Financing the Water and Sanitation Sectors: A Hybrid Literature Review

Abstract

:1. Introduction

- Ameyan and Chan [16], focused on water supply PPP (public-private partnership) projects and aimed to find influencing factors capable of skewing private sector decision to participate and invest in water supply projects, through an explorative research approach: a literature review of success factors, a survey with a group of PPP experts, and a multicriteria analysis of the collected data. Ultimately, this study identified, among other factors, the need to have an enabling policy and legal frameworks, profitable water projects, the public acceptance/support of private sector involvement in water services, and strong and competent public water authorities.

- Dithebe et al. [17] analyzed the perceived occurrence of challenges delaying the delivery of water infrastructure assets in South Africa, which included a literature review focused on existing financing models. It identified a growing investment deficit for infrastructure development in Africa and stated that the application of innovative financing (IF) solutions (such as PPPs, loan guarantees, municipal bonds, low-interest loans, and credit options available to all spheres of governmental projects) would result in positive outcomes such as: “efficiency of financial flows, reduction of delivery time and costs, and the establishment of a direct link between financial flows and measurable performance”. In conclusion, this paper’s literature review identified the challenges facing infrastructure development in developing countries: “high transactions costs, financial sector impediments, lack of projects development capacity, lack of credit history and cost recovery constraints”.

- What has been the evolution and current research trend of studies on WSS financing?

- What are the main themes studied in the past and insights offered in the literature regarding WSS financing?

