Short-Term Electricity Price Forecasting by Employing Ensemble Empirical Mode Decomposition and Extreme Learning Machine

Abstract

:1. Introduction

2. Methodology

2.1. Ensemble Empirical Mode Decomposition

2.2. Extreme Learning Machine

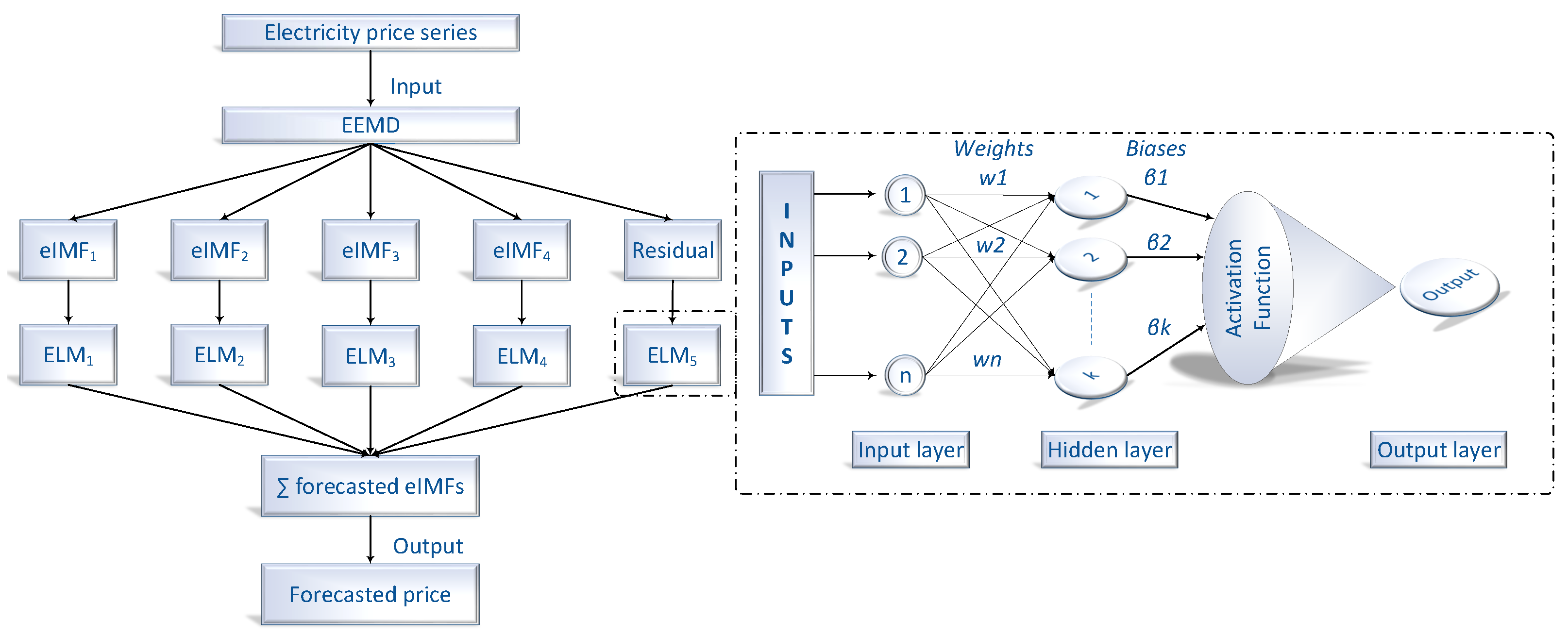

2.3. Combined EEMD-ELM Forecasting Model

3. Results and Simulations

3.1. Experimental Design

3.2. Dataset Description

3.3. Performance Evaluation Metric

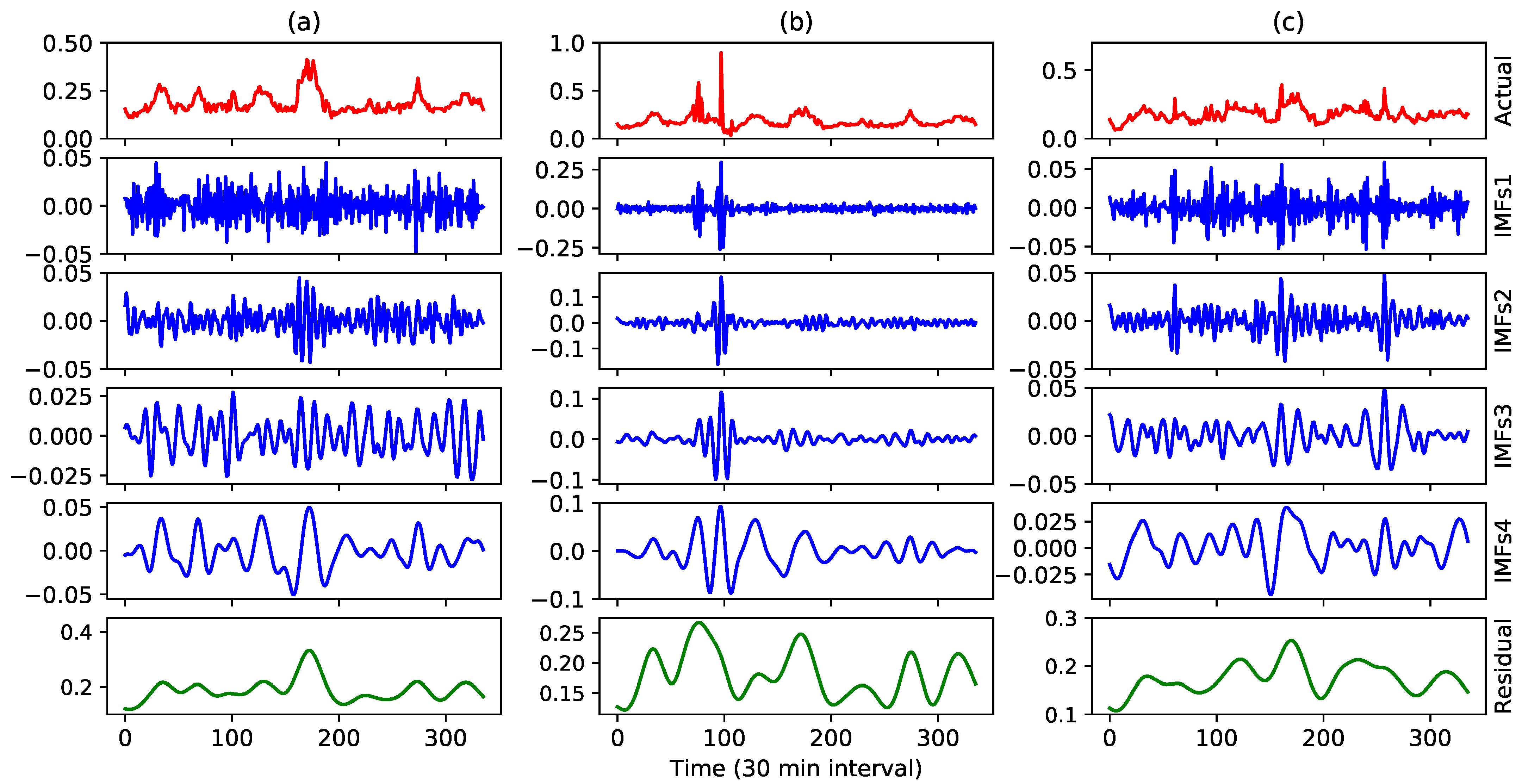

3.4. Analysis of IMFs

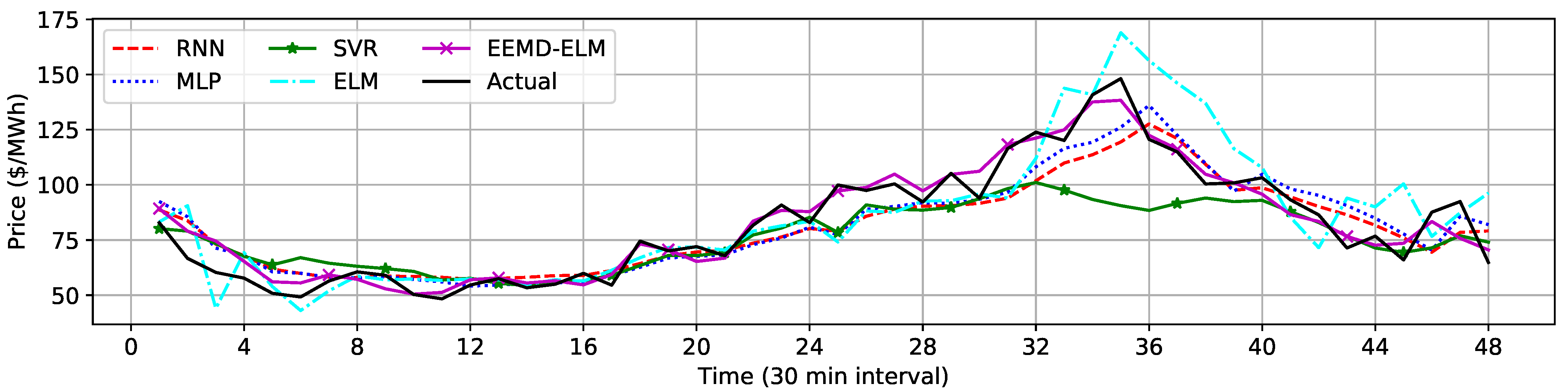

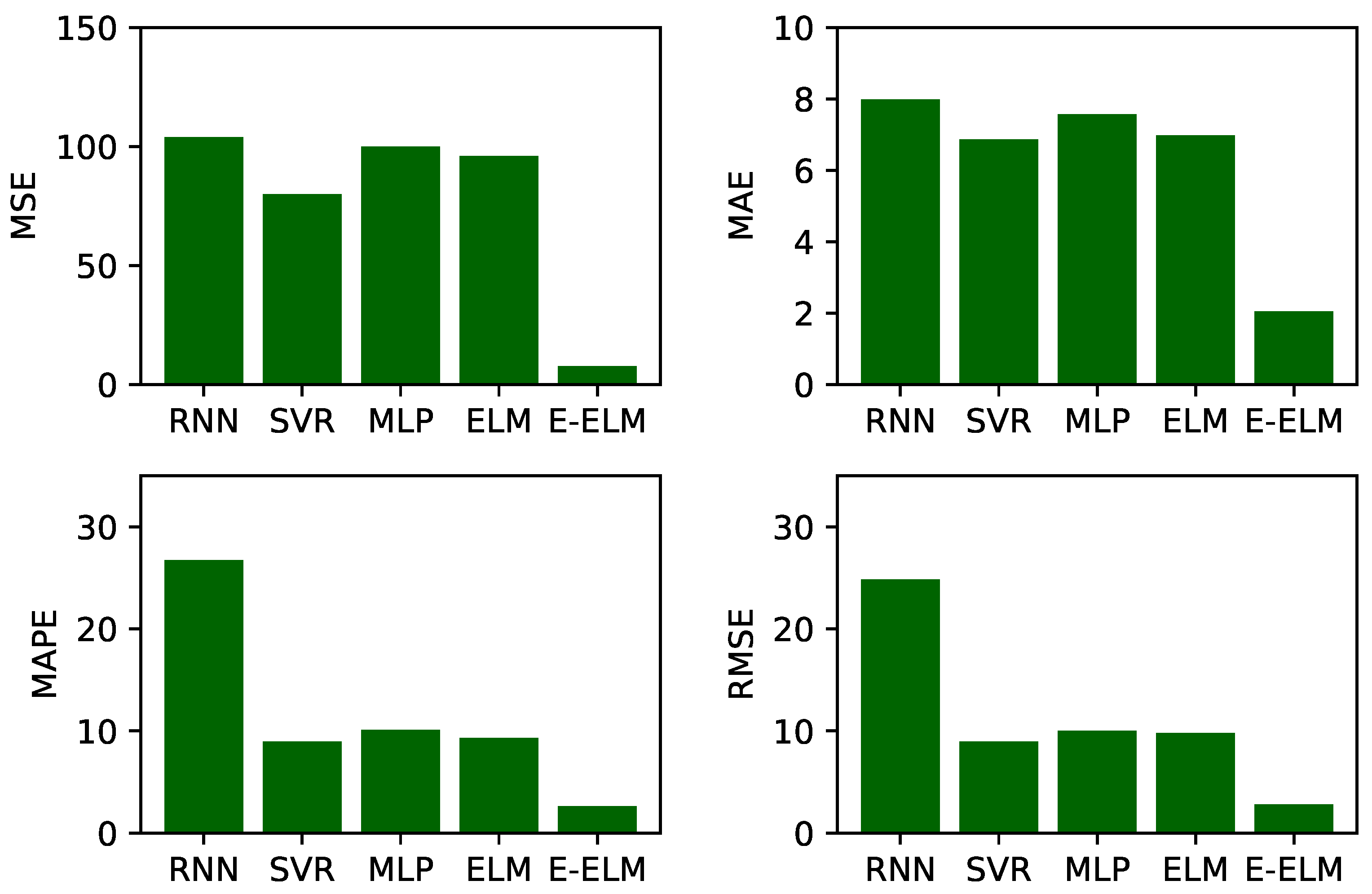

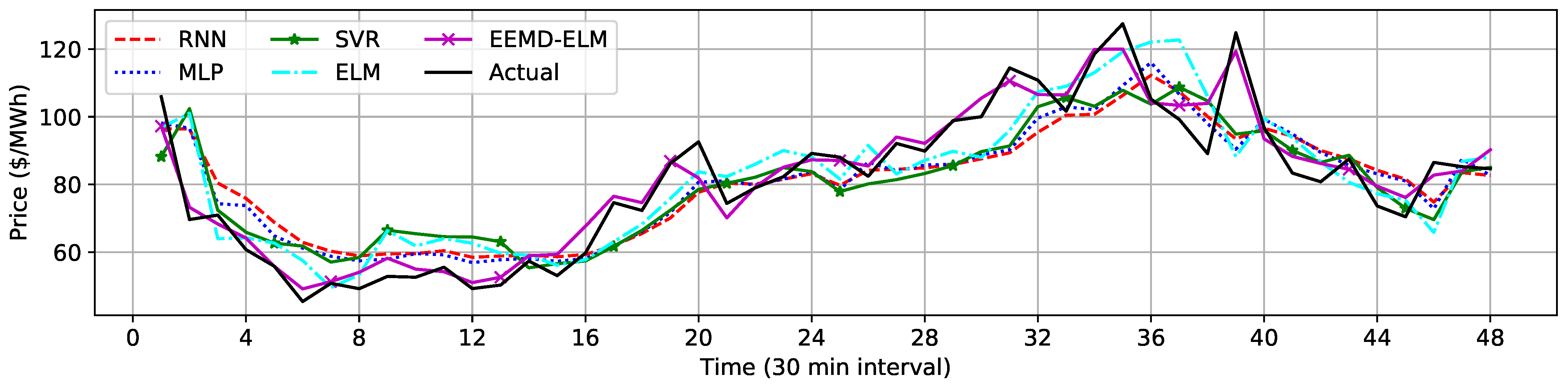

