1. Introduction

After recent accounting scandals caused the bankruptcy of many large organizations across the world, the efficacy of the control mechanisms and authenticity of the accounting information has been thrown into question. Managers can misuse the powers entrusted by the stakeholders by applying their discretion over accounting numbers (

Lazzem and Jilani 2018). This study discusses the Earnings Management (EM, hereafter) phenomena, which has become a very hot topic in the recent decade.

Numerous definitions of EM are available in the literature. However, the most comprehensive and widely used definition is; “Earnings management occurs when managers employ judgment in financial reporting and in structuring transactions to alter financial reports. The motive is either to mislead certain stakeholders about the underlying economic performance of the company or to influence contractual outcomes that depend on the reported accounting numbers” (

Healy and Wahlen 1999). Hence, distorting the firm’s actual financial information from stakeholders and influencing credit terms are the key objectives of EM. Managers can adopt an opportunistic approach to manipulate earnings either through Real Earning Management (REM) or through Accrual-based Earning Management (AEM) activities. They can undertake REM activities throughout the fiscal period, however, AEM activity is only possible at the end of a fiscal year but before the issuance of financial reports so as to reflect that the income target has been achieved (

Zang 2012).

The notion of corporate life cycle stages is derived from the organizational sciences literature (

Hasan and Habib 2017). The theory of CLC postulates that a firm moves through a number of foreseeable phases of development and its structure, capabilities, resources and strategies vary significantly over different phases of firm life cycle (

Gray and Ariss 1985;

Miller and Friesen 1984). This theory also provides help to the management with some fundamental guidelines, diagnostic tools and parameters for assessing the firms’ transition from one stage to another (

Hasan et al. 2015). Recent studies show that CLC is not based on a single firm level element, rather it is a combination of multiple factors, i.e., firms’ external and internal factors, unobservable and observable factors, macro-economic factors and various firm and management related attributes (

Hasan and Habib 2017).

CLC is an inherited and time-varying phenomenon which helps to predict a firm’s level of cash holdings, risk-return paradox, capital structure, dividend policy, debt maturity structure, investment criteria and quality of disclosure, among other things (

Akbar et al. 2020;

Al-Hadi et al. 2016;

DeAngelo et al. 2006;

Faff et al. 2016;

Hasan and Habib 2017;

Zhang and Xu 2020). In the context of EM, extant literature suggests that institutional environment, cost of capital, audit quality, financing constraints, diversification and asymmetric information have an effect on the EM practices of the firms (

Abad et al. 2018;

Alzoubi 2018;

An et al. 2016;

Farrell et al. 2014;

Habib et al. 2019;

Rodríguez-Pérez and van Hemmen 2010).

Habib and Hasan (

2017) also suggested that firm risk taking is higher (lower) during the introduction and decline (growth and maturity) phase of CLC.

Drake (

2015) argued that tax-avoidance practices are expected to vary over the CLC stages.

Hasan et al. (

2017) have claimed that CLC stages have significant correlation with tax-avoidance practices. They found that compared to the shake-out stage, introductory and decline (growth and mature) stages have positive (negative) association with corporate tax-avoidance practices. Similar outcomes are proved by (

Mangoting and Onggara 2019) in the context of Indonesian manufacturing sector. This suggests that variations in tax-avoidance practices also affect the managers’ attitude towards the EM practices over CLC stages. Moreover, financial distress also has a significant association with EM (

Agustia et al. 2020;

Ghazali et al. 2015;

Habib et al. 2013;

Jacoby et al. 2019;

Li et al. 2020). This financial distress/bankruptcy risk level varies over different stages of CLC (

Akbar et al. 2019). Thus, it is reasonable to posit that managerial EM practices may also respond differently to the varying stages of a firm life cycle. However, no empirical study has been designed to explore the possible effects of corporate life cycle stages on the earnings management behavior of firms. Therefore, the prime objective of present study is to investigate the impact of CLC stages on the EM of sample firms.

