1. Introduction

Renewable energy has become a key priority in many geographical areas as it provides clean and sustainable energy, among other benefits, to companies and households [

1,

2,

3,

4]. Furthermore, investment in renewable energy is crucial to achieving the ambitious climate targets outlined in the Paris Agreement, where large investments in infrastructure are required to ensure growth and meet the basic needs of the population in developed countries [

5]. Hence, according to OECD estimates [

6], economic growth requires an investment in infrastructure (energy, transport, water or telecommunications) of around 95 trillion dollars from 2016 to 2030, that is, 6.3 trillion dollars per year, ignoring purely climate considerations. Moreover, for the infrastructure supply to be consistent with the 2 °C global temperature target, investments of 6.9 trillion dollars per year are required, although climate variability would persist [

7]. All these elements make it essential to properly organise and structure the financing circuit for the energy transition [

8].

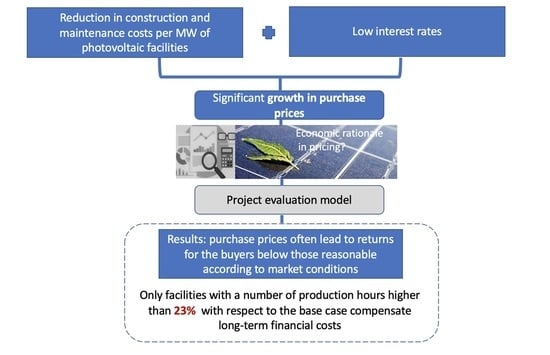

In this framework, recent trends in renewables depict a scenario that involves a race for licenses and locations, where investors are willing to pay relatively high prices for projects that are not under construction and, in some cases, not even ready-to-build (RTB) [

9]. Low interest rates and cost reduction largely determine this fact. In the specific case of the Spanish market, photovoltaic projects have experienced strong reductions in capital expenditures (CapEx) and operational expenses (OpEx), with CapEx falling on average from 6.000 € k/MW to around 500–600 € k/MW, and OpEx falling from 50 €/MWh to 20–25 €/MWh. This environment has allowed installed capacity to exceed 50,000 MW in 2019, with wind projects exceeding 25,000 MW and solar plants 11,000 MW [

10].

As a result, the Spanish renewable energy industry is attracting significant attention from a wide range of investors willing to undertake new renewable energy projects. In fact, in 2019, the sole transmission agent and operator of the national electricity system in Spain—Red Eléctrica de España—received requests amounting to 125,200 MW, which is well above the expected capacity for Spain until 2030, according to the forecasts of the Spanish Government (48,550 MW of installed capacity for wind projects and 38,404 MW for photovoltaic plants, according to the National Energy and Climate Plan 2021–2030). This environment has led to an increase in purchase prices paid for RTB facilities—reaching 100–200 €/MW according to data from Mergermarket database—with large utilities, energy providers and financial investors acting generally as buyers. This framework raises the question of the economic rationale behind the prices paid for RTB projects.

Accordingly, based on the growing interest in promoting renewable energy within the framework of the climate targets of the European Union, as well as the results of previous literature that emphasises the existence of a green bubble [

11,

12,

13], in this paper we compare the internal rate of return (IRR) of a standard photovoltaic plant located in Spain, with the cost of equity required by different types of investors who usually channel funds to these projects, in particular, domestic utility companies and foreign solar funds. Hence, using an approach similar to that followed by Martín et al. [

14], we study the existence of economic reasons that explain the purchase prices of photovoltaic projects. Specifically, building on the fact that renewable energy projects should guarantee a net present value (NPV) equal to or greater than zero to ensure their economic viability, we study whether this is often the case under current market conditions or whether inflated purchase prices consistently translate into negative NPV. Importantly, Martín, Coronas, Alonso, de la Hoz and Matas [

14] find that the onshore wind and photovoltaic auctions in Denmark in 2019 require very specific scenarios to be viable, raising doubts about their effective implementation. For example, in the specific case of photovoltaic energy in the Danish market, the authors show that this energy source is not profitable for any WACC, concluding that either a 60% discount on the investment cost or an annual increase of 6.8% in the market price is required for the NPV to reach the breakeven point.

