Sustainability of Energy-Induced Growth Nexus in Brazil: Do Carbon Emissions and Urbanization Matter?

Abstract

:1. Introduction

2. Literature Review

2.1. Economic Growth and CO2 Emission Relationship

2.2. Economic Growth and Energy Consumption Relationship

2.3. Economic Growth and Trade Openness Relationship

2.4. Economic Growth and Urbanization Relationship

2.5. Theoretical Framework

3. Data and Methodology

3.1. Data

3.2. Methodology

3.2.1. Unit Root Test

3.2.2. Maki Co-Integration Test

3.2.3. ARDL Approach

3.2.4. Fully Modified Ordinary Least Square (FMOLS) and Dynamic ordinary least square DOLS Long-Run Estimators

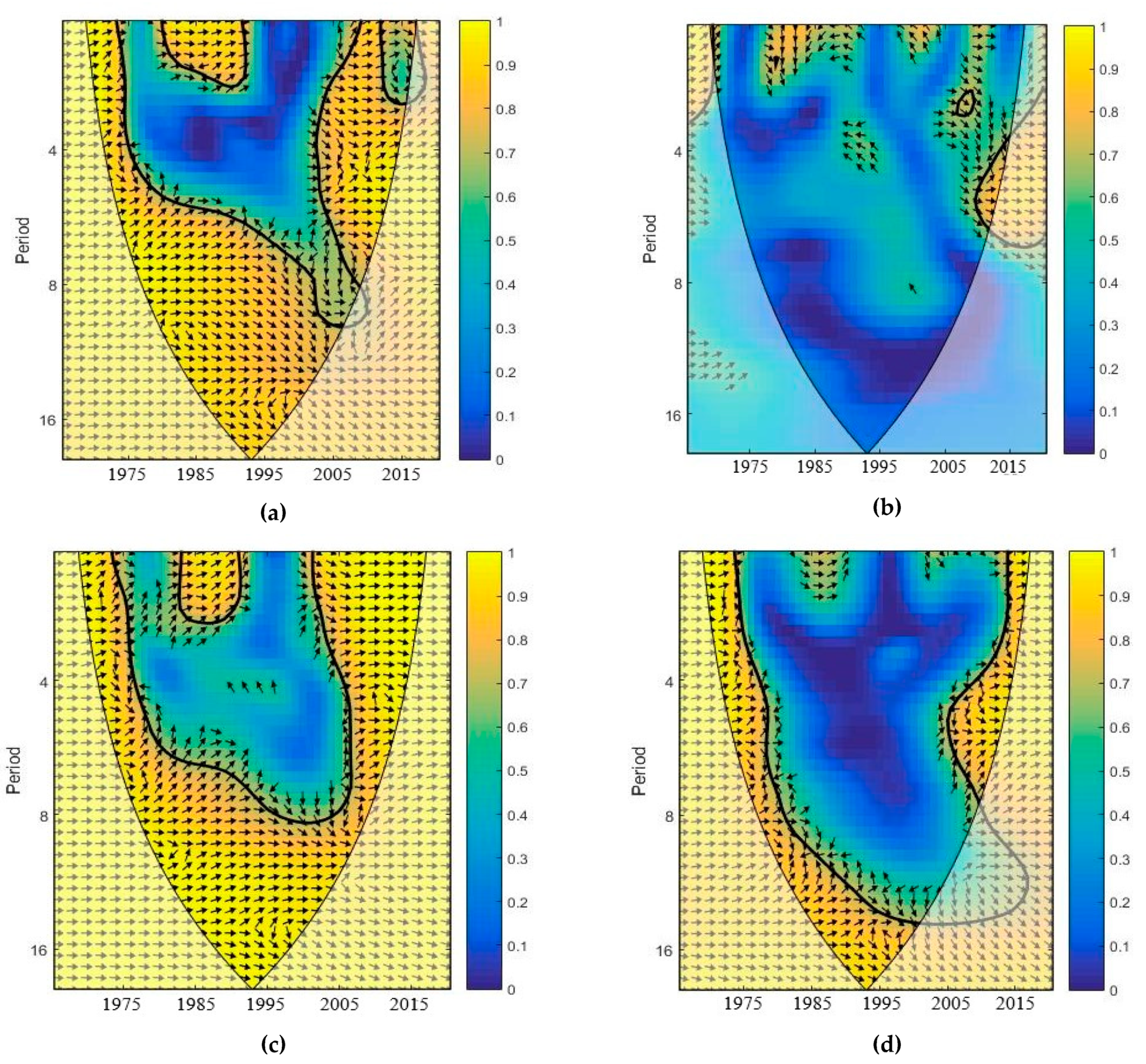

3.2.5. Wavelet Approach

3.2.6. Gradual Shift Causality

4. Findings and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| Acronyms | |

| ADF | Augmented Dickey-Fuller |

| ARDL | Autoregressive Distributed Lag |

| BRICS | Brazil, Russia, India, China, and South Africa |

| CO2 | Carbon Dioxide |

| COP21 | UN Climate Change Conference in Paris |

| DOLS | Dynamic Ordinary Least Square |

| EKC | Environmental Kuznets Curve |

| EN | Energy Consumption |

| FMOLS | Fully Modified Ordinary Least Squares |

| GDP | Economic Growth |

| GHGs | Greenhouse Gas Emissions |

| GMM | Generalized Method of Moments |

| IEA | International Energy Agency |

| OECD | The Organization for Economic Co-operation and Development |

| PMG-ARDL | Pooled Mean Group Autoregressive Distributed Lag |

| PP | Phillips-Perron |

| R&D | Research and Development |

| TY | Toda and Yamamoto |

| UAE | United Arab Emirates |

| VAR | Vector Autoregression |

| ZA | Zivot and Andrews |

| Symbols | |

| Coefficient of the Regressors | |

| Speed of adjustment | |

| Error term | |

| Null hypothesis | |

| Alternative hypothesis | |

References

- Rjoub, H.; Odugbesan, J.A.; Adebayo, T.S.; Wong, W.K. Sustainability of the Moderating Role of Financial Development in the Determinants of Environmental Degradation: Evidence from Turkey. Sustainability 2021, 13, 1844. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Kirikkaleli, D. Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: Application of wavelet tools. Environ. Dev. Sustain. 2021, 1–26. [Google Scholar] [CrossRef]

