Systemic Illiquidity Noise-Based Measure—A Solution for Systemic Liquidity Monitoring in Frontier and Emerging Markets

Abstract

:1. Introduction

2. Liquidity in Systemic Risk

- Market infrastructures are efficient and transparent, leading to low search and transactions costs;

- Market participants have easy access to funding;

- Risk appetite is abundant;

- A diverse investor base ensures that factors affecting individual investors do not translate into broader price volatility.

2.1. Systemic Illiquidity: Research and Existing Measures

2.2. Measures of Systemic Illiquidity—Overview

2.3. Measures of Systemic Illiquidity—Empirical Application Possibilities

- Developing (frontier or emerging) markets in terms of the structure (banking sector dominance, with traditional banking products), maturity (affecting data availability and historical data span), and depth (including the limited variety of markets, the size of the stock market, and the numbers and types of existing financial instruments);

- Relatively well-developed economies in terms of the stability of prices (relatively low and stable inflation), currency, capital flows, and monetary policy targets and tools.

3. Parametric Models and Their Potential in Systemic Liquidity Analysis

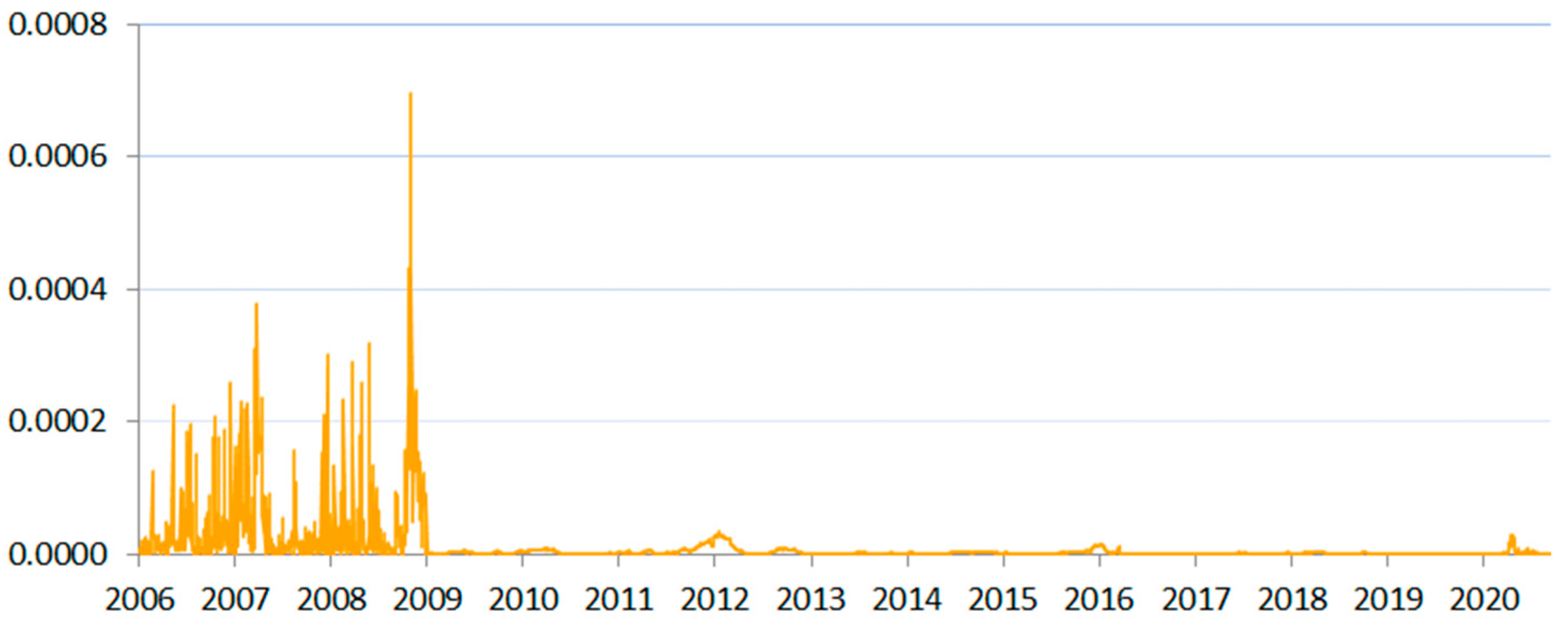

4. Empirical Application of the Systemic Illiquidity Noise-Based Measure

4.1. Methodology

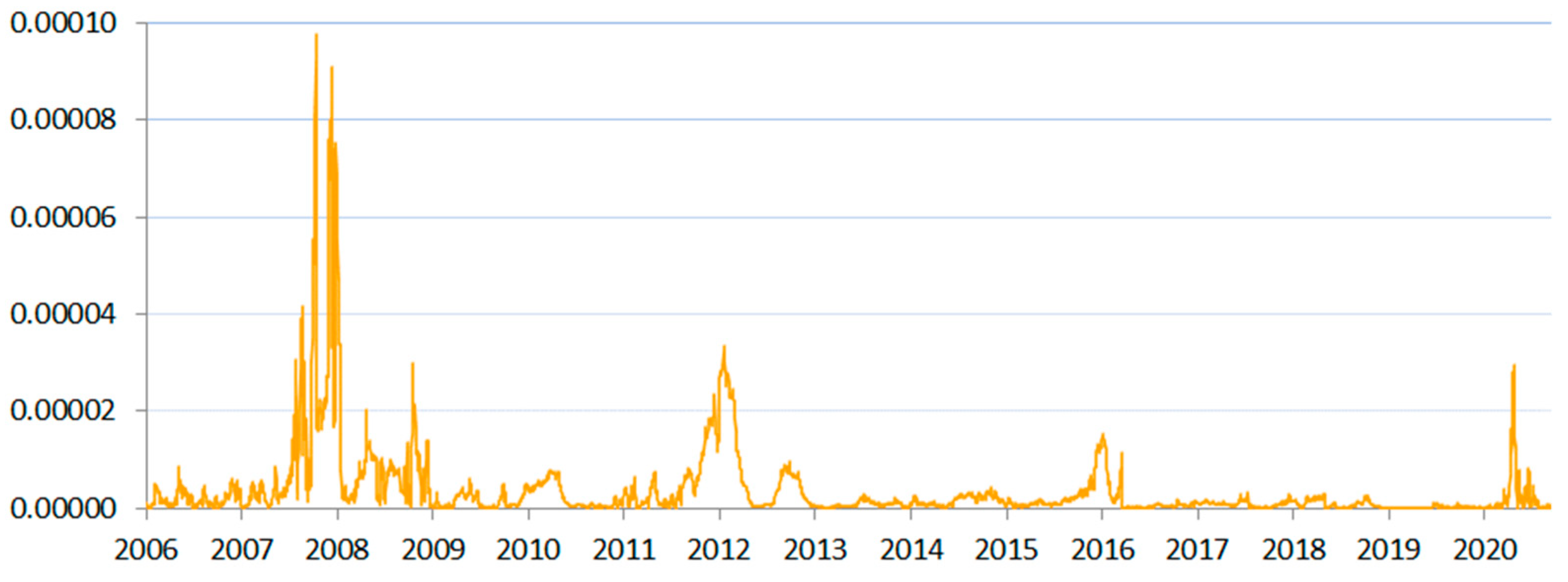

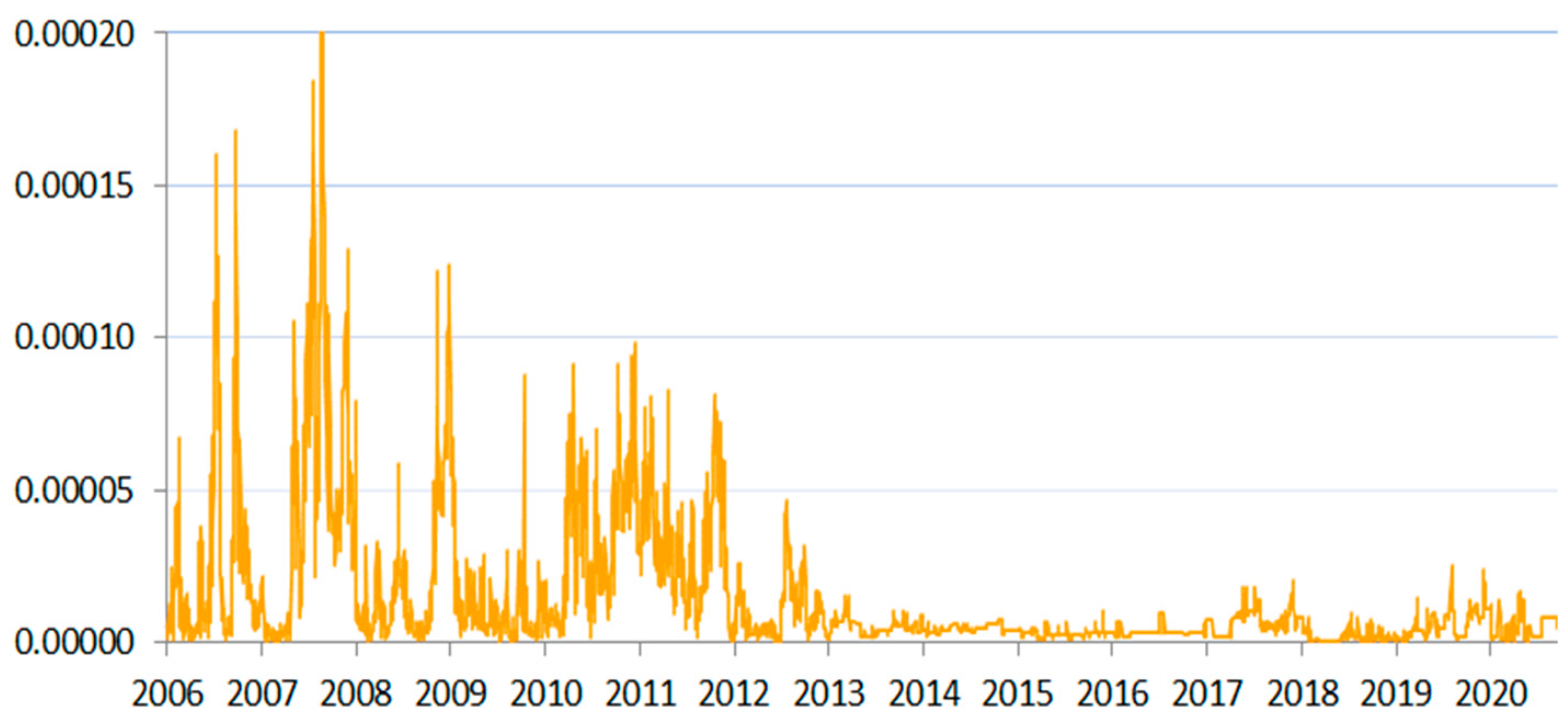

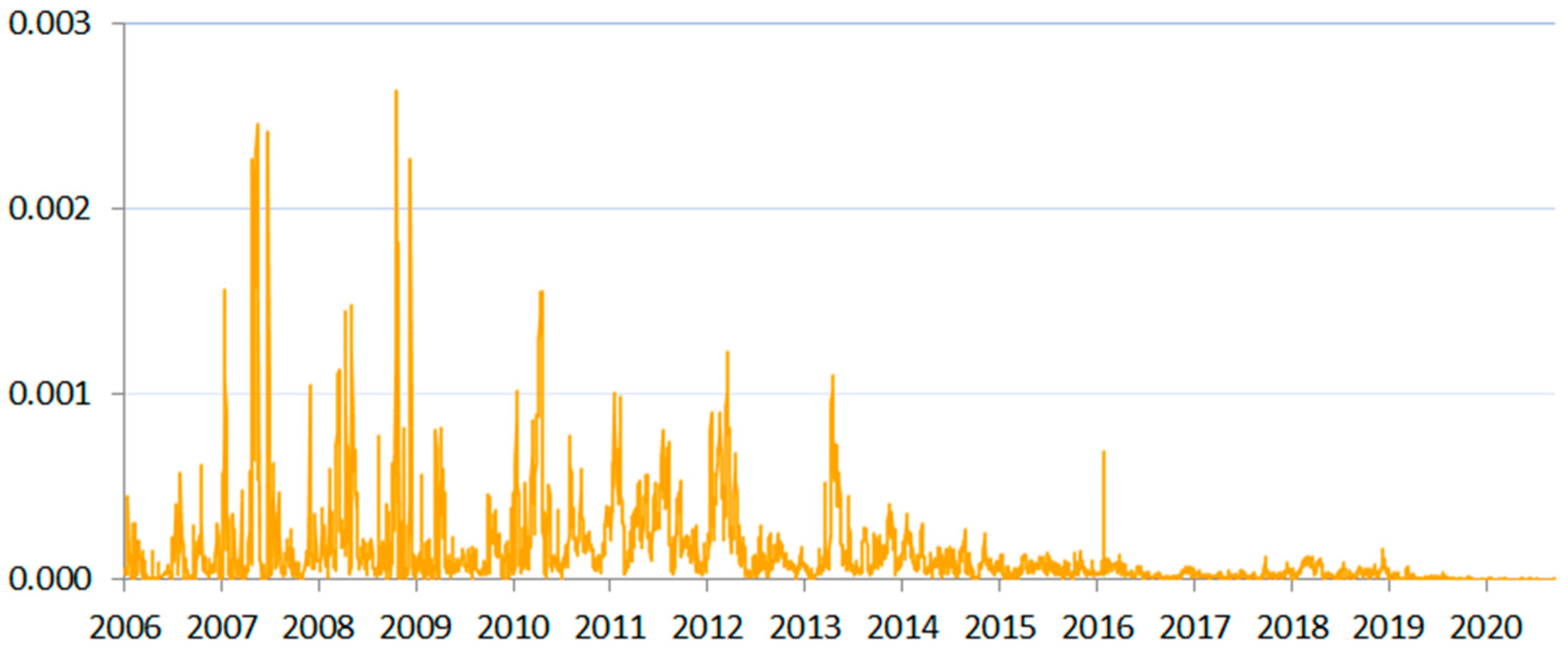

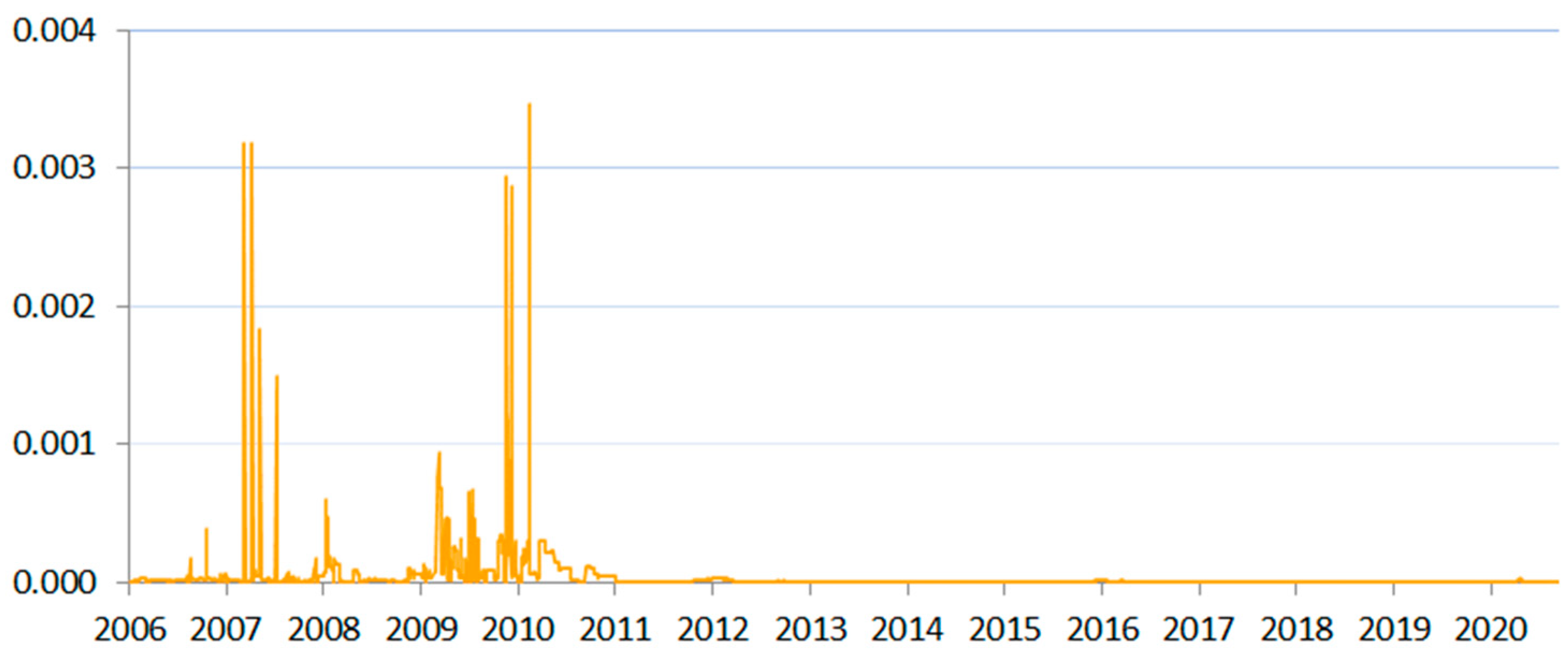

4.2. Data and Empirical Results

4.3. COVID-19 Pandemic

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix B

| Measurement Output | Authors | Short Description |

|---|---|---|

| Liquidity factor | Pastor and Stambaugh (2003) | A measure of market liquidity computed as the equally weighted average of the liquidity measures of individual stocks, using daily data. Specifically, the liquidity measure for a stock is the ordinary least squares regressed function of quantities of the daily returns on this stock in a given month, its volume, and the value-weighted market return. The measure relies on the principle that order flow induces greater return reversals when liquidity is lower, viewing volume-related return reversals as arising from liquidity effects. |

