What Determines Innovative Performance of International Joint Ventures? Assessing the Effects of Foreign Managerial Control

Abstract

:1. Introduction

2. Theory and Hypotheses

2.1. International Joint Ventures and Innovation

2.2. Foreign Managerial Control, Local Embeddedness, and Innovation

2.3. Factors Regulating the Cost of Foreign Managerial Control

3. Research Design

3.1. Sample and Data

3.2. Dependent Variable

3.3. Independent Variable

3.4. Moderating Variables

3.5. Control Variables

3.6. Statistical Method

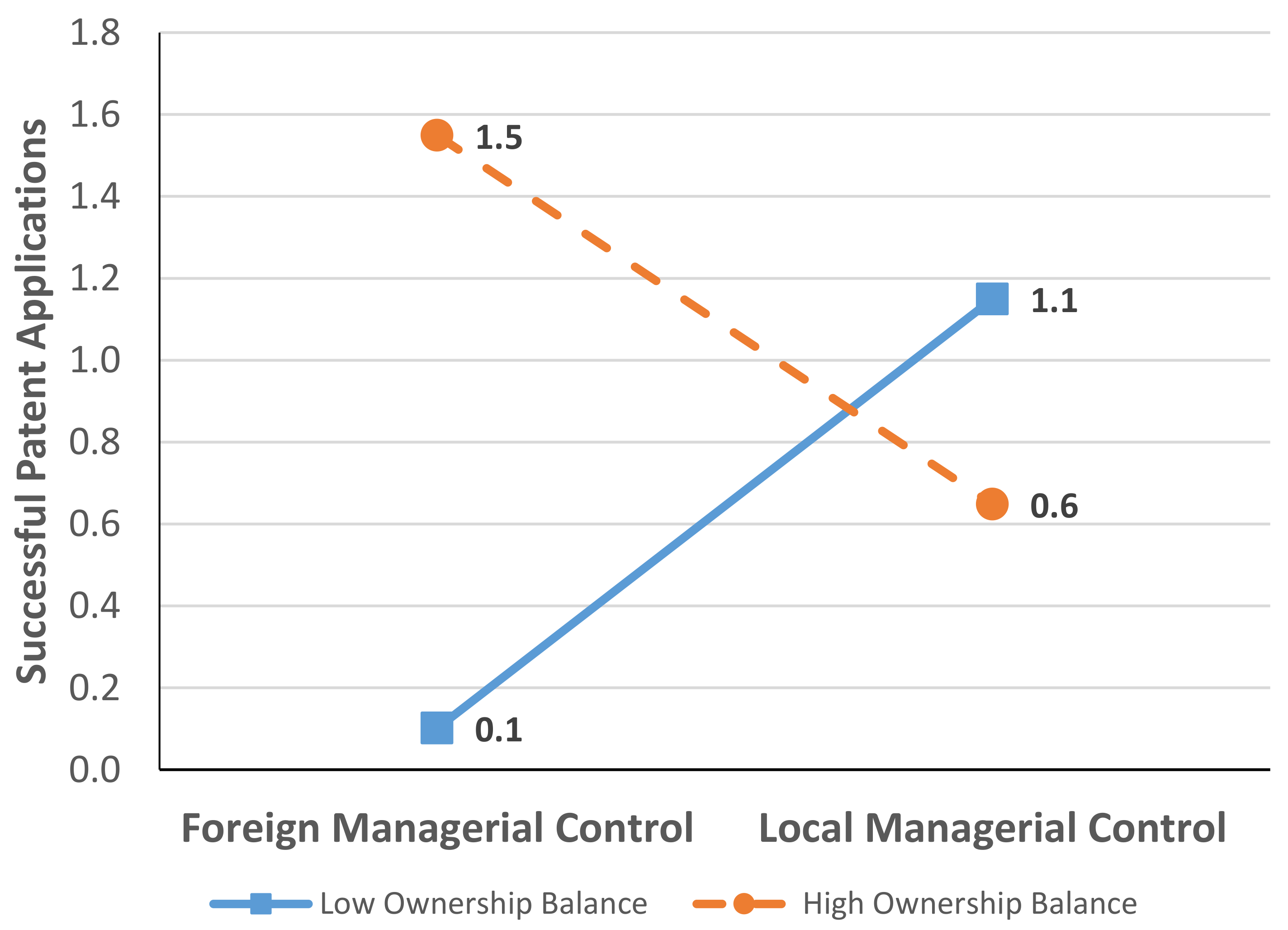

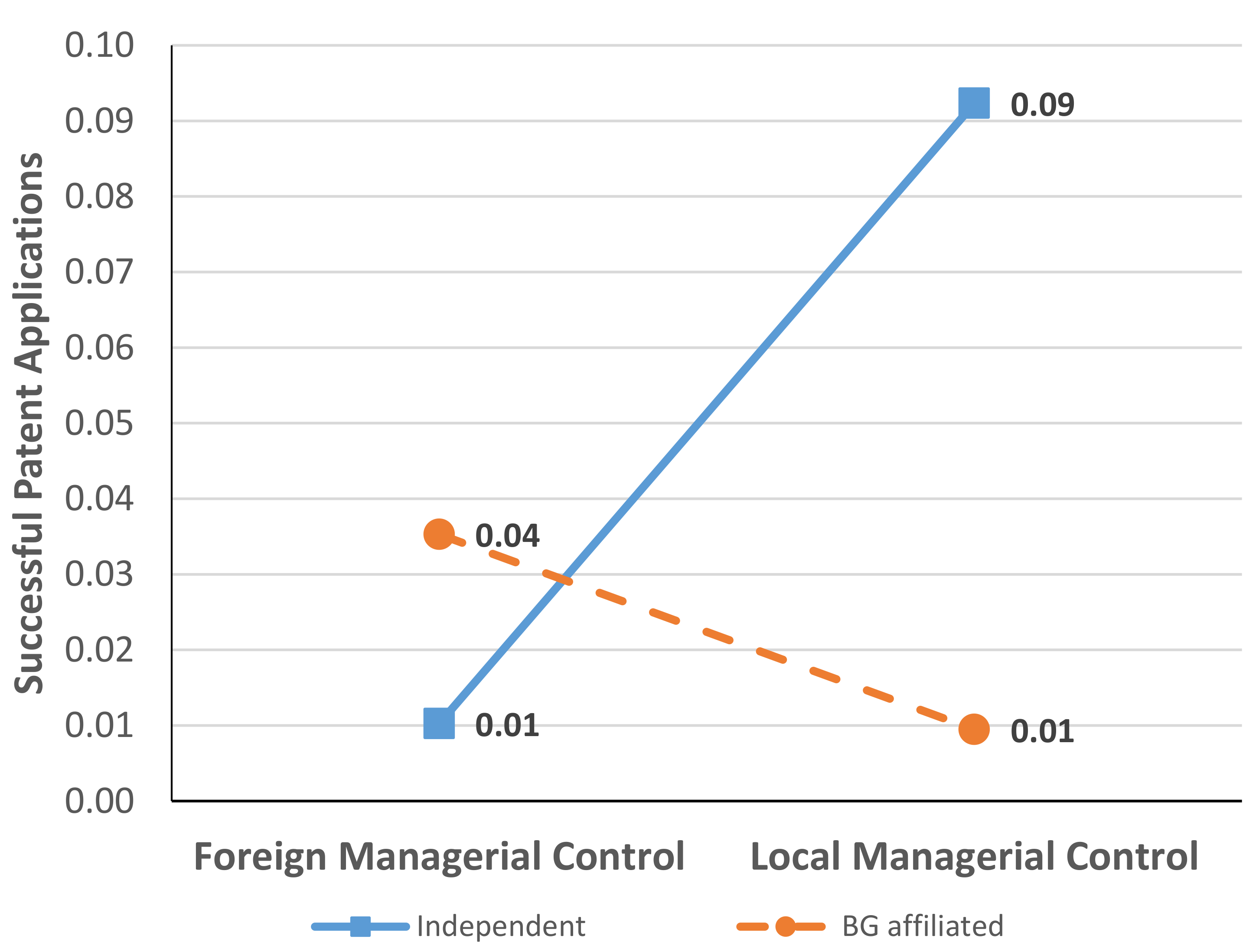

4. Results

5. Discussion and Conclusions

6. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Ahuja, G.; Lampert, C.M.; Tandon, V. Moving Beyond Schumpeter: Management Research on the Determinants of Technological Innovation. Acad. Manag. Ann. 2008, 2, 1–98. [Google Scholar] [CrossRef]

- Fleming, L.; Sorenson, O. Technology as a complex adaptive system: Evidence from patent data. Res. Policy 2001, 30, 1019–1039. [Google Scholar] [CrossRef]

- Fleming, L.; Sorenson, O. Science as a map in technological search. Strateg. Manag. J. 2004, 25, 909–928. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowldege of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strateg. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Chun, M.Y.-S.; Nhung, D.T.H.; Lee, J. The Transition of Samsung Electronics through Its M&A with Harman International. J. Open Innov. Technol. Mark. Complex. 2019, 5, 51. [Google Scholar]

