Who Drives Green Innovation? A Game Theoretical Analysis of a Closed-Loop Supply Chain under Different Power Structures

Abstract

:1. Introduction

- Who should drive the green innovation strategy in a CLSC?

- Who should have market leadership in a CLSC?

- How does green innovation strategy and market leadership affect the equilibrium decisions and profits of the members of a CLSC?

2. Literature Review

2.1. Green Supply Chains

2.2. Recycling and Reusing Issues in Closed-Loop Supply Chains (CLSCs)

2.3. Power Structures

2.4. Research Gaps

3. Problem Description

3.1. Notations

3.2. Assumptions

4. Equilibrium Analyses on Stackelberg Games

4.1. Manufacturer-Driven Green Innovation

4.1.1. Model MM: Manufacturer-Led Stackelberg Game

4.1.2. Model MR: Retailer-Led Stackelberg Game

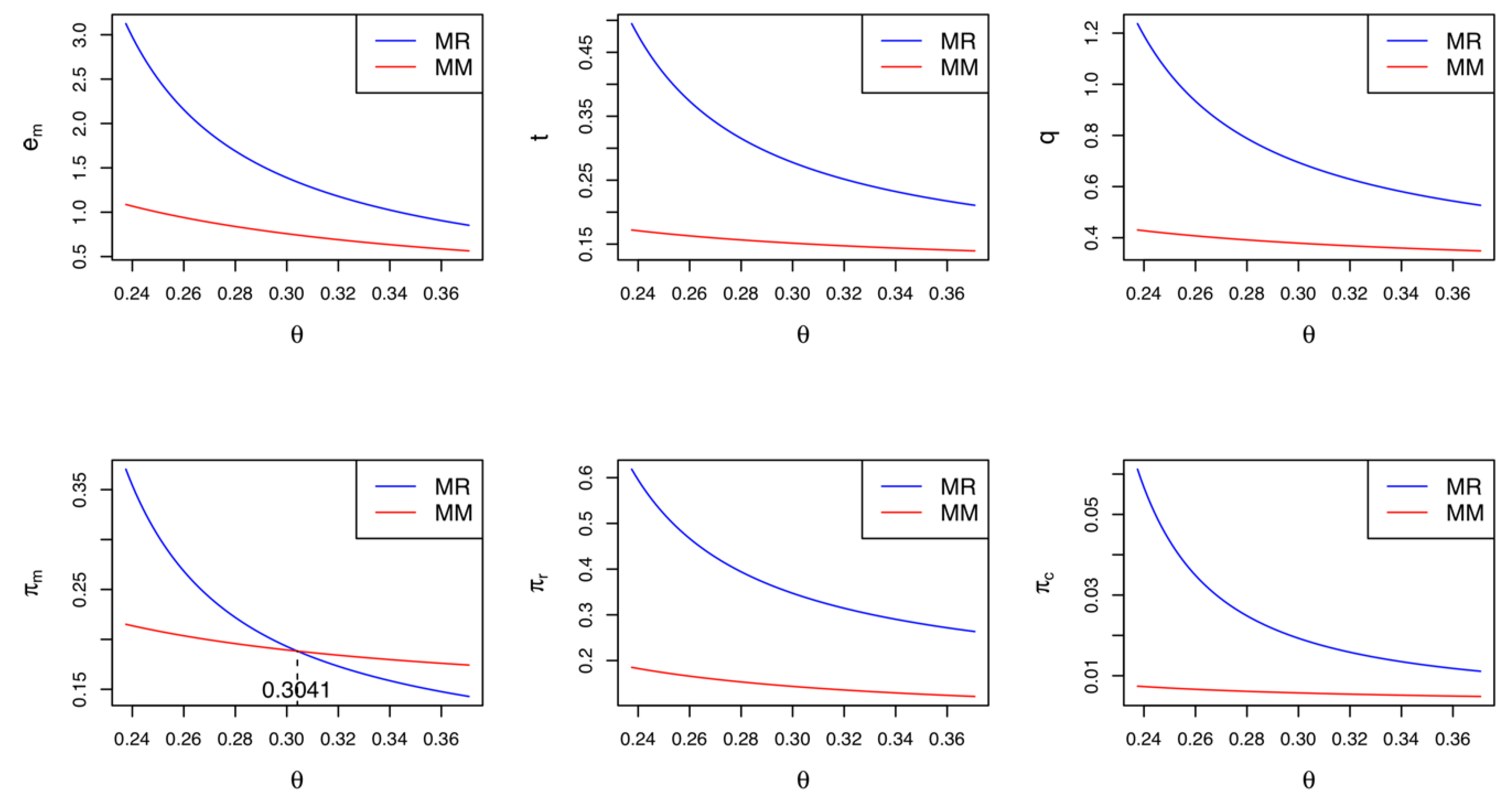

4.1.3. Model MM vs. Model MR

4.2. Retailer-Driven Green Innovation

4.2.1. Model RM: Manufacturer-Led Stackelberg Game

4.2.2. Model RR: Retailer-Led Stackelberg Game

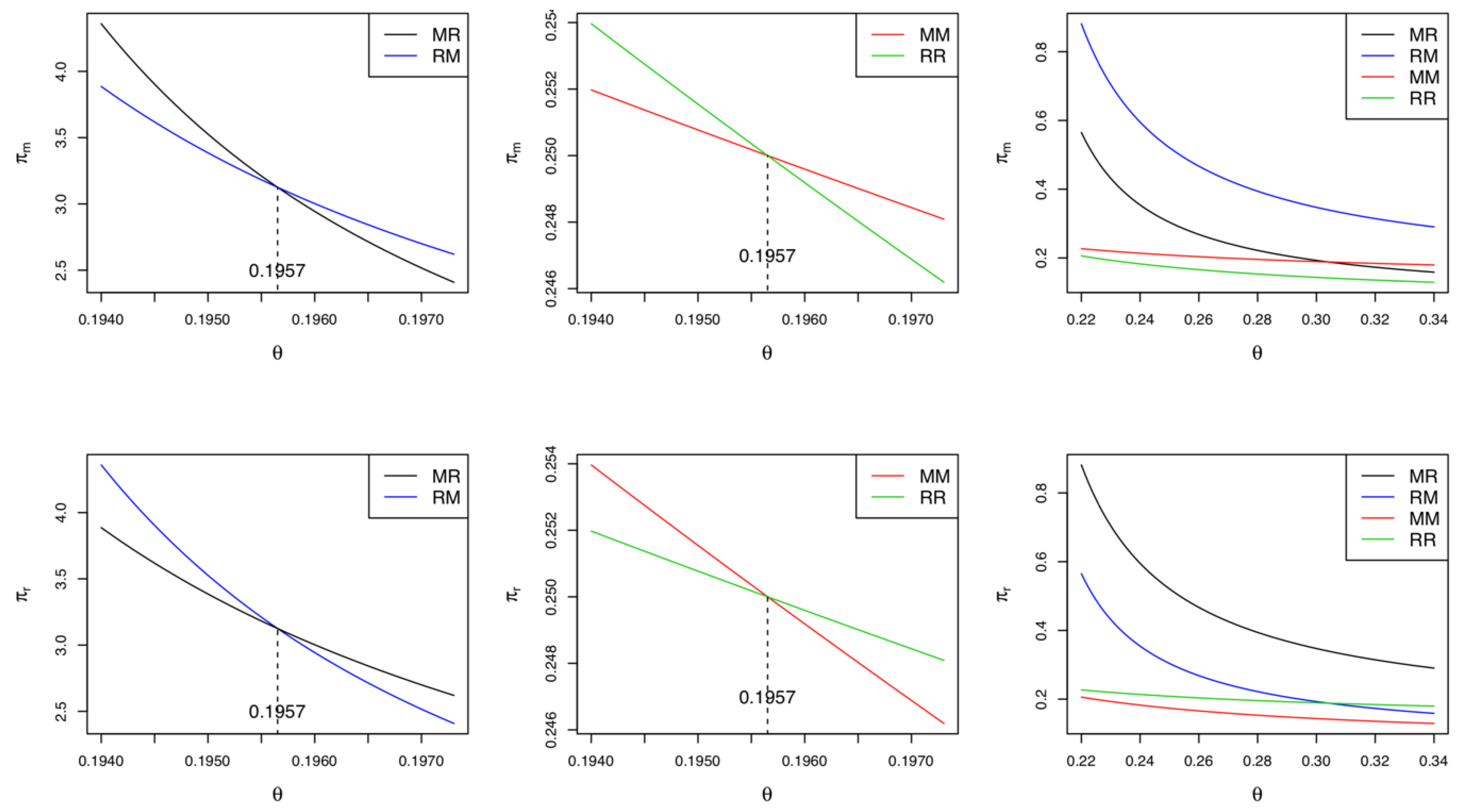

4.2.3. Model RM vs. Model RR

4.3. Both-Driven Green Innovation

4.3.1. Model BM: Manufacturer-Led Stackelberg Game

4.3.2. Model BR: Retailer-Led Stackelberg Game

4.3.3. Model BM vs. Model BR

5. Comparative Analysis

5.1. Comparison of Green Innovation Efforts, Collecting Rates, and Demands among Different Models

