Interactive Fuzzy Multi Criteria Decision Making Approach for Supplier Selection and Order Allocation in a Resilient Supply Chain

Abstract

:1. Introduction

2. Literature Review

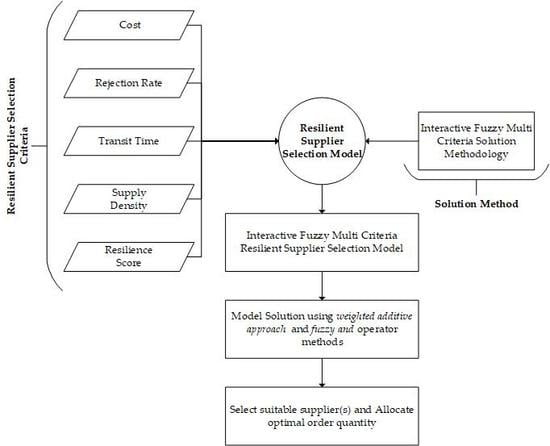

3. Problem Formulation

3.1. Mathematical Model Notations

| • Indices | |

| s existing suppliers | s = 1, 2, … S |

| l number of objective functions | l = 1, 2, … L |

| • Parameters | |

| Total demand of required material | |

| Purchase cost of required material from supplier s | |

| Transportation cost of material from supplier s | |

| Percentage of the rejected material delivered by the supplier s | |

| Capacity of supplier s | |

| Minimum acceptable purchase quantity from supplier s | |

| mxs | Maximum number of suppliers selected for required material |

| Transit time from supplier s | |

| dsab | Distance between selected supplier a ∈ s and selected supplier b ∈ s (a ≠ b) |

| rss | Resilience index score of supplier s |

| • Decision Variables | |

| Purchase quantity from supplier s | |

| 1, If supplier s is selected, otherwise 0. | |

3.2. Model Objectives

3.3. Model Constraints

4. Fuzzy Based Solution Methodology

5. An Illustration

6. Model Solution and Result Analysis

7. Sensitivity Analysis

8. Conclusion and Future Suggestions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Schoenherr, T.; Modi, S.B.; Benton, W.C.; Carter, C.R.; Choi, T.Y.; Larson, P.D.; Leenders, M.R.; Mabert, V.A.; Narasimhan, R.; Wagner, S.M. Research Opportunities in Purchasing and Supply Management. Int. J. Prod. Res. 2012, 50, 4556–4579. [Google Scholar] [CrossRef]

- Kim, J.S.; Jeon, E.; Noh, J.; Park, J.H. A Model and an Algorithm for a Large-Scale Sustainable Supplier Selection and Order Allocation Problem. Mathematics 2018, 6, 325. [Google Scholar] [CrossRef]

- Mari, I.S.; Lee, Y.H.; Memon, M.S.; Park, Y.S.; Kim, M. Adaptivity of Complex Network Topologies for Designing Resilient Supply Chain Networks. Int. J. Ind. Eng. 2015, 22, 102–116. [Google Scholar]

- Tang, C.; Tomlin, B. The Power of Flexibility for Mitigating Supply Chain Risks. Int. J. Prod. Econ. 2008, 116, 12–27. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nguyen, V.T.; Thai, H.T.N.; Tran, N.N.; Tran, T.L.A. Sustainable Supplier Selection Process in Edible Oil Production by a Hybrid Fuzzy Analytical Hierarchy Process and Green Data Envelopment Analysis for the Smes Food Processing Industry. Mathematics 2018, 6, 302. [Google Scholar] [CrossRef]

- Wang, X.; Herty, M.; Zhao, L. Contingent Rerouting for Enhancing Supply Chain Resilience from Supplier Behavior Perspective. Int. Trans. Oper. Res. 2016, 23, 775–796. [Google Scholar] [CrossRef]

- Chopra, S.; Sodhi, M. Reducing the Risk of Supply Chain Disruptions. Mit Sloan Manag. Rev. 2014, 55, 72–80. [Google Scholar]

