5.2.1. The Results of the Benchmark Model

Column (1) of

Table 2,

Table 3 and

Table 4 show the results of the Benchmark Model, corresponding to JJJ, YRD and PRD, respectively. In the regression equation, ER variables are lagged by one year in order to control for endogeneity with the dependent variable, which is consistent with Kheder and Zugravu [

31]. The impact of environmental regulations on economic activities is often lagging behind, because firms also need time to prepare for relocation. Except for the dummy variable, all the other variables are log-linearized, and the regression coefficients represent the elasticity of independent variables.

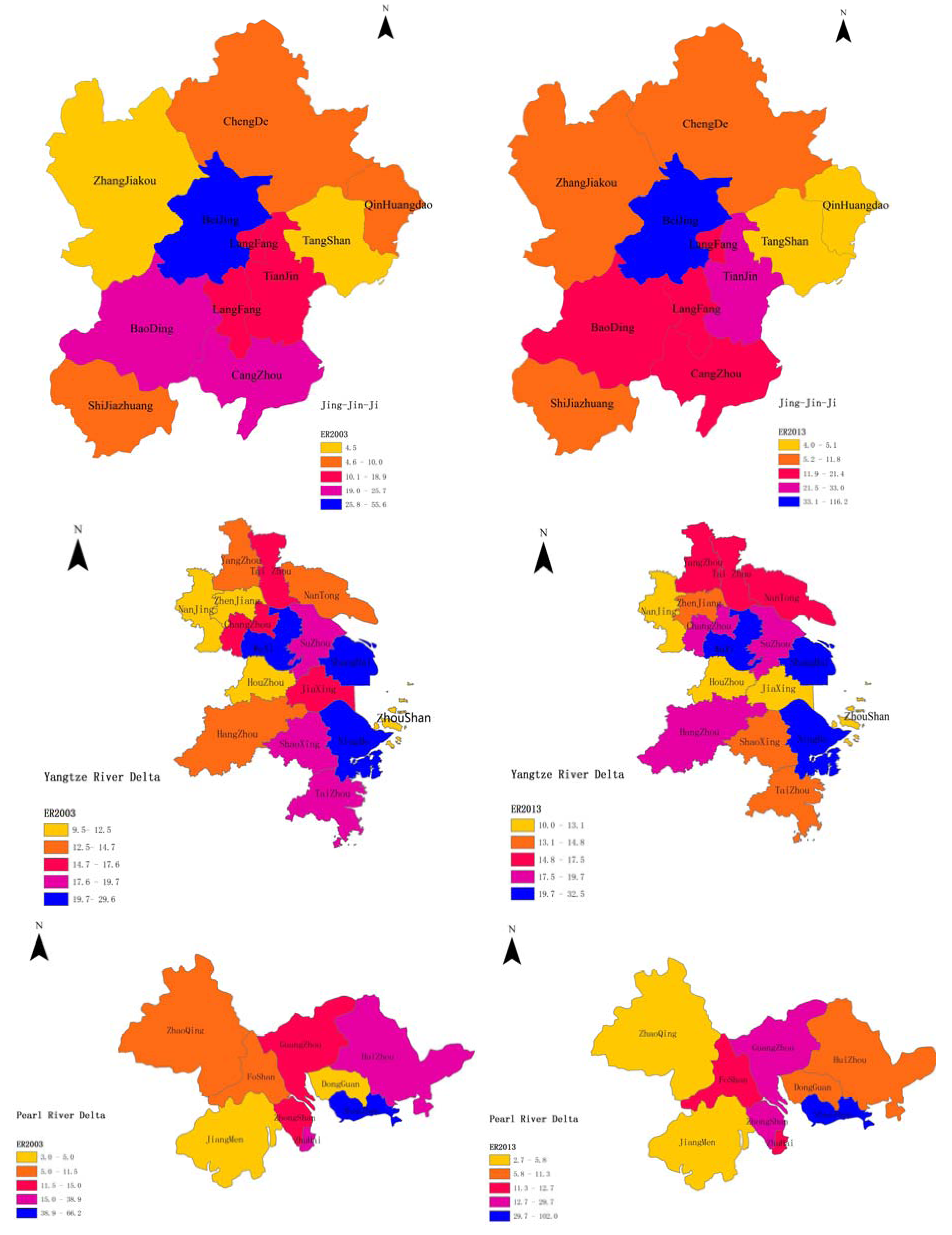

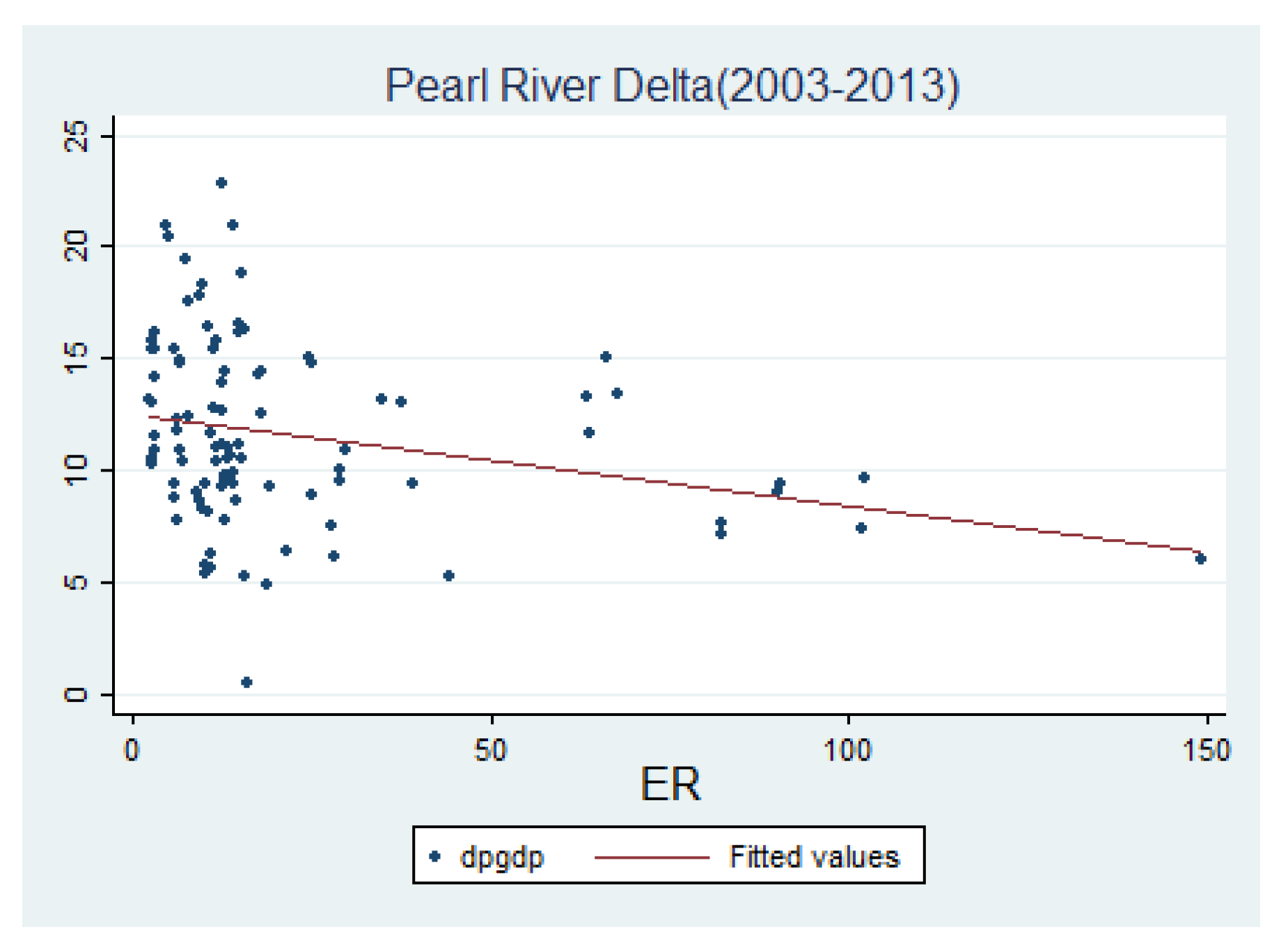

We observe that the results are consistent with theory and our predictions. Concerning our core variable, environmental regulation, it seems to be an important factor for urban economic growth. In all of the three estimate results, the estimated coefficients of lnERt−1 are always negative and consistently significant at the 1% level, indicating that more stringent environmental regulations deter urban economic growth. Comparing the three estimate results, we find that there are significant differences in the extent of impact of environmental regulation on economic growth. Among them, the coefficient of lnERt−1 in JJJ is the smallest, which is −0.054. It shows that, for cities in JJJ, the stringency of the environmental regulation increased by 1%, and the growth rate of GDP per capita decreased by 0.054%. For YRP, the coefficient of lnERt−1 is −0.147, which sits in the middle of the three. It indicates that the environmental regulation stringency increased by 1%, and the growth rate of GDP per capita decreased by 0.147%. In PRD, the elasticity value is −0.494, which means that the environmental regulation stringency increased by 1%, and