1. Introduction

Continuous economic restructuring, especially industrial restructuring, is an important source of economic growth and a necessary prerequisite for maintaining high-quality economic development. At this stage, China’s economic development has entered a new era, and the basic feature is that the economy has changed from a high-speed growth stage to a high-quality development stage. Relying on the traditional extensive development mode, high environmental pollution and ecological damage have hindered the process of economic structure transformation. Environmental governance has become an unavoidable top priority in China’s transformation of development mode and optimization of economic structure. Since the 1980s, Chinese governments at all levels have gradually established and formulated relatively perfect environmental protection systems and policies to reduce pollution emissions and improve environmental quality, and achieved certain results. However, the unsustainable development mode of exchanging environmental pollution for economic growth for a long time has led to the serious situation of environmental pollution in various regions.

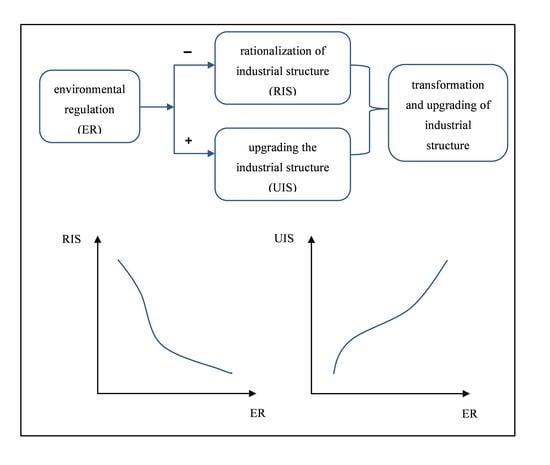

The transformation and upgrading of industrial structure based on breaking the constraints of energy and resources and alleviating the pressure on the ecological environment is an important way to achieve a win-win situation between environmental protection and economic growth. It is an important starting point for China to realize the green economy and sustainable development to promote the transformation of industrial development mode from traditional factor driven to intensive innovation driven and from low value-added to high value-added through the pressure of environmental constraints brought by environmental regulation. The transformation and upgrading of industrial structure is the core tool to coordinate the economy and environment. On the one hand, the industrial structure is directly related to how the economic system uses resources and discharges waste. Industrial structure is not only the converter of natural resource input, but also the control body of the quantity and type of pollutants. On the other hand, environmental regulation will increase the cost of enterprises. Driven by maximizing profits, enterprises adjust production behavior and cause changes in industrial structure. Therefore, it is necessary for us to organically combine the transformation and upgrading of industrial structure with research on environmental protection. As a necessary means for the government to protect the environment, studying its impact on the transformation and upgrading of industrial structure has theoretical and practical significance for realizing environmental protection and structural transformation.

In fact, the deteriorating ecological environment has not allowed China to wait for the unknown inflection point in the environmental Kuznets curve, and appropriate intervention is needed to achieve green economic development [

1]. As a necessary means for the government to protect the environment, whether environmental regulation can go hand in hand with industrial transformation and upgrading is worth further study. The representative results of the early academic research on the economic effects of environmental regulation are the “compliance cost” and “Porter hypothesis”. “Compliance cost” starts from a static perspective and assumes that the technological level, resource allocation, production process and consumer demand of the enterprise remain unchanged. It assumes that strict environmental regulations increase additional cost of pollution control for enterprises, so as to make the enterprise production ability and profit levels drop, weaken enterprise competitiveness, and ultimately hinder economic growth. Based on a dynamic perspective, the “Porter Hypothesis” holds that appropriate environmental regulation can motivate innovative activities and optimize resource allocation in order to reduce costs, stimulate the “innovation compensation” effect, and then promote the improvement of production efficiency and the enhancement of competitive strength, so that environmental protection and economic growth can be balanced.

In recent years, many scholars have empirically tested the Porter hypothesis according to different hypotheses and obtained different conclusions. Most of the findings support the Porter hypothesis. For example, some scholars found that the increase in enterprises’ pollution emission reduction expenditures can promote the growth of environmental protection patent applications, and this relationship is very prominent in industries with strong international competitiveness, which supports the weak Porter Hypothesis [

2,

3]. Some studies distinguish between regulation-induced and voluntary environmental innovations. Both regulation-induced and voluntary innovation can improve enterprise resource efficiency and profitability, but regulation-induced innovation has a greater impact. However, the Porter hypothesis does not hold in general for its “strong” version, but depends on the type of environmental innovation [

4]. In addition, some scholars have also proved with the strong Porter hypothesis that stricter environmental policies improve growth and the environment and induce profitable innovation [

5]. Moreover, some studies used Chinese panel data to conduct empirical tests and found that higher environmental regulation intensity could promote technological progress and green total factor productivity, which supports the Porter hypothesis [

6,

7,

8,

9].