The contribution of this study is manifold: first, we provide an extension to the literature on EM determinants by documenting varying managerial opportunistic behavior towards EM practices across the CLC stages. Second, a large number of studies have used only one type of EM (mostly AEM) in their analysis to reach the conclusion. However, to cope up with this deficiency in the extant literature we employ both AEM and REM in the present study. Third, to empirically demonstrate the CLC stages where firms will be more and/or less engaged in both AEM and REM practices is a fairly new topic. Fourth, the contribution of this study may be observed in context of its auxiliary validation of the (

Dickinson 2011) measure, which to the best of our knowledge has remained unexplored in this relation. Fifth, our study also contributes to CLC literature by documenting the unique role of CLC to express the cross-sectional variations in EM behaviors. Finally, our research has direct implications for creditors and investors, because investors usually rely on the analyst coverage for growth and mature phased firms, while accounting information becomes more relevant during the earlier and decline phase of firms (

Dickinson et al. 2018). Present study recommends that creditors and investors should appraise the EM activities in conjunction with CLC stages.

Why China?

China is the second largest economy of the world and experts forecast that it will achieve the mark of world’s largest economy in the next decade.

1 Further, China has become exemplar for all developing countries and it plays a very significant and active role in the global economy (

Khan et al. 2018;

Zaman and Oehler-Şincai 2019;

Erokhin and Gao 2020;

Prabhakar and Erokhin 2020;

Zaman and Oehler-Şincai 2020). Moreover, the Chinese corporate sector is completely different from the rest of the developed and emerging economies because of the its unique regulatory environment and capital market mechanism (

Lan et al. 2013).

Khan et al. (

2017) have documented that the Chinese financial and legal system is not well developed as compared to other developed countries, which makes the present research more influential and interesting. Furthermore, many listed firms in China are governed and controlled by the local and central governments (

Lan et al. 2013). The central government gives subsidies to state-owned firms for meeting the criteria of central government, which might cause the managers to use their incentives on earnings to artificially fulfill standards. In Chinese quoted firms, analysts usually set tough targets for managers and may also impose pressure on firms’ managers (

Cang et al. 2014), which in turn ultimately motivates the managers to fabricate earnings in order to meet the analysts’ expectations. Moreover,

Morck et al. (

2000) document that in emerging economies, including China, stock price movement is synchronous with those of developed countries. This phenomenon enhances the protection of minority shareholders in stock markets of emerging economies. Therefore, EM is considered very common on the mainland (

Noronha et al. 2008). For all of these reasons, we believe that China is an interesting case for this research.

The rest of the paper proceeds as follows: literature review and hypothesis development is presented in

Section 2; research design is discussed in

Section 3;

Section 4 presents the univariate and multivariate analysis; and

Section 5 concludes the study.

2. Literature Review and Hypothesis Development

CLC theory posits that firms do not follow a static pattern throughout their life. Instead, they formulate and employ various strategies in order to maximize the efficiency of available scare resources at each stage of CLC (

Jenkins et al. 2004). Moreover, profitability, earnings persistence, cash-flows volatility, idiosyncratic volatility and the cost of capital also varies across CLC stages (

Hasan and Habib 2017;

Hribar and Yehuda 2007). Therefore, it would be interesting to explore whether managers’ attitudes toward EM practices also vary across different stages of CLC.

The first CLC stage is the “Introduction stage.” This is also known as the “Start-Up stage” (

Habib and Hasan 2017), “existence stage” (

Lester and Parnell 2008), “birth stage” (

Lippitt and Schmidt 1967) and “entrepreneurial stage” (

Quinn and Cameron 1983). This is the time a firm enters in the market and there is high risk and uncertainty in the market (

Yoo et al. 2019). The ownership of these firms is usually held by a single individual or very few shareholders (

Lester et al. 2003).

