 7026 | 80.28% |

| Misaligned | 248 | 3.61% | 300 | 3.92% | 517 | 6.36% | 1808 | 20.49% | 1726 | 19.72% | |

| Five | Aligned | 4254 | 96.16% | 4375 | 96.26% | 4733 | 94.25% | 5191 | 83.73% | 4015 | 81.82% |

| Misaligned | 170 | 3.84% | 170 | 3.74% | 289 | 5.75% | 1009 | 16.27% | 892 | 18.18% | |

| More | Aligned | 8689 | 97.09% | 10,119 | 97.03% | 9853 | 95.10% | 9347 | 85.73% | 7428 | 82.53% |

| Misaligned | 269 | 2.91% | 310 | 2.97% | 508 | 4.90% | 1556 | 14.27% | 1572 | 17.47% | |

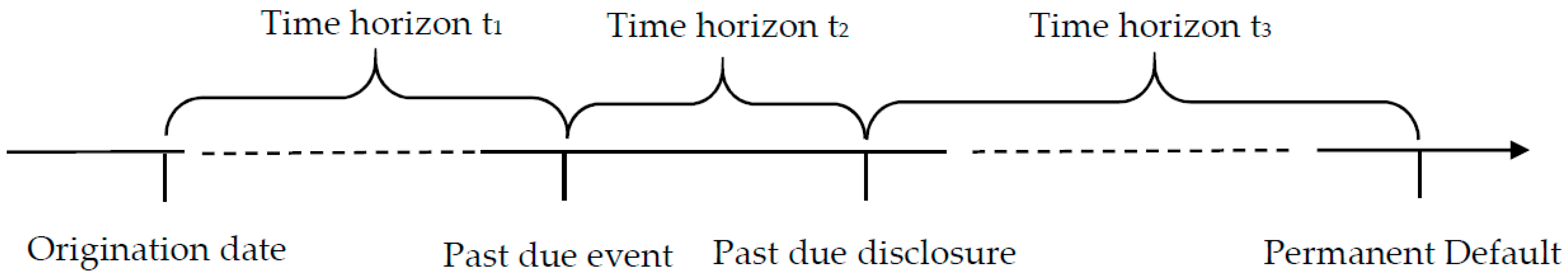

| Time Horizon | Stats | Total Debt Outstanding (000€) | Number of Lenders | Debt Concentration (HHI) | Role of the Main Bank (%) | Collateral/Debt |

|---|---|---|---|---|---|---|

| Before Past due | Mean | 95.86 | 2.56 | 50.32% | 69.31% | 6.22% |

| Median | 139.15 | 2.00 | 50.01% | 67.16% | 0.00% | |

| Dev. St. | 787.13 | 2.63 | 36.41% | 26.13% | 19.01% | |

| Past due event not disclosed | Mean | 121.22 | 2.95 | 52.71% | 67.21% | 6.55% |

