University Endowment Committees, Modern Portfolio Theory and Performance

Abstract

:1. Introduction

2. Theory and Hypotheses

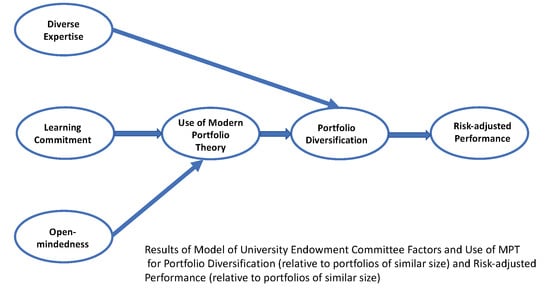

2.1. Diverse Committee Expertise

2.2. Learning Commitment

2.3. Open-Mindedness

2.4. Portfolio Theory

2.5. Diversification of Portfolio (Relative to Other Endowments of Similar Size)

3. Research Methods

3.1. Sample

3.2. Data Collection and Screening

3.3. Measurement

3.4. Independent Variables

3.5. Portfolio Theory

3.6. Diversification of Portfolio

3.7. Performance

3.8. Control Variables

3.9. Exploratory Analysis

3.10. Confirmatory Factor Analysis

3.11. Common Method Variance

3.12. Reliability and Validity Analysis

3.13. Hypotheses Testing

4. Results and Discussion

5. Research Contributions

- Extending the research on investment committee composition and diversity. A considerable body of research has examined the effects of having decision-making boards diversified by gender, race or ethnic background. A smaller body has looked at board diversity in terms of having representatives of multiple professions, such as lawyers, accountants and financial officers. This study is additive by analyzing the effect of having specialty expertise within the field of investment professionals. This suggests that finer tuning of board diversity may be beneficial in other research settings.

- Using group norms such as learning commitment and open-mindedness in a new setting. These norms have been used in marketing studies and in certain organizational behavior literature, but this is the first time (to the author’s knowledge) that it has been used in an institutional investment domain.

- Developing a measurement scale for the use of Portfolio Theory as a decision-making process. The scale captures the three key components of estimating investment returns, variance, and correlations of return. The author had the honor of meeting with Professor Harry Markowitz, founder of the theory, in March 2011 and was pleased that he found the construct items to be suitable.

- Measuring portfolio diversification and performance relative to portfolios of similar size. Research about university endowment performance has long acknowledged the links between diversified portfolios, performance and portfolio size. This study also finds that the performance benefits of broader diversification accrue to smaller portfolios.

- The use of risk-adjusted portfolio returns instead of absolute returns. Performance data from annual NACUBO studies are expressed in absolute returns, which do not take risk into account. Risk-adjusted returns are generally considered to be preferable in making comparisons between various portfolios with differing objectives.

6. Practical Contributions

- Demonstrating the value of having committee members with expertise in a variety of asset classes. This will help match the skills available to the skills needed.

- Developing an atmosphere where continual learning is highly valued and practiced. This not only augments the committee’s knowledge, but also the dedication to continual improvement.

- Encouraging the practice of open-mindedness in investment committee meetings so that differing opinions can be fully vetted, and assumptions can be tested.

- Supporting the use of Portfolio Theory principles when analyzing various asset classes. This can be expected to improve the risk-reward profile of the portfolio.

- Professional, paid staff can make significant contributions to performance. Staff may provide valuable functions such as analysis of money managers and specific securities that are beyond the committee’s responsibilities. This study indicated that larger staffs have greater contributions to performance than smaller staffs. Understandably, the improvement in performance should be expected to exceed the cost of a larger staff. And, with good reason, the quality of staff should also be considered, not just the number of staff.

7. Limitations

8. Applicability

Funding

Conflicts of Interest

Appendix A. Constructs, Definitions and Items

- Diverse Expertise (EXP): Committee members’ expertise across a broad variety of asset classes and investments.

- Our committee over the 5-year period always included expertise across a broad variety of asset classes. (EXP1)

- Our committee always included expert knowledge in both traditional and alternative asset classes. (EXP2)

- Our committee always included experts in both public and private investments. (EXP4)

- Learning Commitment (LCom): The shared belief that learning is essential for success.

- Investment committee members were in agreement that their ability to learn about endowment management is essential to our success. (LC1)

- The basic values of the committee included learning as key to improvement. (LC2)

- The committee viewed learning as an investment, not an expense. (LC3)

- The committee was committed to learning about successful endowment practices. (LC4)

- The committee believed learning is a key commodity for long-term success. (LC5)

- Open-Mindedness (OM): The committee’s critical assessment of its assumptions, biases and decisions.