From a methodological perspective, our approach combines classic methods commonly used to evaluate investments—i.e., the IRR and the NPV—with other models provided by the asset pricing theory—e.g., the Vasicek [

15] model or the Campbell and Shiller [

16] model—that allow us to account for the time-varying nature of discount rates. Importantly, although constant discount rates are frequently used in practice to evaluate new investment projects, abnormally high or low market returns can lead to underestimating or overestimating project performance, thereby hindering well-informed investment decisions. Furthermore, time-varying discount rates are central to correctly evaluating finite-life projects, given their lower indebtedness over time. Therefore, this paper contributes to filling de gap between the classic project evaluation techniques and the recent findings provided by the asset pricing theory. Moreover, we use our model to study the average number of operation hours that allows the project to provide an IRR that covers the implied cost of equity throughout the project life, as well as the maximum purchase price affordable for a notional utility company located in Spain and a generic infrastructure fund located in UK, under current market conditions. In this regard, it should be noted that most of the infrastructure funds operating in the renewable energy industry in Spain are located outside of this country and many of them are based in London. Consequently, for the sake of simplicity, we use a generic UK investor to represent this investor typology.

Our paper contributes to the previous literature in the following terms. First, to the best of our knowledge, this is the first study to analyse the rationale behind the purchase price of RTB solar plants in Spain, using conditional discount rates to capture the effect of the current level of interest rates and equity risk premia in the performance of the project. Second, our results provide updated projections in the performance of Spanish photovoltaic plants. These projections are fully consistent with the current regulatory framework in this country, thus expanding our knowledge of current trends in renewables. Third, our model helps reconcile some widely recognised asset pricing models in the literature with classic procedures used in practice to determine discount rates, allowing us to realistically estimate the conditional cost of equity of photovoltaic projects. In particular, our approach allows us to determine time-varying discount rates that are fully consistent with the current conditions of financing markets. Furthermore, our model helps us control the NPV of the project for the current level of both the risk-free rate and equity risk premium, which allows us to avoid that our results artificially reject the market overvaluation, especially given the low level of interest rates at the valuation date. Finally, our methodology helps us to capture the effects of the purchase power of some international investors on project prices, given their relatively low cost of capital.

The remainder of the paper is organised as follows.

Section 2 describes the model.

Section 3 presents and discusses the empirical results. Finally,

Section 4 concludes the paper.