the per capita GDP growth rate decreased by 0.494%. Environmental regulation has the greatest impact on cities of PRD, which may be due to the industrial structure of PRD. In PRD, most peripheral cities’ industries mainly rely on OEM, which produce some pollution and are sensitive to the pollution cost. Therefore, the impact of environmental regulation in PRD is larger than for the other two urban agglomerations.

5.2.2. The Long-Term Effects of Environmental Regulation on Economic Growth

In order to determine the long-term effects of environmental regulation on economic growth, we have introduced the square of environmental regulation variables in regression equations to determine whether the change in environmental regulation levels has a threshold effect on economic growth in the three urban agglomerations. From the results of Column (2) in

Table 2,

Table 3 and

Table 4, it can be found that

lnERt−1 and its square are not significant at the 10% level for the three regression results. Even if the confidence level is expanded to 20%, the coefficients are still not significant for the three regression results, which shows that the environmental regulation has no long-term effect on economic growth.

This result may be due to the following two reasons. Firstly, the long-term effect of environmental regulation on economic growth has not been shown in the period of our study (2003–2013). Even though environmental regulation can promote economic growth through industrial upgrading, the long-term growth effects are not significant during this period. Secondly, though the threshold effect exists, the threshold value of the environmental regulation index may be too low or too high. For JJJ and YRD, ER and economic growth show an inverted U shaped relationship which means that the impact of environmental regulation on economic growth increases after a period of