Why the Par Value of Share Matters to Investors

Abstract

:1. Introduction

2. Literature Review and Research Hypotheses

2.1. Background

2.2. Hypotheses

3. Sample Description and Research Methods

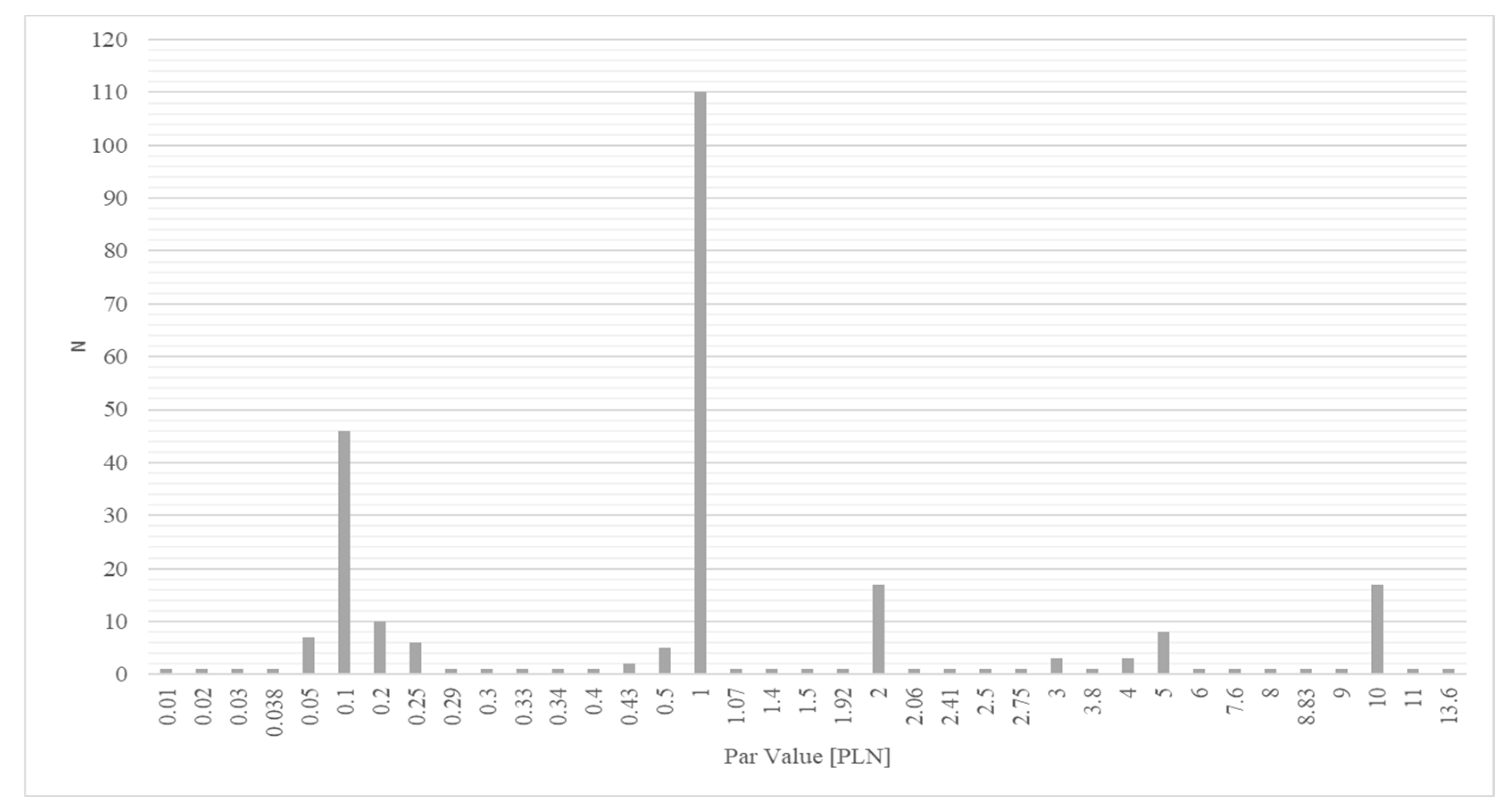

3.1. Sample

- Financial institutions (e.g., banks and insurance companies);

- IPOs which were not connected with new common stock issuance;

- IPOs for which data were incomplete.

3.2. Research Methods

- Profitability: return on equity (ROE);

- Asset productivity: sales-to-assets ratio (S/A);

- Leverage: debt ratio (D/A) and the shareholder equity-to-fixed assets ratio (E/FA);

- Liquidity: cash ratio (CR);

- Market timing: Warsaw Stock Exchange WIG Index (WIG);

- Number of shares issued: natural logarithm of number of shares issued (Ln(NrSh));

- Size: natural logarithm of total assets (Ln(Assets));

- Accounting characteristics of the shares: natural logarithm of PaV (Ln(PaV)) and natural logarithm of book value of shares (Ln(BV));

- Sector of the economy: 12 sectors (Sector) were distinguished and assigned numbers from 1 to 12, respectively: architecture, trade, information technology and telecommunications, chemical and pharmaceutical industry, metal industry, raw material industry, light industry, power engineering, food industry, non-financial services and financial services, media;

- To test the signaling function of share capital, the ratio of share capital in equity (SC/E) was used. (Note: SC/E was also used as a dependent variable.)