3. Results and Discussion

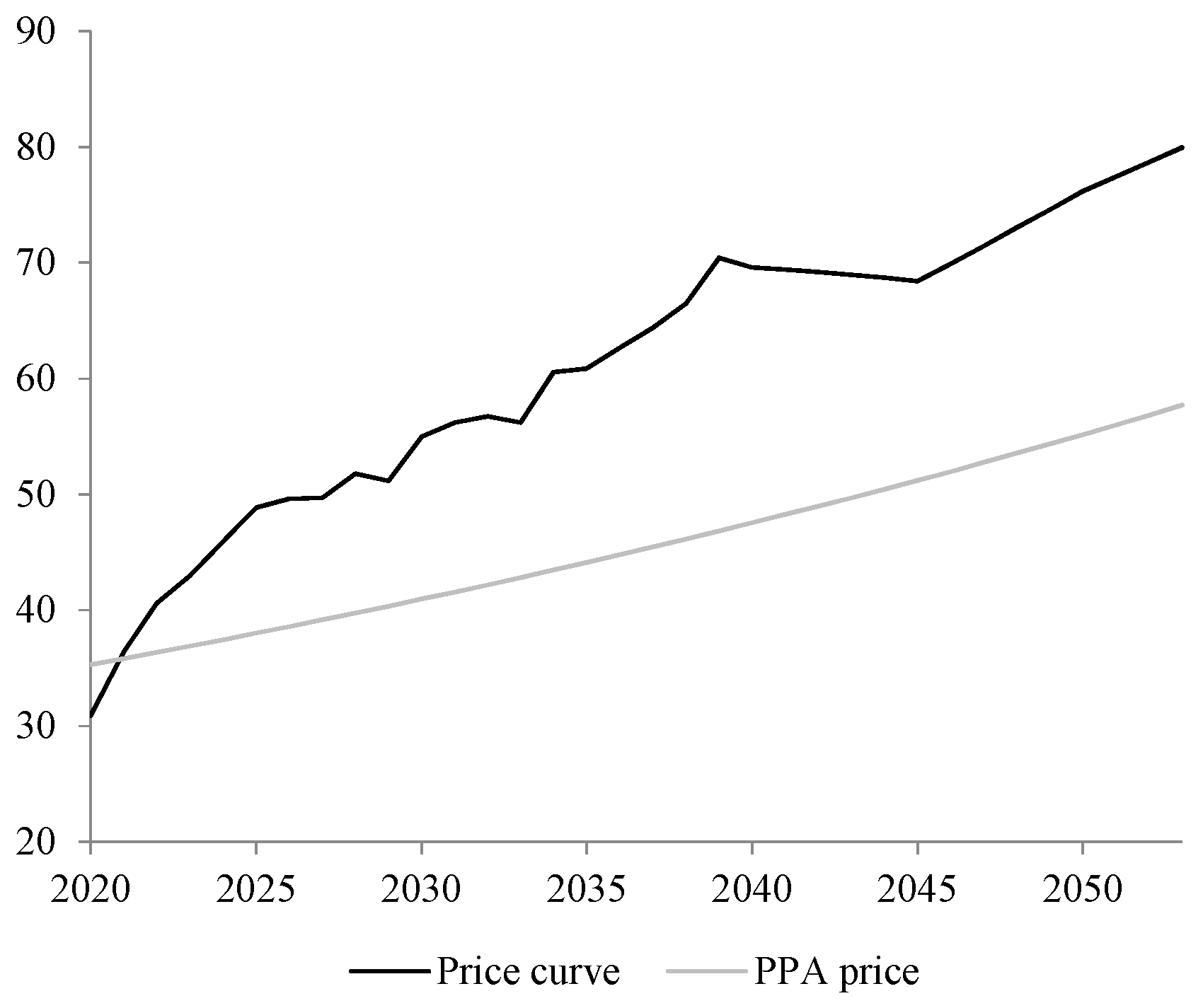

In this section, we study the consistency between the expected IRR for shareholders of the photovoltaic project under analysis, according to assumptions in

Table 1 and

Table 2, and the cost of equity that results from the methodology described in the previous section. To analyse the extent to which the specific nature of the investor can result in significant variations in discount rates, we determine the cost of equity from two different perspectives. First, we use an equal-weighed portfolio comprising Spanish utility companies to estimate the cost of equity from the perspective of a Spanish notional investor. Second, using an analogous approach, we use an equal-weighed portfolio comprising shares issued by UK solar funds to estimate the cost of equity from the perspective of a UK notional investor.

On this basis, we use the assumptions in

Table 1 and

Table 2 to perform the calculations shown in

Table 3,

Table 4 and

Table 5. Specifically,

Table 3 and

Table 4 show the pro forma balance sheet and profit and loss account, while

Table 5 shows the cash flow waterfall of the project.

Figure 2 depicts the main items of the cash flow waterfall in

Table 5. All projections correspond to the base case, as defined in

Table 1 and

Table 2. As shown in

Table 3, once project construction is completed in 2022, fixed assets amount to 25,371 thousand euros, while bank debt amounts to 18,872 thousand euros (17,777 thousand euros at the end of the year, after debt repayments). As usual in this type of project, the profit and loss accounts in

Table 4 show that revenue grows at a steady rate from 2023 onwards, and financial expenses decrease as indebtedness is reduced.