Jaafar and Halim (

2016) contend that at the introduction stage of CLC, firms require higher investment as these firms have more opportunities to invest in projects with Positive Net Present-Value (NPV). However, initially, start-up firms earn low profits and face difficulties in meeting their expenditures; this situation is known as “Death Valley” (

Laaksonen and Sipilä 2006). Moreover, introduction firms bear higher costs of debt (

Bulan and Yan 2009), high uncertainty of R&D expenditures (

Yoo et al. 2019) and bankruptcy risk (

Akbar et al. 2019). With regard to AEM,

Krishnan et al. (

2018) point out that during introduction phases, the amount of accruals will be high, which motivates the managers to exercise their discretion over reported accounting figures. Consistent with resource-based theory

Koester et al. (

2013) have documented that at the birth stage, firms will allocate and use their resources for its competitive advantage, which may be achieved through aggressive tax planning. Moreover, young firms grow rapidly which makes it difficult to ensure high financial reporting quality (

Doyle et al. 2007). The introductory stage also negatively affects the firm reporting quality (

Can 2020). Idiosyncratic volatility and uncertainty about cash-flows is also much higher for the new start-ups (

Habib and Hasan 2017;

Irvine and Pontiff 2009). These factors (low profitability, higher cost of debt, bankruptcy risk, high uncertainty of R&D expenditures, accruals and idiosyncratic volatility, among others) may trigger the managers to use EM tactics to present a better financial picture to the creditors for obtaining loans at a lower cost.

The second CLC stage is the “Growth stage” also known as the “Survival stage” (

Lester and Parnell 2008). Growth firms are characterized by new resources, success, development and expansion of business activities (

Rautanen 2013). This stage is also defined as a growing phase of an enterprise which is yet to attain maturity. Growth firms are usually more structured in operations and decentralized in the decision-making process as compared to the introduction phase. At this stage, the debt ratio starts deteriorating (

Bulan and Yan 2009), and sales-volume and market share expands considerably (

Bender 2013;

Mokhova and Zinecker 2013), even though these firms have a lower level of assets but still have meaningful market value (

Paul Hribar and Yehuda 2015). Moreover, compared to new entrants, growth firms have higher sales growth, higher profit ratios and less asymmetric information (

Akbar et al. 2019). Besides, growth firms are promising and have less uncertainty about cash flows (

Dickinson 2011;

Spence 1979). Although these firms have positive financing cash flow, they still need loans to fuel rapid expansion (

Krishnan et al. 2018) and receive much analyst coverage which reduces the mispricing and uncertainty issues (

Hasan and Habib 2017). However, at the growth phase, firms may have more concerns about their reputation, while tax aggressiveness may badly affect the reputation of the firm (

Vacca et al. 2020) which in turn ultimately dampens the managers involvement in tax-avoidance practices at this phase (

Austin and Wilson 2015;

Graham et al. 2014;

Hasan et al. 2017). This stage also increases the demand for accountability and transparency from the firm in order to seek additional external financings (

Habib and Hasan 2019). Further, through the visibility hypothesis, (

Hamers et al. 2016) have documented that analyst following is much greater in the growth stage as compared other CLC stages, which might dampen the managers’ involvement in EM tactics.

Krishnan et al. (

2018) also assert that growth firms exhibit proper internal control and monitoring mechanisms and consequently a higher financial reporting quality. These arguments indicate that less information asymmetry, higher internal cash-flow generation and analyst coverage, lower demand of external financing and strict internal control mechanisms restrict managers from engaging in EM practices.

The third stage of CLC is the “Mature stage” also known as the “Formalization and Control stage” (

Quinn and Cameron 1983). This is the time when competition becomes fierce and business expansion and profits are stagnant (

Yoo et al. 2019). Mature firms are considered to be highly stable, large, rich and profitable as compared to the growth phase (

Bulan and Yan 2010).