- Committee members frequently questioned their biases about investing. (OM 1)

- Committee members routinely judged the quality of the decisions they made. (OM2)

- The committee was not afraid to reflect critically on investment-related assumptions it made. (OM3)

- Committee members realized that the way we perceive the markets must be continually questioned. (OM4)

- Use of Portfolio Theory (PT): The Committee’s consideration of principles of Portfolio Theory in making portfolio decisions.

- When making portfolio decisions, the committee routinely considered expected returns of investments. (PT1)

- The committee routinely reassessed expected returns of investments based on changing market conditions. (PT2)

- The committee routinely considered the correlation of returns of existing and potential portfolio holdings. (PT3)

- As part of the portfolio decision-making process, the committee analyzed investments’ historical variation of returns. (PT4)

- The committee considered the risk-return characteristics of the overall portfolio when making changes in its composition. (PT5)

- The committee carefully considered the downside risks of existing and potential investments. (PT6)

- Diversification of Portfolio (DPort): The degree of endowments’ portfolio diversification relative to their size category in annual industry surveys.

- Our endowment’s diversification over the SINGLE FISCAL YEAR 2009 relative to our size category was… (DPort1)

- Our endowment’s diversification over the FIVE YEARS ended 2009 compared to our size category was…(DPort 2)

- Our endowment’s diversification over the DECADE ended fiscal 2009 compared to our size category was…(DPort3)

Appendix B

| Portfolio Theory | Learning Commitment | Diverse Expertise | Open Mindedness | Portfolio Diversification | MSAs | Communalities | |

|---|---|---|---|---|---|---|---|

| LCom1 | 0.710 | 0.963 | 0.755 | ||||

| LCom2 | 1.011 | 0.890 | 0.918 | ||||

| LCom3 | 0.953 | 0.924 | 0.829 | ||||

| LCom4 | 0.811 | 0.938 | 0.815 | ||||

| LCom5 | 1.004 | 0.915 | 0.915 | ||||

| EXP1 | 0.882 | 0.879 | 0.827 | ||||

| EXP2 | 1.038 | 0.840 | 0.932 | ||||

| EXP4 | 0.842 | 0.919 | 0.754 | ||||

| OM1 | 0.797 | 0.914 | 0.515 | ||||

| OM2 | 0.906 | 0.866 | 0.733 | ||||

| OM3 | 0.784 | 0.896 | 0.730 | ||||

| OM4 | 0.238 | 0.526 | 0.945 | 0.616 | |||

| PT1 | 0.822 | 0.913 | 0.647 | ||||

| PT2 | 0.812 | 0.905 | 0.641 | ||||

| PT3 | 0.914 | 0.917 | 0.827 | ||||

| PT4 | 0.871 | 0.929 | 0.712 | ||||

| PT5 | 0.866 | 0.937 | 0.738 | ||||

| PT6 | 0.726 | 0.942 | 0.607 | ||||

| DPort1 | 0.844 | 0.803 | 0.695 | ||||

| DPort2 | 0.959 | 0.775 | 0.943 | ||||

| Dport3 | 0.784 | 0.844 | 0.640 |

Appendix C

| Descriptive Statistics | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Minimum | Maximum | Mean | Std. Deviation | Skewness | Kurtosis | |||

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std. Error | Statistic | Std. Error | |

| LCom1 | 179 | 1.00 | 7.00 | 5.3799 | 1.28555 | −1.206 | 0.182 | 1.729 | 0.361 |

| LCom2 | 179 | 1.00 | 7.00 | 5.1676 | 1.29166 | −0.791 | 0.182 | 0.550 | 0.361 |

| LCom3 | 179 | 1.00 | 7.00 | 5.1453 | 1.22755 | −0.447 | 0.182 | 0.016 | 0.361 |

| LCom4 | 179 | 1.00 | 7.00 | 5.3520 | 1.37151 | −0.921 | 0.182 | 0.375 | 0.361 |

| LCom5 | 179 | 1.00 | 7.00 | 5.2458 | 1.34746 | −0.778 | 0.182 | 0.300 | 0.361 |