Table 3 and

Table 4 show that bank charges at the beginning of the project life give rise to deferred taxes amounting to 79 thousand euros in 2021, which reduce the tax burden of the firm in 2022.

Based on the projections shown in

Table 5 for equity contributions and the dividends paid to shareholders,

Table 6 shows the detail of the calculations used to determine the implied cost of equity of the project considering a time-varying discount rate.

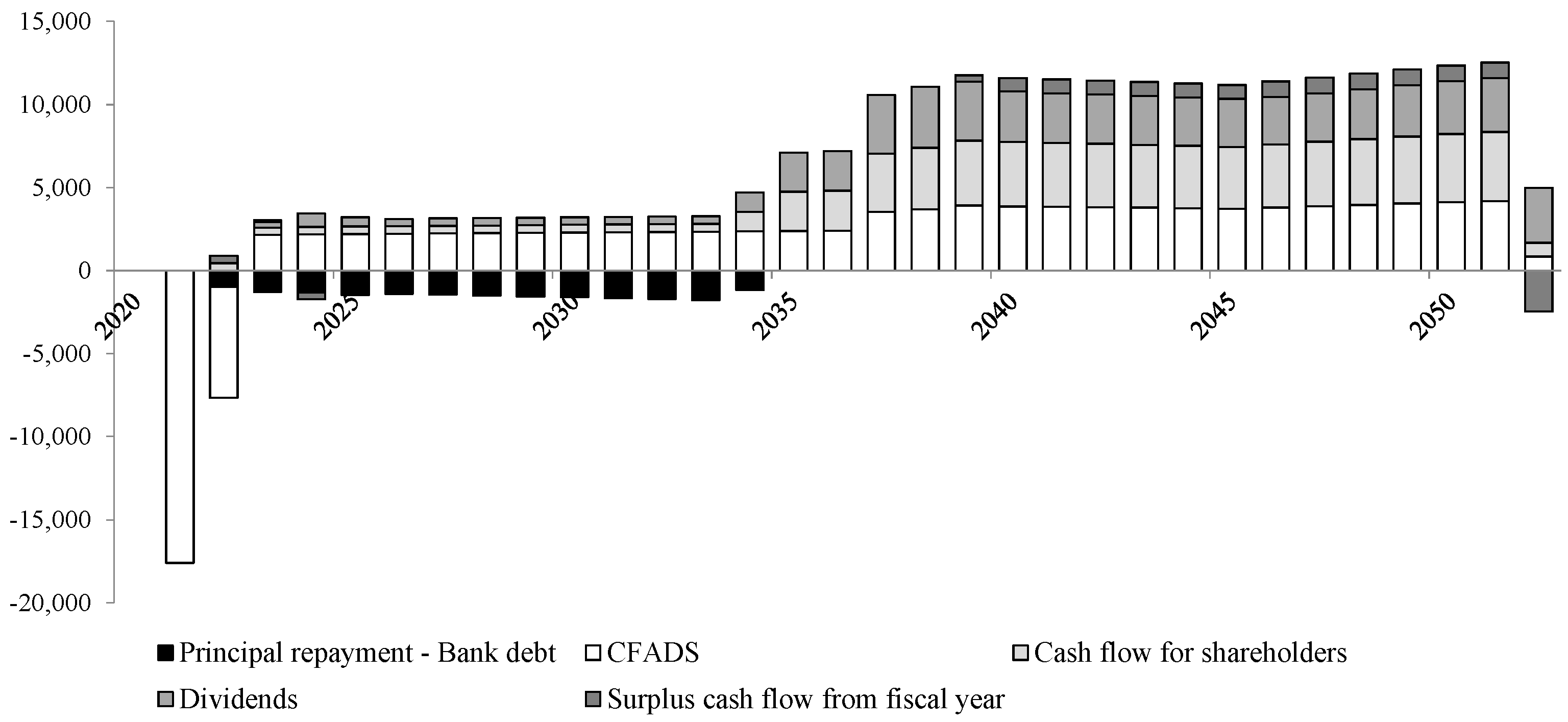

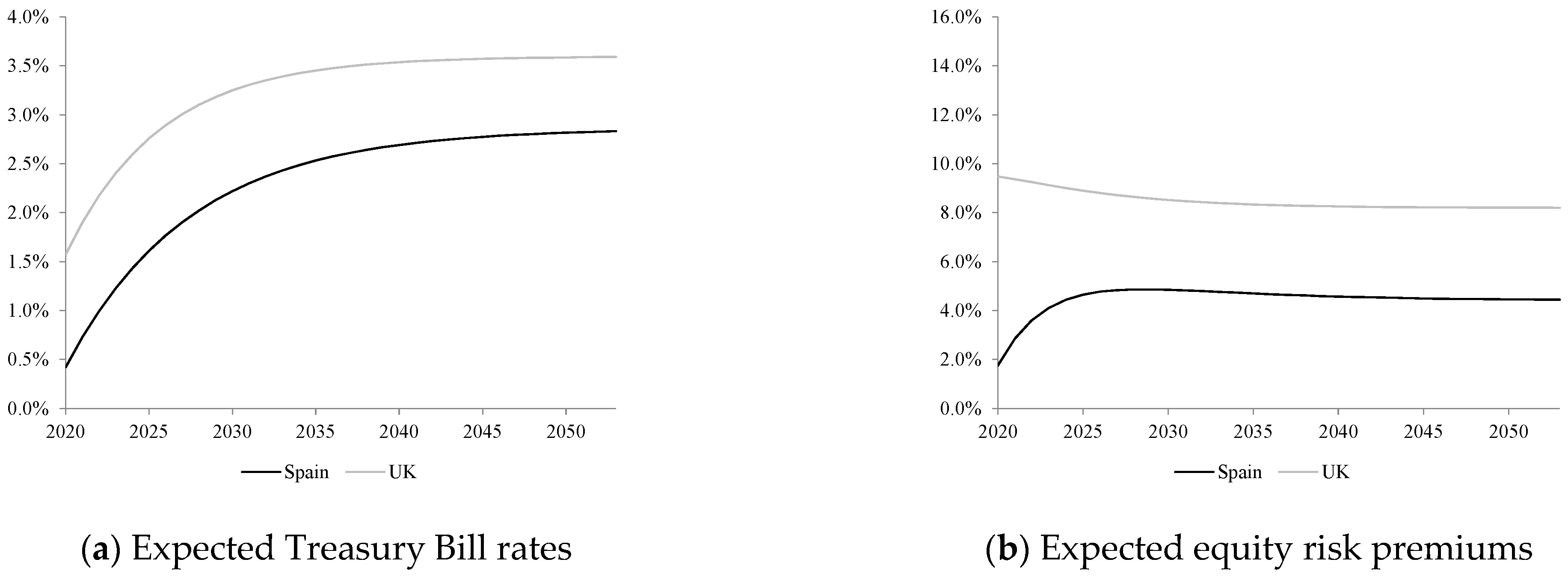

As noted in the previous section, we estimate the risk-free rate in Panels A and B in

Table 6 using the Euler approximation of the Vasicek [

15] model and one-year Treasury Bill rate data for Spain and UK, respectively, as provided by the OECD Statistics section, for the period from January 1989 to December 2018. We assimilate the long term mean interest rate—

b in Expression (3)—to the average Treasury Bill rate for each country in the period 1994–2018.

Table 7 shows the regression results provided by the Vasicek [

15] model, while

Figure 3a plots the interest rate estimates for Spain and UK, for the period 2020–2053.

To estimate the expected equity risk premium for Spain and UK, we compile return data for all stocks traded on the Madrid Stock Exchange and the London Stock Exchange from the Datastream database, for the period from January 1989 to December 2018. Specifically, we compile the following data series: (i) total return index (RI series), (ii) market value (MV series), and (iii) dividend yield (DY series). Hence, our data series comprise 398 and 4385 stocks for Spain and UK, respectively.

