1. Introduction

Government policies create contests between stakeholders who choose to compete over contracts and grants. The actions of these stakeholder contests can actually generate a positive externality: winners of the contest often attract additional third-party donations from those groups wanting to also jump on the bandwagon of the victorious player. For example, consider the case of the external benefits with a governance contest between charity organizations when government grants are given to one of them. The charity organizations compete with each other to win government grants. After the contest is over, the winning organizations receives additional donations from third party donors. The charities are not intentionally trying to receive these extra donations. The more each charity tries to win government grants, the more donations they receive. Donors also do not take strategic action as to how the donation is used. The charities’ activities financed by government grants generate these external benefits. Another example is patent races for COVID-19 vaccines. Recently, it has been argued that cross-vaccination of COVID-19 vaccines made by other pharmaceutical companies can increase the effectiveness of vaccines. The companies that obtain patents for the vaccines do not produce the vaccines for their opponents. However, a positive assessment of cross-vaccination increases the value of patents.

The open question is whether externalities caused by governance contests can continue to work for a virtuous circle of governance. Here the virtuous cycle of governance refers to a situation in which the external effects of governance contests increase the expected payoffs of stakeholders, while lowering rent dissipation, and reducing the inequality of the expected payoffs of them. This study defines the situation in which external effects improve the efficiency and fairness of government contests as a virtuous circle of governance. To address this question, we must consider two things. The first is whose payoffs are affected by externalities. The second is how a virtuous circle of governance is measured. First, externalities examined in the contest literature can be classified into two types: Player-externality and winner-externality. In the player-externality contests, the externalities generated by players’ efforts influence the rent (or the prize) for the loser as well as the winner. An example is government grants which are given to one of charity organizations. The more charities try to win the grants, the more donations they receive. The government grants generate external benefits for both charities. In the winner-externality contests, externalities only influence the rent the winner gets. It is possible that government grants only generate external benefits for the winner. The contests with government grants can be classified as the winner-externality contests. For example, the competition of universities to win research grants is a contest with winner-externality. A university that wins research grants can earn more donation by gaining by high reputation.

Second, we consider the equilibrium expected payoffs of stakeholders (i.e., players), the difference in them, and real rent-dissipation rates as suitable criteria for measuring a virtuous circle of governance contests. The increase in expected payoffs of players is crucial to form a virtuous circle of governance contests. However, it is not straightforward to determine whether a change in the difference in equilibrium expected payoffs of players lead the governance contests on a path of virtuous circle. We can think that a large gap in equilibrium expected payoffs or a change in the gap that do not meet the efficiency of the players’ efforts does not help a virtuous circle of governance contests. For governance contests to have a virtuous circle, its efficiency must be met. In the literature related to contests, a (nominal) rent-dissipation rate is considered as a criterion for measuring efficiency of contests. [

1] defines the (nominal) rent-dissipation as: “

The total expenditure of resources by all agents attempting to capture a rent or prize.” However, [

2] points out that nominal rent-dissipation rates are no longer a valid measure of social waste resulting from rent seeking when externalities exist. In the context, this study considers the real rent-dissipation rate as a criterion for measuring efficiency of governance contests with externalities.

This paper first explores how externalities arising from two types of governance contests affect the equilibrium expected payoffs of the players with asymmetric efficiency of efforts. In detail, we consider: How the gap between equilibrium expected payoffs of the players respond to the changes in externalities and the difference in efficiency of players’ efforts; and how the equilibrium expected payoffs of the players respond to them.

In the Nash equilibrium of each contest, we find the player with relatively low efficiency of efforts is the underdog, and the rival is the favorite [

3]. Recall an underdog has less than 50 percent chance of winning, whereas the favorite has a greater than 50 percent. Solving the player-externality contest, we find two things. First, if the efficiency of the underdog’s efforts is close to that of the favorite’s efforts, then the equilibrium expected payoff of the underdog can be close to or above that of the favorite. Second, the equilibrium total expected payoff increases with the degree of positive externality. Solving for the Nash equilibrium of the winner-externality contest, we demonstrate two results. First, the equilibrium expected payoff of the underdog is smaller than that of the favorite. Second, the gap between the equilibrium expected payoffs of the players and the equilibrium total expected payoff increase with the degree of positive externality.