3.5. Forecasting Result of NSW

3.6. Forecasting Result of QLD

3.7. Forecasting Result of VIC

4. Conclusions and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Abbreviations

| AEMO | Australian energy market operator |

| AI | Artificial intelligence |

| ANN | Artificial neural network |

| ANFIS | Adaptive network-based fuzzy inference system |

| ARMA | Autoregressive moving average |

| ARIMA | Autoregressive integrated moving average |

| CI | Computational intelligence |

| CNN | Convolutional neural network |

| DL | Deep learning |

| DM | Diebold–Mariano |

| EEMD | Ensemble empirical mode decomposition |

| ELM | Extreme learning machine |

| ENN | Elman neural network |

| GBM | Gradient boosting machine |

| GRNN | Generalized regression neural network |

| GRU | Gated recurrent unit |

| IMF | Intrinsic mode functions |

| KNN | K-nearest neighbor |

| LASSO | least absolute shrinkage and selection operator |

| LSSVM | Least squares support vector machine |

| LSTM | Long short term memory |

| MAE | Mean absolute error |

| MAPE | Mean absolute percentage error |

| ML | Machine learning |

| MLP | Multi-layer perceptron |

| MSE | Mean square error |

| NN | Neural network |

| NSW | New South Walves |

| QLD | Queensland |

| RBFN | Radial basis function network |

| RMSE | Root mean square error |

| RNN | Recurrent neural network |

| SCA | Sine-cosine algorithm |

| SSA | Singular spectrum analysis |

| SVM | Support vector machine |

| SVR | Support vector regression |

| VIC | Victoria |

| VMD | Variational mode decomposition |

| WNN | Wavelet neural network |

References

- Aslam, S.; Herodotou, H.; Mohsin, S.M.; Javaid, N.; Ashraf, N.; Aslam, S. A survey on deep learning methods for power load and renewable energy forecasting in smart microgrids. Renew. Sustain. Energy Rev. 2021, 144, 110992. [Google Scholar] [CrossRef]