- Mahmood, I.P.; Zheng, W.T. Whether and how: Effects of international joint ventures on local innovation in an emerging economy. Res. Policy 2009, 38, 1489–1503. [Google Scholar] [CrossRef]

- Shao, Y.; Shi, L. Cross-border open innovation of early stage tech incubation: A case study of forge, the first UK-China accelerator program. J. Open Innov. Technol. Mark. Complex. 2018, 4, 37. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Lil, H.Y.; Hitt, M.A.; Cui, G. R&D intensity and international joint venture performance in an emerging market: Moderating effects of market focus and ownership structure. J. Int. Bus. Stud. 2007, 38, 944–960. [Google Scholar] [CrossRef]

- Zhou, C.; Li, J. Product innovation in emerging market-based international joint ventures: An organizational ecology perspective. J. Int. Bus. Stud. 2008, 39, 1114–1132. [Google Scholar] [CrossRef]

- Barkema, H.G.; Shenkar, O.; Vermeulen, F.; Bell, J.H. Working abroad, working with others: How firms learn to operate international joint ventures. Acad. Manag. J. 1997, 40, 426–442. [Google Scholar]

- Geringer, J.M.; Hebert, L. Control and performance of international joint ventures. J. Int. Bus. Stud. 1989, 20, 235–254. [Google Scholar] [CrossRef] [Green Version]

- Yan, A.; Gray, B. Antecedents and effects of parent control in international joint ventures. J. Manag. Stud. 2001, 38, 393–416. [Google Scholar] [CrossRef]