Using these data, we determine the value-weighted market return and the value-weighted dividend yield for the period under consideration. These series allow us to estimate the AR(1) process for the dividend yield and run the forecasting regression defined in Expression (5) (all data are publicly available at [

42]).

Table 7 shows the regression results for these models, while

Figure 3b depicts the expected equity risk premiums that result from Expression (5) for Spain and UK, for the period 2020–2053. Importantly, the estimates in

Table 7 show that the dividend yield is highly persistent over time and exhibits a strong predictive power in forecasting the return of the market portfolio, consistently with the results achieved for other countries and markets [

43]. Moreover, the predictive power of the dividend yield increases significantly with the horizon, as is often the case with most business cycle predictors (not shown in

Table 7).

To estimate beta coefficients, we form two equal-weighed portfolios that allow us to determine the cost of equity for a Spanish and a UK notional investor, respectively. Specifically, these portfolios comprise the following securities: (i) Endesa, S.A. and Iberdrola common stocks, traded on the Madrid Securities Exchange, and (ii) Foresight Solar Fund Ltd. and Bluefield Solar Income Fund Ltd. shares, traded on the London Stock Exchange. Importantly, in order to partially overcome the limitations of the CAPM in determining discount rates, we increase the cost of equity that results from Expression (2) by the alpha coefficients provided by the time-series regressions of portfolio returns on the market portfolio, thus accounting for the pricing errors delivered by the model.

Table 8 shows alpha and beta estimates, where unlevered betas are determined using the average equity value, debt and effective tax rate for the companies considered, as provided by the Datastream database, on the Hamada [

41] model.

We use the risk-free rates and equity risk premiums in

Figure 3, together with alpha and beta estimates in rows labelled ‘Average—Spain’ and ‘Average—UK’ in

Table 8, to estimate the time-varying cost of equity of the project for a notional sponsor in Spain or UK, respectively, as shown in

Table 6. Specifically, each year we simultaneously determine the equity value and the cost of equity using the equity value itself and the bank debt of the period to estimate the levered betas according to the Hamada [

41] model. As a result, the NPV of the project amounts to 1822 thousand euros when we use the cost of equity of a Spanish notional sponsor, and 3057 thousand euros when we use the cost of equity of an UK notional investor, as shown in Panels A and B in

Table 6, respectively. To estimate the implied cost of equity throughout the life of the project, we determine the IRR for shareholders that results from subtracting the NPV of the project from the proceeds for shareholders, according to the following expression:

where

denotes the proceeds for shareholders in the period from

t − 1 to

t, and

is the implied cost of equity.

Table 6 shows that the implied cost of equity of the Spanish notional sponsor amounts to 10.7%, while it falls to 9.82% for the UK notional investor.

In any case, the results in

Table 6 completely ignore the fact that the companies considered to estimate alphas and betas usually invest in turnkey facilities, thus ignoring construction risk. As noted in the previous section, in order to consider the increase in the implied cost of equity that results from construction risk, we use the assumptions shown in

Table 1 for the base case and the worst-case scenarios to run a Monte Carlo simulation on the projections shown in

Table 3,

Table 4 and

Table 5. As a result, we obtain a construction risk premium of 2.06%.

To compare the cost of equity of the project with the IRR for shareholders and, consequently, analyse the economic rationale behind the purchase prices paid for ready-to-build solar farms in Spain,

Table 9 summarises the main results of our study under different scenarios. Specifically, column I in

Table 9 comprises the results achieved for our base case, according to the projections shown in

Table 3,

Table 4,

Table 5 and

Table 6. Importantly, while the IRR for shareholders in column I is determined using the proceeds for shareholders shown in

Table 6, the IRR for the buyer subtracts a purchase price of 100 € k/MW from the proceeds for shareholders in

Table 6, which is consistent with the current prices paid for these transactions in Spain, as noted above. On the other hand, column II in

Table 9 comprises the results obtained when we set the production of the solar farm to match the IRR for the buyer to the cost of equity increased by the construction premium. Hence, the required hours of operation should increase from 2200—as considered in the base case—to 2718 for that purpose, as labelled in column II. Finally, columns III and IV in

Table 9 show the results of the model when we set the purchase price to match the IRR for the buyer to the cost of equity of a Spanish notional investor (45 € k/MW) and an UK notional investor (78 € k/MW), respectively.