Other studies have rejected the Porter hypothesis. Jaffe and Palmer (1997) [

10] tested the Porter hypothesis by using panel data of the US manufacturing industry and pointed out that although the cost of environmental regulation could increase R&D expenditure, it had no impact on innovation output. They also pointed out that some supporters of “Porter hypothesis” used case studies that were not rigorous enough and did not provide a basic criterion for reasonable environmental regulation. Ederington and Minier (2003) [

11] found that strict environmental regulation had a great impact on net imports, that is, environmental regulation weakened the competitiveness of enterprises. Some studies have analyzed the relationship between environmental regulation and ecological innovation, and found that only long-term goals and market incentives are positively correlated with ecological innovation. Traditional regulatory tools, namely legally binding tools, cannot effectively trigger innovation behavior at the enterprise level. Refs. [

12,

13] used mixed regression and systematic GMM methods to study the impact of different environmental regulation tools on China’s energy conservation and emission reduction technologies, and the results did not support the weak Porter hypothesis.

From the current research progress, scholars mainly focus on the relationship between human capital [

14,

15,

16,

17], trade opening [

18,

19,

20], financial development [

21,

22,

23,

24], industrial policy [

25,

26] and the change in industrial structure. The discussion on the impact of environmental regulation on industrial transformation and upgrading has gradually begun to grow, and many scholars have drawn different conclusions based on different empirical methods. Xiao and Li (2013) [

27] found that environmental regulation mainly affects the transformation and upgrading of industrial structure through technological innovation, demand and international trade. Moreover, environmental regulation plays a positive role in promoting the direction and path of industrial upgrading, and environmental regulation and industrial structure upgrading can achieve a win-win situation. Guo and Yuan (2020) [

28] studied the forcing effect of environmental regulations and government R&D subsidies on the upgrading of industrial structure, and found that the coupling effect of environmental regulations and government R&D subsidies significantly enhanced the “innovation compensation” effect, which was conducive to promoting the upgrading of industrial structure. Some scholars have investigated the impact of informal environmental regulation on the upgrading of industrial structure. As an external binding force, informal environmental regulation in the form of environmental media reports promotes the upgrading of industrial structure by increasing the dual pressure of local government supervision and public opinion [

29].

However, some scholars have come to different conclusions. Zhong et al. (2015) [

30] theoretically analyzed the impact of environmental regulation on corporate behavior, and then verified the relationship between environmental regulation and industrial structure adjustment by using the panel threshold model. The study showed that there was a U-shaped curve relationship between the two, and only when the threshold value was crossed, environmental regulation could effectively force industrial structure transformation and upgrading. Shen et al. (2020) [

31] drew a similar conclusion, namely, that only a higher intensity of environmental regulation could effectively promote the transformation and upgrading of the manufacturing industry. Moreover, some studies show that when the level of economic development is low, the impact of environmental regulation on industrial structure upgrading is not significant. Only when the level of economic development tends to be high, environmental regulation will significantly promote green technology innovation and industrial structure upgrading [

32].

The purpose of this paper is to examine the nonlinear impact of environmental regulation on industrial structure transformation and upgrading. In the following part of this paper, the PSTR model is used to test the relationship between environmental regulation and industrial upgrading on the basis of controlling relevant variables, and the robustness test is carried out. The analysis of the relationship between environmental regulation and industrial structure transformation and upgrading can provide reference for the government to make selective environmental regulation decisions. Compared with previous studies, the innovation of this paper is mainly reflected in the following three aspects: (1) In terms of ideas, this paper further considers the impact of environmental regulation on the transformation and upgrading of China’s industrial structure when there are differences in the level of economic development and human capital, and expands and supplements previous studies on single factors. (2) Methodologically, in contrast with previous regression equation analysis and in order to verify the continuous and gradually changing nonlinear effect of environmental regulation on the transformation and upgrading of industrial structure, this paper uses the panel smooth transition regression (PSTR) model proposed by González et al. (2004) [

33]. A series of estimates and tests are carried out for smooth transformation effects and parameters of functions with exogenous variables, so as to reflect the nonlinear characteristics of the problem analyzed and the gradual behavior of transformation. (3) In terms of data, this paper constructs a more basic and comprehensive index of environmental regulation, so as to reflect the intensity of environmental regulation in China. In addition, this paper measures the transformation and upgrading of industrial structure from the two aspects of rationalization and upgrading of industrial structure. Compared with the previous industrial structure upgrading index measurement, this method can more objectively reflect the upgrading level of China’s regional industrial structure.

