Economic and Technological Analysis of Commercial LNG Production in the EU

Abstract

:1. Introduction

- Wide availability;

- Conventional spark-ignition and internal combustion engines compatibility; and

- Low operational cost.

2. Literature Review

- What role will natural gas have in the energy mix?

- How will the internal gas market work?

- How will the security of the gas supply be ensured?

- Diversification.

- Accepting the (global) market and its principles.

- Strategic reserves in case of supply failure.

- Enough quality information (IEA).

- The interdependence of producers and consumers.

- Dialogue with new consumers (China, India).

- Greater efficiency, savings, research, and development.

3. Materials and Methods

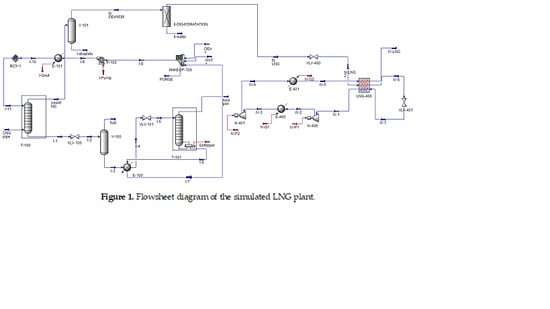

3.1. Technical Model

3.1.1. Gas Sweetening

3.1.2. Dehydration

3.1.3. Liquefaction

3.2. Economic Model

3.2.1. Costs and Financing

3.2.2. Economic Indicators

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Arteconi, A.; Polonara, F. LNG as vehicle fuel and the problem of supply: The Italian case study. Energy Policy 2013, 62, 503–512. [Google Scholar] [CrossRef]

- European Commission. Green Paper: Towards a European Strategy for the Security of Energy Supply; European Commission: Luxembourg, 2001. [Google Scholar]

- Pfoser, S.; Schauer, O.; Costa, Y. Acceptance of LNG as an alternative fuel: Determinants and policy implications. Energy Policy 2018, 120, 259–267. [Google Scholar] [CrossRef]

- Enteria, N.; Yoshino, H.; Takaki, R.; Mochida, A.; Satake, A.; Baba, S.; Ishihara, H.; Yoshie, R. Case analysis of utilizing alternative energy sources and technologies for the single family detached house. Sol. Energy 2014, 105, 243–263. [Google Scholar] [CrossRef]

- Kruyt, B.; Lehning, M.; Kahl, A. Potential contributions of wind power to a stable and highly renewable Swiss power supply. Appl. Energy 2017, 192, 1–11. [Google Scholar] [CrossRef]

- Vlk, F. Alternativní pohony motorových vozidel. Soud. Inž. 2004, 4, 212–224. [Google Scholar]

- Arteconi, A.; Brandoni, C.; Evangelista, D.; Polonara, F. Life-cycle greenhouse gas analysis of LNG as a heavy vehicle fuel in Europe. Appl. Energy 2010, 87, 2005–2013. [Google Scholar] [CrossRef]

- International Energy Agency. Market Report Series: Gas 2018. Available online: https://webstore.iea.org/download/summary/1235?fileName=English-Gas-2018-ES.pdf. (accessed on 9 April 2019).

- Khan, M.I.; Yasmin, T.; Shakoor, A. Technical overview of compressed natural gas (CNG) as a transportation fuel. Renew. Sustain. Energy Rev. 2015, 51, 785–797. [Google Scholar] [CrossRef]

- British Petroleum BP Statistical Review of World Energy 2018. Available online: https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf. (accessed on 11 November 2018).

- Bittante, A.; Pettersson, F.; Saxén, H. Optimization of a small-scale LNG supply chain. Energy 2018, 148, 79–89. [Google Scholar] [CrossRef]

- Severová, L.; Svoboda, R.; Kopecká, L. Increase in prices of farmland in the Czech Republic. Prop. Manag. 2017, 35, 326–338. [Google Scholar] [CrossRef]

- Svoboda, R.; Severová, L. Regional Cooperation of Farmers and Producers of Organic Food in the Czech Republic and EU (Federal Republic of Germany). In Proceedings of the International Scientific Conference on Opportunities and Threats to Current Business Management in Cross-Border Comparison, Pilsen, Czech Republic, 2015; pp. 93–99. [Google Scholar]

- Sredl, K.; Mikhalkina, E. Regional Characteristics of the Development of Agricultural Enterprises in the Czech Republic. In Proceedings of the International Scientific Conference on Opportunities and Threats to Current Business Management in Cross-Border Comparison, Pilsen, Czech Republic, 2015; pp. 107–115. [Google Scholar]

- Sredl, K.; Rodonaia, E. Comparison of Conventional and Organic Farming of Agricultural Companies in the Czech Republic and Germany. In Proceedings of the International Scientific Conference on Opportunities and Threats to Current Business Management in Cross-Border Comparison, Pilsen, Czech Republic, 2017; pp. 157–162. [Google Scholar]

- Pongas, E.; Todorova, A.; Gambini, G. Statistical Analysis of EU Trade in Energy Products, with Focus on Trade with the Russian Federation. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Archive:Trade_in_energy_products (accessed on 12 January 2019).