| A set of interpretable parameters | Getmansky et al. (2004) | The proposal to use autocorrelation of returns of hedge funds as a proxy of their liquidity; the first-, second-, and third-order autocorrelations for each hedge fund’s returns are computed using an econometric model of return smoothing coefficients and used as a proxy for quantifying illiquidity exposure—the less liquid the fund, the more serial correlation is observed. |

| Broader hedge-fund-based systemic risk measures | Chan et al. (2006) | A set of three measures quantifying the hedge funds’ impact on systemic risk by examining the risk/return profiles of hedge funds, using returns and sizes data, at the individual and aggregate levels in relation to the investment risk they bear: autocorrelation-based measure of illiquidity exposures, a liquidation probability-based measure, and the regime-switching-based model quantifying the aggregate distress level in the hedge fund sector. |

| Five measures of contagion potential | Billio et al. (2012) | A structured approach to measure systemic risk with indicators based on illiquidity (quantified by autocorrelation) and correlation, using principal component analysis (indicating the degree of assets commonality), regimeswitching models, Granger causality tests (indicating the direction of propagation of systemic triggers), and network diagrams (visualizing the connectedness via directional networks), focused on detecting of interdependence between banks, brokers, insurers, and hedge funds, based on statistical relations among their market returns. This way, the authors quantify the potential contagion effects in the analyzed financial system. |

| A system of liquidity risk charges (LRCs) | Perotti and Suarez (2011) | Pigouvian charges are calculated per unit of refinancing risk-weighted liabilities based on a vector of additional systemic factors (such as size and interconnectedness) in a given period. The weighting function is decreasing and smooth to avoid regulatory arbitrage, which could distort market rates. The model is aimed at making banks internalize negative systemic effects of fragile funding strategies, but the computed size of charges may be used as a tool for quantifying liquidity risk showing which institutions generate more risk for the financial system. |