- Wang, K.; Wang, Y.; Hu, X.; Sun, Y.; Deng, D.J.; Vinel, A.; Zhang, Y. Wireless big data computing in smart grid. IEEE Wirel. Commun. 2017, 24, 58–64. [Google Scholar] [CrossRef]

- Aslam, S.; Khalid, A.; Javaid, N. Towards efficient energy management in smart grids considering microgrids with day-ahead energy forecasting. Electr. Power Syst. Res. 2020, 182, 106232. [Google Scholar] [CrossRef]

- Wang, K.; Xu, C.; Zhang, Y.; Guo, S.; Zomaya, A.Y. Robust big data analytics for electricity price forecasting in the smart grid. IEEE Trans. Big Data 2017, 5, 34–45. [Google Scholar] [CrossRef]

- Aurangzeb, K.; Aslam, S.; Mohsin, S.M.; Alhussein, M. A Fair Pricing Mechanism in Smart Grids for Low Energy Consumption Users. IEEE Access 2021, 9, 22035–22044. [Google Scholar] [CrossRef]

- Xiang-ting, C.; Yu-hui, Z.; Wei, D.; Jie-bin, T.; Yu-xiao, G. Design of intelligent Demand Side Management system respond to varieties of factors. In Proceedings of the CICED 2010 Proceedings, Nanjing, China, 13–16 September 2010; pp. 1–5. [Google Scholar]

- Carrión, M.; Arroyo, J.M.; Conejo, A.J. A bilevel stochastic programming approach for retailer futures market trading. IEEE Trans. Power Syst. 2009, 24, 1446–1456. [Google Scholar] [CrossRef]

- Ortiz, M.; Ukar, O.; Azevedo, F.; Múgica, A. Price forecasting and validation in the Spanish electricity market using forecasts as input data. Int. J. Electr. Power Energy Syst. 2016, 77, 123–127. [Google Scholar] [CrossRef]

- Khan, A.; Aurangzeb, K.; Aslam, S.; Alhussein, M. Multiscale Modeling in Smart Cities: A Survey on applications, Current Trends, and Challenges. Preprints 2021, 13, 1–42. [Google Scholar] [CrossRef]

- Yang, W.; Wang, J.; Niu, T.; Du, P. A hybrid forecasting system based on a dual decomposition strategy and multi-objective optimization for electricity price forecasting. Appl. Energy 2019, 235, 1205–1225. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef] [Green Version]

- Chan, S.C.; Tsui, K.M.; Wu, H.; Hou, Y.; Wu, Y.C.; Wu, F.F. Load/price forecasting and managing demand response for smart grids: Methodologies and challenges. IEEE Signal Process. Mag. 2012, 29, 68–85. [Google Scholar] [CrossRef]

- Hao, Y.; Tian, C. The study and application of a novel hybrid system for air quality early-warning. Appl. Soft Comput. 2019, 74, 729–746. [Google Scholar] [CrossRef]

- Li, C.; Xiao, Z.; Xia, X.; Zou, W.; Zhang, C. A hybrid model based on synchronous optimisation for multi-step short-term wind speed forecasting. Appl. Energy 2018, 215, 131–144. [Google Scholar] [CrossRef]

- Wang, J.; Niu, T.; Lu, H.; Guo, Z.; Yang, W.; Du, P. An analysis-forecast system for uncertainty modeling of wind speed: A case study of large-scale wind farms. Appl. Energy 2018, 211, 492–512. [Google Scholar] [CrossRef]

- Chen, K.; Yu, J. Short-term wind speed prediction using an unscented Kalman filter based state-space support vector regression approach. Appl. Energy 2014, 113, 690–705. [Google Scholar] [CrossRef]

- Wang, J.; Yang, W.; Du, P.; Niu, T. A novel hybrid forecasting system of wind speed based on a newly developed multi-objective sine cosine algorithm. Energy Convers. Manag. 2018, 163, 134–150. [Google Scholar] [CrossRef]