5.2. Comparison of Profits among Different Models Led by the Manufacturer

5.3. Comparison of Profits among Different Models Led by the Retailer

5.4. Comparison of Profits among Models MM, MR, RM, and RR

5.5. Comparison of Profits among All Six Models

5.6. Comparison of Supply Chain Profits among Different Models

6. Future Research Topics

7. Conclusions

- Under the MG strategy, where only the manufacturer drives green innovations, the retailer and the collector always prefer a retailer-led CLSC. Meanwhile, the manufacturer prefers a self-led CLSC (retailer-led CLSC) if the cost sensitivity of the green innovation efforts is high (low).

- Under the RG strategy, where only the retailer drives green innovations, the manufacturer and the collector always prefer a manufacturer-led CLSC. Meanwhile, the retailer prefers a self-led CLSC (manufacturer-led CLSC) if the cost sensitivity of the green innovation efforts is high (low).

- Under the BG strategy, where both the manufacturer and retailer are in charge of green innovations, the profits for the collector are identical in both a manufacturer-led and a retailer-led CLSC. If the cost sensitivity of the green innovation efforts is relatively low, the manufacturer (retailer) prefers a CLSC led by the retailer (manufacturer). Otherwise, they prefer self-led CLSCs.

- In the manufacturer-led CLSC, all supply chain members prefer the BG strategy the most and the MG strategy the least. Similarly, in the retailer-led CLSC, all supply chain members also prefer the BG strategy the most and the RG strategy the least.

- When only one member drives green innovations in the CLSC, the most and least profitable game model for each supply chain member will depend on the cost of the green innovation efforts.

- If the cost sensitivity of the green innovation efforts is relatively low (high), among the six different game models analyzed here, the manufacturer achieves the highest profit in Model BR (Model BM), where the retailer-led (manufacturer-led) CLSC uses the BG strategy. Similarly, if it is relatively low (high), the retailer achieves the highest profits in Model BM (Model BR). The collector’s most profitable games are Models BM and BR, where its profits are identical.

- Under the BG strategy, the overall green innovation efforts, the collecting rate of used products, and the market demand are all highest. Therefore, the BG strategy not only maximizes the profits of the supply chain but also encourages its members to focus on environmental protection issues, such as green innovations and recycling.

Funding

Conflicts of Interest

Appendix A

Appendix B

References

- Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 9 February 2020).

- Brundtland Report. Available online: https://www.britannica.com/topic/Brundtland-Report (accessed on 9 February 2020).