| Contrarian strategy liquidity measure (CSL) | Khandani and Lo (2011) | A proposal to apply mean-reversion equity market strategy (buying losers and selling winners over 5 to 60 min lagged returns) to proxy the market-making (i.e., liquidity-provisioning) profits and to obtain equity market liquidity measure by observing the performance of this trading strategy. The authors showed that when it does very well, there is less liquidity in the market, and vice versa. |

| Price-impact liquidity measure (PIL) | An inverse proxy of liquidity, in which liquidity is measured with a linear-regression estimate of the volume required to move the price of a security by one dollar; i.e., higher values of lambda imply lower liquidity and market depth. The aggregate measure of market liquidity (PIL) is computed as the daily cross-sectional average of the estimated price-impact coefficients. | |

| Systemic Liquidity Risk Index (SLRI) | Severo (2012) | The SLRI is calculated by integrating the deviations of the following basis spreads: covered interest parity, the on-the-run versus the off-the-run interest-rate spread on government bonds, and the interest-rate spread between the overnight index swap (OIS) and short-term government bonds and the CDS basis spread, to represent the degree of their comovement first component score from a principal component analysis (based on historical time-series data) is used. |

| Liquidity Mismatch Index (LMI) | Brunnermeier et al. (2014) | Measures the difference between the cash-equivalent future values of the assets and liabilities of a bank; it utilizes the cash-equivalent value, which is the product of the asset or liability current value, multiplied by the liquidity weight (positive for assets, negative for liabilities), which depends on an assumed stress scenario, Value-at-Liquidity-Risk, defined as the quantile of worst losses (e.g., 5%), and the Expected Liquidity Loss, which corresponds to the average of the liquidity losses beyond this threshold. The authors proposed to use LMI to identify the most systemically important financial institutions. |