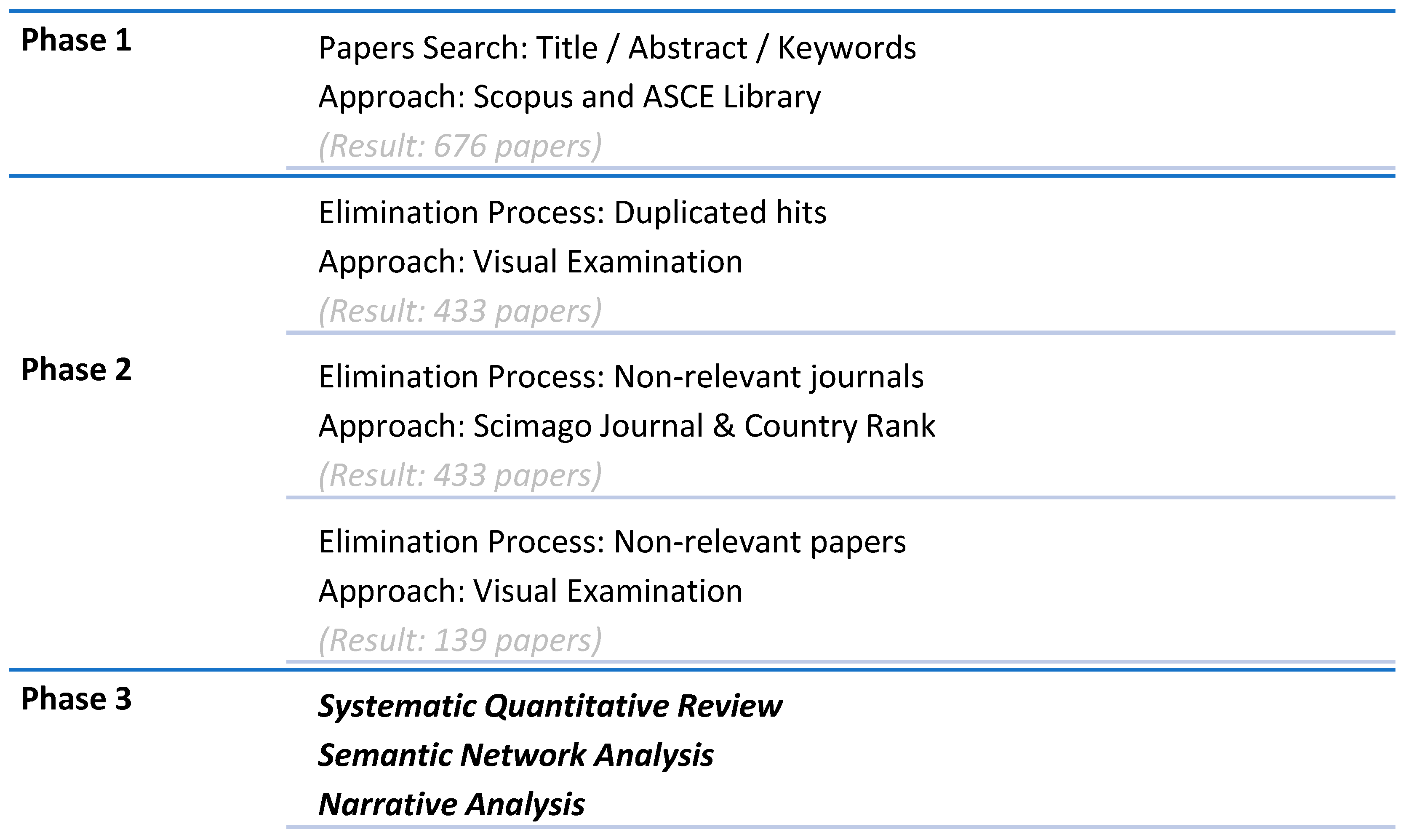

2. Materials and Methods

3. Results

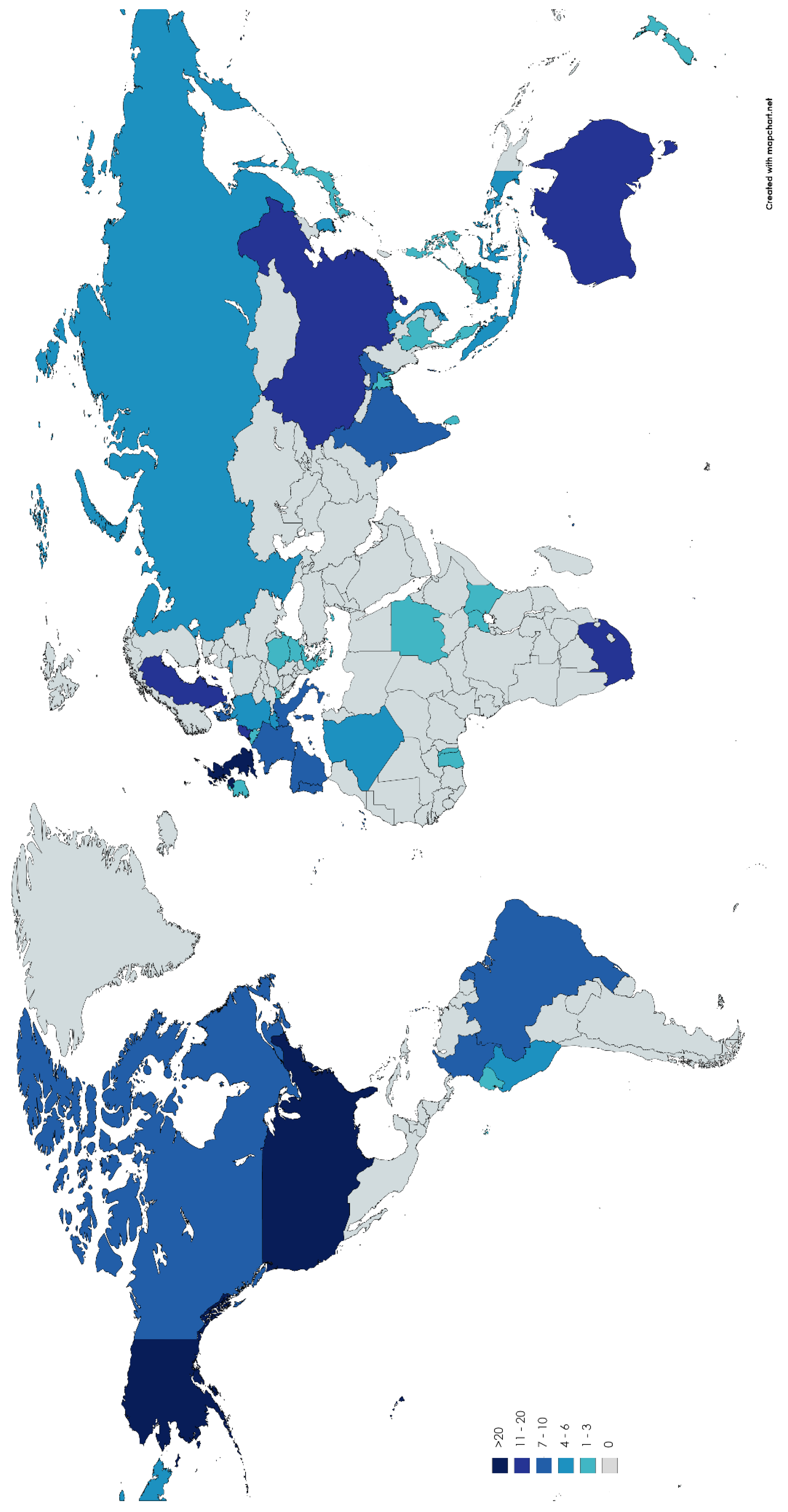

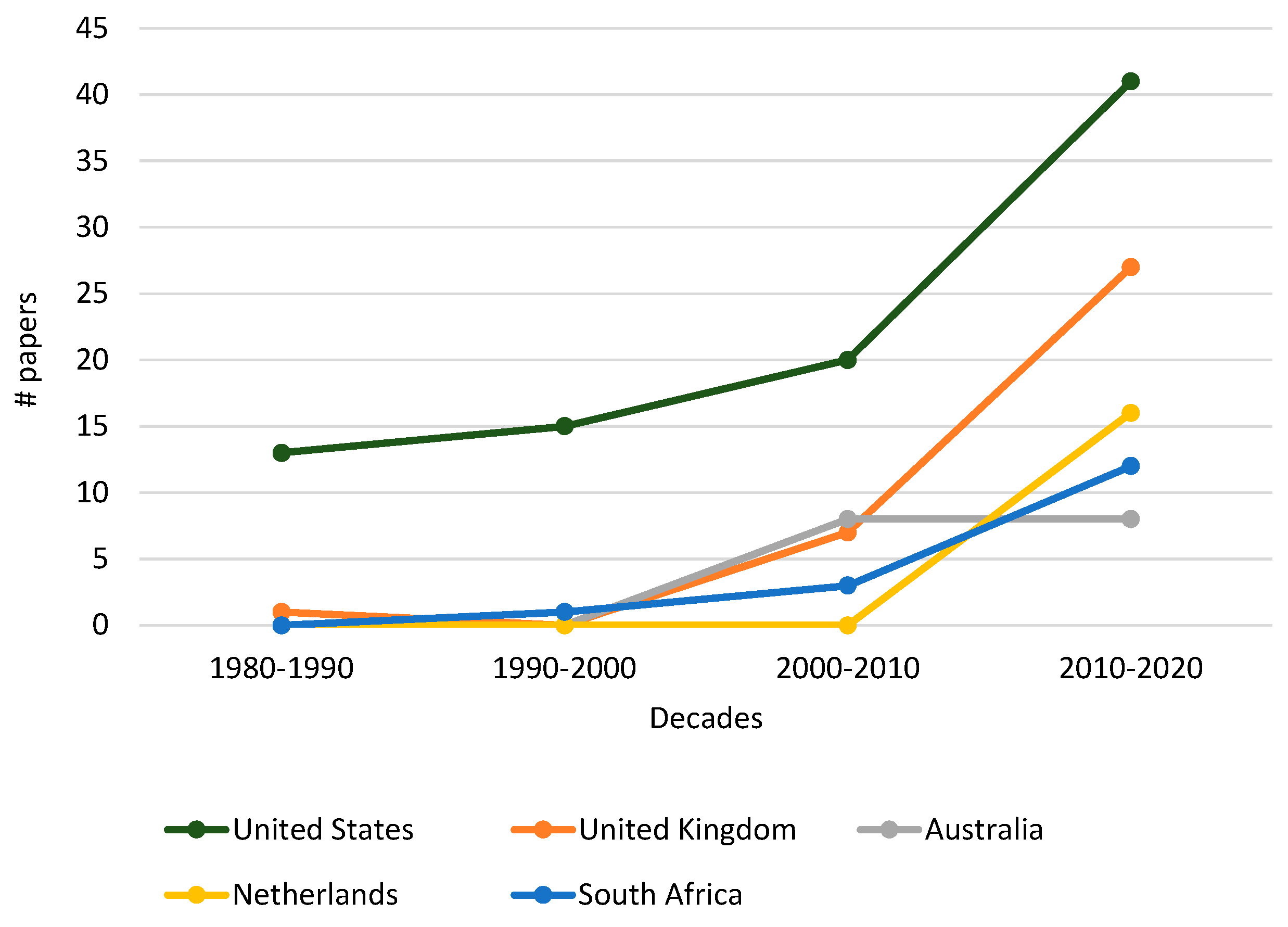

3.1. Systematic Quantitative Review

3.2. Semantic Analysis

4. Discussion

4.1. Sustainable Development

4.2. Water Management and Public Finance

4.3. Project Financing

4.4. Public Policy

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Search Number | Scopus—Search Codes |