- Lin, W.M.; Gow, H.J.; Tsai, M.T. An enhanced radial basis function network for short-term electricity price forecasting. Appl. Energy 2010, 87, 3226–3234. [Google Scholar] [CrossRef]

- Zhao, W.; Wei, Y.M.; Su, Z. One day ahead wind speed forecasting: A resampling-based approach. Appl. Energy 2016, 178, 886–901. [Google Scholar] [CrossRef]

- Performance of alternative electricity price forecasting methods: Findings from the Greek and Hungarian power exchanges. Appl. Energy 2020, 277, 115599. [CrossRef]

- Marcjasz, G. Forecasting Electricity Prices Using Deep Neural Networks: A Robust Hyper-Parameter Selection Scheme. Energies 2020, 13, 4605. [Google Scholar] [CrossRef]

- Huang, C.J.; Shen, Y.; Chen, Y.H.; Chen, H.C. A novel hybrid deep neural network model for short-term electricity price forecasting. Int. J. Energy Res. 2021, 45, 2511–2532. [Google Scholar] [CrossRef]

- Sun, L.; Li, L.; Liu, B.; Saeedi, S. A Novel Day-ahead Electricity Price Forecasting Using multi-modal combined Integration via Stacked Pruning Sparse Denoising Auto Encoder. Energy Rep. 2021, 7, 2201–2213. [Google Scholar] [CrossRef]

- Kostrzewski, M.; Kostrzewska, J. The Impact of Forecasting Jumps on Forecasting Electricity Prices. Energies 2021, 14, 336. [Google Scholar] [CrossRef]

- Varshney, H.; Sharma, A.; Kumar, R. A hybrid approach to price forecasting incorporating exogenous variables for a day ahead electricity market. In Proceedings of the 2016 IEEE 1st International Conference on Power Electronics, Intelligent Control and Energy Systems (ICPEICES), Delhi, India, 4–6 July 2016; pp. 1–6. [Google Scholar]

- Rafiei, M.; Niknam, T.; Khooban, M.H. Probabilistic forecasting of hourly electricity price by generalization of ELM for usage in improved wavelet neural network. IEEE Trans. Ind. Inform. 2016, 13, 71–79. [Google Scholar] [CrossRef]

- Ugurlu, U.; Oksuz, I.; Tas, O. Electricity price forecasting using recurrent neural networks. Energies 2018, 11, 1255. [Google Scholar] [CrossRef] [Green Version]

- Ribeiro, M.H.D.M.; Stefenon, S.F.; de Lima, J.D.; Nied, A.; Marini, V.C.; Coelho, L.d.S. Electricity price forecasting based on self-adaptive decomposition and heterogeneous ensemble learning. Energies 2020, 13, 5190. [Google Scholar] [CrossRef]

- Ozozen, A.; Kayakutlu, G.; Ketterer, M.; Kayalica, O. A combined seasonal ARIMA and ANN model for improved results in electricity spot price forecasting: Case study in Turkey. In Proceedings of the 2016 Portland International Conference on Management of Engineering and Technology (PICMET), Honolulu, HI, USA, 4–8 September 2016; pp. 2681–2690. [Google Scholar]

- Qiao, W.; Yang, Z. Forecast the electricity price of US using a wavelet transform-based hybrid model. Energy 2020, 193, 116704. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, J.; Gao, Y. A hybrid short-term electricity price forecasting framework: Cuckoo search-based feature selection with singular spectrum analysis and SVM. Energy Econ. 2019, 81, 899–913. [Google Scholar] [CrossRef]

- Yang, W.; Wang, J.; Niu, T.; Du, P. A novel system for multi-step electricity price forecasting for electricity market management. Appl. Soft Comput. 2020, 88, 106029. [Google Scholar] [CrossRef]

- Khalid, R.; Javaid, N.; Al-Zahrani, F.A.; Aurangzeb, K.; Qazi, E.u.H.; Ashfaq, T. Electricity load and price forecasting using Jaya-Long Short Term Memory (JLSTM) in smart grids. Entropy 2020, 22, 10. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Heydari, A.; Nezhad, M.M.; Pirshayan, E.; Garcia, D.A.; Keynia, F.; De Santoli, L. Short-term electricity price and load forecasting in isolated power grids based on composite neural network and gravitational search optimization algorithm. Appl. Energy 2020, 277, 115503. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, N.E. Ensemble empirical mode decomposition: A noise-assisted data analysis method. Adv. Adapt. Data Anal. 2009, 1, 1–41. [Google Scholar] [CrossRef]

