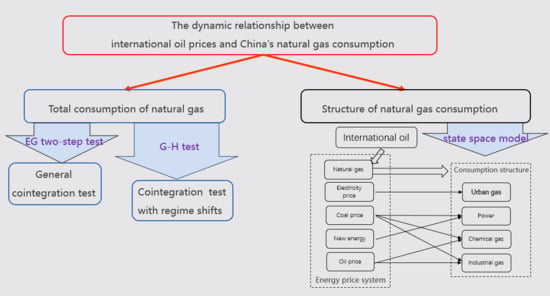

5.2.1. EG Two-Step Cointegration Test

As the data of natural gas consumption and the international oil price are stationary regarding the first-order differences, they meet the conditions of the cointegration test. First, the long-term relationship between natural gas consumption and international oil price was analyzed by using the two-step cointegration test proposed by Engle and Grange. It uses the least square method for the first step regression, and the estimated results are shown in

Table 4.

In the second step, the unit root test was carried out for the fitting residual sequence

, and the ADF and PP test methods were selected. The results are shown in

Table 5. It can be seen that both test methods show that the residual is non-stationary, that is, there is no long-term stable cointegration relationship between China’s natural gas consumption and international oil prices.

This result is not consistent with many existing research conclusions. It is generally believed that there is a close substitutional relationship between natural gas and oil in production and consumption. The international oil price has a long-term impact on China’s natural gas consumption, so their series has a long-term cointegration relationship in theory. Through comparison, we found that much of the current research sample ranges were from up to the end of 2007. However, global political and economic events, such as the global financial crisis in 2008, the widespread exploitation of shale gas in 2015, and US sanctions against Iran in 2019, may have led to structural changes in the relationship between the two. Traditional cointegration testing methods cannot detect the cointegration relationship with regime shifts. Therefore, the accuracy of the above tests needs to be further verified.

5.2.2. Cointegration Test with Regime Shifts

This section uses the cointegration test method proposed by Gregory and Hansen (1996), considering the possibility of structural changes in the cointegration vector, using the following three models to test the cointegration relationship. Among them, and represent China’s natural gas consumption and international crude oil price, respectively. Here, “ln” represents the logarithmic processing of the data.

Level shift with trend (C/T):

Table 6 shows the test results under the three different models. The null hypothesis is that there is no cointegration relationship. It can be seen that the statistics of the C and C/T models significantly reject the null hypothesis at the level of 1%, and the C/S model rejects the null hypothesis at the level of 5%, which indicates that there is still a cointegration relationship between China’s natural gas consumption and crude oil price when considering the endogenous structure breakpoint.

By analyzing the location of the structural breakpoint, we have found that the cointegration relationship between natural gas consumption and the oil price has undergone two structural transformations at the end of 2008 and the beginning of 2015. Among them, the global financial crisis broke out in the second half of 2008. In November, the total foreign trade volume of China began to show a negative growth, which fell by 9% year on year. Since November 2008, the global financial crisis has had a substantial impact on China’s foreign trade. Taking 2008 as the boundary, the international energy market began to enter the post financial crisis era. At the beginning of 2015, the construction of the “the Belt and Road” stage entered a stage of pragmatic promotion. China’s natural gas price consolidation plan was promulgated and implemented, unifying the stock and incremental gas gate station price, comprehensively adjusting the price of natural gas for non-resident users, and attempting to liberalize prices of direct gas for customers. At the same time, the energy market began to form the three pillars of Organization of the Petroleum Exporting Countries (OPEC), the United States, and Russia. The driving mechanism between oil and natural gas has changed such that the market has undergone a structural adjustment. The international energy market has entered a new triangle era. The locations of structural change points determined by the model correspond precisely to the nodes of the changing times of the international energy market. According to the results of the cointegration test, we can infer that the relationship between China’s natural gas consumption and international oil price is affected by the global economic performance, the international energy situation, the degree of opening-up strategies, and the market-oriented reform of natural gas price in China.

According to the conclusion of the cointegration test with regime shifts, virtual variables were introduced to fit the above three models, and the results are shown in

Table 7.

In order to test the robustness of the model results, the Hatemi-J test of double structure mutation was used in this paper to verify and explain the different structure mutation points of the above three models. The test results are shown in

Table 8.

The results of the two methods are November 2008, January 2012, and March 2015. Among them, in January 2012, Guangdong Province and the Guangxi Autonomous Region became the pilots of natural gas price reform, adopting the market net return value to price natural gas for the first time. The price of natural gas has become an essential factor affecting the consumption of natural gas. After the two tests, we found that November 2008 was identified as the structural mutation point of the cointegration relationship between natural gas consumption and the crude oil price in China, and January 2012 and November 2015 were the potential structural mutation points.

According to the results of the cointegration test with regime shifts, we determined November 2008 as the structural mutation point, dividing all the samples into two subsamples, and adding control variables for regression. As the time series of variables are not stable, lnCN and lnPO are I (1) sequences, and lnCO are I (0) sequences, and the autoregressive-distributed lag model (ARDL) is used for regression in this paper. The results are shown in

Table 9. From 1998 to 2008, China’s natural gas consumption, international oil price and China’s oil consumption had a cointegration relationship, but after the structural change in 2008, the cointegration relationship was not significant, given that the natural gas price reform made the natural gas price become an essential factor that affects natural gas consumption since January 2012. The natural gas price (lnPN) was added into the model as a control variable to test the data after 2012. The results are shown in

Table 10. The inspection results are shown in

Table 11.

