Digital Finance, Environmental Regulation, and Green Technology Innovation: An Empirical Study of 278 Cities in China

Abstract

:1. Introduction

2. Literature Review

3. Research Hypotheses

4. Research Design Data Description

4.1. Model Construction

4.2. Variable Selection and Data Source

4.2.1. Explained Variable

4.2.2. Core Explanatory Variable

4.2.3. Control Variables

5. Empirical Analysis

5.1. Spatial Autocorrelation Test

5.2. Model Selection

5.3. Spatial Effect Analysis

5.3.1. Spatial Model Results

5.3.2. Spatial Effect Decomposition

5.4. Robustness Test

5.5. Heterogeneity Analysis

5.6. Discussion of Empirical Results

6. Conclusions and Suggestions

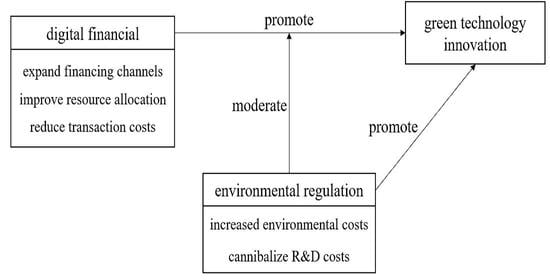

- Digital finance has an important role to play in promoting local green technology innovation. It is obvious that the low superlative threshold, low cost, high efficiency and informatization of digital finance encourage local enterprises’ green technology innovation through channels such as improving financing availability, reducing financing cost and transaction time, and improving resource allocation rate.

- Government environmental regulation facilitates the development of green technology innovation in local and adjacent areas. For one thing, it shows that the Porter hypothesis is valid in China. For another, environmental governance also reflects the relationship between learning and competition among local governments in China. When local governments force companies to innovate in green technologies by enforcing strict environmental regulations, neighboring governments also strengthen environmental regulations to achieve high-quality development.

- Environmental regulation plays a positive moderating role in the process of digital finance affecting green technological innovation. That is, environmental regulation plays a positive moderating role in the process of digital finance affecting green technology innovation. It shows that in the process of digital finance promoting green technology innovation, government environmental regulation plays an important guiding role.

- There is regional heterogeneity in the relationship between digital finance, environmental regulation, and green technology innovation. Among them, the environmental regulation in North China inhibits the local green technology innovation the most; Digital finance in Central China can not only promote green technology innovation in the region but also green technology innovation in neighboring regions through a spillover effect.

- The development of the secondary industry hinders the progress of green industry and further inhibits the level of urban green technology innovation.

7. Research Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Pan, S.; Ye, D.; Ye, X. Is Digital Finance inclusive? Empirical evidence from Urban innovation. Economist 2021, 4, 101–111. [Google Scholar]

- Feng, S.; Guo, R.; Li, X. Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. D 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Cuerva, M.C.; Triguero-Cano, Á.; Córcoles, D. Drivers of green and non-green innovation: Empirical evidence in Low-Tech SMEs. J. Clean. Prod. 2014, 68, 104–113. [Google Scholar] [CrossRef]

- Huang, Y.; Huang, Z. The Development of Digital Finance in China: Present and Future. Chin. Econ. Quart. 2017, 17, 1489–1502. [Google Scholar]

- Tang, S.; Wu, X.; Zhu, J. Digital Finance and enterprise technological innovation: Structural characteristics, mechanism identification and effect differences under financial supervision. J. Manag. World 2020, 36, 52–66. [Google Scholar]

- Hsu, P.H.; Xuan, T.; Yan, X. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- Paramati, S.R.; Mo, D.; Huang, R. The role of financial deepening and green technology on carbon emissions: Evidence from major OECD economies. Financ. Res. Lett. 2021, 41, 101794. [Google Scholar] [CrossRef]

- Wu, Y.; Huang, S. The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China’s new energy enterprises. Energy Econ. 2022, 112, 106158. [Google Scholar] [CrossRef]

