1. Introduction

With the acceleration of urbanization, residents’ demands for system reliability, power quality and living environment are increasing. Traditional overhead transmission networks are no longer suitable for future urban development due to environmental concerns and energy policies [

1]. Given this background, underground power transmission, which presents solutions to some of the environmental and aesthetic problems involved with overhead transmission, is becoming a major trend. Underground power corridors are a precondition of realizing the construction of an urban underground power transmission network, and the urban utility tunnel (UUT), which not only functions as a power corridor, but also houses municipal engineering pipelines such as communication cables, water supply pipes, drainage pipes, heating pipes, and gas pipes, is becoming the carrier of the network of future urban underground integrated energy systems (IES) [

2]. UUT permits the installation, maintenance, and removal of pipelines without the necessity of road excavations, which avoids wasting resources and causing inconvenience for society, improves the reliability of power supply, increases the value of developable land, and promotes total urban functionality. The laying of power pipelines into UUT has become an important part of the 13th five-year plan of electricity for the State Grid Corporation in China. However, UUT is more expensive to construct compared to classical solutions for urban utilities [

3]. Relying solely on the financial support of the government, it is difficult to make up for the high construction costs of utility tunnels. In fact, the increase in network maintainability leads to a cost reduction of pipeline maintenance and renovation, making pipeline companies the main beneficiaries of UUT [

4]. As a result, the Ministry of Housing and Urban-Rural Development of China, together with the National Development and Reform Commission, issued an order in 2015, which requires pipeline companies to pay usage charges to the construction and operation units of the tunnel to alleviate the financial pressure faced by local governments [

5]. Although the value and importance of urban utility tunnels has been widely confirmed [

6,

7], the usage charges have put a heavier burden on pipeline companies, leading to resistance from these companies. Therefore, it is of great significance to establish a fair and practical cost sharing mechanism for improving the enthusiasm of pipeline companies such as power companies and communication companies towards participation in the construction of UUT.

The financing criteria are often the key issues when building a utility tunnel. The utility tunnels in Britain, France and other European countries are considered as communal facilities which are completely funded by the government. The government owns the UUT and leases it to pipeline companies in the form of a paid lease [

8]. Japan adopts a diversified investment pattern, and the distribution ratios of pipeline companies as well as road management units is determined based on the specific conditions of each region according to the utility tunnel law. The diversified investment pattern is also employed in some UUT pilot projects in China. For example, Taiwan Province adopted the government-fallback-balance mechanism, which guarantees that the construction cost shared by pipeline companies is basically the same as the traditional pipeline laying cost, and the remaining cost (of about 33% of the total cost) is borne by the government. The construction costs of the UUT pilot projects in Haidong city of Qinghai province and Yinchuan city of Ningxia Hui Autonomous Region of China are allocated based on the proportion of pipeline laying costs, while the construction cost of the UUT in Guangzhou Higher Education Mega Center of Guangdong province, China is allocated according to the proportion of the pipeline cross-sectional area [

9]. Indeed, there is no clear and instructive regulation on the cost-sharing mode for the construction cost of UUT under China’s diversified investment pattern.

Traditional proportion-based methods, such as the spatial proportional method (SPM) and the direct-laying cost method (DCM), have been employed in most of the existing publications to allocate the construction cost of UUT [

8,

9,

10,

11]. The SPM takes the proportion of area occupied by pipelines as the allocation ratio of UUT construction cost, and the effective area of a pipeline includes the cross-sectional area and the necessary operating space for its installation and maintenance. The DCM allocates the UUT construction cost according to the proportion of pipeline laying cost, including the direct cost of pipeline laying and the indirect cost of road excavation. Moreover, a modified incremental method is used in reference [

8] to allocate the marginal cost of operation and maintenance of UUT. A multiobjective programming model is established in reference [

10] for UUT construction cost allocation. An improved proportion-based allocation method which combines SPM with DCM is proposed in reference [

11] to obtain the ultimate cost distribution ratio of pipelines. Subjective group-decision [