| EXP1 | 179 | 1.00 | 7.00 | 5.0838 | 1.70218 | −0.768 | 0.182 | −0.477 | 0.361 |

| EXP 2 | 179 | 1.00 | 7.00 | 5.0112 | 1.67932 | −0.759 | 0.182 | −0.358 | 0.361 |

| EXP4 | 179 | 1.00 | 7.00 | 4.9497 | 1.63623 | −0.782 | 0.182 | −0.269 | 0.361 |

| OM1 | 179 | 1.00 | 7.00 | 4.5866 | 1.27069 | −0.446 | 0.182 | −0.020 | 0.361 |

| OM2 | 179 | 1.00 | 7.00 | 5.0782 | 1.40005 | −0.811 | 0.182 | 0.149 | 0.361 |

| OM3 | 179 | 1.00 | 7.00 | 5.4246 | 1.27582 | −0.954 | 0.182 | 0.754 | 0.361 |

| OM4 | 179 | 1.00 | 7.00 | 5.5251 | 1.24665 | −1.131 | 0.182 | 1.522 | 0.361 |

| PT1 | 179 | 2.00 | 7.00 | 5.7263 | 0.97608 | −0.636 | 0.182 | 0.507 | 0.361 |

| PT2 | 179 | 2.00 | 7.00 | 5.5475 | 1.10755 | −0.761 | 0.182 | 0.462 | 0.361 |

| PT3 | 179 | 1.00 | 7.00 | 5.5028 | 1.26035 | −1.139 | 0.182 | 1.561 | 0.361 |

| PT4 | 179 | 1.00 | 7.00 | 5.5810 | 1.19356 | −1.066 | 0.182 | 1.500 | 0.361 |

| PT5 | 179 | 1.00 | 7.00 | 5.8603 | 1.11554 | −1.267 | 0.182 | 2.134 | 0.361 |

| PT5 | 179 | 2.00 | 7.00 | 5.8156 | 0.99130 | −0.951 | 0.182 | 1.142 | 0.361 |

| DPort1 | 179 | 1.00 | 5.00 | 3.5587 | 0.94849 | −0.290 | 0.182 | −0.667 | 0.361 |

| DPort2 | 179 | 1.00 | 5.00 | 3.4358 | 0.99440 | −0.236 | 0.182 | −0.684 | 0.361 |

| Dport3 | 179 | 1.00 | 5.00 | 3.1676 | 1.12921 | −0.098 | 0.182 | −0.841 | 0.361 |

| Valid N (listwise) | 179 | ||||||||

Appendix D

| Code | Q2_1 | Q2_2 | Q2_4 | Q1_1 | Q1_2 | Q1_3 | Q1_4 | Q1_5 | Q3_1 | Q3_2 | Q3_3 | Q3_4 | Q8_1 | Q8_2 | Q8_3 | Q8_4 | Q8_5 | Q8_6 | Q6_1 | Q6_2 | Q6_3 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q2_1 | 1 | ||||||||||||||||||||

| Q2_2 | 0.87 | 1 | |||||||||||||||||||

| Q2_4 | 0.78 | 0.83 | 1 | ||||||||||||||||||

| Q1_1 | 0.43 | 0.40 | 0.40 | 1 | |||||||||||||||||

| Q1_2 | 0.42 | 0.37 | 0.38 | 0.82 | 1 | ||||||||||||||||

| Q1_3 | 0.38 | 0.35 | 0.39 | 0.75 | 0.88 | 1 | |||||||||||||||

| Q1_4 | 0.47 | 0.42 | 0.43 | 0.76 | 0.83 | 0.81 | 1 | ||||||||||||||

| Q1_5 | 0.43 | 0.38 | 0.39 | 0.80 | 0.91 | 0.86 | 0.87 | 1 | |||||||||||||

| Q3_1 | 0.29 | 0.24 | 0.30 | 0.45 | 0.34 | 0.33 | 0.38 | 0.34 | 1 | ||||||||||||

| Q3_2 | 0.46 | 0.38 | 0.44 | 0.48 | 0.39 | 0.41 | 0.49 | 0.39 | 0.61 | 1 | |||||||||||

| Q3_3 | 0.46 | 0.40 | 0.47 | 0.58 | 0.50 | 0.47 | 0.54 | 0.47 | 0.56 | 0.76 | 1 | ||||||||||

| Q3_4 | 0.56 | 0.52 | 0.54 | 0.57 | 0.44 | 0.46 | 0.53 | 0.46 | 0.56 | 0.57 | 0.64 | 1 | |||||||||

| Q8_1 | 0.25 | 0.21 | 0.26 | 0.41 | 0.34 | 0.31 | 0.43 | 0.32 | 0.27 | 0.31 | 0.36 | 0.37 | 1 | ||||||||

| Q8_2 | 0.33 | 0.23 | 0.25 | 0.39 | 0.31 | 0.28 | 0.36 | 0.29 | 0.31 | 0.33 | 0.37 | 0.44 | 0.73 | 1 | |||||||

| Q8_3 | 0.40 | 0.34 | 0.36 | 0.46 | 0.38 | 0.33 | 0.40 | 0.37 | 0.33 | 0.40 | 0.45 | 0.48 | 0.69 | 0.74 | 1 | ||||||

| Q8_4 | 0.35 | 0.26 | 0.29 | 0.42 | 0.32 | 0.28 | 0.37 | 0.31 | 0.26 | 0.37 | 0.45 | 0.41 | 0.66 | 0.64 | 0.79 | 1 | |||||

