Determinants of Financial Performance in China’s Intelligent Manufacturing Industry: Innovation and Liquidity

Abstract

:1. Introduction

2. Theoretical Background

2.1. The Fourth Industrial Revolution and China’s Intelligent Manufacturing

2.2. Literature Review

3. Research Model and Analysis Methods

3.1. Methodology of SEM

3.2. Research Model and Hypotheses

3.3. Data Collection and Survey Overview

4. Results of Empirical Analysis

4.1. General Characteristics of the Samples

4.2. Analysis of Measurement Model

4.2.1. Reliability Analysis

4.2.2. Validity Analysis

4.3. Analysis of Structural Model

4.3.1. Structural Model Fit

4.3.2. Verification of Hypotheses

4.4. Confirmation of Mediating Effects

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bao, Xiaomin. 2015. Corporate financial flexibility and liquidity management. Economic and Social Observation 1: 104. [Google Scholar]

- Barrett, Paul. 2007. Structural equation modelling: Adjudging model fit. Personality and Individual Differences 42: 815–24. [Google Scholar] [CrossRef]

- Bartlett, Maurice Stevenson. 1951. The effect of standardization on a Chi-square approximation in factor analysis. Biometrika 38: 337–44. [Google Scholar]

- Bentler, Peter M., and Chih-Ping Chou. 1987. Practical Issues in Structural Equation Modeling. Sociological Methods & Research 16: 78–117. [Google Scholar]

- Bollen, Kenneth A. 1990. Overall Fit in Covariance Structure Models: Two Types of Sample Size Effects. Psychological Bulletin 107: 256–59. [Google Scholar] [CrossRef]

- Brown, Timothy A. 2006. Confirmatory Factor Analysis for Applied Research. New York: Guilford. [Google Scholar]

- Chen, Yongdang, Zhiyou Han, Kunyu Cao, Xianrong Zheng, and Xiaobo Xu. 2020. Manufacturing upgrading in industry 4.0 era. Systems Research and Behavioral Science 37: 766–71. [Google Scholar] [CrossRef]

- Cheng, Zhonghua, and Jun Liu. 2015. Industrial agglomeration, market potential, and regional wage gaps. Collected Essays on Finance and Economics 3: 10–16. [Google Scholar]

- China Intelligent Manufacturing Industry Development Report. 2019. Available online: https://www.dx2025.com/archives/2485.html (accessed on 21 March 2020).

- Crutchley, Claire E., and Robert S. Hansen. 1989. A Test of the Agency Theory of Managerial Ownership, Corporate Leverage, and Corporate Dividends. Financial Management 18: 36–46. [Google Scholar] [CrossRef]

- Daft, Richard L., Juhani Sormunen, and Don Parks. 1988. Chief executive scanning, environmental characteristics, and company performance: An empirical study. Strategic Management Journal 9: 123–139. [Google Scholar] [CrossRef]

- DeVellis, Robert F. 1991. Scale Development: Theory and Applications. London: SAGE Publications. [Google Scholar]

- Dijkstra, T.K., and J. Henseler. 2015. Consistent and asymptotically normal PLS estimators for linear structural equations. Computational Statistics & Data Analysis 81: 10–23. [Google Scholar]

- Eljelly, Abuzar M.A. 2004. Liquidity-profitability tradeoff: An empirical investigation in an emerging market. International Journal of Commerce and Management 14: 48–61. [Google Scholar] [CrossRef]

- Enekwe, C.I., C.I. Agu, and K.N. Eziedo. 2014. The effect of financial leverage on financial performance: Evidence of quoted pharmaceutical companies in Nigeria. Journal of Economics and Finance 5: 17–25. [Google Scholar] [CrossRef] [Green Version]

- Gao, L. 2006. Introduction to Applied Higher Education. Beijing: Science Press. [Google Scholar]

- Hair, J.F., C.M. Ringle, and M. Sarstedt. 2011. PLS-SEM: Indeed a silver bullet. The Journal of Marketing Theory and Practice 19: 139–52. [Google Scholar] [CrossRef]