- Tang, X.; Ding, S.; Gao, X.; Zhao, T. Can digital finance help increase the value of strategic emerging enterprises? Sustain. Cities Soc. 2022, 81, 103829. [Google Scholar] [CrossRef]

- Lin, C.; Ma, Y.; Malatesta, P.; Xuan, Y. Corporate ownership structure and the choice between bank debt and public debt. J. Financ. Econ. 2013, 109, 517–534. [Google Scholar] [CrossRef]

- Zhao, J.; Li, Y.; Zhu, L. Digital finance, green innovation and high quality urban development. South China Financ. 2021, 10, 22–36. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Zhang, M.; Liu, Y. Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Sci. Total Environ. 2022, 156463. [Google Scholar] [CrossRef]

- Nie, X.; Jiang, P.; Zheng, X.; Wu, Q. Research on digital finance and regional technological innovation. J. Finan. Res. 2021, 3, 132–150. [Google Scholar]

- Xu, Z. Does digital Inclusive Finance promote urban innovation? Empirical analysis based on spatial spillover and threshold characteristics. South China Financ. 2021, 2, 53–66. [Google Scholar] [CrossRef]

- Yu, L.; Zhao, D.; Xue, Z. Research on the use of digital finance and the adoption of green control techniques y family farms in China. Technol. Soc. 2020, 62, 101323. [Google Scholar] [CrossRef]

- Habiba, U.; Cao, X.; Anwar, A. Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 2022, 193, 1082–1093. [Google Scholar] [CrossRef]

- Lee, C.; Wang, F. How does digital inclusive finance affect carbon intensity? Econ. Anal. Policy 2022, 75, 174–190. [Google Scholar] [CrossRef]

- Zhao, X.; Mahendru, M.; Ma, X.; Rao, Y.; Shang, Y. Impacts of environmental regulations on green economic growth in China: New guidelines regarding renewable energy and energy efficiency. Renew. Energy 2022, 187, 728–742. [Google Scholar] [CrossRef]

- Weitzman, M.L. Free Access vs Private Ownership as Alternative Systems for Managing Common Property. J. Econ. Theory 1974, 8, 225. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental Regulation and Innovation: A Panel Data Study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Porter, M.A. America’s Green Strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Porter, M.A.; Vander, L.C. Towards a New Conception of the Environment Competitiveness Relationship. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Brunnermeierab, S.B.; Cohenc, M.A. Determinants of Environmental Innovation in US Manufacturing Industries. Environ. Econ. Manage. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Li, G.; Li, Y.; Quan, J. Environmental regulation, R&D investment and green technology innovation capability of enterprises. Sci. Sci. Manag. S. T. 2018, 39, 61–73. [Google Scholar]

- Li, X.; Du, K.; Ouyang, X.; Liu, L. Does more stringent environmental regulation induce firms’ innovation? Evidence from the 11th Five-year plan in China. Energy Econ. 2022, 112, 106110. [Google Scholar] [CrossRef]

- Zhang, D.; Zheng, M.; Feng, G.; Chang, C. Does an environmental policy bring to green innovation in renewable energy? Renew. Energy 2022, 195, 1113–1124. [Google Scholar] [CrossRef]

- Yuan, B.; Xiang, Q. Environmental Regulation, Industrial Innovation and Green Development of Chinese Manufacturing: Based on an Extended CDM Model. J. Clean. Prod. 2017, 176, 895–908. [Google Scholar] [CrossRef]

- Yuan, B. Does the “unlocking” of system and technology drive the green development of China’s manufacturing industry? Chin. J. Popul. Resour. Environ. 2018, 28, 117–127. [Google Scholar]

- Lanoie, P.; Laurent-Lucchetti, J.; Johnstone, N.; Ambec, S. Environmental policy, innovation and performance: New insights on the Porter hypothesis. Econ. Manag. Strategy 2011, 20, 803–842. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Sato, M. The impacts of environmental regulations on competitiveness. Rev. Environ. Econ. Policy 2017, 11, 183–206. [Google Scholar] [CrossRef]