Hasan et al. (

2015) state that mature firms enjoy their presence in the market for a longer time period when compared to earlier phases, therefore these firms are followed more keenly by analysts. At the mature phase, firms have greater access toward the resources (such as expertise), which implies that management have much more concerns for efficiently managing its core operations instead of tax-avoidance practices (

Agyei et al. 2020;

Koester et al. 2013). At this stage, firms are interested in sustaining what they have already accomplished instead of exploring new opportunities. Consequently, these firms do not require much of the debt financing, even though they are able to get loans at lower rate (

Bulan and Yan 2009). Besides, mature firms have higher fixed assets, less uncertainty, more growth opportunities and less asymmetric information problems (

Suberi et al. (

2012). Furthermore, at this stage, cash-flows from operations and earnings level become positive (

Hasan and Habib 2017;

Paul Hribar and Yehuda 2015). In addition,

O’Connor and Byrne (

2015) reveal that at the mature stage, firms have a better ranking in governance activities and are also more accountable and transparent as compared to other CLC stages.

Zadband and Omrani (

2014) also documented that at maturity stage firms reveal the highest level of reporting quality. Further, a recent study has concluded that during the maturity phase the firm’s disclosure narrative is less ambiguous, less complex and much more optimistic (

Bakarich et al. 2019). Therefore, based on these arguments, we expect that the mature stage stifles the managerial involvement in EM practices.

The fourth CLC stage is the “Shake-Out stage” also known as the “Renewal phase” (

Lester and Parnell 2008) and “Revival phase” (

Miller and Friesen 1984). This stage arises when competitors with lower market share begin to leave the market, which intensifies the competition among strong competitors (

Carroll 1985;

Karniouchina et al. 2013). Theoretically, the shake-out stage is characterized by a tough business environment due to increased uncertainty between the Mature and Terminal stage (

Dickinson 2011). At this stage, sales volume tends to decline, thus firms are forced to boost innovation-related activities to attain stability (

Mangoting and Onggara 2019). On the contrary, (

Dickinson 2011) posits that during the shake-out stage of the life cycle, firm size increases. (1985) states that the number of products produced by the firm starts to decline which causes a further reduction in product prices. Further, in the shake-out stage, reduced monitoring level leads to an increase in after tax cash-flows, which may provide incentive for managers to actively avail the tax-avoidance practices (

Richardson et al. 2015). Although many researchers have discussed the shake-out phase, because of competing arguments the true nature of this stage is still unclear. Therefore, by following (

Hasan et al. 2015;

Wang et al. 2020) we use this stage as a benchmark to interpret the findings of other CLC stages.

The last stage of CLC is the “Decline stage” (

Dickinson 2011) also referred to as the “Terminal stage”, typically characterized by decreasing earning and sales volume (

Paul Hribar and Yehuda 2015) which could trigger the demise of a firm. During the decline phase, board members are usually interested in their personal goals instead of firm related goals (

Quinn and Cameron 1983). This is considered the toughest stage that a firm confronts during its life cycle.

Bakarich et al. (

2019) have concluded that the decline stage firms make more complex and ambiguous disclosures.

Dickinson (

2011) states that during this stage firms’ growth, cash-flows and profits start to decline, which in turn increase the uncertainty about return on investment, cash-flow volatility and earnings level. Besides, financially troubled decline firms usually face the dilemma of an inadequate internal control system (

Doyle et al. 2007). Hence, this stage requires the managers to reflect a stable condition in front of investors (

Zamrudah and Salman 2013). Thus, managers of declining firms play with accruals in an attempt to minimize the chances of debt covenant violations (

DeFond and Jiambalvo 1994).

Edwards et al. (

2016) claimed that when firms are financially distressed, they are likely to get involved in tax-avoidance practices due to low liquidity level. In this stage, firms usually pursue more risky projects that could motivate the managers to pursue aggressive tax and financing strategies (

Akhtar 2012;

Habib and Hasan 2019).