- Hanel, P., and Alain St-Pierre. 2002. Effects of R&D spillovers on the profitability of firms. Review of Industrial Organization 20: 305–22. [Google Scholar] [CrossRef]

- Henseler, J., C.M. Ringle, and R.R. Sinkovics. 2009. The use of partial least squares path modeling in international marketing. Advances in International Marketing 20: 277–319. [Google Scholar]

- Hofer, C.W. 1983. ROVA: A new measure for assessing organizational performance. Advances in Strategic Management 2: 43–55. [Google Scholar]

- Jackson, D.L. 2003. Revisiting sample size and number of parameter estimates: Some support for the N: q hypothesis. Structural Equation Modeling 10: 128–41. [Google Scholar] [CrossRef]

- Jacobs, Jane. 1969. The Economy of Cities. New York: Vintage. [Google Scholar]

- Patterson, James. 2020. 6 IT Trends That Will Bring Breakthrough Changes in 2019. Available online: https://transcosmos.co.uk/blog/2019-it-trends/ (accessed on 17 October 2019).

- Jaruzelski, Barry, Kevin Dehoff, and Rakesh Bordia. 2005. The Booz Allen Hamilton Global Innovation 1000: Money Isn’t Everything. Strategy+Business. Available online: https://www.urenio.org/wp-content/uploads/2009/01/global-innovation-1000-2005.pdf (accessed on 8 April 2020).

- Jie, Yanga, Limeng Yinga, and Manru Gao. 2020. The influence of intelligent manufacturing on financial performance and innovation performance:the case of China. Enterprise Information Systems 14: 812–32. [Google Scholar] [CrossRef]

- Johns, Ashley, and Christianlly Cena. 2018. What is an External Environment in Business?-Definition, Types & Factors. Study.com Homework Help Resource. Available online: https://study.com/academy/lesson/what-is-an-external-environment-in-business-definition-types-factors.html (accessed on 22 March 2020).

- Kline, Rex B. 2015. Principles and Practice of Structural Equation Modelling. New York: The Guilford Press. [Google Scholar]

- Lee, Jongok, Kyuhyun Lee, Sunyang Jeong, Sungbok Cho, and Jinhyo Yoon. 2005. R&D Management. Seoul: Kyungmoon Publisher. [Google Scholar]

- Li, Pei-nan, Lan-xiang Zhao, and Jin-bo Wan. 2014. The impact of innovation factors on industry innovation performances: an empirical analysis based on Chinese manufacturing and high technology industries. Studies in Science of Science 32: 604–612. [Google Scholar]

- Li, Zibiao, Shuang Liu, and Zhe Li. 2016. Threshold Effect of Industrial Agglomeration on Technological Innovation’s Capability: Case of Biological Manufacturing Industry in China. Technology Economics 35: 67–73. [Google Scholar] [CrossRef]

- Liu, Siao, and Chunlai Chai. 2011. Analysis of Knowledge Spillover Effect from the Perspective of Manufacturing Agglomeration and R&D Investment. The Forum on Science and Technology in China 7: 32–37. [Google Scholar]

- Liu, Siming, Shijin Zhang, and Huidong Zhu. 2019. Measure the power of national innovation and the effects of high-quality economic development. The Journal of Quantitative & Technical Economics 36: 3–23. [Google Scholar] [CrossRef]

- Chan, Louis K.C., Jason Karceski, and Josef Lakonishok. 2003. The Level and Persistence of Growth Rates. The Journal of Finance 27: 643–84. [Google Scholar] [CrossRef] [Green Version]

- MacKinnon, David P., Amanda J. Fairchild, and Matthew S. Fritz. 2010. Mediation Analysis. Annual Review of Psychology 58: 593–614. [Google Scholar] [CrossRef]

- Maness, Terry S., and John T. Zietlow. 2005. Short-Term Financial Management. Ohio: South-Western. [Google Scholar]

- Manufacturing Trends Report. 2019. Available online: https://info.microsoft.com/rs/157-GQE-382/images/ EN-US-CNTNT-Report-2019-Manufacturing-Trends.pdf (accessed on 8 January 2020).