4. Results and Discussion

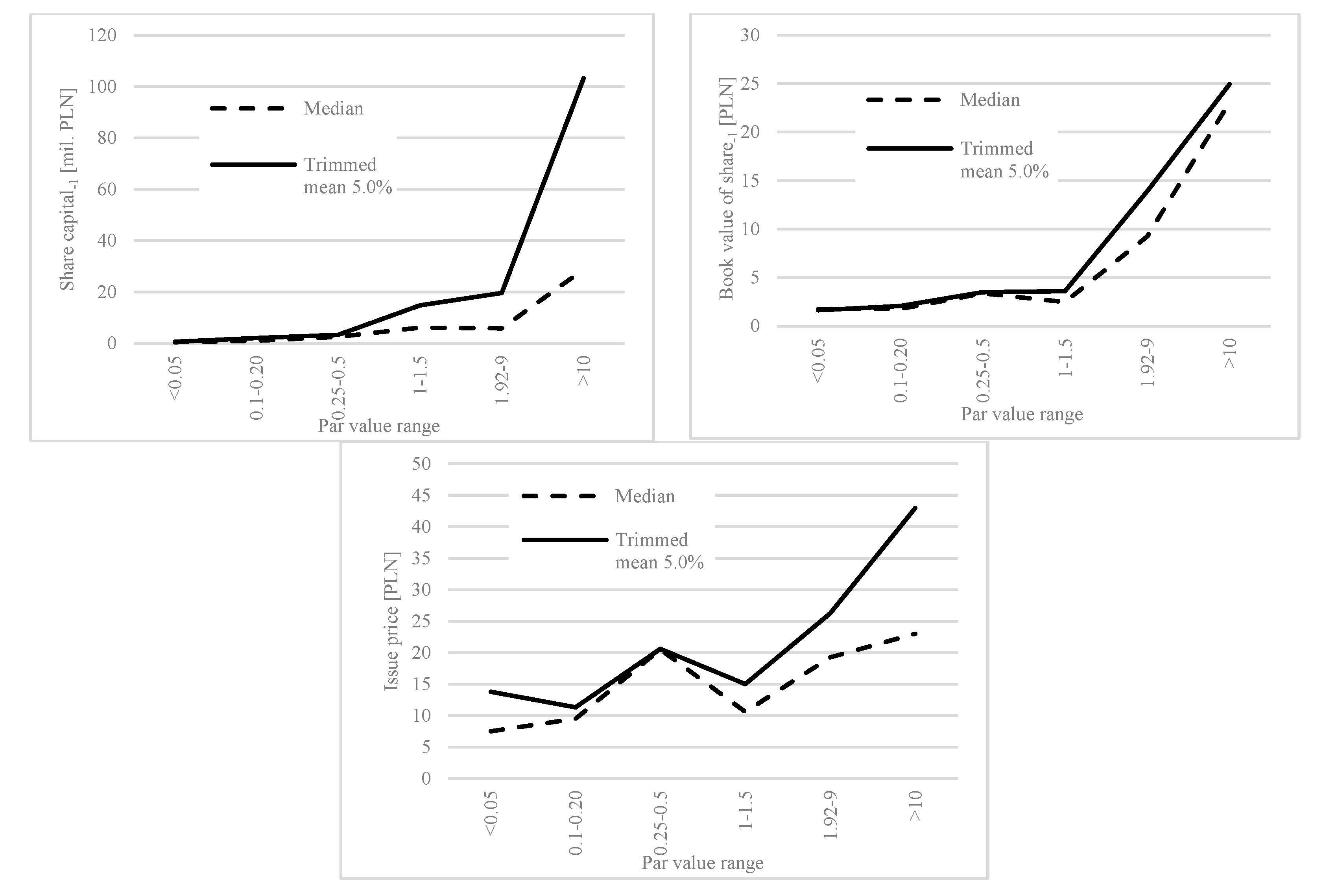

4.1. Analysis of the First-Degree Parameters

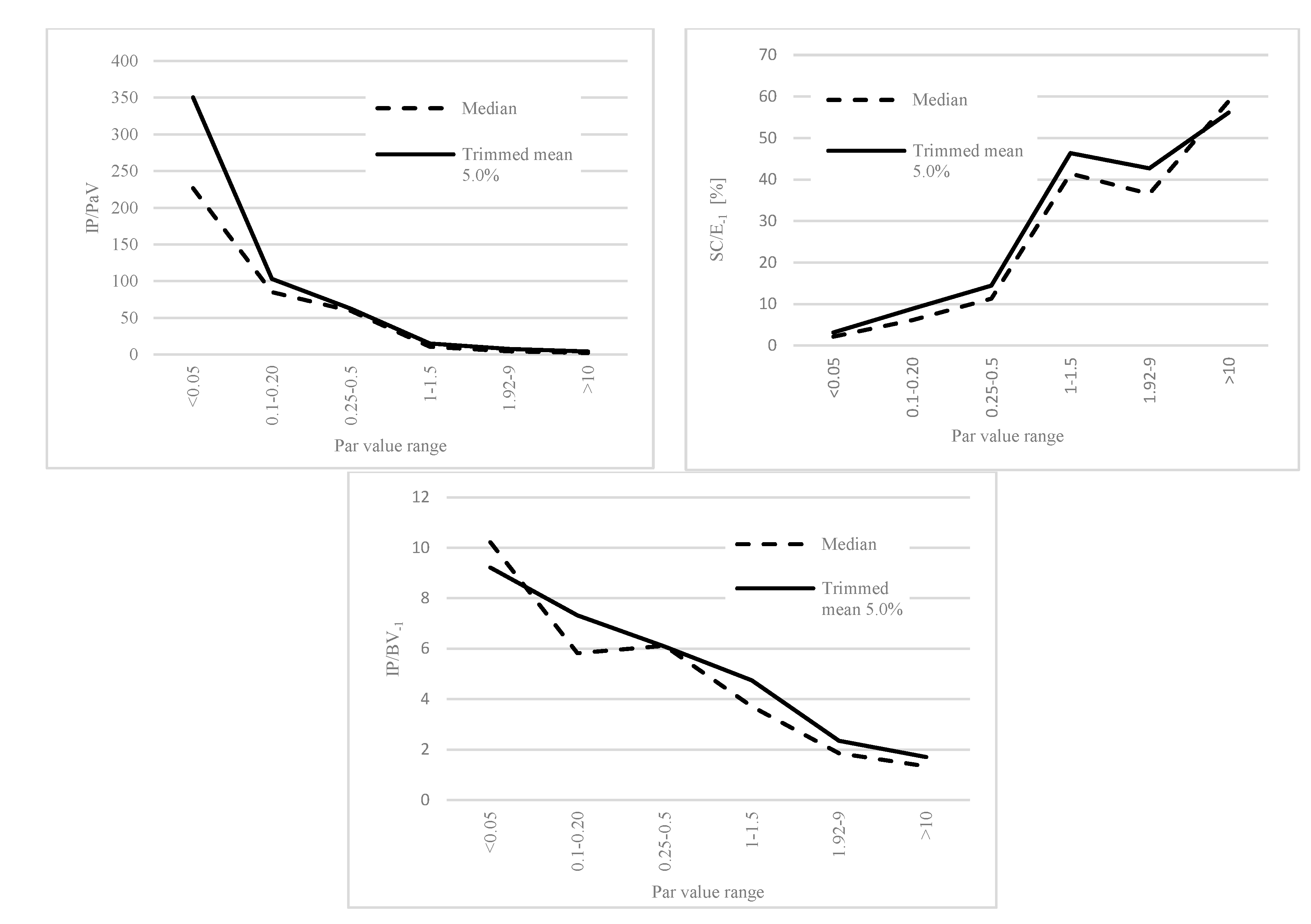

4.2. Analysis of the Second-Degree Parameters

5. Conclusions

Practical Implications and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Angel, James J. 1997. Tick Size, Share Prices, and Stock Splits. Journal of Finance 52: 655–81. [Google Scholar] [CrossRef]

- Armour, John. 2000. Share Capital and Creditor Protection: Efficient Rules for a Modern Company Law. The Modern Law Review 63: 355–78. [Google Scholar] [CrossRef] [Green Version]

- Bachner, Thomas. 2009. Creditor Protection in Private Companies: Anglo-German Perspectives for a European Legal Discourse. New York: Cambridge University Press. [Google Scholar]

- Baker, H. Kent, and Patricia L. Gallagher. 1980. Management’s View of Stock Splits. Financial Management 9: 73–77. [Google Scholar] [CrossRef]

- Baker, Malcolm, Robin Greenwood, and Jeffrey Wurgler. 2009. Catering Through Nominal Share Prices. The Journal of Finance 64: 2559–90. [Google Scholar] [CrossRef] [Green Version]

- Böcskei, Elvira, László Vértesy, and András Bethlendi. 2020. The Accounting and Legal Issues of Capital Reserve, with Particular Emphasis on Capital Increase by Share Premium. Public Finance Quarterly 2: 225–44. [Google Scholar]

- Brycz, Bogumiła, Tadeusz Dudycz, and Michał Kowalski. 2017. Is the Success of an Issuer an Investor Success? Evidence from Polish IPOs. Baltic Journal of Economics 17: 57–77. [Google Scholar] [CrossRef]

- Cho, Seong-Soon, Sadok El Ghoul, Omrane Guedhami, and Jungwon Suh. 2014. Creditor Rights and Capital Structure: Evidence from International Data. Journal of Corporate Finance 25: 40–60. [Google Scholar] [CrossRef]