12], the Min-Max method [

13] and cooperative game theory [

14,

15] are also used to solve allocation problems. However, the above-mentioned studies only focus on the cost sharing from a single point of view and consider more about the rationality of the allocation method in theory, while the cost allocation among pipeline companies is a multi-attribute decision-making problem that needs to be solved in practice. In addition, it is worth noting that China’s UUT originates from underground power corridors, which is different from those in European countries. For example, the utility tunnel in Paris is derived from underground drainage systems. Therefore, in China, power cables are considered as the most important pipelines set up in UUT, and the economic benefits of power companies should receive more attention. Although the difference of construction cost, operation cost, and maintenance cost between the UUT-laying pipeline and traditional buried pipeline within the life cycle of utility tunnel is proposed in references [

8,

9,

11], the additional benefits brought from power network expansion in the life cycle of UUT are not considered, which makes the evaluation results inaccurate.

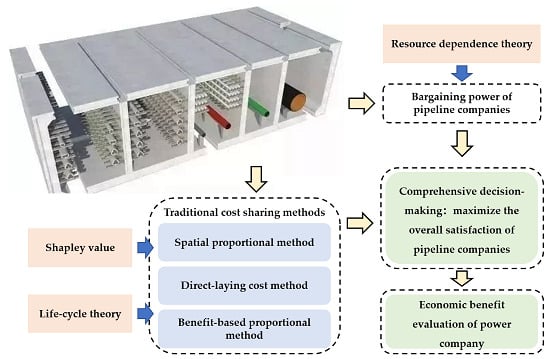

Given this background, a comprehensive decision-making mechanism for UUT construction cost allocation is proposed to overcome the limitations of traditional cost sharing methods and maximize the overall satisfaction of pipeline companies, and the economic benefit of UUT-laying power cables is also evaluated on this basis. First, the traditional SPM is improved based on the Shapley value. The comprehensive decision-making model of UUT construction cost allocation is established by using the improved spatial proportion, the life-cycle direct-laying cost proportion and the benefit proportion of pipeline companies as the cost allocation indexes. The process of determining the cost allocation ratio of each pipeline company is considered to be a bargaining, and the resource dependence theory (RDT) is introduced to quantify the bargaining power of pipeline companies. The weights of the cost allocation indexes are optimized with the objective of maximizing the overall satisfaction of the pipeline companies. The impact of power network expansion on the economic benefit of power company within the life cycle of UUT is also considered in the case studies. Hence, the contributions of this paper can be highlighted as follows:

An improved spatial proportional cost allocation method is proposed based on the Shapley value, which takes into account the cross-sectional area of the pipeline itself and the public operating space, making the cost allocation ratio of each pipeline company more reasonable than traditional SPM.

A comprehensive decision-making mechanism of UUT cost allocation is designed based on the occupied area and the direct laying costs of pipelines, as well as the economic benefits of pipeline companies. The bargaining power of pipeline companies is analyzed based on the resource dependence theory, which makes the proposed cost allocation method more practical.

The impacts of power network expansion are first considered in calculating the economic benefits of UUT-laying cables under various scenarios, which makes the economic benefit evaluation of UUT-laying power cables more comprehensive and accurate.

The rest of this paper is organized as follows. In

Section 2, the improved SPM, life-cycle DCM and benefit proportion method for cost allocation are proposed. The comprehensive decision-making model of UUT construction cost allocation is presented in

Section 3. Case studies and conclusions are presented in

Section 4 and

Section 5, respectively.

2. Proportional Allocation Method for UUT Construction Cost

Construction and maintenance costs are the main costs of an urban utility tunnel. For local governments, the benefits of UUT are indirect and lie within a long-term perspective, involving special public benefits such as no disruption of the highway, no traffic interruption caused by trench digging, and the increase of the developable surface land area. However, the relevant data is difficult to obtain, since they cannot be easily observed and measured. In this paper, the government is assumed to bear part of the construction cost of UUT and the total maintenance cost. The concern of pipeline companies is the allocation of the remaining part of the construction cost, which is much higher than the cost of traditional buried pipelines, and it is easy to hinder pipeline companies from participating in UUT construction.