| Systemic risk-adjusted liquidity (SRL) model | Jobst (2014) | Estimates the probability and severity of joint liquidity events; i.e., instances of banks jointly breaching their Net Stable Funding Ratios. Estimation process: 1. The components of the NSFR are valued at market prices in order to generate a time-varying measure of funding risk relative to prudential liquidity standards. 2. Aggregate cash flow implications of changes to liquidity risk are modeled as a put option to estimate losses expected from insufficient stable funding. 3. Individually estimated liquidity risk net exposures are aggregated via a multivariate distribution to determine the probabilistic measure of joint liquidity shortfalls on a system-wide level. |

| Systemicness | Greenwood et al. (2015) | A linear model of fire-sale-induced liquidity crises, computing banks’ equity shock exposures to system-wide deleveraging and to spillovers induced by individual banks; systemicness is a (quantity) measure of a bank’s contribution to financial sector fragility, proportional to its size, leverage, and connectedness (owning large and illiquid asset classes to which other banks are also highly exposed).The key assumption is that banks target a given level of leverage, and this implies asset sales when leverage grows beyond the target. It allows the measurement of how the distribution of banks’ leverage and risk exposures contributes to systemic risk. |

| Cumulative Distance to Default (CDD) | Karkowska (2015) | The distance-to-default measure is a market-based measure of credit risk based on Merton’s model, in which the equity of a firm is modeled as a call option on the value of its assets. The exercise price is equal to the value of the liabilities (the firm defaults when its assets’ value falls below its debt face value). For implementation, the face value of debt is assumed to be equal to the sum of short-term liabilities and half the long-term liabilities from the balance-sheet data. The model is calibrated using the analyzed institution’s market value and its equity price volatility. Karkowska used this method to derive the DD value for each institution forming the studied banking system and aggregated the data to obtain a systemic risk measure equal to the total probability of default of all the studied institutions. |

| Aggregate vulnerability (AV) and illiquidity concentration | Duarte and Eisenbach (2019) | An extension of the systemicness measure that includes the panel analysis tracking vulnerabilities over time. It takes banks’ leverage, asset holdings, asset liquidation behavior, and the price impact of liquidating assets in the secondary market as given, and models banks’ responses to negative liquidity shocks (fire-sale spillovers); using information embedded in repo haircuts to account for changes in asset-specific liquidity and flow-of-funds data, it allows to measure aggregate liquidity, defined as the sum of all the second-round spillover losses (not the initial direct losses) as a share of the total equity capital in the system; the factors’ decomposition applied produces a new component of AV, namely illiquidity concentration. The authors showed that the measure Granger-causes most other systemic risk measures. |

| 1 | Countries were classified according to the criteria of the S&P DJI’s Global Benchmark Index for the study period. |

| 2 | Poland instigated the emergency mechanism to limit public debt in 2014, when the debt was at 56% of GDP. |

| 3 | In that period, several cases of monely laundering were reported in the CEE region, including ABLV bank (Latvia), Danske Bank (Estonia), Versobank (Estonia), and other smaller banks in the Baltics. |

References

- Acharya, Viral V., and Ouarda Merrouche. 2013. Precautionary Hoarding of Liquidity and Interbank Markets: Evidence from the Subprime Crisis. Review of Finance 17: 107–60. [Google Scholar] [CrossRef]

- Acharya, Viral V., Douglas Gale, and Tanju Yorulmazer. 2011. Rollover Risk and Market Freezes. The Journal of Finance 66: 1177–209. [Google Scholar] [CrossRef] [Green Version]

- Afonso, Gara, Anna Kovner, and Antoinette Schoar. 2011. Stressed, Not Frozen: The Federal Funds Market in the Financial Crisis. Staff Report 437. New York: Federal Reserve Bank. [Google Scholar]

- Allen, Franklin, and Douglas Gale. 1994. Limited Market Participation and Volatility of Asset Prices. The American Economic Review 84: 933–55. [Google Scholar]

- Allen, Franklin, and Douglas Gale. 2000a. Bubbles and Crises. The Economic Journal 110: 236–55. [Google Scholar] [CrossRef]

- Allen, Franklin, and Douglas Gale. 2000b. Financial Contagion. Journal of Political Economy 108: 1–33. [Google Scholar] [CrossRef]

- Allen, Franklin, Elena Carletti, and Douglas Gale. 2009. Interbank market liquidity and central bank intervention. Journal of Monetary Economics 56: 639–52. [Google Scholar] [CrossRef] [Green Version]

- Andrieş, Alin Marius, Simona Nistor, and Nicu Sprincean. 2018. The impact of central bank transparency on systemic risk—Evidence from Central and Eastern Europe. Research in International Business and Finance 51: 100921. [Google Scholar] [CrossRef]

- Aragon, George, and Philip Strahan. 2009. Hedge Funds as Liquidity Providers: Evidence from the Lehman Bankruptcy. Working Paper 15336. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Balogh, Eva S. 2015. Ten Hungarian Banks Failed Within One Year. Hungarian Spectrum, March 4. [Google Scholar]

- Banerjee, Ryan N., and Hitoshi Mio. 2014. The Impact of Liquidity Regulation on Banks. BIS Working Papers 470. Basel: Bank for International Settlements. [Google Scholar]

- Bank for International Settlements (BIS). 2005. Zero-Coupon Yield Curves: Technical Documentation. BIS Paper No 25. Basel: Monetary and Economic Department, Bank for International Settlements. [Google Scholar]

- Bank for International Settlements (BIS). 2020. A Global Sudden Stop. Chapter 1 and Chapter 2, Annual Economic Report 2020. Basel: Bank for International Settlements. [Google Scholar]

- Bank for International Settlements (BIS). 2021. COVID-19 Support Measures. Extending, Amending and Ending. April 6. Available online: https://www.fsb.org/wp-content/uploads/P060421-2.pdf (accessed on 23 March 2021).

- Bank of Estonia (BE). 2007. Financial Stability Review 2/2007. Available online: https://www.eestipank.ee/en/publications/series/financial-stability-review (accessed on 23 March 2021).

- Bank of Estonia (BE). 2011. Financial Stability Review 2/2011. Available online: https://www.eestipank.ee/en/publications/series/financial-stability-review (accessed on 23 March 2021).

- Bank of Latvia (BoL). 2007. Financial Stability Report. Available online: https://www.bank.lv/en/publications-r/financial-stability-report (accessed on 23 March 2021).

- Bank of Latvia (BoL). 2019. Financial Stability Report. Available online: https://www.bank.lv/en/publications-r/financial-stability-report (accessed on 23 March 2021).

- Bank of Lithuania (BL). 2009. Financial Stability Review. Available online: https://www.lb.lt/en/ch-publications/category.39/series.169#group-2 (accessed on 23 March 2021).