- Cook, William W. 1921. Stock Without Par Value. American Bar Association Journal 7: 534–37. [Google Scholar]

- D’Mello, Ranjan, Oranee Tawatnuntachai, and Devrim Yaman. 2003. Why Do Firms Issue Equity after Splitting Stocks? The Financial Review 38: 323–50. [Google Scholar] [CrossRef]

- Dewing, Arthur S. 1934. The Financial Policy of Corporations, 3rd rev. ed. New York: Ronald Press. [Google Scholar]

- Dudycz, Tadeusz, and Bogumiła Brycz. 2017. What Drives the Amount of Capital Raised at IPO? Evidence from the Warsaw Stock Exchange. Argumenta Oeconomica 2: 61–89. [Google Scholar] [CrossRef] [Green Version]

- Dyl, Edward A., and William B. Elliott. 2006. The Share Price Puzzle. The Journal of Business 79: 2045–66. [Google Scholar] [CrossRef]

- Edvinsson, Leif, and Michael S. Malone. 1997. Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower. New York: Harper Business. [Google Scholar]

- Enriques, Luca, and Jonathan R. Macey. 2001. Creditors Versus Capital Formation: The Case Against the European Legal Capital Rules. Cornell Law Review 86: 1165–204. [Google Scholar]

- Espenlaub, Susanne, Abhinav Goyal, and Abdulkadir Mohamed. 2020. The Impact of Shareholders and Creditors Rights on IPO Performance: An International Study. The British Accounting Review 52: 100872. [Google Scholar] [CrossRef]

- Fernando, Chitru S., Srinivasan Krishnamurthy, and Paul A. Spindt. 1999. Is Share Price Related to Marketability? Evidence from Mutual Fund Share Splits. Financial Management 28: 54–67. [Google Scholar] [CrossRef]

- Gompers, Paul A., and Andrew Metrick. 2001. Institutional Ownership and Equity Prices. The Quarterly Journal of Economics 116: 229–59. [Google Scholar] [CrossRef]