3. The Nonlinear Relationship between Environmental Regulation and RIS

3.1. Data

Our empirical background uses annual data of 29 provinces and cities in China. The period of study is from 2004 to 2015. The data are obtained from the “China Environmental Yearbook”, “China Industrial Statistical Yearbook”, “China Economic Network Statistics Database” and “China Statistical Yearbook”. The sample and the period choice were constrained by the availability of data.

Table 1 displays the descriptive statistics of the used variables.

3.2. Discussion of the Linearity Results

Table 2 and

Table 3 respectively show the linearity hypotheses and no remaining nonlinearity test results of the PSTR model under different location parameter dimensions when treating economic development level and human capital level as transition variables. It can be seen from the results in

Table 2 and

Table 3 that in the case of m = 1 and m = 2,

,

and

statistics reject the original hypothesis

at the significance level of 5%. This means that there is a nonlinear relationship between environmental regulation and RIS. Further, no remaining non-linearity test of the PSTR model shows that the original assumption

cannot be rejected when

m = 1 or

m = 2. It shows that the PSTR model only contains a nonlinear transition function, that is,

r = 1. Next, we use AIC and BIC criteria to determine the best value of m. When

m = 1, the AIC value and BIC value corresponding to the transition variable are less than the value when

m = 2. Based on this, it can be concluded that the best combination of the number of transition functions and the dimension of position parameters in the model is

r = 1,

m = 1.

3.3. Discussion of the Empirical Results

The findings of the PSTR regression model are recorded in

Table 4. Among these, columns (1) and (2) are the estimated results when economic development level and human capital level are used as transformation variables, respectively. According to the results in

Table 4, the interpretation is as follows:

From column (1), we can see that the environmental regulation exerts a significant negative impact on RIS for the low and high regimes. The coefficient of environmental regulation on RIS is 0.2648 in the low regime and 0.0594 (0.2648–0.2054) in the high regime. It can be seen that with the gradual improvement of the level of economic development, the inhibitory effect of environmental regulation on the rationalization of industrial structure is gradually decreasing.

Specifically, the level of industrial structure in economically backward areas is low, and the coordination between industries is poor. At this time, the improvement of environmental regulation may aggravate the distortion of the factor market, affect industrial productivity, reduce the efficiency of resource allocation and hinder the rational development of industrial structure. With the gradual development of the economic level, the Party Central Committee began to implement the strategy of promoting regional coordinated development in order to reduce the regional gaps; each region combined with its own comparative advantages and industrial foundation were expected to pursue a reasonable layout of industrial structure, and the regional industrial transfer was promoted in an orderly manner. However, there is a large gap in the level of industrial structure between the east, central and western regions of China, and the problem of repeated industrial construction is still prominent. Under this background, the implementation of environmental regulation policy is not conducive to strengthening the correlation between industries and reduces the efficiency of resource allocation, resulting in the failure to give full play to the role of environmental regulation in promoting the rationalization of industrial structure.

From columns (2), it can be seen that the impact of environmental regulation on RIS is still significantly negative in both regimes. In the first regime, the coefficient of environmental regulation on RIS is 0.2382, and in the high regime, it is 0.0619 (0.2382–0.1763). It can be seen that with the improvement of human capital level, the negative effect of environmental regulation on the RIS is becoming smaller and smaller. The possible reason is that the improvement of the level of human capital will lead to the agglomeration of other factors of production (mainly material capital), which gives the industrial sectors and regions with high stock of human capital a comparative advantage in gathering resources. The agglomeration effect promotes the transfer and allocation of other production factors among industries and improves the rationality of industrial structure.

Furthermore, the urbanization level and opening up to trade have a significant effect on RIS. In the low regime, the urbanization level and opening up variables have a positive significant impact on RIS. However, in the high regime, they hinder the RIS. Moreover, human capital has a significant negative impact on RIS in the low regime. Nonetheless, it exerts a positive influence on RIS in the high regime.

3.4. Results of Robustness Test

In order to further test the robustness of the nonlinear relationship between environmental regulation and RIS, this paper uses the ratio of pollutant discharge fee income to industrial added value as an alternative variable for robustness analysis. The nonlinear test results of the model are shown in

Table 5 and

Table 6.

According to the results in

Table 5 and

Table 6, the relationship between environmental regulation and RIS is nonlinear. Next, the nonlinear least square method is used to estimate the model, and the estimation results are shown in

Table 7. The estimated coefficient of environmental regulation is significant. When treating the level of economic development and the level of human capital as the transformation variables, the impact of environmental regulation on the RIS has nonlinear characteristics. With the improvement of economic level and human capital level, the negative impact of environmental regulation on RIS is gradually reduced.

To sum up, the estimation results using the ratio of pollutant discharge fee income to industrial added value as an alternative variable are robust. Compared with the above estimation results, the estimation coefficient symbols of explanatory variables are basically the same, and the significance level of variables does not change significantly, indicating that the estimation results of the above model are reliable.