- Marshall, Alfred. 1890. Principles of Economics: Great Minds Series. New York: Prometheus Books. [Google Scholar]

- McCutchen, William W., and Paul M. Swamidass. 1996. Effect of R&D expenditures and funding strategies on the market value of biotech firms. Journal of Engineering and Technology Management 12: 287–99. [Google Scholar] [CrossRef]

- Michael, Black. 2019. How Can Developing Countries Take Advantage of the Fourth Industrial Revolution? GEOSPATIAL WORLD Blog. Available online: https://www.geospatialworld.net/blogs/how-can-developing-countries-take-advantage-of-the-fourth-industrial- revolution/ (accessed on 23 March 2020).

- Ministry of Science and Technology of China. 2020. Statistical Analysis of the Characteristics of Chinese Enterprises’ Innovation Activities in 2018. Available online: http://www.most.gov.cn/kjbgz/202004/t20200417_153225.htm (accessed on 17 August 2020).

- Hancock, Gregory R., and Ralph O. Mueller. 2001. Rethinking construct reliability within latent variable systems. Structural Equation Modeling: Present and Future 1: 195–216. [Google Scholar]

- Davis, Nicholas. 2016. What Is the Fourth Industrial Revolution? Available online: https://www.weforum.org/agenda/2016/01/what-is-the-fourth-industrial-revolution/ (accessed on 10 August 2020).

- Nunnally, Jum C., and Ira H. Bernstein. 1994. Psychometric Theory, 3rd ed. New York: Mc Graw Hill. [Google Scholar]

- Pearce, John A., D. Keith Robbins, and Richard B. Robinson Jr. 1987. The impact of grand strategy and planning formality on financial performance. Strategic Management Journal 8: 125–34. [Google Scholar] [CrossRef]

- Quatraro, Francesco. 2009. The Diffusion of Regional Innovation Capabilities: Evidence from Italian Patent Data. Regional Studies 43: 1333–1348. [Google Scholar] [CrossRef] [Green Version]

- Samiloglu, F., and K. Demirgunes. 2008. The effect of working capital management on firm profitability: Evidence from Turkey. The International Journal of Applied Economics and Finance 2: 44–50. [Google Scholar] [CrossRef]

- Sartal, Antonio, Josep Llach, Xose H. Vázquez, and Rodolfo de Castro Vila. 2017. How much does Lean Manufacturing need environmental and information technologies? Journal of Manufacturing Systems 45: 260–272. [Google Scholar] [CrossRef]

- Shrader, Charles B., Lew Taylor, and Dan R. Dalton. 1984. Strategic Planning and Organizational Performance: A Critical Appraisal. Journal of Management 10: 149–171. [Google Scholar] [CrossRef]

- Sinharay, Sandip. 2010. Discrete Probability Distributions. International Encyclopedia of Education 3: 132–134. [Google Scholar] [CrossRef]

- Statistics Solutions. 2020. Structural Equation Modeling. Available online: https://www.statisticssolutions.com/structural-equation-modeling/ (accessed on 11 June 2020).

- Titman, Sheridan, and Roberto Wessels. 1988. The Determinants of Capital Structure Choice. The Journal of Finance 42: 1–19. [Google Scholar] [CrossRef]

- Venkatraman, N., and John E. Prescott. 1990. The Market Share-Profitability Relationship: Testing Temporal Stability across Business Cycles. Journal of Management 16: 783–805. [Google Scholar] [CrossRef] [Green Version]

- Wang, Hong. 2017. The impacts of policies support on the performance of agricultural public companies. Finance Economy 3: 114–16. [Google Scholar]

- Wang, Zhuquan, Wenjing Liu, and Fang Gao. 2007. Survey on Working Capital Management of Chinese Listed Companies: 1997~2006. Journal of Accounting Research 12: 69–75. [Google Scholar] [CrossRef]