We then compare the outcomes—nominal and real rent-dissipation rates—of the two types of governance contests. The results of this comparison address the following questions: Which of the two contests causes lower rent-dissipation rate? How rent-dissipation rates respond when the degree of externality and the relative efficiency of the players’ efforts change?

The three findings are derived from the comparison of the outcomes of the two contests. First, both nominal and real rent-dissipation rates in the player-externality contest are lower than those in the winner-externality contest. Second, nominal rent-dissipation rate in the two contests increase with the degree of externality. Third, real rent-dissipation rate in the player-externality declines with the degree of externality, while changes in real rent-dissipation rate in the winner-externality contest vary depending on the degree of externality and the relative efficiency of the players’ efforts.

This paper is organized as follows:

Section 2 summarizes previous studies on the two types of contests. In

Section 3, we solve the player-externality contest, and perform the comparative statics of the equilibrium expected payoffs with the degree of the externality. In

Section 4, we solve for the Nash equilibrium of the winner-externality contest. Then we perform the comparative statics of the equilibrium expected payoffs with the degree of the externality. In

Section 5, we compare the outcomes of the two types of contests. Finally,

Section 6 summarizes the main conclusions of this study, and explains the implications on a virtuous circle of governance contests.

2. Related Literature

Contests with externalities are classified as those with player-externality and those with winner-externality. Some studies consider the player-externality contests [

2,

4,

5]. The two previous studies introduce group contests with external benefits—group contests that consider the relationship between the equilibrium level of effort level, the socially optimal level of effort, and the size of rent (the prize) [

2], and group contests that consider public information on intra-group sharing rule [

4].

The winner-externality contests are studied by [

6,

7,

8,

9,

10]. Some previous paper shows excessive increases in players’ equilibrium effort levels due to external benefits and increased equilibrium total effort level (i.e., nominal rent-dissipation) [

6,

7]. In reality, the winner-externality contests are applied to labor tournament and military conflicts. A paper addresses external benefits happened in labor tournament and external damages incurred in military conflicts, and analyzes how the equilibrium effort levels and the equilibrium expected payoffs of players change in each externality [

8]. Reference [

8] shows that players’ (labors’) equilibrium effort levels increase in external benefits, while players’ (warring parties’) equilibrium effort levels decrease in external damage. In addition, [

8] shows that externalities do not make their equilibrium expected payoffs changed. In group contests with private and public information on intra-group sharing rules are examined by [

9].

This paper is closely related to [

11,

12,

13,

14] that simultaneously examine the two types of contests such as the player-externality contests and the winner-externality contests. A previous paper shows that asymmetric externalities can lead to multiple equilibria in contests [

11]. Reference [

12] introduces strategic equivalence in contests, and define the contests are strategically equivalent if players’ best response functions are the same. Then, they show that the various kinds of contests can be strategically equivalent. Furthermore, they show that contest designers can achieve various goals using contests that are strategically equivalent contests but can have different equilibrium expected payoffs. Unlike the previous studies, Reference [

13] studies the two types of contests where abilities of players’ efforts are different. He finds that, in the two contests, the equilibrium expected payoffs of players with higher ability are higher than those of players with lower ability.

These papers that consider the two types of contests assume that the degree of player-externality and that of winner-externality are the same. This assumption is the basis for analyzing whether the two contests are strategically equivalent. However, in cases such as government grants, the degree of externality that occurs in the two types of contests may differ because total amount of donations from donors is set. Accordingly, this paper assumes that the degree of player-externality is different from that of winner-externality.

In terms of analyzing efficiency of governance, this paper is related to [

15,

16]. These papers suggest that players are more likely to behave partners than rivals. Furthermore, Reference [

16] finds that equilibrium effort levels decrease in the degree of cooperation among players.

The earlier studies we have so far discussed have focused on efficiency of the contests. In contrast, this study examines both efficiency and the fairness of contests with externalities. We focus on a contests model in which there is a difference in the relative efficiency of players’ efforts.