According to reference [

5], the main factors to be considered in cost allocation among pipeline companies include: (1) the proportion of area occupied by pipelines, (2) the cost of traditional buried pipeline laying, (3) the economic benefits such as the reduction of maintenance cost of UUT-laying pipeline (compared with the traditional buried pipeline) and the reasonable return on investment in UUT construction. Therefore, the following three proportional methods are employed to establish the comprehensive decision-making model for the cost allocation among pipeline companies.

2.1. Improved Spatial Proportional Method Based on Shapley Value

Generally, the more pipelines are laid in the UUT, the more the underground space is needed and the higher the construction cost becomes. As a result, the SPM is proposed to allocate the construction cost based on the proportion of area occupied by the pipelines, which includes the cross-sectional area of the pipeline itself and the required operating space for its installation and maintenance. The cross-sectional structure of UUT laying power cables and communication cables is shown in

Figure 1. Apart from the space occupied by systems such as ventilation, lighting, and firefighting, the space of the UUT is mainly composed of the power cables, communication cables, and their public operation space (indicated by blue shadows).

Pipeline companies should not only bear the construction costs related to their own cross-sectional area, but also share the construction costs of public operating space. The traditional SPM allocates the public operating space (in the form of cross-sectional area) to each pipeline company according to the proportion of cross-sectional area of pipelines. However, there is no clear quantitative relationship between the operating space and the cross-sectional area of pipelines, which makes the traditional SPM unreasonable. Indeed, compared with multiple single cabins, when pipelines are laid in an integrated cabin, the total operating space required is reduced, which reduces the construction cost of the UUT, thus resulting in cooperation benefits. To this context, cooperative game theory could be used to improve the traditional SPM, and the Shapley value is used to solve the improved spatial proportional allocation index. The expected incremental cost that pipeline produces when laid into utility tunnel is the basis for the Shapley value-based cost allocation method, ensuring that the allocation solution is fair and desirable [

16]. Since the order that the pipelines laid into the utility tunnel affects the incremental cost produced, the Shapley value considers all orders equally and gives them equal weights. Compared with other cooperative game methods such as Core and Nucleolus, the Shapley value solution is unique and more acceptable, and has a clear calculation process, which makes it more feasible in cost allocation [

17]. Let

N represent the set of

n types of pipelines in the utility tunnel, and the improved spatial proportion cost allocation index of pipeline

i can be expressed as:

where

represents the cost allocation index of pipeline

i under Shapley value-based SPM.

Si is the occupied area of pipeline

i, including the cross-sectional area of pipeline and its allocated public operating space.

M is a virtual set of

m types of pipelines including pipeline

i, and

SM is defined as the cross-sectional area of the utility tunnel containing these

m types of pipelines. The term

models the incremental contribution that pipeline

i makes to the cross-sectional area of the utility tunnel. Although the time complexity of Shapley value is O(

n!), it is generally acceptable to the computer because of the small number of pipeline types. The larger the index

is, the higher the cost allocation ratio of pipeline

i should be.

2.2. The Life Cycle Direct-Laying Cost Method

The direct-laying cost method (DCM) determines the cost allocation ratio of each pipeline company according to the proportion of traditional buried pipeline laying cost (referred to as direct-laying cost). The pipeline company with higher direct-laying cost should bear more allocated construction cost. The UUT-laying pipelines and traditional buried pipelines vary in service life and breakage rate, which leads to different maintenance cost and repeated laying frequency of pipelines. Therefore, when DCM is used for UUT construction cost allocation, the direct-laying cost of pipeline should be calculated in a specific time period. In this paper, the time period is set to the life cycle of UUT for the reason that life cycle cost theory considers all stages of UUT from planning, construction, operation to retirement, avoiding decision-making being limited to a certain period of time [

18]. After discounting the direct-laying cost of pipelines in the life cycle to the present value, the DCM based cost allocation index of pipeline

i can be expressed as:

where

represents the cost allocation index of pipeline

i.

Tg is the life cycle of UUT.

is the total direct-laying cost of pipeline

i in

Tg.

is the service life of traditional buried pipeline

i and

denotes the number of its repeated laying times.

is the direct-laying cost of pipeline

i at the

t-th re-laying and

is the maintenance cost at the

h-th year.

r is the annual interest rate. The larger the index

is, the higher the cost allocation ratio of pipeline

i should be.