- Wen, Lu, SungHoon Park, Siwei Liu, TaeHyun Nam, and GiTae Yeo. 2018. Connection Analysis of Container Ports of the Bohai Rim Economic Circle (BREC). The Asian Journal of Shipping and Logistics 34: 145–150. [Google Scholar] [CrossRef]

- Weston, Rebecca, and Paul A. Gore Jr. 2006. A Brief Guide to Structural Equation Modeling. The Counseling Psychologist 34: 719–751. [Google Scholar] [CrossRef]

- Woo, Jongpil. 2012. Concept and Understanding of Structural Equation Model. Seoul: Hannarae Academy. [Google Scholar]

- World Economic Forum. 2018. The Future of Jobs Report 2018. Geneva: World Economic Forum, Available online: http://www3.weforum.org/docs/WEF_Future_of_Jobs_2018.pdf (accessed on 15 November 2019).

- World Intelligent Manufacturing Center Development Trend Report. 2019. Available online: https://www.vzkoo.com/doc/9793.html (accessed on 20 March 2020).

- Xie, Yongping, Yixuan Yin, Wei Xue, Hui Shi, and Dazhi Chong. 2020. Intelligent supply chain performance measurement in Industry 4.0. Systems Research and Behavioral Science 37: 711–18. [Google Scholar] [CrossRef]

- Xu, Lifei. 2018. Research on Influence of Government Subsidies on Corporate Performance of Agriculture Related Listed Companies in China. Ph.D. dissertation, Inner Mongolia Agricultural University, Hohhot, China. [Google Scholar]

- Xu, Dong, and Guoming Xian. 2002. Oligopoly, Capital Structure and Asset Liquidity. Nankai Economic Studies 3: 38–41. [Google Scholar]

- Xu, Gang, Weidong Zhu, and Huiqian Sun. 2014. Research on the Policy Effect of Government Subsidies. Economic Developments 6: 88–95. [Google Scholar]

- Yang, Caihong. 2019. Research on the Relationship between Local Economic Development and Business Performance of Business Circulation Enterprises. Journal of Business Economics 20: 5. [Google Scholar]

- Yang, Shipeng, Jianguang Zhang, Xuan Li, and Yuanyuan Ren. 2009. Research on the Financial Performance Effect of the Liquidity of Military Listed Companies. Friends of Accounting 7: 97–99. [Google Scholar]

- Yi, Yaqun, and Yi Liu. 1999. The Systematic Analysis on the Environmental Factors of the Enterprise Strategy Change. Master’s dissertation, Xi’an Jiaotong University, Xi’an, China. [Google Scholar]

- Zhang, Xinrong, Zhengwei Liang, and Xujiang Chen. 2016. The Timing Mode Selection of Government Subsidies: Based on the Mediating Effect Analysis of Government Subsidies, R&D Investment and Enterprise Performance of Hi-Tech Industry. Science & Technology Progress and Policy 33: 42–47. [Google Scholar] [CrossRef]

- Zhu, Zhaohui, and Feng Huang. 2012. The Effect of R&D Investment on Firms’ Financial Performance: Evidence from the Chinese Listed IT Firms. Modern Economy 3: 915–19. [Google Scholar] [CrossRef] [Green Version]