- Cioca, L.I.; Ivascu, L.; Rada, E.C.; Torretta, V.; Ionescu, G. Sustainable development and technological impact on CO2 reducing conditions in Romania. Sustainability 2015, 7, 1637–1650. [Google Scholar] [CrossRef] [Green Version]

- Stern, N.H.; Peters, S.; Bakhshi, V.; Bowen, A.; Cameron, C.; Catovsky, S.; Zenghelis, D. Stern Review: The Economics of Climate Change; Cambridge University Press: Cambridge, UK, 2006; Volume 30, p. 2006. [Google Scholar]

- EIA U Energy Information Administration. International Energy Outlook. US Department of Energy. Available online: https://www.iea.org/countries/brazil (accessed on 1 March 2021).

- Nathaniel, S.P.; Bekun, F.V. Electricity consumption, urbanization, and economic growth in Nigeria: New insights from combined cointegration amidst structural breaks. J. Public Aff. 2021, 21, e2102. [Google Scholar] [CrossRef] [Green Version]

- Adebayo, T.S.; Odugbesan, J.A. Modeling CO2 emissions in South Africa: Empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ. Sci. Pollut. Res. 2020, 28, 9377–9389. [Google Scholar] [CrossRef] [PubMed]

- Kirikkaleli, D.; Adebayo, T.S. Do public-private partnerships in energy and renewable energy consumption matter for consumption-based carbon dioxide emissions in India? Environ. Sci. Pollut. Res. 2021, 1–14. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Rjoub, H. Relationship among Economic Growth, Energy Consumption, CO2 Emission, and Urbanization: Evidence from MINT Countries. SAGE Open 2020, 10, 2158244020914648. [Google Scholar] [CrossRef] [Green Version]

- World Bank World Development Indicators. Available online: http://data.worldbank.org/ (accessed on 1 March 2021).

- Carbonbrief. Available online: https://www.carbonbrief.org/the-carbon-brief-profile-brazil (accessed on 1 March 2021).

- BP. British Petroleum. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 1 March 2021).