| Q8_5 | 0.36 | 0.30 | 0.31 | 0.46 | 0.40 | 0.37 | 0.47 | 0.40 | 0.23 | 0.31 | 0.42 | 0.42 | 0.66 | 0.63 | 0.76 | 0.72 | 1 | ||||

| Q8_6 | 0.39 | 0.33 | 0.39 | 0.43 | 0.36 | 0.33 | 0.42 | 0.37 | 0.29 | 0.34 | 0.48 | 0.44 | 0.58 | 0.57 | 0.70 | 0.64 | 0.74 | 1 | |||

| Q6_1 | 0.28 | 0.27 | 0.27 | 0.23 | 0.20 | 0.18 | 0.25 | 0.22 | 0.16 * | 0.13 ns | 0.17 * | 0.18 * | 0.23 | 0.19 * | 0.21 | 0.16 * | 0.22 | 0.18 * | 1 | ||

| Q6_2 | 0.38 | 0.37 | 0.36 | 0.27 | 0.24 | 0.24 | 0.32 | 0.28 | 0.18 * | 0.21 ** | 0.29 | 0.27 | 0.25 | 0.25 | 0.26 | 0.19* | 0.27 | 0.24 | 0.81 | 1 | |

| Q6_3 | 0.33 | 0.34 | 0.30 | 0.21 ** | 0.21 ** | 0.16 * | 0.30 | 0.24 | 0.17 * | 0.20 * | 0.26 | 0.21 ** | 0.22 | 0.20 * | 0.19 * | 0.13 ns | 0.21 ** | 0.21 ** | 0.66 | 0.78 | 1 |

Appendix E

References

- Amason, Allen C. 1996. Distinguishing the effects of functional and dysfunctional conflict on strategic decision making: Resolving a paradox for top management teams. The Academy of Management Journal 39: 123–48. [Google Scholar]

- Bär, Michaela, Alexander A. Kempf, and Stefan Ruenzi. 2011. Is a Team Different from the Sum of its Parts? Evidence from Mutual Fund Managers. Review of Finance 15: 359–96. [Google Scholar] [CrossRef] [Green Version]

- Barber, Brad. M., and Terrance Odean. 2008. All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies 21: 785–818. [Google Scholar] [CrossRef] [Green Version]

- Barberis, Nicholas, Ming Huang, and Richard H. Thaler. 2006. Individual Preferences, Monetary Gambles, and Stock Market Participation: A Case for Narrow Framing. American Economic Review 96: 1069–90. [Google Scholar] [CrossRef] [Green Version]

- Boynton, Andrew. C., Robert W. Zmud, and Gerry C. Jacobs. 1994. The influence of IT management practice on IT use in large organizations. MIS Quarterly 18: 299–318. [Google Scholar] [CrossRef]

- Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower. 1986. Determinants of portfolio performance. Financial Analysts Journal 42: 39–44. [Google Scholar] [CrossRef]

- Brinson, Gary, Brian D. Singer, and Gilbert. L. Beebower. 1991. Determinants of portfolio performance II: An update. Financial Analysts Journal 47: 40–48. [Google Scholar] [CrossRef]

- Brown, Keith C., Lorenzo Garlappi, and Christian I. Tiu. 2010. Asset allocation and portfolio performance: Evidence from university endowment funds. Journal of Financial Markets 13: 268–94. [Google Scholar] [CrossRef]

- Brown, Jeffrey R., Stephen Dimmock, Jun-Koo Kang, David Richardson, and Scott Weisbenner. 2011. The governance of university endowments: Insights from a TIAA-CREF Institute Survey. TIAA-CREF Research Dialogue 101: 1–15. [Google Scholar]

- Calantone, Roger J., S. Tamer Cavusgil, and Yushan Zhao. 2002. Learning orientation, firm innovation capability, and firm performance. Industrial Marketing Management 31: 515–24. [Google Scholar] [CrossRef]

- Cohen, Wesley M., and Daniel. A. Levinthal. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- Day, George S. 1994. The capabilities of market-driven organizations. Journal of Marketing 58: 37–52. [Google Scholar] [CrossRef]

- Day, George S., and Prakash Nedungadi. 1994. Managerial representations of competitive advantage. Journal of Marketing 58: 31–44. [Google Scholar] [CrossRef]