- Beamish, P.W.; Lupton, N.C. Managing Joint Ventures. Acad. Manag. Perspect. 2009, 23, 75–94. [Google Scholar] [CrossRef] [Green Version]

- Andersson, U.; Forsgren, M. Subsidiary Embeddedness and Control in the Multinational Corporation. Int. Bus. Rev. 1996, 5, 487–508. [Google Scholar] [CrossRef]

- Johanson, J.; Vahlne, J.E. The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership. J. Int. Bus. Stud. 2009, 40, 1411–1431. [Google Scholar] [CrossRef]

- Mainela, T.; Puhakka, V. Embeddedness and networking as drivers in developing an international joint venture. Scand. J. Manag. 2008, 24, 17–32. [Google Scholar] [CrossRef]

- Chesbrough, H.; Bogers, M. Explicating open innovation: Clarifying an emerging paradigm for understanding innovation. In New Frontiers in Open Innovation; Oxford University Press: Oxford, UK, 2014; pp. 3–28. [Google Scholar]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Boston, MA, USA, 2003; ISBN 1-57851-837-7. [Google Scholar]

- Bogers, M.; Chesbrough, H.; Heaton, S.; Teece, D.J. Strategic management of open innovation: A dynamic capabilities perspective. Calif. Manag. Rev. 2019, 62, 77–94. [Google Scholar] [CrossRef]

- Schilling, M.A. Strategic Management of Technological Innovation, 5th ed.; McGraw-Hill Education: New York, NY, USA, 2016. [Google Scholar]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef] [Green Version]

- Ganotakis, P.; Love, J.H. The innovation value chain in new technology-based firms: Evidence from the UK. J. Prod. Innov. Manag. 2012, 29, 839–860. [Google Scholar] [CrossRef]

- Kapoor, R. Persistence of integration in the face of specialization: How firms navigated the winds of disintegration and shaped the architecture of the semiconductor industry. Organ. Sci. 2013, 24, 1195–1213. [Google Scholar] [CrossRef] [Green Version]

- Roper, S.; Du, J.; Love, J.H. Modelling the innovation value chain. Res. Policy 2008, 37, 961–977. [Google Scholar] [CrossRef] [Green Version]

- Yun, J.J.; Yigitcanlar, T. Open Innovation in Value Chain for Sustainability of Firms. Sustainability 2017, 9, 811. [Google Scholar] [CrossRef] [Green Version]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef] [Green Version]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Zaheer, S. Overcoming the Liability of Foreignness. Acad. Manag. J. 1995, 38, 341–363. [Google Scholar] [CrossRef]

- Gulati, R. Does familiarity breed trust? The implications of repeated ties for contractual choice in alliances. Acad. Manag. J. 1995, 38, 85–112. [Google Scholar]

- Gulati, R.; Gargiulo, M. Where Do Interorganizational Networks Come From? Am. J. Sociol. 1999, 104, 1439–1493. [Google Scholar] [CrossRef] [Green Version]

- Kilduff, M.; Tsai, W. Social Networks and Organizations; Sage Publications: London, UK, 2003. [Google Scholar]

- Andersson, U.; Forsgren, M.; Holm, U. Subsidiary embeddedness and competence development in MNCs—A multi-level analysis. Organ. Stud. 2001, 22, 1013–1034. [Google Scholar] [CrossRef]

- Schmidt, T.; Sofka, W. Liability of foreignness as a barrier to knowledge spillovers: Lost in translation? J. Int. Manag. 2009, 15, 460–474. [Google Scholar] [CrossRef]

- Knoben, J.; Oerlemans, L.A. Proximity and inter-organizational collaboration: A literature review. Int. J. Manag. Rev. 2006, 8, 71–89. [Google Scholar] [CrossRef] [Green Version]

- Shaw, A.T.; Gilly, J.-P. On the analytical dimension of proximity dynamics. Reg. Stud. 2000, 34, 169–180. [Google Scholar] [CrossRef]

- Breschi, S.; Malerba, F. The geography of innovation and economic clustering: Some introductory notes. Ind. Corp. Chang. 2001, 10, 817–833. [Google Scholar] [CrossRef]

- Hoekman, J.; Frenken, K.; Tijssen, R.J. Research collaboration at a distance: Changing spatial patterns of scientific collaboration within Europe. Res. Policy 2010, 39, 662–673. [Google Scholar] [CrossRef]

- Pouder, R.; St John, C.H. Hot spots and blind spots: Geographical clusters of firms and innovation. Acad. Manag. Rev. 1996, 21, 1192–1225. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Ding, D.Z. Control, conflict, and performance: A study of US-Chinese joint ventures. J. Int. Mark. 1997, 5, 31–45. [Google Scholar] [CrossRef]

- Kogut, B. Joint Ventures: Theoretical and Empirical Perspectives. Strateg. Manag. J. 1988, 9, 319–332. [Google Scholar] [CrossRef]

- Lane, P.J.; Salk, J.E.; Lyles, M.A. Absorptive capacity, learning, and performance in international joint ventures. Strateg. Manag. J. 2001, 22, 1139–1161. [Google Scholar] [CrossRef]

- Galunic, D.C.; Rodan, S. Resource recombinations in the firm: Knowledge structures and the potential for schumpeterian innovation. Strateg. Manag. J. 1998, 19, 1193–1201. [Google Scholar] [CrossRef]