- Dias, J. Climate Politics: Contemporary Trend to Achieve Energy Security and Environment Sustainability–Case Studies of INDIA and BRAZIL (1972 to 2018). East. Afr. J. 2019, 2, 22–31. [Google Scholar]

- Malefane, M.R.; Odhiambo, N.M. Trade Openness and Economic Growth: Empirical Evidence from Lesotho. Glob. Bus. Rev. 2019. [Google Scholar] [CrossRef]

- Iyoha, M.; Okim, A. The impact of trade on economic growth in ECOWAS countries: Evidence from panel data. CBNJ Appl. Stat. 2017, 8, 23–49. [Google Scholar]

- Adhikary, B.K. FDI, Trade Openness, Capital Formation, and Economic Growth in Bangladesh: A Linkage Analysis. Int. J. Bus. Manag. 2010, 6, 16. [Google Scholar] [CrossRef]

- Buhari, D.Ğ.A.; Lorente, D.B.; Nasir, M.A. European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. J. Environ. Manag. 2020, 273, 111146. [Google Scholar]

- Abbott, J. Green Infrastructure for Sustainable Urban.Development in Africa; Routledge: London, UK, 2013. [Google Scholar]

- Bouznit, M.; Pablo-Romero, M.D.P. CO2 emission and economic growth in Algeria. Energy Policy 2016, 96, 93–104. [Google Scholar] [CrossRef]

- Lacheheb, M.; Rahim, A.S.A.; Sirag, A. Economic growth and CO2 emissions: Investigating the environmental Kuznets curve hypothesis in Algeria. Int. J. Energy Econ. Policy 2015, 5, 4. [Google Scholar]

- Bastola, U.; Sapkota, P. Relationships among energy consumption, pollution emission, and economic growth in Nepal. Energy 2015, 80, 254–262. [Google Scholar] [CrossRef]

- Aye, G.C.; Edoja, P.E. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Financ. 2017, 5, 1379239. [Google Scholar] [CrossRef]

- Gorus, M.S.; Aydin, M. The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: Causality analysis in the frequency domain. Energy 2019, 168, 815–822. [Google Scholar] [CrossRef]

- Wang, S.; Li, Q.; Fang, C.; Zhou, C. The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci. Total. Environ. 2016, 542, 360–371. [Google Scholar] [CrossRef]

- Muhammad, B. Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy 2019, 179, 232–245. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S. Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 2020, 4, 23–36. [Google Scholar] [CrossRef]

- He, X.; Adebayo, T.S.; Kirikkaleli, D.; Umar, M. Analysis of Dual Adjustment Approach: Consumption-Based Carbon Emissions in Mexico. Sustain. Prod. Consum. 2021, 27, 947–957. [Google Scholar] [CrossRef]

- Khobai, H.; Le Roux, P. The relationship between energy consumption, economic growth and carbon dioxide emission: The case of South Africa. Int. J. Energy Econ. Policy 2017, 7, 102–109. [Google Scholar]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2018, 81, 2002–2010. [Google Scholar] [CrossRef] [Green Version]

- Awosusi, A.A.; Adebayo, T.S.; Kirikkaleli, D.; Akinsola, G.D.; Mwamba, M.N. Can CO2 emissiovns and energy consumption determine the economic performance of South Korea? A time series analysis. Environ. Sci. Pollut. Res. 2021, 1–16. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Kalmaz, D.B. Determinants of CO2 emissions: Empirical evidence from Egypt. Environ. Ecol. Stat. 2021, 1–24. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Mikayilov, J.I.; Galeotti, M.; Hasanov, F.J. The impact of economic growth on CO2 emissions in Azerbaijan. J. Clean. Prod. 2018, 197, 1558–1572. [Google Scholar] [CrossRef]

- Saidi, K.; Hammami, S. The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep. 2015, 1, 62–70. [Google Scholar] [CrossRef] [Green Version]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Z.; Kirikkaleli, D.; Adebayo, T.S.; Adeshola, I.; Akinsola, G.D. Modelling CO2 emissions in Malaysia: An application of Maki cointegration and wavelet coherence tests. Environ. Sci. Pollut. Res. 2021, 1–15. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Gumede, M.I.; Bekun, F.V.; Etokakpan, M.U.; Balsalobre-Lorente, D. Modelling coal rent, economic growth and CO2 emissions: Does regulatory quality matter in BRICS economies? Sci. Total Environ. 2020, 710, 136284. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef] [Green Version]