- Barkauskaite, Aida, Ausrine Lakstutiene, and Justyna Witkowska. 2018. Measurement of Systemic Risk in a Common European Union Risk-Based Deposit Insurance System: Formal Necessity or Value-Adding Process? Risks 6: 137. [Google Scholar] [CrossRef] [Green Version]

- Berg, Andrew, and Catherine Pattillo. 1999. Are Currency Crises Predictable? A Test. IMF Staff Papers 46: 108–38. [Google Scholar]

- Bessembinder, Hendrik, Jia Hao, and Michael L. Lemmon. 2011. Why Designate Market Makers? Affirmative Obligations and Market Quality. Working Paper. Washington, DC: International Monetary Fund. [Google Scholar]

- Bhattacharya, Sudipto, and Douglas Gale. 1987. Preference shocks, liquidity and central bank policy. In New Approaches to Monetary Economics. Edited by William Barnett and Kenneth Singleton. New York: Cambridge University Press, pp. 69–88. [Google Scholar]

- Billio, Monica, Mila Getmansky, Andrew W. Lo, and Loriana Pelizzon. 2012. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics 104: 535–59. [Google Scholar] [CrossRef]

- Blåvarg, Martin, and Patrick Nimander. 2002. Interbank Exposures and Systemic Risk. Sveriges Riksbank’s Economic Review 2: 19–45. [Google Scholar]

- Boss, Michael, Helmut Elsinger, Martin Summer, and Stefan Thurner. 2004. Network topology of the interbank market. Quantitative Finance 4: 677–84. [Google Scholar] [CrossRef]

- Boyson, Nicole M., Christof W. Stahel, and Rene M. Stulz. 2010. Hedge Fund Contagion and Liquidity Shocks. Journal of Finance 65: 1789–816. [Google Scholar] [CrossRef]

- Brunnermeier, Markus K. 2008. Bubbles. In New Palgrave Dictionary of Economics. Edited by Lawrence E. Blume and Steven Durlauf. London: Palgrave Macmillan. [Google Scholar]

- Brunnermeier, Markus K., and Lasse H. Pedersen. 2009. Market Liquidity and Funding Liquidity. Review of Financial Studies 22: 2201–38. [Google Scholar] [CrossRef] [Green Version]

- Brunnermeier, Markus K., and Martin Oehmke. 2013. The Maturity Rat Race. The Journal of Finance 68: 483–521. [Google Scholar] [CrossRef]

- Brunnermeier, Markus K., and Yuliy Sannikov. 2014. A Macroeconomic Model with a Financial Sector. The American Economic Review 104: 379–421. [Google Scholar] [CrossRef] [Green Version]

- Brunnermeier, Markus K., Gary Gorton, and Arvind Krishnamurthy. 2014. Liquidity Mismatch Measurement. In Risk Topography: Systemic Risk and Macro Modeling. NBER Chapters. Cambridge: National Bureau of Economic Research, pp. 99–112. [Google Scholar]

- Brunnermeier, Markus K., Thomas M. Eisenbach, and Yuliy Sannikov. 2013. Macroeconomics with Financial Frictions: A Survey. In Advances in Economics and Econometrics, Tenth World Congress of the Econometric Society. New York: Cambridge University Press, vol. 2, pp. 3–96. [Google Scholar]

- Buiter, Willem Hendrik. 2008. Central Banks and Financial Crises. London School of Economics and Political Science Discussion Paper 619. Financial Markets Group. London: London School of Economics and Political Science. [Google Scholar]

- Bulgarian National Bank (BNB). 2014. Economic Review. April. Available online: https://www.bnb.bg/bnbweb/groups/public/documents/bnb_publication/pub_ec_r_2014_04_en.pdf (accessed on 23 March 2021).

- Caballero, Ricardo, and Alp Simsek. 2013. Fire Sales in a Model of Complexity. The Journal of Finance 68: 2549–87. [Google Scholar] [CrossRef] [Green Version]

- Cantú, Carlos, Paolo Cavallino, Fiorella De Fiore, and James Yetman. 2021. A Global Database on Central Banks’ Monetary Responses to Covid-19. BIS Working Papers 934. Basel: Bank for International Settlements. [Google Scholar]

- Cespa, Giovanni, and Thierry Foucault. 2014. Illiquidity Contagion and Liquidity Crashes. Review of Financial Studies 27: 1615–60. [Google Scholar] [CrossRef] [Green Version]

- Chan, Nicholas, Mila Getmansky, Shane M. Haas, and Andrew W. Lo. 2006. Do Hedge Funds Increase Systemic Risk? Federal Reserve Bank of Atlanta Economic Review 91: 49–80. [Google Scholar]

- Chan-Lau, Jorge A., Marco Espinosa, and Juan Sole. 2009. On the Use of Network Analysis to Assess Systemic Financial Linkages. Global Financial Stability Report. Washington, DC: International Monetary Fund. [Google Scholar]

- Choudhry, Moorad. 2018. An Introduction to Banking: Principles, Strategy and Risk Management (Securities Institute), 2nd ed. Chichester: John Wiley & Sons, Ltd. [Google Scholar]

- Christensen, Jens H., and James M. Gillan. 2014. Does Quantitative Easing Affect Market Liquidity? Federal Reserve Bank of San Francisco Working Paper 2013-26. Available online: https://www.frbsf.org/economic-research/publications/working-papers/2013/26/ (accessed on 12 February 2021).

- Cifuentes, Rodrigo, Hyun Shin, and G. ianluigi Ferrucci. 2005. Liquidity Risk and Contagion. Journal of the European Economic Association 3: 556–66. [Google Scholar] [CrossRef]

- Clementi, David. 2001. Financial Markets: Implications for Financial Stability. Balance Sheet 9: 7–12. [Google Scholar] [CrossRef]

- Coval, Joshua D., and Erik Stafford. 2007. Asset Fire Sales (and Purchases) in Equity Markets. Journal of Financial Economics 86: 479–512. [Google Scholar] [CrossRef] [Green Version]

- Cox, John C., Jonathan Ingersoll, and Stephen Ross. 1981. The relation between forward prices and futures prices. Journal of Financial Economics 9: 321–46. [Google Scholar] [CrossRef]

- Czech National Bank (CNB). 2007. Financial Stability Report. Available online: https://www.cnb.cz/en/financial-stability/fs-reports/ (accessed on 23 March 2021).

- Czech National Bank (CNB). 2008. Financial Stability Report. Available online: https://www.cnb.cz/en/financial-stability/fs-reports/ (accessed on 23 March 2021).

- Czech National Bank (CNB). 2010–2011. Financial Stability Report. Available online: https://www.cnb.cz/en/financial-stability/fs-reports/ (accessed on 23 March 2021).

- Czech National Bank (CNB). 2012. Financial Stability Report. Available online: https://www.cnb.cz/en/financial-stability/fs-reports/ (accessed on 23 March 2021).

- Croatian National Bank (CNB). 2016. Financial Stability, No. 17. Available online: https://www.hnb.hr/en/-/financial-stability-17 (accessed on 23 March 2021).

- de La Grandville, Olivier. 2001. Bond Pricing and Portfolio Analysis. Cambridge and London: MIT Press. [Google Scholar]

- Diamond, Douglas W., and Raghuram G. Rajan. 2005. Liquidity Shortages and Banking Crises. Journal of Finance 60: 615–47. [Google Scholar] [CrossRef] [Green Version]

- Drehmann, Mathias, and Nikola Tarashev. 2011. Systemic Importance: Some Simple Indicators. BIS Quarterly Review. Available online: https://ssrn.com/abstract=1785264 (accessed on 12 February 2021).