suppression. However, ER index’s threshold values are 7.389 and 8.331, respectively, which are less than most ER indexes in our research. For PRD, environmental regulation and economic growth show a U shaped relationship, while the threshold value is 219695, apparently too large and meaningless for this problem.

5.2.3. Channels for the Spillover in the Urban Agglomeration

Column (3)–(6) in

Table 2,

Table 3 and

Table 4 show the regression results of spatial econometric models under the above four weight matrices, respectively. LR, AIC and SC test values show that the SAR model that we used is appropriate. Introducing spatial interaction in spatial econometric models has been advocated by previous researches [

66,

67]. As Harris

et al. [

67] observed, “the standard approach using W is that spillovers are entered through the interaction between regions of the dependent or other variables in the model, weighted by

, as the proxies for spatial spillovers.” Therefore, the different spatial weight matrices reflect different types of interaction among cities in the urban agglomeration. In other words, the regression results under different weight matrices shed a light on the significance of spillover effects in different channels, which is very important in exploring the characteristics of the economic network in the urban agglomeration and in analyzing the mechanism of economic interaction among cities in the urban agglomeration.

Analyzing the estimation results of JJJ, YRP and PRD, under four different weight matrices, the estimated coefficient of lnERt−1 is negative and consistently significant. This verifies that our benchmark model is robust, and the impact of environmental regulation on economic growth is consistent with reality. The value of Rho, the coefficient of spatial lag variable , can reflect the spillover effect and spillover channels by its significance.