- Shen, N.; Liu, F. Can high-intensity environmental regulation really promote technological innovation?—Retest based on “Porter hypothesis”. China Soft. Sci. 2012, 4, 49–59. [Google Scholar]

- Su, X.; Zhou, S. The influence and regulation of dual environmental regulation and government subsidy on enterprise innovation output. Chin. Popul. Resour. Environ. 2019, 29, 31–39. [Google Scholar]

- Hu, X.; Chen, M.; Luo, Y.; Chen, Y. Coupling coordination, spatial convergence and green innovation effect of manufacturing and producer services. Stat. Inf. Forum 2021, 36, 97–112. [Google Scholar] [CrossRef]

- Li, Y.; Li, F.; Li, X. Environmental regulation, digital inclusive finance and urban industrial upgrading: Based on spatial spillover effect and moderating effect. Inq. Econ. Iss. 2022, 1, 50–66. [Google Scholar]

- Wang, W.; Bei, D. Digital inclusive finance, government intervention and county economic growth: An empirical analysis based on threshold panel regression. Econ. Theory Econ. Manag. 2022, 42, 41–53. [Google Scholar]

- Shi, F.; Ding, R.; Li, H.; Hao, S. Environmental Regulation, Digital Financial Inclusion, and Environmental Pollution: An Empirical Study Based on the Spatial Spillover Effect and Panel Threshold Effect. Sustainability 2022, 14, 6869. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who is financing corporate green innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Yu, C.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, H.; Chang, C. Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Econ. 2022, 110, 106004. [Google Scholar] [CrossRef]

- Xie, X.; Shen, Y.; Zhang, H.; Guo, F. Can digital finance boost entrepreneurship? Evidence from China. Chin. Econom. Quart. 2018, 17, 1557–1580. [Google Scholar]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- He, C.; Li, C.; Geng, X.; Wen, Z. Research on the influence of digital finance on local economic development. Procedia Comput. Sci. 2022, 202, 385–389. [Google Scholar] [CrossRef]

- Ryals, L.; Payne, A. Customer relationship management in financial services: Towards information-enabled relationship marketing. J. Strateg. Mark. 2001, 9, 3–27. [Google Scholar] [CrossRef]

- Luo, D.; Luo, M.; Lv, J. Can Digital Finance Contribute to the Promotion of Financial Sustainability? A Financial Efficiency Perspective. Sustainability 2022, 14, 3979. [Google Scholar] [CrossRef]

- Serrano-Cinca, C.; Gutiérrez-Nieto, B. Microfinance, the long tail and mission drift—ScienceDirect. Int. Bus. Rev. 2014, 23, 181–194. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.A.; Siering, M. Digital Finance and FinTech: Current research and future research directions. J. Bus. Econ. Manag. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Zhao, H.; Zheng, X.; Yang, L. Does Digital Inclusive Finance Narrow the Urban-Rural Income Gap through Primary Distribution and Redistribution? Sustainability 2022, 14, 2120. [Google Scholar] [CrossRef]

- Liao, G.; Yao, D.; Hu, Z. The Spatial Effect of the Efficiency of Regional Financial Resource Allocation from the Perspective of Internet Finance: Evidence from Chinese Provinces. Emerg. Mark. Financ. Trade 2019, 56, 1211–1223. [Google Scholar] [CrossRef]

- Dendramis, Y.; Tzavalis, E.; Adraktas, G. Credit risk modelling under recessionary and financially distressed conditions. J. Bank. Financ. 2018, 91, 160–175. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, L.; Yue, Z. Research on development of digital finance in improving efficiency of tourism resource allocation. Resour. Environ. Sustain. 2022, 8, 100054. [Google Scholar] [CrossRef]