- Duarte, Fernando, and Thomas Eisenbach. 2019. Fire-Sale Spillovers and Systemic Risk. Staff Report 645. New York: Federal Reserve Bank. [Google Scholar]

- Duffie, Darrell. 2020. Still the World’s Safe Haven? Redesigning the U.S. Treasury Market after the COVID-19 Crisis. Hutchins Center Working Papers No 62. June. Available online: https://www.brookings.edu/research/still-the-worlds-safe-haven/ (accessed on 25 March 2021).

- Dziwok, Ewa. 2017. Chosen measures for pricing of liquidity. In Contemporary Trends and Challenges in Finance. Edited by Krzysztof Jajuga, Lucjan Orlowski and Karsten Staehr. Springer Proceedings in Business and Economics. Cham: Springer, pp. 3–9. [Google Scholar]

- EIOPA. 2016. Financial Stability Report, EIOPA-FSI-16-016. Frankfurt am Main: European Insurance and Occupational Pensions Authority. [Google Scholar]

- EIOPA. 2017. Technical Documentation of the Methodology to Derive EIOPA’s Risk-Free Interest Rate Term Structures. EIOPA-BoS-15/035. January 30, Frankfurt am Main: European Insurance and Occupational Pensions Authority. [Google Scholar]

- Elsinger, Helmut, Alfred Lehar, and Martin Summer. 2006. Risk Assessment for Banking Systems. Management Science 52: 1301–14. [Google Scholar] [CrossRef] [Green Version]

- European Banking Authority (EBA). 2020. Guidelines on Legislative and Non-Legislative Moratoria on Loan Repayments Applied in the Light of the COVID-19 Crisis, Consolidated Version, December 2. Available online: https://www.eba.europa.eu/regulation-and-policy/credit-risk/guidelines-legislative-and-non-legislative-moratoria-loan-repayments-applied-light-covid-19-crisis (accessed on 25 March 2021).

- European Central Bank (ECB). 2020. Financial Stability Review. Frankfurt am Main: European Central Bank. [Google Scholar]

- Fabozzi, Frank J. 2007. Fixed Income Analysis, 2nd ed. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Feldman, Ron, and Jason Schmidt. 2001. Increased Use of Uninsured Deposits: Implications for Market Discipline. Minneapolis: Federal Reserve Bank of Minneapolis-Fed Gazette, pp. 18–19. [Google Scholar]

- Financial Stability Board (FSB). 2020. Holistic Review of the March Market Turmoil. November 17, Basel: Financial Stability Board. [Google Scholar]

- Flannery, Mark J. 1996. Financial Crises, Payment System Problems, and Discount Window Lending. Journal of Money, Credit and Banking 28: 804–24. [Google Scholar] [CrossRef]

- Gabrieli, Silvia, and Co-Pierre Georg. 2014. A Network View on Interbank Market Freezes. Discussion Paper 44/2014. Frankfurt am Main: Deutsche Bundesbank. [Google Scholar]

- Garcia, Maria Teresa Medeiros, and Vítor Hugo Ferreira Carvalho. 2019. A cross-sectional application of the NelsonSiegel-Svensson model to several negative yield cases. Cogent Economics & Finance 7: 1. [Google Scholar] [CrossRef]

- Geanakoplos, John. 2010. Solving the present crisis and managing the leverage cycle. Economic Policy Review 16: 101–31. [Google Scholar] [CrossRef] [Green Version]

- Gersl, Adam, and Jaroslav Heřmánek. 2007. Financial Stability Indicators: Advantages and Disadvantages of their Use in the Assessment of Financial System Stability. In CNB Financial Stability Report. Thematic Article 2. Prague: Research Department, Czech National Bank, pp. 69–79. [Google Scholar]

- Getmansky, Mila, Andrew Lo, and Igor Makarov. 2004. An econometric model of serial correlation and illiquidity in hedge fund returns. Journal of Financial Economics 74: 529–609. [Google Scholar] [CrossRef] [Green Version]

- Gofman, Michael. 2015. Efficiency and Stability of a Financial Architecture with Too-Interconnected-To-Fail Institutions. External Seminar Paper. Washington, DC: International Monetary Fund. [Google Scholar]

- Gorton, Gary, and G. uillermo Ordonez. 2014. Collateral Crises. The American Economic Review 104: 343–78. [Google Scholar] [CrossRef]

- Greenwood, Robin, Augustin Landier, and David Thesmar. 2015. Vulnerable banks. Journal of Financial Economics 115: 471–85. [Google Scholar] [CrossRef]

- Gromb, Denis, and Dimitri Vayanos. 2002. Equilibrium and welfare in markets with financially constrained arbitrageurs. Journal of Financial Economics 66: 361–407. [Google Scholar] [CrossRef] [Green Version]

- Heider, Florian, Marie Hoerova, and Cornelia Holthausen. 2015. Liquidity hoarding and interbank market spreads: The role of counterparty risk. Journal of Financial Economics 118: 336–54. [Google Scholar] [CrossRef]

- Hördahl, Peter, and Ilhyock Shim. 2020. EME bond portfolio flows and long-term interest rates during the Covid-19 pandemic. BIS Bulletin 18. May 20. Available online: https://www.bis.org/publ/bisbull18.htm (accessed on 25 March 2021).

- Hu, Grace Xing, Jun Pan, and Jiang Wang. 2013. Noise as Information for Illiquidity. The Journal of Finance 68: 2341–82. [Google Scholar] [CrossRef] [Green Version]

- International Monetary Fund (IMF). 2009. Assessing the Systemic Implications of Financial Linkages. In Global Financial Stability Review. Washington, DC: International Monetary Fund, pp. 73–110. [Google Scholar]

- International Monetary Fund (IMF). 2015. Vulnerabilities, Legacies, and Policy Challenges. In Risks Rotating to Emerging Markets, Global Financial Stability Report. Washington, DC: International Monetary Fund. [Google Scholar]

- International Monetary Fund (IMF). 2017. Bulgaria. Financial System Stability Assessment. IMF Country Report, no. 17/132. Washington, DC: International Monetary Fund. [Google Scholar]

- International Organization of Securities Commissions (IOSC). 2020. Money Market Funds during the March-April Episode, Thematic Note, OR03/2020. November. Available online: https://www.iosco.org/library/pubdocs/pdf/IOSCOPD666.pdf (accessed on 23 March 2021).

- Iyer, Rajkamal, and Jose-Luis Peydro. 2011. Interbank Contagion at Work: Evidence from a Natural Experiment. Review of Financial Studies 24: 1337–77. [Google Scholar] [CrossRef] [Green Version]

- Iyer, Rajkamal, and Manju Puri. 2012. Understanding Bank Runs: The Importance of Depositor-Bank Relationships and Networks. American Economic Review 102: 1414–45. [Google Scholar] [CrossRef] [Green Version]

- James, Jessica, and Nick Weber. 2000. Interest Rate Modeling. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Jobst, Andreas A. 2012. Measuring Systemic Risk-Adjusted Liquidity (SRL). A Model Approach, International Monetary Fund Working Paper, WP/12/209. Washington, DC: International Monetary Fund. [Google Scholar]

- Jobst, Andreas A. 2014. Measuring systemic risk-adjusted liquidity (SRL)—A model approach. Journal of Banking and Finance 45: 270–87. [Google Scholar] [CrossRef]