- Barroso, A.P.; Machado, V.H.; Barros, A.R.; Machado, V.C. Toward a Resilient Supply Chain with Supply Disturbances. Presented at the 2010 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Macao, China, 7–10 December 2010. [Google Scholar]

- Torabi, S.A.; Baghersad, M.; Mansouri, S.A. Resilient Supplier Selection and Order Allocation under Operational and Disruption Risks. Transp. Res. Part E: Logist. Transp. Rev. 2015, 79, 22–48. [Google Scholar] [CrossRef]

- Carvalho, H.; Azevedo, S.G.; Cruz-Machado, V. Agile and Resilient Approaches to Supply Chain Management: Influence on Performance and Competitiveness. Logist. Res. 2012, 4, 49–62. [Google Scholar] [CrossRef]

- Ribeiro, P.J.; Barbosa-Povoa, A. Supply Chain Resilience: Definitions and Quantitative Modelling Approaches–a Literature Review. Comput. Ind. Eng. 2018, 115, 109–122. [Google Scholar] [CrossRef]

- Parkouhi, V.S.; Ghadikolaei, A.S. A Resilience Approach for Supplier Selection: Using Fuzzy Analytic Network Process and Grey Vikor Techniques. J. Clean. Prod. 2017, 161, 431–451. [Google Scholar] [CrossRef]

- Hosseini, S.; Al Khaled, A. A Hybrid Ensemble and Ahp Approach for Resilient Supplier Selection. J. Intell. Manuf. 2016, 1–22. [Google Scholar] [CrossRef]

- Sahu, A.K.; Datta, S.; Mahapatra, S.S. Evaluation and Selection of Resilient Suppliers in Fuzzy Environment: Exploration of Fuzzy-Vikor. Benchmarking Int. J. 2016, 23, 651–673. [Google Scholar] [CrossRef]

- López, C.; Ishizaka, A. A Hybrid Fcm-Ahp Approach to Predict Impacts of Offshore Outsourcing Location Decisions on Supply Chain Resilience. J. Bus. Res. 2017. [Google Scholar] [CrossRef]

- Sabouhi, F.; Pishvaee, M.S.; Jabalameli, M.S. Resilient Supply Chain Design under Operational and Disruption Risks Considering Quantity Discount: A Case Study of Pharmaceutical Supply Chain. Comput. Ind. Eng. 2018, 126, 657–672. [Google Scholar] [CrossRef]

- Jabbarzadeh, A.; Fahimnia, B.; Sabouhi, F. Resilient and Sustainable Supply Chain Design: Sustainability Analysis under Disruption Risks. Int. J. Prod. Res. 2018, 1–24. [Google Scholar] [CrossRef]

- Wang, T.-K.; Zhang, Q.; Chong, H.; Wang, X. Integrated Supplier Selection Framework in a Resilient Construction Supply Chain: An Approach Via Analytic Hierarchy Process (Ahp) and Grey Relational Analysis (Gra). Sustainability 2017, 9, 289. [Google Scholar] [CrossRef]

- Hosseini, S.; Barker, K. A Bayesian Network Model for Resilience-Based Supplier Selection. Int. J. Prod. Econ. 2016, 180, 68–87. [Google Scholar] [CrossRef]

- Haldar, A.; Ray, A.; Banerjee, D.; Ghosh, S. A Hybrid Mcdm Model for Resilient Supplier Selection. Int. J. Manag. Sci. Eng. Manag. 2012, 7, 284–292. [Google Scholar] [CrossRef]

- Haldar, A.; Ray, A.; Banerjee, D.; Ghosh, S. Resilient Supplier Selection under a Fuzzy Environment. Int. J. Manag. Sci. Eng. Manag. 2014, 9, 147–156. [Google Scholar] [CrossRef]

- Sawik, T. Selection of Resilient Supply Portfolio under Disruption Risks. Omega 2013, 41, 259–269. [Google Scholar] [CrossRef]

- Sawik, T. Joint Supplier Selection and Scheduling of Customer Orders under Disruption Risks: Single vs. Dual Sourcing. Omega 2014, 43, 83–95. [Google Scholar] [CrossRef]