The results in

Table 9, column I show that, although the IRR for the shareholders in the base case (12.4%) exceeds the cost of equity for both a Spanish notional investor (10.7%) and an UK notional investor (9.8%) when we ignore the construction risk, if we include the construction premium, the project provides a near-zero NPV, with the cost of equity for a Spanish investor (12.8%) slightly exceeding the IRR for shareholders. However, it should be noted that the cost of equity is clearly above the IRR for the buyer (9.2%) either including or ignoring the construction premium, which suggests that current purchase prices of RTB solar plants are overvalued in the Spanish market. In any case, column I in

Table 9 shows that the cost of equity of a UK notional investor amounts to 9.8% when we ignore construction risk, meaning that foreign solar funds can exert upward pressure on purchase prices of solar farms, exploiting their lower cost of equity.

On the other hand, column II in

Table 9 shows that the breakeven point of operation hours that equals the IRR for the buyer with the increased cost of equity for both a Spanish notional investor and an UK notional investor amounts to 2718 h, that is, 23.53% more than the number of hours assumed in the base case, which is not easy to achieve under current technological conditions. In this second scenario, the IRR for the buyer amounts to 12.4%, suggesting that the current prices of solar farms are economically viable only for the most efficient parks.

Consistent with the results shown in columns I and II, column III in

Table 9 shows that the purchase price that equals the IRR for the buyer with the cost of equity for a Spanish notional investor amounts to 45 € k/MW, that is, 55% less than the purchase price assumed in the base case. On the other hand, the lower cost of equity of UK solar funds allows these investment vehicles to reach a purchase price of 78 € k/MW. In any case, it should be noted that the production assumed in the base case (2200 h) prevents the project from providing an IRR for the buyer that simultaneously compensates for the cost of equity and the construction premium.

4. Conclusions

Based on updated data from the Spanish renewable energy market in early 2020, and using return data from both the Spanish and the UK equity markets to determine conditional discount rates, the forecasts shown in the previous section for a generic photovoltaic plant located in Spain provide us with three major findings. First, although the expected IRR for shareholders largely compensates for the implied cost of equity that results from conditional discount rates both ignoring and including construction risks, prices paid at the valuation date for RTB facilities translate into an IRR for the buyer that is clearly below the implied cost of equity. Consistent with previous literature on the topic [

11,

12,

13,

14], these results suggest that, although Spanish RTB photovoltaic plants provide on average a near-zero NPV for shareholders, the NPV for buyers paying purchase prices equal to or greater than 100 € k/MW for these facilities—as is often the case at the valuation date—is likely to fall below zero, which is consistent with an apparent overvaluation of the market.

Second, on average, the purchase prices paid at the valuation date for RTB photovoltaic plants only compensate the implied cost of equity in the case of the most efficient projects. In particular, our results show that only facilities that exceed a production of 2718 h—that is, 23.53% more than the number of hours considered in the base case—provide an IRR for shareholders that compensate the cost of equity. That production translates into an IRR for shareholders equal to 16.4% (see column II in

Table 9), which would realistically require not only an increase in production hours, but also a further decrease of investment and operation costs. Remarkably, for that number of hours, both the IRR for the buyer and the implied cost of equity amount to 12.4%.

Third, notwithstanding the above, specialised investors, such as international investment vehicles investing in projects globally, can exploit their lower cost of equity to pay prices significantly higher than those affordable by domestic investors in non-financial industries. Specifically, our results show that, while the purchase price that allows large domestic utilities to compensate their cost of equity amounts to 45 € k/MW, this price rises to 78 € k/MW in the case of UK solar funds, that is, 73.33% higher. These results suggest that specialised international investors can exert upward pressure on purchase prices of solar plants, exploiting their lower cost of equity.