- Du, G.; Liu, Z.; Lu, H. Application of innovative risk early warning mode under big data technology in Internet credit financial risk assessment. Comput. Appl. Math. 2021, 386, 113260. [Google Scholar] [CrossRef]

- Chen, H.; Chen, X. “Trickle-Down” or “Polarization”: The Improvement Effect of Digital Inclusive Finance on Rural Relative Poverty. J. YunNan Univ. Finan. Econ. 2021, 37, 15–26. [Google Scholar]

- Jiang, R.; Xie, X. Financial exclusion and the Elimination of rural financial service Gaps. Banker 2010, 6, 108–111. [Google Scholar]

- Long, X.; Wan, W. Heterogeneity of scale of environmental regulation, firm profit margin and compliance cost. Chin. Indu. Econ. 2017, 6, 155–174. [Google Scholar]

- Zhao, J.; Zhang, R.; Li, C. Innovation compensation effect of financial development on environmental regulation to improve industrial green total factor productivity. J. Cap. Univ. Econ. Trade 2021, 23, 38–49. [Google Scholar]

- Zhu, D.; Ren, L. Environmental regulation, foreign direct investment and China’s industrial green transformation. J. Int. Trade. 2017, 11, 70–81. [Google Scholar]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Liu, D.; Chen, J.; Zhang, N. Political connections and green technology innovations under an environmental regulation. J. Clean. Prod. 2021, 298, 126778. [Google Scholar]

- Zhang, P.; Zhang, P.; Cai, G. Comparative study on the impact of different types of environmental regulations on enterprise technological innovation. Chin. J. Popul. Resour. Environ. 2016, 8–13. [Google Scholar] [CrossRef]

- Zhang, C.; Lu, Y.; Guo, L.; Yu, T. Intensity of environmental regulation and progress of production technology. J. Econom. Res. 2011, 46, 113–124. [Google Scholar]

- Wen, H.; Zhong, Q.; Lee, C. Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 2022, 82, 102166. [Google Scholar] [CrossRef]

- Lu, B. Expedited patent examination for green inventions: Developing countries’ policy choices. Energy Policy 2013, 61, 1529–1538. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Sun, T.; Zhang, X.; Cheng, Z. Measuring the development of Digital inclusive finance in China: Index compilation and spatial Characteristics. Chin. Econom. Quart. 2020, 19, 1401–1418. [Google Scholar]

- Ye, Q.; Zeng, G.; Dai, S.; Wang, F. Impact of different environmental regulatory tools on energy conservation and emission reduction technology innovation in China: Based on panel data of 285 prefecture-level cities. Chin. J. Popul. Resour. Environ. 2018, 28, 115–122. [Google Scholar]

- Zhang, T.; Jiang, F.; Wei, Z. Can digital economy become a new driving force for China’s high-quality economic development? Inq. Econ. Iss. 2021, 1, 25–39. [Google Scholar]

- Xu, Y.; Li, S.; Zhou, X.; Shahzad, U.; Zhao, X. How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew. Energy 2022, 189, 917–926. [Google Scholar] [CrossRef]

- Xin, M. Research on technological innovation effect of environmental regulation from perspective of industrial transfer: Evidence in China’s thermal power industry. Clean. Eng. Technol. 2021, 4, 100178. [Google Scholar] [CrossRef]

- Xie, Z. Research on the Impact of Digital Finance on regional technological Innovation in China. Sichuan Univ. 2021, 489, 132–150. [Google Scholar]

- Zheng, F.; Li, J. The impact of technological environmental regulation on green innovation in resource-based cities: A case study of the Yangtze River Economic Belt. Urban Probl. 2022, 2, 35–4575. [Google Scholar]