- Osorio-Tejada, J.; Llera, E.; Scarpellini, S. LNG: An alternative fuel for road freight transport in Europe. WIT Press 2015, 168, 235–246. [Google Scholar] [CrossRef]

- Herbes, C.; Halbherr, V.; Braun, L. Factors influencing prices for heat from biogas plants. Appl. Energy 2018, 221, 308–318. [Google Scholar] [CrossRef]

- Simmer, L.; Aschauer, G.; Schauer, O.; Pfoser, S. LNG as an alternative fuel: The steps towards European implementation. WIT Press 2014, 186, 887–898. [Google Scholar] [CrossRef]

- European Commission BIOLNG4EU. Available online: https://ec.europa.eu/inea/en/connecting-europe-facility/cef-transport/2016-nl-tm-0339-s (accessed on 22 March 2019).

- Baccioli, A.; Antonelli, M.; Frigo, S.; Desideri, U.; Pasini, G. Small scale bio-LNG plant: Comparison of different biogas upgrading techniques. Appl. Energy 2018, 217, 328–335. [Google Scholar] [CrossRef]

- He, T.; Liu, Z.; Ju, Y.; Parvez, A.M. A comprehensive optimization and comparison of modified single mixed refrigerant and parallel nitrogen expansion liquefaction process for small-scale mobile LNG plant. Energy 2019, 167, 1–12. [Google Scholar] [CrossRef]

- Kanbur, B.B.; Xiang, L.; Dubey, S.; Choo, F.H.; Duan, F. Finite sum based thermoeconomic and sustainable analyses of the small scale LNG cold utilized power generation systems. Appl. Energy 2018, 220, 944–961. [Google Scholar] [CrossRef]

- Ancona, M.A.; Bianchi, M.; Branchini, L.; De Pascale, A.; Melino, F.; Mormile, M.; Palella, M.; Scarponi, L.B. Investigation on small-scale low pressure LNG production process. Appl. Energy 2018, 227, 672–685. [Google Scholar] [CrossRef]

- Möller, A. Material and Energy Flow-Based Cost Accounting. Chem. Eng. Technol. 2010. [Google Scholar] [CrossRef]

- European Parliament Energy Policy: General Principles. Available online: http://www.europarl.europa.eu/factsheets/en/sheet/68/energy-policy-general-principles (accessed on 7 December 2018).

- Schulte, S.; Weiser, F. LNG import quotas in Lithuania—Economic effects of breaking Gazprom’s natural gas monopoly. Energy Econ. 2019, 78, 174–181. [Google Scholar] [CrossRef]

- European Commission. Orient—East Med. Available online: https://ec.europa.eu/transport/themes/infrastructure/orient-east-med_de (accessed on 8 April 2019).

- Edison.it. EastMed Pipeline. Available online: https://www.edison.it/en/eastmed-pipeline (accessed on 8 April 2019).

- Prpich, G.; Coulon, F. Assessing unconventional natural gas development: Understanding risks in the context of the EU. Curr. Opin. Environ. Sci. Health 2018, 3, 47–51. [Google Scholar] [CrossRef]

- Madžarević, A.; Ivezić, D.; Živković, M.; Tanasijević, M.; Ivić, M. Assessment of vulnerability of natural gas supply in Serbia: State and perspective. Energy Policy 2018, 121, 415–425. [Google Scholar] [CrossRef]

- Ruble, I. European Union energy supply security: The benefits of natural gas imports from the Eastern Mediterranean. Energy Policy 2017, 105, 341–353. [Google Scholar] [CrossRef]

- Chalvatzis, K.J.; Ioannidis, A. Energy supply security in the EU: Benchmarking diversity and dependence of primary energy. Appl. Energy 2017, 207, 465–476. [Google Scholar] [CrossRef]

- Yergin, D. Ensuring Energy Security. Foreign Aff. 2006, 85, 69. [Google Scholar] [CrossRef]

- Orbánová, A. Moc, Energie a Nový Ruský Imperialismus; Argo: Praha, Czech Republic, 2010; ISBN 978-80-257-0251-2. [Google Scholar]