- DeMiguel, Victor, Lorenzo Garlappi, and Raman Uppal. 2009. Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? The Review of Financial Studies 22: 1915–53. [Google Scholar] [CrossRef] [Green Version]

- Elton, Edwin J., Martin J. Gruber, Stephen J. Brown, and William N. Goetzmann. 2010. Modern Portfolio Theory and Investment Analysis, 8th ed. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Fabozzi, Frank J., Francis Gupta, and Harry M. Markowitz. 2002. The legacy of modern portfolio theory. The Journal of Investing 11: 7–22. [Google Scholar] [CrossRef] [Green Version]

- Fabozzi, Frank J., Petter N. Kolm, Dessislava Pachamanova, and Sergio M. Focardi. 2007. Robust Portfolio Optimization and Management. Frank J. Fabozzi Series; Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Horwitz, Sujin K., and Irwin B. Horwitz. 2007. The effects of team diversity on team outcomes: A meta-analytic review of team demography. Journal of Management 33: 987–1015. [Google Scholar] [CrossRef]

- Forbes, Daniel P., and Frances J. Milliken. 1999. Cognition and corporate governance: Understanding boards of directors as strategic decision-making groups. Academy of Management Review 24: 489–505. [Google Scholar] [CrossRef] [Green Version]

- Francis, Jack C. 2010. Portfolio analysis. In Handbook of Quantitative Finance and Risk Management. Edited by Cheng-Few Lee and John Lee. Part II: 259–66. New York: Springer. [Google Scholar] [CrossRef]

- Garvin, David A. 1993. Building a learning organization. Harvard Business Review 71: 78–91. [Google Scholar]

- Gibson, Roger C. 2004. The rewards of multiple-asset-class investing. Journal of Financial Planning 16: 58–71. [Google Scholar]

- Gibson, Roger C. 2008. Asset Allocation, 4th ed. New York: McGraw-Hill, Inc. [Google Scholar]

- Goetzmann, William N., and Alok Kumar. 2008. Equity portfolio diversification. Review of Finance 12: 433–63. [Google Scholar] [CrossRef] [Green Version]

- Graham, John R., Campbell R. Harvey, and Hai Huang. 2009. Investor competence, trading frequency, and home bias. Management Science 55: 1094–106. [Google Scholar] [CrossRef] [Green Version]

- Grant, Robert M. 1996. Prospering in dynamically-competitive environments: Organizational capability as knowledge integration. Organization Science 7: 375–87. [Google Scholar] [CrossRef]

- Hair, Joseph F., William C. Black, Barry J. Babin, and Rolph E. Anderson. 2010. Multivariate Data Analysis, 7th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Hair, Joseph F., Marcelo Gabriel, and Vijay Patel. 2014. AMOS Covariance-Based Structural Equation Modeling (CB-SEM): Guidelines on Its Application as a Marketing Research Tool. Brazilian Journal of Marketing 13: 44–45. [Google Scholar]

- Hoffman, L. Richard, and Norman R. F. Maier. 1961. Quality and acceptance of problem solutions by members of homogeneous and heterogeneous groups. Journal of Abnormal and Social Psychology 62: 401–7. [Google Scholar] [CrossRef] [PubMed]

- Ibbotson, Roger G., and Paul D. Kaplan. 2000. Does asset allocation policy explain 40, 90, or 100 percent of performance? Financial Analysts Journal 56: 26–33. [Google Scholar] [CrossRef] [Green Version]

- Janis, Irving L. 1972. Victims of Groupthink. Boston: Houghton-Mifflin. [Google Scholar]

- Jemison, David B., and Sim B Sitkin. 1986. Corporate acquisitions: A process perspective. The Academy of Management Review 11: 145–63. [Google Scholar] [CrossRef]

- Kahneman, David, and Dan Lovallo. 1993. Timid choices and bold forecasts: A cognitive perspective on risk taking. Management Science 39: 17–31. [Google Scholar] [CrossRef]

- Kahneman, David, and Amos Tversky. 2000. Choices, Values and Frames. Cambridge: Cambridge University Press. [Google Scholar]

- Kogut, Bruce, and Udo Zander. 1996. What firms do? Coordination, identity, and learning. Organization Science 7: 502–18. [Google Scholar] [CrossRef]

- Kritzman, Mark, and Sebastien Page. 2003. The hierarchy of investment choice. Journal of Portfolio Management 29: 11–23. [Google Scholar] [CrossRef]

- Kumar, Alok, and Sonya S. Lim. 2008. How do decision frames influence the stock investment choices of individual investors? Management Science 54: 1052–64. [Google Scholar] [CrossRef] [Green Version]