- Handschin, Lukas. 2012. Risk-Based Equity Requirements: How Equity Rules for the Financial Sector Can Be Applied to the Real Economy. Journal of Corporate Law Studies 12: 255–93. [Google Scholar] [CrossRef] [Green Version]

- Huang, Roger D., and H. Martin Weingartner. 2000. Do Market Makers Suffer from Splitting Headaches? Journal of Financial Services Research 17: 105–26. [Google Scholar] [CrossRef]

- Huang, Gow-Cheng, Kartono Liano, and Ming-Shiun Pan. 2006. Do Stock Splits Signal Future Profitability? Review of Quantitative Finance and Accounting 26: 347–67. [Google Scholar] [CrossRef]

- Huang, Gow-Cheng, Kartono Liano, Herman Manakyan, and Ming-Shiun Pan. 2008. The Information Content of Multiple Stock Splits. The Financial Review 43: 543–67. [Google Scholar] [CrossRef]

- Huang, Gow-Cheng, Kartono Liano, and Ming-Shiun Pan. 2009. The Information Content of Stock Splits. Journal of Empirical Finance 16: 557–67. [Google Scholar] [CrossRef]

- Huyghebaert, Nancy, and Cynthia Van Hulle. 2006. Structuring the IPO: Empirical Evidence on the Portions of Primary and Secondary Shares. Journal of Corporate Finance 12: 296–320. [Google Scholar] [CrossRef]

- Kee, Ho Yew, and Lan Luh Luh. 1999. The Par Value of Shares: An Irrelevant Concept in Modern Company Law. Singapore Journal of Legal Studies 1999: 552–72. [Google Scholar]

- Kolany, Krzysztof. 2017. GPW to regionalny gigant i europejski karzeł. Bankier.pl. February 28. Available online: https://www.bankier.pl/wiadomosc/GPW-to-regionalny-gigant-i-europejski-karzel-7501816.html (accessed on 12 July 2019).

- KPMG. 2008. Feasibility Study on an Alternative to the Capital Maintenance Regime Established by the Second Company Law Directive 77/91/EEC of 13 December 1976 and an Examination of the Impact on Profit Distribution of the New EU-Accounting Regime. Berlin: KPMG. [Google Scholar]

- Kunz, Roger M., and Sandro Rosa-Majhensek. 2008. Stock Splits in Switzerland: To Signal or Not to Signal? Financial Management 37: 193–226. [Google Scholar] [CrossRef]

- Lakonishok, Josef, and Baruch Lev. 1987. Stock Splits and Stock Dividends: Why, Who, and When. Journal of Finance 42: 913–32. [Google Scholar] [CrossRef]

- Lakonishok, Josef, Andrei Shleifer, and Robert W. Vishny. 1992. The Impact of Institutional Trading on Stock Prices. Journal of Financial Economics 32: 23–43. [Google Scholar] [CrossRef] [Green Version]

- Lowe, Ben, Bradley R. Barnes, and Robert Rugimbana. 2012. Discounting in International Markets and the Face Value Effect: A Double-Edged Sword? Psychology and Marketing 29: 144–56. [Google Scholar] [CrossRef]

- Mulbert, Peter O., and Max Birke. 2002. Legal Capital—Is There a Case Against the European Legal Capital Rules? European Business Organization Law Review 3: 695–732. [Google Scholar] [CrossRef]

- Muscarella, Chris J., and Michael R. Vetsuypens. 1996. Stock Splits: Signaling or Liquidity? The Case of ADR “Solo Splits”. Journal of Financial Economics 42: 3–26. [Google Scholar] [CrossRef]

- Pástor, Ľuboš, and Pietro Veronesi. 2005. Rational IPO Waves. Journal of Finance 60: 1713–57. [Google Scholar] [CrossRef]

- Pelham, Brett W., Tin T. Sumarta, and Laura Myaskovsky. 1994. The Easy Path from Many to Much: The Numerosity Heuristic. Cognitive Psychology 26: 103–33. [Google Scholar] [CrossRef] [Green Version]

- Powell, Gary E., and H. Kent Baker. 1993. The Effects of Stock Splits on the Ownership Mix of a Firm. Review of Financial Economics 3: 70–88. [Google Scholar] [CrossRef]

- Prorokowski, Lukasz, and Paulina Roszkowska. 2014. Comparison of Practitioners’ Views on Managing Equity Investments. Baltic Journal of Management 9: 153–67. [Google Scholar] [CrossRef]

- Rickford, Jonathan. 2004. Reforming Capital—Report of the Interdisciplinary Group on Capital Maintenance. European Business Law Review 15: 920–1027. [Google Scholar]

- Ritter, Jay R. 1984. The “Hot Issue” Market of 1980. Journal of Business 57: 215–40. [Google Scholar] [CrossRef]

- Ritter, Jay R., and Ivo Welch. 2002. A Review of IPO Activity, Pricing, and Allocations. Journal of Finance 57: 1795–828. [Google Scholar] [CrossRef] [Green Version]

- Santella, Paolo, and Riccardo Turrini. 2008. Capital Maintenance in the EU: Is the Second Company Law Directive Really That Restrictive? European Business Organization Law Review 9: 427–61. [Google Scholar] [CrossRef]

- Svedsater, Henrik, Amelie Gamble, and Tommy Gärling. 2007. Money Illusion in Intuitive Financial Judgments: Influences of Nominal Representation of Share Prices. Journal of Socio-Economics 36: 698–712. [Google Scholar] [CrossRef]