- Drake, D.F.; Spinler, S. Sustainable operations management: An enduring stream or a passing fancy. Manuf. Serv. Oper. Manag. 2013, 15, 689–700. [Google Scholar] [CrossRef]

- O’Rourke, D. The science of sustainable supply chains. Science 2014, 344, 1124–1127. [Google Scholar] [CrossRef] [Green Version]

- Tseng, M.-L.; Islam, M.S.; Karia, N.; Fauzi, F.A.; Afrin, S. A literature review on green supply chain management: Trends and future challenges. Resour. Conserv. Recycl. 2019, 141, 145–162. [Google Scholar] [CrossRef]

- Xu, M.; Cui, Y.; Hu, M.; Xu, X.; Zhang, Z.; Liang, S. Supply chain sustainability risk and assessment. J. Clean. Prod. 2019, 225, 857–867. [Google Scholar] [CrossRef]

- Taghikhah, F.; Voinov, A.; Shukla, N. Extending the supply chain to address sustainability. J. Clean. Prod. 2019, 229, 652–666. [Google Scholar] [CrossRef]

- He, J.; Lei, Y.; Fu, X. Do consumer’s green preference and the reference price effect improve green innovation? A theoretical model using the food supply chain as a case. Int. J. Environ. Res. Public Health 2019, 16, 5007. [Google Scholar] [CrossRef] [Green Version]

- Cherrafia, A.; Garza-Reyesb, J.A.; Kumarc, V.; Mishrad, M.; Ghobadiane, A.; Elfezazif, S. Lean, green practices and process innovation: A model for green supply chain performance. Int. J. Prod. Econ. 2018, 206, 79–92. [Google Scholar] [CrossRef]

- Cheng, C.J.; Yang, C.; Sheu, C. The link between eco-innovation and business performance: A Taiwanese Industry Context. J. Clean. Prod. 2014, 64, 81–90. [Google Scholar] [CrossRef] [Green Version]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Shrivastava, P. Environmental technologies and competitive advantage. Strateg. Manag. J. 1995, 16, 183–200. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Eskandarpour, M.; Dejax, P.; Miemczyk, J.; Péton, O. Sustainable supply chain network design: An optimization-oriented review. Omega 2015, 54, 11–32. [Google Scholar] [CrossRef]

- 3R Initiative. Available online: http://www.env.go.jp/recycle/3r/initiative/en/index.html (accessed on 9 February 2020).

- Advantages and Disadvantages of Recycling. Available online: https://www.conserve-energy-future.com/advantages-and-disadvantages-of-recycling.php (accessed on 9 February 2020).

- EL korchi, A.; Millet, D. Designing a sustainable reverse logistics channel: The 18 generic structures framework. J. Clean. Prod. 2011, 19, 588–597. [Google Scholar] [CrossRef]

- Yi, P.; Huang, M.; Guo, L.; Shi, T. Dual recycling channel decision in retailer oriented closed-loop supply chain for construction machinery remanufacturing. J. Clean. Prod. 2016, 137, 1393–1405. [Google Scholar] [CrossRef]

- Gong, Y.; Chen, M.; Zhuang, Y. Decision-making and performance analysis of closed-loop supply chain under different recycling modes and channel power structures. Sustainability 2019, 11, 6413. [Google Scholar] [CrossRef] [Green Version]

- Handfield, R.B.; Walton, S.V.; Seegers, L.K.; Melnyk, S.A. ‘Green’ value chain practices in the furniture industry. J. Oper. Manag. 1997, 15, 293–315. [Google Scholar] [CrossRef]

- Zhang, C.-T.; Liu, L.-P. Research on coordination mechanism in three-level green supply chain under non-cooperative game. Appl. Math. Model. 2013, 37, 3369–3379. [Google Scholar] [CrossRef]

- Zhang, C.-T.; Wang, H.-X.; Ren, M.-L. Research on pricing and coordination strategy of green supply chain under hybrid production mode. Comput. Ind. Eng. 2014, 72, 24–31. [Google Scholar] [CrossRef]

- Madani, S.R.; Rasti-Barzoki, M. Sustainable supply chain management with pricing, greening and governmental tariffs determining strategies: A game-theoretic approach. Comput. Ind. Eng. 2017, 105, 287–298. [Google Scholar] [CrossRef]

- Zhu, W.; He, Y. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Jamali, M.-B.; Rasti-Barzoki, M. A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J. Clean. Prod. 2018, 170, 1029–1043. [Google Scholar] [CrossRef]

- Rahmani, K.; Yavari, M. Pricing policies for a dual-channel green supply chain under demand disruptions. Comput. Ind. Eng. 2019, 127, 493–510. [Google Scholar] [CrossRef]