- Yilmaz-Börekçi, D.; Say, A.İ.; Rofcanin, Y. Measuring Supplier Resilience in Supply Networks. J. Chang. Manag. 2015, 15, 64–82. [Google Scholar] [CrossRef]

- Rajesh, R.; Ravi, V. Supplier Selection in Resilient Supply Chains: A Grey Relational Analysis Approach. J. Clean. Prod. 2015, 86, 343–359. [Google Scholar] [CrossRef]

- Tiwari, R.N.; Dharmar, S.; Rao, J.R. Fuzzy Goal Programming—An Additive Model. Fuzzy Sets Syst. 1987, 24, 27–34. [Google Scholar] [CrossRef]

- Werners, B.M. Aggregation Models in Mathematical Programming. In Mathematical Models for Decision Support; Springer: Berlin/Heidelberg, Germany, 1988; pp. 295–305. [Google Scholar]

- Memon, M.S.; Lee, Y.H.; Mari, S.I. Group Multi-Criteria Supplier Selection Using Combined Grey Systems Theory and Uncertainty Theory. Expert Syst. Appl. 2015, 42, 7951–7959. [Google Scholar] [CrossRef]

- Memon, M.S.; Mari, S.I.; Shaikh, F.; Shaikh, S.A. A Grey-Fuzzy Multiobjective Model for Supplier Selection and Production-Distribution Planning Considering Consumer Safety. Math. Probl Eng. 2018, 2018, 5259876. [Google Scholar] [CrossRef]

- Holling, C.S. Resilience and Stability of Ecological Systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Hamel, G.; Valikangas, L. The Quest for Resilience. Revista Icade Revista de las Facultades de Derecho y Ciencias Económicas y Empresariales 2004, 62, 355–358. [Google Scholar]

- Sheffi, Y. The Resilient Enterprise: Overcoming Vulnerability for Competitive Advantage; MIT Press: Cambridge, MA, USA, 2005. [Google Scholar]

- Sutcliffe, M.K.; Vogus, T.J. Organizing for Resilience. Posit. Organ. Scholarsh. Found. New Discip. 2003, 94, 110. [Google Scholar]

- Woods, D.D. Four Concepts for Resilience and the Implications for the Future of Resilience Engineering. Reliab. Eng. Syst. Saf. 2015, 141, 5–9. [Google Scholar] [CrossRef]

- Zhalechian, M.; Torabi, S.A.; Mohammadi, M. Hub-and-Spoke Network Design under Operational and Disruption Risks. Transp. Res. Part E Logist. Transp. Rev. 2018, 109, 20–43. [Google Scholar] [CrossRef]

- Falasca, M.; Zobel, C.W.; Cook, D. A Decision Support Framework to Assess Supply Chain Resilience. Presented at the 5th International ISCRAM Conference, Washington, DC, USA, 4–7 May 2008. [Google Scholar]

- Mari, S.I.; Lee, Y.H.; Memon, M.S. Complex Network Theory-Based Approach for Designing Resilient Supply Chain Networks. Int. J. Logist. Syst. Manag. 2015, 21, 365–384. [Google Scholar] [CrossRef]

- Priya Datta, P.; Christopher, M.; Allen, P. Agent-Based Modelling of Complex Production/Distribution Systems to Improve Resilience. Int. J. Logist. Res. Appl. 2007, 10, 187–203. [Google Scholar] [CrossRef]

- Azevedo, S.G.; Govindan, K.; Carvalho, H.; Cruz-Machado, V. Gresilient Index to Assess the Greenness and Resilience of the Automotive Supply Chain. Discuss. Pap. Bus. Econ. 2011, 8. [Google Scholar] [CrossRef]

- Miller-Hooks, E.; Zhang, X.; Faturechi, R. Measuring and Maximizing Resilience of Freight Transportation Networks. Comput. Oper. Res. 2012, 39, 1633–1643. [Google Scholar] [CrossRef]