- Zhang, M.; Zhang, L.; Song, Y. Heterogeneous environmental regulation, spatial spillover and haze pollution. Chin. J. Popul. Resour. Environ. 2021, 31, 53–61. [Google Scholar]

| Variable | Name | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| lngt | 2502 | 4.495 | 1.701 | 0 | 9.906 |

| lndf | 2502 | 5.005 | 0.511 | 3.057 | 5.773 |

| lner | 2502 | −3.016 | 0.959 | −8.702 | −0.312 |

| lngdp | 2502 | 16.605 | 0.898 | 14.243 | 19.760 |

| lnie | 2502 | 14.878 | 0.749 | 12.031 | 18.24 |

| lnod | 2502 | 13.374 | 2.597 | 0 | 18.834 |

| lneq | 2502 | 4.503 | 0.242 | 1.703 | 5.062 |

| lnis | 2502 | 3.823 | 0.254 | 2.370 | 4.492 |

| Year | Digital Finance | Green Technology Innovation | ||

|---|---|---|---|---|

| Moran Index | Z Value | Moran Index | Z Value | |

| 2011 | 0.060 *** | 8.352 | 0.062 *** | 16.899 |

| 2012 | 0.070 *** | 9.743 | 0.061 *** | 16.735 |

| 2013 | 0.088 *** | 12.065 | 0.049 *** | 13.550 |

| 2014 | 0.058 *** | 8.111 | 0.051 *** | 14.021 |

| 2015 | 0.068 *** | 9.474 | 0.053 *** | 14.703 |

| 2016 | 0.075 *** | 10.343 | 0.056 *** | 15.493 |

| 2017 | 0.089 *** | 12.233 | 0.060 *** | 16.419 |

| 2018 | 0.118 *** | 16.002 | 0.066 *** | 18.105 |

| 2019 | 0.126 *** | 17.172 | 0.066 *** | 18.147 |

| LM Test | The Current Period | A Phase Lag | ||

|---|---|---|---|---|

| Model (1) | Model (2) | Model (1) | Model (2) | |

| LM Spatial error | 781.159 *** | 756.630 *** | 674.772 *** | 640.610 *** |

| LM Spatial lag | 9.018 *** | 8.410 *** | 7.136 *** | 6.100 ** |

| Robust LM Spatial error | 789.367 *** | 765.303 *** | 686.185 *** | 653.170 *** |

| Robust LM Spatial lag | 17.226 *** | 17.083 *** | 18.548 *** | 18.660 *** |

| The Variable Name | The Current Period | A Phase Lag | ||

|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | |

| lndf | 2.721 *** (22.56) | 3.096 *** (19.30) | 2.660 *** (21.21) | 3.056 *** (18.15) |

| lner | 0.092 *** (5.02) | −0.423 *** (−2.89) | 0.085 *** (4.18) | −0.457 *** (−2.95) |

| lndf*lner | 0.102 *** (3.55) | 0.110 *** (3.53) | ||

| lngdp | 1.156 *** (22.96) | 1.147 *** (22.65) | 1.146 *** (20.98) | 1.133 *** (20.88) |

| lnie | 0.064 (1.26) | 0.068 (1.33) | 0.090 (1.65) | 0.095 ** (1.74) |

| lnod | 0.024 *** (2.94) | 0.026 *** (3.03) | 0.022 *** (2.43) | 0.023 *** (2.56) |

| lneq | 0.133 ** (2.24) | 0.142 ** (2.36) | 0.139 *** (2.25) | 0.147** (2.40) |

| lnis | −0.358 *** (−3.86) | −0.349 *** (−4.62) | −0.329 *** (−3.93) | −0.324 *** (−3.86) |

| w*lndf | −0.198 (−0.44) | −0.260 (−0.34) | −0.229 (−0.48) | −0.669 (−0.79) |

| w*lner | 0.252 * (1.83) | 0.491 (0.49) | 0.104 (0.69) | 0.961 (0.89) |

| w*lngt | 0.339 *** (3.60) | 0.316 *** (2.27) | 0.334 *** (3.53) | 0.297 ** (2.08) |