- Taggart, Robert A. 1977. A Model of Corporate Financing Decisions. Journal of Finance 32: 1467–84. [Google Scholar] [CrossRef]

- Weld, William C., Roni Michaely, Richard H. Thaler, and Shlomo Benartzi. 2009. The Nominal Share Price Puzzle. Journal of Economic Perspectives 23: 121–42. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Ling, Sheng Zhang, and Yingyuan Guo. 2019. The Effects of Equity Financing and Debt Financing on Technological Innovation. Evidence from Developed Countries. Baltic Journal of Management 14: 698–715. [Google Scholar] [CrossRef]

| Equity | Before New Issue | After New Issue | Growth | Share of the New Issue |

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 |

| Share capital | 25,000.00 | 31,250.00 | 25% | 20% |

| Share premium | 43,750.00 | |||

| Reserves | 20,000.00 | 20,000.00 | 0% | 0% |

| Total equity | 45,000.00 | 95,000.00 | 111% | 53% |

| Number of shares | 10,000 | 12,500 | 25% | 20% |

| Nominal value of shares | 2.50 | 2.50 | 0% | 0% |

| Book value of shares | 4.50 | 7.60 | 69% | 41% |

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 1998–2013 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A | ||||||||||||||||||

| Total number of IPOs | 51 | 20 | 11 | 7 | 5 | 6 | 36 | 58 | 63 | 81 | 31 | 13 | 34 | 38 | 19 | 23 | 496 | |

| Sample number of IPOs | 25 | 15 | 9 | 5 | 2 | 5 | 24 | 22 | 25 | 52 | 22 | 9 | 21 | 12 | 4 | 7 | 259 | |

| Ratio, sample number of IPOs to total number of IPOs [%] | 49.0 | 75.0 | 81.8 | 71.4 | 40.0 | 83.3 | 66.7 | 37.9 | 39.7 | 64.2 | 71.0 | 69.2 | 61.8 | 31.6 | 21.1 | 30.4 | 52.2 | |

| GDP growth [%] | 5.0 | 4.5 | 4.3 | 1.2 | 1.4 | 3.9 | 5.3 | 3.6 | 6.2 | 6.8 | 5.1 | 1.6 | 3.8 | 4.3 | 1.9 | 1.6 | 74.5 | |

| WIG | 12,795.6 | 18,083.6 | 17,847.6 | 13,922.2 | 14,366.7 | 20,820.1 | 26,636.2 | 35,600.8 | 50,411.8 | 55,648.5 | 27,228.6 | 39,986.0 | 47,489.9 | 37,595.4 | 47,460.6 | 51,284.3 | ||

| Change in WIG [%] | −12.8 | 41.3 | −1.3 | −22.0 | 3.2 | 44.9 | 27.9 | 33.7 | 41.6 | 10.4 | −51.1 | 46.9 | 18.8 | −20.8 | 26.2 | 8.1 | ||

| Panel B | ||||||||||||||||||

| Assets −1 [PLN million] | Mean | 44.8 | 142.5 | 596.2 | 43.1 | 86.1 | 134.9 | 130.5 | 1044.6 | 118.9 | 97.9 | 496.1 | 2719.5 | 129.7 | 115.2 | 312.9 | 183.3 | 331.9 |

| SD | 35.9 | 172.4 | 1158.3 | 33.8 | 52.8 | 57.0 | 212.7 | 3134.6 | 168.5 | 152.6 | 1868.1 | 7160.0 | 146.2 | 85.6 | 253.5 | 123.5 | 1736.8 | |

| Median | 34.8 | 52.5 | 39.4 | 41.7 | 86.1 | 122.0 | 74.2 | 52.4 | 55.9 | 52.1 | 29.0 | 69.9 | 93.9 | 96.3 | 329.3 | 161.6 | 54.7 | |

| Sales −1 [PLN million] | Mean | 91.4 | 235.8 | 174.0 | 47.5 | 269.4 | 162.8 | 107.3 | 966.3 | 144.5 | 118.3 | 343.6 | 1243.6 | 90.6 | 98.1 | 144.0 | 82.0 | 253.5 |

| SD | 101.9 | 260.9 | 249.5 | 67.7 | 299.5 | 85.1 | 221.2 | 2215.7 | 256.9 | 130.9 | 1072.9 | 3190.0 | 114.5 | 88.5 | 156.8 | 141.8 | 961.8 | |

| Median | 52.8 | 78.5 | 63.1 | 23.1 | 269.4 | 189.3 | 49.2 | 77.7 | 50.0 | 62.5 | 26.8 | 36.5 | 53.7 | 69.2 | 120.7 | 8.0 | 54.9 |

| Variable | Definition |

|---|---|

| PaV | Par value is the per-share amount appearing on stock certificates |

| SC | Share capital = number of shares outstanding multiplied by PaV |

| IP | Issue price is the price at which a new issue of shares is offered to the public |

| BV | Book value of shares, calculated as shareholders’ equity, estimated as the difference between total assets and total liabilities divided by number of shares outstanding |

| Ln(Assets) | Natural logarithm of total assets |

| Ln(PaV) | Natural logarithm of par value |

| Ln(SC) | Natural logarithm of share capital |

| Ln(BV) | Natural logarithm of book value of share |

| SC/E | Ratio of share capital to the total shareholders’ equity |

| S/A | Ratio of sales to total assets |

| ROE | Return on equity, defined as net income divided by shareholders’ equity calculated as the difference between total assets and total liabilities |

| D/A | Debt ratio, defined as total debt (the sum of current liabilities and long-term liabilities) divided by total assets |

| CR | Cash ratio, defined as short-term investments divided by current liabilities |