- Huang, G.B.; Zhu, Q.Y.; Siew, C.K. Extreme learning machine: Theory and applications. Neurocomputing 2006, 70, 489–501. [Google Scholar] [CrossRef]

- Google: What is Colaboratory? 2021. Available online: https://colab.research.google.com/ (accessed on 19 March 2021).

- Diebold, F.X.; Mariano, R.S. Comparing predictive accuracy. J. Bus. Econ. Stat. 2002, 20, 134–144. [Google Scholar] [CrossRef]

| Ref. | Model | Description & Methodology | Study Area | Remarks |

|---|---|---|---|---|

| [20] | SVM, RF, KNN, Regression tree | The performance of different day-ahead electricity price forecasting algorithms was evaluated using data samples from Greece and Hungarian Power Industries, as well as the impact of different training sample sizes on forecasting performance and the impact of training on an hourly clustered sample. | Long-term | Using Hungry data, hourly clustered training models perform better, while hourly non-clustered training models are better for Greece data. |

| [21] | DNN | The proposed methodology for day-ahead power price forecasting solves the hyper-parameter selection problem for DL implementations by establishing a robust ex-ante hyper-parameter selection mechanism. | Long-term | The proposed method reduces the noise and outperforms LASSO estimated model and DNN with non-optimized parameters. |

| [22] | SEPNet (hybrid of VMD, CNN, and GRU) | In SEPNet, the VMD decomposes the complex time series of electricity price into IMFs with different center frequencies. The CNN is employed to extract the time domain features for all IMFs in the VMD domain. Then the GRU processes and learns the time domain features extracted by the CNN which leads to the final forecasting. | Short-term | It is observed that the proposed method has higher performance over VMD in terms of MAPE and RMSE by 84% and 81%, respectively. |

| [23] | SDR-MASES- SPSD method | In the proposed model, the stacked pruning sparse denoising autoencoder (SPSDAE) is used to individually reduce the noise of the data. Then, to detect the features of the input data, a maximum separation subspace (MASES) in sufficient dimension reduction (SDR) is proposed. Finally, a new multimodal combined (MMC) method is introduced to accurately predict the day-ahead electricity price. | Short-term | It is confirmed by simulation that the proposed method achieves higher performance in terms of minimum error rate compared to benchmark methods. |

| [24] | Bayesian models | In the proposed model, the Bayesian jump model is used along with the double exponential model and explanatory variables to detect upward jumps, no jumps, or downward jumps in electricity price. | Short-term | Results suggest that electricity jump predictions are useful for price prediction in peak hours. |

| [25] | Hybrid of SSA and radial basis function NN (RBFNN) | In the proposed method, the SSA captures the trends and oscillatory components of the time series data, while the selection of input features for the NN is based on the correlation analysis. Then, the RBFNN is used for the final prediction based on real-time load and temperature data from New York City. | Short-term | The MAPE of the proposed method is minimum and is 4.73; SSA: 7.36, NN: 7.80, KNN: 10.22, and ARIMA: 13.26 |

| [26] | Hybrid of Generalized ELM, wavelet NN, wavelet preprocessing, and bootstrapping | In the proposed model, bootstrapping is used to implement uncertainty and a generalized ELM is used for low computational cost and fast daily price prediction. In addition, to achieve a better fit of the prediction model to the changes in time series price, wavelet preprocessing is used. To confirm the productivity of the proposed model, real datasets from Ontario and Australia electricity markets are used for implementation. | Short-term | It is confirmed through simulations that the proposed model achieves higher prediction accuracy than its counterparts. |

| [27] | GRU | The objective of this study is to evaluate the performance of different neural networks in predicting the price of electricity. | Short-term | Simulation results confirm the productivity, in terms of MAE, of their proposed multilayer GRU method. |