3. Contest with Player-Externality

Consider the player-externality contest in which externalities generated by players’ efforts influence not only the winner but also the loser’s rent. Players 1 and 2 compete for the exogenous (or initial) rent

R in the contest. We adopt the lottery model of Ref. [

17] where the probability of player

i winning the contest is proportional to the relative size of his exerting effort

xi (

i = 1, 2). Let

pi be the probability that player

i wins the contest. Then,

pi is given by:

This function implies that the highest effort level does not win with probability 1 and the players have equal ability for the contest [

10,

11,

12,

14,

18,

19,

20,

21,

22]. This logit function has been extensively used in the contest theory literature starting with Tullock’s work [

17] and continuing on for example to [

22]. Reference [

23] considers a general logit function as

pi(

xi,

xj) =

axiri/(

axiri +

xjrj), in which

a is the ability parameter reflecting the relative strength of players, and

ri and

rj reflect the marginal productivity of efforts (

i ≠

j). [

15,

24], and [

25] assume players

i and

j have access to identical productivities of efforts:

ri =

rj. Furthermore, [

13] and [

26] assume

ri =

rj = 1. Unlike [

13,

15] and [

23,

24,

25,

26], we focus on the impact of the externalities on Tullock-style contest outcomes, assuming that

a = 1 and

ri =

rj = 1.

The expected payoffs of players 1 and 2 are then:

and:

where

γ (0, 1) is an externality parameter, and

h [1, ∞) is a relative efficiency parameter of player 1′s efforts. In (1) and (2),

γxi represents the external effect of the effort level of player

i—the endogenously determined rent for the winner is

RW =

R +

γ(

x1 +

x2) and that for the loser is

RL =

γ(

x1 +

x2), and the real cost of player 1 is

C1 = −

γ(

x1 +

x2) +

hx1 and that of player 2 is

C2 = −

γ(

x1 +

x2) +

x2. As

h increases, the efficiency of player 1′s efforts become lower than that of player 2.

Player

i decides his effort level to maximize his expected payoff, taking player

j’s effort level as given (

i ≠

j). The first−order condition for maximizing

π1 reduces to:

and that for maximizing

π2 reduces to:

Since

pi is increasing player

i’s effort level at a decreasing rate, the second-order condition for maximizing

πi is satisfied: ∂

pi/∂

xi > 0, ∂

2 pi/∂

xi2 < 0. Using the first-order conditions, we derive the two players’ best response functions,

b1(

x2) and

b2(

x1):

and:

Combining the two best response functions, we obtain a unique Nash equilibrium for the player-externality contest, denoted by (x1*, x2*). Lemma 1 summarizes the outcomes of the player-externality contest.

Lemma 1. In the equilibrium of the player-externality contest players 1 and 2 expend x1* = (1 − γ)R/(1 + h − 2γ)2 and x2* = (h − γ)R/(1 + h − 2γ)2.

The probability of winning for player 1 is p1* = (1 − γ)/(1 + h − 2γ).

The expected payoffs of players are: The endogenous rents for the winner and the loser are: In Lemma 1, it can be easily shown that x1* < x2* and p1* < ½—player 1 is the underdog and player 2 is the favorite. Next, using Lemma 1, we examine: whether the changes in externalities and the difference in efficiency of players’ efforts influence the gap between equilibrium expected payoffs of the players; and how the equilibrium expected payoffs of the players respond to changes in externalities. Proposition 1 summarizes the results of the player−externality contest.

Proposition 1. In the equilibrium of the player-externality contest, we obtain:

- (a)

π1* < π2* for ‘h > 3γ − 1 and 1 < h < 2′ or ‘h ≥ 2′,

π1* = π2* for h = 3γ − 1 and 1 < h < 2,

π1* > π2* for h < 3γ − 1 and 1 < h < 2; and

- (b)

∂(π1* + π2*)/∂γ > 0.

- (c)

∂(π1* + π2*)/∂h < 0 for 1 < h < (2 − γ –2γ2)/(2 − 3γ) and γ < 2/3, or ‘r ≥ 2/3′

∂(π1* + π2*)/∂h = 0 for h = (2 − γ –2γ2)/(2 − 3γ) and γ < 2/3; and

∂(π1* + π2*)/∂h > 0 for h > (2 − γ –2γ2)/(2 − 3γ) and γ < 2/3.