| E/FA | Shareholders’ equity-to-fixed-assets ratio, defined as shareholders’ equity to total fixed assets |

| Ln(NrSh) | Natural logarithm of number of shares issued |

| IP/PaV | Ratio of issue price to the par value of shares |

| IP/BV | Ratio of issue price to the book value of shares |

| WIG | Value of the Warsaw Stock Exchange Index, comprising all companies listed on the main market; the initial value of the WIG Index on 16 April 1991 was 1000 points |

| GDP growth | Gross domestic product growth rate, defined as the percentage change in GDP in one year |

| Sector | Sector of the economy |

| Subscripts: −1, 0, 1, 2, 3 | Indicates the year in relation to the year of issue (0 is the year of issue) |

| Number of the Par Value Group | Range |

|---|---|

| 1 | <0.05 |

| 2 | 0.1–0.20 |

| 3 | 0.25–0.5 |

| 4 | 1–1.5 |

| 5 | 1.92–9 |

| 6 | >10 |

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Sector | 4.97 | 3.75 | 1.00 | ||||||||||||

| 2. ROE −1 | 0.22 | 0.24 | −0.03 (0.633) | 1.00 | |||||||||||

| 3. S/A −1 | 1.88 | 5.45 | −0.09 (0.133) | 0.12 (0.048) | 1.00 | ||||||||||

| 4. D/A −1 | 0.52 | 0.22 | −0.12 (0.053) | 0.19 (0.002) | 0.02 (0.746) | 1.00 | |||||||||

| 5. CR −1 | 0.69 | 2.88 | 0.03 (0.607) | −0.19 (0.002) | −0.01 (0.852) | −0.14 (0.025) | 1.00 | ||||||||

| 6. E/FA | 2.21 | 7.47 | 0.13 (0.041) | 0.05 (0.418) | −0.01 (0.888) | −0.15 (0.016) | 0.34 (0.000) | 1.00 | |||||||

| 7. Ln(Assets) −1 | 11.02 | 1.50 | −0.01 (0.925) | −0.26 (0.000) | −0.17 (0.006) | 0.04 (0.528) | 0.09 (0.152) | −0.13 (0.032) | 1.00 | ||||||

| 8. Ln(NrSh) −1 | 15.83 | 1.43 | 0.00 (0.991) | −0.15 (0.019) | −0.13 (0.036) | −0.17 (0.005) | 0.09 (0.168) | −0.06 (0.308) | 0.62 (0.000) | 1.00 | |||||

| 9. Ln(PaV) | −0.33 | 1.47 | 0.11 (0.081) | −0.30 (0.000) | −0.01 (0.837) | −0.14 (0.025) | 0.10 (0.106) | 0.00 (0.938) | 0.16 (0.010) | −0.29 (0.000) | 1.00 | ||||

| 10. Ln(IP) | 2.54 | 1.04 | −0.04 (0.560) | 0.14 (0.023) | −0.03 (0.601) | 0.13 (0.038) | 0.05 (0.445) | 0.00 (0.991) | 0.18 (0.004) | −0.42 (0.000) | 0.26 (0.000) | 1.00 | |||

| 11. Ln(BV) −1 | 1.23 | 1.23 | 0.03 (0.669) | −0.21 (0.001) | −0.06 (0.315) | −0.18 (0.005) | 0.05 (0.420) | −0.03 (0.628) | 0.45 (0.000) | −0.33 (0.000) | 0.58 (0.000) | 0.65 (0.000) | 1.00 | ||

| 12. WIG | 36,769.81 | 15,187.29 | −0.01 (0.858) | 0.08 (0.204) | −0.10 (0.127) | 0.08 (0.209) | −0.02 (0.701) | 0.08 (0.204) | 0.02 (0.750) | 0.32 (0.000) | −0.42 (0.000) | −0.06 (0.334) | −0.36 (0.000) | 1.00 | |

| 13. SC/E −1 | 0.40 | 0.57 | 0.14 (0.024) | −0.12 (0.050) | 0.02 (0.804) | −0.07 (0.286) | 0.03 (0.621) | 0.01 (0.839) | −0.25 (0.000) | 0.03 (0.584) | 0.30 (0.000) | −0.25 (0.000) | −0.33 (0.000) | 0.03 (0.685) | 1.00 |

| Number of the Par Value Group | N | Mean Value | Kruskal–Wallis test. p-Value for Multiple Comparisons (Bilateral) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Median | Trimmed Mean 5.0% | 1 | 2 | 3 | 4 | 5 | 6 | ||

| Panel A | Share Capital (SC) (PLN million) | ||||||||||

| 1 | 11 | 0.66 | 0.25 | 0.51 | 0.63 | ||||||

| 2 | 56 | 3.54 | 8.75 | 1.00 | 2.05 | 1.000 | |||||

| 3 | 18 | 3.60 | 3.49 | 2.51 | 3.27 | 0.317 | 1.000 | ||||

| 4 | 113 | 69.30 | 472.38 | 6.14 | 14.79 | 0.000 | 0.000 | 0.027 | |||

| 5 | 42 | 27.49 | 48.42 | 5.82 | 19.61 | 0.000 | 0.000 | 0.020 | 1.000 | ||

| 6 | 19 | 866.56 | 3 355.30 | 28.83 | 103.30 | 0.000 | 0.000 | 0.000 | 0.030 | 0.275 | |