- Tang, C.S. Robust Strategies for Mitigating Supply Chain Disruptions. Int. J. Logist. Res. Appl. 2006, 9, 33–45. [Google Scholar] [CrossRef]

- Sheffi, Y.; Rice, J.B., Jr. A Supply Chain View of the Resilient Enterprise. Mit Sloan Manag. Rev. 2005, 47, 41. [Google Scholar]

- Mari, S.I.; Lee, Y.H.; Memon, M.S. Sustainable and Resilient Supply Chain Network Design under Disruption Risks. Sustainability 2014, 6, 6666–6686. [Google Scholar] [CrossRef] [Green Version]

- Pramanik, D.; Haldar, A.; Mondal, S.C.; Naskar, S.K.; Ray, A. Resilient Supplier Selection Using Ahp-Topsis-Qfd under a Fuzzy Environment. Int. J. Manag. Sci. Eng. Manag. 2017, 12, 45–54. [Google Scholar] [CrossRef]

- Sen, D.K.; Datta, S.; Mahapatra, S.S. Dominance Based Fuzzy Decision Support Framework for G-Resilient (Ecosilient) Supplier Selection: An Empirical Modelling. Int. J. Sustain. Eng. 2017, 10, 338–357. [Google Scholar] [CrossRef]

- Parkouhi, S.V.; Ghadikolaei, A.S.; Lajimi, H.F. Resilient Supplier Selection and Segmentation in Grey Environment. J. Clean. Prod. 2019, 207, 1123–1137. [Google Scholar] [CrossRef]

- Papadakis, I.S. Financial Performance of Supply Chains after Disruptions: An Event Study. Supply Chain Manag. Int. J. 2006, 11, 25–33. [Google Scholar] [CrossRef]

- FMGlobal. The 2015 FM Global Resilience Index Annual Report. Available online: https://www.fmglobal.com/assets/pdf/Resilience_Methodology.pdf (accessed on 3 July 2018).

- Mari, S.I.; Lee, Y.H.; Memon, M.S. Sustainable and Resilient Garment Supply Chain Network Design with Fuzzy Multi-Objectives under Uncertainty. Sustainability 2016, 8, 1038. [Google Scholar] [CrossRef]

- Min, H.; Zhou, G. Supply Chain Modeling: Past, Present and Future. Comput. Ind. Eng. 2002, 43, 231–249. [Google Scholar] [CrossRef]

- Jiménez, M.; Arenas, M.; Bilbao, A.; Rodrı, M.V. Linear Programming with Fuzzy Parameters: An Interactive Method Resolution. Eur. J. Oper. Res. 2007, 177, 1599–1609. [Google Scholar] [CrossRef]

- Tayyab, M.; Sarkar, B.; Yahya, B. Imperfect Multi-Stage Lean Manufacturing System with Rework under Fuzzy Demand. Mathematics 2019, 7, 13. [Google Scholar] [CrossRef]

- Li, X.; Chien, C.F.; Yang, L.; Gao, Z. The Train Fueling Cost Minimization Problem with Fuzzy Fuel Prices. Flex. Serv. Manuf. J. 2014, 26, 249–267. [Google Scholar] [CrossRef]

- Selim, H.; Ozkarahan, I. A Supply Chain Distribution Network Design Model: An Interactive Fuzzy Goal Programming-Based Solution Approach. Int. J. Adv. Manuf. Technol. 2008, 36, 401–418. [Google Scholar] [CrossRef]

- Babar Ramzan, M.; Qureshi, S.M.; Mari, S.I.; Memon, M.S.; Mittal, M.; Imran, M.; Iqbal, M.W. Effect of Time-Varying Factors on Optimal Combination of Quality Inspectors for Offline Inspection Station. Mathematics 2019, 7, 51. [Google Scholar] [CrossRef]