- Chen, P.Y.; Chen, S.T.; Hsu, C.S.; Chen, C.C. Modelling the global relationships among economic growth, energy consumption and CO2 emissions. Renew. Sustain. Energy Rev. 2016, 65, 420–431. [Google Scholar] [CrossRef]

- Ahmad, N.; Du, L. Effects of energy production and CO2 emissions on economic growth in Iran: ARDL approach. Energy 2017, 123, 521–537. [Google Scholar] [CrossRef]

- Aslan, A.; OğuzÖCA, L.; Shahbaz, M. Energy Consumption–Trade Openness–Economic Growth Nexus in G-8 Countries. Kapadokya Akad. 2017, 1, 71–97. [Google Scholar]

- Gökmenoğlu, K.; Taspinar, N. The relationship between CO2 emissions, energy consumption, economic growth and FDI: The case of Turkey. J. Int. Trade Econ. Dev. 2015, 25, 706–723. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Lu, Z. Energy consumption and economic growth: New evidence from the OECD countries. Energy 2018, 153, 27–34. [Google Scholar] [CrossRef] [Green Version]

- Baz, K.; Xu, D.; Ampofo, G.M.K.; Ali, I.; Khan, I.; Cheng, J.; Ali, H. Energy consumption and economic growth nexus: New evidence from Pakistan using asymmetric analysis. Energy 2019, 189, 116254. [Google Scholar] [CrossRef]

- Le, H.P. The energy-growth nexus revisited: The role of financial development, institutions, government expenditure and trade openness. Heliyon 2020, 6, e04369. [Google Scholar] [CrossRef]

- Raghutla, C. The effect of trade openness on economic growth: Some empirical evidence from emerging market economies. J. Public Aff. 2020, 20, e2081. [Google Scholar] [CrossRef]

- Ahmed, K. Revisiting the role of financial development for energy-growth-trade nexus in BRICS economies. Energy 2017, 128, 487–495. [Google Scholar] [CrossRef]

- Kumari, D.; Malhotra, N. Export-led growth in India: Cointegration and causality analysis. J. Econ. Dev. Stud. 2014, 2, 297–310. [Google Scholar]

- Egoro, S.; Obah, O.D. The impact of international trade on economic growth in Nigeria: An econometric analysis. Asian Financ. Bank. Rev. 2017, 1, 28–47. [Google Scholar] [CrossRef]

- Coulibaly, R.G. International trade and economic growth: The role of institutional factors and ethnic diversity in sub-Saharan Africa. Int. J. Finance Econ. 2021. [Google Scholar] [CrossRef]

- Amna Intisar, R.; Yaseen, M.R.; Kousar, R.; Usman, M.; Makhdum, M.S.A. Impact of trade openness and human capital on economic growth: A comparative investigation of Asian countries. Sustainability 2020, 12, 2930. [Google Scholar] [CrossRef] [Green Version]

- Zheng, W.; Walsh, P.P. Economic growth, urbanization and energy consumption—A provincial level analysis of China. Energy Econ. 2019, 80, 153–162. [Google Scholar] [CrossRef]

- Ali, H.S.; Nathaniel, S.P.; Uzuner, G.; Bekun, F.V.; Sarkodie, S.A. Trivariatemodelling of the nexus between electricity consumption, urbanization and economic growth in Nigeria: Fresh insights from Maki Cointegration and causality tests. Heliyon 2020, 6, e03400. [Google Scholar] [CrossRef]

- Bakirtas, T.; Akpolat, A.G. The relationship between energy consumption, urbanization, and economic growth in new emerging-market countries. Energy 2018, 147, 110–121. [Google Scholar] [CrossRef]

- Nguyen, H.M. The relationship between urbanization and economic growth: An empirical study on ASEAN countries. Int. J. Soc. Econ. 2018, 45, 316–339. [Google Scholar] [CrossRef]

- Šatrović, E.; Dağ, M. Energy consumption, urbanization and economic growth relationship: An examination on OECD countries. Dicle Üniversitesi Sosyal Bilimler Enstitüsü Dergisi 2019, 11, 315–324. [Google Scholar]

- Liddle, B.; Messinis, G. Which comes first—Urbanization or economic growth? Evidence from heterogeneous panel causality tests. Appl. Econ. Lett. 2014, 22, 349–355. [Google Scholar] [CrossRef]