| Panel B | Book Value (BV) [PLN] | ||||||||||

| 1 | 11 | 1.75 | 1.25 | 1.76 | 1.64 | ||||||

| 2 | 56 | 2.40 | 2.35 | 1.77 | 2.08 | 1.000 | |||||

| 3 | 18 | 3.73 | 2.55 | 3.36 | 3.49 | 0.814 | 0.625 | ||||

| 4 | 113 | 5.12 | 8.68 | 2.48 | 3.59 | 0.810 | 0.143 | 1.000 | |||

| 5 | 42 | 16.75 | 20.59 | 9.24 | 13.91 | 0.000 | 0.000 | 0.026 | 0.000 | ||

| 6 | 19 | 26.01 | 17.25 | 23.09 | 24.95 | 0.000 | 0.000 | 0.000 | 0.000 | 0.888 | |

| Panel C | Issue Price (IP) [PLN] | ||||||||||

| 1 | 11 | 14.80 | 11.80 | 7.50 | 13.78 | ||||||

| 2 | 56 | 13.04 | 11.94 | 9.50 | 11.31 | 1.000 | |||||

| 3 | 18 | 21.21 | 13.54 | 20.50 | 20.59 | 1.000 | 0.298 | ||||

| 4 | 113 | 20.82 | 36.98 | 10.60 | 14.98 | 1.000 | 1.000 | 0.718 | |||

| 5 | 42 | 31.50 | 39.22 | 19.25 | 26.25 | 1.000 | 0.035 | 1.000 | 0.096 | ||

| 6 | 19 | 50.94 | 65.57 | 23.00 | 42.97 | 0.173 | 0.001 | 1.000 | 0.002 | 1.000 | |

| Variables | Ln SC−1 | Ln BV−1 | Ln IP |

|---|---|---|---|

| ROE −1 | −0.020 (0.494) | 0.010 (0.813) | 0.242 *** (0.000) |

| S/A −1 | −0.000 (0.998) | −0.012 (0.755) | −0.031 (0.428) |

| D/A −1 | −0.206 *** (0.000) | −0.127 *** (0.001) | 0.184 *** (0.000) |

| CR −1 | 0.004 (0.876) | −0.041 (0.300) | 0.111 *** (0.008) |

| E/FA −1 | 0.009 (0.758) | 0.005 (0.895) | −0.026 (0.524) |

| WIG | 0.028 (0.337) | −0.083 ** (0.045) | 0.263 *** (0.000) |

| SC/E −1 | 0.345 *** (0.000) | −0.463 *** (0.000) | 0.072 * (0.085) |

| Ln(NrSh) | −0.265 *** (0.000) | ||

| Sector | −0.011 (0.691) | 0.008 (0.828) | −0.052 (0.180) |

| Ln(PaV) | 0.358 *** (0.000) | 0.632 *** (0.000) | |

| Ln(Assets) −1 | 0.701 *** (0.000) | 0.246 *** (0.000) | |

| Ln(BV) −1 | 0.778 *** (0.000) | ||

| R | 0.914 | 0.825 | 0.807 |

| R2 | 0.836 | 0.680 | 0.651 |

| Adjusted R2 | 0.829 | 0.667 | 0.637 |

| F | 126.46 | 52.781 | 46.309 |

| Number of the Par Value Group | N | Mean Value | Kruskal–Wallis Test. p-Value for Multiple Comparisons (Bilateral) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Median | Trimmed Mean 5.0% | 1 | 2 | 3 | 4 | 5 | 6 | ||

| Panel A | IP/PaV | ||||||||||

| 1 | 11 | 455.28 | 501.63 | 226.67 | 350.45 | ||||||

| 2 | 56 | 114.84 | 95.85 | 85.00 | 102.98 | 1.000 | |||||

| 3 | 18 | 64.85 | 46.12 | 59.31 | 62.35 | 0.586 | 1.000 | ||||

| 4 | 113 | 20.57 | 35.40 | 10.60 | 14.91 | 0.000 | 0.000 | 0.001 | |||

| 5 | 42 | 10.37 | 16.87 | 4.25 | 7.56 | 0.000 | 0.000 | 0.000 | 0.346 | ||

| 6 | 19 | 4.98 | 6.54 | 2.30 | 4.17 | 0.000 | 0.000 | 0.000 | 0.007 | 1.000 | |

| Panel B | SC/E−1 | ||||||||||

| 1 | 11 | 4.56 | 5.94 | 2.17 | 3.16 | ||||||

| 2 | 56 | 10.98 | 13.99 | 6.12 | 8.86 | 1.000 | |||||

| 3 | 18 | 15.00 | 10.94 | 11.30 | 14.42 | 0.675 | 1.000 | ||||

| 4 | 113 | 56.99 | 76.04 | 41.44 | 46.37 | 0.000 | 0.000 | 0.001 | |||

| 5 | 42 | 45.41 | 35.58 | 36.55 | 42.70 | 0.000 | 0.000 | 0.015 | 1.000 | ||

| 6 | 19 | 56.62 | 30.81 | 58.89 | 56.14 | 0.000 | 0.000 | 0.001 | 1.000 | 1.000 | |