| [28] | Complementary EEMD, ELM, Gaussian process, and SVM | In the proposed model, the complementary EEMD is used to decompose the current series into a number of subseries. The subseries are predicted using ELM, gradient boosting machine, Gaussian process, and SVM. The results are integrated to output the predicted electricity price | Short-term | The proposed model outperforms the benchmark algorithms in terms of error reduction. |

| [29] | Seasonal ARIMA and ANN | In the proposed work, the current series is decomposed into two components: Linear and non-linear. The linear component is forecast using ARIMA, while the non-linear component is forecast using ANN | Short-term | The proposed model shows a 30 percent improvement in terms of error reduction in forecasting compared to benchmark models. |

| [30] | Hybrid of wavelet transform, SAE and LSTM | Wavelet transform is used to decompose the current series. SAE -LSTM is used to forecast each series. Then the predicted series is reconstructed. The proposed hybrid algorithms overcome the shortcomings of wavelet transform and improve the price forecasting for residential, commercial, and industrial users using an optimal and stratified model. | Short-term | In terms of MAPE reduction, the performance of the proposed model is superior compared to other algorithms. |

| [31] | Hybrid of cuckoo search, SVM, and SSA | In the proposed model, electricity price forecasting is performed by analyzing seasonal trends and patterns. Moreover, a hybrid feature selection algorithm is introduced to improve the electricity price forecasting. | Short-term | MAPE and RMSE of the proposed model along with DM are significantly lower compared to other benchmark models. |

| [32] | RELM, VMD, and MO-SCA | An adaptive, deterministic, and probabilistic model is used for forecasting. A divide-and-conquer strategy is used to improve price forecasting. VMD is used to decompose the current series into a number of series and each series is forecast individually. | Short-term | MAE, RMSE, MAPE, and TIC of the proposed model is significantly lower compared to benchmark models. |

| [33] | LSTM and Jaya optimization algorithm | In the proposed model, the Jaya optimization algorithm is used to tune the hyperparameters of LSTM to accurately forecast the electricity load and price. | Long-term | It is observed that the proposed model achieves low error rate over benchmark models. |

| [34] | VMD GRRN, and gravity search optimization | In the proposed model, a mixed approach is proposed to predict electricity load and price. A hybrid of a neural network and gravity search optimization is developed for input selection to select important features. | Short-term | It is observed from results that RMSE and TIC values of the proposed model are lower than counterparts. |

| State | Tested Models | SVR | MLP | RNN | EEMD-ELM |

|---|---|---|---|---|---|

| NSW | ELM | 1.04 | 1.87 | 1.89 | 3.22 |

| SVR | −0.82 | 0.85 | 4.07 | ||

| MLP | 0.02 | 3.25 | |||

| RNN | 5.12 |

| State | Tested Models | SVR | MLP | RNN | EEMD-ELM |

|---|---|---|---|---|---|

| QLD | ELM | 1.04 | 1.87 | 2.12 | 3.00 |

| SVR | −0.82 | 1.07 | 4.07 | ||

| MLP | 0.25 | 3.25 | |||

| RNN | 5.12 |

| State | Tested Models | SVR | MLP | RNN | EEMD-ELM |

|---|---|---|---|---|---|

| VIC | ELM | −0.56 | 0.16 | −0.84 | 4.10 |

| SVR | −0.72 | −0.27 | 3.82 | ||

| MLP | −1.00 | 3.09 | |||

| RNN | 3.26 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, S.; Aslam, S.; Mustafa, I.; Aslam, S. Short-Term Electricity Price Forecasting by Employing Ensemble Empirical Mode Decomposition and Extreme Learning Machine. Forecasting 2021, 3, 460-477. https://0-doi-org.brum.beds.ac.uk/10.3390/forecast3030028

Khan S, Aslam S, Mustafa I, Aslam S. Short-Term Electricity Price Forecasting by Employing Ensemble Empirical Mode Decomposition and Extreme Learning Machine. Forecasting. 2021; 3(3):460-477. https://0-doi-org.brum.beds.ac.uk/10.3390/forecast3030028

Chicago/Turabian StyleKhan, Sajjad, Shahzad Aslam, Iqra Mustafa, and Sheraz Aslam. 2021. "Short-Term Electricity Price Forecasting by Employing Ensemble Empirical Mode Decomposition and Extreme Learning Machine" Forecasting 3, no. 3: 460-477. https://0-doi-org.brum.beds.ac.uk/10.3390/forecast3030028