|---|---|

| 1 | TITLE-ABS-KEY (“private financ*” AND “wastewater”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 2 | TITLE-ABS-KEY (“private financ*” AND “water”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 3 | TITLE-ABS-KEY (“private financ*” AND “sanitation”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 4 | TITLE-ABS-KEY (“financ* instruments” AND “wastewater”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 5 | TITLE-ABS-KEY (“financ* instruments” AND “water”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 6 | TITLE-ABS-KEY (“financ* instruments” AND “sanitation”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 7 | TITLE-ABS-KEY (“project financ*” AND “wastewater”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 8 | TITLE-ABS-KEY (“project financ*” AND “water”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 9 | TITLE-ABS-KEY (“project financ*” AND “sanitation”) AND (LIMIT-TO (SRCTYPE, “j”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ENGI”) OR LIMIT-TO (SUBJAREA, “ENVI”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”) OR LIMIT-TO (SUBJAREA, “ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 10 | TITLE-ABS-KEY (“public financ*” AND “wastewater” AND “infrastructure”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 11 | TITLE-ABS-KEY (“public financ*” AND “water” AND “infrastructure”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 12 | TITLE-ABS-KEY (“public financ*” AND “sanitation” AND “infrastructure”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 13 | TITLE-ABS-KEY (“financ* tools” AND “wastewater”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 14 | TITLE-ABS-KEY (“financ* tools” AND “water”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 15 | TITLE-ABS-KEY (“financ* tools” AND “sanitation”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 16 | TITLE-ABS-KEY (“sustainable development goal” AND “6” AND “wastewater”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 17 | TITLE-ABS-KEY (“sustainable development goal” AND “6” AND “water”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

| 18 | TITLE-ABS-KEY (“sustainable development goal” AND “6” AND “sanitation”) AND (LIMIT-TO (SRCTYPE,”j”)) AND (LIMIT-TO (SUBJAREA,”BUSI”) OR LIMIT-TO (SUBJAREA,”ENGI”) OR LIMIT-TO (SUBJAREA,”ENVI”) OR LIMIT-TO (SUBJAREA,”SOCI”) OR LIMIT-TO (SUBJAREA,”DECI”) OR LIMIT-TO (SUBJAREA,”ECON”)) AND (LIMIT-TO (LANGUAGE, “English”) OR LIMIT-TO (LANGUAGE, “French”) OR LIMIT-TO (LANGUAGE, “Spanish”)) |

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

References

- UN. The Critical Role of Water in Achieving the Sustainable Development Goals: Synthesis of Knowledge and Recommendations for Effective Framing, Monitoring, and Capacity Development. 2015. Available online: https://sustainabledevelopment.un.org/content/documents/6185Role%20of%20Water%20in%20SD%20Draft%20Version%20February%202015.pdf (accessed on 15 August 2020).

- UN. Report of the Secretary-General on SDG Progress 2019; Special Ed.; United Nations: New York, NY, USA, 2019. [Google Scholar]

- OECD. Financing Water, Investing in Sustainable Growth; Policy Perspectives. OECD Environment Policy Paper No. 11; OECD: Paris, France, 2018; ISSN 2309-7841. [Google Scholar]

- OECD. Making Blended Finance Work for Water and Sanitation: Unlocking Commercial Finance for SD G6; OECD Studies on Water; OECD: Paris, France, 2019. [Google Scholar] [CrossRef]

- OECD. Benchmark Definition of Foreign Direct Investment, 4th ed.; OECD: Paris, France, 2008; ISBN 978-92-64-04573-6. [Google Scholar]

- OECD. Innovative Financing Mechanisms for the Water Sector; OECD: Paris, France, 2010. [Google Scholar] [CrossRef]

- Varela, L. Desafios ao Direito Humano à Água e à Sustentabilidade dos Serviços em Santa Cruz, Cabo Verde; Ambiente & Sociedade: São Paulo, Brazil, 2016; Volume 19. [Google Scholar]

- OECD. DAC Methodologies for Measuring the Amounts Mobilised from the Private Sector by Official Development Finance Interventions; Draft Version; OECD: Paris, France, May 2020. [Google Scholar]

- OECD. Infrastructure Financing Instruments and Incentives; OECD: Paris, France, 2015. [Google Scholar]

- Winpenny, J. Financing Water for All. Report of the World Panel on Financing Water Infrastructure. In Proceedings of the 3rd World Water Forum, Kyoto, Japan, 16–23 March 2003; ISBN 92-95017-01-3. [Google Scholar]

- Rees, J.A.; Winpenny, J.; Wall, A.W. Water Financing and Governance; TEC Background Papers, No. 12; Global Water Partnership/Swedish International Development Agency: Stockholm, Sweden, 2008; ISBN 978-91-58321-70-4. [Google Scholar]

- Badu, E.; Edwards, D.J.; Owusumanu, D.; Brown, D. Barriers to the implementation of innovative financing (IF) of infrastructure. J. Financial Manag. Prop. Constr. 2012, 17, 253–273. [Google Scholar] [CrossRef]

- Kong, D.; Tiong, R.L.; Cheah, C.Y.; Permana, A.; Ehrlich, M. Assessment of Credit Risk in Project Finance. J. Constr. Eng. Manag. 2008, 134, 876–884. [Google Scholar] [CrossRef]

- Ehlers, T. Understanding the Challenges for Infrastructure Finance; BIS Working Papers No 454; Bank for International Settlements: Basel, Switzerland, 2014; ISSN 1682-7678. [Google Scholar]