- Egenhofer, C.; Grigoriev, L.; Socor, V.; Riley, A. European Energy Security: What Should It Mean? What to Do? Centre for European Policy Studies: Brussels, Belgium, 2006; ISBN 978-92-9079-667-1. [Google Scholar]

- Dančák, B. Energetická Bezpečnost a Zájmy Česke Republiky; Masarykova University, Mezinárodní Politologický Ústav: Brno, Czech Republic, 2007; ISBN 978-80-210-4440-1. [Google Scholar]

- Jesień, L. The Future of European Energy Security: Interdisciplinary Conference; Tischner European University: Kraków, Poland, 2006; ISBN 978-83-60125-80-9. [Google Scholar]

- Alabdulkarem, A.; Mortazavi, A.; Hwang, Y.; Radermacher, R.; Rogers, P. Optimization of propane pre-cooled mixed refrigerant LNG plant. Appl. Therm. Eng. 2011, 31, 1091–1098. [Google Scholar] [CrossRef]

- Lim, W.; Choi, K.; Moon, I. Current Status and Perspectives of Liquefied Natural Gas (LNG) Plant Design. Ind. Eng. Chem. Res. 2013, 52, 3065–3088. [Google Scholar] [CrossRef]

- Mortazavi, A.; Somers, C.; Hwang, Y.; Radermacher, R.; Rodgers, P.; Al-Hashimi, S. Performance enhancement of propane pre-cooled mixed refrigerant LNG plant. Appl. Energy 2012, 93, 125–131. [Google Scholar] [CrossRef]

- Jensen, J.B.; Skogestad, S. Optimal operation of a mixed fluid cascade LNG plant. In Computer Aided Chemical Engineering; Elsevier: Amsterdam, Netherlands, 2006; Volume 21, pp. 1569–1574. ISBN 978-0-444-52969-5. [Google Scholar]

- Hasan, M.M.F.; Karimi, I.A.; Alfadala, H.E. Optimizing Compressor Operations in an LNG Plant. In Proceedings of the 1st Annual Gas Processing Symposium; Elsevier: Amsterdam, The Netherlands, 2009; pp. 179–184. ISBN 978-0-444-53292-3. [Google Scholar]

- The Oxford Institute for Energy Studies. LNG Plant Cost Escalation; The Oxford Institute for Energy Studies: Oxford, UK, 2014. [Google Scholar]

- The Oxford Institute for Energy Studies. LNG Plant Cost Reduction; The Oxford Institute for Energy Studies: Oxford, UK, 2018. [Google Scholar]

- Lam, P.-L. The growth of Japan’s LNG industry: Lessons for China and Hong Kong. Energy Policy 2000, 28, 327–333. [Google Scholar] [CrossRef]

- Lin, W.; Zhang, N.; Gu, A. LNG (liquefied natural gas): A necessary part in China’s future energy infrastructure. Energy 2010, 35, 4383–4391. [Google Scholar] [CrossRef]

- Tennyson, R.N.; Schaaf, R.P. Guidelines Can Help Choose Proper Process for Gas Treating Plants. Available online: https://www.researchgate.net/publication/279674565_Guidelines_Can_Help_Choose_Proper_Process_for_Gas_Treating_Plants (accessed on 11 November 2018).

- Peng, D.-Y.; Robinson, D.B. A New Two-Constant Equation of State. Ind. Eng. Chem. Fundam. 1976, 15, 59–64. [Google Scholar] [CrossRef]

- Mokhatab, S.; Mak, J.Y.; Valappil, J.V.; Wood, D.A. Handbook of Liquefied Natural Gas; Gulf Professional Publishing: Oxford, UK, 2013; ISBN 978-0-12-404645-0. [Google Scholar]

- Kidnay, A.J.; Parrish, W.R. Fundamentals of Natural Gas Processing, 1st ed.; CRC Press: Boca Raton, FL, USA, 2006; ISBN 978-0-8493-3406-1. [Google Scholar]

- Netusil, M.; Ditl, P. Natural Gas Dehydration. In Natural Gas—Extraction to End Use; IntechOpen: London, UK, 2012; ISBN 978-953-51-0820-7. [Google Scholar]

- Reuters. U.S. Export Bank Offers to Co-Finance Czech Nuclear Plant. Available online: https://www.reuters.com/article/cez-temelin/u-s-export-bank-offers-to-co-finance-czech-nuclear-plant-idUSL6N0FZ1WH20130729 (accessed on 17 January 2019).