Proposition 1(

a) says that if the difference in efficiency of the two players’ efforts is not significant, then the equilibrium expected payoff of the underdog can be close to or above that of the favorite:

π1* −

π2* = − (

h − 1)(

h + 1 − 3

γ)/(1 +

h − 2

γ)

2 (See

Appendix A). Proposition 1(

b) says that equilibrium total expected payoff increases with the degree of externality: ∂(

π1* +

π2*)/∂

γ = [2{

h(

h − 1) + (1 −

γ)} +

h2 − 2

γh + 1]/(1 +

h − 2

γ)

3 > 0. Our findings are interpreted as follows. If the efficiency of the underdog’s efforts is close to that of the favorite, the two players increase their equilibrium effort levels in

γ, increasing the external benefits. The external benefits generated by the two players’ effort are evenly distributed both to the favorite and also to the underdog. In contrast, the increase in the equilibrium effort level of the underdog is small compared to that of the favorite. In this case, the equilibrium expected payoff of the underdog is greater than that of the favorite.

Proposition 1(

c) indicates that equilibrium total expected payoff decreases and increases with the relative efficiency of players’ efforts: ∂(

π1* +

π2*)/∂

h= {2

h(2 − 3

γ) + 2

γ2 +

γ– 2}/(1 +

h − 2

γ)

3. When

h increases, there may be a situation in which equilibrium total expected payoff decreases: ∂(

π1* +

π2*)/∂

h < 0. The reason this result arises relates to the size of external effects and free riding. Free riding matters more in the player-externality contest than in the winner-externality contest. If the difference in the relative efficiency of efforts increase in the case of large external effects, the underdog reduces more effort than the favorite (see

Appendix A). This is a major factor in lowering the equilibrium total expected payoff.

In sum, Proposition 1 indicates that if the efficiency of the favorite’s efforts exceeds that of the underdog’s efforts enough, then the governance contest with player-externality can meet a virtuous circle of governance contests by reducing the gap between equilibrium expected payoffs of the players and increasing equilibrium total expected payoffs of them. On the other hand, Proposition 1 indicates that if the efficiency of underdog’s efforts is close to that of the favorite’s efforts, then the player-externality contest may not form the virtuous circle of governance contest since the equilibrium expected payoff of the underdog may be greater than that of the favorite and equilibrium total expected payoff may be decreased with high external effects.

4. Contest with Winner-Externality

The winner-externality contests are similar to the one in

Section 3, except that the externalities generated by the players’ efforts only influence the winner’s rent. As mentioned earlier, the degree of externality in the winner-externality contest may be different from that in the player-externality contest. Considering this, this paper denotes the degree of externality in the winner-externality contest as

δ (0, 1) which may be different from

γ: it is possible that

γ ≠

δ. The expected payoffs of the players are:

and:

where the endogenously determined rent for the winner is

RW =

R +

δ(

x1 +

x2) and that for the loser is

RL = 0. The real cost of player 1 is

C1 =

hx1 and that of player 2 is

C2 =

x2.

Player

i selects

xi to maximize

πi, taking player

j’s effort

xj as given. The first-order condition for maximizing

π1 reduces to:

and the first−order condition for maximizing

π2 reduces to:

Note that the first-order conditions expressed in (9) and (10) are further reduced as follows:

and:

The term (∂

p1/∂

x1){

δ(

x1 +

x2)} +

p1δ in (10) and (11) is reduced to

δ. If

δ =

γ, then the best response functions of players 1 and 2 are the same as (5) and (6), which implies that the two contests are strategically equivalent [

12]. Ref. [

13] shows that, even if

γ =

δ, the two types of contests in which players’ abilities are different are not strategically equivalent. This paper complements Ref. [

13] by showing that the two types of contests can be strategically equivalent in the case of asymmetric efficiency of players’ efforts.

Lemma 2 summarizes the outcomes of the winner-externality contest.

Lemma 2. In the equilibrium of the winner-externality contest, players 1 and 2 expend x1** = (1 − δ)R/(1 + h − 2δ)2 and x2** = (h − δ)R/(1 + h − 2δ)2.

The probability of winning for player 1 is p1** = (1 − δ)/(1 + h − 2δ).

The expected payoffs of players are: The endogenous rent for the winner is RW** = (1 + h − δ)R/(1 + h − 2δ).

Lemma 2 says that player 1 with relatively low efficiency of efforts is the underdog, and player 2 with relatively high efficiency of efforts is the favorite:

x1** <

x2** and

p1** < 1/2. Assuming that the efficiency of the players’ efforts is the same, Ref. [

10] shows that the equilibrium expected payoffs of the players remain unchanged by externalities. This study also shows that if the efficiency of the players’ efforts is the same, the equilibrium expected payoffs are not affected by externality:

π1** =

π2** =

R/4 for

h = 1.