- Henderson, R.M.; Clark, K.B. Architectural Innovation—The Reconfiguration of Existing Product Technologies and the Failure of Established Firms. Adm. Sci. Q. 1990, 35, 9–30. [Google Scholar] [CrossRef] [Green Version]

- Henderson, R.; Cockburn, I. Measuring competence? Exploring firm effects in pharmaceutical research. Strateg. Manag. J. 1994, 15, 63–84. [Google Scholar] [CrossRef] [Green Version]

- Hernandez, E.; Shaver, J.M. Network synergy. Adm. Sci. Q. 2019, 64, 171–202. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Puranam, P.; Singh, H.; Zollo, M. Organizing for innovation: Managing the coordination-autonomy dilemma in technology acquisitions. Acad. Manag. J. 2006, 49, 263–280. [Google Scholar] [CrossRef] [Green Version]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic Networks. Strateg. Manag. J. 2000, 21, 203–215. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W. Social capital, networks, and knowledge transfer. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef] [Green Version]

- Meschi, P.-X.; Wassmer, U. The effect of foreign partner network embeddedness on international joint venture failure: Evidence from European firms’ investments in emerging economies. Int. Bus. Rev. 2013, 22, 713–724. [Google Scholar] [CrossRef]

- Hansen, M.T.; Birkinshaw, J. The innovation value chain. Harv. Bus. Rev. 2007, 85, 121. [Google Scholar]

- Shane, S. Technology Strategy for Managers and Entrepreneurs; Pearson/Prentice Hall: Upper Saddle River, NJ, USA, 2009; ISBN 0-13-187932-4. [Google Scholar]

- Gulati, R. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strateg. Manag. J. 1999, 20, 397–420. [Google Scholar] [CrossRef]

- Bruton, G.D.; White, M.A. Strategic Management of Technology and Innovation; South-Western Cengage Learning: Mason, OH, USA, 2011. [Google Scholar]

- Sorenson, O.; Stuart, T.E. Syndication networks and the spatial distribution of venture capital investments. Am. J. Sociol. 2001, 106, 1546–1588. [Google Scholar] [CrossRef]

- Nelson, R.R.; Winter, S. An Evolutionary Theory of Economic Change; Harvard University Press: Cambridge, MA, USA, 1982. [Google Scholar]

- Andersson, U.; Bjorkman, I.; Forsgren, M. Managing subsidiary knowledge creation: The effect of control mechanisms on subsidiary local embeddedness. Int. Bus. Rev. 2005, 14, 521–538. [Google Scholar] [CrossRef]

- Finkelstein, S. Power in Top Management Teams—Dimensions, Measurement, and Validation. Acad. Manag. J. 1992, 35, 505–538. [Google Scholar]

- Uzzi, B. The sources and consequences of embeddedness for the economic performance of organizations: The network effect. Am. Sociol. Rev. 1996, 61, 674–698. [Google Scholar] [CrossRef]

- Uzzi, B. Social structure and competition in interfirm networks: The paradox of embeddedness. Adm. Sci. Q. 1997, 42, 35–67. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: A theory of embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Hennart, J.-F. A transaction costs theory of equity joint ventures. Strateg. Manag. J. 1988, 9, 361–374. [Google Scholar] [CrossRef]

- Hennart, J.-F. The transaction costs theory of joint ventures: An empirical study of Japanese subsidiaries in the united states. Manag. Sci. 1991, 37, 483–497. [Google Scholar] [CrossRef]

- McEvily, B.; Zaheer, A. Bridging ties: A source of firm heterogeneity in competitive capabilities. Strateg. Manag. J. 1999, 20, 1133–1157. [Google Scholar] [CrossRef]

- Kim, J.; Kim, K. How does local partners network embeddedness affect international joint venture survival in different subnational contexts? Asia Pac. J. Manag. 2018, 35, 1055–1080. [Google Scholar] [CrossRef]

- Martin, X.; Salomon, R. Tacitness, learning, and international expansion: A study of foreign direct investment in a knowledge-intensive industry. Organ. Sci. 2003, 14, 297–311. [Google Scholar] [CrossRef]

- Polanyi, M. Personal Knowledge: Towards a Post-Critical Philosophy; University of Chicago Press: Chicago, IL, USA, 2015. [Google Scholar]

- Arrow, K.J. The Limits of Organization; WW Norton & Company: New York, NY, USA, 1974. [Google Scholar]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef] [Green Version]

- Harzing, A.-W. Who’s in charge? An empirical study of executive staffing practices in foreign subsidiaries. Hum. Resour. Manag. Publ. Coop. Sch. Bus. Adm. Univ. Mich. Alliance Soc. Hum. Resour. Manag. 2001, 40, 139–158. [Google Scholar] [CrossRef]

- Tan, D.; Mahoney, J.T. Explaining the utilization of managerial expatriates from the perspectives of resource-based, agency, and transaction costs theories. Adv. Int. Manag. 2003, 15, 179–205. [Google Scholar]

- Bebenroth, R.; Froese, F.J. Consequences of expatriate top manager replacement on foreign subsidiary performance. J. Int. Manag. 2020, 26, 100730. [Google Scholar] [CrossRef]

- Yu, B.B.; Egri, C.P. Human resource management practices and affective organizational commitment: A comparison of Chinese employees in a state-owned enterprise and a joint venture. Asia Pac. J. Hum. Resour. 2005, 43, 332–360. [Google Scholar] [CrossRef]