| R2 | 0.476 | 0.482 | 0.485 | 0.499 |

| observations | 2502 | 2502 | 2224 | 2224 |

| time | fixed | fixed | fixed | fixed |

| city | fixed | fixed | fixed | fixed |

| Variable | Direct | Indirect | Total |

|---|---|---|---|

| lndf | 2.725 *** (22.48) | 1.072 (1.18) | 3.798 *** (4.09) |

| lner | 0.091 *** (5.85) | 0.420 ** (2.10) | 0.511 ** (2.55) |

| Variable | Eliminating Outliers | Variable | Eliminating Outliers | ||

|---|---|---|---|---|---|

| Current Period(1) | Lag Period (2) | Current Period(1) | Lag Period (2) | ||

| lndf | 3.320 *** (19.36) | 3.056 *** (18.15) | lneq | 0.171 ** (2.20) | 0.147 *** (2.40) |

| lner | −0.264 * (−1.94) | −0.457 *** (−2.95) | lnis | −0.291 *** (−3.55) | −0.324 *** (−3.86) |

| lndf*lner | 0.068 ** (2.55) | 0.109 *** (3.53) | w*lndf | −0.525 (−0.50) | −0.668 (−0.79) |

| lngdp | 0.963 *** (18.40) | 1.132 *** (20.88) | w*lner | 1.187 (0.76) | 0.960 (0.89) |

| lnie | 0.203 *** (3.73) | 0.095 * (1.74) | w*lngt | 0.206 (1.02) | 0.296 ** (2.08) |

| lnod | 0.075 *** (6.75) | 0.023 *** (2.56) | |||

| Variable | Northeast China | East China | North China | South China | Central China | Northwest China | Southwest China | |

|---|---|---|---|---|---|---|---|---|

| lndf | Direct | 0.414 ** (2.24) | 0.779 *** (5.31) | −0.269 (−0.91) | 1.361 *** (4.36) | 0.611 ** (2.26) | 0.769 ** (2.31) | 0.387 * (1.82) |

| Indirect | −0.174 (−0.83) | −0.813 (−1.43) | −0.234 (−0.63) | −0.472 (−0.99) | 0.064 ** (2.26) | −0.772 ** (−1.79) | −1.372 ** (−2.33) | |

| Total | 0.240 ** (1.79) | −0.034 (−0.06) | −0.504 * (−1.77) | 0.889 ** (2.22) | 0.676 *** (4.11) | −0.002 (−0.01) | −0.985 * (−1.68) | |

| lner | Direct | −0.040 (−0.82) | 0.114 *** (3.19) | −0.022 (−0.55) | −0.022 (−0.41) | −0.026 (−0.67) | −0.072 (−1.21) | −0.047 (−1.15) |

| Indirect | 0.103 * (1.67) | 0.376 ** (2.23) | −0.246 ** (−2.24) | 0.172 (0.63) | 0.206 *** (4.01) | 0.010 (0.09) | 0.036 (0.23) | |

| Total | 0.063 (1.79) | 0.489 *** (2.98) | −0.268 ** (−2.44) | 0.149 (0.55) | 0.179 *** (5.55) | −0.062 (−0.54) | −0.011 (−0.08) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, Y.; Dai, X.; Zhao, L. Digital Finance, Environmental Regulation, and Green Technology Innovation: An Empirical Study of 278 Cities in China. Sustainability 2022, 14, 8652. https://0-doi-org.brum.beds.ac.uk/10.3390/su14148652

Hu Y, Dai X, Zhao L. Digital Finance, Environmental Regulation, and Green Technology Innovation: An Empirical Study of 278 Cities in China. Sustainability. 2022; 14(14):8652. https://0-doi-org.brum.beds.ac.uk/10.3390/su14148652

Chicago/Turabian StyleHu, Yiqun, Xiong Dai, and Li Zhao. 2022. "Digital Finance, Environmental Regulation, and Green Technology Innovation: An Empirical Study of 278 Cities in China" Sustainability 14, no. 14: 8652. https://0-doi-org.brum.beds.ac.uk/10.3390/su14148652