- Solarin, S.A.; Shahbaz, M.; Shahzad, S.J.H. Revisiting the electricity consumption-economic growth nexus in Angola: The role of exports, imports and urbanization. Int. J. Energy Econ. Policy 2016, 6, 501–512. [Google Scholar]

- Kuznets, S.; Murphy, J.T. Modern Economic Growth: Rate, Structure, and Spread; Yale University Press: New Haven, CT, USA, 1966; Volume 2. [Google Scholar]

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development; International Labour Organization: Geneva, Switzerland, 1993; No. 992927783402676. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Environmental impacts of a North. In American Free Trade Agreement; (No. w3914); National Bureau of Economic Research: Cambridge, MA, USA, 1991; Available online: https://www.nber.org/system/files/working_papers/w3914/w3914.pdf (accessed on 24 January 2021).

- Shafik, N.; Bandyopadhyay, S. Economic Growth and Environmental Quality: Time-Series and Cross-Country Evidence; World Bank Publications: Berlin, Germany, 1992; Volume 904. [Google Scholar]

- Bekun, F.V.; Agboola, M.O.; Joshua, U. Fresh Insight into the EKC Hypothesis in Nigeria: Accounting for Total Natural. In Econometrics of Green Energy Handbook: Economic and Technological Development; Springer: Berlin, Germany, 2020; p. 221. [Google Scholar]

- Udemba, E.N.; Güngör, H.; Bekun, F.V.; Kirikkaleli, D. Economic performance of India amidst high CO2 emissions. Sustain. Prod. Consum. 2021, 27, 52–60. [Google Scholar] [CrossRef]

- Udemba, E.N.; Magazzino, C.; Bekun, F.V. Modeling the nexus between pollutant emission, energy consumption, foreign direct investment, and economic growth: New insights from China. Environ. Sci. Pollut. Res. 2020, 27, 17831–17842. [Google Scholar] [CrossRef]

- Bekun, F.V.; Agboola, M.O. Electricity Consumption and Economic Growth Nexus: Evidence from Maki Cointegration. Eng. Econ. 2019, 30, 14–23. [Google Scholar] [CrossRef] [Green Version]

- Alam, M.J.; Begum, I.A.; Buysse, J.; Van Huylenbroeck, G. Energy consumption, carbon emissions and economic growth nexus in Bangladesh: Cointegration and dynamic causality analysis. Energy Policy 2012, 45, 217–225. [Google Scholar] [CrossRef]

- Alam, K.J.; Sumon, K.K. Causal relationship between trade openness and economic growth: A panel data analysis of asian countries. Int. J. Econ. Financ. Issues 2020, 10, 118–126. [Google Scholar] [CrossRef] [Green Version]

- Kong, Q.; Peng, D.; Ni, Y.; Jiang, X.; Wang, Z. Trade openness and economic growth quality of China: Empirical analysis using ARDL model. Finance Res. Lett. 2021, 38, 101488. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Hatemi, J.A. Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empir. Econ. 2008, 35, 497–505. [Google Scholar] [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-based tests for cointegration in models with regime shifts. J. Econ. 1996, 70, 99–126. [Google Scholar] [CrossRef] [Green Version]

- Maki, D. Tests for cointegration allowing for an unknown number of breaks. Econ. Model. 2012, 29, 2011–2015. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Rjoub, H. Evaluating HIV/Aids prevalence and sustainable development in sub-Saharan Africa: The role of health expenditure. Afr. Health Sci. 2020, 20, 568–578. [Google Scholar] [CrossRef]

- Odugbesan, J.A. The causal relationship between economic growth and remittance in mint countries: An ardl bounds testing approach to cointegration. J. Acad. Res. Econ. 2019, 11, 310–329. [Google Scholar]

- Narayan, P.K. Fiji’s tourism demand: The ARDLapproach to cointegration. Tour. Econ. 2004, 10, 193–206. [Google Scholar] [CrossRef]

- Ayobamiji, A.A.; Kalmaz, D.B. Reinvestigating the determinants of environmental degradation in Nigeria. Int. J. Econ. Policy Emerg. Econ. 2020, 13, 52–71. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Timmermann, A. Small sample properties of forecasts from autoregressive models under structural breaks. J. Econ. 2005, 129, 183–217. [Google Scholar] [CrossRef] [Green Version]