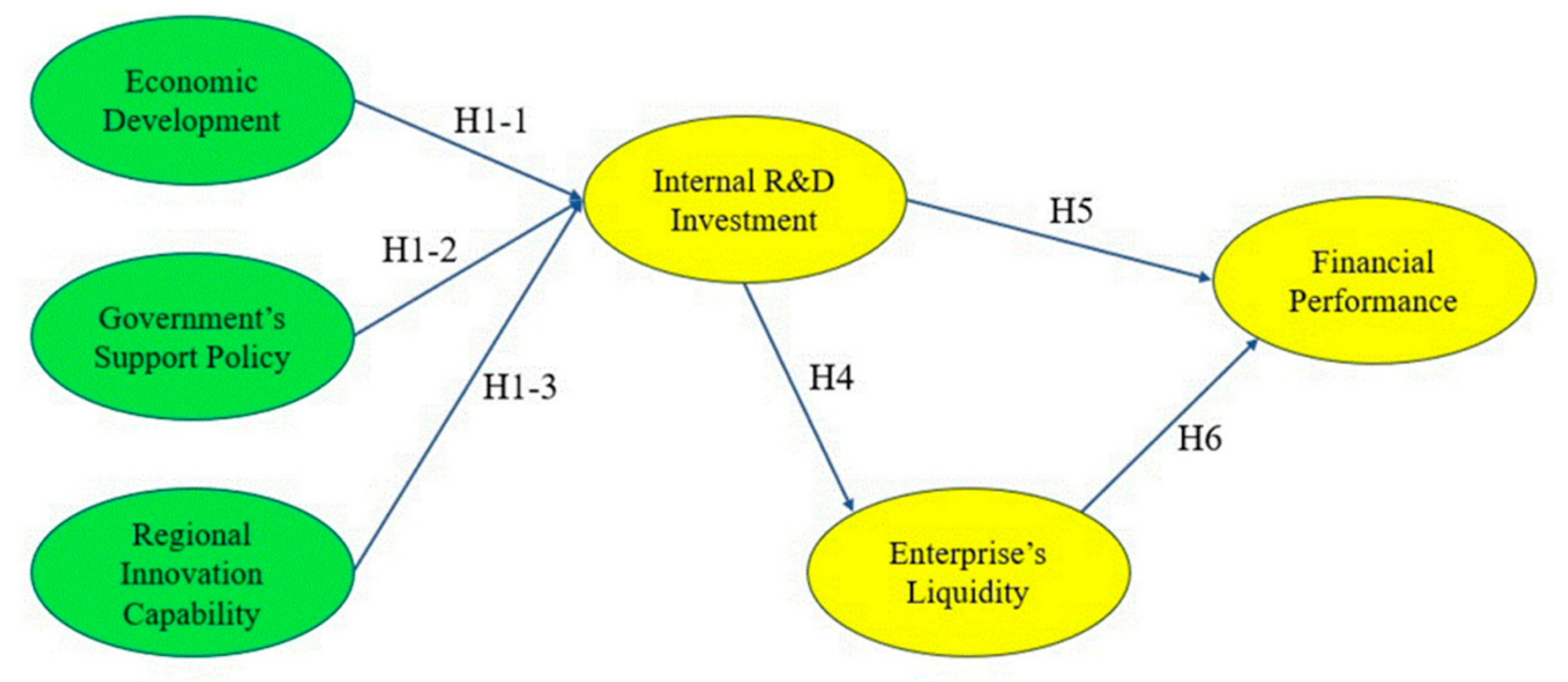

| No. | Hypotheses | |

|---|---|---|

| H1-1 | Urban economic development has a significant and positive impact on an enterprise’s internal R&D investment. | |

| H1 | H1-2 | Government’s support policy has a significant and positive impact on an enterprise’s internal R&D investment. |

| H1-3 | Regional innovation capability has a significant and positive impact on an enterprise’s internal R&D investment. | |

| H4 | There is a significant positive relationship between an enterprise’s internal R&D investment and the enterprise’s liquidity. | |

| H5 | There is a significant positive relationship between an enterprise’s internal R&D investment and the enterprise’s financial performance. | |

| H6 | There is a significant positive relationship between an enterprise’s liquidity and the enterprise’s financial performance. |

| Types | Variables | Items |

|---|---|---|

| Exogenous Variables | Economic Development | City’s GRDP |

| Urbanization Rate | ||

| Government’s Support Policy | Government Subsidies for Enterprise R&D | |

| Financial Support for Science Park Constructions | ||

| Regional Innovation Capability | Human and Resource Environment Index of Regional Innovation | |

| Institutional Service Index of Regional Innovation | ||

| Endogenous Variables | Internal R&D Investment | Ratio of R&D Investment to Operating Income |