- McGinnis, S.M.; McKeon, T.; Desai, R.; Ejelonu, A.; Laskowski, S.; Murphy, H.M. A Systematic Review: Costing and Financing of Water, Sanitation, and Hygiene (WASH) in Schools. Int. J. Environ. Res. Public Health 2017, 14, 442. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ameyaw, E.E.; Chan, A.P.; Owusu-Manu, D.-G. A survey of critical success factors for attracting private sector participation in water supply projects in developing countries. J. Facil. Manag. 2017, 15, 35–61. [Google Scholar] [CrossRef]

- Dithebe, K.; Aigbavboa, C.; Thwala, D.; Oke, A.E. Analysis on the perceived occurrence of challenges delaying the delivery of water infrastructure assets in South Africa. J. Eng. Des. Technol. 2019, 17, 554–571. [Google Scholar] [CrossRef]

- Global Water Intelligence. Global Water Market 2017: Volume 1; Global Intelligence: Austin, TX, USA, 2016. [Google Scholar]

- Dubey, P. Global Water Market to Reach $915 Billion by 2023 as Oil and Commodity Prices Recover, New GWI Forecasts Reveal. Informed Infrastructure. Available online: https://informedinfrastructure.com/40886/global-water-market-to-reach-915-billion-by-2023-as-oil-and-commodity-prices-recover-new-gwi-forecasts-reveal/ (accessed on 6 September 2020).

- Jin, X.; Wang, Y. Chinese Outbound Tourism Research. J. Travel Res. 2015, 55, 440–453. [Google Scholar] [CrossRef] [Green Version]

- Mok, K.Y.; Shen, G.Q.; Yang, J. Stakeholder management studies in mega construction projects: A review and future directions. Int. J. Proj. Manag. 2015, 33, 446–457. [Google Scholar] [CrossRef]

- Yu, Y.; Chan, A.P.; Chen, C.; Darko, A. Critical Risk Factors of Transnational Public–Private Partnership Projects: Literature Review. J. Infrastruct. Syst. 2018, 24, 04017042. [Google Scholar] [CrossRef]

- Tober, M. PubMed, ScienceDirect, Scopus or Google Scholar—Which is the best search engine for an effective literature research in laser medicine? Med. Laser Appl. 2011, 26, 139–144. [Google Scholar] [CrossRef]

- Lupu, C.; Oliveira-Brochado, A.; Stoleriu, O.M. Visitor experiences at UNESCO monasteries in Northeast Romania. J. Heritage Tour. 2018, 14, 150–165. [Google Scholar] [CrossRef]

- Pinto, F.S.; Marques, R.C. Desalination projects economic feasibility: A standardization of cost determinants. Renew. Sustain. Energy Rev. 2017, 78, 904–915. [Google Scholar] [CrossRef]

- OECD. Annex 8: Collective Investment Institutions. OECD Benchmark Definition of Foreign Direct Investment 2008, 4th ed.; OECD Publishing: Paris, France, 2009. [Google Scholar] [CrossRef]

- Marques, R.C.; Miranda, J. Sustainable tariffs for water and wastewater services. Util. Policy 2020, 64, 101054. [Google Scholar] [CrossRef]

- Trémolet, S.; Rama, M. Tracking National Financial Flows into Sanitation, Hygiene and Drinking-Water: Working Paper; Working Paper; World Health Organization: Geneva, Switzerland, 2012. [Google Scholar]

- Pinto, F.; Marques, R. Tariff Suitability Framework for Water Supply Services: Establishing a Regulatory Tool Linking Multiple Stakeholders’ Objectives; Water Resources Management; Springer: Berlin/Heidelberg, Germany, 2016; Volume 30, pp. 2037–2053. ISSN 0920-4741. [Google Scholar]

- Machete, I.F.; Marques, R.C.; Pires, J.S.; Fernandes, E.; Brito, J. Elaboração de Tarifas de Saneamento Sustentáveis—Caso de Estudo de Cabo Verde. In Proceedings of the Anais—XI Congresso Brasileiro de Regulação e 5ª Expo ABAR, Maceió, Brazil, 14–16 August 2019. [Google Scholar]

- Zawahri, N.A.; Sowers, J.L.; Weinthal, E.S. The Politics of Assessment: Water and Sanitation MDGs in the Middle East. Dev. Chang. 2011, 42, 1153–1178. [Google Scholar] [CrossRef] [PubMed]

- Harlin, J.; Kjellén, M. Water and Development: From MDGs towards SDGs. Chapter 1, 8–12. In Water for Development—Charting a Water Wise Path; Report No 35; Jägerskog, A., Clausen, T.J., Holmgren, T., Lexén, K., Eds.; SIWI: Stockholm, Sweden, 2015. [Google Scholar]