- Du, J.; Choi, J.N. Pay for performance in emerging markets: Insights from China. J. Int. Bus. Stud. 2010, 41, 671–689. [Google Scholar] [CrossRef]

- Shin, S.J.; Morgeson, F.P.; Campion, M.A. What you do depends on where you are: Understanding how domestic and expatriate work requirements depend upon the cultural context. J. Int. Bus. Stud. 2007, 38, 64–83. [Google Scholar] [CrossRef]

- Walsh, J.P.; Seward, J.K. On the efficiency of internal and external corporate control mechanims. Acad. Manag. Rev. 1990, 15, 421–458. [Google Scholar] [CrossRef]

- Bleeke, J.; Ernst, D. The way to win in cross-border alliances. Harv. Bus. Rev. 1991, 69, 127–135. [Google Scholar]

- Steensma, H.K.; Lyles, M.A. Explaining IJV survival in a transitional economy through social exchange and knowledge-based perspectives. Strateg. Manag. J. 2000, 21, 831–851. [Google Scholar] [CrossRef]

- Huber, G.P. Organizational learning: The contributing processes and the literatures. Organ. Sci. 1991, 2, 88–115. [Google Scholar] [CrossRef]

- Levitt, B.; March, J.G. Organizational Learning. Annu. Rev. Sociol. 1988, 14, 319–340. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Crossan, M.M. Believing Is Seeing: Joint Ventures and Organization Learning. J. Manag. Stud. 1995, 32, 595–618. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Lyles, M.A.; Steensma, H.K.; Tihanyi, L. Managing tacit and explicit knowledge transfer in IJVs: The role of relational embeddedness and the impact on performance. J. Int. Bus. Stud. 2004, 35, 428–442. [Google Scholar] [CrossRef]

- Zaheer, S.; Mosakowski, E. The dynamics of the liability of foreignness: A global study of survival in financial services. Strateg. Manag. J. 1997, 18, 439–463. [Google Scholar] [CrossRef]

- Granovetter, M. Business Groups. In The Handbook of Economic Sociology; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 1994; pp. 453–475. [Google Scholar]

- Granovetter, M. Business Groups and Social Organization. In The Handbook of Economic Sociology; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 2005; pp. 429–450. [Google Scholar]

- Khanna, T.; Rivkin, J.W. Estimating the performance effects of business groups in emerging markets. Strateg. Manag. J. 2001, 22, 45–74. [Google Scholar] [CrossRef]

- Khanna, T.; Rivkin, J.W. Interorganizational ties and business group boundaries: Evidence from an emerging economy. Organ. Sci. 2006, 17, 333–352. [Google Scholar] [CrossRef]

- Leff, N.H. Industrial Organization and Entrepreneurship in Developing-Countries—Economic Groups. Econ. Dev. Cult. Chang. 1978, 26, 661–675. [Google Scholar] [CrossRef]

- Chang, S.-J.; Chung, C.-N.; Mahmood, I.P. When and how does business group affiliation promote firm innovation? A tale of two emerging economies. Organ. Sci. 2006, 17, 637–656. [Google Scholar] [CrossRef] [Green Version]

- Mahmood, I.P.; Mitchell, W. Two faces: Effects of business groups on innovation in emerging economies. Manag. Sci. 2004, 50, 1348–1365. [Google Scholar] [CrossRef] [Green Version]

- Belenzon, S.; Berkovitz, T. Innovation in Business Groups. Manag. Sci. 2010, 56, 519–535. [Google Scholar] [CrossRef] [Green Version]

- Nepelski, D.; De Prato, G. Internationalisation of ICT R&D: A comparative analysis of Asia, the European Union, Japan, United States and the rest of the world. Asian J. Technol. Innov. 2012, 20, 219–238. [Google Scholar]

- Buckley, P.J.; Park, B.I. Realised absorptive capacity, technology acquisition and performance in international collaborative formations: An empirical examination in the Korean context. Asia Pac. Bus. Rev. 2014, 20, 109–135. [Google Scholar] [CrossRef]

- Blodgett, L.L. Research notes and communications factors in the instability of international joint ventures: An event history analysis. Strateg. Manag. J. 1992, 13, 475–481. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Beamish, P.W. Effect of equity ownership on the survival of international joint ventures. Strateg. Manag. J. 2004, 25, 295–305. [Google Scholar] [CrossRef]

- Chang, S.J. The Rise and Fall of Chaebols: Financial Crisis and Transformation of Korean Business Groups; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Chang, S.J.; Hong, J. Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Acad. Manag. J. 2000, 43, 429–448. [Google Scholar]

- Mahmood, I.P.; Zhu, H.; Zajac, E.J. Where can capabilities come from? Network ties and capability acquisition in business groups. Strateg. Manag. J. 2011, 32, 820–848. [Google Scholar] [CrossRef]

- Cohen, W.M.; Nelson, R.R.; Walsh, J.P. Protecting Their Intellectual Assets: Appropriability Conditions and Why US Manufacturing Firms Patent (or Not); National Bureau of Economic Research: Cambridge, MA, USA, 2000. [Google Scholar] [CrossRef]

- Frear, K.A.; Cao, Y.; Zhao, W. CEO background and the adoption of Western-style human resource practices in China. Int. J. Hum. Resour. Manag. 2012, 23, 4009–4024. [Google Scholar] [CrossRef]