Next, using Lemma 2, we compare the equilibrium expected payoffs of the players, and we examine how the externalities influence the equilibrium expected payoffs. Proposition 2 illustrates the comparison and comparative-statics results.

Proposition 2. In the equilibrium of the winner-externality contest, we obtain:

- (a)

π1** < π2**; and

- (b)

∂(π1** + π2**)/∂δ > 0 and ∂(π2** − π1**)/∂δ > 0.

- (c)

∂(π1** + π2**)/∂h > 0.

Proposition 2(a) shows that the equilibrium expected payoff of the underdog is smaller than that of the favorite: π1** − π2** = − (h − 1)R/(1 + h − 2δ). Proposition 2(b) says that the equilibrium total expected payoff and the gap between the equilibrium expected payoffs increase with the degree of externality: ∂(π1** + π2**)/∂δ = 2(h − 1)2 R/(1 + h − 2δ)3 > 0 and ∂(π2** − π1**)/∂δ = 2(h − 1)R/(1 + h − 2δ)2 > 0. Proposition 2(c) shows that equilibrium total expected payoff increases with the relative efficiency of players’ efforts: ∂(π1** + π2**)/∂h = 2(h − 1)(1 − δ)R/(1 + h − 2δ)3 > 0.

Proposition 2 implies that the increase in the degree of externality exacerbates the inequality in equilibrium expected payoffs of the players by widening the gap between equilibrium expected payoffs of the players (see

Appendix B).

The outcomes of the winner-externality contest in Proposition 2 is different from those of the player-eternality contest in Proposition 1. The key reason is related to the challenge of fairness. The underdog cannot receive external effects in the winner-externality contest, but he can in the player-externality contest. In the player-externality contest, a fairness issue arises when external effects are large or the relative efficiency of efforts are not significant (see Proposition 1(a) or both. But it is unclear which contest is more efficient. This is because efficiency must be compared through the results of both contests, but fairness can be examined as a result of each game. In next section, we explore the efficiency of the two contests by comparing rent dissipation.

5. Comparison of Rent Dissipation

This section compares the nominal rent-dissipation rates and the real rent-dissipation rates of the two type of contests, using Lemmas 1 and 2. Recall the degree of externality arising from the player-externality contest could be different from that arising from the winner-externality contest: γ ≠ δ. For example, the case in which this inequality occurs may arise in the contests of charities to win government grants where total amount of donations from donors is set. Taking this into account, we assume that the degree of externality arising from the player-externality contest is proportional to that arising from the winner-externality contest, and the former is less than the latter: γ = δ/θ and θ > 1. [With the inequality γ < δ, it is possible that 2γ(x1* + x2*) ≠ δ (x1** + x2**). In other words, the external effects with player-externality contest may be greater than those with contest with winner-externality even if γ < δ.]

We begin by comparing the nominal rent-dissipation rates induced by the player-externality contest with those induced by the winner-externality contest. The nominal rent-dissipation rate is defined as the ratio of the equilibrium total effort level to the initial rent. Let

NRD* = (

x1* +

x2*)/

R be the equilibrium total effort level induced in the player-externality contest and

NRD** = (

x1** +

x2**)/

R be that induced in the winner-externality contest. Then,

NRD* and

NRD** are:

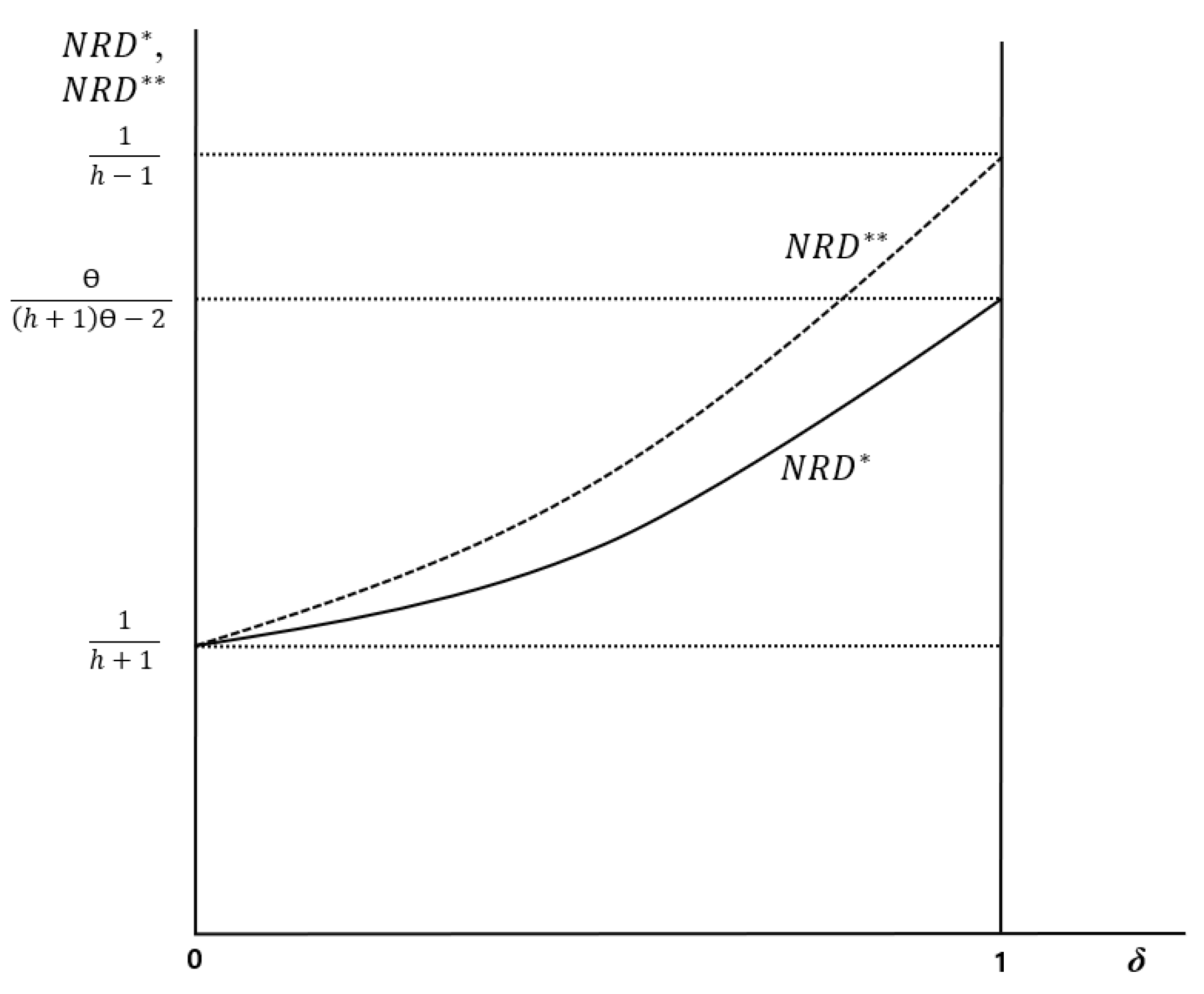

Proposition 3 shows that which of the two contests has a lower nominal rent-dissipation rate, and how the nominal rent-dissipation rate responds when the degree of externality changes in each contest (see

Figure 1). For example, when

h = 2,

δ = 0.5, and

θ = 1.5, we obtain that

NRD* = 0.42 and

NRD** = 0.5:

NRD* <

NRD**. [All decimal fractions are rounded off two decimals.]

Proposition 3.

- (a)

NRD* < NRD**.

- (b)

∂NRD*/∂δ > 0 and ∂NRD**/∂δ > 0.

Proposition 3(

a) says that the nominal rent-dissipation rate in the player-externality contest is lower than that in the winner-externality contest. Proposition 3(

b) says that the nominal rent-dissipation in the two types of contests increase with the degree of externality. Reference [

4] that analyzes the winner-externality contest where the efficiency of players’ efforts is the same concludes that external benefits in the winner-externality contest increase (nominal) rent dissipation. However, if externality occurs, the nominal rent-dissipation is not appropriate as a measure of the waste of social resources [

2].

Consider the real rent-dissipation rates of the two contests. The real rent-dissipation rate is defined as the ratio of the real total cost to the initial rent in the player-externality contest:

RRD* = {

C1* +

C2*}/

R = {(

hx1* +

x2*) − 2

RL*}/

R, where

C1* =

hx1* −

γ(

x1* +

x2*) and

C2* =

x2* −

γ(

x1* +

x2*). Let

RRD** = (

hx1** +

x2**)/

RW** be represented as the real rent−dissipation rate induced in the winner-externality contest.