- Sarkar, B.; Tayyab, M.; Choi, S.K. Product Channeling in an O2O Supply Chain Management as Power Transmission in Electric Power Distribution Systems. Mathematics 2019, 7, 4. [Google Scholar] [CrossRef]

| Authors | Resilience Criteria | Types of Risks | Solution Methodology | |||||

|---|---|---|---|---|---|---|---|---|

| Network Risks | Operational Risks | Possibilistic Programming | Stochastic Programming | Fuzzy Programming | Grey Programming | Other | ||

| Wang, Herty and Zhao [6] | Multi-supplier, production capacity, product quality, production cost | - | ✓ | - | - | - | - | Fluid-dynamic models |

| Torabi, Baghersad and Mansouri [9] | Multiple sourcing, fortifying supplier, pre-positioned inventories, backup supplier, and supplier’s business continuity | - | ✓ | ✓ | ✓ | - | - | - |

| Parkouhi and Ghadikolaei [12] | Benefits, Opportunities, costs, and risks | - | ✓ | - | - | ✓ | ✓ | - |

| Hosseini and Al Khaled [13] | Absorptive capacity, adaptive capacity, and restorative capacity | ✓ | ✓ | - | - | - | - | Predictive analytics models |

| Sahu, Datta and Mahapatra [14] | Investment capacity, Responsiveness, and Inventory capacity | - | ✓ | - | - | ✓ | - | - |

| López and Ishizaka [15] | Flexibility, Visibility, Anticipation, Recovery, Security, Adaptability, Financial strength, Market position, and Collaboration | - | ✓ | - | - | ✓ | - | - |

| Sabouhi, Pishvaee and Jabalameli [16] | multi-sourcing, supplier fortification, and emergency inventory | - | ✓ | - | ✓ | ✓ | - | - |

| Jabbarzadeh, Fahimnia and Sabouhi [17] | Extra production capacities, Multiple sourcing, and Backup suppliers | - | ✓ | - | ✓ | ✓ | - | - |

| Hosseini and Barker [19] | Absorptive capacity, adaptive capacity, and restorative capacity | ✓ | ✓ | - | - | - | - | Bayesian network |

| Haldar, Ray, Banerjee and Ghosh [21] | Investment capacity, Responsiveness, and Emergency inventory holding capacity | - | ✓ | - | - | ✓ | - | - |

| Rajesh and Ravi [25] | Responsiveness, risk reduction, and Technical support | - | ✓ | - | - | - | ✓ | - |

| Parkouhi, Ghadikolaei and Lajimi [46] | Safety, Visibility, Environmental Controls, Trust, Flexibility, Support Services, Future Manufacturing Capabilities, and others | - | ✓ | - | - | - | ✓ | - |

| This paper | Supply density, Transit time, Resilience score of supplier’s locations | ✓ | ✓ | ✓ | - | ✓ | - | - |

| Potential Supplier Location | Purchase Cost of Material ($/unit) | Transportation Cost of Material ($/unit) | Percentage of the Rejected Material | Capacity of Suppliers (1000 units) | Resilience Score |

|---|---|---|---|---|---|

| Korea | (6,8,10) | (0.08,0.13,0.21) | (0.01,0.01,0.02) | (3.08,5,8.08) | 42.1 |

| China | (1,2,4) | (0.11,0.19,0.30) | (0.04,0.06,0.10) | (3.7,6,9.7) | 45.3 |

| Thailand | (4,6,8) | (0.05,0.09,0.14) | (0.02,0.03,0.05) | (3.08,5,8.08) | 39 |

| Bangladesh | (1,3,5) | (0.11,0.17,0.28) | (0.02,0.03,0.05) | (3.7,6,9.7) | 29 |

| India-(Calcutta) | (3,5,7) | (0.10,0.16,0.26) | (0.01,0.02,0.03) | (2.46,4,6.46) | 27.1 |

| India-(Hyderabad) | (3,4,5) | (0.01,0.02,0.03) | (0.01,0.02,0.03) | (4.62,7.5,12.12) | 27.1 |

| Pakistan | (3,5,7) | (0.06,0.10,0.16) | (0.01,0.02,0.03) | (3.08,5,8.08) | 22.2 |

| Turkey | (8,10,12) | (0.08,0.12,0.20) | (0.01,0.01,0.02) | (3.08,5,8.08) | 38.4 |