- Ferdinand, M.; Dimantchev, E.; Fjellheim, H. Animal Spirits versus the Big Picture: Why the Outlook for the Carbon Price Is Still Bullish; Thomson Reuters: Eagan, MN, USA, 2016. [Google Scholar]

- Antweiler, W. Liquefied Natural Gas: Technology Choices and Emissions. Available online: https://wernerantweiler.ca/blog.php?item=2014-11-11 (accessed on 11 November 2018).

- Trading Economics European Union Wage Growth|2019|Data|Chart|Calendar|Forecast. Available online: https://tradingeconomics.com/european-union/wage-growth (accessed on 22 March 2019).

- Arcuri, N.; Bruno, R.; Bevilacqua, P. LNG as cold heat source in OTEC systems. Ocean Eng. 2015, 104, 349–358. [Google Scholar] [CrossRef]

- Hatcher, P.; Khalilpour, R.; Abbas, A. Optimisation of LNG mixed-refrigerant processes considering operation and design objectives. Comput. Chem. Eng. 2012, 41, 123–133. [Google Scholar] [CrossRef]

- Eurostat Electricity Prices for Non-Household Consumers. Available online: http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nrg_pc_205&lang=en (accessed on 22 March 2019).

- European Commission Excise Duty on Energy. Available online: https://ec.europa.eu/taxation_customs/business/excise-duties-alcohol-tobacco-energy/excise-duties-energy_en (accessed on 22 March 2019).

- Global LNG Prices. Available online: https://bluegoldresearch.com/global-lng-prices (accessed on 17 November 2018).

- McLaney, E.; Atrill, D.P. Accounting: An Introduction, 6th ed.; Pearson: Harlow, UK, 2012; ISBN 978-0-273-77183-8. [Google Scholar]

- Pesaran, B.; Pesaran, M.H. Time Series Econometrics Using Microfit 5.0; Oxford University Press: Oxford, UK, 2009; ISBN 978-0-19-956353-1. [Google Scholar]

- Cucchiella, F.; D’Adamo, I.; Rosa, P. Industrial Photovoltaic Systems: An Economic Analysis in Non-Subsidized Electricity Markets. Energies 2015, 8, 12865–12880. [Google Scholar] [CrossRef] [Green Version]

- Romano, S.; Cozzi, M.; Di Napoli, F.; Viccaro, M. Building Agro-Energy Supply Chains in the Basilicata Region: Technical and Economic Evaluation of Interchangeability between Fossil and Renewable Energy Sources. Energies 2013, 6, 5259–5282. [Google Scholar] [CrossRef] [Green Version]

- Emiliano, P.C.; Vivanco, M.J.F.; de Menezes, F.S. Information criteria: How do they behave in different models? Comput. Stat. Data Anal. 2014, 69, 141–153. [Google Scholar] [CrossRef]

- Chang, L.; Zhou, Z.; Chen, Y.; Xu, X.; Sun, J.; Liao, T.; Tan, X. Akaike Information Criterion-based conjunctive belief rule base learning for complex system modeling. Knowl.-Based Syst. 2018, 161, 47–64. [Google Scholar] [CrossRef]

- Kletting, P.; Glatting, G. Model selection for time-activity curves: The corrected Akaike information criterion and the F-test. Z. Med. Phys. 2009, 19, 200–206. [Google Scholar] [CrossRef]

- Hurvich, C.M.; Tsai, C.-L. Regression and time series model selection in small samples. Biometrika 1989, 76, 297–307. [Google Scholar] [CrossRef]

- Schwarz, G. Estimating the Dimension of a Model. Ann. Stat. 1978, 6, 461–464. [Google Scholar] [CrossRef]

- Hyndman, R. auto.arima Function. Available online: https://www.rdocumentation.org/packages/forecast/versions/8.4/topics/auto.arima (accessed on 11 November 2018).

- Faramawy, S.; Zaki, T.; Sakr, A.A.-E. Natural gas origin, composition, and processing: A review. J. Nat. Gas Sci. Eng. 2016, 34, 34–54. [Google Scholar] [CrossRef]

- Khan, M.S.; Lee, S.; Getu, M.; Lee, M. Knowledge inspired investigation of selected parameters on energy consumption in nitrogen single and dual expander processes of natural gas liquefaction. J. Nat. Gas Sci. Eng. 2015, 23, 324–337. [Google Scholar] [CrossRef]

- Statista Electricity Price France 2020–2040|Forecast. Available online: https://0-www-statista-com.brum.beds.ac.uk/statistics/753239/electricity-price-forecast-france/ (accessed on 22 March 2019).