- GWP. National Stakeholder Consultations on Water: Supporting the Post-2015 Development Agenda; Global Water Partner-Ship (GWP) with the Support of the Swiss Agency for Development and Cooperation, the EUWI (Africa Working Group) and UNDP: Stockholm, Sweden, 2013. [Google Scholar]

- Satterthwaite, D. Missing the Millennium Development Goal targets for water and sanitation in urban areas. Environ. Urban. 2016, 28, 99–118. [Google Scholar] [CrossRef] [Green Version]

- Kolker, J.; Kingdom, B.; Trémolet, S. Financing Options for the 2030 Water Agenda. In Water Global Practice, Knowledge Brief; International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Sadoff, C.W.; Hall, J.W.; Grey, D.; Aerts, J.C.J.H.; Ait-Kadi, M.; Brown, C.; Cox, A.; Dadson, S.; Garrick, D.; Kelman, J.; et al. Securing Water, Sustaining Growth: Report of the GWP/OECD Task Force on Water Security and Sustainable Growth; University of Oxford: Oxford, UK, 2015; p. 180. [Google Scholar]

- Alaerts, G. Financing for Water—Water for Financing: A Global Review of Policy and Practice. Sustainability 2019, 11, 821. [Google Scholar] [CrossRef] [Green Version]

- Hutton, G.; Varughese, M. The Costs of Meeting the 2030 Sustainable Development Goal Targets on Drinking Water, Sanita-tion, and Hygiene; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Humphreys, E.; Van Der Kerk, A.; Fonseca, C. Public finance for water infrastructure development and its practical challenges for small towns. Hydrol. Res. 2018, 20, 100–111. [Google Scholar] [CrossRef]

- Schiffler, M. Perspectives and challenges for desalination in the 21st century. Desalination 2004, 165, 1–9. [Google Scholar] [CrossRef]

- Wolfs, M.; Woodroffe, S. Structuring and financing international BOO/BOT desalination projects. Desalination 2002, 142, 101–106. [Google Scholar] [CrossRef]

- Garrick, D.E.; Iseman, T.; Gilson, G.; Brozovic, N.; O’Donnell, E.; Matthews, N.; Miralles-Wilhelm, F.; Wight, C.; Young, W. Scalable solutions to freshwater scarcity: Advancing theories of change to incentivise sustainable water use. Water Secur. 2020, 9, 100055. [Google Scholar] [CrossRef]

- González-Ruiz, J.D.; Arboleda, A.; Botero, S.; Rojo, J. Investment valuation model for sustainable infrastructure systems. Eng. Constr. Arch. Manag. 2019, 26, 850–884. [Google Scholar] [CrossRef]

- Rillaerts, F. Concessions in the water sector. Desalination 1999, 124, 13–17. [Google Scholar] [CrossRef]

- Grimsey, D.; Lewis, M.K. Evaluating the risks of public private partnerships for infrastructure projects. Int. J. Proj. Manag. 2002, 20, 107–118. [Google Scholar] [CrossRef]

- Foster, V.; Briceño-Garmendia, C. Africa Infrastructure Country Diagnostic; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Hall, D.; Lobina, E. Financing Water and Sanitation: Public Realities. 2012. Available online: http://www.world-psi.org/sites/default/files/documents/research/psiru_financing_water_sanitation.pdf (accessed on 17 October 2020).

- Mullin, M.; Daley, D.M. Multilevel Instruments for Infrastructure Investment: Evaluating State Revolving Funds for Water. Policy Stud. J. 2017, 46, 629–650. [Google Scholar] [CrossRef]

- Rondinelli, D.A. Dynamics of Growth of Secondary Cities in Developing Countries. Geogr. Rev. 1983, 73, 42. [Google Scholar] [CrossRef]

- Adank, M.; Tuffuor, B. Management Models for the Provision of Small Town and Peri-Urban Water Services in Ghana; TPP Synthesis Report; WASH Resource Center (RCN): Accra, Ghana, 2013. [Google Scholar]

- Tutusaus, M.; Schwartz, K.; Tutusasus, M. Water services in small towns in developing countries: At the tail end of development. Hydrol. Res. 2018, 20, 1–11. [Google Scholar] [CrossRef]

- Spencer, J.H.; Guzinsky, C. Periurbanization, Public Finance, and Local Governance of the Environment: Lessons from Small-Scale Water Suppliers in Gresik, Indonesia. Environ. Plan. A Econ. Space 2010, 42, 2131–2146. [Google Scholar] [CrossRef]

- Annamalai, T.R.; Jain, N. Project finance and investments in risky environments: Evidence from the infrastructure sector. J. Financial Manag. Prop. Constr. 2013, 18, 251–267. [Google Scholar] [CrossRef]

- Hoggan, D.H.; Kimball, K.R.; Bagley, J.M. State financing of water projects: The UTAH experience. JAWRA J. Am. Water Resour. Assoc. 1981, 17, 1–9. [Google Scholar] [CrossRef]