- Nyilasy, G.; Gangadharbatla, H.; Paladino, A. Perceived green washing: The interactive effects of green advertising and corporate environmental performance on consumer reactions. J. Bus. Ethics 2014, 125, 693–707. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Saha, S.; Nielsen, I.; Moon, I. Optimal retailer investments in green operations and preservation technology for deteriorating items. J. Clean. Prod. 2017, 140, 1514–1527. [Google Scholar] [CrossRef]

- Petljak, K.; Zulauf, K.; Štulec, I.; Seuring, S.; Wagner, R. Green supply chain management in food retailing: Survey-based evidence in Croatia. Supply Chain Manag. Int. J. 2018, 23, 1–15. [Google Scholar] [CrossRef]

- Song, H.; Gao, X. Green supply chain game model and analysis under revenue-sharing contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Tong, Y.; Li, Y. External intervention or internal coordination? Incentives to promote sustainable development through green supply chains. Sustainability 2018, 10, 2857. [Google Scholar] [CrossRef] [Green Version]

- Qin, J.; Zhao, Y.; Xia, L. Carbon emission reduction with capital constraint under greening financing and cost sharing contract. Int. J. Environ. Res. Public Health 2018, 15, 750. [Google Scholar] [CrossRef] [Green Version]

- Chen, P.C.; Chiu, M.C.; Ma, H.W. Measuring the reduction limit of repeated recycling: A case study of the paper flow system. J. Clean. Prod. 2016, 132, 98–107. [Google Scholar] [CrossRef]

- Savaskan, R.C.; van Wassenhove, L.N. Reverse channel design: The case of competing retailers. Manag. Sci. 2006, 52, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.J.; Sheu, J.-B. Environmental-regulation pricing strategies for green supply chain management. Transp. Res. Part E Logist. Transp. Rev. 2009, 45, 667–677. [Google Scholar] [CrossRef] [Green Version]

- Huang, M.; Song, M.; Lee, L.H.; Ching, W.K. Analysis for strategy of closed-loop supply chain with dual recycling channel. Int. J. Prod. Econ. 2013, 144, 510–520. [Google Scholar] [CrossRef]

- Modak, N.M.; Modak, N.; Panda, S.; Sana, S.S. Analyzing structure of two-echelon closed-loop supply chain for pricing, quality and recycling management. J. Clean. Prod. 2018, 171, 512–528. [Google Scholar] [CrossRef]

- Wang, N.; He, Q.; Jiang, B. Hybrid closed-loop supply chains with competition in recycling and product markets. Int. J. Prod. Econ. 2019, 217, 246–258. [Google Scholar] [CrossRef]

- Liu, Y.; Shi, Q.Q.; Xu, Q. Alliance decision of supply chain considering product greenness and recycling competition. Sustainability 2019, 11, 6900. [Google Scholar] [CrossRef] [Green Version]

- Panda, S.; Modak, N.M.; Cardenas-Barron, L.E. Coordinating a socially responsible closed-loop supply chain with product recycling. Int. J. Prod. Econ. 2017, 188, 11–21. [Google Scholar] [CrossRef]

- Shu, T.; Liu, Q.; Chen, S.; Wang, S.; Lai, K.K. Pricing decisions of CSR closed-loop supply chains with carbon emission constraints. Sustainability 2018, 10, 4430. [Google Scholar] [CrossRef] [Green Version]

- He, J.; Zhang, L.; Fu, X.; Tsai, F.-S. Fair but risky? Recycle pricing strategies in closed-loop supply chains. Int. J. Environ. Res. Public Health 2018, 15, 2870. [Google Scholar] [CrossRef] [Green Version]

- Li, D.; Peng, Y.; Guo, C.; Tan, R. Pricing strategy of construction and demolition waste considering retailer fairness concerns under a governmental regulation environment. Int. J. Environ. Res. Public Health 2019, 16, 3896. [Google Scholar] [CrossRef] [Green Version]

- Spengler, J.J. Vertical integration and antitrust policy. J. Political Econ. 1950, 58, 347–352. [Google Scholar] [CrossRef]