- Knaut, A.; Tode, C.; Lindenberger, D.; Malischek, R.; Paulus, S.; Wagner, J. The reference forecast of the German energy transition—An outlook on electricity markets. Energy Policy 2016, 92, 477–491. [Google Scholar] [CrossRef]

- Wilson, R.; Luckow, P.; Biewald, B.; Ackerman, F.; Hausman, E. 2012 Carbon Dioxide Price Forecast; Synapse: Cambridge, Massachusetts, 2012. [Google Scholar]

- CE Delft Power to Ammonia: Energy and Electricity Prices Scenarios 2020-2023-2030. Available online: https://www.cedelft.eu/en/publications/1911/power-to-ammonia-energy-and-electricity-prices-scenarios-2020-2023-2030 (accessed on 23 January 2019).

- Wang, Y.; Wang, J.; Zhao, G.; Dong, Y. Application of residual modification approach in seasonal ARIMA for electricity demand forecasting: A case study of China. Energy Policy 2012, 48, 284–294. [Google Scholar] [CrossRef]

- Kriechbaumer, T.; Angus, A.; Parsons, D.; Rivas Casado, M. An improved wavelet–ARIMA approach for forecasting metal prices. Resour. Policy 2014, 39, 32–41. [Google Scholar] [CrossRef] [Green Version]

- Zhu, B.; Wei, Y. Carbon price forecasting with a novel hybrid ARIMA and least squares support vector machines methodology. Omega 2013, 41, 517–524. [Google Scholar] [CrossRef]

- Naderi, M.; Khamehchi, E.; Karimi, B. Novel statistical forecasting models for crude oil price, gas price, and interest rate based on meta-heuristic bat algorithm. J. Pet. Sci. Eng. 2019, 172, 13–22. [Google Scholar] [CrossRef]

- Van Goor, H.; Scholtens, B. Modeling natural gas price volatility: The case of the UK gas market. Energy 2014, 72, 126–134. [Google Scholar] [CrossRef]

- Varahrami, V.; Haghighat, M.S. The assessment of liquefied natural gas (LNG) demand reversibility in selected OECD countries. Energy Rep. 2018, 4, 370–375. [Google Scholar] [CrossRef]

- Ancona, M.A.; Bianchi, M.; Branchini, L.; De Pascale, A.; Melino, F.; Mormile, M.; Palella, M. On-site LNG production at filling stations. Appl. Therm. Eng. 2018, 137, 142–153. [Google Scholar] [CrossRef]

| Parameter | Oil | Natural Gas |

|---|---|---|

| Market form | Global | Regional |

| Contracts form | Short-term | Long-term |

| Dependence on specific supplier and infrastructure | Low | High |

| Main threat | Price growth | Physical supply disruption |

| Parameter | Value |

|---|---|

| Critical temperature | 241.14 K |

| Critical pressure | 12.97×106 Pa |

| Molar volume | 1.22×10−4 m3 mol−1 |

| Acentric factor | 0.055 |

| Process | Input Consumption per Year |

|---|---|

| Natural gas for liquefaction | 2.49×105 m3 |

| Acid gas treatment | 18 kWh |

| Dehydration | 5 kWh |

| Liquefaction | 199 kWh |

| Time Series | Model | AIC | AICc | BIC |

|---|---|---|---|---|

| Price of LNG | ARIMA (0,1,0) | −119.27 | −119.21 | −117.04 |

| Price of electricity | ARIMA (0,2,1) | −126.84 | −126.56 | −119.38 |

| Price of emission allowances | ARIMA (0,1,0) with drift | −43.7 | −43.32 | −40.65 |

| LNG demand | ARIMA (0,2,1) | 378.52 | 380.02 | 379.32 |

| Electricity | Gas | Depreciation | Wages | Emission Allowances | Excise Duty | Loans |

|---|---|---|---|---|---|---|

| 4.23% | 6.64% | 18.02% | 16.51% | 3.56% | 43.71% | 7.34% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hönig, V.; Prochazka, P.; Obergruber, M.; Smutka, L.; Kučerová, V. Economic and Technological Analysis of Commercial LNG Production in the EU. Energies 2019, 12, 1565. https://0-doi-org.brum.beds.ac.uk/10.3390/en12081565

Hönig V, Prochazka P, Obergruber M, Smutka L, Kučerová V. Economic and Technological Analysis of Commercial LNG Production in the EU. Energies. 2019; 12(8):1565. https://0-doi-org.brum.beds.ac.uk/10.3390/en12081565

Chicago/Turabian StyleHönig, Vladimír, Petr Prochazka, Michal Obergruber, Luboš Smutka, and Viera Kučerová. 2019. "Economic and Technological Analysis of Commercial LNG Production in the EU" Energies 12, no. 8: 1565. https://0-doi-org.brum.beds.ac.uk/10.3390/en12081565