- Almeida, H.; Wolfenzon, D. A theory of pyramidal ownership and family business groups. J. Financ. 2006, 61, 2637–2680. [Google Scholar] [CrossRef] [Green Version]

- Scherer, F.M. Firm size, market structure, opportunity, and the output of patented inventions. Am. Econ. Rev. 1965, 55, 1097–1125. [Google Scholar]

- Scherer, F.M. The propensity to patent. Int. J. Ind. Organ. 1983, 1, 107–128. [Google Scholar] [CrossRef]

- Tey, L.S.; Idris, A. Cultural fit, knowledge transfer and innovation performance: A study of Malaysian offshore international joint ventures. Asian J. Technol. Innov. 2012, 20, 201–218. [Google Scholar] [CrossRef]

- Hofstede, G.H. Culture’s Consequences: Comparing Values, Behaviors, Institutions, and Organizations Across Nations, 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2001; ISBN 0-8039-7323-3. [Google Scholar]

- Dutta, D.K.; Beamish, P.W. Expatriate Managers, Product Relatedness, and IJV Performance: A Resource and Knowledge-based Perspective. J. Int. Manag. 2013, 19, 152–162. [Google Scholar] [CrossRef]

- Nohria, N.; Gulati, R. Is slack good or bad for innovation? Acad. Manag. J. 1996, 39, 1245–1264. [Google Scholar] [CrossRef] [Green Version]

- Greve, H.R. A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Acad. Manag. J. 2003, 46, 685–702. [Google Scholar]

- Baum, J.A.C.; Rowley, T.J.; Shipilov, A.V.; Chuang, Y. Dancing with Strangers: Aspiration Performance and the Search for Underwriting Syndicate Partners. Adm. Sci. Q. 2005, 50, 536–575. [Google Scholar] [CrossRef] [Green Version]

- Greene, W.H. Econometric Analysis, 7th ed.; Prentice Hall: Boston, MA, USA, 2012; ISBN 0-13-139538-6. [Google Scholar]

- Hausman, J.; Hall, B.H.; Griliches, Z. Econometric-Models for Count Data with an Application to the Patents R and D Relationship. Econometrica 1984, 52, 909–938. [Google Scholar] [CrossRef] [Green Version]

- Heckman, J. Statistical Models for Discrete Panel Data. In The Econometrics of Panel Data; McFadden, D., Manski, C., Eds.; MIT Press: Cambridge, MA, USA, 1981. [Google Scholar]

- Heckman, J. Heterogeneity and State Dependence. In Studies in Labor Markets; Rosen, S., Ed.; University of Chicago Press: Chicago, IL, USA, 1981; pp. 91–139. [Google Scholar]

- Hsiao, C. Analysis of Panel Data; Econometric Society monographs; Cambridge University Press: Cambridge, NY, USA, 1986; ISBN 0-521-25150-8. [Google Scholar]

- Plumper, T.; Troeger, V.E. Efficient estimation of time-invariant and rarely changing variables in finite sample panel analyses with unit fixed effects. Polit. Anal. 2007, 15, 124–139. [Google Scholar] [CrossRef]

- Petersen, T. Analyzing Panel Data: Fixed- and Random-Effects Models. In Handbook of Data Analysis; SAGE Publications: London, UK, 2004; pp. 332–345. ISBN 978-0-7619-6652-4. [Google Scholar]

- Killing, P.J. Strategies for Joint Venture Success; Praeger: New York, NY, USA, 1983. [Google Scholar]

- Yan, A.; Zeng, M. International joint venture instability: A critique of previous research, a reconceptualization, and directions for future research. J. Int. Bus. Stud. 1999, 30, 397–414. [Google Scholar] [CrossRef]

- Cohen, J.; Cohen, P.; West, P.W.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences, 3rd ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 2003. [Google Scholar]

- Pollock, T.G.; Lee, P.M.; Jin, K.; Lashley, K. (Un) Tangled Exploring the Asymmetric Coevolution of New Venture Capital Firms’ Reputation and Status. Adm. Sci. Q. 2015, 60, 482–517. [Google Scholar] [CrossRef] [Green Version]

- Andersson, U.; Forsgren, M.; Holm, U. The strategic impact of external networks: Subsidiary performance and competence development in the multinational corporation. Strateg. Manag. J. 2002, 23, 979–996. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef] [Green Version]

- Burt, R.S. Brokerage & Closure. An Introduction to Social Capital; Oxford University Press: New York, NY, USA, 2005. [Google Scholar]

- Coleman, J.S. Social Capital in the Creation of Human Capital. Am. J. Sociol. 1988, 94, S95–S120. [Google Scholar] [CrossRef]

- Walker, G.; Kogut, B.; Shan, W. Social capital, structural holes and the formation of an industry network. Organ. Sci. 1997, 8, 109–125. [Google Scholar] [CrossRef]

- Rasiah, R. Building networks to harness innovation synergies: Towards an open systems approach to sustainable development. J. Open Innov. Technol. Mark. Complex. 2019, 5, 70. [Google Scholar] [CrossRef] [Green Version]

- Tajudeen, F.P.; Jaafar, N.I.; Sulaiman, A. External Technology Acquisition and External Technology Exploitation: The Difference of Open Innovation Effects. J. Open Innov. Technol. Mark. Complex. 2019, 5, 97. [Google Scholar] [CrossRef] [Green Version]