2.3. The Benefit-Based Proportional Allocation Method

According to the benefit principle [

19], the benefit-based proportional method (BPM) determines the cost allocation ratio of each pipeline company according to the economic benefit that the pipeline produces when laid into a utility tunnel. The economic benefit of each pipeline company (also known as the investment income) mainly includes the construction cost reduction caused by the decrease of repeated laying times of the pipeline, and the maintenance cost reduction caused by the decrease of pipeline breakage rate and leakage rate within the life cycle of UUT. After being discounted to the present value, the cost allocation index of pipeline

i under BPM can be expressed as:

where

represents the cost allocation index of pipeline

i under BPM.

and

denote the construction cost reduction and the maintenance cost reduction, respectively.

is the service life of UUT-laying pipeline

i and

denotes the number of repeated laying times of pipeline

i.

is the laying cost of pipeline

i in UUT at the

t-th repeat and

is its maintenance cost at the

h-th year. Similarly, the larger the index

is, the higher the cost allocation ratio of pipeline

i should be.

3. Comprehensive Decision-Making Mechanism of UUT Cost Allocation Considering the Bargaining Power of Pipeline Companies

Considering that the cost allocation ratio of each pipeline company varies greatly under the above-mentioned three allocation indexes, it is difficult to satisfy the wishes of all pipeline companies at the same time by allocating UUT construction cost with a single index. For example, the water supply companies will bear a large proportion of UUT construction cost under SPM, while the proportion under DCM is much smaller because the direct-laying cost of water supply pipelines is much lower than that of communication and power cables. All pipeline companies want to adopt cost allocation indexes that are beneficial to themselves, and it is difficult to reach an agreement. To solve this problem, the cost allocation among pipeline companies is regarded as a process of bargaining in this paper, and a comprehensive decision-making mechanism is established for the weight determination of the above-mentioned allocation indexes.

Negotiations are held among pipeline companies on their respective cost allocation ratios, and the pipeline company’s satisfaction

ui with the outcome of the negotiations is defined as:

where

ωi is the comprehensive decision result (CDR) of cost allocation ratio of pipeline

i.

and

denote the maximum and minimum cost allocation ratios of pipeline

i under different cost allocation indexes, respectively. If the satisfaction of any pipeline company is too low, the traditional buried pipeline would replace the UUT-laying pipeline, thus hindering the construction of the utility tunnel. Thus, the optimization problem for the comprehensive decision-making mechanism of the cost allocation among pipeline companies is expressed as:

where

U is the overall satisfaction of pipeline companies, and

αi is the coefficient indicating the bargaining power of the

i-th pipeline company.

λS,

λC, and

λR represent the weights of the improved SPM, DCM, and BPM within the CDR, respectively.

Cg is the UUT construction cost and

λG is the proportion of

Cg shared by the government.

βi is the biggest discount that the pipeline company

i can accept. Inequality constraint Equation (14) is the individual rational constraint, which ensures that the cost shared by the pipeline company is lower than its net income from laying the pipeline into a utility tunnel. Inequality constraint Equation (15) limits the cost allocation proportions of pipeline companies so as to ensure that UUT-laying pipelines will not be replaced by traditional buried pipelines. Inequality constraint Equation (16) is the group rational constraint, which ensures that the UUT construction cost can be fully shared by pipeline companies.

It is believed that there is an interdependent relationship between pipeline companies based on the two facts: (1) the construction of UUT requires mutual cooperation between pipeline companies; (2) the government shares part of the construction cost of UUT to ensure that pipeline companies can obtain profits. However, the differences in cost-sharing, the cost-benefit ratio, and payback period of pipelines companies lead to their different preferences for cooperation, which is reflected in the differences in bargaining power in alliance negotiations. It can be seen from Equation (11) that the overall satisfaction of pipeline companies is related to the bargaining power of each pipeline company. The greater the bargaining power of the

i-th pipeline company in the cost allocation negotiation, the greater its impact on the overall satisfaction of pipeline companies, and the lower the cost allocation proportion it obtained through optimization. Therefore, the relationship between pipeline companies is interdependent and competitive. The bargaining power of pipeline companies is analyzed based on the resource dependence theory (RDT) [

20] in this paper.