| Panel C | IP/BV−1 | ||||||||||

| 1 | 11 | 10.30 | 7.18 | 10.22 | 9.21 | ||||||

| 2 | 56 | 8.71 | 9.10 | 5.82 | 7.32 | 1.000 | |||||

| 3 | 18 | 6.20 | 3.04 | 6.12 | 6.09 | 1.000 | 1.000 | ||||

| 4 | 113 | 6.10 | 8.74 | 3.72 | 4.75 | 0.103 | 0.168 | 1.000 | |||

| 5 | 42 | 2.58 | 2.19 | 1.86 | 2.36 | 0.000 | 0.000 | 0.001 | 0.001 | ||

| 6 | 19 | 1.83 | 1.41 | 1.34 | 1.71 | 0.000 | 0.000 | 0.000 | 0.001 | 1.000 | |

| Variables | SC/E−1 | IP/PaV | IP/BV−1 |

|---|---|---|---|

| ROE −1 | −0.101 (0.106) | 0.262 *** (0.000) | 0.262 *** (0.000) |

| S/A −1 | 0.001 (0.986) | −0.007 (0.905) | −0.018 (0.709) |

| D/A −1 | 0.019 (0.738) | −0.069 (0.259) | 0.176 *** (0.000) |

| CR −1 | 0.020 (0.734) | 0.020 (0.754) | 0.081 (0.110) |

| E/FA −1 | −0.056 (0.345) | −0.048 (0.458) | −0.039 (0.439) |

| WIG | 0.216 *** (0.001) | 0.189 *** (0.002) | 0.148 *** (0.007) |

| SC/E −1 | −0.178 *** (0.005) | 0.514 *** (0.000) | |

| Ln(NrSh) | −0.177 *** (0.001) | ||

| Sector | 0.095 * (0.091) | 0.028 (0.638) | −0.018 (0.707) |

| Ln(PaV) | 0.402 *** (0.000) | −0.311 *** (0.000) | |

| Ln(Assets) −1 | −0.363 *** (0.000) | 0.061 (0.355) | |

| R | 0.491 | 0.381 | 0.685 |

| R2 | 0.241 | 0.145 | 0.469 |

| Adjusted R2 | 0.213 | 0.114 | 0.448 |

| F | 8.774 | 4.670 | 21.924 |

| Number of the Par Value Group | N | Mean Value | Kruskal–Wallis Test. p-Value for Multiple Comparisons (Bilateral) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Median | Trimmed Mean 5.0% | 1 | 2 | 3 | 4 | 5 | 6 | ||

| Panel A | SC/E0 | ||||||||||

| 1 | 11 | 1.72 | 1.87 | 1.09 | 1.38 | ||||||

| 2 | 56 | 4.70 | 4.99 | 3.31 | 3.85 | 1.000 | |||||

| 3 | 18 | 6.97 | 5.10 | 4.65 | 6.54 | 0.624 | 1.000 | ||||

| 4 | 113 | 30.07 | 27.01 | 19.88 | 27.53 | 0.000 | 0.000 | 0.001 | |||

| 5 | 42 | 31.74 | 23.12 | 24.23 | 30.55 | 0.000 | 0.000 | 0.000 | 1.000 | ||

| 6 | 19 | 48.45 | 24.64 | 41.77 | 48.08 | 0.000 | 0.000 | 0.000 | 0.149 | 1.000 | |

| Panel B | SC/E1 | ||||||||||

| 1 | 11 | 1.66 | 1.78 | 1.27 | 1.42 | ||||||

| 2 | 55 | 5.35 | 12.32 | 2.86 | 3.27 | 1.000 | |||||

| 3 | 18 | 6.32 | 4.52 | 4.28 | 5.93 | 0.727 | 1.000 | ||||

| 4 | 113 | 29.83 | 31.81 | 17.08 | 25.74 | 0.000 | 0.000 | 0.001 | |||

| 5 | 41 | 36.04 | 31.68 | 23.97 | 32.83 | 0.000 | 0.000 | 0.000 | 1.000 | ||

| 6 | 19 | 48.40 | 27.97 | 39.71 | 47.41 | 0.000 | 0.000 | 0.000 | 0.139 | 1.000 | |

| Panel C | SC/E2 | ||||||||||

| 1 | 11 | 1.27 | 1.19 | 1.20 | 1.05 | ||||||

| 2 | 53 | 6.86 | 15.79 | 2.41 | 3.39 | 1.000 | |||||

| 3 | 18 | 6.43 | 4.40 | 4.58 | 6.17 | 0.338 | 1.000 | ||||

| 4 | 108 | 35.29 | 56.81 | 17.19 | 27.35 | 0.000 | 0.000 | 0.003 | |||

| 5 | 40 | 39.90 | 63.78 | 22.28 | 30.27 | 0.000 | 0.000 | 0.001 | 1.000 | ||

| 6 | 19 | 48.85 | 32.07 | 38.69 | 45.75 | 0.000 | 0.000 | 0.000 | 0.170 | 1.000 | |

| Panel D | SC/E3 | ||||||||||

| 1 | 10 | 2.32 | 3.26 | 1.13 | 1.58 | ||||||

| 2 | 51 | 12.80 | 40.40 | 2.38 | 4.32 | 1.000 | |||||

| 3 | 15 | 6.61 | 4.14 | 4.79 | 6.49 | 0.898 | 1.000 | ||||

| 4 | 102 | 41.28 | 140.29 | 15.50 | 25.23 | 0.000 | 0.000 | 0.050 | |||

| 5 | 38 | 37.47 | 34.50 | 27.90 | 33.49 | 0.000 | 0.000 | 0.002 | 0.946 | ||

| 6 | 19 | 56.58 | 54.25 | 40.54 | 50.26 | 0.000 | 0.000 | 0.000 | 0.158 | 1.000 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dudycz, T.; Brycz, B. Why the Par Value of Share Matters to Investors. Int. J. Financial Stud. 2021, 9, 16. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs9010016

Dudycz T, Brycz B. Why the Par Value of Share Matters to Investors. International Journal of Financial Studies. 2021; 9(1):16. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs9010016

Chicago/Turabian StyleDudycz, Tadeusz, and Bogumiła Brycz. 2021. "Why the Par Value of Share Matters to Investors" International Journal of Financial Studies 9, no. 1: 16. https://0-doi-org.brum.beds.ac.uk/10.3390/ijfs9010016