- Leibowitz, Martin L., Anthony Bova, and P. Brett Hammond. 2010. The Endowment Model of Investing. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Lerner, Josh, Antoinette Schoar, and Jialan Wang. 2008. Secrets of the academy: The drivers of university endowment success. Journal of Economic Perspectives 22: 207–22. [Google Scholar] [CrossRef]

- Lewin, Arie Y., and Henk W. Volberda. 1999. Prolegomena on coevolution: A framework for research on strategy and new organizational forms. Organization Science 10: 519–34. [Google Scholar] [CrossRef]

- Lindell, Michael K., and David J. Whitney. 2001. Accounting for common method variance in cross-sectional research designs. Journal of Applied Psychology 86: 114–21. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lord, Mimi. 2014a. Smaller university endowments: Team characteristics, portfolio composition and performance. Qualitative Research in Financial Markets 6: 4–32. [Google Scholar] [CrossRef]

- Lord, Mimi. 2014b. University endowment committees: How a learning orientation and knowledge factors contribute to portfolio diversification and performance. The European Journal of Finance. [Google Scholar] [CrossRef]

- Markowitz, Harry M. 1952. Portfolio selection. The Journal of Finance 7: 77–91. [Google Scholar]

- Markowitz, Harry M. 1959. Portfolio Selection: Efficient Diversification of Investments. New York: John Wiley & Sons. [Google Scholar]

- Mason, Richard O., and Ian I. Mitroff. 1981. Challenging Strategic Planning Assumptions. New York: Wiley. [Google Scholar]

- Michaud, Richard O., and Robert O. Michaud. 2008. Efficient Asset Management. New York: Oxford University Press. [Google Scholar]

- NACUBO. 1990–2008. National Association of College and University Business Officers (NACUBO). NACUBO Endowment Study. Certain Data. Available online: https://www.nacubo.org/Research/2020/Historic-Endowment-Study-Data (accessed on 30 May 2020).

- NACUBO. 2009. National Association of College and University Business Officers (NACUBO) & Commonfund Institute. NACUBO-Commonfund study of endowments. Certain Data. Available online: https://www.nacubo.org/Research/2020/Public-NTSE-Tables (accessed on 30 May 2020).

- Podsakoff, Philip M., and Dennis W. Organ. 1986. Self-reports in organizational research: Problems and prospects. Journal of Management 12: 531–44. [Google Scholar] [CrossRef]

- Rubenstein, Mark. 2006. A History of the Theory of Investments. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Scharfstein, David S., and Jeremy C. Stein. 1990. Herd behavior and investment. The American Economic Review 80: 465–79. [Google Scholar]

- Schweiger, David M., and William R. Sandberg. 1989. The utilization of individual capabilities in group approaches to strategic decision-making. Strategic Management Journal 10: 31–43. [Google Scholar] [CrossRef]

- Senge, Peter M. 1990. The Fifth Discipline: The Art and Practice of the Learning Organization. New York: Doubleday. [Google Scholar]

- Sinkula, James M. 1994. Market information processing and organizational learning. Journal of Marketing 58: 35–45. [Google Scholar] [CrossRef]

- Sinkula, James M., William E. Baker, and Thomas Noordewier. 1997. A framework for market-based organizational learning: Linking values, knowledge, and behavior. Journal of the Academy of Marketing Science 25: 305–18. [Google Scholar] [CrossRef]

- Sjoberg, Lennart. 2000. Factors in risk perception. Risk Analysis 20: 1–11. [Google Scholar] [CrossRef] [PubMed]

- Slater, Stanley F., and John C. Narver. 1995. Market orientation and the learning organization. The Journal of Marketing 59: 63–74. [Google Scholar] [CrossRef]

- Smith, Ken A., Satish P. Vasudevan, and Mohan R. Tanniru. 1996. Organizational learning and resource-based theory: An integrative model. Journal of Organizational Change Management 9: 41–53. [Google Scholar] [CrossRef]

- Statman, Meir. 2010. What Investors Really Want: Know What Drives Investor Behavior. New York: McGraw-Hill. [Google Scholar]

- Swensen, David F. 2009. Pioneering Portfolio Management: An Unconventional Approach to Institutional Investing. New York: The Free Press. [Google Scholar]

- Szulanski, Gabriel. 1996. Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strategic Management Journal 17: 27–43. [Google Scholar] [CrossRef]

- Thaler, Richard. 2005. Advances in Behavioral Finance, Vol. II. Princeton: Princeton University Press. [Google Scholar]

- Tobin, Daniel R. 1993. Re-Educating the Corporation: Foundations for the Learning Organization. Essex Junction: Oliver Wright. [Google Scholar]