- Uribe-Echeberria, R.; Igartua, J.I.; Lizarralde, R. Implementing Open Innovation in Research and Technology Organisations: Approaches and Impact. J. Open Innov. Technol. Mark. Complex. 2019, 5, 91. [Google Scholar] [CrossRef] [Green Version]

- Choi, C.B.; Beamish, P.W. Split management control and international joint venture performance. J. Int. Bus. Stud. 2004, 35, 201–215. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.S. Between trust and control: Developing confidence in partner cooperation in alliances. Acad. Manag. Rev. 1998, 23, 491–512. [Google Scholar] [CrossRef] [Green Version]

- Hamel, G. Competition for Competence and Inter-Partner Learning Within International Strategic Alliances. Strateg. Manag. J. 1991, 12, 83–103. [Google Scholar] [CrossRef]

- Krackhardt, D. Simmelian ties: Super strong and sticky. In Power and Influence in Organizations; Kramer, R.M., Neale, M.A., Eds.; Sage: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Knott, A.M. Persistent heterogeneity and sustainable innovation. Strateg. Manag. J. 2003, 24, 687–705. [Google Scholar] [CrossRef]

- Child, J. Organizational Structure, Environment and Performance: The Role of Strategic Choice. Sociol. J. Br. Sociol. Assoc. 1972, 6, 1–22. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper Echelons: The Organization as a Reflection of Its Top Managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef] [Green Version]

- Ren, C.R.; Guo, C. Middle managers’ strategic role in the corporate entrepreneurial process: Attention-based effects. J. Manag. 2011, 37, 1586–1610. [Google Scholar] [CrossRef] [Green Version]

- Rouleau, L. Micro-practices of strategic sensemaking and sensegiving: How middle managers interpret and sell change every day. J. Manag. Stud. 2005, 42, 1413–1441. [Google Scholar] [CrossRef]

- Bantel, K.A.; Jackson, S.E. Top Management and Innovations in Banking—Does the Composition of the Top Team Make a Difference. Strateg. Manag. J. 1989, 10, 107–124. [Google Scholar] [CrossRef]

- Kim, S.; Jin, K. Organizational governance of inter-firm resource combinations: The impact of structural embeddedness and vertical resource relatedness. J. Manag. Organ. 2017, 23, 524–544. [Google Scholar] [CrossRef]

- Macaulay, S. Non-contractual relations in business: A preliminary study. Am. Sociol. Rev. 1963, 55–67. [Google Scholar] [CrossRef]

- Gans, J.S.; Hsu, D.H.; Stern, S. The impact of uncertain intellectual property rights on the market for ideas: Evidence from patent grant delays. Manag. Sci. 2008, 54, 982–997. [Google Scholar] [CrossRef] [Green Version]

- Popp, D.; Juhl, T.; Johnson, D. Time in purgatory: Determinants of the grant lag for US patent applications. Top. Econ. Anal. Policy 2004, 4. [Google Scholar] [CrossRef]

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Successful patent applications | 2.00 | 8.02 | ||||||||||||||

| 2. Cultural distance | 78.91 | 20.19 | −0.08 | |||||||||||||

| 3. Industry concentration | 0.06 | 0.07 | −0.12 | 0.14 | ||||||||||||

| 4. Industry propensity to patent | 2.03 | 3.50 | −0.03 | 0.09 | 0.45 | |||||||||||

| 5. IJV R&D intensity | 0.03 | 0.21 | 0.15 | 0.13 | −0.01 | 0.05 | ||||||||||

| 6. IJV Advertising intensity | 0.01 | 0.02 | −0.07 | −0.13 | 0.02 | −0.08 | −0.03 | |||||||||

| 7. IJV size | 24.82 | 2.01 | 0.28 | −0.21 | 0.01 | −0.04 | −0.09 | −0.21 | ||||||||

| 8. IJV tenure | 8.22 | 5.35 | 0.10 | 0.05 | −0.13 | −0.05 | −0.03 | −0.11 | 0.41 | |||||||

| 9. IJV current ratio | 2.55 | 3.52 | −0.04 | −0.04 | −0.10 | −0.10 | −0.03 | −0.02 | −0.12 | 0.04 | ||||||

| 10. IJV debt-to-equity ratio | 2.25 | 7.72 | −0.05 | 0.03 | −0.02 | −0.04 | −0.02 | 0.20 | −0.15 | −0.12 | −0.12 | |||||

| 11. IJV profitability | 0.06 | 0.14 | −0.00 | 0.08 | −0.12 | −0.30 | −0.09 | −0.07 | 0.14 | 0.19 | 0.10 | −0.22 | ||||

| 12. Business group affiliation | 0.29 | 0.45 | 0.31 | −0.19 | −0.03 | −0.08 | 0.11 | −0.17 | 0.32 | 0.14 | 0.04 | −0.02 | −0.00 | |||

| 13. Ownership balance | 0.38 | 0.13 | −0.27 | −0.10 | 0.07 | −0.13 | −0.06 | 0.14 | −0.09 | −0.13 | 0.06 | 0.01 | 0.01 | −0.06 | ||

| 14. Co-management | 0.13 | 0.34 | −0.09 | −0.24 | −0.16 | −0.07 | −0.05 | 0.17 | 0.04 | 0.02 | −0.03 | 0.02 | 0.02 | 0.10 | −0.09 | |