- Ismail, R. Benefits of the expanding privatisation of Malaysian water supply systems. Water Supply 1999, 17, 79–85. [Google Scholar]

- Ngowi, A.B.; Pienaar, E.; Akindele, O.; Iwisi, D. Globalisation of the construction industry: A review of infrastructure financing. J. Financial Manag. Prop. Constr. 2006, 11, 45–58. [Google Scholar] [CrossRef]

- Shan, S. Status Quo and Analysis of Risk Management Based on the PPP Project of Coastal Construction Enterprises. J. Coast. Res. 2019, 98, 263–266. [Google Scholar] [CrossRef]

- Marques, R.C.; Berg, S. Risks, Contracts, and Private-Sector Participation in Infrastructure. J. Constr. Eng. Manag. 2011, 137, 925–932. [Google Scholar] [CrossRef]

- Larson, W.M.; Freedman, P.L.; Passinsky, V.; Grubb, E.; Adriaens, P. Mitigating corporate water risk: Financial mar-ket tools and supply management strategies. Water Altern. 2012, 5, 582–602. [Google Scholar] [CrossRef] [Green Version]

- Shen, L.; Li, H.; Li, Q.M. Alternative Concession Model for Build Operate Transfer Contract Projects. J. Constr. Eng. Manag. 2002, 128, 326–330. [Google Scholar] [CrossRef]

- Luís-Manso, P.; Finger, M. Risk sharing and capacity investment in the urban water sector in Europe. Environ. Econ. Invest. Assess. 2006, 98, 177–186. [Google Scholar] [CrossRef]

- Kwakkel, J.; Walker, W.; Haasnoot, M. Coping with the Wickedness of Public Policy Problems: Approaches for Decision Making under Deep Uncertainty. J. Water Resour. Plan. Manag. 2016, 142, 01816001. [Google Scholar] [CrossRef] [Green Version]

- Knight, F.H. Risk, Uncertainty and Profit, Hart; Schaffner and Marx: New York, NY, USA, 1993. [Google Scholar]

- Megginson, W.L. Introduction to the special issue on project finance. Rev. Financial Econ. 2010, 19, 47–48. [Google Scholar] [CrossRef]

- Kayser, D. Recent Research in Project Finance—A Commented Bibliography. Procedia Comput. Sci. 2013, 17, 729–736. [Google Scholar] [CrossRef] [Green Version]

- Merk, O.; Saussier, S.; Staropoli, C.; Slack, E.; Kim, J. Financing Green Urban Infrastructure; Working Papers; OECD Regional Development, OECD Publishing Service: Paris, France, 2012; Volume 10. [Google Scholar]

- Mostafavi, A.; Abraham, D.M.; Sinfield, J. Innovation in Infrastructure Project Finance: A Typology for Conceptualization. Int. J. Innov. Sci. 2014, 6, 127–144. [Google Scholar] [CrossRef]

- Wang, Y.; Zhao, Z.J. Performance of Public–Private Partnerships and the Influence of Contractual Arrangements. Public Perform. Manag. Rev. 2017, 41, 177–200. [Google Scholar] [CrossRef]

- Muller, M. Lessons from transforming a South African special-purpose vehicle into a project implementation agency. Proc. Inst. Civ. Eng. Manag. Procure. Law 2018, 171, 189–196. [Google Scholar] [CrossRef]

- Porciuncula, A.D. Creative financing solution for water supply and sanitation in the Philippines. Ocean Coast. Manag. 2009, 52, 374–377. [Google Scholar] [CrossRef]

- Trindade, B.; Reed, P.; Characklis, G. Deeply uncertain pathways: Integrated multi-city regional water supply infrastructure investment and portfolio management. Adv. Water Resour. 2019, 134, 103442. [Google Scholar] [CrossRef]

- Acheampong, E.N.; Swilling, M.; Urama, K. Sustainable Urban Water System Transitions Through Management Reforms in Ghana. Water Resour. Manag. 2016, 30, 1835–1849. [Google Scholar] [CrossRef]

- Harvey, B.; Mercusot, M. Cooperation between Mediterranean countries of Europe and the southern rim of the Mediterranean. Desalination 2007, 203, 20–26. [Google Scholar] [CrossRef]

- Mekonnen, M.M.; Hoekstra, A.Y. Four billion people facing severe water scarcity. Sci. Adv. 2016, 2, e1500323. [Google Scholar] [CrossRef] [Green Version]

- Alifonso, X.P.; García, S.S. Water infrastructure financing in spain: Potential for securitization. Fuzzy Econ. Rev. 2015, 20, 31–43. [Google Scholar] [CrossRef]