| Brazil | (6,8,10) | (0.09,0.14,0.22) | (0.02,0.04,0.06) | (3.7,6,9.7) | 47.8 |

| Mexico | (7,9,11) | (0.11,0.17,0.28) | (0.02,0.03,0.05) | (4.31,7,11.31) | 44.8 |

| Supplier Location | Transit Time (days) |

|---|---|

| Korea | (7.39,12,19.39) |

| China | (9.24,15,24.24) |

| Thailand | (1.23,2,3.23) |

| Bangladesh | (1.85,3,4.85) |

| India-(Calcutta) | (1.23,2,3.23) |

| India-(Hyderabad) | (0.62,1,1.62) |

| Pakistan | (3.08,5,8.08) |

| Turkey | (8.01,13,21.01) |

| Brazil | (14.78,24,38.78) |

| Mexico | (19.71,32,51.71) |

| Suppliers’ location. | Korea | China | Thailand | Bangladesh | India (Calcutta) | India (Hyderabad) | Pakistan | Turkey | Brazil | Mexico |

|---|---|---|---|---|---|---|---|---|---|---|

| Korea | N/A | 1028.16 | 3723.83 | 3783.61 | 4037.39 | 5212.7 | 5768.78 | 7641.12 | 16,739.92 | 12,029.52 |

| China | 1028.16 | N/A | 2743.18 | 3059.41 | 3304.68 | 4478.2 | 5273.64 | 7587.05 | 17,589.43 | 13,051.91 |

| Thailand | 3723.83 | 2743.18 | N/A | 1526.77 | 1616.16 | 2388.26 | 3709.84 | 6926.22 | 17,348.59 | 15,721.92 |

| Bangladesh | 3783.61 | 3059.41 | 1526.77 | N/A | 250.06 | 1432.18 | 2374.24 | 5408.55 | 16,067.89 | 15,092.77 |

| India (Calcutta) | 4037.39 | 3304.68 | 1616.16 | 250.06 | N/A | 1180.87 | 2186.91 | 5327.76 | 15,902.02 | 15,299.76 |

| India (Hyderabad) | 5212.7 | 4478.2 | 2388.26 | 1432.18 | 1180.87 | N/A | 1461.88 | 4788.23 | 14,979.22 | 15,878.77 |

| Pakistan | 5768.78 | 5273.64 | 3709.84 | 2374.24 | 2186.91 | 1461.88 | N/A | 3334.57 | 13,710.04 | 14,838.79 |

| Turkey | 7641.12 | 7587.05 | 6926.22 | 5408.55 | 5327.76 | 4788.23 | 3334.57 | N/A | 10,723.38 | 11,983.21 |

| Brazil | 16,739.92 | 17,589.43 | 17,348.59 | 16,067.89 | 15,902.02 | 14,979.22 | 13,710.04 | 10,723.38 | N/A | 5692.39 |

| Mexico | 12,029.52 | 13,051.91 | 15,721.92 | 15,092.77 | 15,299.76 | 15878.77 | 14,838.79 | 11,983.21 | 5692.39 | N/A |

| Objective | Cost ($) | Rejection (%) | Transit Time (days) | Supply Density | Resilience Score |

|---|---|---|---|---|---|

| Minimize Cost | 22,514.93 | 0.097 | 19.04 | 0.022 | 38.2 |

| Minimize Rejection | 75,796.12 | 0.025 | 26.45 | 0.056 | 39.22 |

| Minimize Transit time | 38,143.47 | 0.052 | 3.17 | 0.017 | 29.79 |

| Maximize Supply density | 70,159.31 | 0.1 | 61.11 | 0.286 | 43.41 |

| Maximize Resilience score | 50,560.14 | 0.1 | 41 | 0.12 | 47.89 |

| Model Objectives | Weighted Additive Approach a | Werners’ 'Fuzzy and' Operator b | ||