| High-level Scientific Research Personnel | ||

| University-enterprise Cooperation Projects for Technological Innovation | ||

| Enterprise’s Liquidity | Current Ratio (Working Capital Ratio) | |

| Cash Ratio | ||

| Owner’s Equity Ratio | ||

| Financial Performance | Profit Margin Ratio | |

| Return on Assets | ||

| Social Contribution Rate | ||

| General Characteristics | Attributes | |

| Industry Classifications | ||

| Location by Economic Circles | ||

| Applied Technologies | ||

| Categories | Frequency (N = 317) | Percentage (%) | |

|---|---|---|---|

| Attributes | Listed Enterprise | 317 | 100 |

| Unlisted Enterprise | 0 | 0 | |

| Industry Classifications | Machinery Manufacturing | 143 | 45.11 |

| Information and Communications Technology | 92 | 29.02 | |

| Biomedicine and Instruments | 20 | 6.31 | |

| New Material | 34 | 10.73 | |

| Transportation and Logistics | 20 | 6.31 | |

| Others | 8 | 2.52 | |

| Locations by Economic Circles | Bohai Rim Economic Circle | 60 | 18.93 |

| Midlands Economic Circle | 45 | 14.20 | |

| Yangtze River Delta Economic Circle | 116 | 36.60 | |

| Pearl River Delta Economic Circle | 78 | 24.60 | |

| Southwest Economic Circle | 13 | 4.10 | |

| Others | 5 | 1.58 | |

| Applied Technologies | Internet of Things | 214 | 25.91 |

| Artificial Intelligence | 152 | 18.40 | |

| 3D Printing | 50 | 6.05 | |

| Big Data | 310 | 37.53 | |

| Robotics | 100 | 12.10 | |

| Post-listing Operation Period | 1~5 years | 32 | 10.07 |

| 5~10 years | 217 | 68.50 | |

| over 10 years | 68 | 21.43 |

| Variables | Observed Variables | Factor Loading | Cronbach’s Alpha | rho_A (ρA) |

|---|---|---|---|---|

| Economic Development | Eco1 | 0.90 | 0.969 | 0.971 |

| Eco2 | 0.96 | |||

| Government’s Support Policy | Gov1 | 0.78 | 0.877 | 0.931 |

| Gov2 | 0.97 | |||

| Regional Innovation Capability | Tech1 | 0.96 | 0.858 | 0.930 |

| Tech2 | 0.71 | |||

| Internal R&D Investment | Rnd1 | 0.84 | 0.801 | 0.814 |

| Rnd2 | 0.76 | |||

| Rnd3 | 0.78 | |||

| Enterprise’s Liquidity | Liqui1 | 0.95 | 0.850 | 0.894 |

| Liqui2 | 0.82 | |||

| Financial Performance | Perf1 | 0.71 | 0.820 | 0.946 |

| Perf2 | 0.80 | |||

| Perf3 | 0.81 |

| Latent Variables | Items | Factor Loading | Std.Err | z-Value | SMC | Std.all | p-Value | CR | AVE |

|---|---|---|---|---|---|---|---|---|---|

| Economic Development | Eco1 | 1.000 | - | - | 0.850 | 0.922 | - | 0.975 | 0.950 |

| Eco2 | 1.165 | 0.040 | 29.139 | 0.787 | 0.870 | 0.000 | |||

| Government’s Support Policy | Gov1 | 1.000 | - | - | 0.692 | 0.701 | - | 0.941 | 0.895 |

| Gov2 | 1.708 | 0.267 | 13.407 | 0.769 | 0.812 | 0.000 | |||

| Regional Innovation Capability | Tech1 | 1.000 | - | - | 0.627 | 0.726 | - | 0.956 | 0.841 |

| Tech2 | 1.045 | 0.195 | 26.521 | 0.725 | 0.869 | 0.000 | |||

| Internal R&D Investment | Rnd1 | 1.000 | - | - | 0.714 | 0.905 | - | 0.827 | 0.674 |