- Liu, J.; Yang, H.; Gosling, S.N.; Kummu, M.; Flörke, M.; Pfister, S.; Hanasaki, N.; Wada, Y.; Zhang, X.; Zheng, C.; et al. Water scarcity assessments in the past, present, and future. Earth’s Futur. 2017, 5, 545–559. [Google Scholar] [CrossRef]

- Jamison, M.A.; Holt, L.; Berg, S.V. Measuring and Mitigating Regulatory Risk in Private Infrastructure Investment. Electr. J. 2005, 18, 36–45. [Google Scholar] [CrossRef]

| Search Number | Keywords | Results | |||

|---|---|---|---|---|---|

| 1 | Private Financ * | Wastewater | 5 | ||

| 2 | Water | 32 | |||

| 3 | Sanitation | 5 | |||

| 4 | Financ* Instruments | Wastewater | 2 | ||

| 5 | Water | 41 | |||

| 6 | Sanitation | 0 | |||

| 7 | Project Financ * | Wastewater | 15 | ||

| 8 | Water | 85 | |||

| 9 | Sanitation | 7 | |||

| 10 | Public Financ * | Infrastructure | Wastewater | 3 | |

| 11 | Water | 24 | |||

| 12 | Sanitation | 8 | |||

| 13 | Financ * Tools | Wastewater | 2 | ||

| 14 | Water | 17 | |||

| 15 | Sanitation | 3 | |||

| 16 | Sustainable Development Goal | 6 | Wastewater | 26 | |

| 17 | Water | 209 | |||

| 18 | Sanitation | 119 | |||

| Total | 603 | ||||

| Journals | Papers |

|---|---|

| Desalination | 11 |

| Science of the Total Environment | 6 |

| Journal of Water Resources Planning and Management | 5 |

| Water Policy | 5 |

| International Journal of Water Resources Development | 4 |

| Journal of the American Water Resources Association | 4 |

| World Development | 4 |

| Journal of Construction Engineering and Management | 3 |

| Sustainability (Switzerland) | 3 |

| Water (Switzerland) | 3 |

| Development Policy Review | 2 |

| Environment and Planning A | 2 |

| Environment and Planning C: Politics and Space | 2 |

| International Journal of Project Management | 2 |

| Journal of Environmental Engineering | 2 |

| Journal of Financial Management of Property and Construction | 2 |

| Journal of Urban Planning and Development | 2 |

| Proceedings of Institution of Civil Engineers: Management, Procurement and Law | 2 |

| Proceedings of the Institution of Civil Engineers: Municipal Engineer | 2 |

| Water Alternatives | 2 |

| Water Bulletin | 2 |

| Water Resources Research | 2 |

| Water Supply | 2 |

| Others | 65 |

| Total Number of Papers | 139 |

| Authors | Studies |

|---|---|

| Briscoe, J. | 2 |

| Characklis, G.W. | 2 |

| Giné-Garriga, R. | 2 |

| Humphreys, E. | 2 |

| Jiménez, A. | 2 |

| Mehta, P. | 2 |

| Mourad, K.A. | 2 |

| Pérez-Foguet, A. | 2 |

| Qadir, M. | 2 |

| Reed, P.M. | 2 |

| Schwartz, K. | 2 |

| Tan, J. | 2 |

| Others | 331 |

| Author’s Affiliation | Country | Studies |

|---|---|---|

| Stockholm International Water Institute | Sweden | 11 |

| The World Bank | United States | 8 |

| Technical University of Denmark | Denmark | 7 |

| University of California | United States | 7 |

| McKenna Long and Aldridge LLP | United States | 6 |

| Cornell University | United States | 5 |

| Loughborough University | United Kingdom | 5 |

| Universidad Industrial de Santander | Colombia | 5 |

| University of Oxford | United Kingdom | 5 |

| UNSW-UWS Research Centre | Australia | 5 |

| Other Affiliations | N/A | 278 |

| Methodology | Papers |

|---|---|

| Qualitative | 44 |

| Quantitative | 29 |

| Mixed | 47 |

| N/A | 19 |

| Total Number of Papers | 139 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Machete, I.; Marques, R. Financing the Water and Sanitation Sectors: A Hybrid Literature Review. Infrastructures 2021, 6, 9. https://0-doi-org.brum.beds.ac.uk/10.3390/infrastructures6010009

Machete I, Marques R. Financing the Water and Sanitation Sectors: A Hybrid Literature Review. Infrastructures. 2021; 6(1):9. https://0-doi-org.brum.beds.ac.uk/10.3390/infrastructures6010009

Chicago/Turabian StyleMachete, Inês, and Rui Marques. 2021. "Financing the Water and Sanitation Sectors: A Hybrid Literature Review" Infrastructures 6, no. 1: 9. https://0-doi-org.brum.beds.ac.uk/10.3390/infrastructures6010009