RRD** is defined as the ratio of the real total cost to the endogenous rent for the winner. Then, they are:

Expressions (14) and (15) allow us to analyze how the real rent-dissipation rates vary depending on the type of the contest. Let Q ≡ [4 h − (h − 1){2(1 + h2)}1/2]/{2(1 + h)} where − 1 < Q < 0 for 1 ≤ h ≤ 3.73, and 0 < Q < 1 for h > 3.73.

Proposition 4 summarizes the outcomes of the comparison and the comparative-statics of the real rent-dissipation rates (see

Figure 2 and

Appendix C).

Proposition 4.

- (a)

RRD* < RRD**.

- (b)

∂RRD*/∂δ < 0,

∂RRD**/∂δ > 0 for 0 < δ < Q and 1 < h < 3.73; and

∂RRD**/∂δ < 0 for ‘Q < δ < 1 and 1 < h < 3.73′ or ‘h ≥ 3.73′.

Proposition 4(

a) indicates that real rent-dissipation rate is lower in the player-externality contest. For example, when

h = 2,

δ = 0.5, and

θ = 1.5, we obtain that

RRD* = 0.26 and

RRD** = 0.5:

RRD* <

RRD**. Proposition 4(

b) shows that the real rent-dissipation rate in the player-externality decreases with the degree of externality, while the impact of externalities on real rent-dissipation rate in the winner-externality contest depends not only on externalities themselves but also on the efficiency of players’ efforts (see

Figure 2). There are two cases. First, if 1 <

h < 3.73, then real rent-dissipation rate in the winner-externality contest increases and declines with the degree of externality. Second, if

h ≥ 3.73, then real rent-dissipation rate decreases with the degree of externality.

Many studies have examined the efficiency of contests with externalities. The previous studies that examine the winner-externality contests including [

6,

7,

10] have shown that nominal rent-dissipation is increased with positive externalities. For example, [

9] examines the winner-externality shows that real rent-dissipation is increased with positive externalities. In contrast, [

2] examines the player-externality shows that rent-dissipation is decreased with positive externalities. If

h = 1 in this study, the comparative-statics results of the previous studies still hold.

6. Concluding Remarks

Most governance contests cause externalities generating by stakeholders’ efforts invested to win the contest. Externalities arising from the governance contests can play a key role in the virtuous circle of governance contests. This study has explored the equilibrium expected payoffs of the players, the difference in their equilibrium expected payoffs, and rent-dissipation rates which are the main measures of the virtuous circle of governance contests. To understand the impacts of externality on the virtuous circle of governance contests, we have considered two types of contests with symmetric externality and asymmetric efficiency of players’ efforts. Our results suggest that if a contest designer wants to maintain a virtuous circle of governance contests, he would choose the player-externality contest. In other words, a contest designer can choose the player-externality contest to increase equilibrium total expected payoff of the players, and decline the difference in equilibrium expected payoffs of them, and reduce the real rent-dissipation rate.

This study has also showed that contest designers should pay attention to fairness of the contests. For example, this is the case when contest designers choose the player-externality contest to take advantage of the externalities. If the difference between the efficiency of the underdog’s efforts and that of the favorite’s efforts is small, the equilibrium expected payoff of the underdog could exceed the equilibrium expected payoff of the favorite. This means that the choice of contest designers can incur a problem of fairness. An analysis that considers the fairness remains a task for future research.

The contribution of this study is that we are the first to raise the issue of efficiency and fairness of contests with externalities simultaneously. In addition, this study shows that the comparative-statics results on real rent-dissipation vary by introducing the relative efficiency of efforts in the winner-externality contest.

This study has yet to answer various parts to consider in governance contests with externalities. For example, if both players worked hard at an earlier to win the endogenous prize including external effects, the conclusions this study has obtained may be changed. [

15,

16] examine the repeated contests without externalities. This study can be extended by considering a model along the lines of [

15,

16], adding externalities. This study assumes two-player Tullock-type contests. The contests are more realistic with a large number of players participating in the contests. [

2,

4,

9] analyze the two-symmetric-group contests with externalities. This study can be extended by [

2,

4,

9], considering two-asymmetric-group contests. New research will be needed to better understand the nature of these models. We leave this as future research.