- Kapuściński, Mariusz, and Ewa Stanisławska. 2017. Measuring bank funding costs in the analysis of interest rate pass-through: Evidence from Poland. Economic Modelling 70: 288–300. [Google Scholar] [CrossRef]

- Karaś, Marta. 2019. Measuring Financial System Stability—Analysis and Applications for Poland. Ph.D. thesis, Wrocław University of Economics, Wrocław, Poland, February. [Google Scholar]

- Karaś, Marta, and Witold Szczepaniak. 2019. Three ways to improve systemic risk analysis of the CEE region using SRISK and CoVaR. Paper presented at the International Risk Management Conference, Working Paper, Milan, Italy, June 17–18. [Google Scholar]

- Karkowska, Renata. 2015. Ryzyko Systemowe. Charakter i Źródła Indywidualizacji w Sektorze Bankowym. Kraków: Wolters Kluwer. [Google Scholar]

- Khandani, Amir E., and Andrew W. Lo. 2011. What Happened to the Quants in August 2007? Evidence from Factors and Transactions Data. Journal of Financial Markets 14: 1–46. [Google Scholar] [CrossRef]

- Kiyotaki, Nobuhiro, and John Moore. 2002. Evil Is the Root of All Money. American Economic Review 92: 62–66. [Google Scholar] [CrossRef] [Green Version]

- Kubinschi, Matei, and Dinu Barnea. 2016. Systemic risk impact on economic growth—The case of the cee countries. Romanian Journal of Economic Forecasting 16: 79–94. [Google Scholar]

- Kumar, Manmohan P., and Avinash Persaud. 2001. Pure Contagion and Investors Shifting Risk Appetite; Analytical Issues and Empirical Evidence. IMF Working Papers WP/01/134. Washington, DC: International Monetary Fund. [Google Scholar]

- Loutskina, Elena, and Philip E. Strahan. 2009. Securitization and the Declining Impact of Bank Finance on Loan Supply: Evidence from Mortgage Originations. Journal of Finance 64: 861–89. [Google Scholar] [CrossRef] [Green Version]

- Lubiński, Marek. 2013. Międzynarodowy rynek pieniężny i zarażenie, Gospodarka Narodowa. The Polish Journal of Economics 264: 19–41. [Google Scholar]

- Lucas, Robert E. 1978. Asset Prices in an Exchange Economy. Econometrica 46: 1429–45. [Google Scholar] [CrossRef]

- Martellini, Lionel, Philippe Priaulet, and Stéphane Priaulet. 2003. Fixed-Income Securities: Valuation, Risk Management, and Portfolio Strategies. Chichester: John Wiley & Sons Ltd. [Google Scholar]

- Mehra, Yash P. 1995. Some Key Empirical Determinants of Short-Term Nominal Interest Rates. Federal Reserve Bank of Richmond. Economic Quarterly 81: 33–51. [Google Scholar]

- Mishkin, Frederic. 2007. Systemic Risk and the International Lender of Last Resort, Board of Governors of the Federal Reserve. Paper presented at Tenth Annual International Banking Conference, Chicago, IL, USA, September 28. [Google Scholar]

- Morris, Stephen, and Hyun Song Shin. 2012. Contagious Adverse Selection. American Economic Journal: Macroeconomics 4: 1–21. [Google Scholar] [CrossRef] [Green Version]

- National Bank of Romania (NBR). 2007. Financial Stability Report. Available online: https://www.bnr.ro/Regular-publications-2503.aspx (accessed on 23 March 2021).

- National Bank of Romania (NBR). 2008. Financial Stability Report. Available online: https://www.bnr.ro/Regular-publications-2504.aspx (accessed on 23 March 2021).

- Nelson, Charles R., and Andrew F. Siegel. 1987. Parsimonious Modelling of Yield Curves. Journal of Business 60: 473–89. [Google Scholar] [CrossRef]

- Nelson, William R., and Roberto Perli. 2007. Selected Indicators of Financial Stability. In Risk Measurement and Systemic Risk. Frankfurt am Main: ECB, pp. 343–72. [Google Scholar]

- Nymand-Andersen, Per. 2018. Yield Curve Modelling and a Conceptual Framework for Estimating Yield Curves: Evidence from the European Central Bank’s Yield Curves. Statistics Paper Series, No 27; Frankfurt am Main: European Central Bank. [Google Scholar]

- Pastor, Lubos, and Robert Stambaugh. 2003. Liquidity risk and expected stock returns. Journal of Political Economy 111: 642–85. [Google Scholar] [CrossRef] [Green Version]

- Perotti, Enrico C., and Javier Suarez. 2011. A Pigovian Approach to Liquidity Regulation. International Journal of Central Banking 7: 3–41. [Google Scholar] [CrossRef] [Green Version]

- Radev, Dimitar. 2020. “The Bulgarian Banking Sector in 2020—How Have We Coped and What Is Forthcoming. Address of the Governor of the Bulgarian National Bank”, Bulletin of the Association of Banks in Bulgaria, Issue 64. December. Available online: https://www.bis.org/review/r201209a.htm (accessed on 23 March 2021).

- Sapra, Haresh. 2008. Do accounting measurement regimes matter? A discussion of mark-to-market accounting and liquidity pricing. Journal of Accounting and Economics 45: 379–87. [Google Scholar] [CrossRef]

- Scheinkman, Jose A., and Wei Xiong. 2003. Overconfidence and Speculative Bubbles. Journal of Political Economy 111: 1183–219. [Google Scholar] [CrossRef]

- Schich, Sebastian T. 1997. Estimating the German Term Structure. Discussion Paper 4/97. Frankfurt: Economic Research Group of the Deutsche Bundesbank. [Google Scholar]

- Schmitz, Hendrik. 2011. Direct evidence of risk aversion as a source of advantageous selection in health insurance. Economics Letters 113: 180–82. [Google Scholar] [CrossRef]

- Schoenmaker, Dirk. 1996. Contagion Risk in Banking. LSE Financial Markets Group. London: London School of Economics and Political Science, pp. 86–104. [Google Scholar]

- Schrimpf, Andreas, Hyun Song Shin, and Vladyslav Sushko. 2020. Leverage and Margin Spirals in Fixed Income Markets during the Covid-19 Crisis. BIS Bulletin, No 2. April 2. Basel: Bank for International Settlements. [Google Scholar]

- Severo, Tiago. 2012. Measuring Systemic Liquidity Risk and the Cost of Liquidity Insurance. IMF Working Paper WP/12/194. Washington, DC: International Monetary Fund. [Google Scholar]

- Shiller, Robert, and J. Huston McCulloch. 1990. The term structure of interest rates. In Handbook of Monetary Economics. Edited by B. M. Friedman and F. H. Hahn. Amsterdam: Elsevier, pp. 627–722. [Google Scholar]

- Shleifer, Andrei, and Robert W. Vishny. 1992. Liquidation Values and Debt Capacity: A Market Equilibrium Approach. The Journal of Finance 47: 1343–66. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1997. The Limits of Arbitrage. The Journal of Finance 52: 35–55. [Google Scholar] [CrossRef]

- Svensson, Lars E. 1994. Estimating and Interpreting forward Interest Rates: Sweden 1992–94. NBER Working Paper Series 4871; Cambridge: National Bureau of Economic Research. [Google Scholar]

- Svensson, Lars E. 1995. Estimating Forward Interest Rates with the Extended Nelson & Siegel Method, Quarterly Review. Sveriges Riksbank 3: 13–26. [Google Scholar]

- Svensson, Lars E. 1999. Price Stability as a Target for Monetary Policy: Defining and Maintaining Price Stability. NBER Working Paper 91. Cambridge: National Bureau of Economic Research. [Google Scholar]

- United States Department of the Treasury. 2018. Federal Register, 83/33/Friday, Financial Crimes Enforcement Network Notification. Available online: https://www.fincen.gov/sites/default/files/federal_register_notices/2018-02-16/2018-03214.pdf (accessed on 25 March 2021).