The RDT focuses on the fact that enterprises require resources from others for survival and operation, and suggests that resource dependence is an essential part of enterprise relationships and a reason for the bargaining power imbalance in negotiations [

21]. The level of the interdependence between pipeline companies is mainly determined by two factors, i.e., the importance of external resources and the possibility of alternative suppliers. The construction of UUT requires the joint efforts of the government and pipeline companies, and any one of them is irreplaceable, i.e., there is no alternative suppliers. Thus, the importance of external resources, i.e., the economic benefits of pipeline companies when laying pipelines into utility tunnel, is the key to measure the level of interdependence between pipeline companies. The greater the benefit of the pipeline company, the stronger its dependence on others, the lower the bargaining power in negotiation, and the smaller

αi in Equation (11). The economic benefits of pipeline companies can be measured by indexes such as a net investment income, payback period, and cost-benefit ratio [

22]. Then, the coefficient

αi indicating the bargaining power of pipeline company in the negotiation of UUT construction cost allocation can be expressed as:

where

Pi is the payback period of pipeline company

i.

and

represent construction cost reduction and the maintenance cost reduction within the time

Pi, respectively. It can be seen from Equation (17) that

αi is proportional to the payback period

Pi, and inversely proportional to the net investment income and the cost-benefit ratio (i.e., the ratio of the investment income to the allocated UUT construction cost). Equation (18) denotes that the payback period

Pi is the maximum value of time

t that the net investment income within

t is equal to the allocated cost of pipeline company

i.

Although RDT plays an important role in explaining the organization’s behavior, it does have defects and limitations [

23]. Considering the operational environment, relational networks as well as inter-organizational power dynamics, RDT cannot fully explain the relationship between organizations. Further research can be conducted on the combination of RDT and other theories, e.g., social network theory, game theory, and agency theory, to study the cost-sharing negotiations among pipeline companies, taking into account economic, policy, and social environmental factors.

In summary, the process of the proposed comprehensive decision-making mechanism for UUT construction cost allocation is shown in

Figure 2. Based on the cost allocation mechanism, the economic benefits evaluation of UUT-laying power cables could also be obtained.

4. Case Studies

The data of the utility tunnel project of Shanghai Taopu Science and Technology Intelligence City in China is used for demonstrating the proposed comprehensive decision-making mechanism for UUT construction cost allocation. The utility tunnel consists of three cabins, in which 110 kV cables are laid in the high-voltage power cabin, gas pipelines are laid in the gas cabin, and 10 kV cables, communication cables and water supply pipelines are in the integrated cabin, as shown in

Figure 3. The utility tunnel is 1000 meters long, has a service life of 100 years, and has a total construction investment of 50.9 million CNY. Considering the reduction of civil engineering cost, the improvement of maintenance efficiency and the improvement of operation environment, reasonable assumptions are made on the laying cost, service life and maintenance cost of UUT-laying pipelines based on the data of traditional buried pipelines [

24,

25]. Assuming that the government shares 40% of the construction cost. The annual interest rate is 5%, and the largest discount that pipeline companies are willing to accept is 0.9. The construction cost of the underground power corridor is 5 million CNY/km [

26]. Overall, the engineering parameters of the utility tunnel and pipelines are shown in

Table 1, and the parameters of traditional buried pipelines are shown in

Table 2.

4.1. Cost-Sharing Comparison of Pipeline Companies under Different Cost Allocation Methods

The weights of the improved SPM, DCM, and BPM in the comprehensive decision-making result (CDR) of the UUT cost allocation are 0.3398, 0.3027, and 0.3575, respectively. The allocated cost and proportion of each pipeline company are shown in

Table 3 and

Figure 4, respectively.