| Median | 192.21 | 2.00 | 50.23% | 64.20% | 0.00% | |

| Dev. St. | 891.08 | 2.76 | 33.72% | 25.97% | 19.26% | |

| After past due disclosure | Mean | 122.13 | 2.92 | 52.30% | 67.12% | 6.59% |

| Median | 191.17 | 2.00 | 50.15% | 64.11% | 0.00% | |

| Dev. St. | 894.01 | 2.77 | 33.85% | 25.98% | 19.33% |

| Constant | Time Dummies | Firm Dummies | Obs. | R2 | ||||

|---|---|---|---|---|---|---|---|---|

| Five YTD | 0.30 ** | 0.31 ** | 11.98 ** |  |  | 59,013 | 0.42 | |

| Four YTD | 0.21 ** | 0.21 ** | 12.27 ** |  |  | 59,273 | 0.30 | |

| Three YTD | −0.11 ** | −0.11 ** | 12.31 ** |  |  | 64,978 | 0.32 | |

| Two YTD | −0.11 ** | −0.12 ** | 12.22 ** |  |  | 73,879 | 0.31 | |

| Default Year | −0.23 ** | −0.21 ** | 11.98 ** |  |  | 73,062 | 0.30 | |

| Five YTD | 0.20 | 0.40 | 9.97 ** |  |  | 20,132 | 0.20 | |

| Four YTD | 0.10 | 0.14 | 10.03 ** |  |  | 22,017 | 0.16 | |

| Three YTD | −0.12 | −0.12 * | 10.27 ** |  |  | 28,061 | 0.11 | |

| Two YTD | −0.11 ** | −0.21 ** | 10.47 ** |  |  | 53,297 | 0.11 | |

| Default Year | −0.10 | −0.11 | 10.61 ** |  |  | 59,984 | 0.13 |

| Constant | Time Dummies | Firm Dummies | Obs. | R2 | ||||

|---|---|---|---|---|---|---|---|---|

| Five YTD | 0.21 ** | −0.11 ** | 12.17 ** |  |  | 59,013 | 0.18 | |

| Four YTD | 0.11 ** | −0.11 ** | 12.20 ** |  |  | 64,768 | 0.14 | |

| Three YTD | 0.11 ** | −0.11 ** | 12.25 ** |  |  | 67,850 | 0.18 | |

| Two YTD | −0.11 ** | −0.11 ** | 12.12 ** |  |  | 73,964 | 0.17 | |

| Default Year | −0.22 ** | −0.21 ** | 11.87 ** |  |  | 72,919 | 0.13 | |

| Five YTD | 0.11 | 0.44 ** | 9.91 ** |  |  | 18,153 | 0.14 | |

| Four YTD | 0.11 | 0.22 * | 9.94 ** |  |  | 19,840 | 0.17 | |

| Three YTD | 0.11 | 0.10 | 10.18 ** |  |  | 25,662 | 0.10 | |

| Two YTD | 0.11 ** | 0.20 ** | 10.38 ** |  |  | 50,238 | 0.11 | |

| Default Year | −0.11 | 0.00 | 10.52 ** |  |  | 55,886 | 0.11 |

| Time Horizon | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Five YTD | Four YTD | Three YTD | Two YTD | Default Year | ||||||

| (5) | (6) | (5) | (6) | (5) | (6) | (5) | (6) | (5) | (6) | |

| −0.76 ** | −0.52 ** | −0.41 ** | −0.28 ** | −0.40 ** | ||||||

| 0.90 ** | 0.83 ** | 0.04 | 0.48 ** | 0.05 | ||||||

| 2.18 ** | 2.11 ** | 2.00 ** | 1.73 ** | 1.64 ** | ||||||

| 0.63 * | −0.13 | 0.80 ** | −0.04 | 0.23 ** | ||||||

| Constant | −2.76 ** | −3.10 ** | −3.02 ** | −3.03 ** | −3.01 ** | −2.86 ** | −2.35 ** | −2.41 ** | −2.14 ** | −2.35 ** |

| Time Dummies |  |  |  |  |  |  |  |  |  |  |

| Firm Dummies |  |  |  |  |  |  |  |  |  |  |

| Observations | 59,013 | 59,013 | 59,273 | 59,273 | 64,978 | 64,978 | 73,879 | 73,879 | 73,062 | 73,062 |

| Chi2 | 473.89 ** | 209.35 ** | 27.26 ** | 253.37 ** | 54.25 ** | 316.74 ** | 37.45 | 649.20 ** | 11.61 ** | 760.00 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gibilaro, L.; Mattarocci, G. Financial Distress and Information Sharing: Evidences from the Italian Credit Register. Risks 2021, 9, 94. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9050094

Gibilaro L, Mattarocci G. Financial Distress and Information Sharing: Evidences from the Italian Credit Register. Risks. 2021; 9(5):94. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9050094

Chicago/Turabian StyleGibilaro, Lucia, and Gianluca Mattarocci. 2021. "Financial Distress and Information Sharing: Evidences from the Italian Credit Register" Risks 9, no. 5: 94. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9050094