- Upper, Christian. 2007. Using Counterfactual Simulations to Assess the Danger of Contagion in Interbank Markets. BIS Working Paper 234. Basel: Bank for International Settlements. [Google Scholar]

- Upper, Christian. 2011. Simulation Methods to assess the Danger of Contagion in Interbank Markets. BIS Working Paper 234. Basel: Bank for International Settlements. [Google Scholar]

- Valentinyi, Akos. 2012. The Hungarian Crisis, Vox EU. March 19. Available online: https://voxeu.org/article/hungarian-crisis (accessed on 25 March 2021).

- Vassallo, Danilo, Hermans Lieven, and Thomas Kostka. 2020. Volatility-Targeting Strategies and the Market Sell-Off. Financial Stability Review. Frankfurt am Main: European Central Bank. [Google Scholar]

- Vivar, Molestina Luis, Michael Wedow, and Christian Weistroffer. 2020. Burned by Leverage? Flows and Fragility in Bond Mutual Funds. Working Paper Series No 2413; Frankfurt am Main: European Central Bank. [Google Scholar]

- Zigraiova, Diana, and Petr Jakubik. 2017. Updating the Long Term Rate in Time: A Possible Approach. IES Working Paper No. 03/2017. Prague: Charles University in Prague, Institute of Economic Studies (IES). [Google Scholar]

| Systemic Risk Occurrence | Liquidity Effects | Primary Sector of Occurrence | Other Sectors Possibly Affected by the Effect | Authors |

|---|---|---|---|---|

| Illiquidity exposure | Correlated exposures to illiquidity, free-riding | Banking sector | Shadow banking | Bhattacharya and Gale (1987) |

| Maturity rat-race and excessive short-term debt 1 | Brunnermeier and Oehmke (2013) | |||

| Illiquidity contagion | Fire sales and their effect on prices | Financial assets markets | Banking sector, shadow banking, investment funds, SIFIs | Shleifer and Vishny (1992) |

| Market incompleteness and effects of illiquidity on prices | Allen and Gale (1994, 2000a, 2000b) | |||

| Snowball effect, in which the loss spiral interacts with a margin spiral 1 | Brunnermeier and Pedersen (2009) | |||

| Market illiquidity contagion | Cespa and Foucault (2014) | |||

| Illiquidity-driven crises | Constraints to arbitrage adding to illiquidity | Financial assets markets | - | Shleifer and Vishny (1997) |

| Arbitrage affecting liquidity both ways | Gromb and Vayanos (2002) | |||

| Runs caused by mark-to-market accounting | Banking sector, shadow banking, investment funds, SIFIs | Cifuentes et al. (2005) | ||

| Bank runs triggering illiquidity, which triggers further bank runs | Banking sector | Diamond and Rajan (2005) | ||

| Leverage, illiquidity spirals, and financial frictions | Brunnermeier et al. (2013) | |||

| Brunnermeier and Sannikov (2014) | ||||

| Informationally driven market freezes | Interbank market fragility due to fear of adverse selection | Banking sector | - | Flannery (1996) |

| Lack of information about the counterparty risk causes the banks to stop lending to each other upon large shocks | Caballero and Simsek (2013) | |||

| Interbank market freezes caused by information asymmetry | Heider et al. (2015) | |||

| Information asymmetry as a source of repo markets collapse | Financial assets markets | Banking sector, financial markets, shadow banking, investment funds, | Acharya et al. (2011) | |

| Collateral value vs. its price | Gorton and Ordonez (2014) |

| Quantity-Based Indicators | Price-Based Indicators | |

|---|---|---|

| Monetary liquidity | Base money and broader monetary aggregates | Policy and money-market interest rates |

| Access to central bank liquidity facility (e.g., bidding volume) | ||

| Monetary conditions indices | ||

| Foreign exchange reserves | ||

| Funding liquidity | Bank liquidity ratios | Unsecured interbank lending (Libor–OIS spreads) |

| Secured interbank lending (repo rates) | ||

| Bank net cash flow estimates | Margins and haircuts on repo collateral | |

| FX swap basis | ||

| Maturity mismatch measures | Violation of arbitrage conditions (bond–CDS basis, covered interest rate parity) | |

| Commercial paper market volumes | Spreads between assets with similar credit characteristics | |

| Qualitative surveys of funding conditions | ||

| Market liquidity | Transaction volumes | Bid–ask spreads on selected global assets |

| Qualitative fund manager surveys |

| Measure | Authors | Is the Application Possible? (Data Limitations) | Is Contemporaneous Measurement Possible? (Issues of Lags and Frequency) | Does it Facilitate Systemic Risk Analysis? (Coverage/Proxying the Whole Financial System) |

|---|---|---|---|---|

| Liquidity factor | Pastor and Stambaugh (2003) | YES | YES | NO |

| A set of interpretable parameters | Getmansky et al. (2004) | NO | x | x |

| Broader hedge-fund-based systemic risk measures | Chan et al. (2006) | NO | x | x |

| A system of liquidity risk charges (LRCs) | Perotti and Suarez (2011) | YES | NO | x |

| Contrarian strategy liquidity measure (CSL) | Khandani and Lo (2011) | YES | YES | NO |

| Price-impact liquidity measure (PIL) | Khandani and Lo (2011) | YES | YES | NO |

| Systemic Liquidity Risk Index (SLRI) | Severo (2012) | NO | x | x |

| Daily liquidity noise measure | Hu et al. (2013) | NO | x | x |

| Liquidity Mismatch Index (LMI) | Brunnermeier et al. (2014) | YES | NO | x |

| Systemic risk-adjusted liquidity (SRL) model | Jobst (2014) | YES | NO | x |

| Systemicness | Greenwood et al. (2015) | NO | x | x |

| Cumulative Distance to Default (CDD) | Karkowska (2015) | YES | NO | x |

| Aggregate vulnerability (AV) and illiquidity concentration | Duarte and Eisenbach (2019) | NO | x | x |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dziwok, E.; Karaś, M.A. Systemic Illiquidity Noise-Based Measure—A Solution for Systemic Liquidity Monitoring in Frontier and Emerging Markets. Risks 2021, 9, 124. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9070124

Dziwok E, Karaś MA. Systemic Illiquidity Noise-Based Measure—A Solution for Systemic Liquidity Monitoring in Frontier and Emerging Markets. Risks. 2021; 9(7):124. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9070124

Chicago/Turabian StyleDziwok, Ewa, and Marta A. Karaś. 2021. "Systemic Illiquidity Noise-Based Measure—A Solution for Systemic Liquidity Monitoring in Frontier and Emerging Markets" Risks 9, no. 7: 124. https://0-doi-org.brum.beds.ac.uk/10.3390/risks9070124