Before the structural change in 2008, the main effect of the international oil price on natural gas consumption was a substitution effect, that is to say, oil is the alternative energy of natural gas, and the rise of the international oil price will promote the consumption of natural gas. However, after the structural change in 2008, the long-term impact of the international oil price on China’s natural gas consumption is not significant. After 2012, the long-term impact of international oil price on China’s natural gas consumption changed from a positive impact to a negative impact. China’s natural gas consumption is greatly influenced by oil consumption and the natural gas price, while the international oil price has little influence on China’s natural gas consumption. The impact of other factors on the natural gas market has increased, while the impact of the international crude oil market has significantly weakened.

5.2.3. State Space Model

It can be seen from the results in the previous section, the relationship between China’s natural gas consumption and international oil prices is unfixed. Moreover, China’s natural gas consumption structure is becoming increasingly diversified. Therefore, this section focuses on the dynamic relationship between China’s natural gas consumption structure and international oil prices using a state space model, which can be expressed in the following forms:

where

y is the consumption of natural gas,

x is the international oil price,

i stands for types, and

t denotes time. Equation (4) is the measurement equation and Equation (5) is the state equation.

The consumption data of the four kinds of natural gas, i.e., urban gas, power generation gas, chemical gas and industrial fuel, and the international oil price data are respectively recorded as lncity, lnelectricity, lnchemistry, lnindustry, and LNP. First of all, the state space equations of the four kinds of natural gas consumption and international oil price were established to study the time-varying dynamic relationship and the structural characteristics between them. Then, the results were normalized to analyze the impact of the international oil price on China’s natural gas consumption structure.

Figure 3 shows that the time-varying dynamic relationship between various types of natural gas consumption in China and the international oil price is similar. Nevertheless, different types have their own unique characteristics. From 1998 to 2017, the elasticity of the four types of natural gas consumption to international oil prices decreased first, then increased during the global financial crisis in 2008, where the influence of the international oil price on the four types changed significantly and the elasticity of them fell suddenly and then rebounded rapidly. This feature is consistent with the time of the structural breakpoint detected. As new forms of natural gas consumption, urban gas and power generation gas are greatly affected by the change of oil price, among which the most massive change was found for power generation gas.

Figure 4 shows that the time-varying elasticity of generation gas and urban gas.

From 1998 to 2017, the elasticity of power generation gas to oil price experienced a tortuous process. China began to vigorously develop natural gas power generation in 2004. From 2004 to 2005, 60 sets of gas-steam combined cycle power generation projects were tendered successively in China. The increase of demand for natural gas in the power generation industry led to producers being more sensitive to the substitution relationship between oil and gas, and the impact of oil price on power generation gas increased. Therefore, the elasticity of power generation gas to oil price continued to increase from 2006 to 2008. After 2014, with nuclear power, wind power, solar energy, and other new energy power generation methods gradually coming into the public view, the growth rate of China’s gas-fired power generation installed capacity continued to decrease, and the increasing trend of the elasticity slowed down from then onwards.

The elasticity of urban gas to oil price has gradually decreased since 1998. After China began to import LNG in 2006, the absolute value of urban gas elasticity was lower than 0.03 from February 2006 to February 2007, during which the change of international oil price had little impact on the consumption of urban gas. While, the long-term LNG trade agreement entered into the “window period”, so that there was a limited supply phenomenon in China in 2016, and the elasticity of the urban gas to oil price started to increase. Residential gas and LNG vehicle gas are the main components of China’s urban gas. Demand for residential gas is rigid, while the LNG vehicle gas demand has large elasticity, which is easily affected by the changes in international oil prices. It is quite common to use natural gas as vehicle fuel in developed countries. As a vehicle fuel, LNG has significant economic and social benefits due to its mature technology, clean emission, and low fuel cost. However, it also has disadvantages, such as the high purchase cost and difficulty of fuel supply. In the period of tight natural gas supply, consumers are sensitive to the substitution relationship between oil and gas, and the guiding ability of oil price to natural gas is further strengthened. While in the case of the excess supply of natural gas, restricted by conversion technology, it is difficult for natural gas to replace the consumption of oil products further. At this time, the impact of oil price changes on urban gas is significantly weakened.

Industrial gas consumption is greatly affected by environmental protection policies, while chemical gas consumption is mainly influenced by coal and other alternative energy prices. As the main consumption form of natural gas, they are less affected by the change of oil price.

- 2.

The influence of oil price on the consumption structure of natural gas:

According to

Figure 5, we can see that the change of oil price has the most significant impact on China’s power generation gas and urban gas consumption, and the contribution of them to the change of China’s natural gas consumption is the highest. Among the changes in natural gas consumption caused by international oil prices, the total proportion of power generation gas and urban gas can reach 70%. It is worth noting that the proportion of power generation gas exceeded 40% before 2006, although it has declined and continued to be less than 40% after 2008, where it still ranks first among the four types of natural gas consumption. The contribution of industrial gas and chemical gas to the change of China’s natural gas consumption is relatively low, which accounts for about 30% of the change caused by the international oil price. The consumption of these two types of natural gas is more stable and less affected by the change in oil price.