|---|---|---|---|---|

| μl (x) | fl (x) | μl (x) | fl (x) | |

| Cost | 0.346 | 78,238.03 | 0.195 | 65,374.99 |

| Rejection | 0.051 | 0.12 | 0.366 | 0.072 |

| Transit time | 0.457 | 42.0 | 0.383 | 38.89 |

| Supply density | 0.975 | 0.27 | 0.972 | 0.272 |

| Resilience score | 0.786 | 75.5 | 0.803 | 44.33 |

| Alpha | Objective Weights | μcost | μrej | μtime | μden | μres | fcost | frej | ftime | fden | fres |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.9 | w1 = 0.2, w2 = 0.1, w3 = 0.2, w4 = 0.2, w5 = 0.3 | 0.184 | 0.200 | 0.365 | 0.97 | 0.881 | 65,941.28 | 0.085 | 39.9 | 0.27 | 45.7 |

| w1 = 0.3, w2 = 0.2, w3 = 0.2, w4 = 0.1, w5 = 0.2 | 0.920 | 0.200 | 0.762 | 0.061 | 0.498 | 26,730.90 | 0.085 | 16.9 | 0.03 | 38.8 | |

| 0.6 | w1 = 0.2, w2 = 0.1, w3 = 0.2, w4 = 0.2, w5 = 0.3 | 0.111 | 0.100 | 0.566 | 0.910 | 0.935 | 66,577.34 | 0.092 | 28.3 | 0.25 | 47.4 |

| w1 = 0.3, w2 = 0.2, w3 = 0.2, w4 = 0.1, w5 = 0.2 | 0.851 | 0.200 | 0.762 | 0.061 | 0.634 | 27,727.65 | 0.085 | 16.9 | 0.03 | 42.6 |

| α | γ | μcost | μrej | μtime | μden | μres | fcost | frej | ftime | fden | fres |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.6 | 0.0–0.8 | 0.107 | 0.366 | 0.383 | 0.972 | 0.793 | 66,774.85 | 02.072 | 38.8 | 0.27 | 46.4 |

| 0.9 | 0.366 | 0.366 | 0.383 | 0.972 | 0.451 | 53,167.88 | 0.072 | 38.89 | 0.27 | 38.3 | |

| 1.0 | 0.407 | 0.566 | 0.543 | 0.407 | 0.406 | 51,054.51 | 0.057 | 29.62 | 0.12 | 37.3 | |

| 0.9 | 0.0–0.8 | 0.195 | 0.366 | 0.383 | 0.972 | 0.803 | 65,374.99 | 0.072 | 38.89 | 0.27 | 44.33 |

| 0.9 | 0.366 | 0.366 | 0.383 | 0.972 | 0.541 | 56,259.06 | 0.072 | 38.89 | 0.27 | 39.59 | |

| 1.0 | 0.392 | 0.566 | 0.543 | 0.407 | 0.392 | 54,899.34 | 0.057 | 29.6 | 0.12 | 36.88 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mari, S.I.; Memon, M.S.; Ramzan, M.B.; Qureshi, S.M.; Iqbal, M.W. Interactive Fuzzy Multi Criteria Decision Making Approach for Supplier Selection and Order Allocation in a Resilient Supply Chain. Mathematics 2019, 7, 137. https://0-doi-org.brum.beds.ac.uk/10.3390/math7020137

Mari SI, Memon MS, Ramzan MB, Qureshi SM, Iqbal MW. Interactive Fuzzy Multi Criteria Decision Making Approach for Supplier Selection and Order Allocation in a Resilient Supply Chain. Mathematics. 2019; 7(2):137. https://0-doi-org.brum.beds.ac.uk/10.3390/math7020137

Chicago/Turabian StyleMari, Sonia Irshad, Muhammad Saad Memon, Muhammad Babar Ramzan, Sheheryar Mohsin Qureshi, and Muhammad Waqas Iqbal. 2019. "Interactive Fuzzy Multi Criteria Decision Making Approach for Supplier Selection and Order Allocation in a Resilient Supply Chain" Mathematics 7, no. 2: 137. https://0-doi-org.brum.beds.ac.uk/10.3390/math7020137