| Rnd2 | 0.885 | 0.070 | 7.624 | 0.619 | 0.746 | 0.000 | |||

| Rnd3 | 0.914 | 0.057 | 6.308 | 0.703 | 0.724 | 0.000 | |||

| Enterprise’s Liquidity | Liqui1 | 1.000 | - | - | 0.803 | 0.896 | - | 0.873 | 0.675 |

| Liqui2 | 0.806 | 0.095 | 10.824 | 0.711 | 0.760 | 0.000 | |||

| Financial Performance | Perf1 | 1.000 | - | - | 0.695 | 0.761 | - | 0.898 | 0.723 |

| Perf2 | 0.762 | 0.058 | 11.858 | 0.701 | 0.713 | 0.000 | |||

| Perf3 | 0.946 | 0.079 | 29.949 | 0.837 | 0.874 | 0.000 |

| Goodness of Fit Index | Structural Model | Confirmation Criteria | ||

|---|---|---|---|---|

| Absolute Fit Measures | Overall Fitness of the Model | x2/df | 1.893 | 1.0 ≤ x2/df ≤ 2.0~3.0 |

| RMSEA | 0.067 | ≤0.05~0.08 | ||

| RMR | 0.045 | ≤0.05~0.08 | ||

| Explanatory Power of the Model | GFI | 0.914 | ≥0.90 | |

| AGFI | 0.867 | ≥0.80~0.90 | ||

| Incremental Fit Measures | NFI | 0.908 | ≥0.90 | |

| CFI | 0.939 | ≥0.90 | ||

| IFI | 0.940 | ≥0.90 | ||

| Hypotheses | Est. Std | S.E. | z-Value | p-Value | Results | ||

|---|---|---|---|---|---|---|---|

| H1-1 | Economic Development → Internal R&D Investment | 0.026 | 0.075 | 0.342 | 0.732 | Rejected | |

| H1 | H1-2 | Government’s Support Policy → Internal R&D Investment | 0.375 | 0.061 | 4.641 | 0.009 | Accepted |

| H1-3 | Regional Innovation Capability → Internal R&D Investment | 0.186 | 0.064 | 2.509 | 0.012 | Accepted | |

| H4 | Internal R&D Investment → Enterprise’s Liquidity | 0.559 | 0.077 | 10.846 | 0.000 | Accepted | |

| H5 | Internal R&D Investment → Financial Performance | −0.047 | 0.084 | −0.840 | 0.625 | Rejected | |

| H6 | Enterprise’s Liquidity → Financial Performance | 0.789 | 0.090 | 18.416 | 0.000 | Accepted | |

| Impact Path | Mediating Effect | Path Coef. | Std. Err | t-Value |

|---|---|---|---|---|

| 1 | ECO → RND → LIQUI | 0.010 | 0.020 | 0.340 |

| 2 | GOV → RND → LIQUI | 0.170 | 0.020 | 2.680 ** |

| 3 | TECH → RND → LIQUI | 0.150 | 0.030 | 2.230 * |

| 4 | ECO → RND → PERF | 0.000 | 0.010 | 0.340 |

| 5 | GOV → RND → PERF | 0.030 | 0.010 | 2.010 * |

| 6 | TECH → RND→ PERF | 0.040 | 0.020 | 1.920 |

| 7 | RND → LIQUI → PERF | 0.280 | 0.060 | 3.910 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, G.; Lee, Y. Determinants of Financial Performance in China’s Intelligent Manufacturing Industry: Innovation and Liquidity. Int. J. Financial Stud. 2021, 9, 15. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs9010015

Zhang G, Lee Y. Determinants of Financial Performance in China’s Intelligent Manufacturing Industry: Innovation and Liquidity. International Journal of Financial Studies. 2021; 9(1):15. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs9010015

Chicago/Turabian StyleZhang, Guanghong, and Yune Lee. 2021. "Determinants of Financial Performance in China’s Intelligent Manufacturing Industry: Innovation and Liquidity" International Journal of Financial Studies 9, no. 1: 15. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs9010015