- Tversky, Amos, and Daniel Kahneman. 1973. Availability: A heuristic for judging frequency and probability. Cognitive Psychology 5: 207–32. [Google Scholar] [CrossRef]

- Wadhwa, Anu, and Suresh Kotha. 2006. Knowledge creation through external venturing: Evidence from the telecommunications equipment manufacturing industry. Academy of Management Journal 49: 819–35. [Google Scholar] [CrossRef]

- Weber, Elke U., Niklas Siebenmorgen, and Martin Weber. 2005. Communicating asset risk: How name recognition and the format of historic volatility information affect risk perception and investment decisions. Risk Analysis 25: 597–609. [Google Scholar] [CrossRef]

- Zahra, Shaker, and Gerard George. 2002. Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review 27: 185–203. [Google Scholar] [CrossRef] [Green Version]

| Asset Class | 1993 | 2008 | Asset Class | 1993 | 2008 |

|---|---|---|---|---|---|

| U.S. Equities | 48.1% | 34.9% | Hedge Funds | 0.7% | 12.9% |

| International Equities | 4.2% | 17.0% | Venture Capital | 0.2% | 1.1% |

| U.S. Fixed Income | 33.6% | 17.6% | Private Equity | 0.6% | 3.3% |

| Non U.S. Fixed Income | 1.3% | 1.7% | Natural Resources | 0.3% | 2.2% |

| Real Estate (public) | 0.0% | 1.3% | Cash | 7.3% | 3.9% |

| Real Estate (private) | 1.6% | 2.9% | Other | 2.0% | 1.5% |

| Characteristic | Number of Respondents | Percent of Respondents |

|---|---|---|

| Respondent’s Role with College/University | ||

| Financial officer involved with the endowment | 175 | 98% |

| Outsourced Chief Investment Officer | 2 | 1% |

| Investment Committee Member | 2 | 1% |

| Respondent # of Years in Endowment Role with the College/Univ | ||

| Less than or equal to 2.5 years | 22 | 12% |

| 3 to 5 years | 33 | 18% |

| 6 to 9 years | 30 | 17% |

| 10 to 14 years | 34 | 19% |

| 15 to 19 years | 35 | 20% |

| Greater than 20 years | 23 | 13% |

| Endowment Size | ||

| Category 6: Greater than $1billion | 16 | 9% |

| Category 5: $500 million to $1 billion | 20 | 11% |

| Category 4: $100 million to $500 million | 56 | 31% |

| Category 3: $50 million to $100 million | 30 | 17% |

| Category 2: $25 million to $50 million | 25 | 14% |

| Category 1: Less than $25 million | 32 | 18% |

| Institutional Funding | ||

| Public (State Funded) | 69 | 39% |

| Private | 110 | 61% |

| Number of Voting Members on Investment Committee | ||

| Less than or equal to 3 | 4 | 2% |

| 4–6 | 64 | 36% |

| 7–9 | 84 | 47% |

| 10–13 | 22 | 12% |

| 14–18 | 4 | 2% |

| Greater than or equal to 19 | 1 | 1% |

| Number of Meetings/Year of Investment Committee over 5-year period | ||

| Less than or equal to 3 | 6 | 3.50% |

| 3–4 | 99 | 55.60% |

| 5–8 | 53 | 29.80% |

| 9–12 | 14 | 7.60% |

| Greater than or equal to 13 | 6 | 3.50% |

| # of Finance/Investment Staff with Significant Investment Experience | ||

| 0 | 27 | 15% |

| 1 | 57 | 32% |

| 2 | 43 | 24% |

| 3 | 22 | 12% |

| 4–7 | 22 | 12% |

| 8–12 | 7 | 4% |

| 13–20 | 1 | 0.50% |

| Code | Construct | Est | S.E. | C.R. | p | |

|---|---|---|---|---|---|---|

| EXP_1 | <--- | Diverse Expertise | 0.864 | 0.065 | 13.356 | *** |

| EXP_2 | <--- | Diverse Expertise | 0.892 | 0.063 | 14.161 | *** |

| EXP_4 | <--- | Diverse Expertise | 0.907 | 0.063 | 14.480 | *** |

| LC_1 | <--- | Learning Commitment | 0.844 | 0.060 | 14.095 | *** |

| LC_2 | <--- | Learning Commitment | 0.948 | 0.056 | 17.073 | *** |

| LC_3 | <--- | Learning Commitment | 0.912 | 0.058 | 15.748 | *** |

| LC_4 | <--- | Learning Commitment | 0.888 | 0.058 | 15.381 | *** |