- Edirisinghe, N.C.P.; Bichescu, B.; Shi, X. Equilibrium analysis of supply chain structures under power imbalance. Eur. J. Oper. Res. 2011, 214, 568–578. [Google Scholar] [CrossRef]

- Chen, K.; Zhaung, P. Disruption management for a dominant retailer with constant demand-stimulating service cost. Comput. Ind. Eng. 2011, 61, 936–946. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Zhang, K.; Bai, T.; Shang, J. Reward–penalty mechanism for closed-loop supply chains under responsibility-sharing and different power structures. Int. J. Prod. Econ. 2015, 170, 178–190. [Google Scholar] [CrossRef]

- Gao, J.; Han, H.; Hou, L.; Wang, H. Pricing and effort decisions in a closed-loop supply chain under different channel power structures. J. Clean. Prod. 2016, 112, 2043–2057. [Google Scholar] [CrossRef]

- Cheng, J.; Li, B.; Gong, B.; Cheng, M.; Xu, L. The optimal power structure of environmental protection responsibilities transfer in remanufacturing supply chain. J. Clean. Prod. 2017, 153, 558–569. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Zhou, M. Firms’ green R&D cooperation behaviour in a supply chain: Technological spillover, power and coordination. Int. J. Prod. Econ. 2019, 218, 118–134. [Google Scholar]

- Zhang, S.; Wang, C.; Yu, C.; Ren, Y. Governmental cap regulation and manufacturer’s low carbon strategy in a supply chain with different power structures. Comput. Ind. Eng. 2019, 134, 27–36. [Google Scholar] [CrossRef]

- Liu, W.; Qin, D.; Shen, N.; Zhang, J.; Jin, M.; Xie, N.; Chen, J.; Chang, X. Optimal pricing for a multi-echelon closed loop supply chain with different power structures and product dual differences. J. Clean. Prod. in press. [CrossRef]

- Agi, M.A.N.; Yan, X. Greening products in a supply chain under market segmentation and different channel power structures. Int. J. Prod. Econ. in press. [CrossRef]

- Chen, J.-Y.; Dimitrov, S.; Pun, H. The impact of government subsidy on supply Chains’ sustainability innovation. Omega 2019, 86, 42–58. [Google Scholar] [CrossRef]

- Ma, W.; Zhang, R.; Chai, S. What drives green innovation? A game theoretic analysis of government subsidy and cooperation contract. Sustainability 2019, 11, 5584. [Google Scholar] [CrossRef] [Green Version]

- The Economics of Sustainable Coffee Production. Available online: http://www.triplepundit.com/story/2014/economics-sustainable-coffee-production/39121 (accessed on 9 February 2020).

| Parameters | Descriptions |

| Acquisition cost of a used product incurred by the recycler Change in operation cost due to green innovation effort Cost coefficient of green innovation efforts Collecting investment coefficient Transfer price of a used product paid by the manufacturer Savings per unit from remanufacturing | |

| Decision variables | Descriptions |

| Green innovation effort made by the manufacturer Green innovation effort made by the retailer Retail price Collecting rate Wholesale price | |

| Functions | Descriptions |

| Demand for the product Manufacturer’s profit Retailer’s profit Collector’s profit Supply chain profit () |

| Leader | Manufacturer-Led | Retailer-Led | |

|---|---|---|---|

| Green Innovation | |||

| Manufacturer-driven Retailer-driven Both-driven | MM RM BM | MR RR BR | |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, D. Who Drives Green Innovation? A Game Theoretical Analysis of a Closed-Loop Supply Chain under Different Power Structures. Int. J. Environ. Res. Public Health 2020, 17, 2274. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph17072274

Lee D. Who Drives Green Innovation? A Game Theoretical Analysis of a Closed-Loop Supply Chain under Different Power Structures. International Journal of Environmental Research and Public Health. 2020; 17(7):2274. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph17072274

Chicago/Turabian StyleLee, Dooho. 2020. "Who Drives Green Innovation? A Game Theoretical Analysis of a Closed-Loop Supply Chain under Different Power Structures" International Journal of Environmental Research and Public Health 17, no. 7: 2274. https://0-doi-org.brum.beds.ac.uk/10.3390/ijerph17072274