| 15. Foreign managerial control | 0.28 | 0.45 | −0.11 | −0.01 | 0.18 | −0.09 | −0.07 | 0.04 | 0.23 | −0.03 | −0.01 | 0.00 | −0.02 | −0.13 | 0.02 | −0.24 |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

| Constant | −5.395 | −10.214 * | −9.012 * | −12.092 * | −12.271 * | −13.450 * | |

| (4.989) | (4.916) | (5.089) | (5.009) | (4.993) | (5.334) | ||

| Environmental variables | Cultural distance | −0.003 | 0.006 | 0.006 | 0.013 | 0.009 | 0.016 |

| (0.018) | (0.017) | (0.018) | (0.017) | (0.017) | (0.019) | ||

| Industry Concentration | −14.475 * | −13.416 * | −17.118 ** | −14.805 * | −11.941 * | −14.689 * | |

| (6.033) | (5.769) | (6.276) | (5.762) | (6.473) | (6.641) | ||

| Industry propensity to patent | 0.036 | 0.026 | 0.028 | 0.025 | 0.003 | 0.007 | |

| (0.061) | (0.060) | (0.062) | (0.060) | (0.065) | (0.065) | ||

| IJV-level variables | R&D intensity | 0.334 * | 0.426 * | 0.390 * | 0.423 * | 0.481 * | 0.461 * |

| (0.182) | (0.186) | (0.181) | (0.185) | (0.187) | (0.185) | ||

| Advertising intensity | −27.877 | −25.607 | −53.281 * | −51.616 | −28.277 | −58.474 * | |

| (26.437) | (26.276) | (31.387) | (31.747) | (27.074) | (33.757) | ||

| Size | 0.254 | 0.442 * | 0.411 * | 0.515 ** | 0.528 ** | 0.574 ** | |

| (0.172) | (0.176) | (0.182) | (0.182) | (0.179) | (0.192) | ||

| Tenure (C) | −0.162 | −0.180 * | −0.202 * | −0.205* | −0.225 * | −0.247 * | |

| (0.103) | (0.102) | (0.105) | (0.105) | (0.105) | (0.109) | ||

| Current ratio (unabsorbed slack) | 0.070 | 0.040 | 0.067 | 0.022 | 0.069 | 0.055 | |

| (0.139) | (0.141) | (0.143) | (0.145) | (0.138) | (0.141) | ||

| Debt-to-equity ratio (financial slack) | 0.027 | 0.025 | 0.024 | 0.025 | 0.027 | 0.025 | |

| (0.043) | (0.039) | (0.043) | (0.040) | (0.041) | (0.043) | ||

| Profitability | 0.669 | 0.378 | 0.286 | 0.197 | 0.306 | 0.142 | |

| (0.956) | (0.908) | (0.873) | (0.886) | (0.909) | (0.878) | ||

| Business group affiliation (D) | 0.023 | −0.255 | −0.597 | −0.436 | −0.648 | −0.852 | |

| (0.474) | (0.482) | (0.523) | (0.491) | (0.533) | (0.553) | ||

| Ownership balance (B) | −1.784 * | −1.983 * | −2.219 ** | −1.933 * | −2.278 ** | −2.299 ** | |

| (0.857) | (0.857) | (0.853) | (0.854) | (0.879) | (0.876) | ||

| Co-management | 0.358 | 0.008 | 0.416 | 0.062 | 0.885 | 0.947 | |

| (0.567) | (0.597) | (0.650) | (0.611) | (0.813) | (0.823) | ||

| Foreign managerial control (A) | −1.404 * | −5.690 * | −0.243 | −2.197 ** | −2.554 | ||

| (0.638) | (2.344) | (0.958) | (0.756) | (2.799) | |||

| Moderation effects | (A) × (B) | 12.788 * | 4.345 | ||||

| (6.525) | (7.098) | ||||||

| (A) × (C) | −0.133 | −0.113 | |||||

| (0.084) | (0.095) | ||||||

| (A) × (D) | 3.514 * | 2.989 * | |||||

| (1.603) | (1.744) | ||||||

| Estimation Statistics | IJV–year observations | 445 | 445 | 445 | 445 | 445 | 445 |

| Number of IJVs | 48 | 48 | 48 | 48 | 48 | 48 | |

| log-likelihood | −325.1 | −322.5 | −320.5 | −321.2 | −320.1 | −318.6 | |

| Chi-squared | 103.8 *** | 111.2 *** | 118.6 *** | 113.7 *** | 114.8 *** | 118.8 *** | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jin, K.; Park, C.; Lee, J. What Determines Innovative Performance of International Joint Ventures? Assessing the Effects of Foreign Managerial Control. Sustainability 2020, 12, 8770. https://0-doi-org.brum.beds.ac.uk/10.3390/su12218770

Jin K, Park C, Lee J. What Determines Innovative Performance of International Joint Ventures? Assessing the Effects of Foreign Managerial Control. Sustainability. 2020; 12(21):8770. https://0-doi-org.brum.beds.ac.uk/10.3390/su12218770

Chicago/Turabian StyleJin, Kyuho, Chulhyung Park, and Jeonghwan Lee. 2020. "What Determines Innovative Performance of International Joint Ventures? Assessing the Effects of Foreign Managerial Control" Sustainability 12, no. 21: 8770. https://0-doi-org.brum.beds.ac.uk/10.3390/su12218770