It can be seen from

Table 3 and

Figure 4 that the power company shares a higher proportion of the cost under different allocation methods, which makes it the most important pipeline company participating in the construction of a utility tunnel. Specifically, the differences in the cost allocation proportion of each pipeline company under different allocation methods are summarized as follows:

(1) Under SPM, the UUT construction cost is allocated based on the proportion of area occupied by the pipelines. For the sake of security, 110 kV cables and gas pipelines should be separated from other pipelines and need to be laid in their individual cabins, i.e., the high-voltage power cabin and the gas cabin, making the space occupied by power cables and gas pipelines larger (i.e., 8.75 m2 and 5.40 m2, respectively). The power company also needs to share part of the construction cost of the integrated cabin where 10 kV cables are laid, which makes it share the highest proportion of UUT construction cost (i.e., 25.6%).

(2) Under DCM, the proportion of direct-laying costs among pipelines is used to allocate the UUT construction cost. For power companies, the number of 110 kV and 10 kV cables to be laid is large, and underground power corridors need to be built for traditional buried cables, resulting in a higher total direct-laying cost than other pipelines. For water supply/gas companies, the laying cost of traditional buried pipeline and the frequency of repeated laying are relatively high. However, compared with the large number of power cables and communication cables laid, the laying of water supply and gas pipelines is not a high-cost business, which makes the cost shared by water supply companies and gas companies lower (i.e., 6.0% and 9.3%, respectively).

(3) Under BPM, the cost allocation proportion of each pipeline company is determined according to the economic benefit that the pipeline produces when laid into a utility tunnel. For power companies, the total cost of cable laying is reduced because the utility tunnel replaces the traditional underground power corridor that requires additional investment in construction, resulting in the highest economic benefits for the power companies. On this basis, the cost allocation proportion of power companies is the highest (i.e., 28.1%). For water supply and gas companies, compared with the traditional buried pipelines, UUT-laying pipelines have a lower laying cost, maintenance cost and repeated laying frequency, which increases their economic benefits. Therefore, the costs shared by water supply companies and gas companies under BPM are higher than those shared under other methods.

(4) Under the proposed comprehensive decision-making mechanism, the cost-sharing proportion of each pipeline company is the optimization result of the above-mentioned methods, which maximizes the overall satisfaction of pipeline companies. As shown in

Table 4, the overall satisfaction of the pipeline companies under SPM, DCM and BPM is 54.8%, 72.5%, and 92.8% of the maximum overall satisfaction, respectively, which indicates that the proposed comprehensive decision-making mechanism of UUT cost allocation is more acceptable and more feasible.

4.2. Economic Benefit Evaluation of UUT-Laying Power Cable

Under the comprehensive decision-making allocation mechanism, the power cable laying cost of the power company reduced by 12.5% (i.e., 6.44 million CNY) in the life cycle of the UUT. The payback period (i.e., the time when the cumulative laying cost of UUT-laying power cables is lower than that of traditional buried power cables) of the power company is 51 years, as shown in

Figure 5.

It is worth noting that the service life of traditional buried cables and UUT-laying cables are different, which makes the time point of cable re-laying different. Therefore, the cumulative laying cost of UUT-laying cables may be lower than that of the traditional buried cables during a certain period, but the power company cannot recover the allocated UUT construction cost. Take a 10 kV power cable as an example, due to the improvement of environmental conditions, the average service life of the UUT-laying cable is 40 years, 15 years longer than that of the traditional buried cables. It can be seen from

Figure 5 that in the first 25 years, the UUT-laying cost curve is always higher than the direct-laying cost curve. Within the payback period, the traditional buried 10 kV cables need to be re-laid in the 26th and 51st years at a cost of 9 million CNY per time, while the UUT-laying 10 kV cables only need to be re-laid in the 41st year at a cost of 7.2 million CNY. As a result, in the 15 years period from the 26th to the 40th year, the UUT-laying cost curve is lower than the direct-laying cost curve, but in fact the cost shared by the power company is not offset. After the 51st year, the UUT-laying cost curve is always lower than the direct-laying cost curve, which shows that the power company has completed cost recovery.

It is important to assume that due to the increase of load in the UUT pilot area, the distribution network needs to double its capacity in the

t1-th and the

t2-th year after cable laying. The capacity of other types of pipelines has also increased at the same time, and cost allocation proportion of each pipeline company remains unchanged. Then, considering the expansion of distribution network, the cost comparison of traditional buried cables and UUT-laying cables under two scenarios is shown in

Figure 6 and

Figure 7, respectively.