- Narayan, P.K.; Narayan, S. Estimating income and price elasticities of imports for Fiji in a cointegration framework. Econ. Model. 2005, 22, 423–438. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Hansen, B.E. Statistical Inference in Instrumental Variables Regression with I(1) Processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. A Simple Estimator of Cointegrating Vectors in Higher Order Integrated Systems. Econometrica 1993, 61, 783. [Google Scholar] [CrossRef]

- Goupillaud, P.; Grossmann, A.; Morlet, J. Cycle-octave and related transforms in seismic signal analysis. Geoexploration 1984, 23, 85–102. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Akinsola, G.D.; Odugbesan, J.A.; Olanrewaju, V.O. Determinants of Environmental Degradation in Thailand: Empirical Evidence from ARDL and Wavelet Coherence Approaches. Pollution 2021, 7, 181–196. [Google Scholar]

- Torrence, C.; Compo, G.P. A practical guide to wavelet analysis. Bull. Am. Meteorol. Soc. 1998, 79, 61–78. [Google Scholar] [CrossRef] [Green Version]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector autoregressions with possibly integrated processes. J. Econ. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef] [Green Version]

- Enders, W.; Lee, J. A Unit Root Test Using a Fourier Series to Approximate Smooth Break. Oxf. Bull. Econ. Stat. 2011, 74, 574–599. [Google Scholar] [CrossRef] [Green Version]

- Enders, W.; Jones, P. Grain prices, oil prices, and multiple smooth breaks in a VAR. Stud. Nonlinear Dyn. Econ. 2016, 20, 399–419. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Gormus, N.A.; Soytas, U. Oil prices and real estate investment trusts (REITs): Gradual-shift causality and volatility transmission analysis. Energy Econ. 2016, 60, 168–175. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Shabbir, M.S. Environmental Kuznets Curve hypothesis in Pakistan: Cointegration and Granger causality. Renew. Sustain. Energy Rev. 2012, 16, 2947–2953. [Google Scholar] [CrossRef] [Green Version]

- Adebayo, T.S. Revisiting the EKC hypothesis in an emerging market: An application of ARDL-based bounds and wavelet coherence approaches. SN Appl. Sci. 2020, 2, 1–15. [Google Scholar] [CrossRef]

- Hossain, S. An Econometric Analysis for CO2 Emissions, Energy Consumption, Economic Growth, Foreign Trade and Urbanization of Japan. Low Carbon Econ. 2012, 3, 92–105. [Google Scholar] [CrossRef] [Green Version]

| Investigator (s) | Timeframe | Nation (s) | Technique(s) | Outcomes |

|---|---|---|---|---|

| GDP, CO2, and EC | ||||

| Acheampong [32] | 1990–2014 | 116 nations | PVAR and GMM | CO2 → GDP (−) |

| Adebayo and Odugbesan (2020) | 1971–2016 | South Africa | ARDL and WC | CO2 → GDP (+) |

| Adebayo et al. [7] | 1980–2018 | MINT economies | PARDL and Panel Granger causality | CO2 ≠ GDP |

| Adedoyin et al. [37] | 1990–2014 | BRICS | PARDL | CO2 → GDP (+) |

| Ahmad and Du [40] | 1971–2011 | Iran | ARDL | CO2 → GDP (+) EC → GDP (+) |

| Aye andEdoja [22] | 1971–2013 | 31 developing economies. | DPTM | CO2 → GDP (−) |

| BastolaandSapkota [21] | 1980–2011 | Nepal | ARDL | CO2 → GDP (+) |

| Begum et al. [35] | 1980–2009 | Malaysia | Multivariate approach | CO2 → GDP (+) |

| Bouznitand Pablo-Romero [19] | 1970–2010 | Algeria | ARDL | CO2 → GDP (+) EC → GDP |

| Baz et al. [44] | 1971–2014 | Pakistan | NARDL | EC → GDP (+) |

| Chen et al. [39] | 1993–2010 | 188 countries | VECM | EC → GDP (−) |

| GökmenoğluandTaspinar [42] | 1974–2010 | Turkey | T-Y | CO2 → GDP |

| GorusandAydin [23]) | 1975–2014 | 8 oil-rich MENA | Panel causality | CO2 ≠ GDP |

| Gozgor et al. [43] | 1990–2013 | OECD countries | PARDL | EC → GDP (+) |

| Khobaiand Le Roux [28] | 1971–2013 | South Africa | VECM | CO2 → GDP (+) EC ↔ GDP |