| LC_5 | <--- | Learning Commitment | 0.946 | 0.055 | 17.053 | *** |

| OM_1 | <--- | Open-mindedness | 0.662 | 0.068 | 9.735 | *** |

| OM_2 | <--- | Open-mindedness | 0.827 | 0.063 | 13.176 | *** |

| OM_3 | <--- | Open-mindedness | 0.866 | 0.061 | 14.306 | *** |

| OM_4 | <--- | Open-mindedness | 0.742 | 0.065 | 11.451 | *** |

| PT_1 | <--- | Portfolio Theory | 0.759 | 0.064 | 11.777 | *** |

| PT_2 | <--- | Portfolio Theory | 0.783 | 0.064 | 12.153 | *** |

| PT_3 | <--- | Portfolio Theory | 0.929 | 0.058 | 15.937 | *** |

| PT_4 | <--- | Portfolio Theory | 0.852 | 0.061 | 13.925 | *** |

| PT_5 | <--- | Portfolio Theory | 0.832 | 0.062 | 13.387 | *** |

| PT_6 | <--- | Portfolio Theory | 0.754 | 0.065 | 11.667 | *** |

| DPORT_1 | <--- | Diversification of Portfolio | 0.829 | 0.063 | 13.141 | *** |

| DPORT_2 | <--- | Diversification of Portfolio | 0.987 | 0.057 | 17.215 | *** |

| DPORT_3 | <--- | Diversification of Portfolio | 0.791 | 0.064 | 12.320 | *** |

| Reliability and Validity Tests for Constructs | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Factor | Chronbach’s Alpha | ←Before Controlling for CMV→ | ←After Controlling for CMV→ | |||||||

| C.R. | AVE | MSV | ASV | CR | AVE | MSV | ASV | |||

| Diverse Expertise | EXP | 0.935 | 0.92 | 0.80 | 0.35 | 0.23 | 0.89 | 0.72 | 0.34 | 0.20 |

| Learning Commitment | LCom | 0.960 | 0.96 | 0.83 | 0.36 | 0.22 | 0.94 | 0.79 | 0.36 | 0.18 |

| Open-Mindedness | OM | 0.866 | 0.87 | 0.62 | 0.36 | 0.28 | 0.82 | 0.53 | 0.36 | 0.23 |

| Use of Portfolio Theory | PT | 0.928 | 0.92 | 0.67 | 0.32 | 0.20 | 0.90 | 0.60 | 0.32 | 0.16 |

| Diversification of Portfolio | DPort | 0.895 | 0.90 | 0.76 | 0.17 | 0.11 | 0.87 | 0.68 | 0.17 | 0.09 |

| Convergent Validity Thresholds: CR > 0.7 CR > AVE AVE > 0.5 | Discriminant Validity Thresholds: MSV < AVE ASV < AVE | |||||||||

| Structural Paths | Estimates (Unstandardized) | Critical Ratio | p-Value | Hypothesis Supported/Not Supported |

|---|---|---|---|---|

| Before Trimming Insignificant Paths | ||||

| H1: Diverse Exp → DPort | 0.284 | 3.659 | *** | Supported |

| H2: Diverse Exp → PT | 0.118 | 1.535 | 0.125 | Not Supported |

| H3: LCom → PT | 0.175 | 2.860 | 0.004 | Supported |

| H4: LCom → DPort | 0.071 | 1.146 | 0.252 | Not Supported |

| H5: OM → PT | 0.372 | 3.991 | *** | Supported |

| H6: PT → DPort | 0.112 | 1.471 | 0.141 | Not Supported |

| H7: DPort → PERF | 0.238 | 3.285 | 0.001 | Supported |

| After Trimming Insignificant Paths (starting with least significant) | ||||

| H1: Diverse Exp → DPort | 0.314 | 4.438 | *** | Supported |

| H3: LCom → PT | 0.197 | 3.269 | 0.001 | Supported |

| H5: OM → PT | 0.424 | 4.851 | *** | Supported |

| H6: PT → DPort | 0.142 | 2.046 | 0.041 | Supported |

| H7: DPort → PERF | 0.238 | 3.273 | *** | Supported |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lord, M. University Endowment Committees, Modern Portfolio Theory and Performance. J. Risk Financial Manag. 2020, 13, 198. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm13090198

Lord M. University Endowment Committees, Modern Portfolio Theory and Performance. Journal of Risk and Financial Management. 2020; 13(9):198. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm13090198

Chicago/Turabian StyleLord, Mimi. 2020. "University Endowment Committees, Modern Portfolio Theory and Performance" Journal of Risk and Financial Management 13, no. 9: 198. https://0-doi-org.brum.beds.ac.uk/10.3390/jrfm13090198