It can be seen from

Figure 6 and

Figure 7 that when considering the expansion of distribution network, the payback period of the power company is shortened from 51 years to 26 years under Scenario A, and 46 years in the case of Scenario B. The power cable laying cost reduction of the power company within the life cycle of UUT is increased from 6.44 million CNY to 40.22 million CNY (under Scenario A) and 47.37 million CNY (under Scenario B), respectively. The earlier the distribution network is expanded or rebuilt, the shorter the payback period is, and the higher the economic benefit of UUT-laying power cables is. Generally, in the life cycle of UUT (usually 100 years), the expansion of distribution network and the transformation of power pipelines caused by the growth of regional energy consumption and the development of distributed generation are inevitable [

27]. Therefore, it can be concluded that the use of UUT-laying power cables in place of traditional buried cables in areas with rapid load growth has great economic benefits.

In addition, the relationship between the number of cables of different voltage levels laid in the utility tunnel and the economic benefits of the power company is shown in

Figure 8. The upper limit of the number of 110 kV cables laid in the high-voltage power cabin is 30, and the upper limit of the number of 10 kV cables laid in the integrated cabin is 60.

It can be seen from

Figure 8 that it is not economical for power companies to lay only 110 kV cables in a utility tunnel. With the increase of the number of 10 kV cables laid in the integrated cabin, the economic benefits of the power company have been continuously improved. When the number of 110 kV and 10 kV cables reaches their upper limits, the maximum net income (i.e., 15.31 million CNY) of the power company without considering the expansion of distribution network can be obtained, and the cost shared by the power company is about 17.56 million CNY, accounting for 34.5% of the total UUT construction cost. Compared with traditional buried cables, 10 kV UUT-laying cables have the advantages of lower laying cost, lower maintenance cost, and longer service life (i.e., lower repeated laying frequency), which is the main source of economic benefits of laying cables in UUT. Therefore, power companies should pay attention to the coordination of 110 kV and 10 kV UUT-laying cables in the distribution network planning to maximize their economic benefits.

4.3. Cost-Sharing Comparison of Single Integrated Cabin under Different Cost Allocation Methods

It is worth noting that the construction costs of UUT projects in different regions can vary hugely, which may be caused by the difference of cabin types and regional economic development [

11]. To further prove the effectiveness of the proposed comprehensive decision-making cost allocation mechanism, the UUT project in Ningbo City, Zhejiang Province, China, is also used for demonstration [

28]. The cross-sectional view of utility tunnel of Yincounty Avenue in Ningbo is shown in

Figure 9. It is an integrated cabin in which 10 kV power cables, communication cables, and water supply pipelines are laid, while 110 kV cable and gas pipeline need not be laid. The total investment in construction is 60 million CNY per kilometer, 40% of which is funded by the government. The engineering parameters of the tunnel and pipelines are shown in

Table 5.

The optimization results of the proposed comprehensive decision-making mechanism are shown in

Table 6. The weights of the improved SPM, DCM, and BPM in the comprehensive decision-making result (CDR) of the UUT cost allocation are 0.5361, 0, and 0.4639, respectively. As shown in

Table 6, under DCM, the cost-sharing proportion of power company and telecommunications company reaches the maximum at the same time, i.e., 33.1% and 18.7%, respectively. It is believed that the two companies will oppose the DCM, and as expected, DCM has the lowest overall satisfaction among the four methods. The overall satisfaction of the pipeline companies under DCM and BPM is 69.2% and 72.0% of CDR, respectively. It can be concluded that although the data from different UUT projects may have an impact on the simulation results, under the proposed comprehensive decision-making mechanism, the cost-sharing ratio that achieves the maximum overall satisfaction can always be obtained.

For power companies, the cost-sharing proportion under SPM (i.e., 16.0%) is significantly lower than that in

Figure 4 (i.e., 25.6%). This is because when only 10 kV cables are laid, there is no need to build an individual high-voltage power cabin, which reduces the proportion of area occupied by the power cables. Accordingly, under the comprehensive decision-making mechanism, the cost allocation ratio of the power company is also reduced. Overall, laying 10 kV power cables in UUT has higher economic benefits than 110 kV cables.