| Lacheheb et al. (2015) | 1971–2009 | Algeria | ARDL | CO2 → GDP (+) |

| Le [20] | 1990–2014 | 46 developing nations | Panel causality | EC ↔ GDP |

| Mikayilov et al. [33] | 1992–2013 | Azerbaijan | Multivariate approach | CO2 → GDP (+) |

| Muhammad [25] | 2001–2017 | MENA | GMM | EC → GDP (−) CO2 → GDP (+) |

| SaidiandHammami [34] | 1990–2012 | 58 countries | GMM | CO2 → GDP (+) |

| Salahuddin et al. [29] | 1980–2013 | Kuwait | ARDL and VECM | GDP → CO2 |

| Wang et al. [24] | 1990–2017 | China | VECM | CO2 ≠ GDP |

| Zhang et al. [36] | 1960–2018 | Malaysia | MC, T-Y, and Fourier T-Y | GDP → CO2 |

| GDP and Trade Openness | ||||

| Adhikary [15] | 1986–2008 | Bangladesh | VECM | TR → GDP (−) |

| Ahmed [47] | 1991–2013 | BRICS | Panel VECM Granger causality | GDP → TR |

| Coulibaly [50] | 1980–2017 | 44 sub-Saharan Africa | PARDL | TR → GDP (+) |

| EgoroandObah [49] | 1981–2015 | Nigeria | OLS | TR → GDP (+) |

| IyohaandOkim [16] | 1990–2013 | ECOWAS | POLS, fixed and Random effect model | TR → GDP (+) |

| KumariandMalhotra [48] | 1980–2012 | India | Granger causality | TR ↔GDP (+) |

| MalefaneandOdhiambo [14] | 1979–2013 | Lesotho | ARDL | TR ≠ GDP |

| Raghutla [46] | 1993–2016 | Emerging economies | Panel Granger causality | GDP → TR |

| GDP and Urban | ||||

| Ali et al. [53] | 1971–2014 | Nigeria | FMOLS, CCR and VECM causality | URB → GDP (−) |

| Nathaniel andBekun [6] | 1971–2014 | Nigeria | FMOLS, DOLS, CCR and VECM causality | URB↔GDP (−) |

| Nguyen [55] | 1971–2014 | ASEAN | PMG and D-GMM | URB → GDP(+) |

| Zhengand Walsh [52] | 2001–2012 | 29 provinces in China | FE and GMM | URB → GDP (+) |

| ŠatrovićandDağ [56] | 1996–2015 | 34 OECD | PVAR | URB → GDP (+) |

| Variable | Description | Units | Sources |

|---|---|---|---|

| CO2 | Environmental Sustainability | Metric Tonnes Per Capita | British Petroleum |

| Energy Consumed | Energy consumption per capita (kWh) | ||

| Economic Growth | GDP Per Capita Constant $US, 2010 | World Development Indicators | |