Krishnan et al. (

2020) observed that violation of the matching principle during the introduction and decline stages leads to more aggressive and conservative recognition of earnings, which results in poor reporting quality. Moreover, these firms tend to escalate investment activities (

Habib and Hasan 2017) in an attempt to regain their market share (

Dickinson 2011). Decline-staged firms also face higher bankruptcy risk/financial distress (

Akbar et al. 2019) and are usually involved in fraudulent reporting activities to conceal their poor performance (

Rosner 2003). Based on the above arguments, we expect that managers of declining firms may opportunistically utilize EM practices to get cheap loans and also to portray a stable position in front of stakeholders. Therefore, we hypothesize that:

Compared to the shake-out stage of CLC;

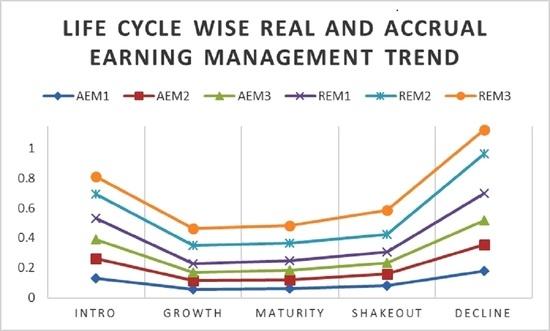

Hypothesis 1 (H1). Accruals base EM is higher during introduction and decline stages but lower during the growth and maturity stages.

Hypothesis 2 (H2). Real EM is higher during introduction and decline stages but lower during the growth and maturity stages.

5. Conclusions

The present study investigates the role of CLC stages in influencing EM practices (AEM and REM). We propose that managers opportunistically change their behavior towards EM practices over different stages of CLC. For this purpose, we employ a large panel of 3250 non-financial Chinese listed firms, with 27,019 firm-year observations and cover the time span from 2009 to 2018. Panel data techniques, such as fixed-effects and random-effects models, have been employed to estimate regression models. The study findings reveal that, during the introduction and decline stages of CLC, managers opportunistically use EM practices to secure cheap loans and portray a stable financial position to the stakeholders. Interestingly, as compared to the introduction stage, managers of declining firms are more inclined to engage in both AEM and REM practices. Moreover, consistent with the proposition, we find that growth and mature firms do not significantly involve in any kind of EM practices, mainly because of the less asymmetric information, higher analyst coverage and ability to get loans at lower rates, as well as higher accountability and transparency of these firms. Last but not least, our results reveal that managers of sample firms were unable to exploit discretionary expenses to manipulate earnings of the firm at any stage of CLC. These findings add a fresh perspective to corporate life cycle research by uncovering the role of the corporate life cycle in influencing the earning management behavior of firm’s managers.

Findings of this study have some important implications for the regulators, creditors and investors of the Chinese listed firms. Tentative managerial behavior during the introduction and decline stages of CLC to engage in EM practices confirms the existence of asymmetric information between investors and the managers of Chinese listed firms. Further, dependability on financial reports for making decisions has always been considered doubtful due to the incorporation of the accruals principle in making financial reports. This grants the possibility of the use of EM tactics to artificially manage the earnings. Thus, the regulators should put in place strict measures to ensure fair reporting and disclosure of financial position of the introductory and decline stage firms. Nevertheless, financial analysts should also give extensive coverage to the financial data of such firms to curb EM practices.

Dickinson et al. (

2018) argued that investors and creditors are usually interested in relying only on analyst coverage for growth and mature stage firms, while value-relevance of accounting information becomes more relevant at birth and decline staged firms. Therefore, our study recommends that investors should exercise caution while investing in the early and decline stage firms. Likewise, the creditors shall also account for the life cycle stage of the firm before extending credit. Last but not least, if concerned parties of accounting reports observe that managers have access to free cash-flows, then they should enhance their expectations regarding lending their money to firms. Despite the important contribution to the literature on earnings management and CLC, the present study also bears some limitations. First, we only measure the managers’ opportunistic behavior through employing different AEM and REM proxies. Future studies may extend this research by examining the mediating influence of top management’s characteristics such as executive background, gender, age and qualification in the association between EM and CLC. Finally, the findings of this research are only generalizable to countries at a similar stage of corporate development, such as China. Hence, industry- and country-wise investigation of this relationship is needed to validate this association across diverse samples and corporate settings. Given the composition of the research team, future research directions will take into account the group of former communist countries from Central and Eastern Europe that bear some similarities to China’s economy, such as the recent establishment of stock exchanges and reduced financial education of citizens.