Comparing the estimation results of Rho, we can find that there are differences in the economic spillover channels for the three urban agglomerations. Specifically, for the results of JJJ, Rho value is significant under the weight matrices and , but the Rho value under is only –4.6 × 10−4, which lacks economic significance. Therefore, the weight matrix reflects the channels and mechanisms for the economic spillover within JJJ, and the impact is significantly positive. That is, the greater the economic disparity among cities in JJJ is, the stronger the economic spillover effect that occurs. There is a close connection and interaction between cities with a huge economic gap between them, which is consistent with the industrial transfer policy of JJJ. Beijing, for example, has been transferring capital steel and other heavy industrial enterprises to Tangshan, Baoding and other surrounding cities since 2005. Since then, the central government further put forward the policy of “transfer the non-capital function” to relieve Beijing’s urban congestion and huge environmental pressure. As such, a series of industrial firms will gradually relocate to Shijiazhuang, Qinhuangdao where the level of economic development is relatively low. It is worth noting that the regression results under and are not significant, which shows that the geographical factor and environmental regulation disparity are not important factors affecting the economic spillover of JJJ. This shows that the industrial transfer in JJJ is mostly policy-oriented rather than market-oriented, which is mainly because the enterprises of JJJ are mainly composed of state-owned enterprises, whose business decisions are made by the government and not the market.

As shown in

Table 3, for YRP, Rho value is significant under the weight matrices

,

and

, which means that spillover occurs onto neighbors and cities with different economic development levels or with different environmental regulation policies. The Rho value under

is significantly positive, which suggests that neighboring cities in YRP have close interaction with each other, and also have a similar economic growth level, showing signs of collaborative development. The Rho value under

is significantly negative at −0.454. This shows that “zero-sum game” caused by the environmental regulation disparity existing in YRD. The firms transfer from cities with more stringent environmental regulation policies to cities with laxer policies, so the growth rates in these two kinds of cities show a negative correlation. Obviously, when environmental regulation disparity exists, some cities’ rapid economic growth occurs at the expense of the cities with more stringent environmental regulations. Similarly, the Rho value under

shows that the cities with economic disparity also experience the “zero-sum game”.

For PRD, the estimation results show that the Rho value is significant under matrices and . The Rho value under is only 0.001, which is meaningless for economic interpretation. What is interesting is that the Rho value under is significantly positive, and the value is 0.431, which is significantly different from the results of JJJ and YRD, indicating that the cities with environmental regulation disparity have a positive correlation with each other. To explore the reason for this, we can draw some insights from the “vacating cage to change bird” policy advocated by the Guangdong provincial government. The cities with environmental regulation disparity may be presented with opportunities to grow from the industrial transfer. For cities with more rigorous environmental regulations, they clear the polluting firms away and then give room for more suitable enterprises to move in. Through this process, these cities achieve the goal of updating their development patterns to ones that are more sustainable. For cities with more lenient environmental regulations, firms move in and bring demand for employment, which gives peripheral cities a chance to achieve a faster economic growth rate. It can be seen that environmental regulation disparity in PRD has an important role in promoting the overall level of sustainable growth, and the “Race to the bottom” phenomenon has not been evident.

Comparing the spatial econometric regression results of the three urban agglomerations, there are great differences in the spillover effects and spillover channels. Specifically, environmental regulation disparity has become an important spillover channel for YRD and PRD. In these two urban agglomerations, environmental regulation in PRD has promoted the coordinated growth through industrial transfer and industrial structure upgrades. For YRD, there is a trade-off between cities with environmental regulation disparities, and the whole economy falls into the “zero-sum game” dilemma. The reason for this situation is mostly due to the benefits of industrial structure upgrading in cities with severe environmental regulations that cannot compensate for the losses arising from industrial transfer. In JJJ, the impact of environmental regulation disparity on the spillover effect is not significant, and political factors play an important role in the spillover process. In summary, environmental regulation significantly affects cities’ economic growth, but only in YRD and PRD does environmental regulation disparity become a spillover channel through the process of industrial transfer.