| Trade Openness | Trade % of GDP | ||

| URB | Urbanization | Urban Population |

| GDP | CO2 | EN | TR | URB | |

|---|---|---|---|---|---|

| Mean | 3.902783 | 0.192920 | 3.995030 | 1.288434 | 8.022385 |

| Median | 3.921660 | 0.186635 | 4.020799 | 1.286297 | 8.065876 |

| Maximum | 4.078945 | 0.420169 | 4.230180 | 1.472438 | 8.263024 |

| Minimum | 3.567361 | −0.169761 | 3.509201 | 1.062128 | 7.628913 |

| Std. Dev. | 0.131563 | 0.136254 | 0.194313 | 0.112608 | 0.191576 |

| Skewness | −1.041734 | −0.680209 | −1.008270 | −0.026551 | −0.516989 |

| Kurtosis | 3.635868 | 3.304426 | 3.253316 | 1.836478 | 1.999171 |

| Jarque-Bera | 10.87433 | 4.453654 | 9.465971 | 3.108883 | 4.745509 |

| Probability | 0.004352 | 0.107870 | 0.008800 | 0.211307 | 0.093224 |

| Obs | 55 | 55 | 55 | 55 | 55 |

| At Level I(0) | First Difference I(1) | |||

|---|---|---|---|---|

| I and T | Break−Time | I and T | Break−Time | |

| GDP | −6.352 *** | 2008 | −5.654 ** | 2004 |

| CO2 | −4.250 | 2005 | −6.512 * | 2011 |

| EC | −6.744 * | 1997 | −7.604 * | 2003 |

| TO | −4.543 | 2001 | −6.261 * | 2000 |

| URB | −4.136 | 2010 | −6.326 * | 2010 |

| T−Statistics | Critical Values | ||

|---|---|---|---|

| Model | 5% | Break−Years | |

| Trend and Regime shifts | |||

| GDP = f(CO2, EC, URB, TO) | −7.0670 * | −6.911 | 1997 |

| GDP = f(CO2, EC, URB, TO) | −8.67253 * | −7.638 | 1997, 1978 |

| GDP = f(CO2, EC, URB, TO) | −8.67253 * | −8.254 | 1997, 1978, 1989 |

| GDP = f(CO2, EC, URB, TO) | −11.8168 * | −8.871 | 1997, 1978, 1989, 2008 |

| GDP = f(CO2, EC, URB, TO) | −11.81687 * | −9.482 | 1997, 1978, 1989, 2008, 1971 |

| Model Estimated | Lag Length | F-Statistics | Cointegration |

|---|---|---|---|

| GDP = f(CO2, EC, URB, TO) | (2, 2, 0, 2, 0) | 6.59 * | Yes |

| Significant Level | L-B I(0) | U-B I(1) | |

| 0.05 | 3.25 | 4.49 | |

| 0.1 | 3.74 | 5.06 |

| FMOLS | DOLS | |||||

|---|---|---|---|---|---|---|

| Variables | Coefficient | t-Statistic | Probability | Coefficient | t-Statistic | Probability |

| EN | 0.4610 * | 4.5840 | 0.000 | 0.4798 * | 3.7096 | 0.000 |

| CO2 | 0.2472 * | 3.6116 | 0.000 | 0.2682 * | 2.9964 | 0.004 |

| TR | 0.0135 | 0.6778 | 0.501 | 0.0182 | 0.6772 | 0.501 |

| URB | 1.1039 ** | 1.7735 | 0.083 | 1.0044 ** | 2.4196 | 0.019 |

| R2 | 0.98 | 0.98 | ||||

| Adj R2 | 0.97 | 0.97 | ||||

| S.E. of regression | 0.0086 | 0.009 | ||||

| Causality Path | Wald-Stat | No of Fourier | p-Value | Decision |

|---|---|---|---|---|

| GDP → EN | 11.91722 | 3 | 0.1033 | Do not Reject Ho |

| EN → GDP | 22.35976 | 3 | 0.0022 * | Reject Ho |

| GDP → URB | 3.883241 | 2 | 0.7931 | Do not Reject Ho |

| URB → GDP | 14.18274 | 2 | 0.0480 ** | Reject Ho |

| GDP → TR | 6.418874 | 3 | 0.4917 | Do not Reject Ho |

| TR → GDP | 18.18920 | 3 | 0.0111 ** | Reject Ho |

| CO2 → GDP | 21.42625 | 3 | 0.0031 * | Reject Ho |

| GDP → CO2 | 3.600954 | 3 | 0.8244 | Do not Reject Ho |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adebayo, T.S.; Awosusi, A.A.; Odugbesan, J.A.; Akinsola, G.D.; Wong, W.-K.; Rjoub, H. Sustainability of Energy-Induced Growth Nexus in Brazil: Do Carbon Emissions and Urbanization Matter? Sustainability 2021, 13, 4371. https://0-doi-org.brum.beds.ac.uk/10.3390/su13084371

Adebayo TS, Awosusi AA, Odugbesan JA, Akinsola GD, Wong W-K, Rjoub H. Sustainability of Energy-Induced Growth Nexus in Brazil: Do Carbon Emissions and Urbanization Matter? Sustainability. 2021; 13(8):4371. https://0-doi-org.brum.beds.ac.uk/10.3390/su13084371

Chicago/Turabian StyleAdebayo, Tomiwa Sunday, Abraham Ayobamiji Awosusi, Jamiu Adetola Odugbesan, Gbenga Daniel Akinsola, Wing-Keung Wong, and Husam Rjoub. 2021. "Sustainability of Energy-Induced Growth Nexus in Brazil: Do Carbon Emissions and Urbanization Matter?" Sustainability 13, no. 8: 4371. https://0-doi-org.brum.beds.ac.uk/10.3390/su13084371